Spot Bitcoin ETFs could soon be making a grand entrance into the US market, as the count of Bitcoin ETF applications with the SEC continues to grow.

While Bitcoin supporters are giddy with excitement over institutional involvement, they’ve missed something BIG.

Something that could actually compromise the very essence of Bitcoin.

And we’re about to tell you what no one else will.

Before we get started, a quick recap is in order.

In our previous letter, we dove into the mechanics of ETFs, using gold ETFs as an example.

We uncovered the hidden truths behind these commodity-backed funds – from a lack of insurance and audits for custodian-held gold to the potentially fake gold sitting in the vaults of custodians.

We told you how the same issues could be lurking around the corner when it comes to Bitcoin ETFs.

We also introduced you to “Phantom Bitcoin,” wherein the participation of multiple custodians and exchanges within Bitcoin ETFs could potentially obscure the actual impact of ETF acquisitions on the Bitcoin market in the long term.

And therein lies the BIGGEST problem – one that could destroy the very essence of Bitcoin itself.”

So what could this BIG problem be?

In order to understand this, let’s go back to something we wrote many years ago.

They Control Everything

For years, I have explained how central banks have seized control of the world. They literally own everything.

Sitting at the top is the king of all banks, the Federal Reserve.

As the head honcho, the Federal Reserve System has three primary responsibilities (according to the Fed itself):

- Conducting monetary policy

- Supervising and regulating banking institutions

- Providing payments services to banking institutions.

“Economic conditions in the US and worldwide depend on how well the Fed does its job, and that affects everyone.”

In simpler words, the Fed oversees every financial transaction, controls interest rates, controls the banks, and controls liquidity and the money supply.

It controls everything.

Learning the Hard Way

Throughout its 100-year history, the Fed has learned that when it increases the money supply, inflation occurs very rapidly; conversely, the Fed has always known that decreasing the money supply leads to deflation very rapidly (one could argue that was how the Fed maintained control throughout history.)

Shortly after its official inception in 1913, the Fed began to intervene by increasing the money supply as a result of the financing requirements of World War I.

During the first two years under Fed control, inflation averaged 1%. By the third year, it had reached 7.9%; by the fourth year, 17.4%; fifth year, 18%; sixth year, 14.6; and seventh year, 15.6%.

Coincidentally – or not – according to the National Bureau of Economic Research, 20% of the total cost to the US of the war was financed through money creation – roughly the amount of inflation that took place during that time.

After seven years, inflation reversed course with the US having fallen into a deep depression.

Over the next decade, inflation remained subdued.

That is, until World War II.

Via Worldpress.org:

“During and immediately after World War II, the Fed maintained extremely low interest rates in order to reduce war-financing costs for the government. As these policies became unnecessary and inflationary after the war, the Fed was compelled by the Treasury to maintain the low cost of debt. The result of this highly accommodating monetary policy was 14 percent inflation in 1947 and rising unemployment that persisted into the early 1950s.”

(Note that the above historical events are very similar to what has happened over the last decade, with the exception of extremely high inflation.)

Then came the end of the Bretton Woods system, when gold’s link was removed from the US dollar, effectively giving the Fed the ability to increase the money supply at will.

And that is what the Fed did.

The Fed’s actions immediately resulted in, and directly affected, inflation – as increasing the money supply always has – leading to the great inflation of the 1970’s.

Unavoidable Consequences?

In its own words, the Fed manages monetary policy to promote a healthy economy by keeping prices stable and supporting a high level of employment. It attempts to do this through inflation targeting.

Since its inception, the Fed has attempted to keep prices stable while increasing the money supply. That’s because, as I mentioned many times before, the more the Fed can lend the US (money printing), the more control it will have over the country.

Via our past Letter:

“…the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

But throughout the three historical examples – WWI, WWII, and the end of Bretton Woods – the Fed has not been able to keep inflation subdued when money was created – just as every nation or bank has not been able to do in the past.

That is, up until the last twenty years.

And that is where modern day financial science comes into play…

The Truth About Inflation

Increasing the money supply has always led to an immediate and noticeable increase in inflation.

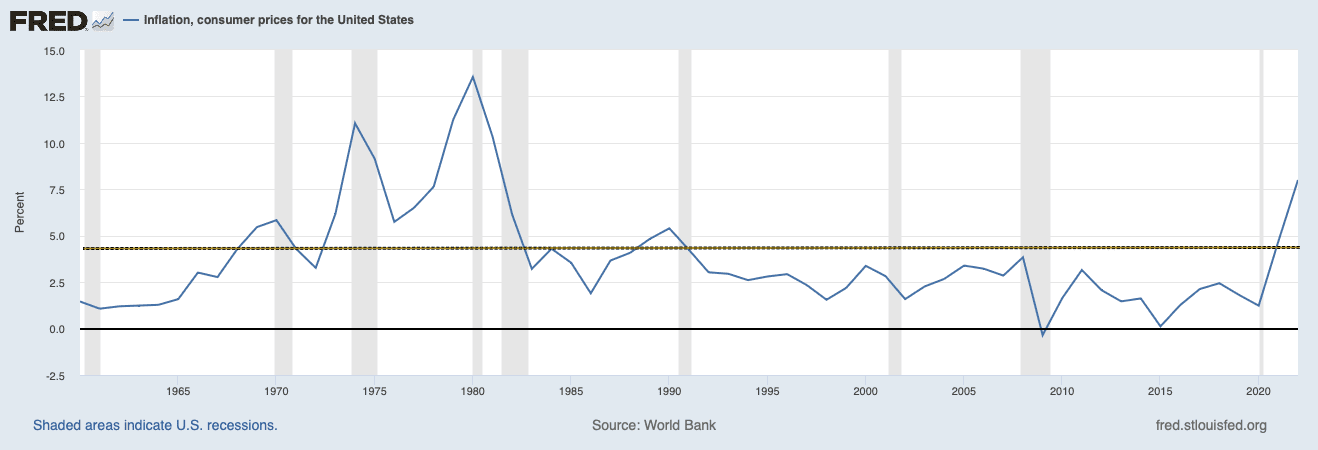

But between 1991-2021, average annual US inflation never rose above 4% – despite record amounts of monetary injections.

As a matter of fact, since the end of the Bretton Woods system, inflation under 3% was a rare occurrence, happening only once in 1986.

That is, up until 1993.

The Fed Learns Price Control

After 1993, things changed dramatically; annual average inflation over 4% never happened again (until 2021).

But how?

How was the Fed able to come close to target a rate of 2% inflation, despite record-low interest rates and dramatic increases in the money supply?

How was the Fed able to achieve this feat when everyone before has failed?

Well, it’s actually quite simple.

If you control price, you control inflation.

The First ETF

In January 1993, the first ETF began trading (along with regulatory exemptions by the Commodity Futures Trading Commission on certain swaps and hybrid instruments).

At first, it was the S&P 500 Depository Receipt, or what we know as the SPDR. But then came others. Lots of them.

In less than ten years, the ETF market grew from one fund in 1993, to more than 100 funds by 2002.

Today, there are over 1000 ETF funds, many of which are directly related to the price of resources and commodities.

Everything from gold, oil, gas, copper, aluminum, wheat, grains, sugar, cotton, and even livestock, can now be traded via ETF’s instead of a futures contract.

ETF vs. Futures

When you enter into a futures contract, you are essentially agreeing to buy or sell the underlying asset at a future date, regardless of whether its price has gone up or down.

This is how resource producers, such as oil, uranium, and gold companies, hedge their production. They lock in a future selling price for their ongoing production that is only ready for sale sometime in the future. When that contract is up for delivery, the producers deliver physical product to the buyer of that contract.

If a futures contract is settled in cash, there is still a transaction between two parties based on the price of the underlying asset.

An ETF doesn’t work that way.

When you buy shares of an ETF, you only own shares in the ETF fund, and not the underlying asset that the ETF tracks.

And while an ETF fund generally* has to own the underlying asset that it tracks, ETF shareholders do not directly own or have any direct claim to the underlying investments in the fund; they only own part of the fund.

(*I use the word generally because there have been many reports that many of the ETF funds don’t actually have the amount of resources they claim to have. See our Letter, “How Non-Existent Metals are Used as Collateral to Borrow Money.“)

ETFs have become so big with so many assets under management that it has become a recognizable standard in price discovery because many investors often perceive ETF share prices as spot prices for many commodities.

As a result, a selloff in, say, the GLD (the biggest ETF gold fund) could easily lead to a sell-off in paper gold in other global markets.

Price Manipulation

Think of how easy it is for those with money to manipulate prices.

For example, we all remember the NFT craze where Bored Ape digital art were selling for millions.

All it took to create that value were a few headlines telling investors that one Bored Ape just sold for millions. After that, the floodgates opened for other Bored Ape art, with many NFTs also exploding in value as a result.

It wouldn’t have mattered that Rob sold the Bored Ape to Paul, who borrowed the money from Rob.

Now imagine what you could do to price discovery if you have unlimited capital.

Through ETFs and other financial instruments (derivatives), the Fed and the downstream banks were able to stabilize price while creating more money than ever.

For years I have said that the majority of liquidity injections will go into the financial markets, which is why I have predicted that the stock market would continue to rise until the injections run dry.

There have been record amounts of liquidity injections – injections that can’t directly stimulate the economy because they are merely asset swaps. And we have had record-low interest rates for nearly a decade.

Yet, outside of the last two years, inflation has remained subdued.

In other words, if you control price, you control inflation.

Is it a coincidence that inflation didn’t budge once ETFs were introduced in 1993?

Back to Bitcoin

As we just told you, ETF’s require no physical delivery of the underlying asset that it tracks.

When it comes to spot Bitcoin ETFs, the same is true.

The only thing transacted is cash.

Here’s how a spot Bitcoin ETF works:

- An investor buys ETF units on a public exchange

- The ETF Provider uses the invested funds to buy Bitcoin.

- This Bitcoin is securely held in trust by regulated custodians for the ETF Provider, often in cold storage wallets

- If a unit holder wishes to redeem their ETF units, the ETF Provider sells an equivalent amount of Bitcoin to facilitate the redemption process.

Note how nowhere in the above steps does an investor actually take delivery of Bitcoin. Also remember that cold storage wallets are offline – removed from the blockchain.

Now recall what we told you in our previous letter, Bitcoin ETFs: What They’re Note Telling You:

“All Bitcoin ETFs, including the proposed ones, have custodians and sub-custodians.”

…All trades via the Bitcoin ETFs will have to be cleared and settled, which means multiple exchanges and custodians.

The more custodians become intertwined, the harder it will become to truly track the buying and selling of Bitcoin via the ETFs.

…Think about it this way: if it’s already too hard to audit physical gold in vaults, imagine auditing anonymous Bitcoin transactions being traded off the Bitcoin blockchain.”

In other words, when someone buys a share of a spot Bitcoin ETF, the actual Bitcoin transaction is happening within the custodians’ cold wallets. And since cold wallets are offline, or off-the-grid, no one really knows what’s actually happening.

You’d simply have to trust that a transaction occurred.

You could think of it like our fractional reserve banking system, where one dollar can be lent out many times over.

(Read our past letter, “How Non-Existent Metals Are Used to Borrow Money,” to learn more about how this works.)

This means your Bitcoin ETF purchase could have zero influence on Bitcoin itself because it could be a wash trade within the custodians’ cold storage wallet.

Carry this forward with multiple ETFs through multiple custodians, and, especially over time, a surge in Bitcoin ETF demand (which would generally drive the price higher) could have little-to-no impact on Bitcoin’s price.

Too Big to Manipulate?

If you think that Bitcoin can’t be manipulated, think again.

If you have been reading this letter for a long time, you’ll have learned about all of the commodity price manipulation that has taken place over the years.

For example, in 2020, JP Morgan traders were convicted of fraud for attempting to manipulate the prices of gold, silver, platinum, and palladium futures contracts.

JPMorgan was fined nearly a billion dollars.

The gold market alone is worth over $13 trillion.

If a few traders can manipulate the price of a market worth over $13 trillion, imagine what they can do to Bitcoin, with a market cap of only $565 billion.

If Bitcoin ETFs explode in demand, these funds could own hundreds of billions of dollars worth of Bitcoin – all offline in cold storage wallets with Bitcoin transactions happening only on the funds’ and custodians’ books.

Remember when we wrote this:

“Today the world’s three biggest asset managers, Blackrock, Vanguard, and State Street Global Advisors, manage over $22 trillion in assets. And this pile of assets has grown more than four times since 2008.

That’s an incredible amount of equity and, in turn, voting power.

By the latest Bloomberg estimates, the “Big Three” and those who control ETFs and mutual funds, today own, on average, 21% of every S&P 500 company.

And get this, they are major shareholders in:

96% of ALL S&P 500 companies.”

The bigger the demand for Bitcoin ETFs, the bigger the market share these institutions will control of Bitcoin.

But that’s not all.

Those JP Morgan traders were able to manipulate the price of futures contracts and physical assets.

Imagine what they can do when they simply have to swap USB sticks.

Seek the truth and be prepared,

Carlisle Kane

When does the house of cards crater?

The Fed is no more!!!! Live and Learn about the reset of all Financial systems LOL

Very insightful article. Well organized. I gained knowledge from it

Ganea nicolae ionut street digului number 15 zarnesti brasov romania 505800 west palm beach miami beach 33411