Despite all the talk of easing inflation, CPI once again came in “hotter than expected.”

Overshooting expectations is bad enough, but more alarming is what its composition revealed.

For the first time in six months, we saw an uptick in prices that weren’t supposed to rise. This signals that inflation is caught up in a dangerous 1970s-like feedback loop.

More on this dangerous signal in a bit.

And with all that’s going on in Europe, this feedback loop is only just kicking in.

Yet, the historical inflation-hedge asset class, gold, keeps cratering—shedding ~20% of its value since its March peak.

Undoubtedly, this has many scratching their heads.

So, what’s going on here? Is the Fed manipulating gold prices or are people so naive they think the Fed has inflation under control? And should you trust gold as a hedge moving forward?

Read on. I’ll address all these questions today.

Inflation Isn’t Slowing Down

Before we judge the price of gold, we have to understand where we are in the inflationary cycle.

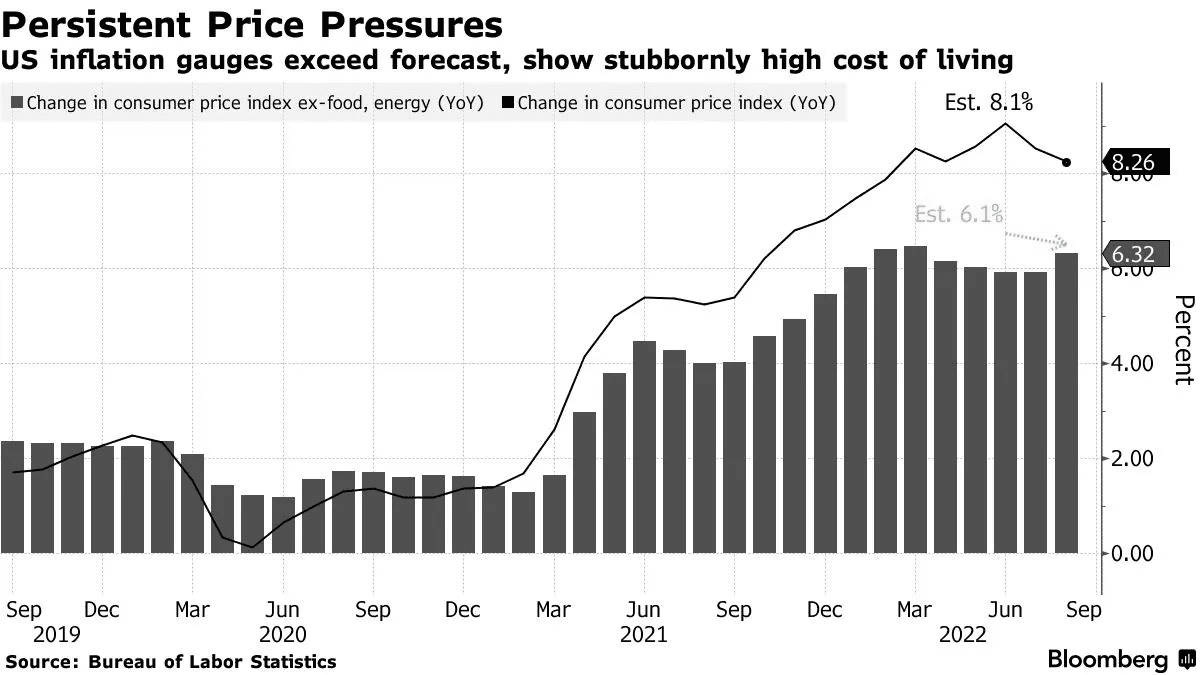

As you’ve probably seen, the last inflation report wasn’t particularly promising.

In August, CPI rose 8.3% compared to a year ago, and 0.1% on a month-over-month basis.

The reading came out in stark contrast to “inflation moderation” that economists expected before the release. The consensus of the Dow Jones survey was that inflation would fall on a monthly basis and dip to 8% YoY.

But this small percentage point discrepancy in expectations vs. reality isn’t the most worrying part.

More worrying is the fact that falling oil prices didn’t rein in inflation growth at all.

And if you look at Core CPI—which is CPI stripped of volatile energy and food prices—it rose for the first time in six months.

This has been largely overlooked in the mainstream media, but it’s critical because it tells us two things.

First, contrary to what Biden claims, this inflation isn’t just a result of the Ukraine war and the food/energy disruptions it brought. It’s an inevitable by-product of a decade-long monetary stimulus and $13 trillion printed out of thin air during Covid.

Second, exploding energy prices are already feeding inflation throughout the entire economy in the same way the 1970s’ oil shocks led to the most destructive inflation in America.

In other words, until now, record energy prices meant only higher utility bills and prices at the pump.

But now those prices are adding a markup to everything: from apparel to new cars and rents. That’s an irreversible chain, and the real inflation in energy prices, as I discussed in “Think Inflation is Over? Think Again” hasn’t even started:

“European governments are now gobbling up gas on the market with no regard for its price. By recent estimates, LNG stock-up is costing Europe 10x (yes, ten times) more than Nord Stream.

So in a free market, this cost will simply trickle down to household and business power bills. But European politicians aren’t going to let that happen. Instead, they’ll subsidize utility companies with hundreds of billions of dollars, so they don’t pass on those insane gas prices.

In other words, after 50 years, price controls are back, which means nominal energy prices have lost all relevance because hundreds of billions in fiscal money artificially suppressed them.”

What will happen when energy prices skyrocket after they are deregulated and fed through the economy?

The Only Way to Tame Runaway Inflation

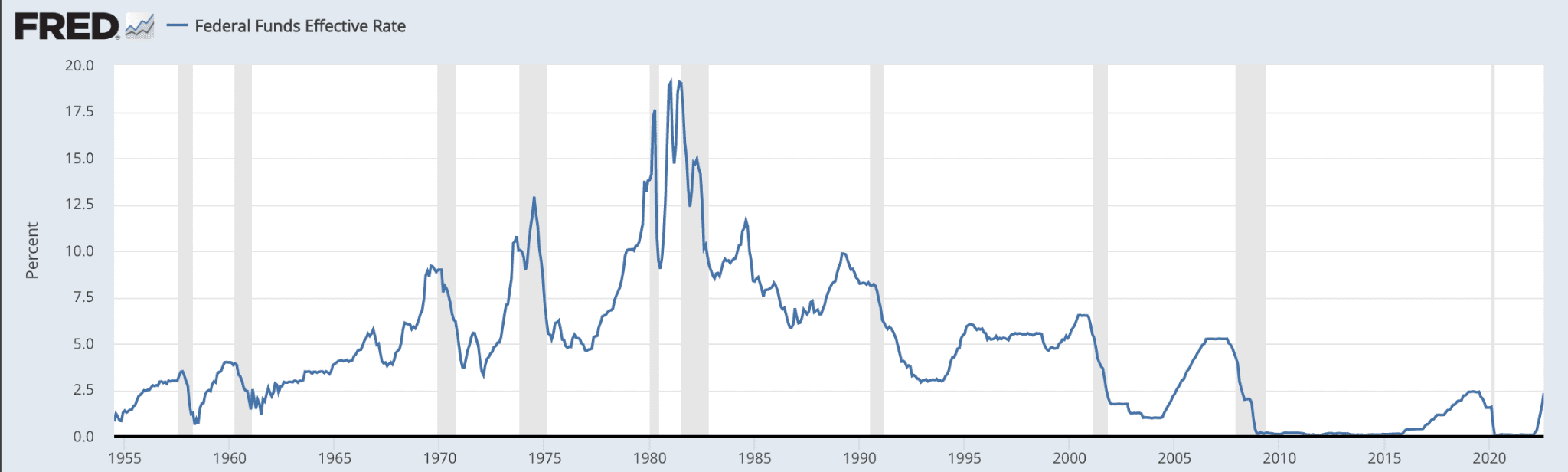

If you think the Fed’s current rate increases are working, let’s put things in perspective.

Although Powell’s hikes seem extreme coming after a decade of zero rates, they aren’t nearly enough to win this inflation battle – even with the most recent 0.75% September hike.

Why?

Because of real interest rates.

As Peter Schiff recently pointed out, the Fed won’t squash inflation as long as it keeps interest rates below inflation. And at 3%, we aren’t even halfway there:

“As long as we have interest rates below the inflation rate, even if they’re higher, they’re still negative, and negative interest rates put upward pressure on inflation. You can’t fight inflation with negative interest rates. It’s like saying, ‘I’m going to fight this fire by pouring gasoline on it. It’s just that I’m only going to pour a little bit of gasoline, not as much gasoline as I was pouring on before.”

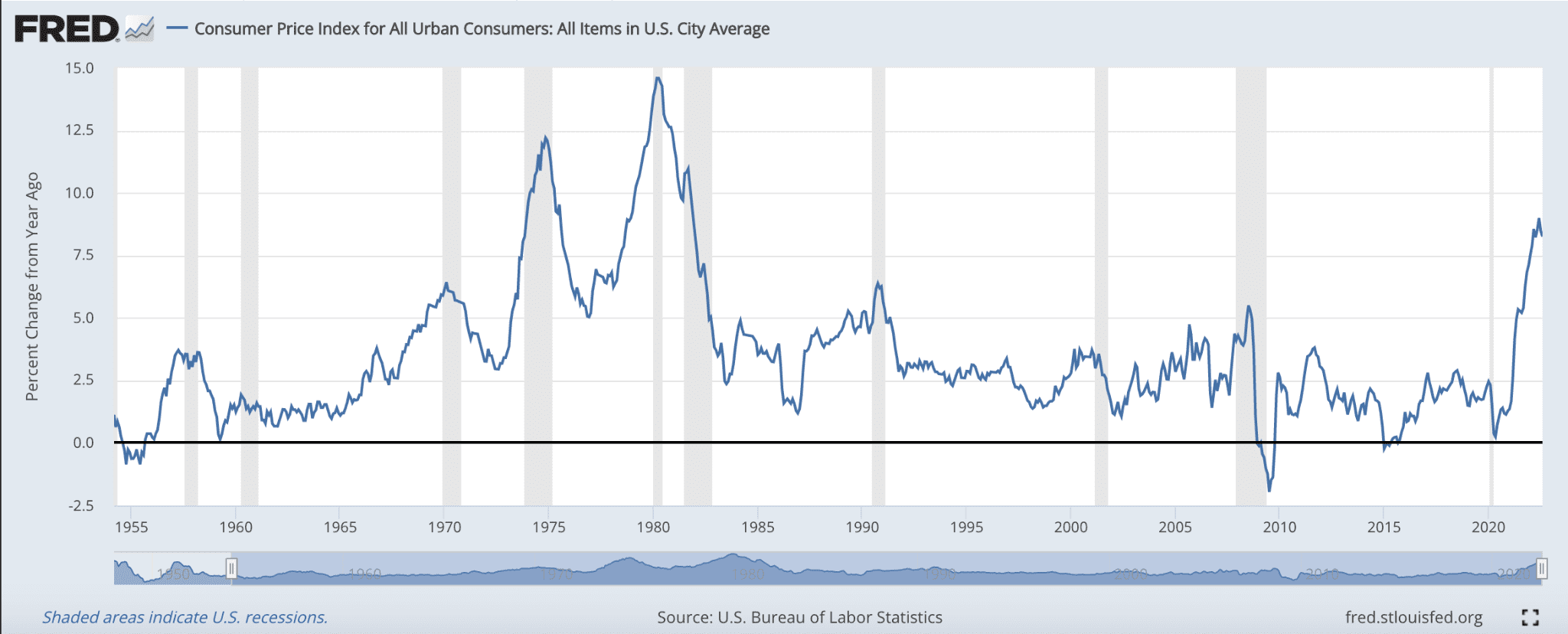

In fact, if you look back all the way to 1973, you’ll see that there hasn’t been an instance when the Fed managed to rein in runaway inflation (exceeding its 2% target) without raising rates above inflation.

See it for yourself in the next two graphs (first is inflation, second—federal fund rates from 1955):

In other words, the only way to tame runaway inflation is to have interest rates above the inflation rate.

If that were to happen at today’s more than 8% inflation rate, look out. It would mean interest rates would need to move above 8% – a rate that would destroy not just homeowners with mortgages, but governments around the world who have piled in trillions in debt at record low rates.

That would be disastrous.

So at this point, the Fed isn’t fighting inflation. It’s making it seem as though it is while trying to save the elite by cushioning the crash in asset prices. But the market clearly doesn’t get it.

The Market Thinks Inflation is Under Control

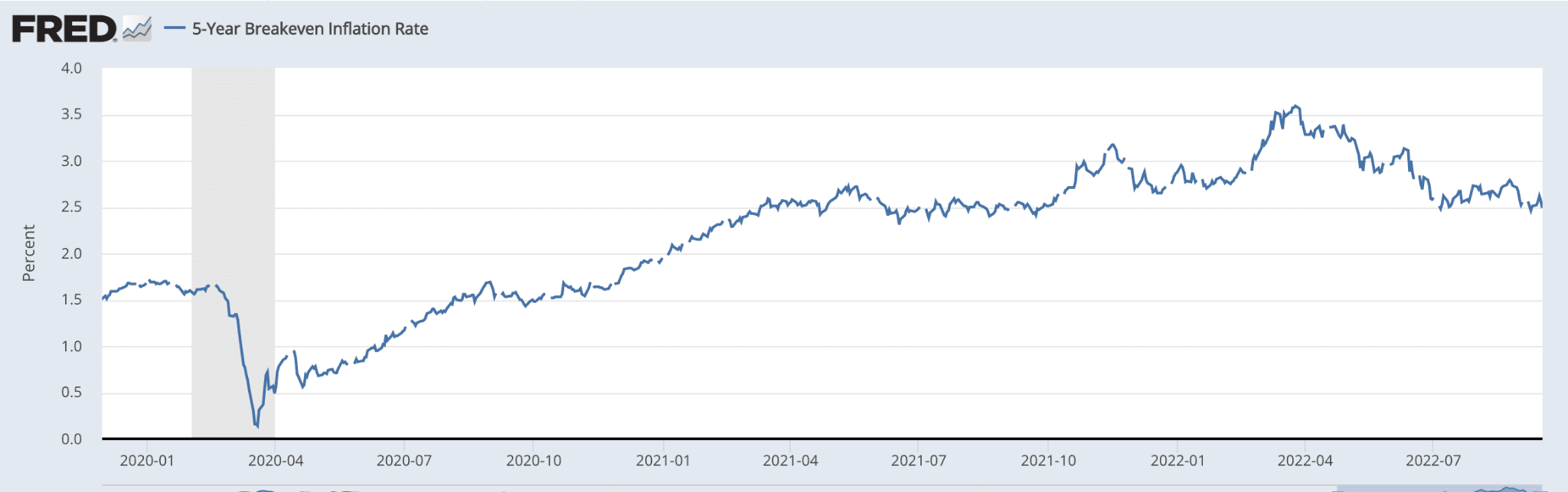

There’s a handy metric called “breakeven inflation rate” that can give us good insight into the investor psyche.

In short, it looks at the difference between the nominal yield of a Treasury and its inflation-linked counterpart. The gap tells us what inflation investors need to justify buying a bond whose interest payments depend entirely on inflation.

Or in the simplest terms, it indicates what inflation investors are expecting in the coming years.

Here’s a 5-year breakeven rate:

It seems investors expect inflation will average just slightly above the target rate over the next five years—when it’s 4x that now. And because this rate has been falling since March, they believe the Fed has it under control.

Yet, as we’ve learned from the last reading, inflation is anything but under control. And the worst is yet to come.

All of which brings us to gold’s seemingly strange reaction to inflation.

What to Make of Gold

Many believe that gold is positively correlated to inflation, or more specifically to CPI—that is, the higher CPI, the higher gold’s price.

But I’ve explained many times that it’s not – at least not in the short term.

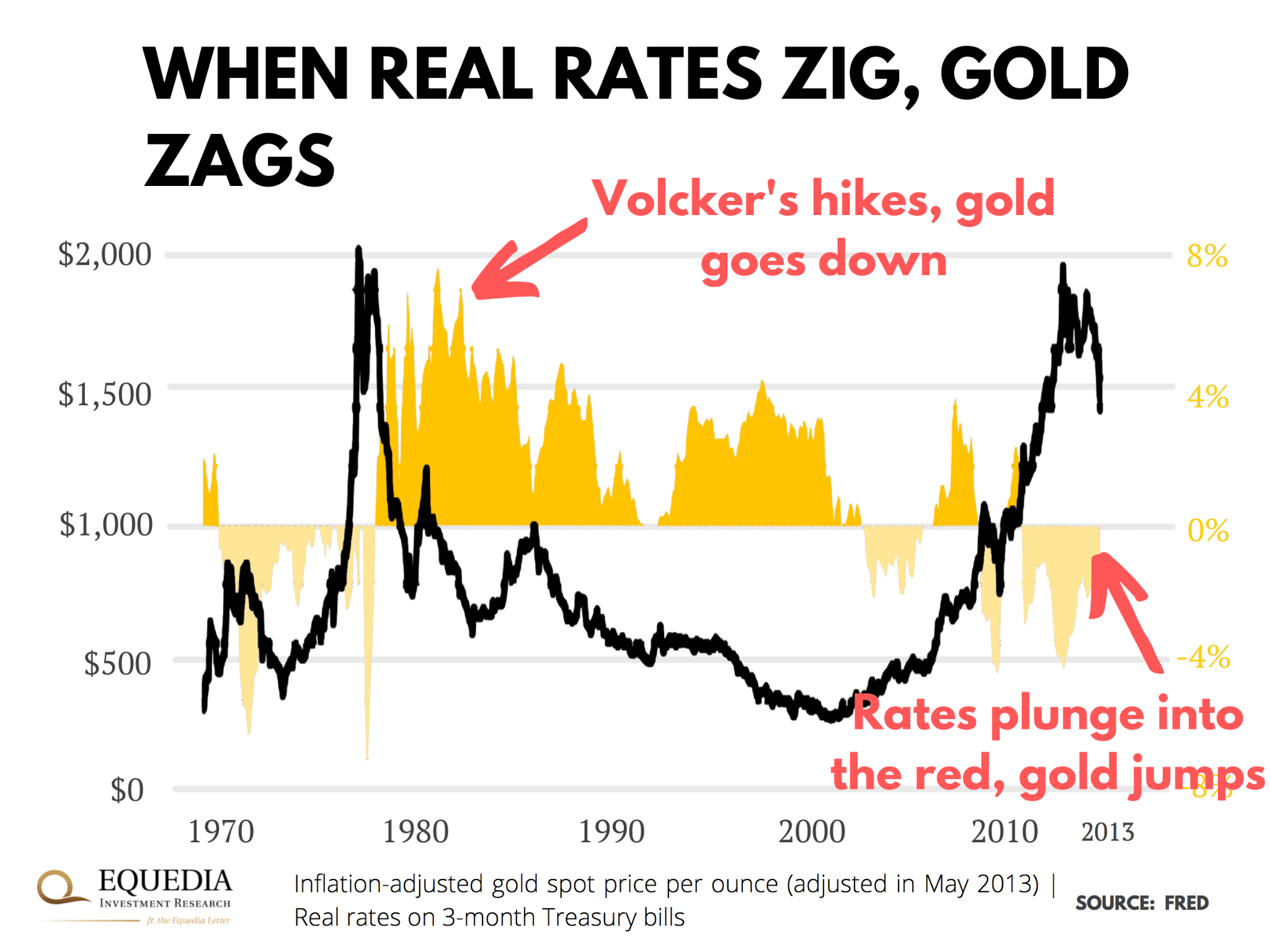

As I mentioned last year, gold prices are entirely driven by one single metric: real yields.

Via “The Gold and Inflation Peg is Wrong“:

“For the most part, gold doesn’t have anything to do with inflation. And most of the time, it doesn’t move in tandem with inflation. In fact, gold tumbled in most inflationary periods after 1980.

In other words, investing in gold based on inflation has largely been a money-losing strategy. Had you used it since 1980, you’d have blown most of your money.

What gold really pays attention to is real interest rates. That’s the interest on “risk-free” debt minus the inflation rate. The higher the real rate, the more you earn in interest after inflation.”

Take a look at this next chart that shows gold’s near-perfect connection to real interest rates. (Yellow shaded area = federal fund rates, black line = gold price in dollars.)

See how gold prices exploded in the 1970s when rates plunged into negative territory after adjusting for inflation? And how gold came crashing down a crazy 75% when rates climbed back up?

There’s simple logic that explains this behavior.

When real interest rates break into positive territory, that means bond investors can beat inflation risk-free with the safest*, short-term government bonds; and naturally, their appetite for gold as an alternative safe haven, shrinks.

(*the argument to this is an all-out fiat currency or government failure. In which case, gold -especially paper gold – will be the least of your concerns.)

And vice versa.

If interest rates are negative adjusted for inflation, government bonds are losing money, which compels investors to look for alternatives.

The catch is that the real yields gold reacts to don’t take into account actual inflation. They are calculated using the “breakeven inflation rate,” which, as we learned, is a derivative metric that gauges long-term inflation expectations.

And because the market believes the Fed has things under control, these expectations are very low, which is why gold has lately lost its lustre.

The Takeaway

There are two ways this could play out for gold.

If Powell keeps hiking no matter what, as he’s pledged many times, gold could be in for a repeat of the Volcker moment. Real rates will skyrocket. Gold will crash further.

But the opposite scenario could also occur.

It doesn’t take much nerve to hike interest rates in an overheated economy with record low unemployment. But what happens if the economy tips into a recession?

Will Powell be so determined to hike again? Keep in mind that if Democrats hold the House and Senate after the midterms, he’ll get a lot of pressure to back down.

What will happen when the real inflationary forces manifest next year as I predicted in “Think Inflation is Over? Think Again”?

Investors will finally realize they’ve been downplaying inflation risk all along, their expectations for it will rise, and real yields will plunge back into the red.

That could easily send gold back beyond $2,000.

In other words, as rates continue to rise, gold will lose its lustre.

However, the moment rates reverse course, gold will likely skyrocket and go much higher than where it is today.

We can’t tell you with certainty what those in control have planned, but if there’s one thing you can take away from this letter, it’s this: despite its unbeatable long-term track record, gold will be extremely volatile at this inflection point in policy.

So when Ivan and I say diversify into real assets, we don’t mean put all your eggs in gold. Instead, diversify across many inflation-shielding investments, including commodities, energy stocks, and high-return money market funds.

Seek the truth and be prepared,

Carlisle Kane

How does one find a high yielding money market fund?

How to find high yielding money marker funds? Thanks

One wild card in the mix is that the US dollar is approaching its 2002 peak against other currencies. It may take a year or two for Europe to stabilize and resolve its energy situation but then the dollar should drop. Between 2002 through 2012 the $US went from 1.2 to 0.74 (-40%) while gold went from $300 to $1800. We will have to see what happens this time around.

Another parallel is that the 2002 dollar peak was associated with an over-enthusiastic housing market and today we are repeating those conditions.

Good luck to all!

I echo comment #1 – what is a high yielding money market fund?

I would be interested in an article (from you) about silver, how its valued and how it moves (any correlation to anything) Thankyou.

What are your thoughts on TIPS (US Treasury Inflation-Protected Securities) and how do they actually work and pros and cons.

From the TreasuryDirect website:

We sell TIPS for a term of 5, 10, or 30 years.

As the name implies, TIPS are set up to protect you against inflation.

Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.

When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount.

TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies.

You can hold a TIPS until it matures or sell it before it matures.

Thanks,

Eric