Barrick Gold – A Golden Decade Ahead?

The merger of RandGold and Barrick Gold was announced in September 2018 and took effect at the start of 2019. So let’s take a look back at what was promised and what was delivered.

The merger took place because it was understood that the combined entity could achieve superior operating metrics. These included the highest Adjusted EBITDA margin and the lowest total cash cost position among senior gold peers. As a result, there was an expectation of sustainable investment in shareholder returns and growth.

A cornerstone of this strategy was to change the way an ore-body was to be mined. Rather than focus on cash flow optimization, the focus would be on input costs.

The change in operating strategy was highlighted in an article that appeared in the Northern Miner on February 22, 2019.

“Mining plans are being moved from a cash flow optimization base to a model focused on optimizing the ore-body, Bristow declared, and “using input costs to drive the margin and design, rather than high-grading revenue to drive the cash flow.”

Coincident with the timing of the merger, Barrick’s stock chart gave investors a reason to sit up and take notice of the changes that were about to take place. A long multi-year downtrend line that was well established was broken to the upside in the second quarter of 2020.

Before the chart breakout occurred, there was a surge of volume.

This reflected both the merger and the optimism by investors for the future.

The old traders’ adage of “Volume Precedes Price” was clearly evident in the chart.

The operating changes that Barrick implemented over a year ago are starting to pay off handsomely. Of course, the rising price of gold helps drive a much better performance, but the strong showing is not solely attributable to the improvement in the price of the yellow metal.

Today Barrick made this announcement that highlighted just how well the company was continuing to operate:

Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) today announced that its Board of Directors has declared a dividend for the second quarter of 2020 of US $0.08 per share, a 14% increase on the previous quarter’s dividend, payable on September 15, 2020, to shareholders of record at the close of business on August 31, 2020.1

Senior executive vice-president and chief financial officer Graham Shuttleworth said that Barrick’s quarterly dividend has more than doubled since the announcement of the Barrick-Randgold merger in September 2018, reflecting Barrick’s continued strong financial performance.

“The Board believes that the dividend increase is sustainable and is reflective of the ongoing robust performance of our operations and continued improvement in the strength of our balance sheet, with total liquidity of $6.7 billion, including a cash balance of $3.7 billion as of the end of the second quarter, and no material debt repayments due before 2033,” said Shuttleworth.”

What about the future? This is an obvious question/concern of investors. The stock has performed well from the inception of the merger to today.

What happens next?

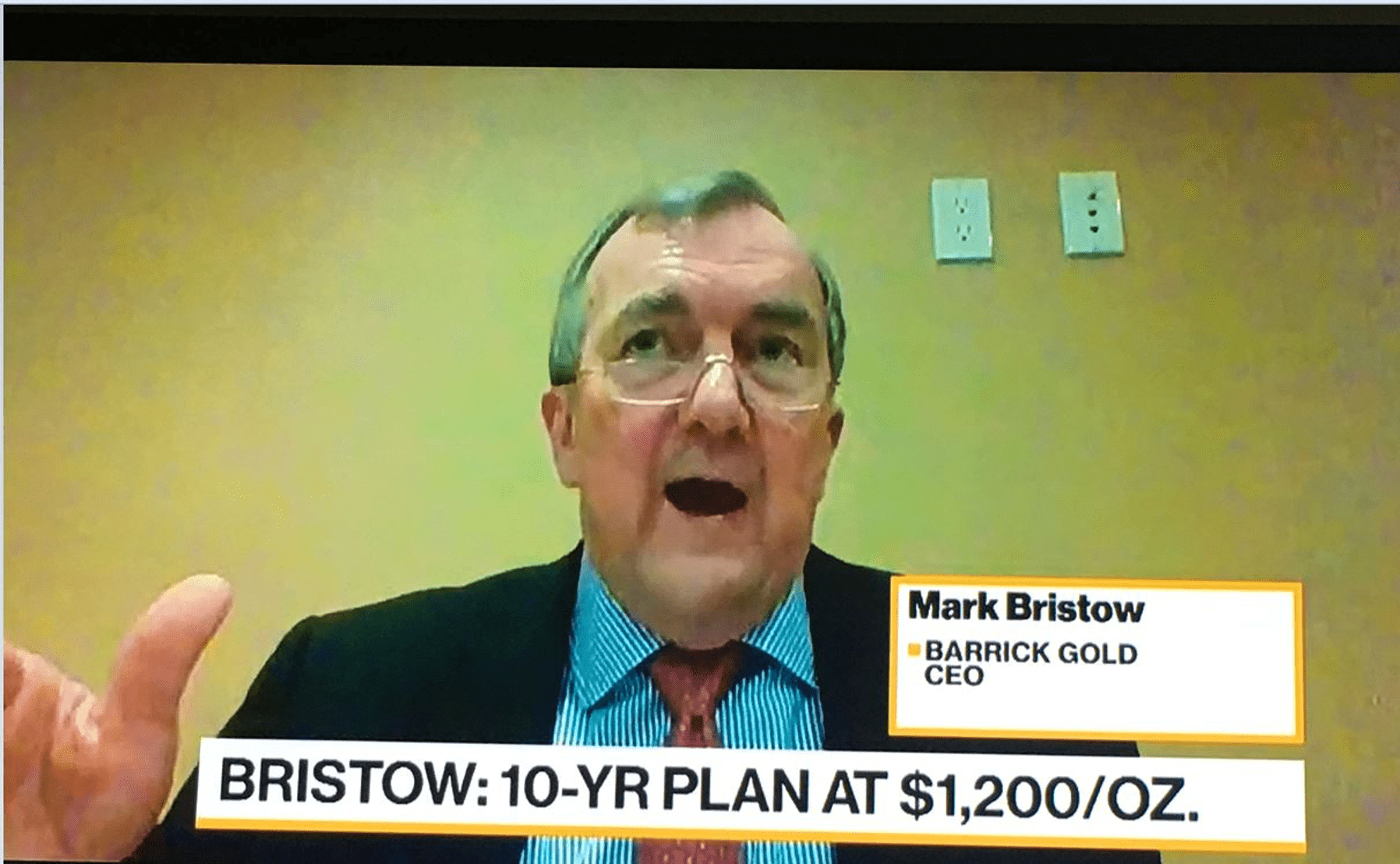

Investor concerns were put to rest by the company’s President & CEO, Mark Bristow, when he announced that Barrick had adopted a detailed 10-year operating plan that will track input costs and optimize the value from an ore-body. He had put in place similar five and 10-year plans at Randgold that distinguished it as a strong operator in a gold price environment that was not nearly as favorable as the one in place today.

As noted in the headline, a very conservative premise for future gold price of $1200 is used as a “base case scenario.” With gold trading above $2000 per ounce, there is plenty of room for the price to oscillate with increased volatility. This includes moves to the downside – not only the upside.

As noted in the headline, a very conservative premise for future gold price of $1200 is used as a “base case scenario.” With gold trading above $2000 per ounce, there is plenty of room for the price to oscillate with increased volatility. This includes moves to the downside – not only the upside.

Summary and Wrap-up

Barrick is a market leader in the gold sector. One of the keystone attributes of a “leader” is to provide direction for others. In the months and years ahead, it will be interesting to keep an eye on the senior gold sector peer group to see how many other companies adopt the “Barrick operating model.”

-John Top