Simple Chart Masks Its Complex Nature

One subject attracts more opinions than any other: what to expect from the US Dollar ($USD) in 2020 and beyond.

There is an overriding theme amongst most “dollar watchers” that is related to the indisputable fact that it has retained its status as the reserve currency for the world. The $USD is recognized as a “go-to” currency during turbulent financial times. I witnessed the power of the $USD during the mid-1990s in Russia. (My wife and I spent three weeks there adopting a baby boy.)

Everyone we came in contact with asked for “dollars.” Russian rubles, the official currency, was not discussed in any small transactions we undertook.

So what about today?

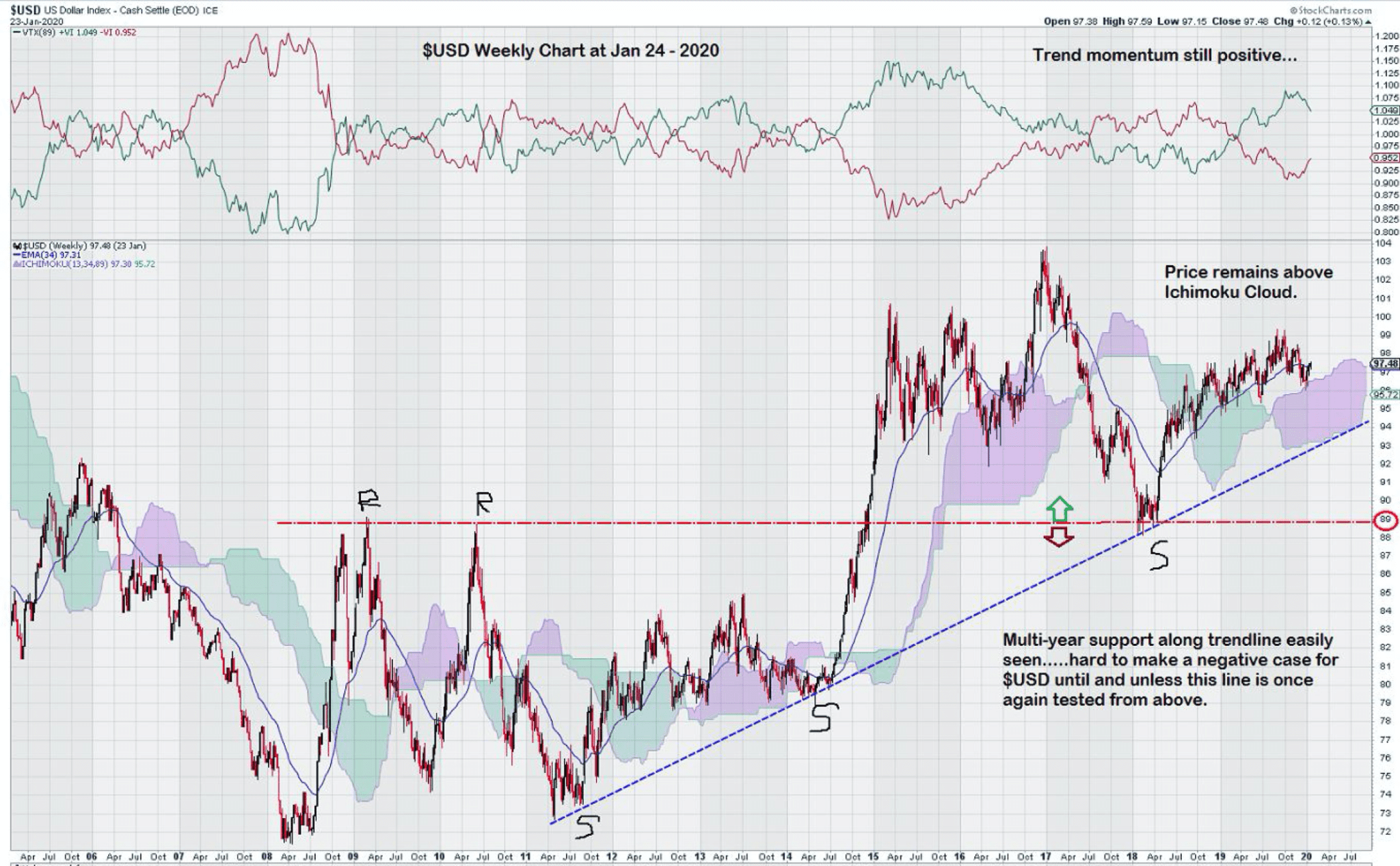

Well, one look at the weekly chart for the $USD is all it takes to see that there has been strong chart action since mid-2011. The $USD weekly chart has developed an easy to follow trend line that has three defined areas of support.

$USD Weekly Chart – Strong and Steady…..So Far

It is hard to make any bearish case for the $USD so long as this trend remains in place. As of today, trend momentum is positive, and the price chart is above the Ichimoku Cloud – both of these chart indicators are positive.

MACD, on long term trend settings, is not shown on this chart. However, the signal line is below the trigger line which is negative, but both lines are above the zero line, which is positive. MACD is at least flattening, or one might make that case that it may be establishing a “rounded top,” but it is too early to suggest that is what is happening.

It is interesting to note that gold, having broken through the 6-year resistance level, nominally at $1350/$1375, has risen in a moderately strong $USD environment.

Counterpoint: A Thoughtful Case for a Lower $USD

“Canada’s most famous economist,” David Rosenberg, has recently left his longtime position of Chief Economist and Strategist at Gluskin Sheff and Associates (2009 – 2019) to start his own firm: Rosenberg Research and Associates. Before leaving Gluskin Sheff, Mr. Rosenberg was the Chief North American Economist at Merrill Lynch in New York. He lays out an economic argument that outlines how the surging stock market is a “bull market in financial engineering.”

In a recent interview with Jay Taylor, he goes on to discuss how he differentiates this bull market from the ones in the 1980s and 1990s, which were predicated on productivity. This bull market is driven by “artificial liquidity” provided by the FED. He goes on to comment that a financial advisor to Nixon in the 1970’s made that point that “anything that can’t last forever, by definition, won’t.”

In summary, the real question that finds its way back to how the $USD will perform in the future is tied to consumer sentiment in the USA. Over 2/3 of GDP growth in the US is consumer-driven. When this portion of GDP growth starts to slow, and unemployment starts to rise, the FED will act by reducing rates. As we all know, further rate reductions are taking place from historically low levels. The impact of additional tiny quarter-point rate reductions is already being questioned as to their efficacy.

The timing for a GDP decline may be in the second half of 2020. This fits well with the $USD chart, which is still well above its trend line.

And finally, since there never are any “easy answers” to “hard questions,” there are a few important factors we have not considered that can be expected to impact the $USD.

The US Federal election, global trade, and growing geopolitical uncertainty are just some of the unknowns that will surely make their presence felt in 2020.

-John Top

I want to read the article but you keep asking for my name and email. Why is it so hard to get too??

LOL… I do find all these “analysis” by “financial experts” really entertaining sometimes. Meanwhile, back in the real world, the more they keep pumping up the ponzi bubble – again – the bigger the pop, it will make the criminal insanity of 2007 look like a fart in a bathtub… FFS, if the “united” states GDP is nearly 3/4 mindless, debt fuelled consummer spending and they already are maxed out in surging credit card and other forms of debt because they already have 3 or 4 or more TVs, phones etc. – and are getting screwed on health care, student, car and now AGAIN on home loans, the they can NOT buy any more crap!

Therefore China WILL slowdown as their mindless consumption and increased debt won’t pick up the slack, which means they will be needing less raw materils which will affect many countries – especially Australia and Canada! THAT “virus” will definitely spread around the world” Now add to that the fucking FED and Wall st. and the cesspit of London playing silly buggers with more “QE” and the REPO fiasco as the parasites re-buy and try to re-package their grossly over valued crap, anyone really paying attention can see that the fan is now spinning out of control – AGAIN! So yeah, with many major players in recent years also grabbing as much gold as they can lay their hands on, what could possibly go wrong with the dollar?

Apologies, the above was written in a rush of bemused frustration, hopefully this reads better…

LOL… I do find all these “analysis” by “financial experts” really entertaining sometimes.

Meanwhile, back in the real world, the more they keep pumping up the ponzi bubble – again – the bigger the pop, it will make the criminal insanity of 2007 look like a fart in a bathtub…

FFS, if the “united” states GDP is nearly 3/4 mindless, debt fuelled consummer spending and they are already maxed out in surging credit card and other forms of debt because they already have 3 or 4 or more TVs, phones etc. – and are also getting screwed on health care, student, car and now AGAIN on home loans – at the end of the day they can NOT afford to buy any more crap! And NO amount of absurd inflation or “employment” and “income” figures can change that!

Therefore China WILL slowdown as their mindless consumption and increased debt won’t pick up the slack, which means they will be needing less raw materils which will affect many countries – especially Australia and Canada! THAT “virus” will definitely spread around the world!

Now add to that the fucking FED with Wall st. and the cesspit of London playing silly buggers with more “QE” (which makes other similar insanity look like small change in comparison) as well as the REPO fiasco and the parasites re-buy and trying to re-package – AGAIN – their grossly over valued crap, anyone really paying attention can see that the fan is now spinning out of control – AGAIN!

So yeah, with many major players in recent years also grabbing as much gold as they can lay their hands on, what could possibly go wrong with the dollar?

Et nisi aliqua Labo