Dear Readers,

This may be the best way to profit from marijuana.

Only…it’s not marijuana.

Yet, it takes full advantage of the excitement behind marijuana – all without the controversy.

That means everyone can participate, regardless of their views.

And that’s a very BIG deal.

But…

Time is Running Out

If you miss the boat this time around, you may question your decision for the rest of your life.

In fact, I have been warning you about this for over a year.

At the end of last year, I specifically said in my Letter:

Via Turning Average Joes to Millionaires:

“It’s going to be an insane year for this cash cow sector that will soon become a global phenomenon.

So regardless of your views of marijuana…if you miss this opportunity, you will most certainly kick yourself.”

Since then, stocks within this cash cow sector have gone nuts.

Even our newest marijuana idea surged over 100% in just one month’s time.

It seems a big announcement happens every week that sends shockwaves – and riches – through the entire market.

And I predict another MASSIVE announcement is coming.

One that will make investors in this already burgeoning sector even richer…that is if they’re in the right segment of the market, at the right time.

I’ll get to that in just a bit.

The Crystal Ball

I have been making some very bold and specific predictions this year.

And within weeks of making those predictions, they came true.

For example…

On June 10, I wrote via “The Insider Guide to Marijuana Legalization“:

“I predict that we will soon see deals – be it debt, stock, or other agreements – between marijuana companies and the big institutions following legalization.”

Less than a week after Legalization passed, one of the biggest banks in Canada, the Bank of Montreal, gave Aurora Cannabis a massive C$200 million debt facility, with a potential upsize to $250 million.

Then…

On July 15, I wrote via “How Trump Tariffs Really Affect the Market“:

“…I can almost guarantee that other big players, such as Big Alcohol, Big Beverage, and Big Institutions will begin to make their mark on the marijuana sector – leading to more ammo for the marijuana stock market.”

Just a few weeks later, Molson Coors Brewing Co. announced a joint venture with Hydropothecary that will work on developing non-alcoholic, weed-injected beverages.

Shortly after that, Constellation Brands (one of the largest beer companies in the world) invested C$5 billion into Canopy Growth.

But that’s all peanuts compared to what I am about to tell you.

The Biggest Marijuana Event of All

If you had the chance, would if you have invested in some of the biggest growing trends of the past decade before they became what they are today?

Would you have invested in Vitamin Water before vitamin-infused waters became a thing?

…Or Red Bull before the energy drink craze took off?

…Or Kombucha before it became a household name?

I am betting the answer is yes.

Because if you invested in the right companies in any of those segments before they became big, you would likely be extremely wealthy.

Of course, those times have mostly passed.

But today, I am going to introduce you to a new segment of the market that I believe could be BIGGER than all of those spaces.

It’s a brand new functional health trend that will take the world by storm – so big that the biggest players in the world have already publicly stated their intentions to participate.

You see, unlike those other segments, this particular one already has significant media coverage – even before sales have really begun.

Heck, even TechCrunch, an American online publisher of technology industry news, just covered the space.

And it’s only the beginning – a newborn segment of a market that could become the single fastest-growing category in the space.

It’s like investing in marijuana stocks a few years ago before Legalization was announced and before recreational weed sales have even taken place.

For example, Canopy Growth (WEED) was under $2 per share just three years ago.

Today, they trade at over $64 – topping nearly $75 earlier this month.

That’s a potential return of more than 3600% in less than 3 years!

If timed correctly, an investment of $10,000 could have turned into over $360,000 in less than three years – and all before the Company has made even one sale of recreational marijuana.

Now…

What if there was a new market that could rival and become just as big as the marijuana market…maybe even bigger?

In fact, according to a new estimate from the Brightfield Group, this market alone could hit a whopping US$22 billion by 2022.

And what if we combined the massive allure of marijuana legalization with the massive functional health beverage trend?

We may have one of the biggest untapped markets of all…

The Biggest Untapped Market

In my latest report from just a couple of weeks ago, I wrote:

“…I predict that the marijuana-infused beverage space will become absolutely massive – not only because it will be an alternative to alcohol, but it will also become a functional health trend as well.”

I then suggested that Big Cola is taking notice.

A week later, that prediction came true.

Just this past week, the single most significant marijuana announcement was made:

Coca-Cola is interested in cannabis.

Last week, a rumour began to circulate that Coca-Cola was in talks with marijuana company Aurora Cannabis to develop functional health beverages infused with cannabidiol, commonly referred to as CBD.

Via BNN Bloomberg:

“The Coca-Cola Co. is in “serious talks” with Aurora Cannabis Inc. to develop cannabis-infused beverages, a groundbreaking move that would signal a significant foray into the marijuana sector by one of the world’s most iconic consumer brands, multiple sources familiar with the matter told BNN Bloomberg.

The sources said that Coca-Cola, the world’s largest beverage company, is interested in developing beverages that are infused with cannabidiol, commonly referred to as CBD, the non-psychoactive chemical found in marijuana plants.

Unlike other deals between alcohol makers and cannabis producers aimed at making drinks that will give consumers a “buzz” similar to inhaling marijuana, Coca-Cola and Aurora would likely develop beverages that will ease inflammation, pain, and cramping.”

While both companies said that no agreements have been made, they both did say they are actively pursuing the infused beverage space…just as I predicted last week.

Via BNN Bloomberg:

“Kent Landers, a spokesman from Coca-Cola, declined to comment about Aurora. However, he added in an emailed statement to BNN Bloomberg that “along with many others in the beverage industry, we are closely watching the growth of non-psychoactive CBD as an ingredient in functional wellness beverages around the world. The space is evolving quickly. No decisions have been made at this time.”

CBD has long been known to have positive health benefits, including pain and inflammation relief, as well as many others.

Even the FDA approved a CBD drug earlier this year.

Even the FDA approved a CBD drug earlier this year.

It’s no wonder CBD may be the next big health trend.

But CBD doesn’t have to be derived from marijuana – it could come from hemp, an already (mostly) legal substance.

And when derived from hemp, CBD contains practically no THC – the primary ingredient that causes people to get “high.”

In other words, it can act as more of a nutritional supplement, rather than a psychoactive or mood altering substance.

And while hemp-derived CBD is still a grey area in terms of legalization, the reality is that even the DEA doesn’t consider CBD to be an illegal substance.

Via the DEA:

“Products and materials that are made from the cannabis plant and which fall outside the CSA (Controlled Substances Act) definition of marijuana (such as sterilized seeds, oil or cake made from the seeds, and mature stalks) are not controlled under the CSA.

Such products may accordingly be sold and otherwise distributed throughout the United States without restriction under the CSA or its implementing regulations.

The mere presence of cannabinoids is not itself dispositive as to whether a substance is within the scope of the CSA; the dispositive question is whether the substance falls within the CSA definition of marijuana.”

But that’s not all.

New American Law to Open Doors

The current United States Farm Bill expires at the end of this month, and many believe that its successor will include the full legalization of hemp across all of the United States.

If passed, the new Farm Bill may not only make hemp – and thus CBD-derived from hemp – legal, but it could open an entirely new market expected to be worth billions.

Via RollingStone:

“For years, experts have predicted that if the cannabis industry expands at its current rate, the American market will reach $20 billion by 2020.

But it turns out that one market is spinning off into a mega-industry of its own: according to a new estimate from cannabis industry analysts the Brightfield Group, the hemp-CBD market alone could hit $22 billion by 2022.”

That’s because hemp producers will gain access to financial services like federal crop insurance, as well as access to banking and traditional capital markets – just as marijuana companies in Canada have.

Imagine getting another opportunity to invest in a space right before legalization!

It’s no wonder Coca-Cola, one of the most iconic brands in the world, just publicly announced their interest in CBD.

And while everyone has been focused on Coca-Cola’s interest in CBD via the Aurora Cannabis Rumour, Coca-Cola has already indirectly taken interest in CBD-infused beverages.

Via Bevnet:

“L.A. Libations EVP David Meniane no longer goes a day without taking CBD.

Since first deciding to explore the space, he has immersed himself in functional beverage brands building around CBD, sampling hundreds of products over the course of the past year.

During that time, Meniane became a true believer in CBD’s physical and mental benefits.

With a green light from their investors, The Coca-Cola Company, it’s a question of “when,” not “if,” L.A. Libations will partner with a CBD-based beverage brand.”

For those unfamiliar with L.A. Libations, they are the key innovation partner of The Coca-Cola Company’s Venturing and Emerging Brand group.

For those unfamiliar with L.A. Libations, they are the key innovation partner of The Coca-Cola Company’s Venturing and Emerging Brand group.

And they have already been given the green light by Coca-Cola to pursue CBD-infused drinks, going as far back as June.

When Constellation Brands announced a $5 billion investment into Canopy, it took the stock market by storm.

But as I mentioned earlier, even that is peanuts when compared to Coca-Cola.

Coca-Cola is more than FOUR TIMES bigger than Constellation Brands.

And you can bet that if Coca-Cola is interested in CBD, Pepsi and others will be too.

That means the global beverage kingpins could soon enter the CBD space and it will be a race to the top.

In other words, the next biggest boom in marijuana isn’t aimed at getting people “buzzed” or “high.”

It will be aimed at everyone.

And that’s a really, really big deal.

Mark my words: Big Beverage is coming.

When they do, I predict it will send shares of companies within the CBD-infused beverage space soaring to record highs.

In fact, the mere rumour of Coca-Cola entering the marijuana space has already led to companies in the CBD-infused beverage category to more than double in share price in just a few short days.

Only, most of those companies don’t have much, let alone a brand.

But one company does…and they just announced something BIG.

Here’s how to invest in marijuana without investing in marijuana.

The Alkaline Water Company

(TSX-V: WTER) (OTC: WTER)

Earlier this month, I wrote a special report on why I believed the Alkaline Water Company was undervalued and why it was a potential takeover target by the big beverage companies.

If you missed that report, I strongly suggest catching up by:

CLICKING HERE

In short, The Alkaline Water Company Inc. is a leading producer of premium bottled alkaline drinking water sold under the brand name Alkaline88.

Alkaline88® is sold in over 40,000 retail locations nationwide in all 50 states, with a distribution that spans more than 150,000 stores.

These include 9 of the top 10 largest retailers in the entire U.S. and two of the largest retailers in the entire world.

Take a look:

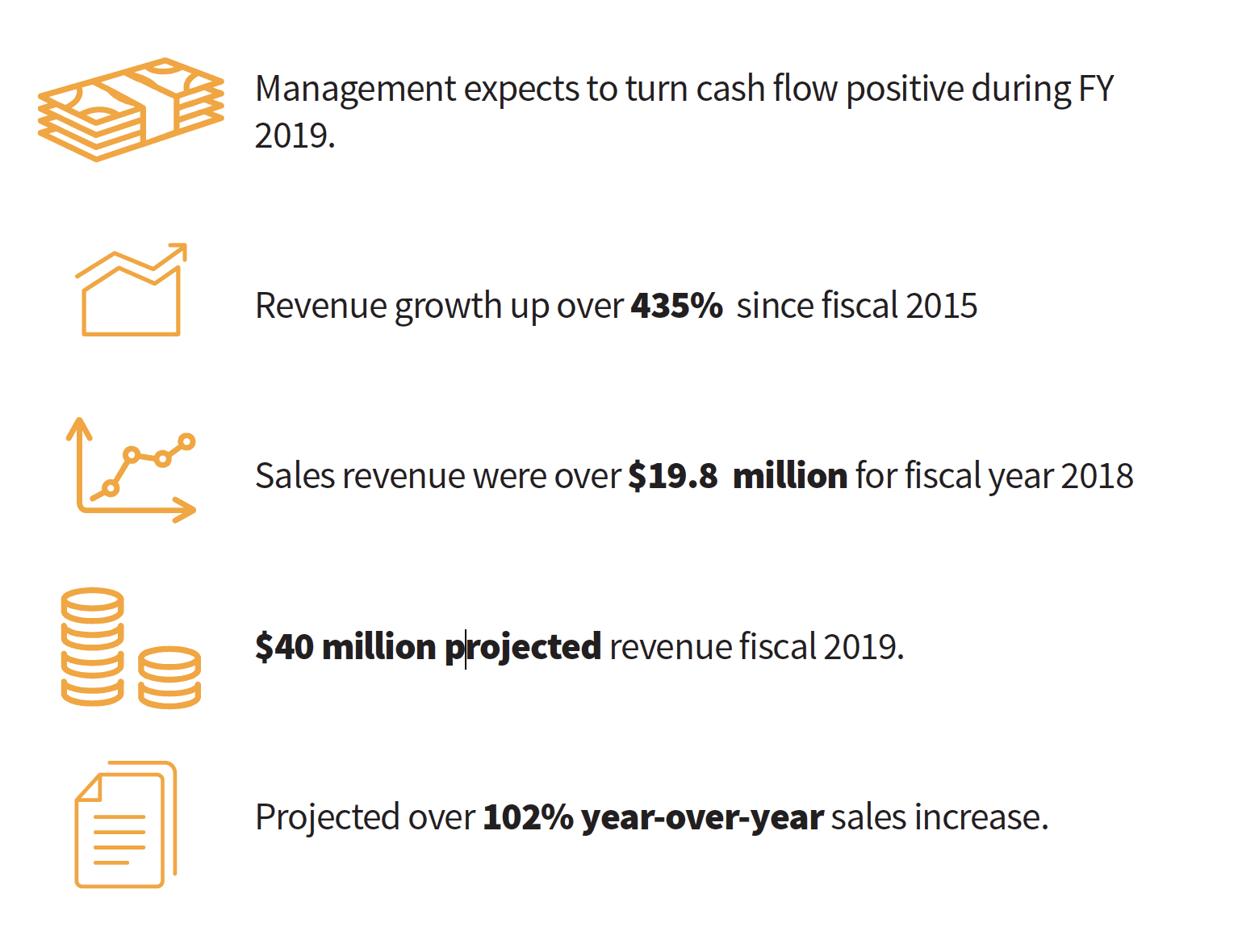

The Company is now both the fastest-growing alkaline water company and the fastest growing premium water brand in the U.S.

The Company is now both the fastest-growing alkaline water company and the fastest growing premium water brand in the U.S.

And that’s pretty big news considering the alkaline water category is the fastest growing premium water category in the US.

Here are just some of the Company’s numbers:

It’s why I believed that they were not only undervalued at the time of my report but why they were a prime takeover target.

It’s why I believed that they were not only undervalued at the time of my report but why they were a prime takeover target.

I listed many of those reasons in my original report, which you can find HERE.

But this past week, I changed my mind.

The Alkaline Water Company is an even BIGGER opportunity than I suspected.

First, recall what I wrote earlier this month:

“…many types of functional beverages – such as those infused with CBD, Hemp, and soon THC – will likely require alkaline water to maintain their efficacy and stability.

Long-time readers of this Letter know that we have made many big predictions regarding the marijuana space with pretty consistent accuracy.

Many of you have also made lots of money as a result.

And I predict that the marijuana-infused beverage space will become absolutely massive – not only because it will be an alternative to alcohol, but it will also become a functional health trend as well.

So it’s no surprise that you may have already seen a few CBD and marijuana beverage companies come to market.

Most of them have little experience – and practically no footprint – when it comes to beverage distribution.

But the Alkaline Water Company has both – which means if they enter the functional beverage market, they not only have a proven distribution platform but a national brand.

Imagine the power of branding associated with the name “alkaline,” as the functional health drink space – and marijuana beverages – explodes.

Alkaline CBD…Alkaline Chlorophyll…Alkaline Hemp…Alkaline THC…Alkaline Calcium…Alkaline…you name it!“

Just this week, the Alkaline Water Company announced it’s entering the functional health drink space, and it will launch a whole new product line.

And one of those products is of absolute significance.

Alkaline Water Goes CBD

The Alkaline Water Company just announced that it is creating a whole new line of products in the healthful water category – the fastest growing beverage category in the world.

This includes Alkaline88® infused with Natural Vitamins and Minerals, Natural Sparkling Alkaline88® water, and Naturally Flavored Alkaline88® water.

Most importantly, it is planning to use its Alkaline88 platform to launch a hemp-derived CBD infused Alkaline88® water, which will be bottled in the 500 ml size with a dosage of 10 mg of hemp-derived CBD per bottle.

In other words, the Alkaline Water Company is entering the marijuana space – without having even to touch marijuana.

In other words, the Alkaline Water Company is entering the marijuana space – without having even to touch marijuana.

But unlike many of the companies touting a CBD-infused beverage line to excite the market, the Alkaline Water Company has already been researching the infused space and has been taste profiling and testing product formulations for the launch of their new product line.

But unlike many of the companies touting a CBD-infused beverage line to excite the market, the Alkaline Water Company has already been researching the infused space and has been taste profiling and testing product formulations for the launch of their new product line.

It also announced a co-packing agreement with American Nutritional Products Inc. (ANP) for the development of each of its recently announced product extensions, whereby ANP will provide A88 Infused manufacturing, formulations, R&D, biomass and extraction within ANP’s state-of-the-art facility.

Should a new US Farm Bill pass at the end of this month, hemp could be fully legalized in the US.

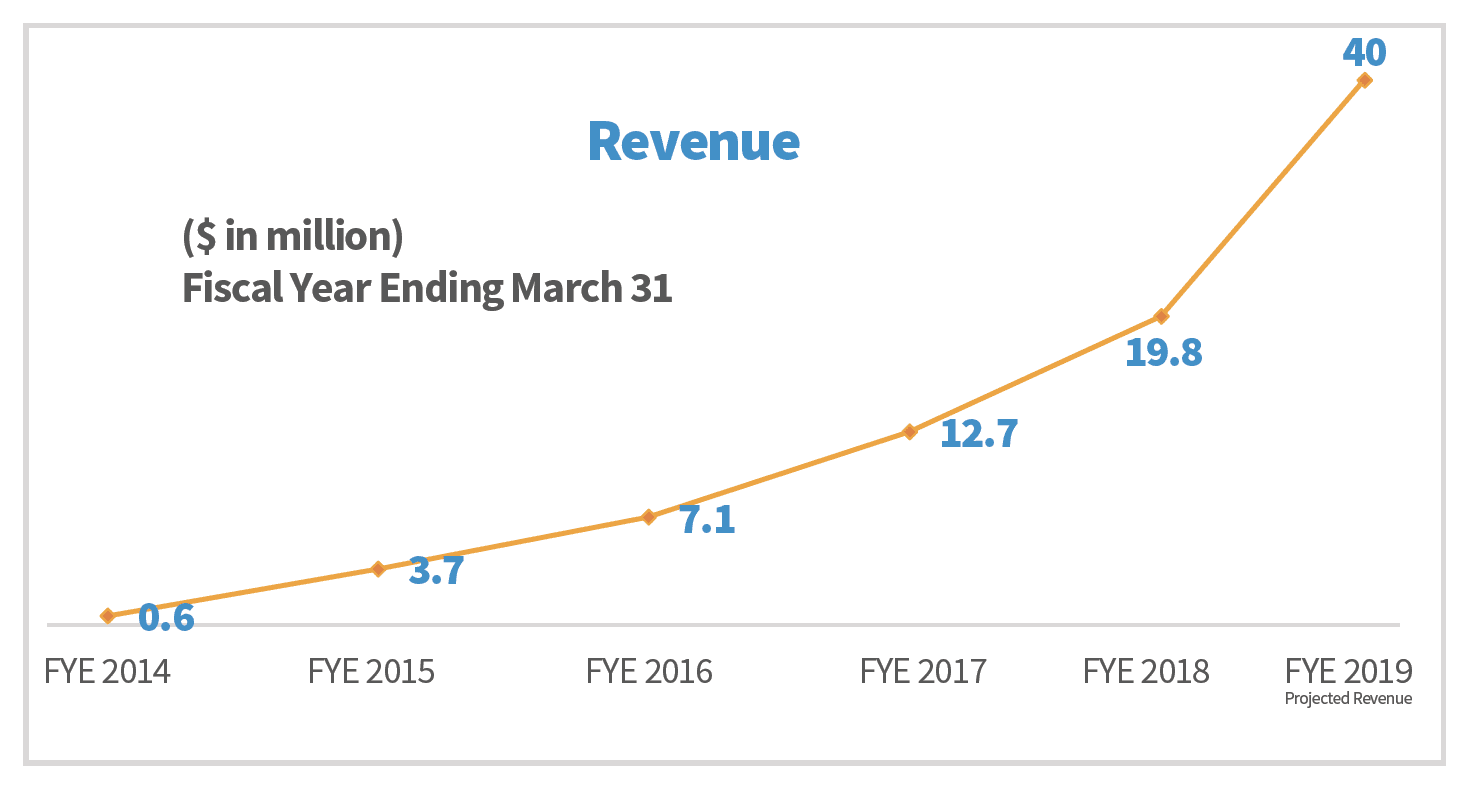

That means the Alkaline Water Company could be in a very advantageous position to quickly launch its CBD-infused drinks and potentially gain rapid market share – especially considering that its core product is already expected to do US$40 million in sales this year, spread across the biggest retailers in the US.

If the Alkaline Water Company is successful in its CBD-infused launch, it could prove very rewarding for shareholders.

And considering their achievements over the past few years, why wouldn’t they be?

The Growth of the Alkaline Water Company

Five years ago, the Alkaline Water Company entered into one of the hottest beverage markets: Alkaline Water.

Today, the Company has transformed into the fastest growing alkaline water brand, on track not only to double its revenue but with expectations to become cash flow positive for the first time this fiscal year.

And that’s a big deal considering most beverage companies on such a high growth curve – let alone bottled water companies – are generally losing lots of money.

And that’s a big deal considering most beverage companies on such a high growth curve – let alone bottled water companies – are generally losing lots of money.

Before I conclude, I want to emphasize what I wrote in my last report about this Company:

“…the really exciting part is that Alkaline Water’s growth can compound in ways the Company hasn’t done before – even though the Company has shown immense and steady growth over the past three years.

Let me explain.

There are a few ways beverages come to market.

1. Direct to Warehouse – selling directly to the retailer.

2. Third-Party Logistics Providers – who essentially act asmiddlemen leveraging their distribution platform.

3. Direct to Store Distribution (DSD) – where middlemen distribute the products for you directly to the retailers’ shelves.

The majority of the Alkaline Water Company’s growth has been their ability to sell the large bottle format directly to the warehouses of retailers – a segment of the market that no one even comes close to touching.

Right now, big-name retailers such as Walmart are primarily selling Alkaline Water’s one-gallon and three-liter bottles, and the Alkaline Water Company sells to them direct.

Judging by Alkaline88’s sales performance, and the fact that Walmart has rolled out Alkaline88 nationwide, the Company’s products are clearly flying off the shelves.

That means Walmart, and other big-name retailers, could easily add different SKU’s such as 1 or 1.5 litres, 750 ml, and six-pack formats without having to bring on new brands into their system – a very time-consuming and risky process.

In other words, Alkaline88 sales could continue its growth organically with the retailers they already have.

But they have barely scratched the surface of the gas stations, convenience stores, and pharmacies, which primarily belong to the DSD and third-party logistics buyers.

They have barely scratched the surface of the single-serve market.

And the Alkaline Water Company has plans to hit those markets next.

Given that their brand is already spread nationwide through the world’s largest retailers, and over 150,000 stores, many of the DSD players – the most prominent players of all – could soon call for Alkaline88 products.

And that would be a major breakthrough for the Alkaline Water Company.”

The above is important because when I wrote that report just a few weeks ago, the Alkaline Water Company only sold alkaline water.

I then wrote…

“…The general consensus is that bottled water companies are being valued at around 4-6 times top-line revenue, but can reach as high as nearly 12 (as was the case with Vitaminwater).

Via CNBC:

“…Companies similar to Essentia are often valued at four to six times revenue…”

So what does that mean for shareholders if the Alkaline Water Company were to be acquired based on their expected US$40 million in revenue for this fiscal year?

Assuming a low-end multiple of 4x revenue, the Alkaline Water Company would be valued at US$160 million.

With Alkaline Water’s current share structure, that would mean more than US$5 per share.

At a 5x multiple, it’s nearly $6.50 per share.

And at 6x it’s $7.75 per share.

Shares of Alkaline Water are less than US$2 today.

And that’s all before we factor in the other potential growth that the Alkaline Water Company has in store, including entering the single-serve market.

And even the international market.”

But things have rapidly changed…

Another Outlook on Valuation

The Alkaline Water Company is now planning to launch a whole new product line – a line which I predict could do very well in a market they have barely scratched the surface of: the DSD market.

Even more exciting is that one of those products will be CBD-infused water.

And as we know, many companies in the marijuana space are commanding insane valuations of over 100 times revenue – some even over 240!

I am not saying that we should expect to see those types of valuations for the CBD infused-beverage space, but what I am saying is that those in the CBD space will likely command very high valuations also.

And why shouldn’t they?

According to New Frontier Data, the domestic Canadian cannabis market will reach C$9.2 billion by 2025.

Meanwhile, the CBD market could reach US$22 billion by 2022 if the new US Farm Bill is passed later this month.

If the CBD market is estimated to become twice as big as the Canadian legalized marijuana market, but in a shorter amount of time, those in the CBD space could possibly command even higher valuations.

Furthermore, we have heard for years that marijuana stocks are overvalued, yet they continue to not only hit record-high valuations but are being supported by big names such as Constellation Brands.

What will happen to CBD-infused beverage stocks, like the Alkaline Water Company, if Coca-Cola or Pepsi Co. officially announce their foray into the space?

What will happen to these stocks if hemp becomes officially legalized across the entire United States, potentially in just a few weeks?

It could be mind-blowing.

Conclusion

I don’t have a crystal ball – even though many of my predictions within the marijuana space have proven both timely and accurate.

But I do have access to numerous sources in the marijuana industry.

And these sources tell me that Big Alcohol and Big Beverage are talking to them.

I suspect we’ll soon see the sector light up again as more big announcements come from not just Big Alcohol (such as Diageo) or Big Beverage (such as Coca-Cola or Pepsi), but also Big Tobacco and Big Pharma.

Remember, when Constellation Brands invested C$5 billion to buy a massive equity stake in Canopy Growth last month, the sector lit on fire.

In fact, shares of Canopy Growth have already doubled in price since that announcement.

What do you suspect will happen when the biggest beverage companies in the world partake in the marijuana space through CBD and CBD-infused beverages?

I’d rather be an investor now before they do.

And that’s why I am invested in the Alkaline Water Company.

The Alkaline Water Company Inc.

Canadian Stock Symbol: TSX-V: WTER

US Stock Symbol: OTCQB: WTER

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure:

We are biased towards the Alkaline Water Company (WTER) because the Company is an advertiser on www.equedia.com. We currently own shares in WTER. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in WTER or trading in WTER securities. Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. WTER and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from WTER, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/

Forward-Looking Statements from Alkaline Water materials

This presentation contains “forward-looking statements.” Statements in this presentation that are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Such forward-looking statements include, among other things, the statements regarding projected growth of 49% to $27.5 billion by 2021 for U.S. bottled water sales; the statement regarding growth rate of U.S. bottled water sales expected for 2018; First Beverage Group’s projection of the global flavored and functional water market reaching $36 billion by 2019; the statement that the new look should give single-serve bottles of The Alkaline Water Company Inc. (the “Company”) a significant sales boost this coming year; the Company’s belief that the Company will be selling Alkaline88 in international markets by Q3 of FY2019; the statement that no company is as uniquely positioned in the 18.5 billion bottled water market than the Company; the statement that the Company and its product, Alkaline 88 are well positioned for a brand-drive acquisition and the Company would be well-positioned for a buy-out by Big Soda; the statements that the Company is engaged in a forward-looking plan and in the areas of marketing, sales, financing and production, the Company has plans in place for continued success; and the statements that the Company’s current production capacity well exceeds its mid-term volume projections and should demand exceed projections, the Company is ready to meet that demand with little or no shortfall in product supply. The material assumptions supporting these forward-looking statements include, among others, that the demand for the Company’s products will continue to significantly grow; that the past production capacity of the Company’s co-packing facilities can be maintained or increased; that there will be increased production capacity through implementation of new production facilities, new co-packers and new technology; that there will be an increase in number of products available for sale to retailers and consumers; that there will be an expansion in geographical areas by national retailers carrying the Company’s products; that there will be an expansion into new national and regional grocery retailers; that there will not be interruptions on production of the Company’s products; that there will not be a recall of products due to unintended contamination or other adverse events relating to the Company’s products; and that the Company will be able to obtain additional capital to meet the Company’s growing demand and satisfy the capital expenditure requirements needed to increase production and support sales activity. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, governmental regulations being implemented regarding the production and sale of alkaline water; additional competitors selling alkaline water in bulk containers reducing the Company’s sales; the fact that the Company does not own or operate any of its production facilities and that co-packers may not renew current agreements and/or not satisfy increased production quotas; that fact that the Company has a limited number of suppliers of its unique bulk bottles; the potential for supply chain interruption due to factors beyond the Company’s control; the fact that there may be a recall of products due to unintended contamination; the inherent uncertainties associated with operating as an early stage company; changes in customer demand; the extent to which the Company is successful in gaining new long-term relationships with new retailers and retaining existing relationships with retailers; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and sales activity; competition in the industry in which the Company operates and market conditions. These forward-looking statements are made as of the date of this presentation, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although the Company believes that any beliefs, plans, expectations and intentions contained in this presentation are reasonable, there can be no assurance that any such beliefs, plans, expectations or intentions will prove to be accurate. Readers should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents the Company files with the SEC, available at www.sec.gov, and on the SEDAR, available at www.sedar.com. The Company has not conducted any clinical studies regarding the health benefits of alkaline water and accordingly makes no claims as to the benefits of alkaline water.

Does anyone know which cannabis company Alkaline partnered with ?

How do I get in an how much do I have to invest

Hello Paul,

Currently, WTER shares are at $3.66; therefore, you can buy as many shares as you can afford. I just bought some shares, I expect the shares to drop a little since the shares have gone up from $1.90 to $4.60 in the last 20 days. I will buy some more shares once the price starts to go up again.

Man i already haveing bought my shares marketbis looking good on my part ….by ur shares now https://www.linkedin.com/feed/update/urn:li:activity:6485942780005879808

Hi can I get in and how much it will cost to invest

Can I get in on this investment, and how much will it cost me????

Join Robinhood and we’ll both get a stock like Apple, Ford, or Sprint for free. Make sure you use my link.

https://share.robinhood.com/edda2

Join Robinhood and we’ll both get a stock like Apple, Ford, or Sprint for free. Make sure you use my link.

https://share.robinhood.com/edda2

How much to get in

Hope WTER works out better than the short telescope idea.

Great insight

This sounds two good to be true.if this comes true makes me want two invest .

Great follow up to original WTER report.

I think it may be worth the time for Equedia readers to look over the 10-K. Management does have an incentive to reach the $40M sales number; if they do, they trigger the conversion of their preferreds (Series D) to common (5,000,000 according to filing). The Series C preferreds (1,500,000) trigger once $15M in sales are reached.

I do like the product but remain cautious on the management team. In Q4 2016, CEO Steven Nickolas was removed for “just cause”. This is old news, i know, but something to point out. This is the nature of a companies of its size, I suppose. Bright side is that the annual report was filed in 2018 without a delay. The company previously failed to file in 2017 and 2016 its annual report in a timely manner.

Overall, I do think it’s worth the risk especially with the US Farm Bill cited; if “industrial hemp” is legalized, there will be lots of runway . Since Ivan’s initial report, WTER has done well.

What is the fee to get stared

Join Robinhood and we’ll both get a stock like Apple, Ford, or Sprint for free. Make sure you use my link. https://share.robinhood.com/jackh747

What is the cost to get started? I have been drinking

Alkaline water for about 3 months, from a company called flow. They just came up with flavour, ginger, lemon, watermelon, lime. Very good tasting flavours.

I want to invest soon need to know what to do next…

Join Robinhood and we’ll both get a stock like Apple, Ford, or Sprint for free. Make sure you use my link.

https://share.robinhood.com/edda2

I would be very interested in info on this venture.

Thanks

Could u show me how to invest and make lots of my way I’m tired of struggling please

its tough when u have to struggle u can learn a lot by google look up company and their financial report will be there then u can make an educated decision, good luck

Would like to know more info

Like to know what Investment groups in Canada that I should see to Invest. If thats a question you can answer for me.

New to the investment game. Interesting article…interesting venture. Need more details.

Would like more info on how to invest and what cost if any to get started. Cost of shares.

Anyone know where to go to invest? Very interested.

Lety, as I’ve stated to some folks, find a discount broker like Charles Schaawb or E-Trade. Commissions are less and you can buy and sell stocks very easily.

Very interested

More info please

Let me know what stock agency should be used.

Bruce, I use E-Trade and have no problems. Use a discount broker if possible, commissions are a lot less.

How do i invest in this

Has Nexoptic run into a wall. Is there a big corporate issue I don’t know about? Is it dead money? Just curious.

Become an associate for FREE to purchase/sell organic CBD oil! No $ no commitment. Get in on the ground-floor before the industry really takes off! http://www.toatley.MyCTFOCBD.com

Hi need to know how to invest

How to on vest and is a registered company

need more info

How do we invest ?

How do we invest and what’s the turn around on your money?

I would like to invest, how can I do this?

Can we have more detail? What are the steps of investment other than researching the company

Would like to invest 2000.

I’m retired and don’t gave a lot of money to invest, so how can I get in this comoany

I have been thinking about this since the conception of legalizing Marijuana , but I don’t have a large amount of money to put into this, somewhere between 1000 and 2000 dollers.

Big busines for all

Can I still invest in canibus stock for under 5 bucks a share and how

Numerous stocks available under $5.00

I would like someone to help me invest in Quick lawn service

How can I get in to investing

I want to invest

Very inrerested

Wave of the future till its 100% legal….no intrigue after this

Hello my name is Clemente

.A i am 41 years of age amd i am quite interested in this new improved production .In 2011 i was diagnosed with M.S and i have been told this just might be something that could help me with combating my M.S l

Amd so i would like to sent all the information about this new product for i am very interested in this .

I have not tried it because I work for the airlines. I have been told by friends that it help me with hurtful area of my body.

Whats are the rules forma investing?

how can i get into the business

I really need this done why I’m between jobs!

How can I invest in this and What’s the minimum investment requirement?

Medical procedures are reveling incredible results for human recovery this is a new age and New dawn nature’s way of saying I’m hear to help

OK what is the game plane here?? I though this suffered was not good for you, now it coming back say it is? So is the game plane here? Let me know & what the cost of it to get in on it??

Need to invest but strapped for cash and want to get in

So when can I invest with lenders n get 85% when stock is won?

Proper!

I am interested in it and would like to know how to start up immediatelt– may i have the name of Companiesd that i can invest in.

Meanwhile anyone can as well register with CBD for free and start making money and continue the use of their excellent products. http://www.godlyn.myCTFOCBD.com have a wonderful period

Outstanding!!!!!

After reading this remarkable letter. I eager to invest in the ever growing products that are at hand. Please instruct me on how to get the processing going full steam ahead. Let’s all secure our future by making money the legal way.

I am also very interested in how to start investing it says that we can use there money tell me how to get started

How do I buy shares in the company?

HELP us with training our minds to get out of the hell I was abandoned and left to die by spouse and trying to make it

It was good for God saik

I’m interested in investing tell me how to get started.

Good evening I am very interested in this opportunity to unable me to provide a better sound future for retirement because I know the system is not design for that. I look forward to communions regarding the partnership!!!

I’m interested in getting started is there someone that helps you do that? God bless Eva McGill

Thanks so much for your detailed information.

Please keep me updated ASAP when new Technology Company is getting

ready to put new product out.

I’m ready

I would like to know more about how I can get involved in investing.

I’m interested in investing,please let me know how much I need to get started.

I would be very interested in learning more about investing, the cost of the stock and fees.

Thank in advance!

It sounds very good. Like the previous comments. How much and what do I have to do to get started. Thank you 😊

How much and what do I need to get started. What is my participation in this

Im interested in vesting

I want to invest

I am 63 with no retirement fund at living on $1,000 a month fixed income I’ve been up pot smokers since the 60s I’m telling you anything that has to do with cannabis or hemp it is legalized I know it’s just a no-brainer it’s going to just be huge I would think in the pharmaceutical area so my question is what company did you get the most profit out of a water company do they need the water to make the drink or medical? It’s hard to say cuz they’re going to use it in a lot of stuff but investment is imperative as soon as possible to get the fast money until it levels off once it’s exposed can’t you tell us how to do it or what how to start as people that don’t know I don’t see you answer to anybody’s question and you got a whole bunch of them some of us don’t know what we’re doing and we have very little so it’s important to learn it soon as the less us poor people have to invest the better before they get too expensive like a book for dummies book or something thank you for your education you didn’t even ask for money personally that’s it’s like really rare I’m sick of doing these online surveys they’re Liars you never get paid and they all ask the same thing and you get all kinds of junk mail and you never get to the end of it it’s so all lies I’ve never seen or known anybody that got a damn paycheck from them I don’t know really how to invest but because they’re going to need a lot of water to make the drink with the hemp and cannabis in it right? My concern is there’s a lot of water companies and I’ve never seen the one your I’ve never I see hundreds of them on the shelves I’ve never seen the one you’re talking about today so my question is if that’s what you’re getting at that is the water company investment because they’re already talking about it even though it’s not a big company it’s best to invest in any of them that are considering getting into this Market and you suspect that this one is the best one that you think to invest in because you know for a fact that they are already ready to put the new drinks on the Shelf they’re just waiting for a certain legalizations is that correct they’re the closest to jumping in quicker before everybody else gets on board and everything’s too crazy and expensive I don’t know really how to invest I hope you can help us all out that want to learn about it and get in before it’s too late I noticed a lot of people suffering like me in your comments believe me we’re a few of the billions that are so you’re a very kind to educate us

How do I join how much do I need to invest with you guys

use a discount broker ( e-trade for example) and buy the shares on your own. It’s very easy to set up an account and start trading. Try not to use a broker because when trading due to their fees. I’ll go into further detail once I know you received this reply. I’ll walk you through the whole process.

Hey This is a good thing

How do I invest in this?

Beverly, the stock trades right now for about $3.60 a share. Open an account and buy as many as you want. Remember the ‘ol saying though “only invest as much as you can afford to lose”. This of course does not mean you’ll lose on a certain stock, just be cautious. The stock market is nothing more than a high priced poker game. Good luck.

How do I get ahold of the free money to start trading with I would really like to make money for you and me ASAP

this whole thing sounds way too good to be true but I’m going to apply and see what happens wish me luck

I am really excited about this.II need to get my Credit Card debt taken care of so I have money to get a place.Been homeless for almost 4 yeafs. it’s time. Kimberly Carona

I love this idea!!!

Very interested in aquring cheap stock options

No comment

I’m very interested!! How do I get started??? I’m from Ohio and I know just how big this is already and it’s growing.. Please explain to me how I get involved?? Sincerely, Tina

How can I be apart of this action now

What do I need to do?

Teach me how to in this please

How can I invest

How do I get in I have no idea how to get started.

What’s the catch

How do I get started?

Yes how do I get started

Yes how do I get started

How do I get started

If I had to pick a drink I’d call it turtle juice

My name is Thomas Noel and I am interested in participating. I am eager to learn more about investing in a stock, cannabis or the water. Please send me information on how to purchase. I’m 63 and would like to live out my years comfortably.

yes I want in

How do I get started

Help me get in

Lots of money to be made made…

Great article

i am a new member a d dont know how thus works yet but am excited to SEE what happens. God bless you all.

Sounds Extremely interesting and profitable!!

How do I start investing, love the potential for growth. What’s the stock ? Need to invest asap.

BDCI, TGGI, IGPK All will impact Cannabis Market, All future USA leaders.

ready !!!!

Comment