For the full interactive edition, please CLICK HERE

Dear Readers,

There’s no doubt the world is on tilt.

U.S. stocks tumbled for a third week, pushing the S&P 500 to its longest losing streak since August. The MSCI BRIC Index (MXBRIC), which tracks stocks in Brazil, Russia, India and China entering a bear market, fell more than 20 percent from this year’s peak.

As I mentioned before, this was to be expected. And as I mentioned before, that means the governments of the world will be spending and printing more money.

It’s no wonder the leaders of the world’s wealthiest nations, the G8, said on Saturday their governments were going to spend more in Europe to revive the continent’s struggling economy – a complete opposite turn from the idea that the way to recovery was through strict fiscal austerity.

Strict fiscal austerity? Yeah, right…

With more money printing already confirmed, both gold and silver should move higher – and along with it – the companies within the sector.

If you had the opportunity to buy gold and silver shares from last week’s dip, good for you. I think you will be rewarded. If you haven’t, it’s not too late.

As a result of the recent slump, very good companies in the precious metals sector took a major hit.

Including one of my favourite silver companies, MAG Silver (TSX: MAG) (NYSE.A: MVG).

An Absolute Monster: MAG Silver’s CRD Discovery

Last week, MAG Silver announced an extremely important news release regarding its 100% owned Cinco de Mayo project, confirming it has the largest Carbonate Replacement Deposit (CRD) manto in the world.

For those of you who have read my report, “The World’s Most Important Silver Project” you should have a basic understanding of MAG’s Cinco de Mayo project.

However, you may not understand just how big and important it is becoming. One of the world’s foremost mining figures in Mexico says that Cinco de Mayo has the potential to be “an absolute monster.”

That’s why I sat down with MAG Silver’s Dan MacInnis, President & CEO and Dr. Peter Megaw, Founder and Director, last week to get a better scope of the project. Both of these gentlemen are highly regarded in the industry – especially in Mexico. Their accomplishments are vast and their expertise unmatched.

What they told me not only confirms that Cinco de Mayo is a company maker on its own, but that the market truly doesn’t understand how big Cinco really is and what it could possibly be worth.

But I can understand why. MAG holds an interest in one of the highest grade silver deposits in the world and its clearly overshadowing Cinco de Mayo.

But once you read what I am about to tell you, you may change your attitude.

What is Cinco de Mayo?

First of all, the Cinco de Mayo (Cinco) project hosts is a Carbonate Replacement Deposit (“CRD”). These CRD’s represent approximately 40% of Mexico’s 10-billion ounce historic silver production and have been mined for more than 400 years. They are characterized by massive to semi-massive silver-lead-zinc sulphide intrusions.

The attractive characteristics of CRDs are simple. They have potential for large tonnage and high grades; potential for substantial base metal credits to the precious metal resource; and, sulphide replacement in carbonates (limestone) mitigates oxidation, and is therefore more metallurgically amenable and environmentally benign. In other words they’re cheap to mine and have a minimal environmental footprint.

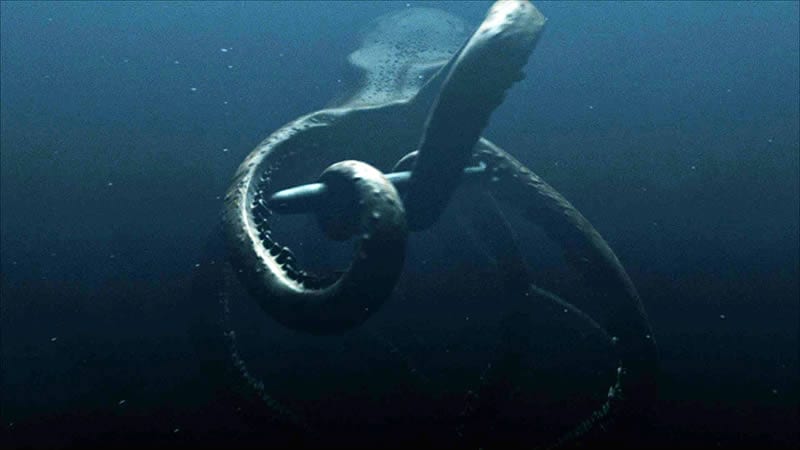

As you can see from the above CRD’s have many different parts. As Dr. Megaw explained, think of a CRD like an octopus. The stock and skarn are the body of the octopus and the manto are the tentacles.

MAG’s Jose Manto at Cinco has now become the world’s largest manto in a CRD system. Dr. Peter Megaw did his PHD on CRD’s and he has never seen a manto as big as the one they’ve found at Cinco.

The Significant of Jose Manto/Bridge Zone at Cinco

Mantos are usually ribbon-like and no more than 150 metres wide at the top end.

The manto found at Cinco is currently 350-400 metres wide in dip length. It’s also averaging 3.5 to 4 metres thick and almost 4000 metres long of continual mineralization so far. It’s still open along strike. This thing is massive. It’s 4000m X 400m X 4 metres – its huge. And there’s multiple zones in there.

The mantos at Santa Eulalia, the biggest chimney manto system known in the world, get up to 4km long and up to 15-20 metres thick but they’re less than 85 metres wide. That means MAG’s Jose Manto proving to be on the same scale as the biggest mantos ever found – and its growing.

The silver grades found in the assays thus far are exceptional. On average, they are between 150-250 g/t Ag with base metals (Pb+Zn) in the order of 12-15% plus. Assays as high as 60% lead and 30% zinc have been found.

(Note: For those of you who lwant an equivalent figure, every 5% of lead/zinc is equal to approximately 100 grams of silver at current prices)

These numbers show that the current manto at Cinco is a new high grade base metal, silver-rich discovery.

The more MAG drills, the more they are confirming the continuity.

Out of this World

When you drill to delineate a manto, you normally would drill off at 50 metres or 100 metres spacing max. MAG is currently drilling 250 metres along the axis and 50 metres perpendicular to the axis. Management is so confident in the size of the system that they’re stepping out and drilling 250 metres – and they’re hitting!

Nobody has ever been able to drill a manto in a CRD system out like this.

There are no other examples in the world where the CRD mineralization was as laterally persistent and consistent as the Jose Manto/Bridge Zone to allow this type of drilling that MAG is doing.

For example, Excellon Resources went underground on one of these systems having an initial resource of 65,000 tonnes. They now have, between production and resources, about a million tonnes and are continuing to follow the manto by drilling on 15 metres centres. If they step off more than about 25 metres, they’ll be off the ore body.

You could look at any of these manto systems in the world and you would have a very hard time defining a drill program because of its snake-like shape. Even if you knew where the manto was, you’d have a hard time drilling it off as consistently as MAG has.

What Does that Mean?

Normally the ore bodies in a manto are more erratic. As Dr. Megaw put it they’re more like spaghetti. What MAG has found is more like Lasagne compared to everything else. He’s never seen anything like it. Nor has anyone else I know.

No one understands why MAG has been able to drill out Cinco like that and the only assumption I can make is that they are onto something of incredible size.

MAG has intersected mineralization in about 390 drill holes out of a total 420 holes drilled to date, in an area about 12 by 14 km. And I am talking about holes with at least some visible mineralization or some mineralization that gives MAG an assay. That tells you that the size of the system is huge. Everywhere you look, there’s some sort of mineralization.

The Mother Lode

Some of the deep drilling results from MAG’s latest release indicate that MAG may be close to the source of all of the fluids and that source is usually related to a large skarn or large intrusive which is all part of the system MAG is exploring.

The proximal area of these CRD deposits contain strong molybdenum (moly)-gold mineralization.

Within Cinco, MAG has already found the moly-gold mineralization in the CRD system. Except – like the Jose Manto/Bridge zone – it’s unlike anything they have ever seen.

Pozo Seco High Grade Moly

In August 2010 MAG announced their first mineral resource estimate for the Pozo Seco Moly-Gold discovery. Results confirm that Pozo Seco is a significant high grade oxide molybdenum/gold deposit within the CRD system at Cinco which contains an indicate resource of 29.07 million tonnes at 0.147% molybdenum (94,012,000 pounds moly) and 0.25 grams per tonne gold (230,000 ounces gold) with an inferred resource of 23.38 million tonnes at 0.103% molybdenum (53,205,000 pounds moly) and 0.17 grams per tonne gold (129,000 ounces gold).

That’s more than 3 times the average grade of a moly deposit.

Dr. Megaw has pretty much looked at every showing that exists in Mexico for CRD’s. He has seen the style of mineralization at Pozo Seco in several of the big deposits. In fact San Martin, the biggest skarn deposit in Mexico, has the biggest zone of that style he’s ever seen.

That was until they discovered Pozo Seco.

The moly zone at San Martin is 200-250 meters in diameter, its irregular and its about 20 meters thick. The one at Pozo Seco is 2500 meters long, 300 meters wide, and 35-250 metres thick. It completely blows away the similar alteration features found at San Martin.

Given the size of the manto and the size of Pozo Seco, the source of the system could be an absolute monster.

The moly gold zone at Cinco completely blows away the benchmark for anything similar. You put that together with the size of Jose Manto and it clearly suggests that part of the system MAG hasn’t found yet has the potential to be an absolute monster.

Can Cinco be the biggest CRD ever found?

It could very well be but MAG needs to do more drilling to find out.

There are, however, reasons to believe it could become the biggest.

The biggest CRD, Santo Eulalia, has produced over 50 million tonnes, has six parallel mantos of comparable size and each manto had about 8 million tonnes – and that’s before you get into the big chimneys that are 700 metres high and 100 metres in diameter.

These CRD systems are characterised by a series of parallel ore bodies. MAG has only found one so far – and its already proving to be the biggest manto ever seen.

As I mentioned earlier, Peter describes these systems as being like an octopus. MAG has found a couple of tentacles which alone could already potentially be mine builders.

But when you consider they still have other tentacles and the body of the octopus to find, the upside could be massive.

When you compare MAG’s showings to other CRD systems, there’s every reason to believe that the whole system falls on MAG’s property.

MAG has 28,000 hectares of property. The biggest system known of this type is about 8km from one end to the other. You can pretty much take any point of the Jose manto and go 8 km in any direction and MAG’s got the property.

MAG has already found the biggest manto and the biggest moly-gold signature within a CRD system. That means MAG may be onto one of the biggest discoveries in Mexico in a very long time and potentially the biggest CRD ever.

It’s no wonder why MAG has increased their drilling at Cinco. They have a massive new discovery that could prove to be a world class deposit.

But don’t for one second think that MAG’s team hasn’t already found what they are looking for. They already have an extremely high-grade moly-gold deposit at Cinco. Their Jose Manto/Bridge zone itself is already showing signs that it can potentially be a mine on its own and proving that it may hit critical mass soon.

I am not the only who thinks so.

Here’s a few analyst comments on MAG’s latest release regarding Cinco:

“Overall, we see the drill results in this news release as further evidence of a large CRD system at play and having high potential to reach critical mass. At this stage, we believe drilling confirms our 10 million tonne plus estimate.” – Michael Gray, Macquarie Capital Markets

“We maintain our SPECULATIVE BUY recommendation on the shares of MAG Silver with a target price of C$18.00 per share. Based on a 4,000 metre strike with an average width of 3 to 5 metres and a down dip extension to 250+ metres, we believe Cinco de Mayo has the potential to host 100+ million ounces of silver plus significant lead and zinc.” – Nicholas Campbell, Canaccord

“Today’s drill results demonstrate continuity of massive sulphides occurring over about 1km along the Bridge Zone. The strong lateral and vertical continuity of mineralization at the Bridge Zone increases our confidence that this zone could add significant tonnage to resources at Cinco de Mayo. We highlight significant upside potential for the combined Bridge Zone-Jose Manto-Cinco Ridge corridor with a total 4km strike length along the entire zone.

We are also encouraged by deep drilling results which suggest that the Company may have located the feeder zone to the system, which demonstrates the potential for a significantly larger body of mineralization to depth.

Overall, the results provide further validation of our thesis that Cinco de Mayo is an exploration project with significant growth potential and could drive significant value for investors. We continue to believe that MAG offers three ways to win for investors: (1) Potential takeover by Fresnillo (2) Development of a robust stand-alone Juanicipio project (3) Promising secondary Cinco de Mayo project.” – Jamie Spratt, Clarus Securities

With the release of their updated Preliminary Economic Assessment, which is expected before month-end, and the continual drilling success at Cinco, MAG shareholders could soon be rewarded in more ways than one – especially if MAG decides to spin out Cinco, which management has already been suggesting.

The next few weeks will be critical for MAG. Do not blink. You may miss something big.

Until next week,

Ivan Lo

Equedia Weekly

Disclosure: I am long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies.I am also biased towards MAG Silver because they are an advertiser and I own shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including MAG Silver. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, MAG Silver and its management has no control over our editorial content and any opinions expressed are those of our own.

Forward Looking Statements

MAG Silver Corp is a Canadian issuer.

Daniel MacInnis P.Geo is a non-independent Qualified Person and has compiled this presentation from industry information and 43-101 reports and news releases with specific underlying Qualified Persons as set out in the Releases and reports. Industry Information has been compiled from publicly available sources and may not be complete, up to date or reliable.

This presentation contains forward-looking statements within the meaning of Canadian and U.S. securities laws. Such forward looking statements are subject to risks and uncertainties which could cause actual results to differ materially from estimated results. Such risks and uncertainties include, but are not limited to, the Company’s ability to raise capital to fund development and exploration, changes in general economic conditions or financial markets, changes in metal prices, general cost increases, litigation, legislative, environmental and other judicial, regulatory, political and competitive developments in Mexico or Canada, technological and operational difficulties or inability to obtain permits encountered in connection with The Company’s exploration activities, community and labor relations matters and changes in foreign exchange rates, all of which are described in more detail in the Company’s filings with the Securities and Exchange Commission. There is no certainty that any forward looking statement will come to pass and investors should not place undue reliance upon forward-looking statements

This presentation uses the term “Indicated Resources”. MAG advises investors that although this term is recognized and required by Canadian regulations (under National Instrument 43-101 Standards of Disclosure for Mineral Projects), the U.S. Securities and Exchange Commission does not recognize this term. Investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into reserves.

Cautionary Note to Investors Concerning Estimates of Inferred Resources: This presentation uses the term “Inferred Resources”. MAG advises investors that although this term is recognized and required by Canadian regulations (under National Instrument 43-101 Standards of Disclosure for Mineral Projects), the U.S. Securities and Exchange Commission does not recognize this term. Investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves. In addition, “Inferred Resources” have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies except for Preliminary Assessment as defined under Canadian National Instrument 43-101. Investors are cautioned not to assume that part or all of an Inferred Resource exists, or is economically or legally mineable. The Company may access safe harbor rules. Please see complete information on SEDAR and at the SEC on EDGAR.

This presentation is for information purposes only and is not a solicitation. Please contact the Company for complete information and consult a registered investment representative / advisor prior to making any investment decision.

Note to U.S. Investors: Investors are urged to consider closely the disclosure in MAG Silver’s Form 40F, File no. 001-33574, available at their office: Suite 770-800 West Pender, Vancouver BC, Canada, V6C 2V6 or from the SEC: 1(800) SEC-0330. The Company may access safe harbor rules.

Investors are urged to consider closely the disclosures in MAG Silver’s annual and quarterly reports and other public filings, accessible through the Internet at www.sedar.com and www.sec.gov/edgar/searchedgar/companysearch.html

Neither the TSX Venture Exchange nor the New York Stock Exchange Alternex has reviewed or accepted responsibility for the accuracy or adequacy of this presentation.

Disclaimer and Disclosure

Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Companies do pay us to advertise on our website and we often distribute our reports on featured companies. While we are never paid to write a rosy and positive report on any company, we do market our reports using the advertising fees paid for by our featured companies.

This process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Our revenue is generated by sponsor companies and we grow our readership by using the advertising fees we charge to distribute our reports. This helps both Equedia and our client companies gain exposure and allows us to provide you with our research at no cost.

Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid $5833.33 plus HST per month for 6 months which totals $35,000 plus hst of media coverage on MAG Silver Corp. plus any additional expenses we may incur as a result of additional distribution. MAG Silver Corp. has paid for this service. Equedia.com may purchase shares of MAG Silver without notice and intend to sell every share we purchase for our own profit. We may sell shares in MAG Silver Corp without notice to our subscribers.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

Comments 1