Former Commissioner Reveals a Shocking Truth About the US Labor Market and the Stock Market Outlook for Both Canadian and U.S. Stocks

Bernanke is once again playing with the market and controlling the minds of retail investors while giving wavering input to the algo-machines.

A batch of better-than-expected earnings from large corporations also fueled the rally.

Despite a lower close on Friday, the Dow and the S&P 500 climbed to record intraday highs on Thursday. The benchmark S&P 500 is now up nearly 18% for the year.

The TSX also hit a six-week high Thursday, but is still a long way off from its record close above 15,000 in 2008, and still lagging U.S. equivalents for the third year running.

Does the recent bounce suggest that the worst is over for the Canadian market?

The Canadian Market

The resource-heavy TSX has been hit hard by lower commodity prices but that may change soon according to BMO Capital Markets’ latest commodity report:

“The correction has likely been overdone in some areas, and commodities should stabilize and recover moderately through 2014 as global growth regains momentum.” – Earl Sweet, senior economist, BMO Capital Markets.

Bank of America Merrill Lynch told us on Thursday that the TSX materials sector is one of the most oversold sectors in the world, with a deviation of 34.3 from its 200-day moving average. The only sectors more oversold? Global gold miners and South African materials.

Given that about one-third of the TSX is comprised of materials, signs of a bottom are close. From its peak in April 2011, the TSX materials sector is down nearly 50%

From a technical perspective, things are also improving on the Canadian front, including the stock-to-bond ratio which is now pushing above its 200-week average. The last two times that happened, in September 2004 and December 2010, Canadian stocks outperformed bonds over the following months.

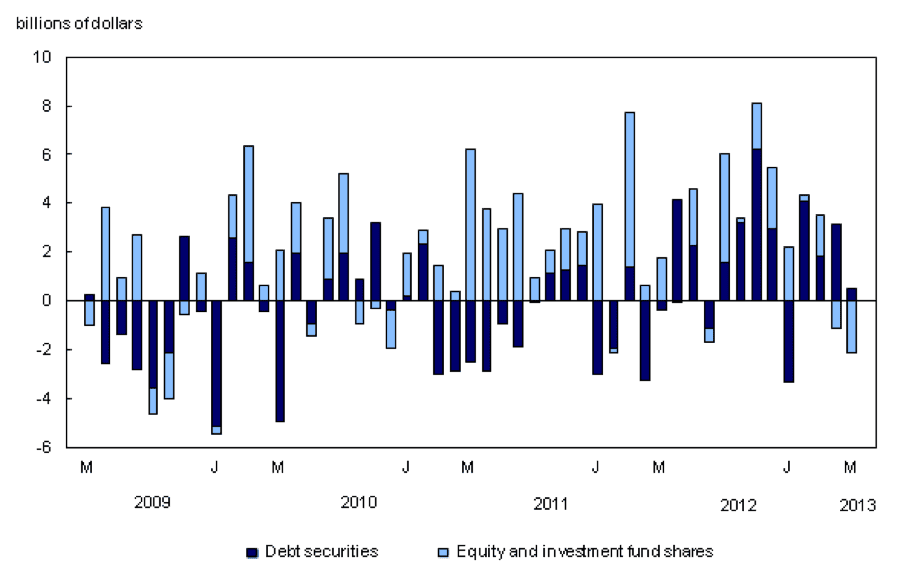

Meanwhile, according to foreign securities data from Statistics Canada, Canadian stock flows are improving relative to bond flows. More importantly, the data shows that foreign buyers are interested in Canadian equities again, while Canadians are now selling out of U.S. stocks and potentially buying back into Canadian stocks.

Via Statistics Canada:

“…Foreign investors purchased $1.2 billion of Canadian equities in May, adding to April’s $2.2 billion. This activity was widespread across sectors, notably gold, energy, bank, communication and transportation.

…Canadian investors reduced their holdings of foreign securities by $1.6 billion in May, the largest divestment since August 2012, led by sales of US securities.

Canadians sold $2.2 billion of foreign stocks in May, all US instruments. This marked the third consecutive month of divestment in US equities. The net sale of $2.5 billion of these instruments was the largest since October 2008, when US stock prices declined significantly.”

Canadian Investment in Foreign Securities

If the trend continues, we may come out of the summer and end the year on a high note.

However, I remain cautious on anything commodity related as there are more than just supply and demand fundamentals at work. There are chances

of another credit disaster from a major nation, and we may witness more growth issues exposed in China; both of which will hurt commodity prices, which means Canadian stocks could continue to suffer.

For now, Canadian stocks may finally be in a better position than their U.S. counterparts.

U.S. Stocks

U.S. stocks continue to climb in bull market fashion. But how does the current market compare to the peak of 2007, prior to the 2008 crash?

During the peak of 2007, the 12-month trailing P/E ratio (as reported earnings) was 17.7x.

The current 12-month trailing P/E ratio is 18.3x.

That suggests that stocks are now more expensive than they were during the 2007 peak.

Adding to the euphoria, U.S. stock prices are now outrunning corporate profits, which also suggests that stocks are running at a faster pace than it should.

While corporate earnings last week blew away analyst expectations, we have to remember that analysts expectations have already been lowered substantially; anything shy of their already-lowered expectations would mean total disaster.

It’s not hard to beat earnings expectations when you’re not expecting much to begin with.

The Inverse Correlation

Despite reaching yet another all-time high, analysts continue to tell us that U.S. stocks are cheap.

That’s funny because it would imply there is now an inverse correlation between GDP estimates – which continue to see downward revisions – and the Dow and S&P, which continue to soar higher.

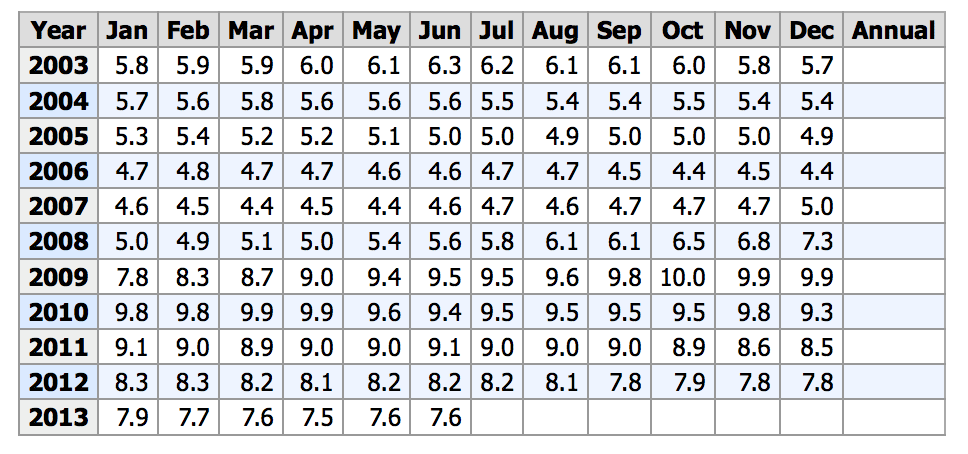

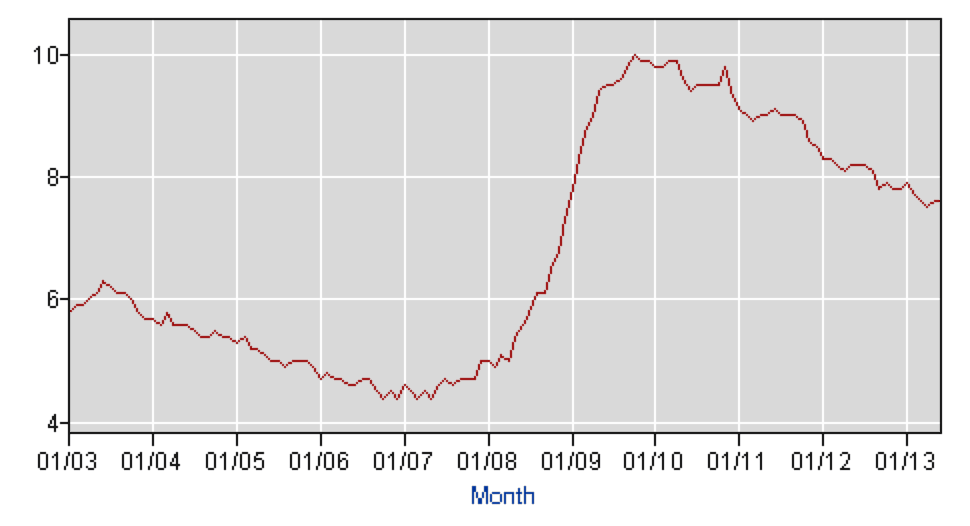

The stock market is now higher than it was in 2007, yet GDP is down and unemployment is up.

Seasonally Adjusted Unemployment Rate

Go figure.

The Truth About the Labor Market

While the media continues to tell you that job numbers are improving and unemployment is shrinking, the real labor market and recent unemployment numbers may actually be a lot worse than the Bureau of Labor Statistics (BLS) will have you believe.

While the media continues to tell you that job numbers are improving and unemployment is shrinking, the real labor market and recent unemployment numbers may actually be a lot worse than the Bureau of Labor Statistics (BLS) will have you believe.

And this isn’t just coming from me – even though I have written many letters in the past regarding true unemployment numbers and how they are derived.

This is coming directly from a previous BLS commissioner, Keith Hall.

Via the NYPost:

“Keith Hall believes the US economy is a lot sicker than the 7.6 percent unemployment rate would lead you to believe.

And he should know.

Hall was, from 2008 until last year, the guy in charge of Washington’s Bureau of Labor Statistics, the agency that compiles that rate.

“Right now [it’s] misleadingly low,” says Hall, who believes a truer reading of those now wanting a job but without one to be more than 10 percent.

The fly in the ointment is the BLS employment-to-population ratio, which is currently at 58.7 percent. “It’s lower than it was when the recession ended. I think that’s a remarkable statistic,” says Hall, a senior research fellow at the Mercatus Center at George Mason University in Fairfax, Va.

That level tells Hall the real unemployment rate is actually about 3 percentage points higher than the BLS number. If the jobless rate is unacceptable at 7.6 percent, it’d be shockingly bad if he is right and the true rate is 10.6 percent.

How could they be so different?

…Hall confirms that the jobless rate that makes the headlines – called the U-3 by BLS – doesn’t take into account people who have stopped looking for work but does count as employed folks who have worked as little as an hour during the preceding month.

A broader (and more accurate) measure of the state of US labor – called U-6, which includes the underemployed – jumped sharply in June to 14.3 percent from 13.8 percent the month before.

Hall reckons there are millions of U-6 people on top of the 4.5 million long-term unemployed.

…”This has been a very slow, very bad recovery,” he says. “And I think the numbers have really struggled as a result. In fact, I’ve been very disappointed in the coverage of the numbers.”

…There are other problems with numbers coming out of BLS, according to Hall. And they will just add to the confusion.

All parts of Washington’s data-collecting machine adjust to smooth out the bumps caused by the seasons of the year. But the recession that started five years ago was so severe and the recovery so anemic that the seasonal adjustments have been thrown off.”

Well said.

To sum it up: The true rate of unemployment may be closer to 10.6%.

Good job Bernanke.

Until next time,

Ivan Lo

The Equedia Letter

Commodities will recover slowly as the world is in a depression so there is no great demand.

Precious metals may defy this.

What is interesting is the uranium market. There are 60 plus power stations under construction world wide , but what investors need to know is when these plants are coming online so we know when uranium is likely to increase

What does the productivity rate look like? Is this the reason that businesses are doing well and employment lags? Doing more with less is a great way to help profits, but, lower employment.

Looking only at technicals, I believe a bottom is trying to form in the commodities.

Gold and silver specifically have been drastically oversold so the likelihood of an UP move in the short-term is very high. As the U.S. debt clock is now pushing US$17trillion and a new debt ceiling will need to be approved probably within the next 2 months, it is very likely that the USD dollar will come under considerable selling pressure heading into fall. This in turn should make the coming UP move in gold instruments more sustainable and result in still further gains. Jmvho.

the whole game is rigged. unfortunalty not in favour of the middle class. if the super rich had paid the taxes they should like the middle class do, there would probably be fewer super rich and the middle class would be reliefd of the tax burden. the tax system has to be overhauled. taxes should be paid on gross income for all companies included. no expense deduction and no subsidies. we would all be richer

analysts claiming the market is cheap, in spite of technicals and fundamentals is remarkably reminiscent of that “Pied Piper” tune about what good investments the housing mkt related products, derivatives, etc., that Goldman was singing to its clients at the exact time they, Goldmen, was SELLING their own holdings in those very same products into the market. I guarantee you some, if not a lot, of these analyst are now, have been already, and will continue to to quietly take partial profits in this “cheap” market if it continues an upward trend. Additionally, being privy to brokerage info and intent, they will have both feet out the door as they graciously warn their clients of imminent danger

Couldnt Agree with you more Dennis. Analysts really have no clue what they’re doing, imo. They’re analysts because they couldn’t cut it as a money manager. They say things are good when theyre good and things are bad when theyre bad, never really making any real calls. Anyone can do that.

great bounce for the TSX today. Well timed newsletter. Thank you, Kevin T.

I wonder sometimes if the prices of gold and silver are being manipulated down so the gov’t can buy it up and then later talk it back up and give a lot of it away to pay down the debt. Then they can drive prices down again, buy it back and then manipulate the prices back up and then the debt can come down and the gov’t ends up with their precipous metals back in their position. Bernanke says QE could come to a halt and prices drop. He then says well maybe we will have to keep it going and possibly increase the monthly amount and drive the prices back up. When from what I have heard, the U.S. tells Germany it will take years to give them back their gold when if they have been paid to hold it for them, why can’t they just ship it back to them? Where is Germany’s gold? This whole game is rigged by the gov’t, the Fed, and the ultra rich.With as much money that has been created out of paper, why do they not have $10,000.00 bolls or $100K bills.

If the U.S. ever goes back to a gold standard, they will have to all of a sudden increase the price of gold and silver to astronomical levels.

when the market was crashing in 2008 and a company was expecting say $400 million in earnings and only hit say $300 million, the prices crashed. The so called experts then lowered expectations to say $250 million and then they hit $275 milion, people acted like that was great because they beat expectation when they lost more again but the gave such low expectation only to make it as though a company was doing well. I see it first hand all over the U.S. and things are horrible.

fantastic issues altogether, you simply received a emblem new reader.

What may you suggest about your put up that you simply made a few days ago?

Any certain?