We have an inherent cognitive flaw.

As a species, we are quick to respond to instant changes. For example, if we touch a hot plate, we instantly know not to do it again.

However, if that change manifests over a longer time, we unconsciously adapt and become blind to it—for example, long exposure to the hot sun, which can lead to cancer over many years.

Kind of like the boiling frog that blithely swims in a pot of water as it comes to a boil.

Ivan’s Boldest Prediction

In 2017, Equedia’s founder Ivan Lo predicted “the Great Reset” and broke down the sequence of events that would lead to it. Here’s a quick summary from his letter “These Six Events Will Determine Our Future“:

“…I want to paint our current picture to give you a bird’s eye view.

It plays out like this (with many of these points overlapping one another):

1. Inflate: Make people feel good by giving them cheap money through Quantitative Easing (QE) and low-interest rates – increase the money supply.

2. Deflate: Take the good feeling away by taking away cheap money through Quantitative Tightening (QT) and higher rates – decrease the money supply.

3. Control: Subdue the population by taking their focus away from the real situation. Think media control; think the increase of opioid usage and the legalization of marijuana; think President Trump; think billionaire-funded protests.

4. Divide: Segregate society by inducing riots and hate crimes.

5. War: Mask the international financial and economic crisis through the rhetoric of war, or even war itself.

6. Reset: Global economic reset will be blamed on war; not the monetary actions of the powerful elite.”

Six years ago, much of the above would seem like a conspiracy. Today, we’ve seen every event happen, with number 6 slowly playing out.

This might give the impression that the Great Reset will play out as a major historic event. But in reality, it’s a well-disguised, multi-decade wealth transfer that will enslave you without you even realizing it.

Let me explain.

Inflating/Deflating Cycles

In his Great Reset prediction, Ivan mentions the Fed’s monetary cycles.

Many think the Fed’s inflate-then-deflate policy is a zero-sum game that resets itself with each cycle, but it isn’t.

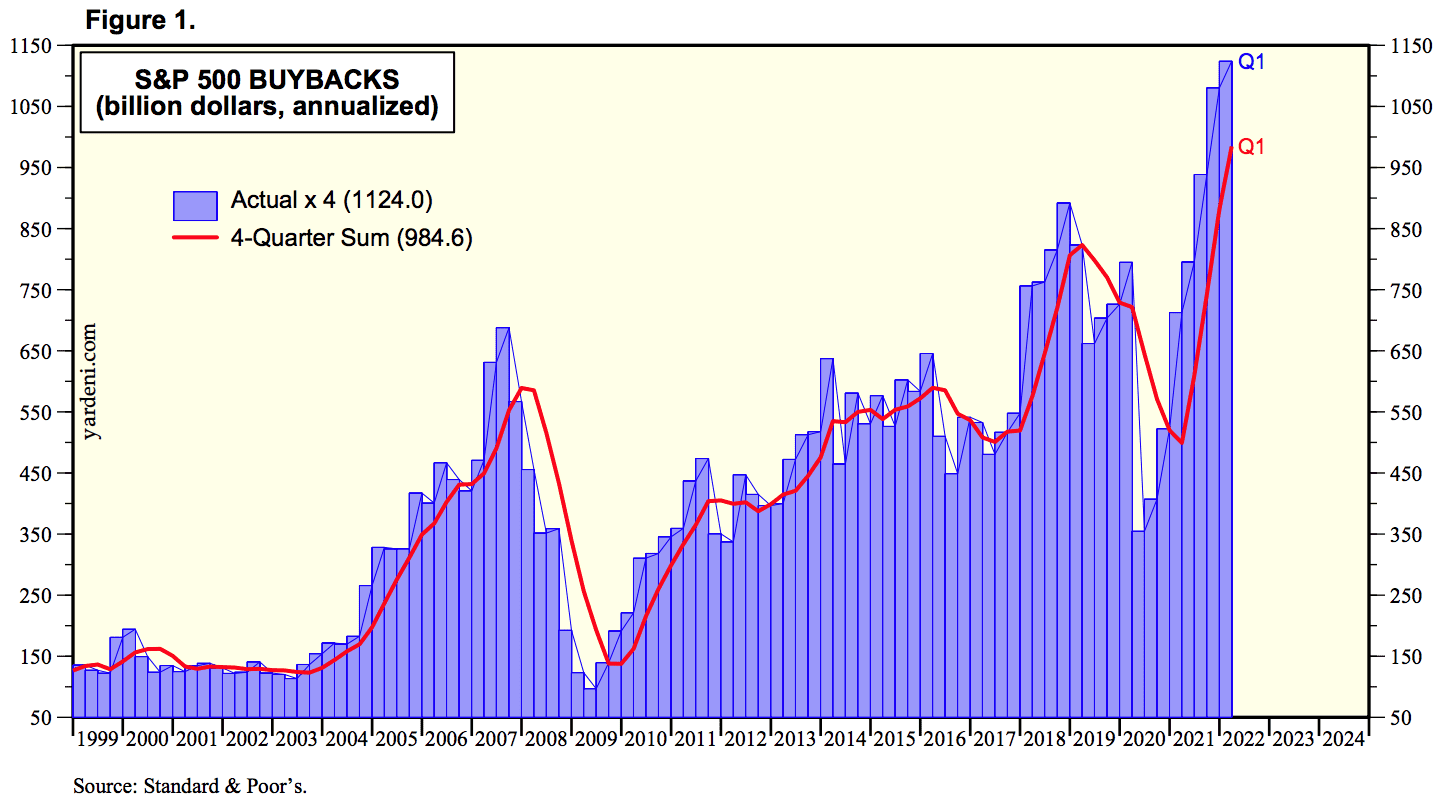

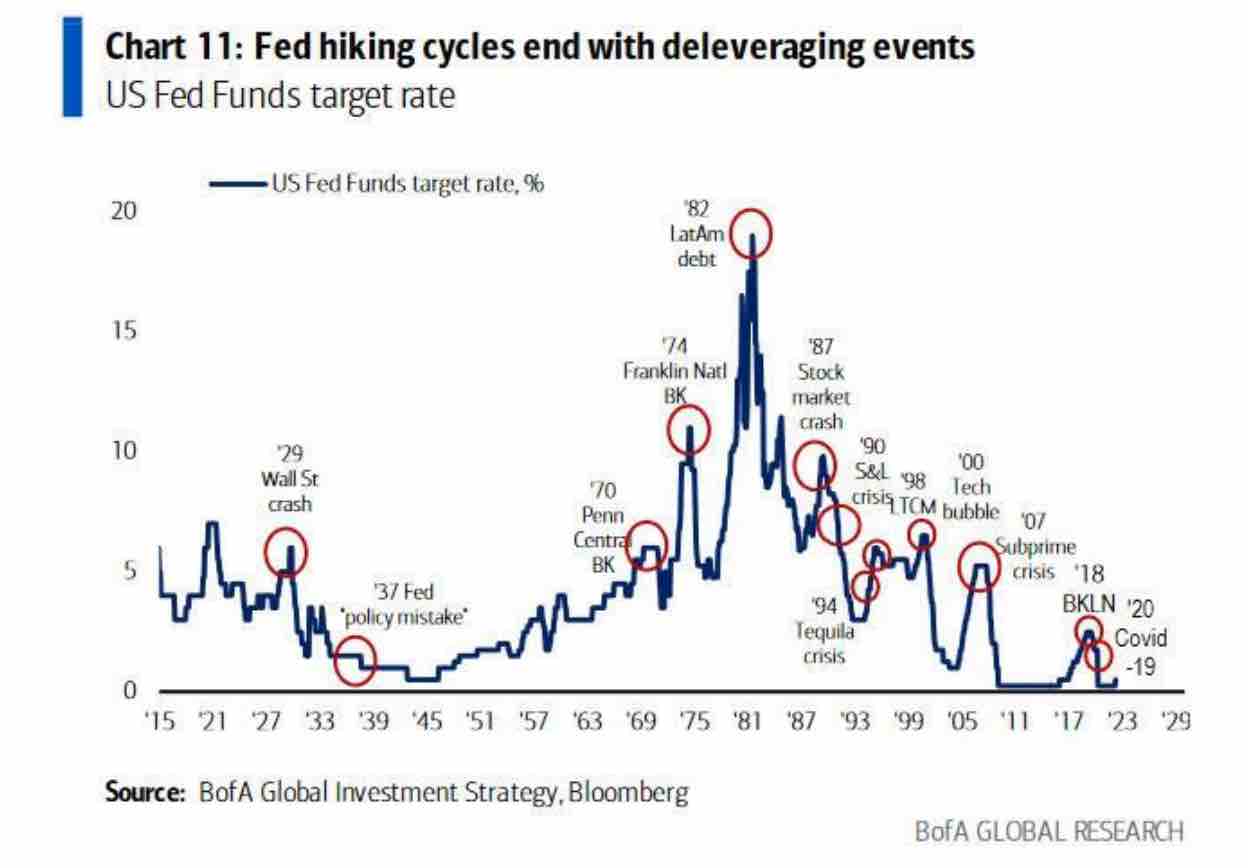

Take a look at this Bank of America chart showing the Fed’s cycles over the past 100 years:

Note the pattern that began after Volcker’s ’80s tightening—the first deflating cycle after the dollar was de-pegged from gold and became a fiat currency.

Every deflating cycle was smaller than the one that preceded it. The Fed just couldn’t raise rates enough before the economy threw a tantrum and had to loosen up again.

Although policymakers present it as the riddle of the century and one of the greatest policy challenges, you don’t need a horde of PhDs in the Fed’s ivory tower to answer it.

In fact, there’s a very simple explanation for it: accumulated debt.

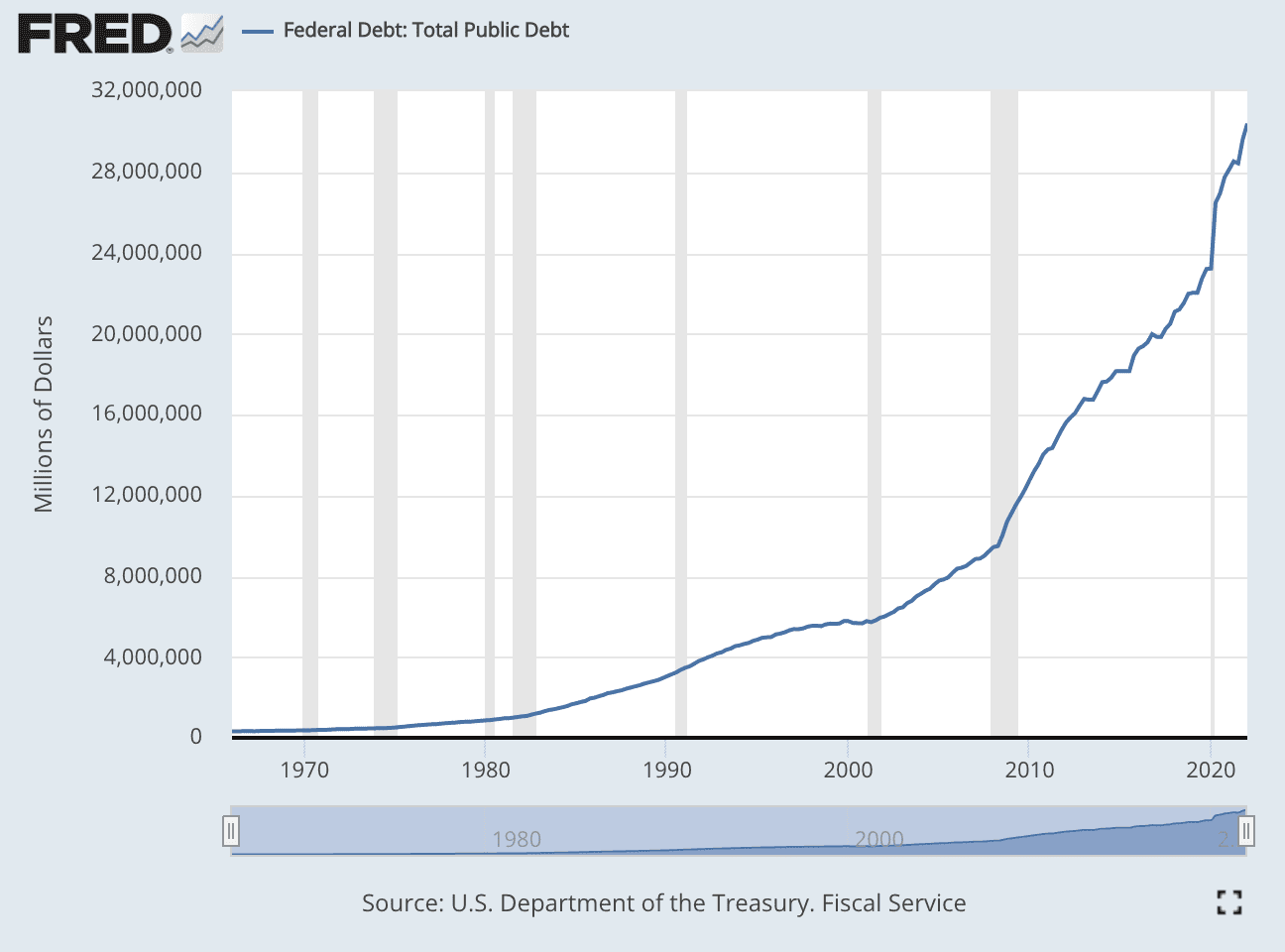

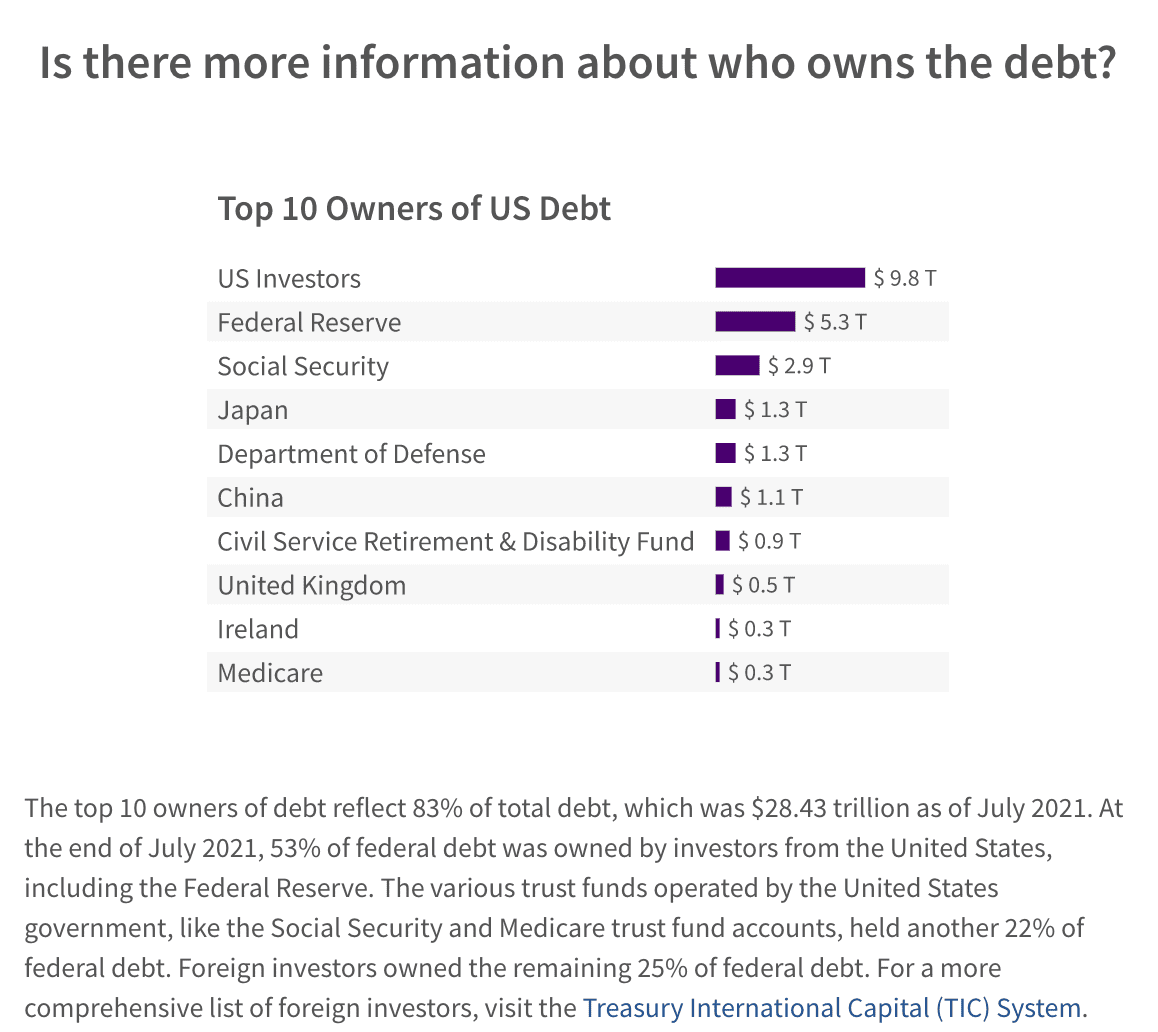

Each inflating/deflating cycle foisted more debt into the economy. For example, take a look at federal debt growth in the US:

And as I revealed a few weeks back, this on-the-book debt is just the tip of the iceberg. From “The Great Debt Trap (Part 1)”:

“This hockey stick-shaped graph is just the official, on-the-books federal debt. It doesn’t include the lion’s share of other obligations—such as Medicare and Social Security.

In fact, the Treasury’s February fiscal report data revealed that, if you include benefits and entitlement programs, total federal obligations crest over $100 trillion. That’s 100,000,000,000,000!”

Private debt is off the charts, too:

“…A decade of the Fed’s near-free money led Americans to build up a record $15.6 trillion of debt. Despite that, the appetite for credit continues to blossom. Last year, consumers were taking out loans at the fastest rate since 2003.

Corporate America isn’t falling behind, either. In 2021, non-financial corporate debt hit a record $11 trillion, according to the Fed’s data. But, most worrisome, the biggest pile-on was recorded in the most “uncreditworthy” companies.”

This ever-growing pile of debt is a monetary feedback loop.

More debt makes the economy more sensitive to the cost of money. As a result, the Fed loosened policy and debased the currency, forcing even more debt into the economy.

And on goes the vicious cycle.

Think about it.

It took US Fed Chair Jerome Powell hiking rates to just over 1.5% to cut the value of many stocks in half!

Can you imagine how leveraged the economy is when it can’t operate at half the cost of money as it has in the past 100 years?

Ever-Growing Debt and Lower Rates

It’s clear that this combo of ever-growing debt and declining cost of money may give the economy a short-lived boost but is unsustainable in the long run.

At the policy level, more debt means the Fed has less wiggle room to raise rates because the economy is more reactive to debt servicing costs. In turn, the Fed keeps buying assets, driving rates lower—even when the economy is strong.

Such has been the case over the last decade.

In order for the Fed to keep rates artificially low, it has to buy bonds from the Treasury as part of quantitative easing (QE).

In fact, the Fed has bought so many Treasuries that it’s the second-biggest lender to America – second only to America itself.

Congress, of course, could use that money to curb deficit spending and pay off federal debt. Yet, it uses it to finance its elite-favoring agenda while drowning the nation in more debt.

At the economic level, the Fed’s loose policy forces people and businesses to go into debt, too—whether they like it or not. I wrote about this surprisingly little-discussed phenomenon in my letter “The Great Debt Trap (Part 1)“:

“Say you run a small coffee shop on a busy street bustling with a dozen cafes competing for your customers. Then one day, the Fed slams down the rates, and your barista competitors seize the chance to take out cheap business loans.

They use that money to spruce up storefronts, buy fancy Italian coffee machines, or refurnish their venues to create a more inviting atmosphere—all to lure in more customers. Including yours.

How do you stay competitive?

You do the same thing as them: borrow.

Even if you were doing just fine without debt, now that your competition is leveraging cheap money, so must you—or else you’ll fall behind. It’s a rat race of debt.

The same goes for people in general.

During Covid, Americans fell over themselves to buy homes in fierce bidding wars. And it wasn’t just about cheaper mortgages – many wanted to lock in the deal before cheap money jacked up housing prices even more.

Can you blame them for taking on debt out of fear of getting priced out of homeownership—like tens of millions of Americans who already have?

In other words, cheap money is forced conformity to debt.”

So what happens when the nation collectively has more debt? Costs rise and it becomes less productive.

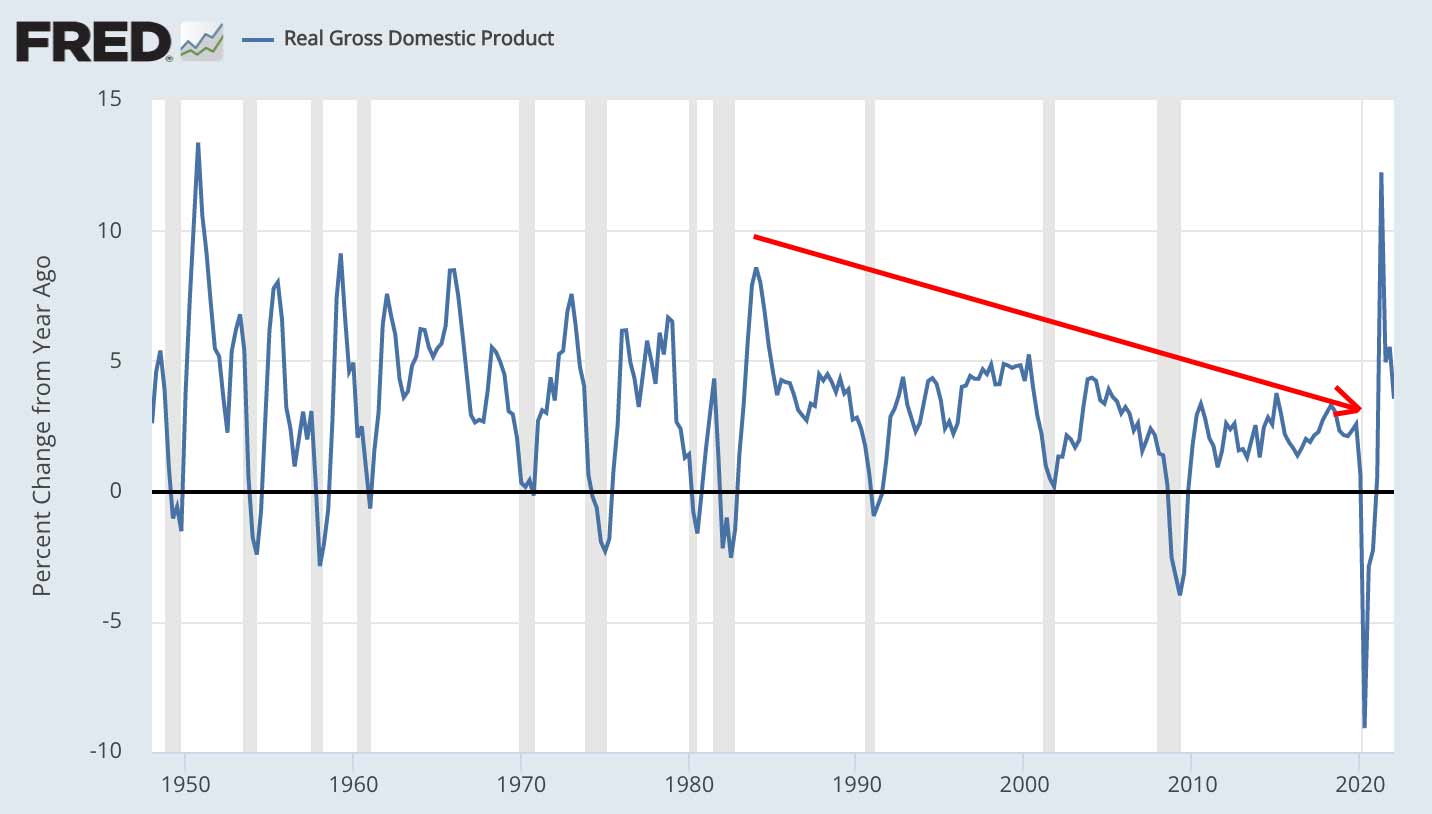

Look at how America’s real GDP growth had been persistently slumping from 1980 until Covid (Covid skews the picture because trillions of dollars were shoved into the economy over a short time):

Socializing Losses, Privatizing Profits

So we’ve got a deteriorating economy that keeps piling on debt, and we’ve been trimming the cost of money to postpone paying the piper.

How is it in anyone’s interest to hold this feedback loop as the status quo? Aren’t the elite sabotaging themselves by destroying the very “soil” that feeds them? Unfortunately not.

Have you heard of the saying “privatizing gains, socializing losses”? It refers to the policy that treats company profits as the sole property of shareholders and its losses as a national responsibility.

Let me give you an example.

In the last decade, America’s 500 biggest companies plowed $22.5 trillion of their earnings into buybacks. Instead of expanding business or just saving up for a rainy day, they spent that money to artificially prop up their stocks.

In fact, corporate America snapped up so many of their own shares that they even out-invested Wall Street. As I wrote in “The Biggest Dealer in the World“:

“Take a look:

-

- From 2018 through 2019, companies in the S&P 500 spent more money on buybacks than on CAPEX (source)

- Worse, more than half of these buybacks were financed by debt (source)

- During 2018 (when economic confidence was at the peak and buybacks hit a record), real wages in the US dropped 1.4% (source)

- And for most of the 2010s, corporate America gobbled up more stock than institutional, retail, and foreign investors combined!”

Think about it.

The Fed made money so cheap and the economy so indebted and weak that corporations saw no point in investing back in business. The economy wasn’t growing fast enough to justify the expansion.

The rich aren’t too concerned about it.

Buybacks handsomely reward the biggest shareholders and top executives who earn most of their fortunes through capital gains – which is precisely why Ivan said, despite all the doom and gloom after 2008, to stay invested in the stock market.

But what happens when things hit the fan, and these buyback-infused companies stumble? The Fed steps in and bails them out by lending them billions of printed dollars.

A good example is Covid and airlines.

Via the Guardian:

“The United States’ five largest airlines – which are pushing for a $50bn-plus bailout to help them survive the Covid-19 crisis – have handed out more than $45bn to shareholders and executives over the last five years, research by the Guardian has found.

Delta, American Airlines, United, Southwest, and Alaska have spent $44.9bn on share repurchases and dividends in the last five years, according to Guardian research. In addition, nearly $750m has been paid out to executives over the same time period.

According to separate data compiled by Bloomberg, these five airlines have spent 96% of their free cashflow on buying back their own shares over the last decade.”

No wonder buybacks keep breaking records quarter after quarter despite recession fears:

Why bail out companies that budget their money for capital distribution schemes?

No wonder the elite aren’t pushing for policy change.

Why would they care about long-term consequences that will be “socialized” when they can exclusively “privatize” short-term gains?

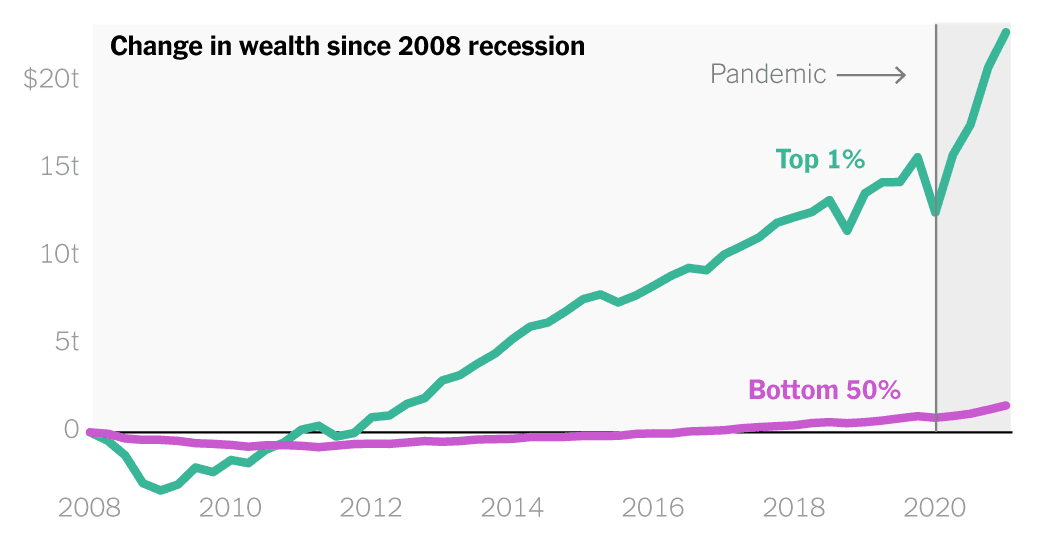

I can give you many more examples. But the most irrefutable proof is in inequality, which is growing in line with the Fed’s increasingly loose policy.

Take a look at this chart:

Not only did the bottom 50% see no real net worth grow or any increase in their real income, but most of them have been priced out of homeownership.

Worse, they’ll now have to collectively fund this ever-growing pile of debt with their quickly depreciating money.

Gradually, Then Suddenly

This is the Great Reset unfolding before our very eyes.

It’s a systematic wealth transfer that’s quietly sucking the money from the bottom classes through debt and faux capital distribution schemes—like the ones I just showed.

And it’s damn effective because GDP growth won’t bring people to the streets.

The “boiling point” is somewhere over the horizon, but I don’t believe we’re there yet. The Elite has many more creative ways to impose more debt on the nation while “privatizing” the short-lived gains that come with it.

- There’s Modern Monetary Theory (MMT) that tries to legitimize unlimited deficit spending.

- There’s the Fed Secondary Market Corporate Credit Facility (SMCCF) introduced during Covid that the Fed can use to gobble up assets directly from corporate America at its discretion. Who knows, maybe next time they’ll buy stocks like Japan.

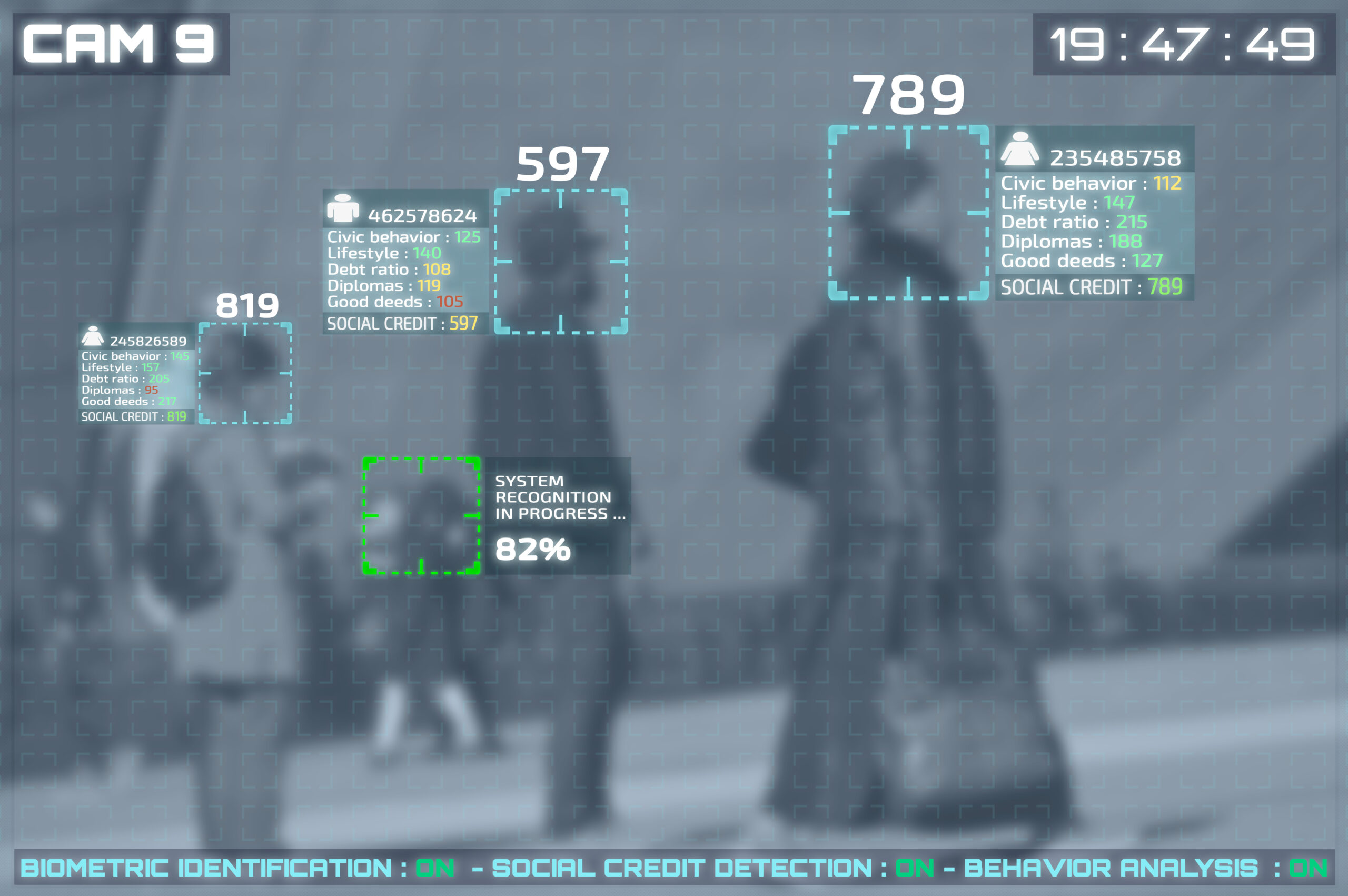

- Then there’s the upcoming digital dollar, which can open up a new array of economic positives. In the last letter, I discussed a “neo-fiscal policy” that could inject the Fed’s printed dollars directly into select industries or companies and Ivan’s prediction that we could have “expiring money.”

There’s no better way to summarize this letter than these two lines from Ernest Hemingway’s novel The Sun Also Rises:

“How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

Seek the truth,

Carlisle Kane

BRANDON IS THE LEADER OF THE NEW COMMUNIST PARTY BUT HE IS JUST A PUPPET BEING CONTROLED BY THE SUPER RICH AND WE KNOW WHO THEY ARE !! WHY DON’T SOME OF OUR AMERICAN EX MILITARY SPECIAL FORCES GET TOGETHER AND TEACH THESE WORTHLESS BASTARDS A LESSON ON OUR CONSTITUTION AND BILL OF RIGHTS WITH A LITTLE PRESSURE ??? JUST ASKING !!!!! VIETNAM VET 67-68

All human affairs are cyclical. But in the late 1970’s the U.S. Congress passed a law that bans economic downturns. That law tasked the Fed with attaining, and then maintaining, full employment at low inflation. How is the Federal Reserve attempting to meet the low inflation part of its dual mandate from Congress? By putting most of the new money that comes from them into the system as loans from banks. Loans have to be paid back. But the federal government is also attempting to prop up the economy with ever-increasing amounts of borrowed money. The national debt eventually going exponential under those circumstances is completely inevitable. I predicted it a long time ago already. And the consequences of the national debt going exponential will not be good.

So what does someone with $1M in cash and stocks (60-40) invest in now?

All very interesting but what is a normal person supposed to do about it? Being aware doesn’t pay no bills.

The GDP graph purports to show decline since 1980 but the decline is across the whole of the graph, ie: since 1950

THIS STEEPING VOLCANO GOES BACK TO THE ROMAN EMPIRE DAYS “CONTROL THE MASSES ” THUS MANIPULATION FOR POWER AND WEALTH BY THE FEW OVER THE POPULICE.