The hype is back.

And that means A LOT of naïve idiots are, too.

Yes, I am talking about the GameStop ($GME) meme hype, reignited once again by Reddit’s DeepFu**ingValue, otherwise known as Roaring Kitty on Youtube and X, otherwise known as Keith Gill in real life.

After turning $53k into $20 million in 2021, testifying before Congress on the meme stock craze, disappearing for three years, and having a hit movie made about him, RoaringKitty is back on social media.

But forget what you read on X or the news about what is happening.

We’ve heard it all – and most of it is bullsh*t.

Unlike the treasure trove of garbage conspiracies from uneducated new investors, we’re going to tell you what is really going on – with evidence to back it up.

You can come up with a more sensible conclusion after.

Here goes.

A Simple Reality

On May 12th, after a nearly three-year hiatus, Keith Gill, a former marketer at an insurance firm and “financial analyst,” returned to X.

His first post? A sketch of a gamer leaning forward and ready to play again, which many assume was related to GameStop.

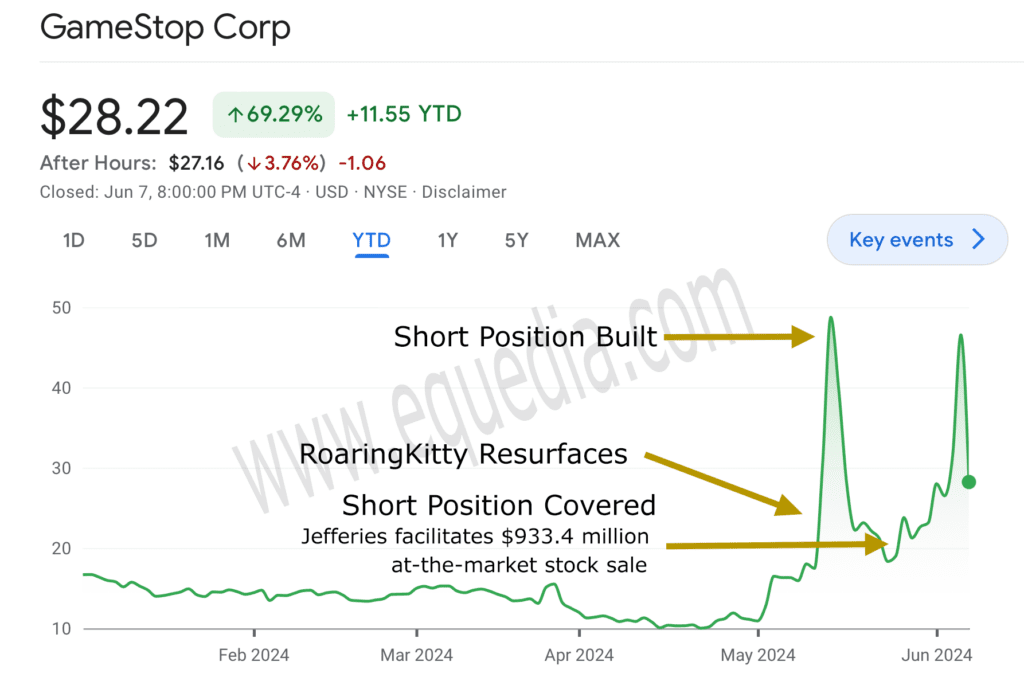

The next day, shares of GameStop hit a high of $38.20 – up from $17.46 the day before.

Shares traded (volume) soared by over 400%.

But Gill wasn’t done.

The next day, he continued to barrage X with a series of clips from various movies and TV shows, with cryptic innuendos.

Such as this May 14th clip from the movie Troy when Brad Pitt (Achilles) takes down a giant – presumably representing the retail investor (the little guys) vs. the hedge funds (the giant):

Shares of GameStop soared to a high of $64.83, with volume exceeding 200 million shares traded.

But again, Gill wasn’t done.

He continued to barrage X with more clips, with many suggesting some sort of comeback or revival.

Like this:

But it was of no use.

Short positions in GameStop soared, sending shares lower and lower.

At this point, almost every retail investor believes that the shorts must be covered by buying shares, which should—in turn—send the stock soaring higher, especially if retail investors don’t sell.

In theory, “they’re” not wrong; shorts do have to cover by buying shares.

But this is where so many retail investors get it wrong.

The shorts DO have to cover. But it doesn’t have to cover in the open market.

Let me explain.

Short-Selling Basics

Short selling is a trading strategy in which an investor borrows stock and sells it on the open market with the expectation that the price will decline. The goal is to buy the stock back later at a lower price, return it to the lender, and profit from the difference between the initial selling price and the repurchase price.

To execute a short sale, an investor must have a margin account and borrow stock from a broker. The investor then sells the borrowed stock in hopes of buying it back at a lower price in the future.

If the stock drops, the investor can repurchase it at a lower price, return the borrowed shares to the broker, and keep the difference as profit.

Simply put, if you borrow stock to sell short, you have to return it.

But what if I told you there was a way to avoid buying shares back in the open market?

Well, there is. And EVERY pro knows this.

On May 17th, someone big had already made a move.

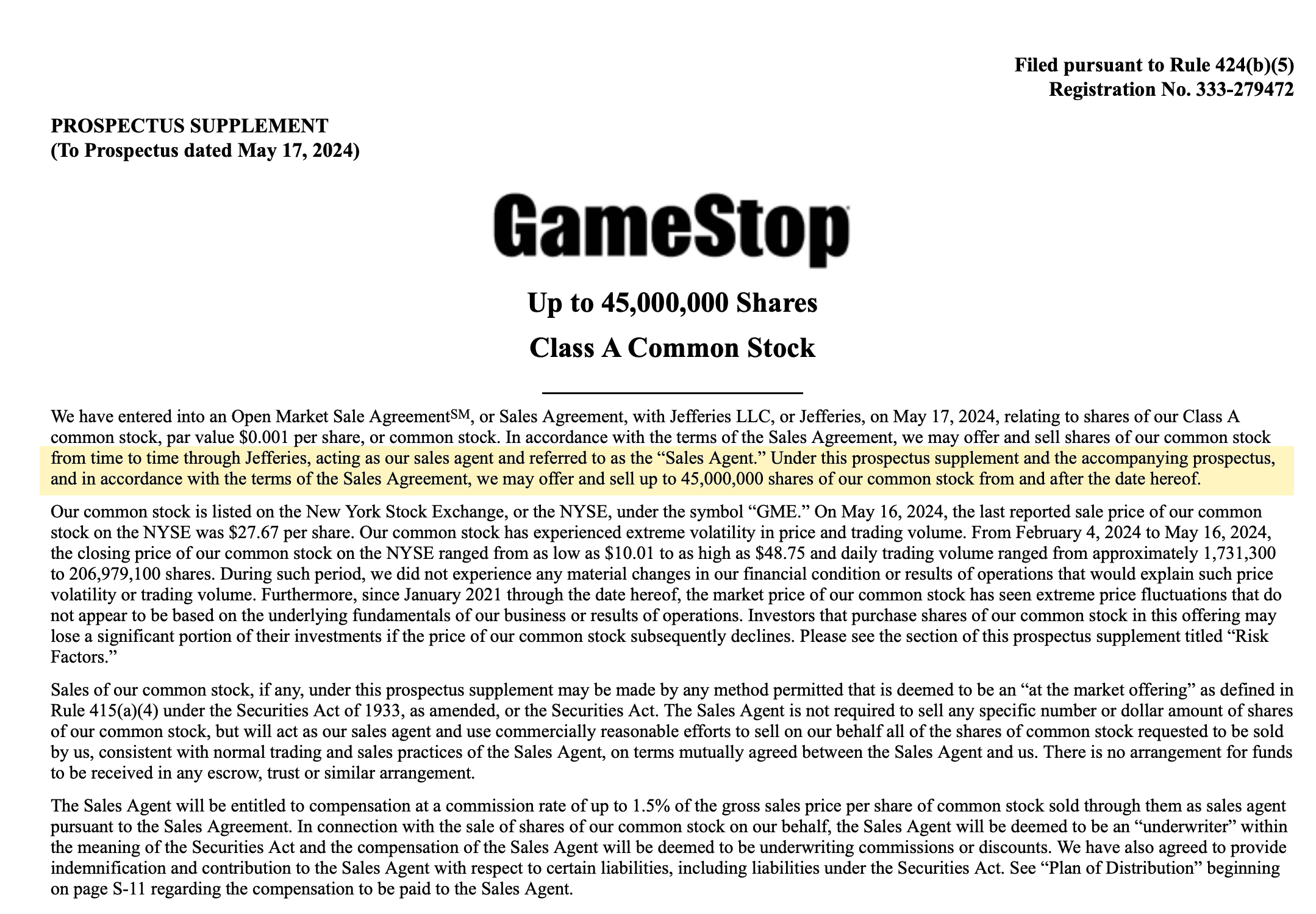

Via the SEC:

As of May 17th, Jefferies LLC can buy up to 45 million GameStop shares – directly from GameStop.

Jefferies LLC is one of the world’s leading full-service investment banking and capital markets firms.

In other words, it doesn’t have to buy shares back in the open market.

In other words, it doesn’t have to buy from a retail investor holding the stock in hopes of a short covering.

In other words, the shorts have already been “pre-covered.”

All a fund – who is short on GameStop – has to do to cover its shorts, is to buy the shares direct from GameStop, facilitated by Jefferies – or borrow from Jefferies at interest rates that Jefferies dictates.

And that’s exactly what happened.

On May 24th, 2024, GameStop closed an at-the-market offering for ALL of the 45,000,000 shares registered for sale on May 17th.

Via GameStop:

“GameStop disclosed on May 17th, 2024 that it filed a prospectus supplement with the US Securities and Exchange Commission to offer and sell up to a maximum amount of 45,000,000 shares of its common stock from time to time through the ATM Program.

The Company sold the maximum number of shares registered under the ATM Program for aggregate gross proceeds (before commissions and offering expenses) of approximately $933.4 million.”

That’s around $20.74 per share.

That’s 45 million shares covered – just like that.

Shares of GameStop closed at $19 the same day.

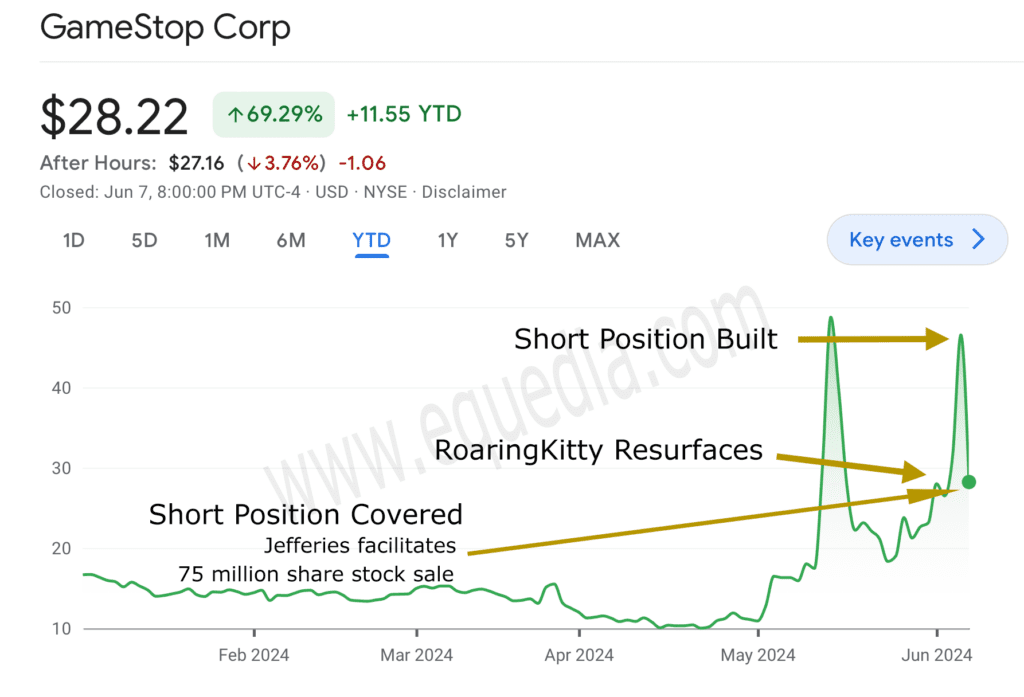

Here’s what that looked like:

But surely…there will be another run?

Especially as retail investors chant, “THEY HAVE TO COVER.”

Well, no, they might not need to anymore. They might have already covered it through GameStop’s near-billion-dollar at-the-market offering.

Nonetheless, this didn’t stop retail investors from continuing to pour in.

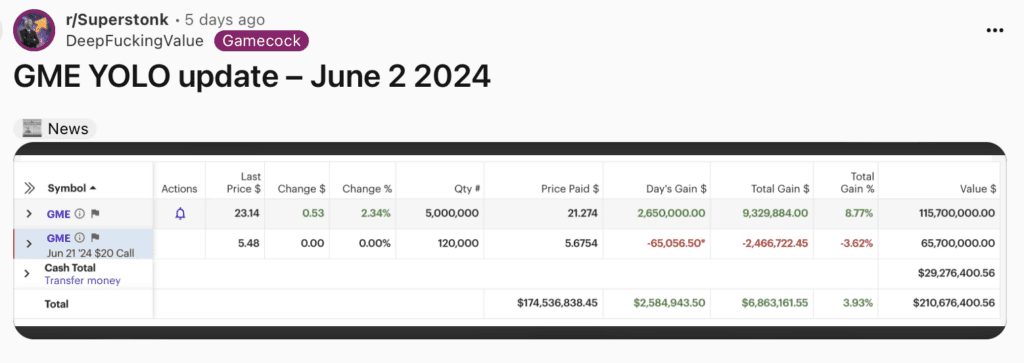

One week later, on June 2nd, Gill returned to Reddit under DeepFu**ingValue and posted a screenshot showing what many believe to be his holdings.

The screenshot shows a portfolio of 5 million GameStop shares at an average price of $21.27 a share, valued at $115.7 million. It also shows that he’s bought 120,000 call options with a strike price of $20 that will expire on June 21st.

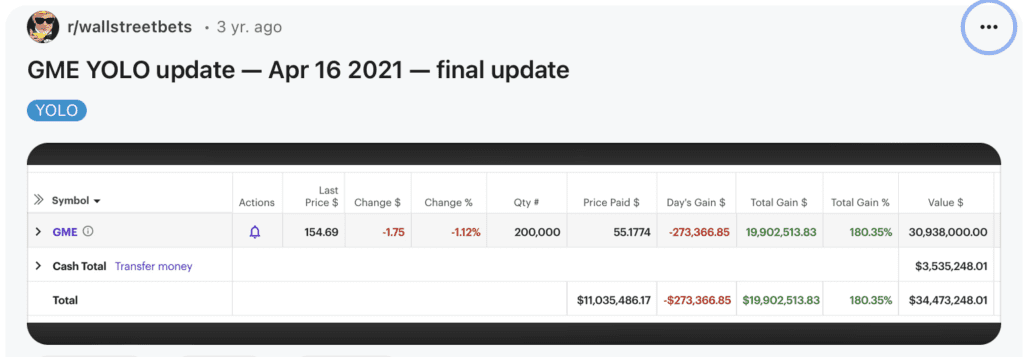

It is still a mystery how RoaringKitty somehow turned his $34.5 million in 2021 (as seen by an image he posted, see below) into well over $100 million.

Nonetheless, retail investors followed his lead.

Shares of GameStop doubled again following that post, hitting highs of $40 the next day before being shorted down to $28 by day’s end.

In the following days, similar events occurred – many highs and many lows.

This time, however, surely the shorts have to cover…right?

Right!

Except…not in the open market, duh.

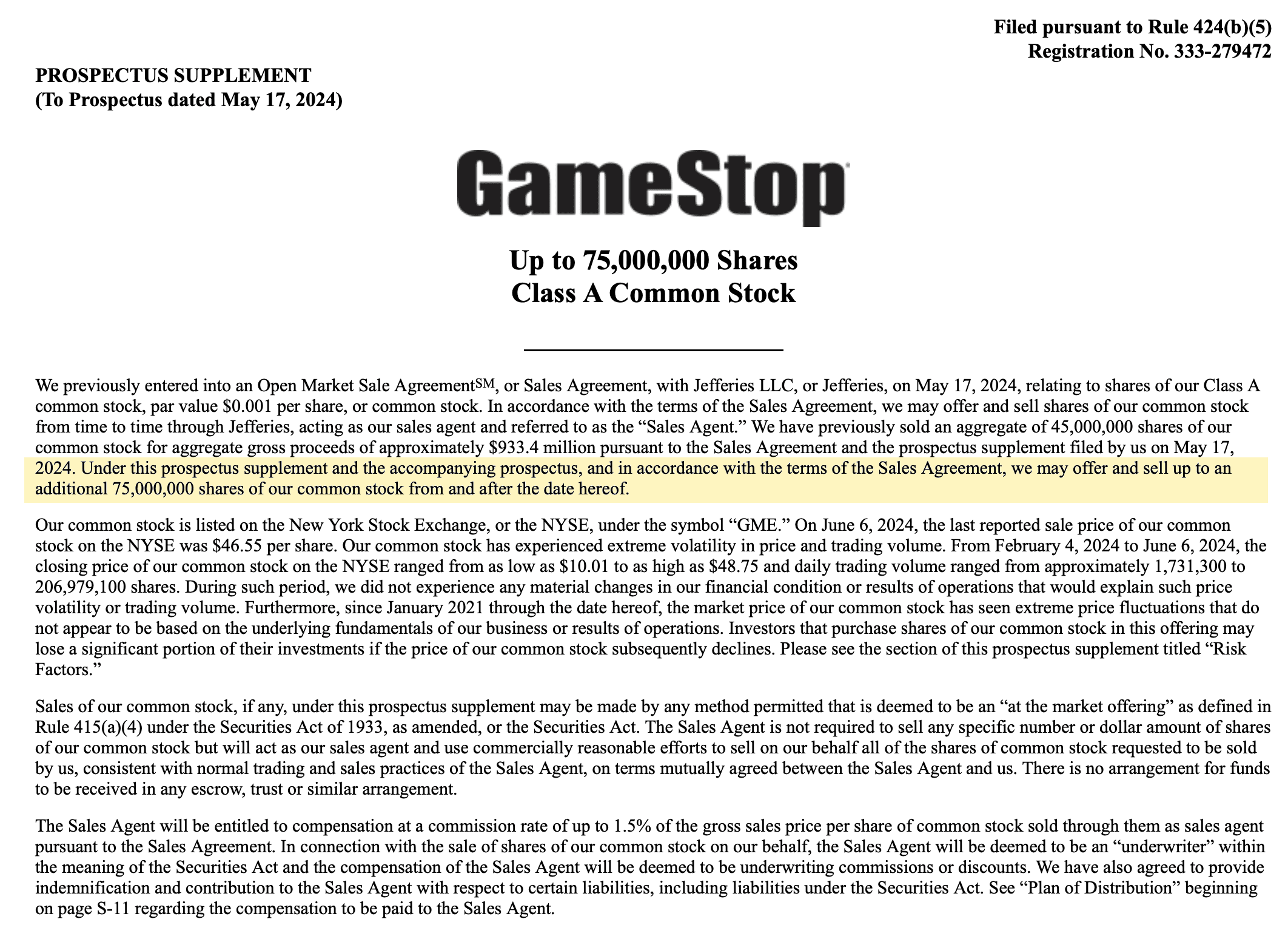

On June 7th, 2024 – via GameStop SEC filings:

In other words, the shorts now have up to 75 million shares of coverage, facilitated by, yes, you guessed it, Jefferies.

Here’s what that looks like again.

Get the picture?

So, despite what silly arguments retail investors have made on X, such as how Gil has 12 million shares of call options he can exercise (forcing the seller to buy 12 million shares in the open market, which will drive the stock up), there is now 75 million shares of coverage available at any time through Jefferies.

At Friday’s closing price of $28.22, that’s over $2.1 billion worth of coverage that does NOT have to be covered in the open market.

Gil on Top

Let’s not be stupid. Sorry, I mean, let’s not be naïve.

We understand if you truly believe that Keith Gill is here to go up against the hedge funds and win one for the little guys. We’ve been there.

But despite dressing and acting like a crazed lunatic, Keith Gill is no dummy – he’s still up a significant amount of capital with a cost base of around $21 (if the picture of his holdings is real.)

He hasn’t told anyone to buy. He hasn’t told anyone to sell. He hasn’t said a word that would imply telling investors to buy stock.

In fact, I would argue his cryptic messages on X is actually trolling retail investors.

Take a look:

Yet, retail investors happily support him by buying shares of GameStop, driving the price of GameStop higher.

And, to be fair, that’s not Gil’s fault. It’s no different than investors who drive up the share prices of stocks politicians buy, thinking the politicians have special information (they might).

Meanwhile, Gil sits pretty with a handsome profit as his followers continue to HODL (hold).

In other words, both Gil and the hedgies are making boatloads of money.

We just showed you how the game works – pun intended – TWICE.

If you choose to play it, that’s on you.

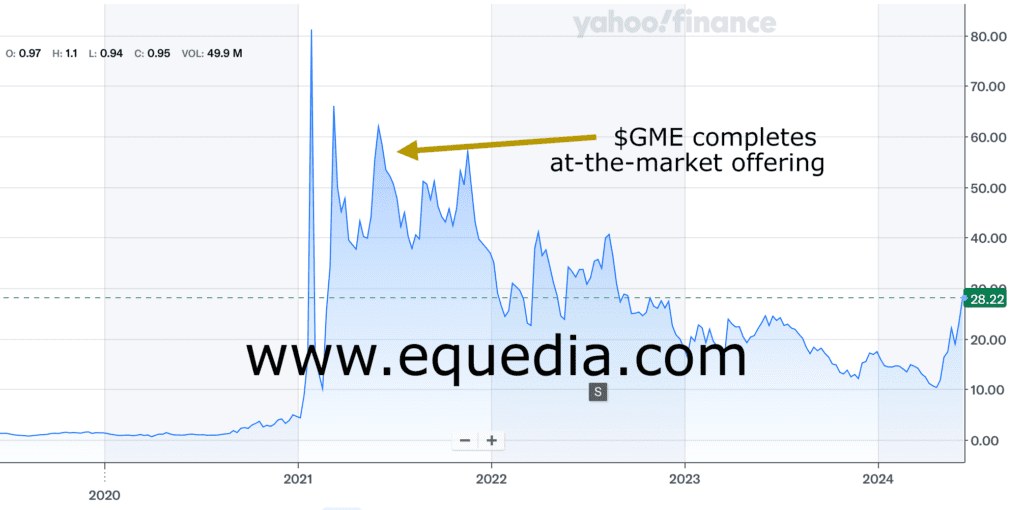

But let us remind you the last time GameStop completed an at-the-market offering in 2021:

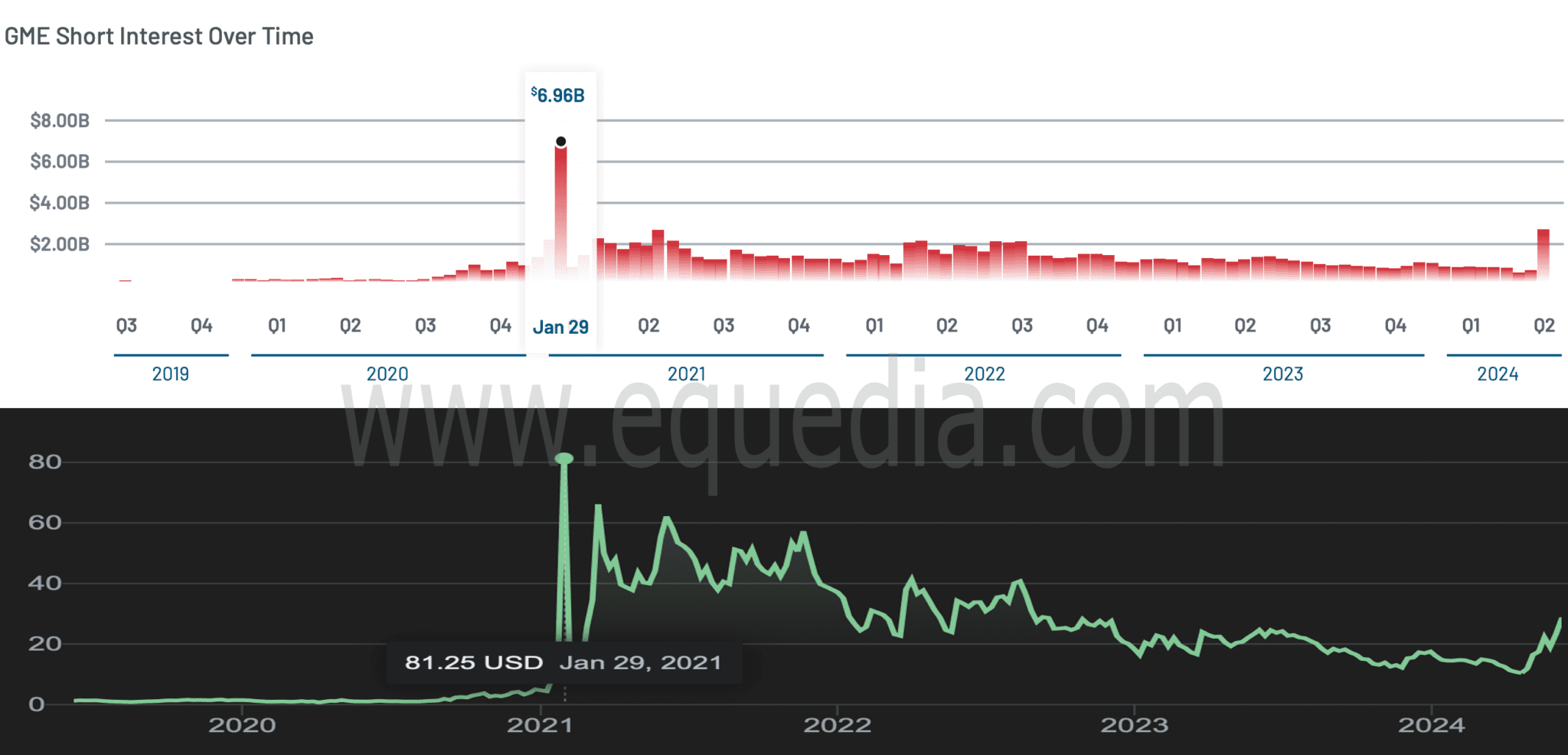

And since there are so many Redditors and Tweeters claiming that the short interest is so big that the bounce will be even bigger, let’s also remind you what happened the last time short interest in GameStop reached a peak of nearly $7 billion in 2021: Now, is this a bad thing? Are we against Gil? Are we against the hedgies?

Now, is this a bad thing? Are we against Gil? Are we against the hedgies?

Not at all.

They’ve successfully gamed the system.

And while there will be a lot of losers, there will be winners, too.

Take GameStop, for example.

If investors want to bet and risk their money on GameStop’s ability to turn themselves into something big, let them!

Let’s be real: GameStop made less than $7 million in profit last year, but it’s valued at nearly $10 billion.

However, thanks to the shorties, hedgies, Redditors, media, and HODLers, GameStop has raised a ton of cash—all of which can be deployed to transform its business.

And if it DOES end up with the total 75 million share sale, GameStop could have billions in the bank.

With that type of capital, it could transform itself into a totally different company.

An AI play, perhaps?

Does this mean the bounce is over?

If you really want to know, don’t ask @TheRoaringKitty; ask Jefferies.

Seek the truth and be prepared,

Carlisle Kane