Dear Readers,

The market missed a very big announcement this week.

It could be one of the biggest within the sector for 2016.

Yet, the market hasn’t even figured it out.

That’s because we’re all blindsided by the negativity spewing out of world markets.

But luckily, that means there is an opportunity for us to take advantage of the market’s misdirection again.

Let me explain.

Déjà Vu

There’s no doubt the world is on tilt.

On Friday, the S&P 500 sank to its lowest level since October 2014, and the Dow lost more than 500 points, reaching its lowest level since August.

The MSCI BRIC Index (MXBRIC), which tracks stocks in Brazil, Russia, India and China entering a bear market, is now at its lowest point since 2009.

Is this déjà vu all over again?

Nearly four years ago, I wrote this:

“U.S. stocks tumbled for a third week, pushing the S&P 500 to its longest losing streak since August. The MSCI BRIC Index (MXBRIC), which tracks stocks in Brazil, Russia, India and China entering a bear market, fell more than 20 percent from this year’s peak.”

In that Letter, I talked about one of my favourite silver companies at the time. Following that letter, this Company nearly doubled in value over the next few months because of a massive discovery that the market missed amongst the negativity.

This week, I feel we’re being presented with the same opportunity as was the case nearly four years ago. But this time, with a different company.

I am sure you want to see this, but I’ll get back to it in a bit.

Why the Stock Market is Falling

The world is in a heap of trouble: U.S. markets are collapsing, tensions in the Middle East are rising, China is slowing, and nations around the world are losing trust with one another.

To make matters worse, the world’s number one economic power and the centre of the financial market is showing signs of great distress.

Sales at U.S. retailers fell again in December to mark the weakest year since 2009. It’s no wonder Wal-Mart, the world’s largest retailer, is set to close nearly 300 stores, affecting 16,000 employees worldwide.

But retail isn’t the only thing that’s struggling.

Industrial production in the U.S. also fell 1.8% year-over-year. It may not sound like much, but the drop not only marks the fastest pace of collapse since May 2008 but its now at a level that always produces a recession.

We’ve known about these weak underlying tones for some time. So why are the markets finally falling now?

About a year ago, I wrote a letter titled, “Secrets of Bank Involvement in Oil Revealed“:

“The energy sector represents around 17-18 percent of the high-yield bond market valued at around $2 trillion.

Over the last few years, energy producers have raised more than a whopping half a trillion dollars in new bonds and loans with next to zero borrowing costs – courtesy of the Fed.

This low-borrowing cost environment, along with deregulation, has been the goose that laid the golden egg for every single energy producer. Because of this easy money, however, energy producers have become more leveraged than ever; leveraging themselves at much higher oil prices.

But with oil suddenly dropping so sharply, many of these energy producers are now at serious risk of going under.

In a recent report by Goldman Sachs, nearly $1 trillion of investments in future oil projects are at risk.

… The drop in oil prices has already caused a financial disaster for Norway and Russia. If oil’s drop continues, it will do the same for America and Europe.

Debt defaults for oil companies in America have already begun, and credit has frozen up. If oil doesn’t bounce back next year, be prepared for a financial disaster contagion.”

Oil hasn’t bounced back. For the first time in 12 years, oil closed at under $30 a barrel. As such, we’re now witnessing the financial disaster contagion I said would happen just over a year ago if oil didn’t recover.

BHP Billiton, one of the world’s largest minng companies, just told us it would take a $7.2 billion write-down on its onshore U.S. shale assets. Late last year, America’s biggest miner, Freeport-McMoRan, took a $3.5 billion write down, and has lost nearly 80% of its value over the last year – its market value has shrunk to $5 billion from $14 billion in just three months.

But that’s just oil. What about the financial disaster contagion?

According to Bloomberg, it took only seven months to unwind two years of global stock gains:

“With markets from Asia to Europe entering bear markets this month, stocks worldwide have lost more than $14 trillion, or 20 percent, in value from a record last June amid worries over global growth and deepening oil declines. The pace of the drop has been so fast that it has already unraveled about half of the rally since a low in 2011.”

Putting that into perspective and we see that it took four years to add $30 trillion, but only seven months to lose half of those gains.

It’s no wonder why game-changing news releases are being lost in the mix.

What do you think of the market’s massive losses?

CLICK HERE to Share Your Thoughts

No Surprise Here

Everywhere you look, world economies are falling, but this shouldn’t be a surprise. In fact, I have said that 2016 is the year we should be careful on many occasions:

Via How this Landmark Decision Could Destroy the Market:

“The market could still hold up after September, and still end up in the green this year. But I certainly won’t say that about 2016.”

I also said this:

Via The Great US Debt Rotation:

“Is the rotation from stocks to bonds a precursor to the next market crash, just as it was leading up to the crash of 2008?

Here’s a Letter I wrote from earlier this year, “The Truth About the Fed“:

“…My prediction is simple: yields will rise (which they appear to be doing already), transferring equity-side investments over to bonds to soak up the piles of debt in the market.

Meanwhile, we have a long ten years of little to no growth coming our way, with a stock market crash headed our way in the near future as the system rebalances liquidity.”

And this is precisely what’s happening.

Via the Globe and Mail:

“The latest global asset flow figures from BAML and data provider EPFR show investors bought $3.4-billion of government bonds in the week to Jan. 13, the largest inflow in almost a year. They also pulled $11.9-billion out of global equity funds, the largest outflow in 18 weeks.”

If you take a look at the chart on the US 10 Year Treasury yield, you can see the trend is up.

Do you agree with my analysis regarding the Great US Debt Rotation?

Do you believe that the sale of equities will fuel the purchase of government debt?

CLICK HERE to Share Your Thoughts

The Canadian Dollar

Not only did I say the market would fall, but I also said we should expect the Canadian dollar to fall.

With oil yet having to find a bottom, a struggling resource market, and an overly frothy real estate market, don’t expect the Canadian Dollar to climb anytime soon.

And as I mentioned in How to Win in the Stock Market With Justin Trudeau in Power:

“A strong U.S. dollar and lower input costs on the back of sliding energy prices are boosting gold producers in jurisdictions where the currency is weaker. This is particularly true for gold producers in Canada and Australia, where the currencies continue to weaken against the Greenback.”

It is this weak Aussie currency that brings us back to our story.

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

The Big Announcement the Market Missed

Amidst the negative stories jamming up media headlines, the market missed a game-changing announcement from the only junior gold producer I currently own:

Newmarket Gold

(TSX: NMI) (OTXQX: NMKTF)

If you’re a new reader, go back and read my initial report, “The Most Undervalued Opportunity You Never Heard Of,” to get a better understanding of what you are about to read.

Since my original report, Newmarket Gold (Newmarket) has been one of the best performing gold producers, climbing from $0.82 (at the time of my report) to a high of $1.75 last year.

And despite many readers having made some significant profits, the real story is just be beginning.

Before I tell you why, here’s a quick review.

Why Newmarket Gold?

Newmarket (TSX: NMI) (OTCQX: NMKTF) is a junior gold producer in Australia that’s managed by some of the best in the industry. One look at the team and you will see the names of some of the top minds within the gold sector.

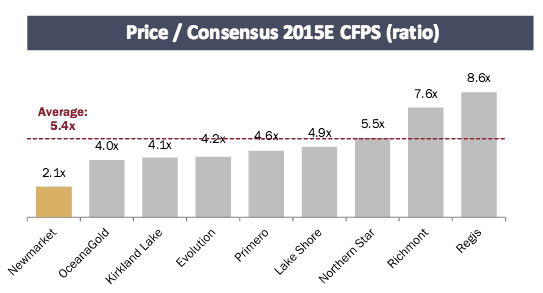

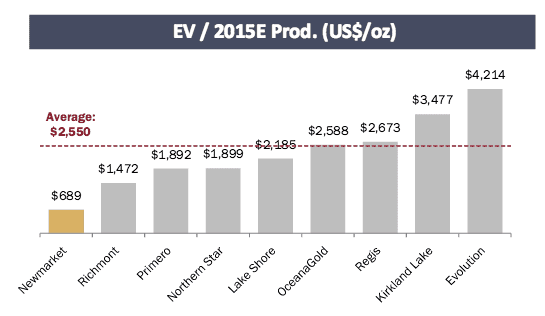

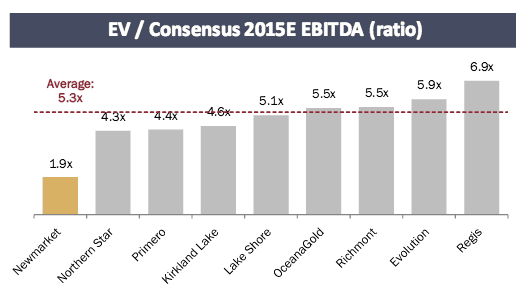

Despite its strong share performance last year, the Company is still very much undervalued when compared to its peers in almost every metric.

Take a look:

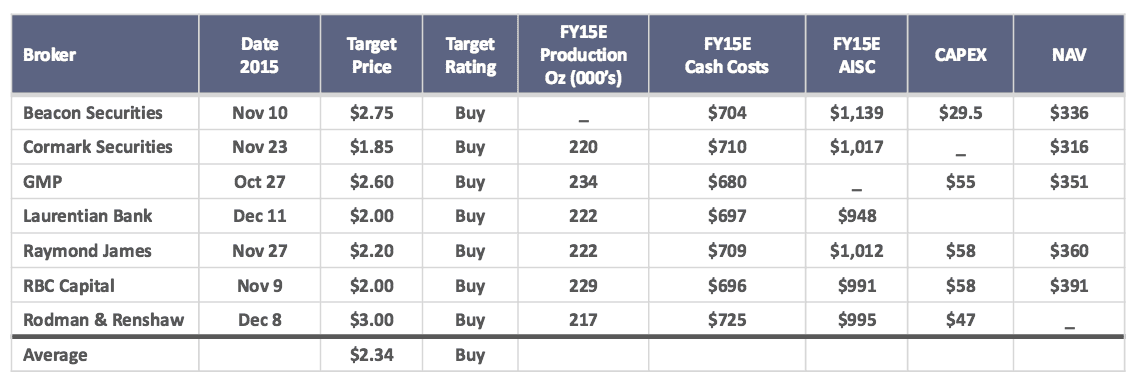

But many of these analysts may soon have to raise their target prices and change their models completely.

Why?

This is where it gets exciting.

Newmarket just announced a massive discovery – one that not only marks a major inflection point for the Company, but one that will make everyone in the sector take notice.

A Massive Discovery at Fosterville

Fosterville is well-known amongst the gold mining community. It’s Newmarket’s flagship asset that’s been producing gold for nearly nine solid years.

However, over the last year, grades at Fosterville have been steadily improving, leading to four consecutive quarters of improving grades.

Why is that important?

Generally, as you move deeper into mine life, grade goes down – not up. That’s because when you begin production at a mine, you go after the higher grades first to pay off the costs of building out the mine and speed up your return on investment.

So how is Fosterville increasing grades after nine years of mining?

Bigger than Before

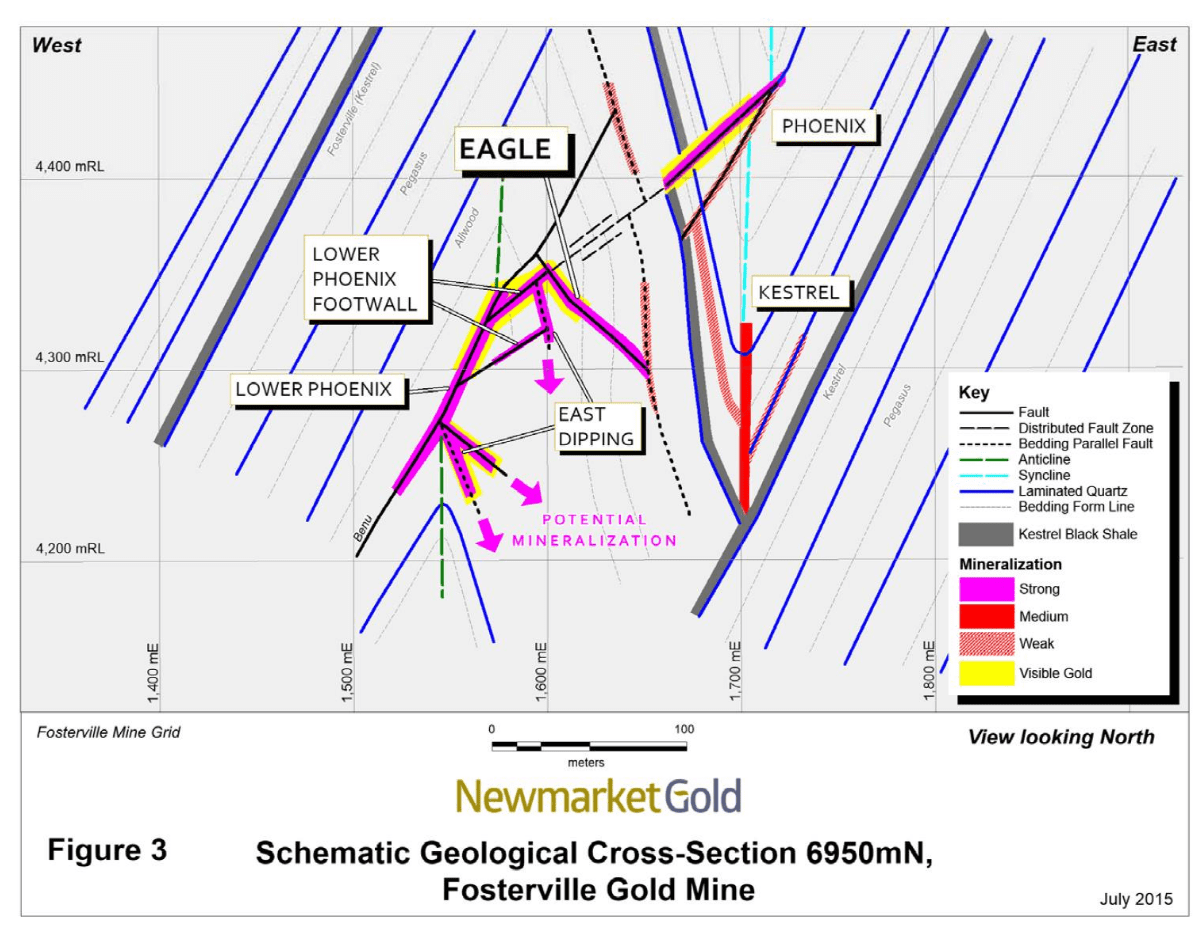

Six months ago, Newmarket discovered the Eagle and the East Dippers zones at Fosterville – high-grade zones with coarse visible gold.

Over the next six months, Newmarket has been able to trace these continuous zones with very high success – which is odd because high-grade vein systems with coarse visible gold are generally very hard to trace.

Their success hasn’t stopped.

This week, on January 11, 2016, Newmarket released new drill results from these zones with record high-grade visible gold intercepts outside of the known Mineral Resources at the Eagle Fault discovery and other structures in the Lower Phoenix System.

For the first time ever, Newmarket also announced that the vertical extent of the Eagle Fault zone is now 600m along strike and 290m of vertical height, with visible gold-bearing Eagle mineralization remaining open for expansion down-plunge.

Just take a look at some of these numbers.

Drilling on the Eagle Fault continues to return high-grade mineralization containing visible gold including:

- 161 g/t Au(1) over 7.35 m (ETW 4.94 m) in hole UDH1481 (Including 499 g/t Au(1) over 2.25 m)

- 32.02 g/t Au(1) over 6.25m (ETW 6.14m) in hole UDH1416 (Including 355 g/t Au(1) over 0.35m)

Drilling of the East Dipping Fault continues to intersect significant widths, up to 13.50 m of high-grade mineralization and included two major intercepts:

- 645 g/t Au(1) over 3.50 m (ETW 3.41m) in hole UDH1456 (Including 7,368 g/t Au(1) over 0.30m)

- 45.47 g/t Au(1) over 14.95m (ETW 13.50m) in hole UDH1408 (Including 1,321 g/t Au(1) over 0.35m)

Obviously, these are very high-grade results.

But that’s not the whole story.

The results represent a story that is much bigger than it appears – much, much bigger than what the market understands.

You see, in the nine years of mining, Fosterville has never had coarse visible gold. Now it’s making record grade discoveries.

Even geologists who know Fosterville well can’t quite fathom these changes. Not only is Fosterville becoming a very different deposit, but it could very well be the discovery of a lifetime.

And here’s where the story really begins.

The Rush to Bendigo

The discovery of major gold deposits have been instrumental in the creation of some of the world’s most well-known cities. In Australia, no other gold discoveries have been more instrumental than that of the great Bendigo, Ballarat, and Ararat discoveries during the 1850s.

What started off as alluvial mining soon became hard rock mining and news of the finds intensified the Victorian gold rush bringing an influx of migrants to the city from around the world within a year and transforming it from a sheep station to a major settlement in the newly proclaimed Colony of Victoria.

It has been said that together the discoveries have produced over 80 millions ounces of gold. Not many places on earth have done that.

Since 1851, Bendigo itself produced over 25 million ounces of high-grade gold, making it the highest producing goldfield in Australia in the 19th century and the largest gold mining economy in eastern Australia.

So what makes Bendigo so special and how did it produce so much high grade gold?

Chasing Saddle Reefs

Bendigo is host to an extremely well-known saddle reef system – a gold system with lots of coarse visible gold, usually small in sectional area but extensive along strike.

To understand its significance, we have to understand how saddle reef systems form.

A saddle reef deposit is a deposit associated with the crest of an anticline fold and usually occurring beneath a reverse fault. It occupies the dilational void of the fold hinge. As such, Saddle reefs do not occur in synclines or flat strata, but in the anticline.

A syncline is a fold with younger layers closer to the center of the structure, whereas an anticline is a type of fold that is an arch-like shape and has its oldest beds at its core.

So how are they formed?

About 450 million years ago, sediments were laid down, and an east-to-west compressional environment occurred. The strata that were originally flat-lying was folded up into anticlines and synclines.

50-100 million years later, after the compressional environment folded the strata in the Bendigo area, granites intruded that folded sequence.

Now the thesis is that those granites drove the mineralizing fluids. So now you have a high volume of fluids and a compressional environment, which led to the folding that occurred during that phase.

If you recall, mining 101 teaches us that gold deposits form as a result of fluids that drive through open space to create a plumbing style system.

In the case of Bendigo’s saddle reef environment, the thesis is that the deposit formed when the granite either reintroduced the gold or drove the gold into the dilatant zones, creating very high-grade ore shoots.

A saddle reef environment is a system of dreams. Many have tried to find it, but have many failed.

You can see how incredible it would be if someone were to find one.

Well, Newmarket could very well be that next “someone.”

A Strong Comparison

Newmarket’s flagship asset, Fosterville, is only 20km away from Bendigo.

So it’s no surprise that the host rocks of both Fosterville and Bendigo are the same in both age and composition.

Take a look at the schematic cross section below where the synform, or syncline, is represented by the dark line on the right, and shaped like a “V”.

On the left we have the antiform, or the anticline.

As you can see, the Eagle, the Lower Phoenix, and the East Dipper discoveries occur in the anticline – just like Bendigo’s saddle reefs.

If you take a closer look, right where the word “Eagle” is on the picture, that’s a strata sandstone, or shale. You can see its offset there, cut by that red line, dipping to the left-hand side of the page. The strata is offset upwards on the top and downward below. That’s a reverse fault.

As I mentioned earlier, what you need to form saddle reef veins are:

- an anticline (you can see we have that here, the strata forms a peak as opposed to a V on the right side)

- a reverse fault (shown also in the picture)

It is usually under that reverse fault that you get saddle reef veins like the ones found at Bendigo, and the new discoveries at Fosterville have the exact same mineralogy as that of Bendigo, including the most important of all: lots of coarse visible gold.

Why now?

Now you may be asking, “Why didn’t they find this before? Why did it take nine years?”

Fosterville’s Phoenix system is in a syncline. At Bendigo, synclines don’t host the saddle reef veins, so it wasn’t until Newmarket discovered the Lower Phoenix six months ago that the potential Bendigo style mineralization came into play.

When you drill a west-dipping sulphide package, you’re generally drilling it from west to east. As a result, you would thereby miss veins that dip in the other direction – veins that dip to the east.

Since the discovery, Newmarket has been drilling scissor holes, both in the West-dipping sulphides and also the Eagle and East Dippers.

That means there’s a chance that further up plunge they missed even more Eagle-style mineralization.

That is why the news release this week was so important. The high-grade coarse visible gold found in the new holes show a trend that leads toward a saddle reef type environment. And what are saddle reefs known for? High-grade ore shoots with tens of millions of ounces of gold production.

In other words, after nearly nine years of production, Fosterville may have just begun to hit the gold jackpot.

Drilling shows high predictability, meaning that they’re hitting gold where they are supposed to be hitting gold.

In other words, Fosterville could very well be a Saddle Reef type environment.

And we may soon find out.

Prepare for March

In regular news releases, companies don’t often go into the granularity of how structures form and what they are or could be.

However, in 43-101 geological reports, geologists will likely commit to the style of mineralization. I can’t say for sure Newmarket will use the term “saddle reef” but I bet comparisons are already being made.

In just a couple of months, Newmarket is going to announce a new 43-101 reserve and resource complete with sections on extensive geology, structures, and mineralization.

Last year’s 43-101 reports didn’t include anything from the Eagle and East Dippers but this year, it will. And for the first time, they will be putting geological impressions about the new discoveries on paper.

If they use the term saddle reef, the market could light up because geologists know how big a saddle reef discovery is.

Even if they don’t use that term in the upcoming 43-101, there is no denying the similarities.

What’s more is that Newmarket is already feeding ore from the Eagle zone through the mill and it’s already having an extremely positive effect on mill grades and production profile and costs.

Newmarket is installing a gravity circuit to accommodate the newly discovered abundant free gold. The circuit should be active in Q2 which means we should begin to see even greater recoveries than the current 90%-ish they’re getting now at Fosterville using a BIOX refractory recovery system. 90% recoveries are tremendous using a BIOX system, almost as good as you can get and better than most.

When the new gravity circuit is installed, recoveries are likely to be even higher, adding even more to the bottom line.

So Much Upside

I haven’t even begun to talk about the potential for massive organic growth through drilling that Newmarket is continuing to do at Fosterville. The high predictability and drilling success at Fosterville is already paving way for Newmarket to begin exploring even further outside of the known reserve and resources – preparations for a 1km step out drilling are already being made.

Then there’s Newmarket’s other mine, Stawell, where Newmarket has also made new discoveries with piles of drill holes waiting to be released – so many that the Company is expected to have an inferred resource come out within the next few months.

If you recall from my original report, Stawell’s Aurora B East Flank is looking very similar to the West Flank that historically produced 2.5 million ounces.

The story is focused on Fosterville at the moment, but don’t let Stawell get lost in the mix – it’s a big story on its own with new visible gold discoveries.

An Opportunity in Disguise

With such a volatile stock market, we can already see that many people, especially the Chinese, are flocking back to gold. While I can’t predict the price of gold in the short term, gold producers in Australia, and even Canada, are benefiting from their weakening currencies.

Gold is rising in Aussie dollars, and since ALL of Newmarket’s costs are in Aussie dollars, this makes Newmarket very attractive when compared to other gold producers.

So if you’re going to buy gold equities in a challenging gold market, it would be dumb not to look at Aussie producers. And since many of the top ASX-listed junior gold producers are already at, or near, their 52-week highs, it only makes sense to be looking at Newmarket.

Newmarket is not only significantly undervalued on many metrics against its Aussie peers, but it is even more so against many of its Canadian peers. That is why Newmarket is the only junior gold producer I own right now.

But the biggest story is one that the market hasn’t caught onto yet: that Newmarket may be on to a Bendigo-style saddle reef system – a gold system that shaped Australia’s history.

That alone could be one of the biggest mining stories this year.

And the market doesn’t even know it yet.

CLICK HERE to Share Your Thoughts

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

We’re biased towards Newmarket Gold Inc. because they are an advertiser. We now own shares which were purchased in the open market following our initial report dated July 26, 2015. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Newmarket Gold Inc. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Newmarket Gold Inc. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Market going lower: Fund managers hitting their stops, retail stock traders don’t know what they are doing. Pension fund managers haven’t a clue, Third World War in progress using oil as the weapon of mass destruction, key note investors manipulating the market influence, and the suckers keep buying stocks on the way down.

A very compelling letter on the trouble times that coming. I am very glad that I am in a food business for farm direct selling, and would like to expand this sometime thru crowed funding or ipo, but honestly don’t know how to do it.

I am going to take your insight and buy a couple k worth of their stock, (my first stock ever).

Can you recommend a broker service to use ??

Thank you for all you do to try and help.

Brian

What about the outstanding Crocadile Gold Warrents due Mar 16 as a way to play Newmarket ? ( 1.22 Croc Gold shares to 1 Newmarket )

S&P500 is at a very dangerous inflection point around 1865 or the August low’s. Next level of support is around 1750 another 6% or Jan low’s then 1655 or another 5% or Oct 2014 low’s.

S&P is finally starting to bend after holding up all other markets for years and appears to be running out of steam here as we test support levels. This is the 3rd time we are testing this 1865 area and time will tell if this is just another pullback.

If it falls further to the 2nd level of support or 1750, then we have a technical breakdown and perhaps a true game changer because for the S&P it will be the 1st time since 2009 that the market makes a lower low than the previous year and that is a confirmation that your intermediate term is bearish.

I suspect the catalyst for this to play out will be lower oil prices, followed by a wave of bankruptcies and a crashing junk bond market. If there is increased tensions in the Middle East or a civil war before then, all bets are off. Buy Gold and oil.

Is it as you write the only junior you own?

What of integra gold?

Hi Austin, Newmarket is the only junior gold “producer” that I own at the moment. I still own Integra (development/exploration stage) and believe in its future.

I thought Timmins Gold was such a great deal too. What’s the thoughts on it now?

Hi Terry and thanks for your question. We covered Timmins Gold nearly four years ago – at the time, they climbed from under $2 to nearly $4. After the first year, we no longer covered them and had sold our position (just over a year after our coverage). I generally would not hold any producers for more than 1-2 years, unless their production profile continues to climb and costs remain low. Hope this helps.

Who holds stocks for that long anyways? If you are going to hold for 5 years, you might as well buy a government bond. Nothing goes up forever. Even the world’s biggest companies, just like the ones mentioned in this post. Freeport McMoran down over 90% in two years. America’s biggest mining company.

I remember Timmins, bought it around $2 bucks, sold for above $3 because of this newsletter. My advice to other readers is to read the dates of the letters. If it says 2012, and you just read the report now, do some due diligence, lots can change in 4 years!

If you are up 100%, take your profits, get out, and ride the rest if you wish, but if you get 100% and dont take profits, you’re not a very smart investor.

You are bang on the money my man, one of the biggest deposit in the World will be before us shortly. I am bias I have owned share for 5 yrs in the Crocodile gold country. What a amazing story to tell your kids and leave them some wealth.