Dear Reader,

Gold recently broke over its “six-year price hurdle” of $1350-$1375.

Central banks and billionaires around the world continue buying it up.

But unbeknownst to most, it has been an even more transformative year than people realise.

Record-breaking, actually.

According to data from Thompson Reuters Eikon, M&A activity for gold miners have already hit a record US$30.5 billion this year – the “biggest M&A binge since bullion prices peaked nearly a decade ago.”

Via Reuters:

“Led by top producers Newmont Goldcorp Corp and Barrick Gold Corp, miners are bulking up to replace dwindling reserves and win back investors who in recent years shunned the sector because of disappointing returns.

This year has seen 348 deals worth more than $30.5 billion, including net debt, according to Refinitiv Eikon data.”

This record-breaking M&A activity is confirming that miners see strong gold prices continuing in the future as they look for ways to expand their reserve base. After all, gold mining companies need to replace the gold ounces that they mine every year. This is the price they pay for being in the gold mining business.

For investors, the real question we should be asking ourselves is: where do all these gold ounces come from?

Risk Capital

It’s important to look at what was to understand what is, to gauge what might be.

So let’s start by taking a long look back at the last gold cycle.

From the early 1970s to the early 1980s, there was a “working model” that allowed small companies to raise funds from speculators that were willing to finance the high-risk undertakings of grassroots exploration.

For those new to mining investments, grassroots exploration is the first stage of trying to find a deposit. It generally means that geologists have a conceptual idea of where a mineral deposit might be and explores his theory through airborne surveys and basic prospecting.

This is the riskiest part of the mining business.

As such, most of these companies failed.

But for the small handful who succeeded, they succeeded in spectacular fashion.

So much so that it kept a long line of gamblers knocking on the doors of the “casino of golden dreams” to come back and place just one more bet.

Specifically, across Canada, there were dozens of small brokerage firms that specialized in providing risk capital to gold exploration companies. They had clients who wanted to place risky bets in hopes of striking it rich – clients who had no idea where to put their money because, of course, the internet didn’t exist at the time.

This was that “working model.”

It is imperative to keep in mind that demographics and the economics of the times played a role as well.

Demographics played a pivotal role because Baby Boomers, the largest segment of the population, were being unleashed on the economy. They could work at jobs that paid well enough to leave them with discretionary income to invest if they were so inclined. The “risk-taking years” of the Baby Boomer generation were from the ages 25 – 45; this matched with the last gold cycle, and, as a group, they were drawn to risk.

It is not coincidence that various governments also instituted large-scale gambling during this period; first, lotteries in the 1980s and then many states and provinces started to license casinos in the 1990s.

The Creation of a New Player

All it took was for a few big discoveries, and more gamblers would pour in.

For example, in 1982, Breakwater Resources made a spectacular gold discovery in Wenatchee, Washington.

Breakwater was financed, in part, by European investors who experienced fantastic financial returns on their early investment in this stunning success.

As a result, various Canadian brokerage companies opened offices in London, Paris, Zurich, and Geneva to tap into a new global source of financing for gold exploration at various stages: early, advanced, and discovery.

During this period, truly fabulous gold deposits were found in the Greenstone belts of Quebec and Ontario, along the major crustal breaks in Nevada that resulted in the formation of the great “Carlin Gold Belt,” and in northwestern British Columbia – now referred to as the “Golden Triangle.” Other areas of the world, such as Australia, South America, and Mexico, also benefitted by more exploration due to a rising gold price.

There was an understated “order to things.”

Small companies who found a gold deposit got bought out by the established producers. At the start of that gold cycle, there was a shortage of what we now refer to as mid-cap companies.

Mid-cap companies were born out of the last gold cycle.

In the first cycle, there used to be only very small companies and large companies in the gold sector. It was always assumed that small companies that found a deposit would be taken over by large and well-established producers.

How, why, and when did this change?

The rising price of gold resulted in a new technology to extract gold from oxide deposits; this was known as “heap-leaching.”

Simply put, low-grade oxide gold deposits that could be easily mined by low cost, open-pit mining methods were placed into production at a relatively low capital cost. Heap leach is a straightforward process that does not require a high degree of technical expertise.

This meant that small companies didn’t really need to rely on large companies for funding and technical “know-how” – they could (and did) do it all themselves and make the transition from an exploration company to a production company. This is what led to the formation of the mid-cap companies in the previous gold cycle.

In summary, during the last gold cycle, there was a mechanism in place to allow for the creation of an “exploration pipeline” to provide a continuous flow of new gold projects to be developed and eventually mined.

However, this is where the positive story turns.

This exploration pipeline is now broken beyond repair due to structural changes in the resource sector that have cut off the valuable funding sources available to small exploration companies.

In addition, the Baby Boomers, who funded the last gold cycle, are now approaching retirement or are already retired, and their appetite for risk is considerably less.

In just a bit, Ivan – whose had plenty of success investing in this sector – will comment on what this means.

“Road Kill” by Unintended Consequences

How did this happen? What structural changes cut off this funding?

The short answer: the gold exploration sector has become “roadkill by unintended consequences.” Not once but twice!!

As everyone who is a parent to a child labeled millennial, generation X, or younger, technology has become ubiquitous with all aspects of today’s society.

“OK, so you’re going to tell me that “technology” wiped out the gold exploration business? Come on, give me a break….”

Well…

The Rise of Technology

Remember how we talked about the golden age for exploration companies back in the last gold cycle?

The primary source of funding for these companies was through the many boutique Canadian brokerage firms. These firms had the expertise and know-how to evaluate risk via their in-house mining analysts, coupled with the ability to help these companies properly structure their finance offerings via their in-house corporate finance departments.

Many financings were “distributed financings,” a term that you don’t hear much of these days. This meant that there was a “ready-made” and broadly-held aftermarket for the shares of these companies, and they were able to successively leverage their exploration success to complete financing at higher prices with less and less dilution.

In summary, exploration companies came to these brokerage firms looking for funding, brokerage firms vetted the deals through research and corporate finance, and clients got the risk exposure they wanted. Many would lose, a few would win big. But it was a transparent process that sustained the exploration model for many years. It was a transparent process that sustained the exploration model for many years.

This is not the case today because a majority of these specialized brokerages with access to retail investors in N. America and institutional investors in the US and Europe no longer exist.

What happened to them?

The advent of the internet allowed the big banks to introduce low-cost on-line trading platforms at very, very low commissions. Independent brokerage firms are based on the commission model. By offering discount commissions via on-line trading platforms, bank-owned brokerages undercut the independents to the point that their business model failed.

The term “constructive destruction” comes to mind.

In fact, Ivan Lo wrote about this back in 2013 in his Letter titled, “The Largest Canadian Banks are Taking Over.”

Here is an excerpt:

“While the smaller institutions are drying up along with the TSX Venture, it seems the big Canadian banks are doing just fine; replacing loss in trading revenue with wealth-management profits and investment banking.

RBC wasn’t alone. CIBC reported a profit of $876-million, up 8%, and ahead of analyst estimates.

The big banks in Canada are doing so well that Canadian bankers now rank among highest-paid – and overpaid – CEOs in North America, according to a new list compiled by Bloomberg Markets magazine.”

This effectively sealed the fate of the small brokerages, many of whom simply made the best of it by selling out to the banks – essentially just selling their client lists. There was little else that the banks wanted from them.

What happened next?

Rise of the ETF

The creation of Exchange Traded Funds (ETF’s) in the 1990s resulted in a financial vehicle that allows passive investment in the gold mining sector. Two widely held mining ETFs are the GDX and GDXJ; both are sponsored by Van Eck and became an immediate hit with investors.

An ETF offers diversification similar to a mutual fund, but it may be bought and sold during the trading day with ease and with low fees.

Proof of how successful the GDXJ was became apparent in 2017 when the fund became “full.” In other words, there was still interest in mining stocks, but only through a mechanism that didn’t allow the funds to flow back into these companies.

This was both a blessing and a curse.

Via The Globe and Mail from 2017:

“In an unprecedented move, one of the most popular junior gold miner exchange-traded funds is set to rebalance on Friday after growing too large for its market. After months of volatility, miners and investors alike are preparing for even more uncertainty.

Cursed by its own success as a $4-billion (US) ETF in a $30-billion space, VanEck Vectors Junior Gold Miners ETF (GDXJ-N) began to expand beyond the index it tracks, the MVIS Global Junior Gold Miner’s Index. Combined with VanEck’s Vectors Gold Miner ETF (GDX-N), the company is nearing the significant shareholder status point of 20-per-cent ownership in several companies, many of which are Canadian, which means special filing requirements and significant trading restraints.

As a result, the ETF began buying shares in companies outside of its index, and on April 13, VanEck announced that the index would be expanding to keep up with the ETF’s growth. The ETF will now buy gold miners with a market cap in the range of $75-million to $2.9-billion, from its earlier range of between $75-million and $1.6-billion.

But this also means the fund will have to sell over 50 per cent of its shares in some smaller companies to make room for the additions. After the announcement, the fund’s units fell sharply, from $38.06 prior to the announcement to as low as $29.33 in the following weeks. The aggressive selling pressure has led to a roller coaster for the junior mining sector as shareholders try to make sense of the changes.”

Despite the demand from investors, many of the smaller companies got crushed as a result of the “re-balancing,” while the larger companies, namely the mid-caps, performed well.

Temporary Relief from the China Super Cycle — 2003 – 2011

Of course, technology itself wasn’t the only thing responsible for the decimation of the small-cap mining sector.

The entire base and precious metals sector underwent an unprecedented and generational surge in financing, liquidity, and investor interest starting in 2003 and ending abruptly in 2011 due to the global influence of China as the primary buyer for metals.

The effect of this “one-off” event was easy to follow.

It began with demand in metals markets that translated to better times for senior miners. This, in turn, prompted investors to set their sights on the mid-cap group and then, later, as is the case with every late-stage base metal cycle, the junior exploration companies were the last to get increased market access to financings and market valuation.

At the same time, the the US dollar declined from 2003 – 2008, setting up favorable underlying conditions for gold to perform well. Indeed, gold climbed from around $300 to $950 during this period. After a brief setback during 2008, gold continued to advance to almost $1900, based on a weekly closing price in 2011.

Recently, we featured one of these mid-caps that could be on the verge of being added to one of these ETF’s. If you haven’t read that report, CLICK HERE.

The management group of that Company understands the dynamics of today’s marketplace as it applies to gold companies – especially the importance of being part of this new ETF-platform.

Even more specifically, they recognize that funding early-stage exploration can be a dilutive, destructive process when it comes to shareholder equity. This is why they have developed a different approach to creating shareholder value. Due to their past successes, they are able to fund the acquisition of producing gold assets with strong exploration upside. The strategy is to use cash flow from mining operations to support on-going exploration.

This model is the way forward in the current market that we find ourselves in due to the structural changes that have taken place.

After all, retail participation as a result of regulatory oversight and the destruction of the smaller brokerage firms has practically annihilated the small-cap mining sector.

Where are we now?

From 2011 to 2018, the actively managed funds in the gold sector dropped from $50 billion to around $10 billion. It is not clear if a rising gold price would significantly change how investors will evaluate their risk exposure in gold stocks. The move from active management to passive management is structural in nature.

Therefore it seems reasonable to predict that a higher gold price will undoubtedly result in greater investor participation in various precious metals related ETFs. Companies that are not part of the make-up of these ETF’s could continue to become “market orphans,” as they are now.

So, where does an investor who wants to participate in higher risk/higher return gold-related equities go to get investment exposure?

Recently, we featured one of these mid-caps that could benefit from being added to one of these ETF’s. If you haven’t read that report, CLICK HERE.

The management group of that Company understands the dynamics of today’s marketplace as it applies to gold companies – especially the importance of being part of this new ETF-platform.

Even more specifically, they recognize that funding early-stage exploration can be a dilutive, destructive process when it comes to shareholder equity. This is why they have developed a different approach to creating shareholder value.

Due to their past successes, they are able to fund the acquisition of producing gold assets with strong exploration upside. The strategy is to use cash flow from mining operations to support on-going exploration.

This model is the way forward in the current market that we find ourselves in due to the structural changes that have taken place.

After all, retail participation as a result of regulatory oversight and the destruction of the smaller brokerage firms has practically annihilated the small-cap mining sector.

CLICK HERE FOR THE FULL REPORT ON THIS COMPANY

A Word from Ivan Lo

Now, a word from Ivan Lo…

Ivan : Thanks John.

Most of you are probably asking: What does this mean for the mining sector going forward?

I believe better times are ahead for the sector.

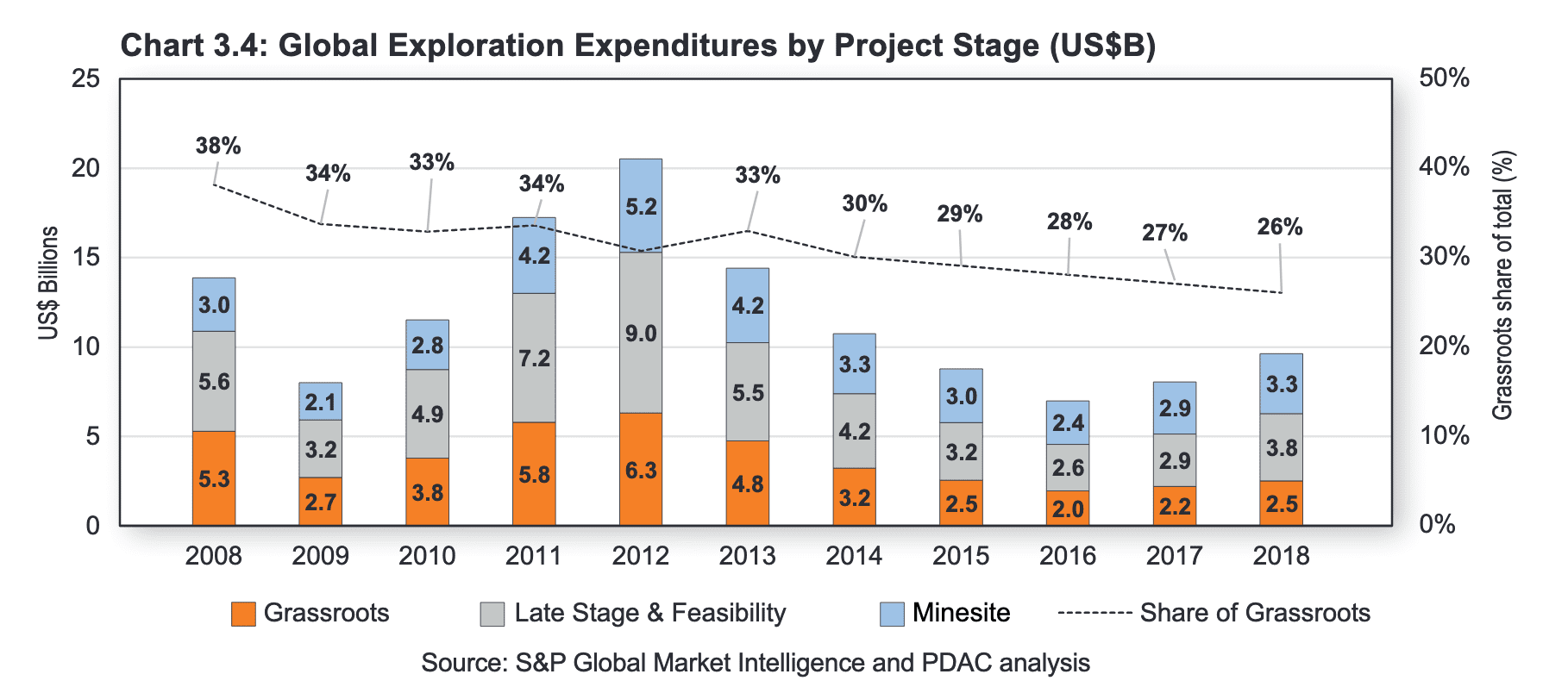

Take a look at this chart from the PDAC’s State of Mineral Finance Report for 2019:

According to the PDAC:

According to the PDAC:

“Analyzing global exploration spending by project stage highlights a worrisome decline in grassroots exploration, as indicated in Chart 3.4. The share of grassroots exploration decreased from 38.2% in 2008 to 26.1% in 2018. This decline is concerning as it can directly link to the rate of discovery of new deposits—and a lack of new discoveries will negatively impact the number of future mines.”

No matter how bad the sector looks, or what environmentalists believe, the world relies on mining to advance – you can’t make electric vehicles, solar panels, or rockets without metals. .

In other words, new discoveries have to be made and existing deposits need to expand; otherwise, the era of electric vehicles will cease to exist or the majority will be priced out even further than they already are today.

With funding practically non-existent for small cap mining stocks, who will make the new discoveries necessary to fuel the new era? Since large cap producers are more focused on cost-cutting and efficiencies to boost their bottom-line, it will likely be the mid-caps that make new discoveries.

So in the near-term, I believe the mid-caps will very well because discoveries are what lead to parabolic rises in share prices.

But that doesn’t mean the small caps are done.

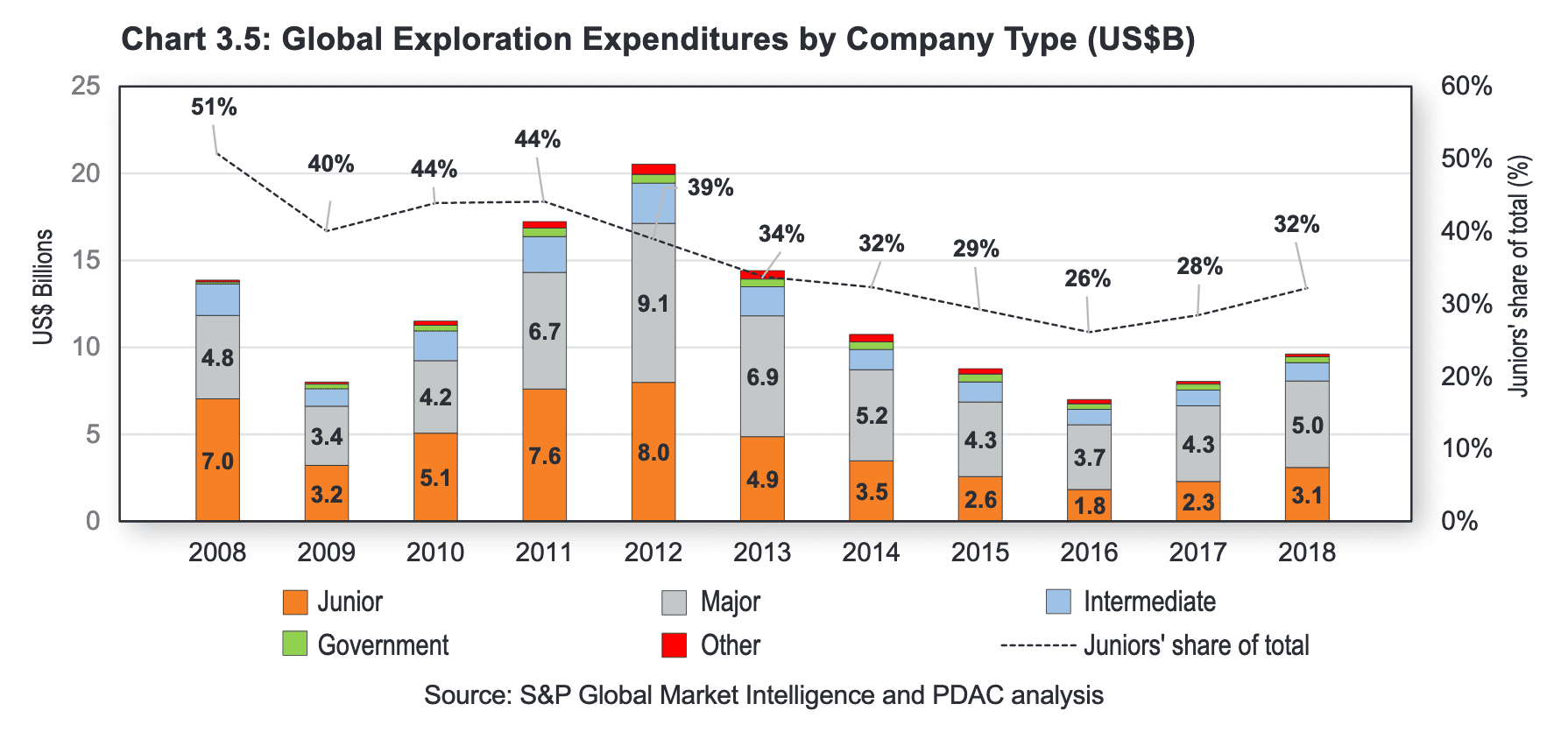

Take a look:

“…the share of exploration expenditures by junior companies as defined by S&P Global (companies with revenue <US$50M) nearly halved from 2008 to 2016, before recovering slightly over the last two years.”

As you can see, the trend for exploration is up.

Via PDAC continued:

“A decline in junior company exploration spending is concerning as, over time, they have shown greater efficiency in making new discoveries, relative to larger peers. Previous research has shown that the ratio of in-situ discovery value to money spent on exploration is significantly higher for junior exploration companies (0.83) compared to senior producing companies (0.63).”

The smaller companies are without-a-doubt the best explorers in the game – they have to be because their success is solely dependent on strong drill results that lead to discoveries.

But with the lack of capital from the retail investor, where is their exploration money coming from?

Simple: The big boys.

The large caps know that the little guys are better explorers. So instead of taking the risks of exploring themselves, they finance the little guys through equity participation.

It’s a great situation because the big producers aren’t generally looking to make money from their equity investments – they’re looking to replace their dwindling reserves. As such, the more a junior is financed by a large cap, the tighter that junior’s share structure becomes. And since an investment by a large cap generally leads to speculation that the small cap will eventually get bought out, more investors pile in.

This combination almost always leads to a rapidly increasing share price.

And as John pointed out at the beginning of this letter, we are now seeing record-breaking M&A activity in the sector, led by top producers who are “bulking up.”

As such, I believe there is still a lot of money sitting on the sidelines waiting to be transferred over to the small cap mining sector.

When just a handful of small caps make new discoveries and get bought out, I believe investors will once again make big bets.

That’s why I believe now is the time to be accumulating the strong small cap names that have been beaten down in the last cycle. Many of them need money; many of them have great assets. That means there’s a lot of great discounts out there.

Let’s start picking at them. I am.

Back to you John.

Conclusion

John: Thanks Ivan.

It’s clear that a rising gold market will continue to fuel healthy M&A activity in the gold sector. There is an absolute shortage of suitable offerings put forth by junior exploration companies, and that is why we see the types of take-overs/mergers that have taken place over the past year.

In the years ahead, with the thin pipeline of quality exploration projects that exists today and with no practical financial solution in sight to correct this condition, are gold miners now more fearful than ever of “peak gold’?

Is this part of what has driven their robust appetite in the past year?

We think so.

If the price of gold continues to climb, the best near-term overall bets would be on the mid-caps – as they eventually either become large caps, or get swallowed up by one.

Eventually, the small-caps will come back. Just not as many as there used to be.

Follow the chart,

John Toporowski, with edits from Ivan Lo

The Equedia Letter

www.equedia.com

What should be my modality?

Please send me the event

The majority of exploration companies cannot afford to support on-going exploration using cash flow from mining operations. Instead, many should be looking at using the “Prospect Generator Model” which has become the resource industry’s most underrated strategy for minimizing risks while maximizing rewards.

These Prospect generators acquire potential land packages w/ high potential for a significant discovery, & then carry out the initial pre-drilling exploration work (i.e. geologic mapping, geophysics, geochemistry).

After successful opportunity is outlined on a property, the next step is securing joint venture or option partnerships. These partnerships often grant a major or mid-tier miner the ability to earn a direct majority interest (from 51 – 100%) in exchange for funding drilling and more advanced, expensive stages of exploration through property and or share payments.

This way, a successful prospect generator can leverage its exploration expertise to identify quality projects and attract partners with the capital needed to fund further exploration. A company that doesn’t have to go to the markets to raise more funds can keep its capital structure tight.

These partnerships not only help prospect generators preserve capital and capital structure, and thereby minimize dilution, but they also provide income to build out a sizeable portfolio through the acquisition and early-stage exploration of other projects.

These deals typically give prospect generators a position in any future discoveries from the project through an equity position in the partner company or royalties based on any future production. In fact, a growing portfolio of royalties may become the main value driver for the company.

Excellent rcap of Ascension of Gold. Dont overlook Copper stock with low share structure. As a 50 year trader in Risk exploration companies I am looking forward to the Apex breakout of Copper on its long term uptrend. Since 2002 low 0.62Us$ spent 2/3 of the time grinding higher into a low volatility acending uptrend. See CMMC.TO. LMC.TO Good Luck with your wealth management.

how do i get on board with little or no money to start up

testery softwerov od roku 2016 bez prijmu ??? baj Jan Šprlak

You review Seabridge Gold (SA) as a Miner who continues to grow and continues to have a business model with concern for the shareholder.