From stocks to real estate, food to lumber, watches to digital art – everything is up.

And yet, there’s no inflation.

In fact, the Bank of Canada believes that inflation expectations for the next two years remain relatively stable.

Even the Federal Reserve doesn’t see inflation running out of control.

Perhaps they know something we don’t.

So let’s find out what they’re really up to by looking at the bigger picture.

Remember, everything happens for a reason…

A World of Money

In 2017, the U.S. annual deficit ballooned to $665 billion – over $160 billion more than originally requested. It was the biggest shortfall since 2013 and the sixth-highest on record.

“Experts” called it reckless spending.

But if that’s reckless, what do you call racking that type of debt in just one month?

The U.S. government just posted a March budget deficit of a whopping $660 billion – $5 billion shy of the entire 2017 “reckless” annual deficit.

Meanwhile, “the deficit for the first six months of the 2021 fiscal year ballooned to a record $1.706 trillion.”

The Fed’s balance sheet now stands at almost $7.8 trillion.

In other words, while it appears the world is full of liquidity and money, it really is just full of debt.

And most people don’t even know it – or even where it’s coming from.

Is Free Money Really Free?

Remember back in 2016 when I told you that governments would soon begin to offer free money?

Via The Secret Government Experiments (2016):

“Everything from Brexit to China’s economic and financial bubble, to the thought of the Fed raising rates, all of these near-term nuisances of politics and financial maneuvering converge into one overall theme: debt.

More importantly, how debt is managed.

Over the past years, I have talked about how the debt bubble – short of a global financial reset – has no choice but to get bigger.

And that’s precisely what’s happening.

Global debt continues to climb to record new highs.

We’re not talking a small amount either; the world is now issuing trillions upon trillions of new debt every year.

In China, total debt (China’s total corporate, household and government debt) grew to a ratio of over 280% last year.

In the U.S., it grew to a staggering 331%.

In Japan, over 400%.

Many countries in Europe, such as Ireland, Portugal, Belgium, Netherlands, Greece, Spain, and Denmark, are all over 300%.

In other words, the total debt-to-GDP ratio in the nations that contribute to the four main world currencies – the Dollar, Yen, Euro, and Yuan – all have exploding debts that are continuing to, well, explode.

This is precisely why central banks around the world are not only NOT raising rates, but some have already deployed negative rates, including Japan and the E.U. – home to two of the five world reserve currencies.

So while most central banks are talking about negative rates, the Fed is the only one talking about raising them.

But if the Fed raises rates too soon, the U.S. will certainly see a decline in exports, which then makes it harder to collect the necessary taxes to pay for its growing debt.

Negative Interest Rates

So, it was no surprise that the Fed announced that it would keep interest rates at 0.25% this week.

The Fed and other central banks believe that if they lower rates, people will spend more or invest in riskier assets because the cost of storing cash becomes too high.

And since governments around the world (including the U.S.) are the biggest borrowers of money, low-interest rates are great.

It means these governments can continue to borrow money and go deeper into debt. The government’s idea is that by spending cheaply borrowed money, they can pull themselves out of debt through economic growth and tax collections.

It also means that banks can borrow money for next to nothing – literally free cash – and then earn profits from that money by lending or other activities such as investing.

On the flip side, if you’re responsible with your money and save – say for your kid’s college tuition or your retirement – low-interest rates aren’t so good.

That’s because when you leave your money in the bank, you might earn a small interest rate. Given how low rates are today, that’s likely 0.1% interest.

In the U.S., inflation has averaged over 2% since 2000. That means that when you adjust for inflation, people who keep their money in the bank are actually losing money every year.

The problem is that no matter how much our governments spend, they simply can’t fix the growing debt problem because of the amount of money required just to service that debt.

The Double-Edge Sword

The lower the interest rates, the more we go into debt.

The more we go into the debt, the more the central banks – the primary holders of this debt – maintain control.

So we’re really in a lose-lose situation.

If we raise interest rates, nations around the world are crippled because their ability to pay off this debt is diminished as a result of the mass amount of debt they accumulated at a low-interest rate.

Global debt has grown by at least $57 trillion (2014*) to $199 trillion, and no major economy has decreased its debt-to-GDP ratio since 2007.

*We’re well beyond that number today.

But at the same time, leaving interest rates low just leads to more borrowing, and the only way to service that debt is by more borrowing.

In the end, the central banks win by maintaining direct control of the world’s governments through monetary policies. If a central bank says jump, a country has to ask, “how high?”

If our governments don’t do as ordered, the central bank simply raises rates, and the country falls into money trouble.

And Canada is no exception, especially since Trudeau is now leading us on the same path.

Canada and Trudeau

Last week, I talked to a mortgage broker about interest rates.

He said that it’s probably best to lock something in because Canada is likely raising rates since we often follow in the footsteps of the U.S., whose central bank has suggested that rates will be raised.

But then I asked him about the housing bubble we currently face.

I asked, “If rates are raised, wouldn’t our housing market be crushed because so many new homebuyers have taken out massive mortgages based on low rates?”

He said that could happen, but banks are very strict with their lending practices in Canada.

Then I asked, “What about Trudeau’s plan of spending billions upon billions of borrowed dollars, based on the assumption that interest rates will remain low?”

He started to scratch his head.

My point is this: With Trudeau’s budget and our current housing situation, the likelihood of Canada raising rates anytime soon is highly unlikely.

Especially when Trudeau tells us that this year’s $30 billion deficit is not a hard limit.

Via Toronto Sun:

“Prime Minister Justin Trudeau suggested on Thursday that a $30 billion budget deficit was not a hard limit as the government’s focus should be on spurring economic growth.

In a wide-ranging interview, Trudeau, 44, said he was not obsessed with a “perfect number” for the budget deficit and instead vowed to find the right path to economic growth, saying that was more important than a specific deficit target.”

Perhaps this is yet another reason why Canadian investors, including institutions, are becoming more speculative. Money is cheap and will likely remain cheap, and the cost of holding money is more than it would be to deploy it in riskier assets.

So what’s the solution?

Government Experiments on Free Money

The only way out is to either raise taxes exponentially, which hurts the economy, or the last and final resort: helicopter money.

What is helicopter money?

Helicopter money is exactly what it sounds like: free money from the skies.

To make things simpler, imagine a tax break or a tax refund given directly to you by the government, which borrowed it from the central bank.

Of course, it’s only temporarily free. The money is still owed by the government to the central bank.

And government debt equals taxpayer debt.

It’s essentially forcing you to borrow money from the central bank.

Don’t think for one second that this is a far-fetched idea.

In fact, not only did Janet Yellen not raise rates this week, she actually alluded to the fact we could see helicopter money coming:

“It is something that one might legitimately consider.”

In Europe, lawmakers are already urging the central bank to deploy free money to citizens.

Via F.T.:

“In an open letter to ECB president Mario Draghi, 18 members of the European Parliament’s social democrat, leftwing and green groups, say that the ECB should look at helicopter money as well as buying bonds from the European Investment Bank “as possible solutions to enhance economic development through direct spending into the real economy.”

Don’t think Canada is out of the question. In fact, basic income experiments are underway – an experiment whereby the government gives people money for free, for nothing.

Don’t believe me? Check Trudeau’s pre-budget report; it’s in there.

In Japan, this is already happening through government asset purchases of stocks.

So what’s wrong with free money (aside from the fact it’s not really “free”)?

The more there is of something, the less it’s worth…”

So while average Joes’ believe the government is helping them by giving them money during this “pandemic,” what’s really happening is that they are forcing their citizens to go into debt.

But that’s not even the most sinister part.

As that last sentence reads, “the more there is of something, the less it’s worth.”

Inflation All-Around

It doesn’t take an expert to see rising prices everywhere – especially where it counts: housing and food.

In the U.S., the average home is up 17%, with asking prices reaching all-time highs.

Via Redfin:

-

- The median home-sale price increased 17% year over year to $341,250, an all-time high. Asking prices reached an all-time high of $353,750.

- Homes that sold during the period were on the market for a median of 23 days, the shortest time on market since 2012. This was 15 days fewer than the same period in 2020.

- 43% of homes sold for more than their list price, an all-time high. This was 17 percentage points higher than the same period a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased 2.1 percentage points year over year to an all-time high of 100.7%, meaning the average home sold for 0.7% more than its asking price.

- 59% of homes that went under contract had an accepted offer within the first two weeks on the market. This is a new all-time high (Redfin’s data for this measure goes back to 2012).

- 46% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high.

Canada is no different, with the average price of a home rising at the fastest annual pace ever.

Via CBC:

“Canada’s red-hot housing market continues to defy expectations, with sales in March up 70 per cent compared to a year ago and average prices up by more than 30 per cent.

… On the price side, the average selling price for a home sold on CREA’s MLS system was $716,828. That’s up by 31.6 per cent in a year, and the biggest annual pace of gain on record.”

And when it comes to food?

Via NBC:

“Shoppers had better start budgeting more for their groceries, according to the latest consumer price index, which shows prices are increasing — and they’re likely to keep going up.

The monthly consumer price index, released Tuesday morning by the Bureau of Labor Statistics, showed a 0.6 percent increase in March, the largest one-month increase in nearly a decade. Over the past year, prices have increased by 2.6 percent overall.

Gas skyrocketed by 9.1 percent last month. Since February, prices of fruits and vegetables have risen by nearly 2 percent, and the index for meats, poultry, fish and eggs has risen by 0.4 percent, according to the government figures.

The spike comes on the back of prices that had already risen during last year’s pandemic stockpiling and supply chain disruptions and never went down.

… Before the pandemic began, the national average for a pound of bacon in January 2020 was $4.72. By last month, the price had soared to $5.11, according to exclusive supermarket point of sale data from NielsenIQ. Ground beef is up to $5.26 a pound, from $5.02. Bread is up to $2.66 a loaf, from $2.44.

…Boston and Philadelphia are paying nearly a dollar more per pound of bacon, while in Chicago it is up by about 70 cents. Several items spiked by over 5 percent at once in Dallas, including eggs, chicken breast, fresh ground beef and sandwich bread.”

In Canada, food prices are expected to go up by as much as five per cent this year.

Meanwhile, global food prices are surging and have now spiked for the tenth month in a row.

Get the point?

When you increase the money supply by such unfathomable amounts, inflation ultimately follows.

And while the powers that be can simply change inflation numbers by changing how it’s calculated, as the Fed just did by discontinuing the M1 and M2 weekly money supply series, average Joes still feel the pain.

Remember: Inflation is the ultimate destroyer of the lower classes. It is the primary power that separates the rich from the poor. The higher inflation goes, the bigger the wealth gap.

And that has been the plan all along…

Middle Class Wipe Out

Over the past years, I have told you that the goal of the elites is to shrink the middle class; that even the policies created from the COVID pandemic was designed to do just that.

Via my Letter, “the Boldest Prediction of 2020” from November:

“The COVID-19 lockdowns and restrictions will be used once again for the purpose of this Great Reset.

The billionaires associated with this Great Reset will end up owning everything in the aftermath. They will be the only ones left with enough money to pick up the broken pieces of the economy.

Moreover, they will end up owning entire sectors of the economy (think the travel industry) by buying bankrupt corporations (think retail outlets, hotels, and airlines) – and even bankrupt countries.

The government will also step in and buy the broken pieces of these assets and turn them into low-income housing, to further support their initiative and sustain their grasp on voters. The Canadian Liberals are already doing this.

This will be the biggest generational wealth transfer in history.

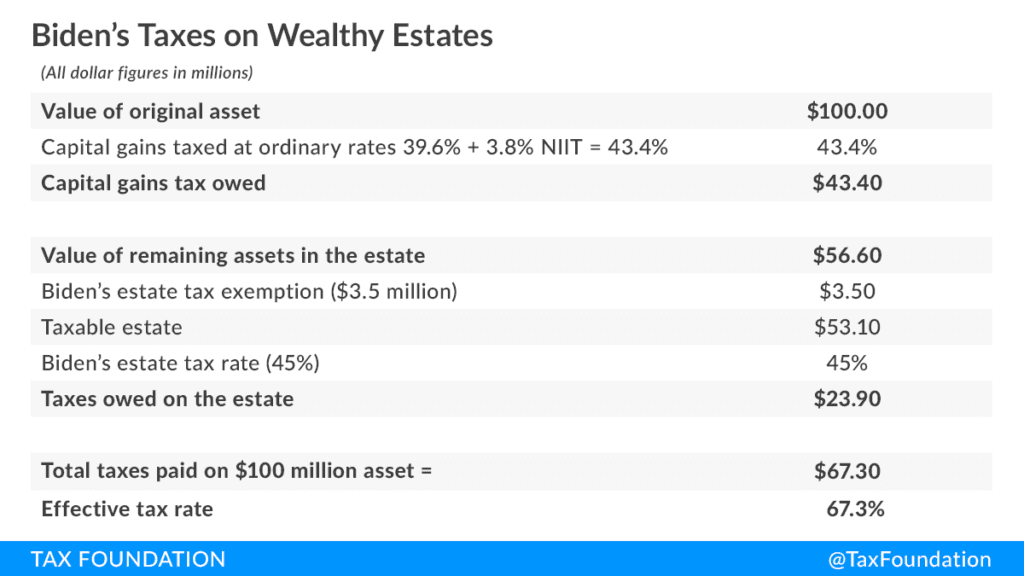

It’s no wonder Biden’s tax plan calls for an incredible increase on the effective tax rate on estates, equal to a whopping 67.3%!

Take a look:

Good luck leaving anything to your children when you pass.

What about work?

Without a doubt, unemployment will climb – and even more so as A.I. takes over. This will force governments to establish some sort of universal basic income (I already predicted this in my letter from 2016, The Secret Government Experiments). Much of this will be paid for by the hard-working and risk-taking entrepreneurs, as the wealth tax forces them to become less-wealthy and thus less challenging to the elite.

Those with homes and mortgage payments who have lost their jobs will be able to remain in their homes but will have to hand over their property through some type of reverse-mortgage-style payment. Those who remain solvent will see their property taxes increase to level the playing field.”

Think about it: businesses have been forced to close, and much of the global economy has been derailed as a result of COVID-19 policies.

Yet, housing prices are climbing at a record pace.

Meanwhile, politicians are talking about raising property taxes. The higher housing prices climb, the bigger the tax bill.

So, is it a surprise that 54 million people fell out of the middle class in 2020?

Via Pew Research:

“A new Pew Research Center analysis finds that the global middle class encompassed 54 million fewer people in 2020 than the number projected prior to the onset of the pandemic. Meanwhile, the number of poor is estimated to have been 131 million higher because of the recession.”

The policies designed to protect us are simply making the rich richer and the poor poorer.

Via The Times:

“The wealth of the world’s billionaires has grown by $4 trillion during the pandemic, even as the global economy suffered its deepest recession since the Second World War.”

And via Fast Company:

“…In the past year, the combined wealth of the (U.S.) nation’s 657 billionaires has increased more than $1.3 trillion, or 44.6%. These billionaires now have a combined net worth of $4.3 trillion, exemplifying the idea of a K-shaped recovery.

… there are 43 new billionaires who didn’t even exist at the start of the pandemic.”

Go figure.

There’s no doubt inflation exists and in much greater numbers than what the “data” show. And you can bet some are already loading up and preparing for the breakout scenario.

And one of them is the world’s rising power and the biggest threat to U.S. dominance: China.

China’s Strategy

According to Statista, Beijing has now displaced New York with the most billionaires.

And while the West continues to struggle with a post-COVID recovery, China is thriving. It just posted a whopping 18.3% GDP growth in the first quarter, and it was the only major economy to report economic growth last year.

In other words, it would be wise to pay attention to China’s actions.

So what exactly has China been doing?

For years, I have been detailing how China has been working with other nations to bypass the US Dollar in international trade.

For example, in 2017, I told you how China was going to launch a yuan-denominated oil futures contract, backed by gold:

Via How the US Dollar Will Collapse:

“Crude exports are primarily priced through the Brent, WTI or Dubai benchmarks – all of which are priced in U.S. dollar.

If China solidifies its rank as the number one importer of oil in the world, it would still be at the mercy of benchmarks priced in U.S. dollar.

In other words, if China truly wants to compete with the U.S. dollar, it must begin pricing oil in its own currency. It must have its own benchmark or marker to serve as a reference price for buyers and sellers of crude oil.

And that’s why it has been working on launching its own crude oil futures on the Shanghai International Energy Exchange.

But there’s a problem.

Why would foreign exporters want to remove themselves from the trusted and easily convertible U.S. dollar?

Simple. Back it up with something tangible.

Via Asia Nikkei:

“…China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry.

The contract could become the most important Asia-based crude oil benchmark, given that China is the world’s biggest oil importer. Crude oil is usually priced in relation to Brent or West Texas Intermediate (WTI) futures, both denominated in U.S. dollars.

China’s move will allow exporters such as Russia and Iran to circumvent U.S. sanctions by trading in yuan. To further entice trade, China says the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong.”

Not only will China’s oil benchmark be priced in yuan, but those still wary of the yuan could convert their holdings into gold.”

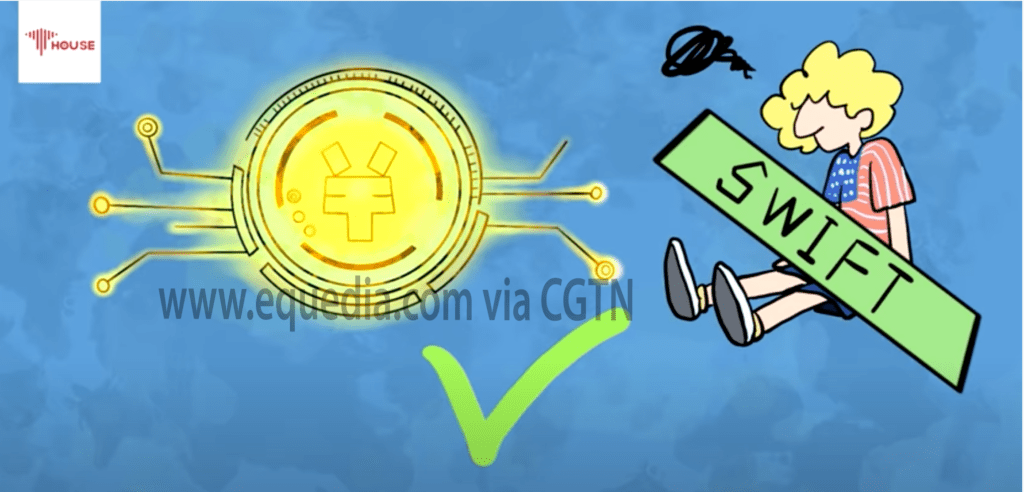

Earlier this month, China moved one step closer to removing US dollar dominance by announcing that it would create its own digital currency.

Via Wall Street Journal:

“Beijing is also positioning the digital yuan for international use and designing it to be untethered to the global financial system, where the U.S. dollar has been king since World War II. China is embracing digitization in many forms, including money, in a bid to gain more centralized control while getting a head start on technologies of the future that it regards as up for grabs.

“In order to protect our currency sovereignty and legal currency status, we have to plan ahead,” said Mu Changchun, who is shepherding the project at the People’s Bank of China.”

But, just like its oil futures contract, if China wants the world to trust its platform, it will likely have to do more than just issue a new digital currency.

Its digital currency marketing campaign might give us some clues.

Via Wall Street Journal continued:

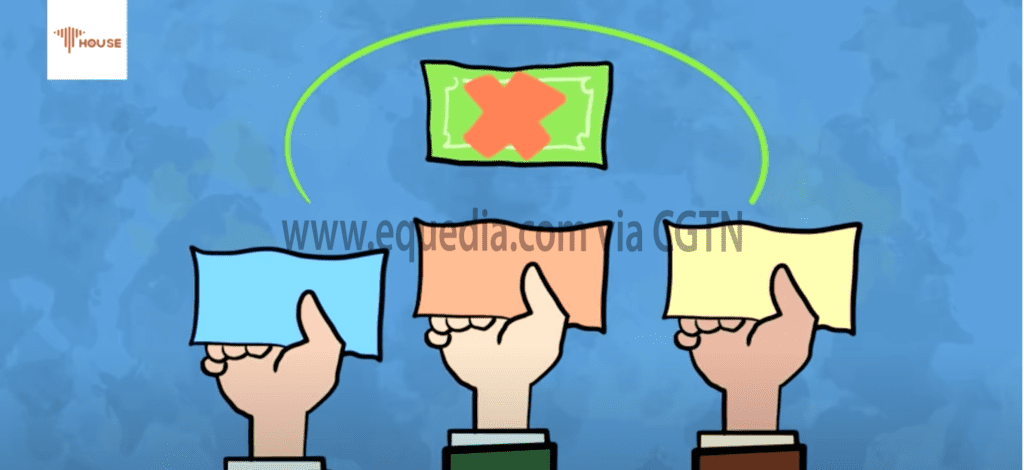

“As China’s marketing for the digital yuan kicks into high gear, an English-language animation circulated online by state broadcaster CGTN shows a man in an American-flag shirt knocked out by a golden coin depicting digital yuan.”

The video even shows a consortium of nations bypassing what appears to be the Greenback.

But could the golden coin be a clue to China’s digital currency plan?

Shortly after announcing its digital currency to the world, China made yet another big announcement: it’s opening its borders to billions of dollars of gold imports.

Via Reuters:

“China has given domestic and international banks permission to import large amounts of gold into the country.”

Why is that important? Because China has long been known to restrict capital flows.

Via Reuters from 2019:

“China’s likely motive for restricting gold shipments was to help limit the amount of money leaving the country amid a plunge in the value of the yuan.

Beijing had previously taken steps to curb capital outflows when its currency weakened, such as squeezing the supply of offshore yuan, clamping down on import invoicing, and encouraging banks to send home dollars held overseas.

It had also restricted gold import quotas before – most recently in 2016 after the yuan weakened sharply, bullion bankers said.”

Simply put, China wants more gold.

And they are already way ahead of the West when it comes to digital payments and transfers (think Alipay and Wechat.)

Conclusion

Five years ago, I was called a conspiracy theorist for suggesting that governments around the world would soon give free money to people.

But that’s exactly what is happening today.

Is it a coincidence that just a few years later, after the global basic income experiments I told you about in 2016, the COVID pandemic happens, and bam, free money?

Perhaps.

But if you go back and read the many letters I have published, these coordinated global political events may not be as coincidental as they appear.

Could China’s gold import announcement have something to do with the announcement of its digital currency? Is China looking to back its digital currency with gold in the future?

Maybe it’s just another coincidence…

Ownership

I personally own both physical gold and silver stored in secure facilities around the world. I also own stock in many gold and silver companies, as I believe they provide the biggest upside in rising precious metals prices.

For example, despite an already healthy return, I still own every share that I originally purchased in gold producer Calibre Mining (TSX: CXB) (OTCQB: CXBMF).

In the silver space, I own shares in silver explorer Sierra Madre Gold & Silver (TSX-V: SM). Although I have yet to cover the company in this newsletter, I have high expectations that climbing silver prices will significantly boost its share price. More to come in the future on this one.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Calibre Mining (CXB) because the Company is an advertiser on www.equedia.com. We currently own shares of CXB and options granted by the Company. We also own shares of Sierra Madre Gold and Silver (SM). You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in or trading in the securities mentioned in this newsletter. CXB, SM and their management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from CXB, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

Ivan,

Remember I’ve replied to your newsletter when you’re blasting the new green deal? I’ve mentioned to you looking at China…and finally you did! Good job! This is an article worth reading!

OC

What is better than bitcoin? Are you saying precious metals? Confusing article or misleading subject heading.

Umm, it’s BIGGER, not better than Bitcoin. I thought it was pretty obvious that he is talking about China’s digital currency.

I am very interested in reading the replies to your most recent post and thank you

If you don’t mind saying so, how many shares of CXB.TO do you own?

We don’t normally post the size of our positions, but its in the 7 figure range. Keep in mind that while we haven’t sold a share from our initial position, it doesn’t mean we don’t intend to. In other words, please do your own due diligence and make your own decisions on when to buy or sell any stock.

What is your timeline for the De-Dollarization as the Primary Reserve Currency of the world whose percentage of use in world trade exchange has dropped to the mid 40’s?

Not anytime soon – but one look at the price increases of items and you can see that the dollar is being devalued. A hedge is smart, and I maintain the stance that precious metal prices are going higher in H2.

Besides gold and silver, what else is a good investment to hedge against inflation so we don’t run out of money as ag product prices run away. Also if the world switched reserve currency to the Yuan, how do you expect that to affect gold

Chicken Little was right.

Several factors influence gold prices but none more reliable than real interest rates (10 year T-Bill – Inflation) which is negative (1.59 – 2.60 = -1.01%) now .Yet, Gold continues to struggle here despite higher inflation, lower Treasurer yields & significantly higher deficits/debts nation wide. Look no further than institutional /central bank/ FED manipulation in the futures and OTC markets protecting the $ at all costs seems to be the theme. So the question becomes, can the FED really control inflation & if not will higher negative real rates bust this silo open & gold soar?

As far as the wealth transfer effect is concerned, this has always happened when the stock market crashes but now with a pandemic is 10x worse b/c it affects everybody not just market participants. Opportunities will be available only for those who have liquid capital (the 1% class) to bail out everybody else. Going after the wealthy doesn’t help. Do the opposite to raise everybody else standard of living.

Lastly, I don’t think China wants to dethrone the $, just level the playing field with it’s own digital currency & have many advantages the US already have with the reserve currency. But I don’t think China will get there. They would have to: 1-Float the yuan, 2-End capital controls, 3-Respect property rights, 4-Have a bond market big enough (China has virtually no gov’t bond market), 5-Have global trust, 6-Be willing to have trade deficits, 7-Stop export priority mercantilism & 8-Have a currency market big enough. They meet only condition 8.

Great reading as always. Um Im not sure parents have anything to pass on after the old age homes take their life saving. My mother is in, after we researched, a modest place in Poco $6500 a month. She is 87 and in great health so by the time she goes they will have taken close to 1 million. My dad passed when they were still living in their Richmond BC home that paid off big time. These debt numbers are irrelevant without context. The debt service is about the same as it was in the 80s with interest rates over 23%. So are we in more debt or the same. And I grew up hearing that we were passing the debt onto our grandchildren and what we did was pass on a fantastic economy to our grandchildren, however Covid makes the waters muddy. I’m not worried and I am a worrier.

William, great points and thank you for sharing!

As always you provide food for thought. All I can recall when reading this is, that you pointed out some years ago, how much physical gold China had and was amassing more. I think it was 900 tonnes of gold in Chinese government coffers, at the time.

The American dollar does not have a physical repository of gold and I can easily see China floating a digital currency with GOLD as the supporting value. Opening the import aspect of gold for the Chinese market only makes this a near certainty. It is a resetting of fortunes China vs USA

I would prefer you give us similar information housing, prices etc as it applies to the Canadian markets.

Thank you, I’ve made money listening to you. Keep up the good work.

You are right on many fronts here. The only thing is that while the American dollar isn’t backed by gold, the U.S. (at least reported) still has the largest holdings of gold. Most certainly, will do more with Canadian numbers also! Thanks again for your readership and comment.