The Fed has a huge problem, but the solution is already underway.

In just a bit, I am going to tell you about the Fed’s biggest problem and how they’re solving it as we speak.

But you need some context first.

A few weeks ago, I exposed who might have been behind the implosion of Terra, one of the largest stablecoin projects—and why it may be part of the bigger plan to introduce a digital dollar.

(If you missed it, read here: Why Did Crypto Crash?)

I wrapped up that letter with this prediction:

”Maybe that was the plan all along: gaslight the masses by letting them believe in something so badly, then deliberately destroy it to raise a generation of hopeless conformists.

Boy, was Ivan right. And that means the elites will be stepping in soon…”

But even I didn’t expect that things would escalate so fast….

Centralizing Payment Flow

Just a week after Terra’s collapse, the Fed’s vice-chair, Lael Brainard, raised concerns about the dollar’s global role.

She warned that the U.S. might lose global financial dominance if it doesn’t digitize its currency.

Via Axios:

“If major foreign jurisdictions move to the issuance of their own digital currencies, it’s important to think about whether the United States would continue to have the same kind of dominance without also issuing.”

“I would hate for Congress to decide five years from now: ‘You, Federal Reserve, you need to catch up. China’s out there. The [European Central Bank] is out there.'”

Then in a June 17 hearing, Fed Chair Jerome Powell sympathized with Brainard and her forewarning.

“A U.S. CBDC (central bank digital currency) could… potentially help maintain the dollar’s international standing,” Powell said.

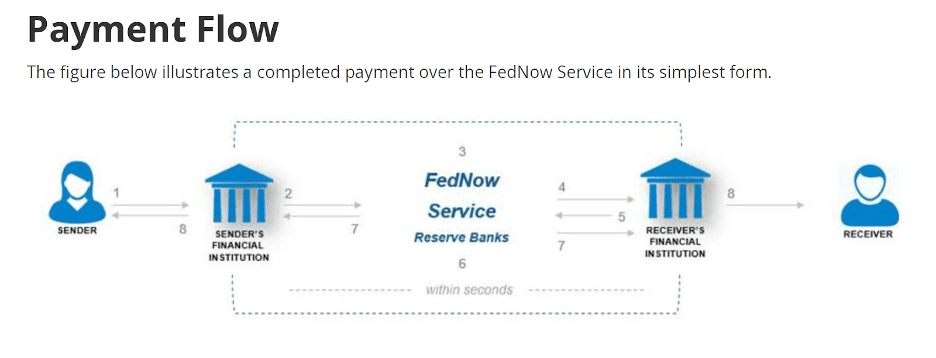

He also announced that next year the Fed will launch FedNow—a clearing house for all inter-bank transactions. Although this system officially has nothing to do with digital currencies, it could very well be the “backend” for the digital dollar.

Just take a look at how this clearing system is designed to disintermediate commercial banks:

And here’s the fine print confirming that all transactions will be routed through the Fed:

Via the Fed:

“Step 1. A sender (i.e., an individual or business) initiates a payment by sending a payment message to its financial institution through an end-user interface outside the FedNow Service. The sender’s financial institution is responsible for screening the payment according to its internal processes and requirements.

Step 2. The sender’s financial institution submits a payment message to the FedNow Service.

Step 3. The FedNow Service validates the payment message, for example, by verifying that the message meets message format specifications.

Step 4. The FedNow Service sends the contents of the payment message to the receiver’s financial institution to seek confirmation that the receiver’s financial institution intends to accept the payment message. At this point, the receiver’s financial institution will have the opportunity to confirm or deny that it maintains the specified account.

Step 5. The receiver’s financial institution sends a positive response to the FedNow Service, confirming that it intends to accept the payment message. Steps 4 and 5 are intended to reduce the number of misdirected payments and resulting exception cases that can occur in high-volume systems.

Step 6. The FedNow Service debits and credits the designated master accounts of the sender’s and receiver’s financial institutions (or their correspondent financial institutions), respectively.”

Once implemented, all they’ll have to do is convert your fiat dollars into digital tokens held in their reserves, and all your finances will be under their sway.

Political Semantic and Fine Print

The Fed is picking words carefully to give the impression they aren’t forcing the digital dollar on us.

In the same post-Terra collapse hearing, Brainard said that the digital dollar could “coexist with and be complementary to stablecoins and commercial bank money” in some future circumstances.

Yet, just a year ago, Powel expressed a polar opposite take.

He said, “You wouldn’t need stablecoins; you wouldn’t need cryptocurrencies, if you had a digital U.S. currency,” using that as an argument in favor of a Fed digital dollar.

Why such sudden “support” for private stablecoins?

Because they know that decentralized private currencies will be gone by the time the digital dollar goes live.

Think about it.

It took just one plotted crash to scare investors off algorithmic stablecoins for good.

Meanwhile, the remaining mainstream stablecoins are backed by the dollar and Treasury reserves. And because Wall Street is their custodian, the Fed has indirect control over their assets.

As I wrote in “Why Did Crypto Crash?“:

“USDC [one of the most popular dollar-backed stablecoins] is not tied to a single blockchain. It’s backed by the dollar and Treasury reserves. And Capitol Hill already pulls strings on it like a puppet.

Not only that, while USDC’s reserves aren’t yet sitting in the Fed’s vaults, they are already regulated by Wall Street, which, as we well know, is the de-facto custodian of the Fed.”

While private stablecoins act like crypto, they only reinforce the digital dollar.

Likewise, in the same hearing, Brainard assured Congress that the Fed won’t digitize the dollar “without clear support from the executive branch and from Congress, ideally in the form of a specific authorizing law.”

Note “Ideally.”

Republican Luetkemeyer astutely picked up on that word, saying it was clever “hedging.” Then Congressman Loudermilk jumped in and asked if the Fed could guarantee it wouldn’t proceed without legislation.

But the Fed’s vice-chair refused to give him a definitive answer.

Later in the hearing, some representatives suggested leaving digital currencies to the private sector as long as they hold reserves with the Fed.

In response, Brainard said that fragmenting the payment system will lead to “instability.” And that the digital dollar would, in effect, dwarf hordes of private digital stablecoins as a settlement currency.

In other words, they’ll legitimize private currencies as play money at best – which contradicts her previous claim that stablecoins and the digital dollar could complement each other.

Remember, pathological liars—especially those who make their living as such—build honesty and trust in one area to conceal dishonesty in another area that really matters.

Regulatory Crackdown

Meanwhile, Capitol Hill is elbows deep in drafting a law that would invalidate private/cryptocurrencies as a means of exchange – just as Ivan once again predicted many years ago.

Last month, the Senate introduced what they proudly call a “landmark” bipartisan crypto legislation.

Titled the Responsible Financial Innovations Act, the bill seeks to set up a legal framework that lets the government regulate digital assets. The initial provisions suggest that all digital assets would be classified into commodities or securities.

From a holder’s perspective, that means they’ll be subject to capital gains tax.

There is, however, a proposed exemption for purchases.

But there’s a catch: purchases can’t go above $200 – yup, barely enough to cover a tank of gas.

In other words, it will act more like food stamps rather than a true means of exchange.

The bill also wants to eradicate all truly decentralized stablecoins that aren’t backed by the dollar.

Via Senate.gov:

“Lummis-Gillibrand establishes 100% reserve, asset type and detailed disclosure requirements for all payment stablecoin issuers. This guarantees that a payment stablecoin holder can always redeem the stablecoin in exchange for the equivalent dollar value, which maintains its value and protects consumers from many of the potential risks associated with stablecoins,” the bill press release stated.”

If this legislation clears Congress more or less as is, private currencies won’t become anything more than “Monopoly” money. And any prospect of building a democratic monetary governance model will go up in smoke.

You’ll be left with de facto outlawed—and easily manipulated—dollar derivatives with little to no real-world utility.

From Neo-Fiscal Policy to Ultimate Censorship

Over the past two centuries, the powers-that-be pursued systematic centralization of money.

We went from the free banking era with hundreds of private currencies… to national banks and an inter-bank uniform currency…to the Fed and its dollar as exclusive legal tender.

Enter the fiat era.

The dollar was de-pegged from gold, and the Fed gained full control over the money supply. Then came quantitative easing, which allowed the Fed to hand out free money to Wall Street.

But at the end of the day, while the Fed oversees all the banks, its power to directly influence the money flow is limited by law because it can’t directly influence the money in circulation.

Its control over the velocity of money (how people spend it) still largely depends on banks that multiply and distribute its dollars throughout the economy.

(I wrote about this in detail in “The End of Monetary System As We Know it.”)

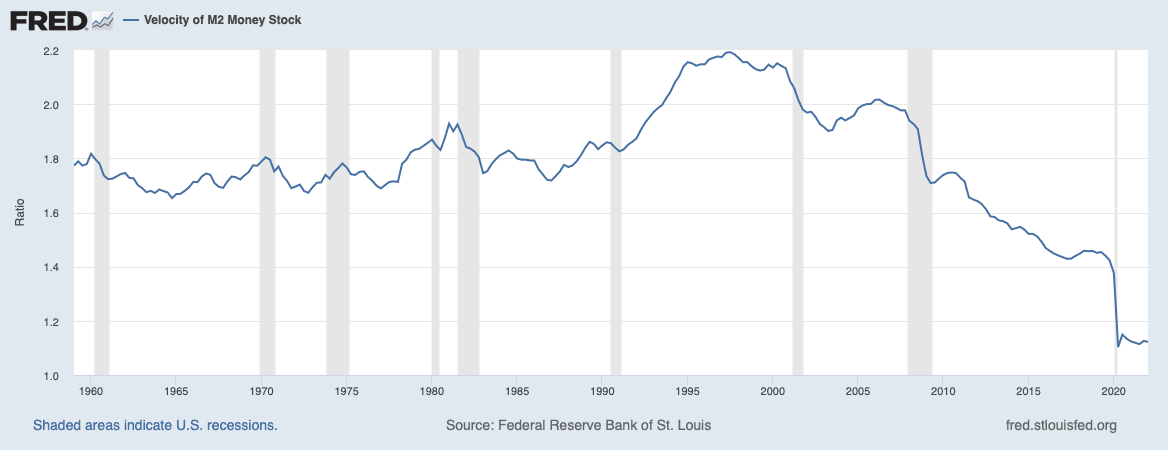

In fact, those who followed the velocity of money (M2 money supply) would have easy predicted the 2020 stock and real estate boom, and also the recent stock downturn and the almost-recession we’re in.

Take a look:

At the beginning of 2020, the velocity of M2 money cratered. This would suggest a full blown depression, or that people stopped spending and invested the money instead; since the economy was still churning in 2020, it would suggest the latter.

With the velocity of money on a steady decline for over 25 years, how can the Fed turn this around?

Therein lies the Fed’s biggest problem: It can’t force people to spend Fed money.

And if people aren’t spending Fed money, they’ll lose trust in it – such has been the case during the past decade of massive money printing that didn’t trickle down to the people.

So what’s the Fed to do?

Ivan has the answer.

Replace Money with Digital Fed Dollar

If you think the Fed has reached its power pinnacle, think again.

The majority of money isn’t in physical cash accounts, such as bank notes and coins, but rather commercial money – deposits and money the bank has on its balance sheet.

If the Fed had the technology to replace cash, it would no longer need brick-and-mortar gatekeepers.

Instead, it can introduce digital dollar tokens, disintermediate commercial banks, and control all currency in circulation.

This isn’t some conspiracy theory.

In fact, the Fed openly admits it.

“A widely available CBDC would serve as a close—or, in the case of an interest-bearing CBDC, near-perfect—substitute for commercial bank money.”

The implications are endless.

In theory, the Fed could pursue some kind of neo-fiscal policy for lack of a better word. As a “wholesale lender,” it could fund select companies and organizations without commercial banks or even the backing of Congress.

“Other concerns revolve around the role of a central bank as a wholesale lender of first resort. State-controlled credit could potentially be susceptible to political pressure for sector-focused lending. Would there be formal criteria for determining which banks [or sectors, think tanks, companies] would qualify for central bank funding? How easy would these be to manipulate in some way?”

In fact, we’ve seen early manifestations of such arbitrary funding during Covid when the Fed bypassed banks and lent money directly to big corp through the Secondary Market Corporate Credit Facility.

The question is, which mandate gave them the power to choose who would receive preferential treatment? Why did most of the money go to Big Corps that weren’t even in need of cash?

For example, the top three most-funded companies were foreign conglomerates, including Volkswagen and Toyota. And fifth came Apple, which was sitting on $38 billion of cash at that time.

The digital dollar has political utility, too.

With programmable digital tokens, the authorities could easily tax and censor those opposing the status quo. As I wrote in “CBDC China: Authoritarian Experiment Goes Mainstream“:

“For example, the government can suddenly deduct a “tax” from your savings to fight climate change. Or punish the unvaccinated with “health insurance surcharges.” Or even straight up freeze digital wallets to censor opinions…”

Heck, Trudeau and his Liberals just introduced Bill C-11. Biden tried to implement a disinformation board. Imagine the control the Fed and the governments would have if our currency became truly digital.

Of course, the people must maintain trust in Fed money for all of this to happen – it’s hard to maintain trust if almost all of the money belongs to commercial banks.

The only way to maintain trust is to give the perception that the people, not the banks, are in control of the money.

The only way to do that is to increase the velocity of money – the more people spend, the less that money sits under commercial bank control.

Which leads us to the Fed’s simple but ultimate solution: the digital dollar.

With the digital dollar, the Fed could issue digital money with an expiration date – a sort of crypto smart contract that forces you to spend the money before it expires.

In other words, during the next “pandemic” and free money bailout, the Fed could MAKE you spend the money instead of allowing you to save or invest it.

Money velocity solved.

What’s Next?

A lot of you have been asking me: How should I protect myself in light of all this?

Short answer: diversify into real assets.

It’s much harder to take away, debase, or “pre-program” a physical thing that’s held its intrinsic value for thousands of years.

And lastly, Ivan urges you to not look at this downturn/recession as a negative – look at it as a positive for yourself. You can’t control it, but you can prepare for it.

Everyone is asking what to invest in NOW?

But the key is patience – not easy when we just had the biggest and longest bull market in history.

I hoped you’ve been listening to Ivan the last decade and made as much money as possible during the bull market, before this predicted downturn.

We hope you’re now cashed up as a result because if we start transitioning to a digital dollar, we’re going to see spending go through the roof.

When this happens, the economy will rebound with massive force. Then you’ll witness real inflation.

In the next cycle, millionaires will become billionaires, and billionaires will become trillionaires.

And you too could become much wealthier – but only if you’re prepared by being patient now, and armed at the ready to take big risks on the rebound.

Seek the truth and be prepared,

Carlise Kane