Here’s my #1 advice: forget the CPI.

You don’t need a politically-manipulated index to confirm that prices are getting out of hand.

Just look around.

Home rentals in America are hitting new records month after month. In metro Miami, the average rent jumped 55.3% over the past year! That’s the highest yearly increase ever witnessed.

At $4.25/gallon, many are feeling the pinch at the pump, too. Even Big Corp is struggling to keep up. JetBlue just canceled 25 routes for the summer season due to rising fuel prices.

Meanwhile, the Ukraine situation is driving up food prices even further.

From crops to fertilizers, agricultural commodities are growing at a breakneck pace.

This month, wheat trading tripped the exchange’s limit of how much it can grow in one day – three times!

You can be sure these pricey raw materials are quietly trickling into final products and into your bills.

And if history teaches us anything, this inflation flare-up is nowhere near over.

What Stoked the Highest Post-War Inflation

In the 1970s, America was struck by the biggest inflation breakout since WWII.

For nearly a decade, prices grew at double digits, which was the direct and indirect consequence of two historical events.

First, Nixon ended the Bretton Woods agreement and broke the dollar off the gold peg. The dollar began floating free. And because the fixed-rate had kept it largely overvalued, its “liberalization” sent the currency into a tailspin.

By 1980, the dollar had lost one-third of its value against major currencies, according to the World Trade Review’s report.

A cheap dollar made imports more expensive. The prices of foreign goods increased, which added to businesses’ costs (eventually passed on to consumers) and people’s actual expenses.

Second, OPEC declared economic war with the West and sent oil prices through the roof. As I wrote in “Could Russia’s Invasion of Ukraine Lead to Hyperinflation?“:

“In 1973, OPEC slapped an oil embargo on four Western superpowers.

The oil cartel, which back then pumped 7 out of 10 global oil barrels, banned all imports to the U.S., Canada, the Netherlands, Japan, and the U.K. They used it as a weapon to retaliate against Israeli allies in the Arab-Israeli war.

The embargo came at the most unfortunate time.

After WWII, America became addicted to cheap Arab oil. By 1971, its share of global crude oil production shrank from 64% to 22%. So when the ban came, the nation couldn’t ramp up domestic production to make up for lost imports.

The first oil shock started.

By 1974, oil became scarce, and its price quadrupled from US$3 to nearly US$12 per 42-gallon barrel ($75 per cubic meter). Thus, plunging America into one of the biggest energy crises in its history.”

In other words, the 1970s inflation was brought on by 1) inflationary monetary change and 2) a supply crunch in oil and other commodities, which translated into higher prices across the board.

Fast forward to today, and things are eerily similar – maybe even worse…

Monetary Policy 3.0

During Covid, the Fed printed trillions of dollars to shore up the stalling economy.

But its inflationary effect isn’t so much about the sheer amount, which is appalling enough. It’s more about how this money has been deployed.

Contrary to popular belief, Covid’s stimulus wasn’t a repeat of the post-2008 stimulus. Back then, the Fed simply stashed money in banks to add liquidity and soothe investors. Most of it didn’t make it to the economy and inflation barely budged.

This time policymakers took a much more direct and aggressive approach.

As I wrote in “Inflation: Much More than Meets the Eye“:

“The Fed’s monetary policy can be broken down into three eras.

In the late 1980s, the Fed began fiddling with federal fund rates to keep tabs on the economy.

The mechanics were simple. When the economy trails off, the Fed lowers rates to make money cheaper to encourage borrowing, which, in turn, stimulates the economy.

Conversely, they raise rates to tame the bubble when the economy overheats.

We can call it “Monetary Policy 1” or MP1.

Then in 2008, fine-tuning rates couldn’t cut it. So the Fed began “Monetary Policy 2,” which is MP1 + printing money to buy bonds from banks (aka Q.E.).

Then, when Covid struck, policymakers again took stimulus up a notch.

They combined rates and money printing (MP2) with aggressive fiscal policy.

While fiscal policy is technically out of the Fed’s control, recall our previous letter, “With Great Power Comes Great Responsibility,” where we revealed that the Fed has insiders working in congress (one could argue congress has insiders working at the Fed; same sh*t, different pile.)

Since the beginning of Covid, Congress handed out $4.84 trillion.

In other words, trillions of printed dollars were splashed all over the economy like gasoline onto a fizzled-out fire.

Ray Dalio, one of the most successful investors of our time, dubbed this “Monetary Policy 3” (MP3).

In the big picture, MP1 and MP2 put money into the banking system, which, as we discussed, wound up in Wall Street and in Big Corp.

Meanwhile, MP3 forced stimulus directly into the economy, which makes it very different than any past easing effort – especially when combined with MP1 and MP2.”

Now add the trillion-dollar infrastructure bill Biden passed at the end of last year and the $1.5 trillion cleared a few weeks ago, and the total fiscal stimulus surpasses $7.5 trillion.

This new monetary experiment is feeding an unprecedented amount of money directly into the economy—on top of stashing trillions in the banking system. And the consequences are as plain as day…

It’s Not a Supply Bottleneck. It’s an Inflationary Monetary Error

The Fed tried to blame inflation on “supply bottlenecks.”

They argued that Covid brought all sorts of disruption that derailed intertwined global supply chains. And that these supposedly temporary supply shocks are stoking inflation in the short term.

There’s some truth to that. We are experiencing all sorts of supply bottlenecks.

But they are not temporary.

In the third year into Covid, we are dealing with…

- Extreme chip shortage. Earlier this year, U.S. Department of Commerce revealed data showing an alarming chip shortage. The U.S. commerce secretary, Gina Raimondo, described it as a “threat” to the entire American industry. In short, it’s bogging down the supply of everything from electronics to cars.

- Building material shortage. Homebuilders are short on basic materials like lumber or steel. The National Association of Homebuilders (NAHB) reports that 9 out of 10 builders reported material delays or shortages last year. This is increasing the lead times and prices of homes during the lowest home inventory in history.

- Meanwhile, warehouses are stocked to the brim, and ports are clogged. Hundreds of container ships are queueing offshore for weeks waiting to offload at the busiest American ports swamped with containers.

And for the most part, these disruptions are not Covid’s fault.

As I showed you at the end of last year, MP3 stimulated demand with no regard to the supply side. And the demand grew so high that supply couldn’t keep up, even at full throttle.

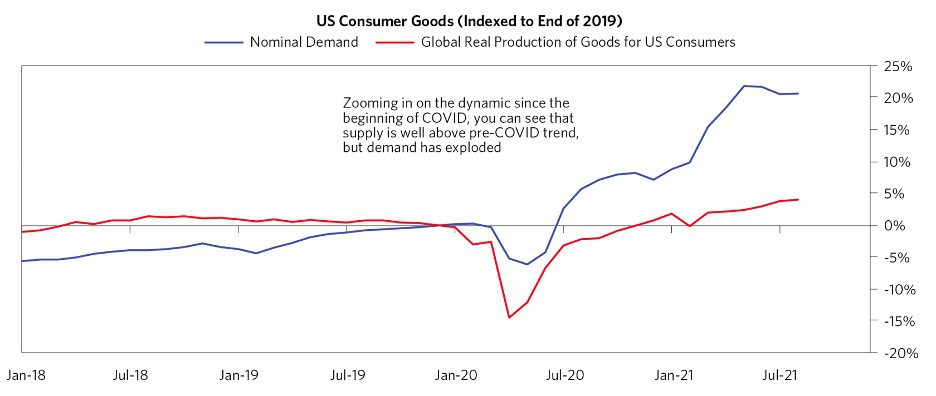

Here’s a chart showing the mismatch when supply in the U.S. more than recovered:

This is direct proof that policymakers overshot this time.

The Commodity Supply Crunch

Just as in the 1970s, we’re grappling with the biggest commodity shortage in decades.

What’s driving it?

The demand driven by printed dollars caught material producers off guard.

They had to crank out more stuff than ever to meet the onslaught of orders. Production capacity maxed out, and inventories were soon depleted. Basic materials became scarce, and their shortage sent prices through the roof.

Meanwhile, global fossil-fuel reserves became so exhausted that many parts of the world were on the brink of a blackout this past winter.

So, the supply crunch was nowhere near resolved – even before the current Ukraine crisis.

More Fuel to the Fire

In response to Russia’s actions, the West’s superpowers, including the U.K., U.S., and Canada, slapped a fossil fuel embargo on the world’s second-largest oil exporter.

On the Eastside, Europe’s two largest breadbaskets are going off the grid. As I wrote before:

“Ukraine is the second-largest country in Europe. Its arable land, almost the size of California, holds a quarter of the world’s black soil reserves.

And that soil produces a large percentage of the world’s staple foods.

By export, Ukraine ranks (source):

-

- #1 in sunflower seed oil (14% of global exports), which is heavily consumed in most food processing

- #5 in wheat (10% of global exports)

- #3 in rape seeds (18% of global exports)

- #4 in barley (10% of global exports)

- #3 in corn (16% of global exports)

And now this breadbasket is being razed to the ground.

According to the U.N. Food and Agriculture Organization, the war has already affected over one-third of the crop fields in Ukraine, which will be left unsown or unharvested this year.”

Meanwhile, Russia is putting its agriculture and other exports on hold to supply its own economy under heavy Western sanctions.

Via Fortune:

“The export ban also includes some forestry products, such as timber, to “states that are undertaking hostile actions against Russia,” which would include the U.S. and members of the E.U. In a separate measure, Russia also imposed an export ban on wheat and other agricultural products to the Eurasian Economic Union until Aug. 31.”

If this war isn’t over soon, we are going to face agricultural commodity “famine” of historic proportions – never mind just high oil and gas prices.

Between Two Evils

This situation is especially dangerous because we are already past the point of easy fixes.

Inflation is quickly approaching 1970s levels. And tinkering around the edges with 0.25% hikes won’t cut it anymore.

Think about it.

When the Fed had to spar with rising prices back in the 70s, it wasn’t enough to raise rates by a couple of percentage points. Heck, even holding them over 10% for a few years didn’t do it.

Volcker had to push rates to a mind-blowing 20% to finally bring inflation down.

This move came at a huge sacrifice. Within the next two years, the economy went through two recessions. Unemployment soared past 10%. Meanwhile, the third world sank into debt madness.

Today there’s much, much more at stake.

That’s because America is more than twice as indebted as it was in the 1970s. And any serious tightening can bring on a crisis that will combine the worst of the 1970s stagflation and the 2008 housing collapse.

Here’s a scary but truthful observation by former Fed, IMF, and World Bank economist Nouriel Roubini:

“After all, debt ratios in advanced economies and most emerging markets were much lower in the 1970s, which is why stagflation has not been associated with debt crises historically. If anything, unexpected inflation in the 1970s wiped out the real value of nominal debts at fixed rates, thus reducing many advanced economies’ public-debt burdens.

Conversely, during the 2007-08 financial crisis, high debt ratios (private and public) caused a severe debt crisis – as housing bubbles burst – but the ensuing recession led to low inflation, if not outright deflation. Owing to the credit crunch, there was a macro shock to aggregate demand, whereas the risks today are on the supply side.

We are thus left with the worst of both the stagflationary 1970s and the 2007-10 period. Debt ratios are much higher than in the 1970s, and a mix of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years.”

This is why central bankers get cold feet when they have to make a move on rates – they’re essentially choosing between two evils.

You either let inflation roam free or fight it head-on and send the economy into a stagflationary depression accompanied by the largest debt crisis in decades. There’s no other way around it.

And whatever they’ll decide—even if it’s doing nothing— it will surely haunt us for the next decade or beyond.

Is it a coincidence that Bill Gates, riddled with speculative conspiracies surrounding Covid, has quietly become the largest farmland owner in the U.S.?

Seek the truth,

Carlisle Kane

Carlisle, Your Equedia newsletter succinctly captures the plethora of mistakes that have been made by government and central banks. Who wouldn’t embrace free money to spend on political per projects. You did not mention the bubbles created by QE, equities, commodities and real estate (mentioned by Jeremy Grantham is his paper, ‘Let the Rumpus Begin’. Of course, there is a fourth bubble, that of debt. Jeremy predicts that the bubbles will burst in 2022/23. The great reset has already begun and God help us all. I wonder what the new normal will look like.

I totally agree with your comments. I and my brokers bought a lot of Canadian rate adjustable preferred shares at low prices compared to their issue price but I still have concerns. If the rates rise high enough many solid companies that issued these shares may lose their capacity to finance the increases in rates due to things like economic negative growth rates and collapsing sales.

P.S. I have No confidence in either Biden or Trudeau when it comes to fiscal policies.

Thank you. Your detailed analysis confirmed my own suspicions. I grew tired of hearing the majority of uninformed Republicans blaming Joe Biden for today”s inflation. I had read Jerome Powell’s early announcement on August 28, 2020, when Powell announced that the Federal Reserve would not be doing anything to slow the rate of inflation. That announcement was made 5 months before Joe Biden took office. I have a college education, buy never had taken Economics. I endeavored to find the truth. It was not a hard process. After checking what causes inflation, I asked myself, what ocurred for Jerome Powell to make his announcement about inflation, that had yet to occur? It was easy to see, and easier for Powell to recognize what was coming. In 2020, Donald Trump’s $5 Trillion Dollar Socialist Stimulus handout ignited the inflation embers that struck in Biden’s second month of office. Until reading your article. I was unaware of any Democrat or Republican stating that fact. There will be more suffering to come, for me, knowing the truth, is imperative. A leader who chooses to lie about a deadly Panndemic, will find it very easy to lie about a lost election in his effort to stay out of prison.@gmail

Do we really need more conspiracy theories about Bill Gates? If you can show that Bill Gates helped Putin plan the assault on Ukraine, then you are onto something. This is an investment research letter. False claims should not be made about someone who has invested wisely. And for Mike. I have lost all trust in 99% of those that call theirselves Republicans. Any American continuing to support the Trump shit show after January 6, can turn in their Patriot card.

I hope you the reader will agree, that we get most of our values from our parents. Look into Bill’s father, and his values. Bill Gates father was a founder of PLANNED PARENTHOOD and now

Bill is the major contributor now that his dad has passed. Check out the thinking of its founder Margret Sager. Then you will know why Bill has spent time and energy in Africa giving Vaccines for Diphtheria to the population with a sterilization agent in the shot.

One day he and Dr Fauci will be tried for crimes against humanity.

When one segment of society is shamed, retribution is a well- used response. When pomposity rears her gray head and plots revenge, are we foolish enough to believe that in some manner, the power brokers saw the opportunity to use anything but the truth to subjugate the middle class and profit by that claim.

Durham is more than a city in North Carolina. Strength to the Republic.!!!!!!

J. Wimmers asks if we really need more conspiracy theories re Bill Gates and in the blink of a blink, V. Gage obliges with a retort. A retort is seldom an answer, most often a knee-jerk reaction. Is it a crime to add a sterilization shot to the Depth shot if the recipient knows about it? Do they?

Dr. Fauci is shooting at a moving target of Covid variants and changes his opinions based on the findings of science, and what POTUS Trump allowed him to say, or so I would like to believe; I’m not current on conspiracy theories so please bring me up to date within the context of what you speak. I’d really like to know as a Crime against Humanity is a serious charge. Before I sling mud I’d like to know why I’m slinging it…my father taught me that.