The Fed is proudly telling you that inflation is easing off.

They’re proudly telling you that their actions are helping.

But behind closed doors, they have much bigger plans for you.

Unfortunately, those plans aren’t in your best interest – especially if you’re not already rich.

Today, we’ll show you how to prepare for their plan.

To understand this, you first have to understand that inflation is a lie.

You see, inflation isn’t coming down because of natural supply and demand fundamentals.

It’s slowing because governments are secretly carrying out Nixon-like price controls – just as we predicted.

This intervention costs you – the taxpayer – trillions of dollars behind the scenes:

So unless they create more money, ironically leading to more of this so-called inflation, it won’t last long.

And once fiscal money runs out, inflation will roar back up just as it did in the late ’70s—only this time with even more force.

Consider the following.

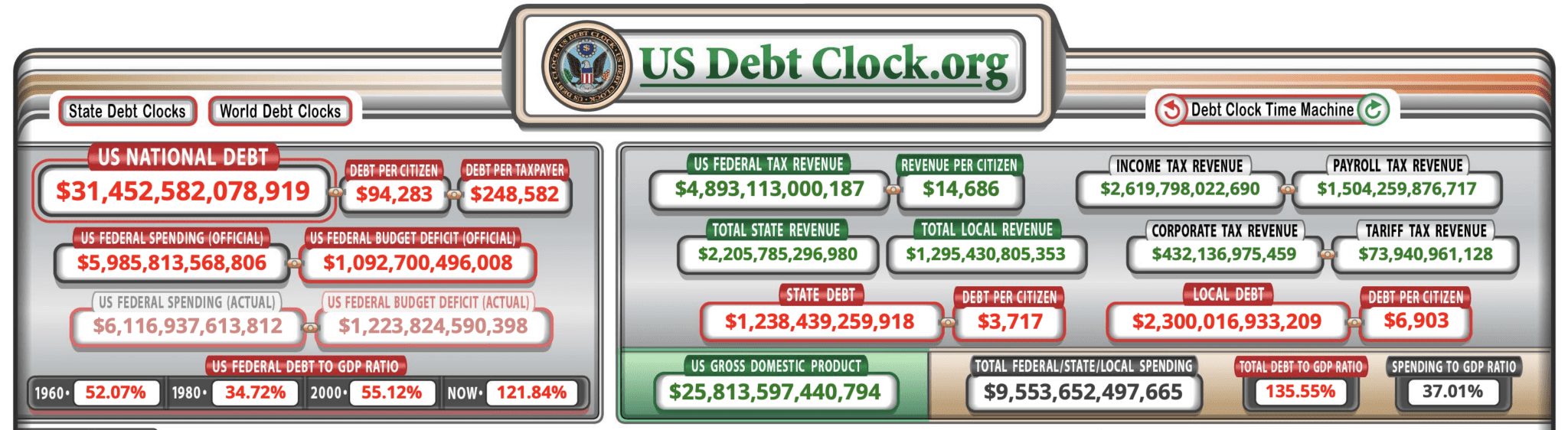

US debt-to-GDP in the 70’s ranged from 31-35%; today it’s at 121%. With a current national total debt of over $31.4 trillion, every citizen owes over $94k, and every taxpayer over $248.5k.

Take a look:

By this time in 2026, that number will reach 147% with a national debt of over $42 trillion.

Let me explain.

Official Inflation Clouds Real Money Debasement

Here is a brief sidebar on official inflation figures.

The cost of living is so complex and personal that even attempting to generalize it is stupid and misleading.

But for argument’s sake, let’s take it as a given.

So, how does the government summarize changes to your cost of living into a single figure?

99% of the time, the inflation figure you see on TV and in headlines is so-called “headline information.”

It measures how the Consumer Price Index (CPI) changed compared to 12 months ago (aka year-over year)—which is deceptive by nature.

If, say, a gallon of gas cost $2 in March of 2020, and $2.50 in March 2021. The headline inflation for March ’21 would be 25%. But if in April ’20, gas was $2.10 and $2.60 in Apr ’21, Apr 21’s inflation would be 23.8%.

See the arithmetic delusion?

Inflation is supposedly falling, yet we are paying more.

That’s not the only mathematical deception.

When you measure price changes in percentage terms, they are prone to another arithmetic flaw called the “base effect.”

Say you are comparing two 12-month periods.

One year has a starting index value of 100 and ends with 110—the other jumps from 200 to 220.

By the logic of headline inflation, both periods had a 10% inflation.

But in reality, the latter results in price changes twice as high as the former.

This effect is barely visible in the current inflation breakout because starting points aren’t that apart…YET.

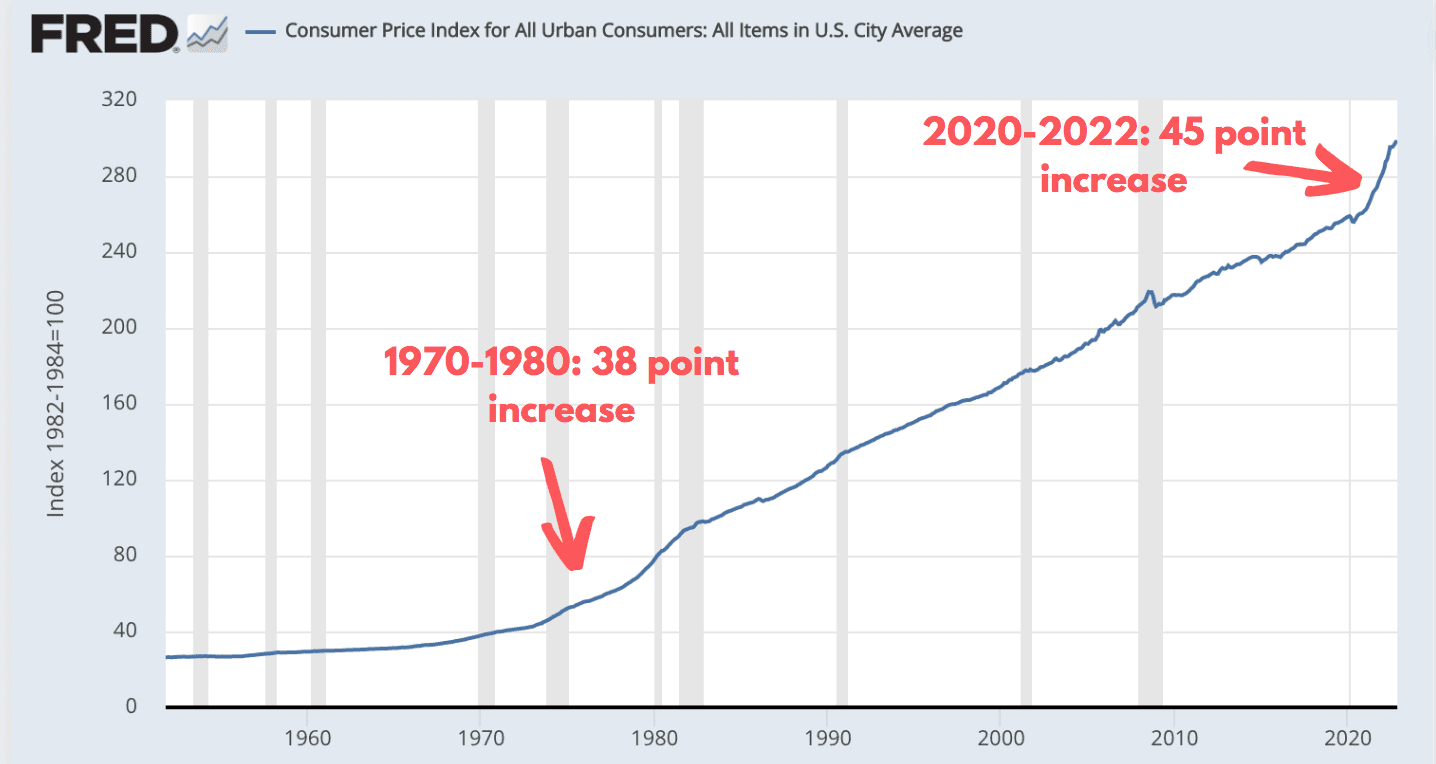

But if you compare today’s inflation to the ’70s, you’ll discover something mind-blowing.

In absolute terms, this inflation breakout has already surpassed the inflation of the entire 1970s:

Not much of a cooldown if you ask me.

It’s like compounding interest, just the other way around.

Instead of growing your wealth at a constantly higher rate, it destroys it faster and faster over time.

But even if you take this “base effect” out of the equation, relative headline inflation isn’t out of the woods yet.

Price Controls

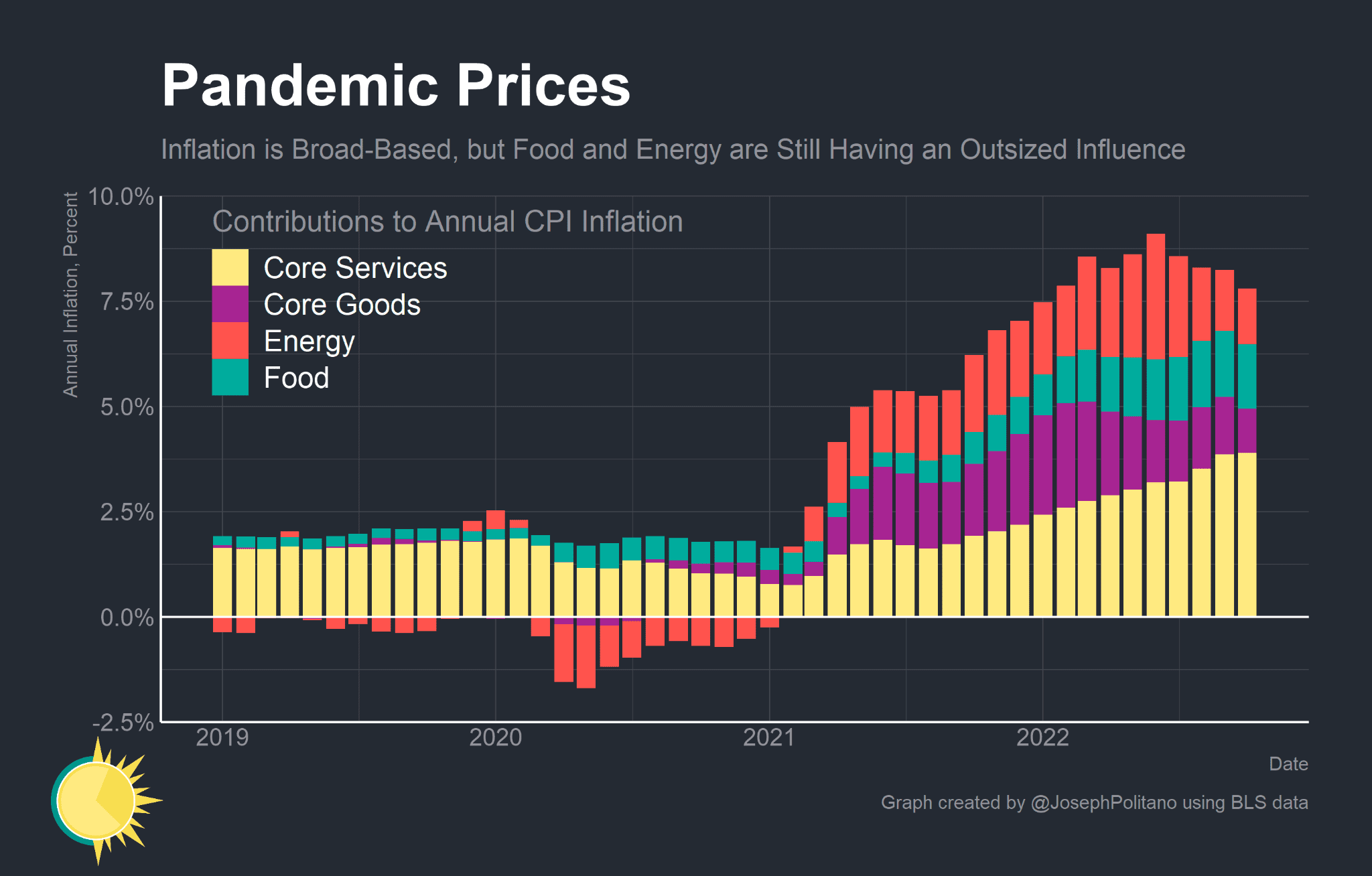

Take a look at the key components of headline inflation and how they’ve changed over the past few years:

Notice how this cooldown is just a result of easing energy prices and core goods, which are almost all directly tied to energy.

That didn’t happen naturally.

There’s still a huge supply and demand mismatch. But governments have successfully tapped national reserves and trillions of dollars in deficit spending to bridge it – for now.

As I wrote in “Think Inflation is Over? Think Again,” the EU will spend nearly $400 billion to cap natural gas prices for 18 months:

“Last week, Europe’s biggest economies pledged to pass a $375 billion fiscal package to last through the winter. The UK alone is planning to spend $150 billion in just the next 18 months.

For perspective, this package is the equivalent of a $1 trillion stimulus in the US. (And remember, that’s on top of trillions spent on Covid relief. But we’ll save deficits for another discussion.)

Where will all these dollars go?

They’ll be used to cap energy prices for 18 months or so.”

(As I just showed you, they are already past the $1 trillion mark, and we are just a couple of months in.)

Meanwhile, the Biden administration is draining the national oil reserve as if there’s no tomorrow.

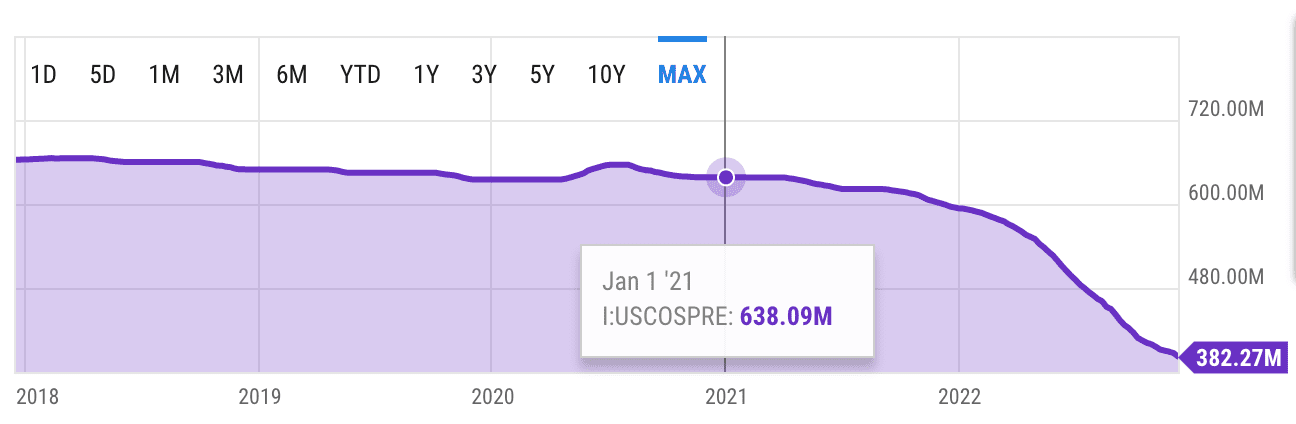

Since Biden took office, the Strategic Petroleum Reserve (SPR) is down almost half—from 638 to 382 million barrels:

That’s the lowest level since 1984, when the US had just begun building a reserve following the Iran oil embargo.

With so much oil from SPR going into supply, it’s no wonder oil prices cratered. But there’s only so much oil in this tank. And guess what will happen when they have to refill it?

That’s price control all over again.

Sure, price manipulation is currently limited to energy. But as I argued in a previous letter, fixing the price of a key input in the economy isn’t any different than a “blanket” price freeze:

“You could say that Nixon’s gambit was a much bigger intervention because it capped the prices of everything. But fixing energy prices is not so much different if you think about it.

As we just discussed, energy is the staple resource that kicks off every supply chain.

So if the government temporarily suppresses the ten-fold marginal increase in its cost, it is, in effect, slapping the lid on 99.9% of products and services in the economy that depends on it.”

What did they expect would happen?

You don’t need a Ph.D. in economics to predict that headline inflation will stall if you freeze the cost of the biggest component in CPI. We knew it right when they announced energy subsidies.

But if Nixon’s price controls in the early 1970s taught us anything, it’s that regulation can’t fix supply and demand.

In the short term, it can cap prices for political gain or whatnot—which is what Nixon did. But once the cap is lifted, those prices will simply rebalance themselves to “real money supply.”

Speaking of which…

Flush with Cash

The bear market and the implosion of tech stocks have created an illusion that the economy is running out of cash.

But is it?

Let’s look at the hard facts.

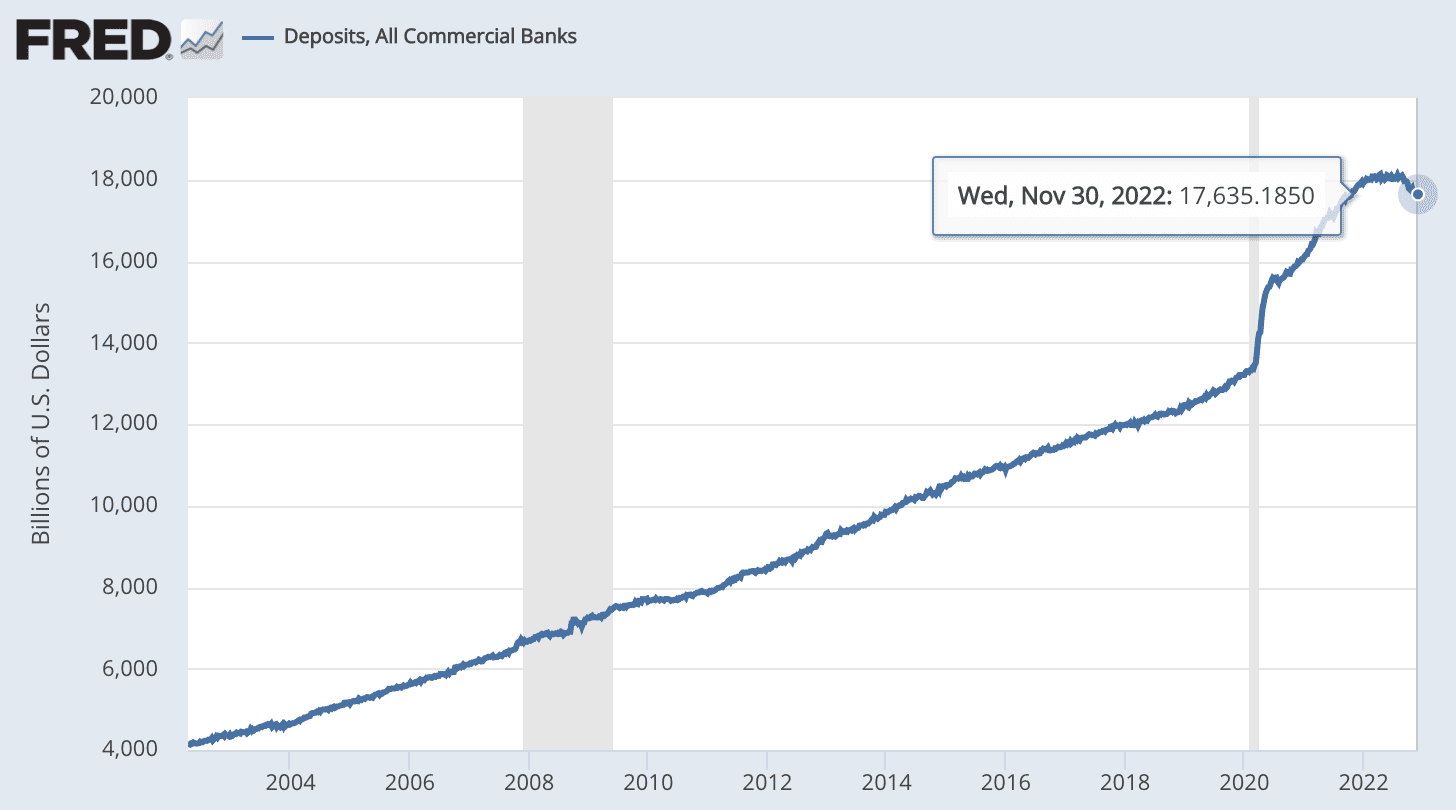

Personal savings have barely dipped from all-time highs. Americans still have $4 trillion more in deposits than they did before Covid:

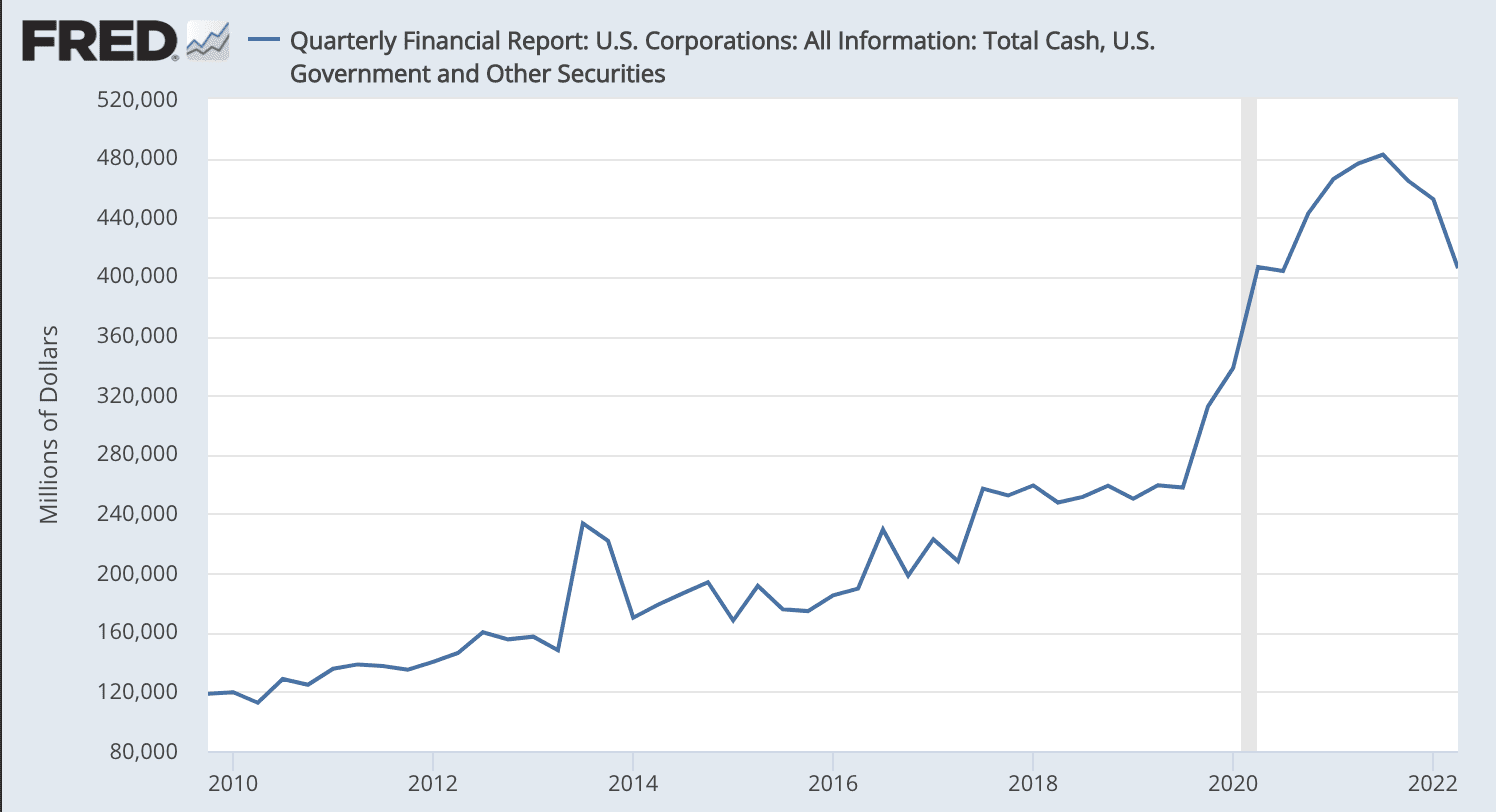

Corporations aren’t cash-strapped either:

As you noticed, cash holdings are beginning to shrink, BUT they are coming down from the highest level on record. Even at this lower level, balance sheets are still flush with cash by historical standards.

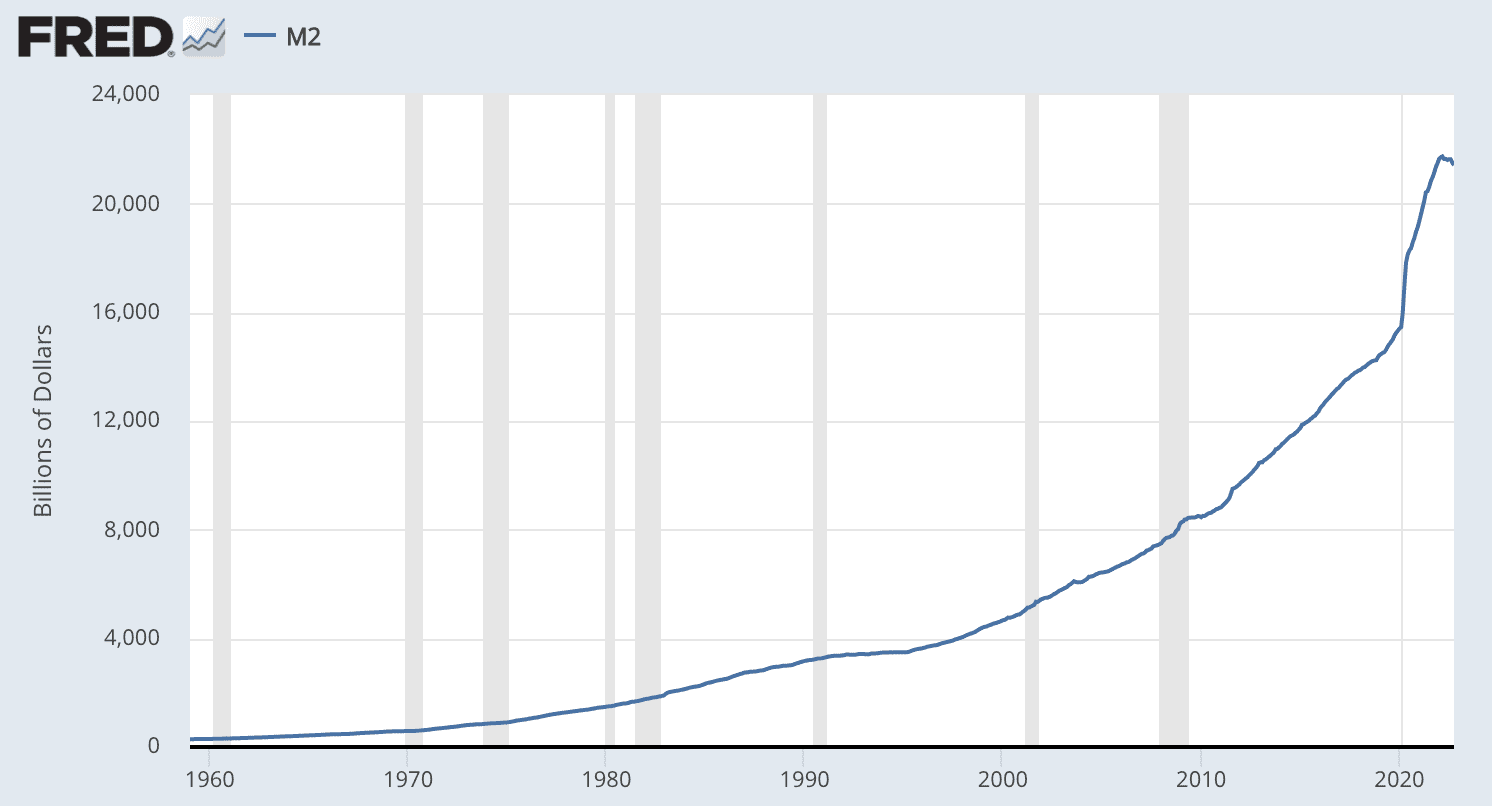

In all, the money supply has barely dipped from its peak:

Why?

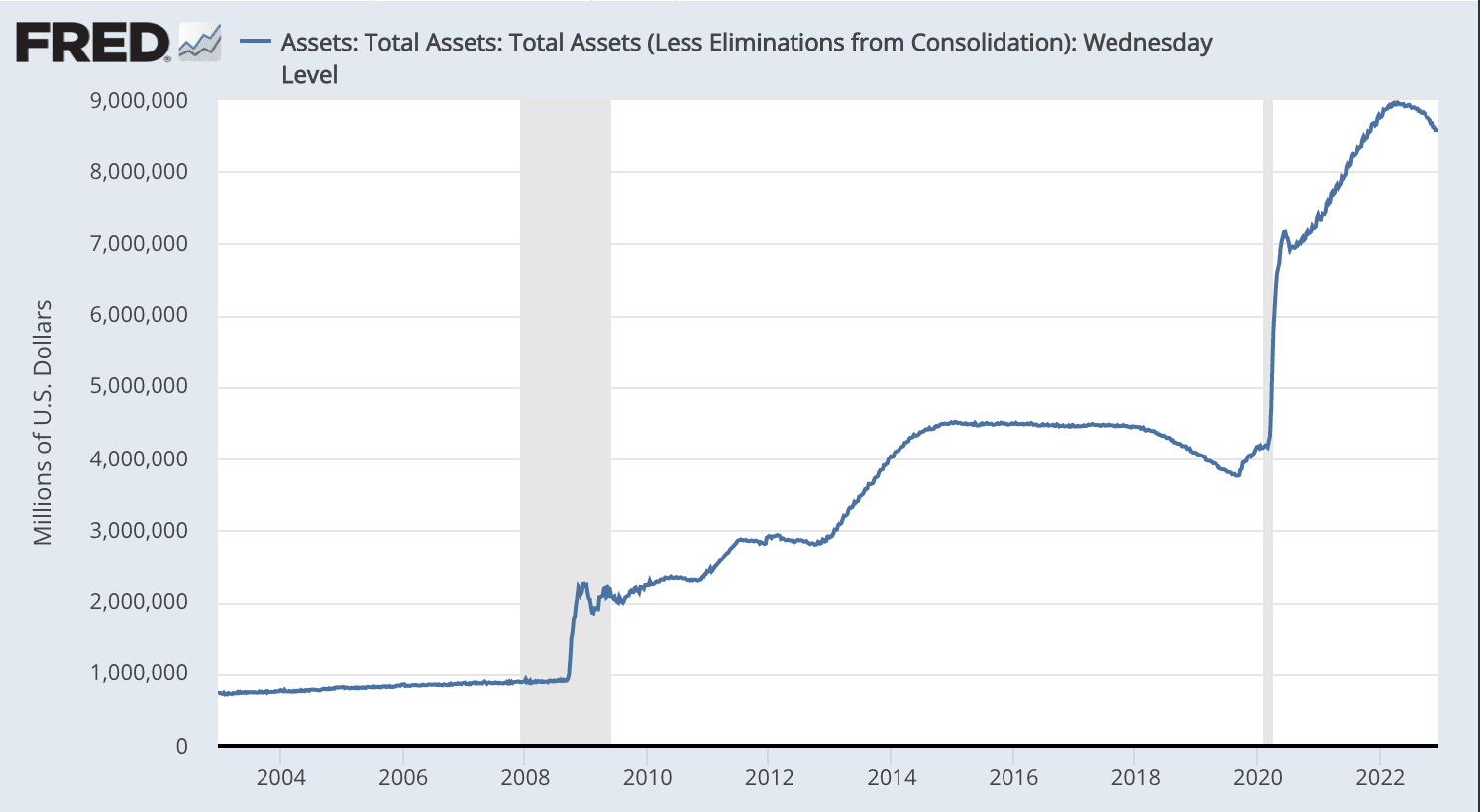

That’s because, for all the monetary tightening, the Fed only sold off $300 billion of $4+ trillion in assets it bought during Covid:

That means, combined with multi-trillion fiscal packages, there is still an excess of ~6 trillion in the economy.

And remember how exuberant QE was? Well, in two years, the Fed doubled it – before QE even had a chance to really reverse. And no one has said a word.

Ever wonder why stocks climbed so high so fast right after COVID began, but fell even faster? That’s why.

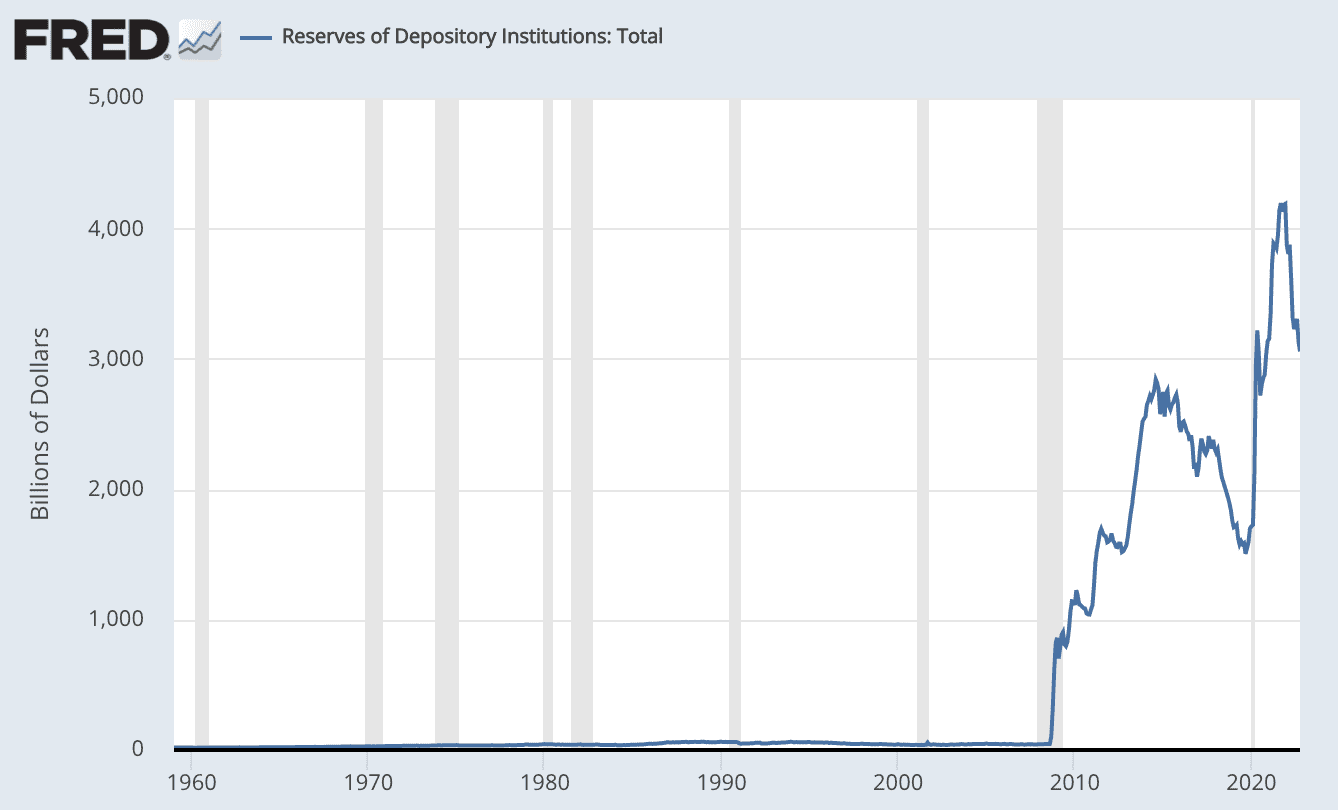

And in contrast to the post-2008 stimulus, those excess dollar bills aren’t sitting in bank reserves. Instead, they are out there, swishing around all over the economy.

Take a look at what’s happening with bank reserves:

After the Covid stimulus, banks grew their reserves. But those reserves aren’t anywhere near the amount of money the government flooded the economy with.

This means the bulk of Covid cash became “real” supply.

This is key.

As we discussed before, when the Fed prints money, it first stuffs it in bank reserves. And it’s only when banks lend it out does it actually make it into the economy (see newsletter from 2014: “How Does the Fed Influence the Stock Market? Like This.“).

That’s why we haven’t seen much change in the money supply; the money has been tucked away in vaults.

This time, a lot of the money is in circulation. And as banks continue to pull the rest of it out of reserves, the money supply will only grow.

The only thing that could quash people’s will to spend is a rise in unemployment.

But right now, jobs are increasing, and wages are growing too.

“According to the latest data release from the Bureau of Labor Statistics, in November, the country added 263,000 payrolls. That’s above the 200,000 payrolls economists that Bloomberg surveyed forecasted — and means one more month than anticipated of more-robust hiring.

November’s increase is good news for workers, who also got another raise that month. Wage growth stayed strong in November, with average hourly earnings rising 5.1% year-over-year — above the 4.6% that economists Bloomberg surveyed predicted. Earnings also rose 0.6% alone in November, far from a slowdown.”

Yes, there is a ton of buzz about tech layoffs. But despite tech’s unproportioned influence in financial markets, their jobs make up just a tiny part of the labor market.

Consider this: According to Goldman Sachs, all tech jobs account for—get this—less than 0.3% of total payrolls.

Even in the unlikely event that all tech workers are immediately laid off, the unemployment rate would barely budge 30 basis points.

With so much excess cash and an apparent strong jobs market, what’s stopping prices from rising once energy subsidies are over?

How to Monetize “Free Money”

When the Fed began printing, and Uncle Sam handed out trillions of dollars in stimulus checks, people were over the moon.

They took it as “free money” and mindlessly splashed it out on worthless meme stocks and cryptos.

Thus, most of this money has been transferred from the people to the elite. Just ask those behind FTX.

But we warned you that money wasn’t free. It was a future tax, and the payday would come due.

Inflation is that tax.

While that money is now no longer in the people’s hands, they still own the debt.

And they still have to pay that tax.

Here’s some simple math.

The money supply is up by about $6 trillion compared to pre-Covid times. And based on this year’s GDP and CPI, inflation has, so far, eaten up just $1.6 trillion of purchasing power.

That means the economy still has to debase the rest of the $4+ trillion to reach equilibrium.

And that, my friends, is how you monetize trillions of dollars in reckless spending.

The Hard Truth

Inflation is a lie. And it’s a scam.

You’ve all heard of inflation targeting and the consensus that we need 2% inflation for a strong and stable economy.

You’ve all heard the saying that if you leave your money in the bank during times of high inflation, you’re losing money.

But let me tell you the truth: inflation doesn’t affect the rich.

In fact, it’s an excellent tool for the rich to make even more money – especially if they’re patient.

Let me explain.

Let’s say the price of milk goes from $5 to $10, and the price of gas doubles from $3/gallon to $6/gallon.

Do you think that would affect someone with $10 million in the bank collecting 5% interest – equal to $500,000 per year?

Obviously not.

But it does affect the middle and lower class to the point where they have to change their spending habits.

So, of course, the government and central banks, designed to protect you from yourself, has to step in and “tame” inflation.

And how do they do that?

Well, they have to raise interest rates, of course.

So let’s say “they” raise interest rates to 10%.

The rich, with their $10 million in the bank, will now make $1,000,000 every year for doing nothing (far more because there’s always a better financial instrument that beats the Fed rate).

But the middle and lower class (especially the younger generation) will now suffer more because, to combat inflation, the central banks just raised the price of the most expensive aspect of living costs: housing.

Especially in Canada where the average mortgage term is 5 years or less.

Via Globe and Mail:

“About 670,000 variable-rate mortgages have been issued since the start of the pandemic, according to the Bank of Canada. Variable-rate mortgages accounted for around 50 per cent of all mortgages issued since mid-2021, compared to an average of 20 per cent in the years before the pandemic.”

In other words, over the next few years, the price of housing is going up for a large subset of homeowners (who will pass as much of this cost as they can onto renters.)

“The bottom line is that mortgage costs for some Canadians have already increased, and they will likely increase for others in time, making home ownership more expensive.” Ms. Rogers said.”

But that’s not all.

By the middle of next year, up to 65% of variable rate mortgages in Canada will hit a trigger point.

“The most common variable-rate product has fixed monthly payments. With every interest rate hike, more of the borrower’s monthly payment goes toward interest. However, when the monthly payment no longer covers any principal, the borrower hits what is known as a trigger rate, and their monthly payment rises. In some cases, the lender allows the borrower to shift the interest onto the principal, which increases the size of the mortgage.

Fifty per cent of these variable-rate mortgage holders have already reached their trigger rate, according to estimates from a new Bank of Canada research paper published Tuesday. That share will rise to 65 per cent by the middle of next year as the central bank continues to hike interest rates to rein in inflation.”

And that’s just variable-rate mortgages in Canada.

What about those who locked in mortgage rates and have to renew in a few years? Could someone who locked in a 5-year rate at 5% afford the same mortgage if interest rates go up to 10%?

Time will tell.

So what should you do if you’re rich?

Be patient and buy hard assets when real estate drops – as it always does when interest rates rise.

What should you do if you’re not rich?

Save. This is especially true for the younger generation (please pass this on to your kids).

Don’t get lured into spending. Live with your parents if you have to. That million-dollar apartment you couldn’t afford could drop another 10, 20, or even 30% in the next few years due to interest rate hikes (*it’s already down more than 10% year-over-year.)

For first-time homebuyers in Canada, it takes 5%-10% for a downpayment.

So if you save $50k-$100k in the next 3-5 years, you’d qualify for that $1 million-dollar apartment. And since housing price drops as interest rates rise, you might be able to buy that same apartment for even less.

And a dollar saved is a dollar earned.

If real estate prices drop 30%, it’s like making $300k (drop in the price of the apartment) with only $50k (downpayment), just for being patient.

And if you think 30% is a steep drop, Canada is already expected to see a near 20% drop from peak.

Via Financial Post:

“Once burning-hot Canadian house prices are expected to tumble a total 17.5 per cent from their peak, roughly double the fall during the 2008-09 financial crisis, in a slowdown already well underway, according to a Reuters poll of market experts.”

If there is one gift you can give your kids for Christmas, I hope this is it: don’t trust the government nor the central banks who run it.

Merry Christmas and Happy New Year!

Seek the truth and be prepared,

Carlisle Kane

As always, I continue to enjoy the Equedia Letter.

True story about one of our daughters who is in Chilliwack. About a year ago they bought an expensive house there ($1.5 million) and got an incredibly low mortgage rate. She told us she had a five year term at this fixed rate. I didn’t believe her for a minute.

Got a call just over a week ago letting us know that her mortgage payment had MORE than doubled to $3,400 every two weeks! Obviously her rate was variable, rather than fixed, and now she is literally paying the price.

How long her and hubby can keep this high payment up I don’t know. But it’s starting to look like they will have little choice but to sell, this time at a hefty loss.

Incidentally, I do pass along your newsletter to our daughters, but of course I cannot force them to read them.

Keith

What an honest article! Canadians really need something like this…no one is telling us the truth. I’m looking for a detached home in city of Laval ( province of Quebec) and prices are still stupid high. Your articles are a priority for my family to read. Thank you for this great service, we all need to get properly educated.

You should get a citizens award for writing them!

Ang

Great article as always, so informative and true. I especially liked your advice in this letter. I have practiced it for years, even then it is still easy to get tripped up in the knifing of cons and cheats.

Keep up the good work!