The gap between Baby Boomers and Millennials is expected to widen over the next three decades considerably. Therefore, we are interested in looking more closely at how this transition will impact economic trends – both existing and future trends.

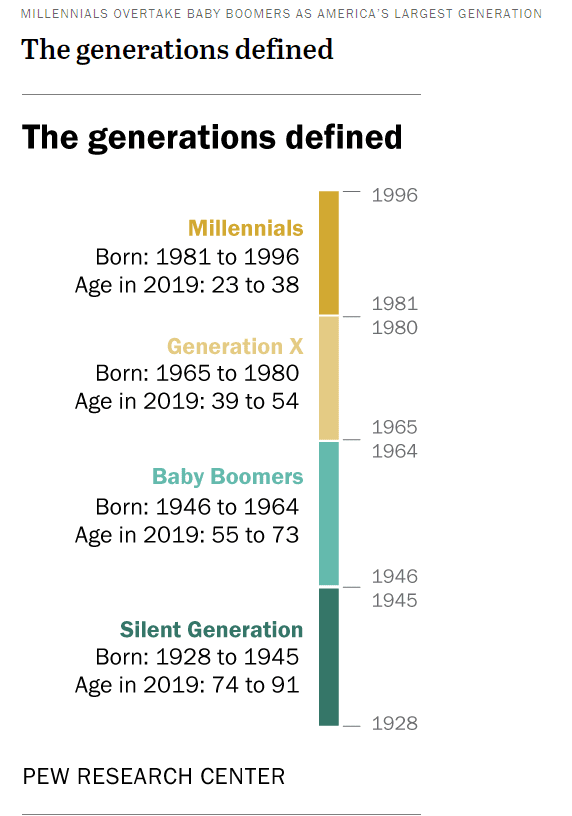

PEW Research Center has studied US Census Bureau information and has separated the US population by age groups. These groups are Millennials, Generation X, Baby Boomers, and Silent Generation.

Here is an “infographic” showing their results:

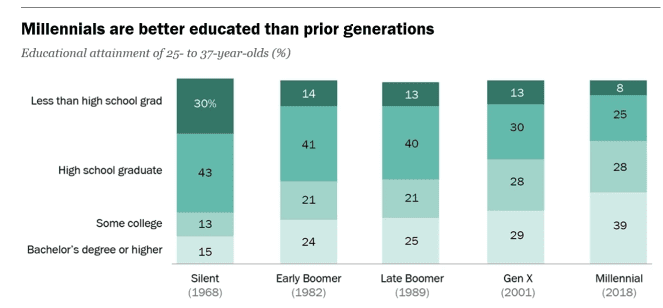

Millennials have the benefit of a higher education than their parents:

But despite this apparent “advantage,” they are earning less, in some cases much less:

“These lower wages may lead to long-term problems for this generation, experts say.

Lower income levels are already having a long-term impact on millennials’ ability to accumulate wealth, either through savings or home equity.

“Millennials are going to be on a completely lower trajectory than previous generations,” says Reid Cramer, director of the Millennials Initiative at New America.

The generational wealth gap has reached “historic proportions,” Cramer says. The average millennial’s wealth in 2016 (ages 23 to 38) was 41% less than those who were at a similar age in 1989, the report says.”

It follows, therefore, that lower-earning Millennials will have less impact on the economy. Not only will they have less to spend, but they will spend what they have in much different ways than did the previous generation.

Investors need to be aware of how Millennials see themselves relating to each other to be able to pinpoint sectors of the economy that will benefit from their involvement as managers and participation as consumers.

One such sector is the communication sector. Even before the COVID pandemic, Millennials were never far from their iPhones.

A digital persona became a direct extension of a real-life one.

FaceTime/Zoom/Skype and other video teleconferencing apps are the favoured form of communication for Millennials.

While Baby Boomers are content to hear a person’s voice, Millennials want to hear and see them.

Companies that allow for sharing ideas and their widespread distribution (Twitter, as an example) become integrated communication platforms for Millennials.

Job search sites such as Linkedin and Indeed provide an easy means for Millennials to transition from one job (gig) to another seamlessly.

It is instructive to consider how Google became the “out of control Pac-Man” for the search engine space. The massive success of Google may serve as a template for others.

One easy investment strategy would be to identify specific areas of the economy favoured by Millennials, then simply invest in the “best of breed.” Rather than trying to keep up with the upstarts, one could simply treat the strongest company in a particular niche sector (say job search) as a Legacy Investment and keep adding to it over time. If the “Google model” is to be repeated, the financial gains over time could be most rewarding.

Millennials, as a group, do not use technology and communication to highlight their success in accumulating assets; rather, it is for the purpose of getting together in small groups for shared experiences.

The ethos of Millennials is captured by the annual Burning Man festival held each year in the Black Rock Desert, north of Reno, Nevada.

Via Fast Company:

“Millennials are the first generation of digital natives and demand digital experiences that are simple and useful (think Apple iOS), personalized (think Spotify), and empowering (think Lyft). Equally important but less understood is cultural currency.

Millennial cultural sensibilities represent a true paradigm shift and revolve around three interrelated pillars–fun, discovery, and community. Not coincidentally, these are the very same pillars that define Burning Man and are the drivers of its ongoing success.”

Baby Boomers grew up with a regimented workplace hierarchy that influenced the way they spent their disposable income.

The “Boss” had a big boat, managers had smaller ones, and workers had a canoe. So everyone who worked for the “Boss” was motivated to work harder to, metaphorically speaking, “get a bigger boat.”

The 1970s and certainly the 1980s were great times to “invest in boats,” even despite a few short-lived recessions along the way. There used to be an old bumper sticker around in the hedonistic, excess-filled 1980s that said: “He who dies with the most toys – wins!”

Millennials do not care about “bigger boats,” or “bigger cars,” or “bigger houses.” This is a very important realization for investors to be aware of.

Millennial’s value lived experiences over the accumulation of material goods*.

(*Ivan here. This could perhaps have been embedded into their psyche via globalist plans such as the Great Reset touted by the World Economic Forum. For example, “You will own nothing. And be happy.” See my past Letter on this topic by clicking here.)

Take a minute and really listen to what Millennials are saying about what they want to achieve in their lives.

They want to travel, they want to go to events and concerts, they want to reach out and grab onto what lies waiting for them. In short, Baby Boomers were all about “things,” and Millennials are all about “experiences.”

Companies that recognize and serve these needs will do exceptionally well.*

(*Ivan here. We are currently invested in a private company that’s set to go public soon that directly targets a Millennials “experience.” More on this shortly. Stay tuned!)

In the future, as there is going to be a stampede of “Globetrotting Millennials” seeking a new, different and unique experience in a faraway place. They will capture this lived experience and then share it with others. Of course, space travel comes to mind, so it should come as no surprise that space travel companies have been rising in value recently.

In effect, by blending the actual with the digital, a person can complete the metamorphosis to “Renaissance Man.”

Travel companies that specialize in niche vacation settings will have a long and steady stream of new business.

Global investors will quickly recognize the spending habits of Millennials, invest accordingly and support these types of businesses.

There will be a surge in the travel business post-COVID. But what about a few years later? Who will still travel, and where will they go? Millennials will drive the future of the travel business. The question may well be not where they will go but rather where they will not go.

Not to be left out, newly minted Chinese Millennials are driven by the same values as their Western counterparts. They also see value in experiences over things.

Via Jing Daily:

“The younger generation takes a greater interest in travel, art collecting and preserving China’s culture, arts, and traditional values, including Buddhist traditions. They are spending money on loftier pursuits that are more personally satisfying and developing a legacy that goes beyond monetary wealth. “

Let’s not forget the surge in investor interest in companies that supply Millennials with their daily nourishment.

One of the strongest growing trends today is the move toward “natural foods.” Many products, including ones like fish, that end up on plates in restaurants also inform the consumer that they will be dining on a fish caught by a local fisherman in a sustainable fishery. The same goes for “farm to table” produce.

As Millennials take over the marketplace, activities in the areas of sustainable food production will only increase. Therefore, this would seem to be a good area to find investment opportunities. A company like Whole Foods comes to mind – hence, a likely reason why Amazon bought it.

Summary and Wrap Up

Millennials are shaping the marketplace now and will have a much more significant impact on it soon as Baby Boomers consume less.

Their spending habits are governed by a need to remain environmentally sensitive and socially aware. Millennials will abandon companies that do not share the same set of social values.

Find the Pac-Man!

The marketplace has always been a contest.

In the past, there has been room for several “winners’. That may be changing. Early investors in Google have seen it consume most of its competitors.

Investors in a Millennial-driven economy must focus on finding that one company that appeals to them for reasons beyond the income statement and balance sheet. Financial success comes later.

The new “best of breed companies” deliver products or services to consumers who are aware of and who approve of their business practices.

Not only must companies make a great product, but they must also do it in a socially acceptable way.

-John Top.