Who Will Prevail?

Retail investors are wondering how the balance of 2020 and 2021 will be reflected by global equity and credit markets. Their counterparts, institutional investors, are also pondering that very same question. The large inter-day fluctuations in global stock markets tell us that despite easing of credit and a “global pandemic of government bailouts,” investors both large and small, remain incredibly skittish.

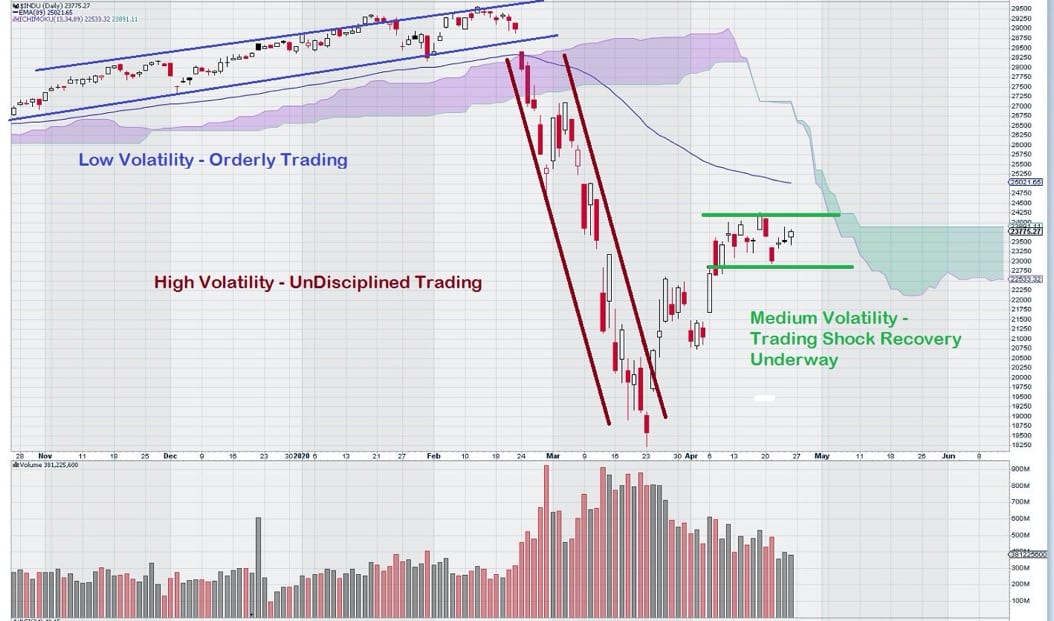

This 6-month daily chart shows precisely how the nature of trading in Dow stocks has undergone three distinct trading patterns. It is visually obvious that the decline contained lots of gaps and several periods where the market was up one day, only to fall the next. This type of trading tells us that the strong negative forces at work in the market were interrupted by brief positive bursts.

Looking at the chart, one might say that it appears that bulls and bears have settled on a valuation range that they are both comfortable with in the past ten trading days. Clearly, there is a “pause” in the trading action as far as direction is concerned.

Lets quickly review the past six months.

First, we can see a slow, steady, and orderly uptrend. Next, we see undisciplined trading that shows many investors and traders trying the catch the proverbial “falling knife.” And finally, we see trading that is defining a small box range from which the market can decide its future direction. For active traders, there will be some technical indicators (Slow Stochastics/Williams %R) that can be derived from this trading range to give a tradeable signal.

What Happens Next?

A powerful hedge fund manager with access to the most modern analytical methods to help formulate and guide his investment strategy now finds himself on even terms with the least informed retail investor.

Why?

Is it because both of them are in the same uncomfortable position about trying to plot a course forward?

Perhaps.

Pros will try to develop an investment thesis based on earnings.

However, because of the uncertain future, this approach will not be valid in the near term, at least in a traditional sense.

For example, Pros rely on the “E” in the P/E ratio to come up with a multiple that they can use to create a basis for valuation. Then, by simple comparison, they can find undervalued or overvalued stocks, which they can buy or sell.

However, moving forward, at least for the next several quarters (and maybe more), earnings (E) will be so negatively impacted that P/E ratios will point to much, much lower valuations than the current market is assigning to various sectors. What will the Pros do then?

In some industries, the travel industry is an obvious one that comes to mind, earnings for the next few quarters will most certainly not reflect the underlying value of companies.

Pros will eventually sort this out using what they rely on most: math. There will be some “adjustment factor” applied to P/E ratios so that the market can adequately re-price companies that are suffering temporary earnings “shock.”

Joes can see this scenario developing as well. I sense that Joes are getting close to the “liquidation decision.” The average investor understands that the next few years are going to be very difficult ones as the shock of the global economic shutdown works its way through the economy, the stock market, and through their portfolios.

The simple solution is to liquidate and be trade-neutral for the next few years. Many small investors may be in sound enough financial position to carry out this strategy.

Pros are saying to their clients, “If you don’t need to access your investment funds for the next 3-5 years, stay put, keep contributing, and investing. If one were to look back five years from now, this decline will be just another opportunity to buy more of the same great companies at discounted prices.”

Joes are taking the traditional “Swiss approach.” Capital preservation, even after a nominal 25% hit, trumps future potential gains. The risk of further portfolio deterioration can not be tolerated by retail investors, as they have seen their decade long wealth-building strategy of “buy and hold” shattered in a matter of a few weeks.

To re-cap, the current market “pause” is soon to be remedied. Pros will start to come up with a series of “post-economic shock” criteria upon which they can assign valuation with some degree of comfort.

Joes will be willing sellers at the current level as they move to a cash position that they will “lock-in” for the next 2 – 3 years. We should start to see this process play out soon.

See the weekly chart for the Dow in the article written last month entitled: No Liquidity Could Spell Big Trouble for the Dow As It Tries to Recover

It is clear from this chart that the “liquidation phase” marked by heavy selling has yet to occur.

When Will It Happen?

Timing markets is never easy. Trying to time market sentiment is even harder. But there are signs starting to emerge that give a clue that Joes are becoming more and more restless.

For example, even within my own personal circle and that of my family, there is a strong undercurrent of fear of the future that has not been resolved. The one comment that I hear repeated over and over again is this: “I have a friend who thinks that it is best to sell everything and wait.”

My visceral sense of the situation is that further declines in the Dow will be triggered when Joes act on the “liquidation strategy*” that they are currently openly commenting to each other about. An increase in trading volumes will let us know that they are starting to withdraw their funds from the market and settling into what I would call “investment hibernation.”

-John Top

*Ivan here. Another great and unbiased opinion John. While I do agree that the market could drop again with a lack of retail participation, I believe that much of this can be propped up by the Fed. Why? Because they have the ability to flow their funds into the market via other banks and funds. The institutions have essentially replaced the retail investor. So as long as the retail investor leaves, the funds will own more at lower prices. And should the market go back up, the retail investors will come back to buy stocks again – and fuel the next boom for the institutions. Just look at Japan, where a large part of the stock market is already owned by the central bank. And just today, the Bank of Japan once again supported the market:

Via Market Watch:

“The Bank of Japan said it will buy an additional 15 trillion yen ($140 billion) of commercial paper and bank loans. It also lifted its ceiling on purchases of Japanese government bonds, which it has been buying for years to help stave off deflation in Japan’s shrinking and aging economy.”

When a retail investor loses, they might lose so much they can’t come back to play. When the funds and banks do, they get free money. How do you lose when money becomes limitless? It’s like playing an old arcade – someone with an unlimited amount of quarters just can’t lose – unless someone pulls the plug on the machine.

look for inv in NZ strong govt low debt 32k per person. total incl sov and corp. Strong exports in agric and hort. Huge opportuniy to tap into middle income and retiree with net worth 1.2 million giving income to retirees this us a market of 700 billion over next years to death.where many are only looking to reverse mortg or conservative options poor returns in Kiwi saver 6per cent average. Look to uilise assets in renewable timber 10 bill infrastructure 39 bill fishing 10 bill honey 5 bill large aquirefers pure water 20 bill good education offering great ptions in 5 G and blockchain to fund these long term investments