Why Banks are Being Forced to Create a Stock Market Bubble

Why Banks are Being Forced to Create a Stock Market Bubble

Dear Readers,

It’s been five years since the crash of 2008 and we still fail to read between the lines.

Every expert, market-timer, and self-proclaimed stock market guru seems to focus on only one side of the story.

But stories always have more than one side.

As a result, we often miss the ups-and-downs of the market.

My job is to explain both sides of the story, no matter how extreme they may be.

By taking the extremes of both sides of a situation, you can find a logical scenario that’s going to give you the most return for the least amount of risk.

This is the most logical way to analyze political events, the financial markets, and stocks.

I often publish shocking stories or events that sometimes seem too scary or farfetched to be true. For example:

- The Real Reason for War in Syria

- The Subprime Crisis Obama is Allowing, But Doesn’t Want You to Know

- The Truth About High Frequency Trading

- The Truth Behind the NASDAQ Glitch

- Shocking Truths About the Labor Market

- Why the TSX Venture is Failing

- The Mother of All Bubbles

- The Truth About the Canadian Housing Market

But these are all factual stories, containing truths and insights that the general media just doesn’t understand.

Or they don’t have the guts to publish.

In many cases, I suggest actionable events that make the most sense.

Here’s where many people get it wrong.

For example, just because I say the economy is not doing as well as the government makes it out to be, doesn’t mean the market is going to fall.

Just because I say there is a massive debt bubble brewing, doesn’t mean the bubble will burst tomorrow.

And just because there is a massive stock market bubble growing, doesn’t mean we’re going to crash anytime soon.

Remember, every story has multiple sides.

If you read between the lines, you’ll begin to understand how to profit from the situation.

Let me go back a few years to explain exactly what I am talking about.

This is extremely important.

A Blast from the Past

Back in 2008, things were bad. So bad that many thought the stock market wasn’t going to survive – especially here in Canada.

Yet, despite how bad things were, I told my readers to buy stocks – in every sector.

On October 27, 2008 I said to follow in the footsteps of Warren Buffet and buy American equities in my letter from October 27, 2008, “Buy Warren Buffet, I am.”

Financial experts, analysts, and journalists shunned me. They said banks were in horrible conditions and the economy was about to contract even further. They told me it was financial Armageddon.

And they were probably right.

But they failed to mention the other side of the story; the part about the record amount of stimulus that would take place in the aftermath, as I had told my readers would happen.

They failed to realize that the world’s most powerful governments and central banks would not allow the world to fall any further.

They failed to mention that the, “do whatever it takes” mentality by the world powers would be deployed to record extent.

Here’s a look at the 5-year S&P 500 chart, which on Friday surpassed 1700:

If you just invested in the index, you should be very happy. Especially considering that interest rates remain at all-time lows.

Now let’s go back to another letter I wrote at the beginning of April 2009:

“Nobody likes resource companies these days. Heck, nobody likes the markets at all.

But I think it’s time for anybody with a sense of reality to once again consider looking at resource plays as a way to reap the incredible opportunities that this market has in store for risk-tolerant and patient investors.

Since last year, I am sure that all of your senses have gravitated towards the sentiment that the resource sector, especially the juniors of the Canadian exchanges, will not last another year. I am sure you have heard that many are stuck with projects that are too big for their companies to handle. I am sure you have seen corporations go belly up right under your nose. I have too. I speak with these companies each and every day.

But have you heard the other side of the story?

Traditional sources of financing have been near impossible for corporations. Remember the days when banks would force upon you every possible loan available? I do. That was last year. But things are different now. Banks have undergone a dramatic overhaul and are now terrified to even mention the word loan.

For most corporations, it doesn’t matter how good your cash flow, revenue, forecasts, or your balance sheet might be. It doesn’t matter if you have been in business for 50 years and have never missed a loan payment. Even the billions upon billions of government bailout funds and depressed central bank rates all across the world are not enough to get the credit flowing again. And you know what? It doesn’t seem to be that big of a deal.

Not to the resource companies, anyway.

In the past few months, natural-resource players have raised well over $40 – $45 billion from outside the regular banking system. Most of the funds, from private investors and investment banks, have been accumulated through private placement bought deals and these astronomical financing figures are still pouring into both the smallest of the small caps and the largest of the large caps.

Need proof?

In February, Kinross raised $400 million (bought deal), then used $150 million to buy 20% of Harry Winston Diamond Corp. Cameco raised $460 million (bought deal) and BHP Billiton creatively raised $3.25 billion through corporate bonds. The list goes on. Even Gold Wheaton*, a company trading at less than $0.26, has raised $200 million in the last few months.

(*Gold Wheaton was acquired by Franco-Nevada in a deal worth $830 million a couple of years later)

Early February, practically every mining junior corporation I spoke with was worried about raising cash. Now many of them have held successful fundraisers over the last 60 days. In less time to follow a full season of your favourite sitcom, the one industry everyone shunned is now at the forefront of cash infusion from private lenders and big time investment players.

The money being poured into the resource sector is obviously coming from the successful and notably wealthy players of our markets. No doubt they see the natural resource sector as the goose that lays the golden eggs and as a force field to deflect the dangers against the battalion of the U.S Treasury’s printing presses.

It’s not only the big investment players coming out to swing their bats.

Let’s not forget the biggest player of them all: China.

Over the last few months, China has been buying up everything natural resource from Copper and Iron miners to Canadian Oil Sands.

According to a statement on their central government’s Web site from Commerce Minister Chen Deming, China will send more commercial missions overseas to make purchases and investments this year. During a recent purchasing tour in February to Germany, Switzerland, Spain and the U.K., Chinese companies spent more than $13 billion. According to the 21st Century Business Herald, the US is the next stop as the Chinese ministry sends a business group on a buying trip to the U.S. later this month.

These investments may not all be in the form of resource-specific plays, but the underlying tones based on their recent actions suggests to me that resource is a big part of their focus.

The big players in the investment business have all come to play ball on the resource sector’s home court. Do you want to be sitting in the nosebleeds when the game begins or do you want a spot in the starting line up?”

Over the next year, many of the stocks within the sector had amazing runs. As a matter of fact, the commodities-driven TSX Venture was outpacing every other exchange in the world as a result. Here’s a chart from my 2009 letter, “Where the Billionaires Invest,“:

Things have obviously changed dramatically since that letter, but readers who took advantage of the upswing were making returns of 100% and more.However, quick rises can also make for quick falls.

The TSX Venture has now been forced back to near five-year lows and many companies – not just juniors – have been wiped out.

Sentiment on the Canadian Streets now is even worse than it was back in 2008. Lot’s of things are making a potential rebound even harder for the overall junior markets. I talked about many of these things:

- How Regulation in Canada Affects Both Companies and Investors

- Proof the Largest Canadian Banks are Taking Over

- Why the TSX Venture is Failing

- The Shocking Truths About High Frequency Trading

The investing sentiment in Canada is as low as it has ever been. Retail investors who follow the advice of reporters, journalists, and newsletters that never put their money where their mouth is, certainly isn’t helping the market.

To quote Warren Buffet:

“I don’t like to opine on the stock market, and again I emphasize that I have no idea what the market will do in the short term. Nevertheless, I’ll follow the lead of a restaurant that opened in an empty bank building and then advertised: “Put your mouth where your money was.” – Warren Buffet, 2008

The time for near-term speculation via fundamentals is gone. Robot traders who react to “tweets” from Twitter are controlling the market. The world has gone mad. And in the process, politicians and bankers are allowing the biggest derivatives and stock market bubble in history.

Last week, I explained how QE money enters the system. I talked about how that money isn’t really being loaned out to consumers; otherwise, we would see it directly reflect in GDP growth.

In reality, that money sits in the banks and is used as collateral to put major risk bets into derivatives and such – for example, the same ones that led to JP Morgan’s $6 billion plus loss, and to massive legal claims against the bank.

How do we know this?

Record Deposits at JP Morgan

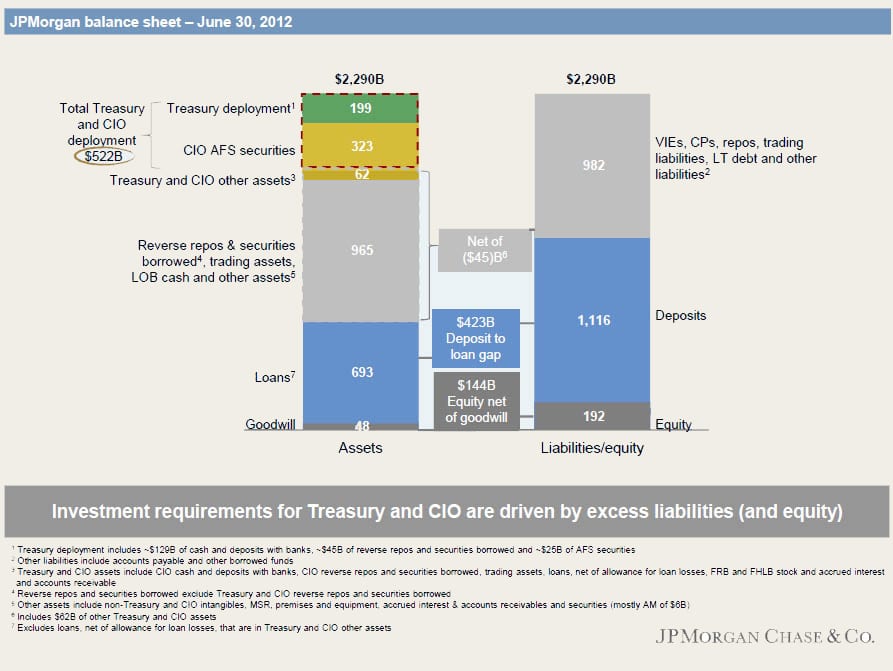

One look at JP Morgan’s data and you can see the widening discrepancy between its loans and deposits. While loans have remained relatively unchanged in the last five years, its deposits have skyrocketed from $750 billion to $1.28 trillion – courtesy of the Fed.

The deposit to loan gap at JP Morgan now sits at $423 billion.

Those who claim that inflation has yet to hit the market can now rely on this data to understand why. We’re not seeing inflation in the core measures because the money hasn’t gone into core inflation assets.

The trillions of dollars injected into the system have gone into placing massive bets on financial instruments. In other words, it has inflated the price of paper assets and has created the biggest stock market bubble of all time.

But why?

Why Banks Are Forced to Make Big Bets

The Fed has given the banks ammunition to generate far greater returns in this low interest rate environment by investing in the capital markets, rather than giving low interest loans to Americans whose jobs may be in danger from a slow-growth economy.

Can you blame the banks?

If they lend to those who don’t qualify for loans, they get scrutinized for bad lending practices. Meanwhile, they’re being forced by the Fed and the government to make loans.

Why would the banks put themselves in a position of scrutiny to generate negative-zero interest rates via high risk loans to Americans who may or may not pay their bills? Wouldn’t it be smarter to use that money as collateral to make big bets in paper assets?

Heck, investing simply in the S&P index alone would’ve returned them more than 80% since 2008; that’s 80% more than they would’ve made lending to Americans at negative-zero per cent interest.

If you were a bank, what would you do?

Welcome to the biggest stock market bubble of all time.

Back to Canada

The market has not been kind to mining stocks. The reality is that no one wants them anymore and funding projects is harder than ever.

But there is also the reality that demand for commodities do eventually outstrip supply when costs of production become too high. This is especially the case for gold miners.

You’re seeing it everywhere. Very few companies – especially the larger ones, such as Barrick – are able to continue production at current spot prices. Yet, demand for gold in the East continues – especially from sovereign buyers and central banks.

There are some incredible deals out there in this space that when the tide turns even slightly, could show us incredible parabolic returns. There will be a race to in-ground precious metals assets.

The other side of the story will begin to show itself in due time. Demand and supply fundamentals will eventually take over. The amount of money creation required to keep the world economies afloat will expand, as I have always said they would after 2008.

Then there’s the story of Janet Yellen who will become the new Fed Chair on Wednesday. We know she is pro-stimulus. With the amount of money in deposits growing at the banks and being used as collateral for big stock market bets, the markets could continue to move higher this year.

Outstanding US corporate debt is now more than $9 trillion and investors have pumped a record $1 trillion plus into bond funds at all-time low yields in the last few years.

Look for more dramatic swings in bond yields as the media uncertainty of QE continues. It may be wise to continue moving away from interest-sensitive sectors (REITS, Utilities, Telco’s) and put a heavier weighting on small and large cap equities in technology, industrials, energy, consumer discretionary, and healthcare.

The Equedia Letter

No one really understands why the stock market is going up when the economy hasn’t been doing well. This is a simple article explaining that. well done.

“No one really understands why the stock market is going up when the economy hasn’t been doing well.” Really? REALLY? Are you paying ANY attention or maybe ever seen “Trading Places”?

And this is dedicated to all those political fucknuckle lackeys, financial “experts” and presstitutes who “didn’t see this crisis coming” either… listen up you pathetic and parasitic muppets…. http://www.youtube.com/watch?v=kShTUmYRyCw

The amount of money sitting in the banks is astounding. Makes you wonder why we aren’t all bankers. Obama and the Fed are not helping the economy. They are just giving away free money, which means our the money we work for will just become worthless.

Thanks for your astute explanation of why the QEn haven’t yet produced inflation.

My question is what do you think Janet Yellen will do about the situation? She surely understands it and knows that if further stimulus does eventually flow into investment (and the sign of that will be rising employment), Americans will suddenly turn optimistic again and start competing for loans–with the inevitable consequence that interest rates will rise.

Yellen probably foresees this. But she will nevertheless push ahead with more stimulus, because she knows that a 4% rate on U.S. debt, while unsustainable with the GDP at 2%, is easily covered by the new revenues that will come from a 3% GDP. And those new tax revenues will be voted on unanimously by the new Democratic Congress of 2014.

Yellen will continue stimulus. The only thing she foresees is using new money to pay back borrowed money. Its all a ponzi scheme, except when the Fed does it, it looks good and no one goes to jail