Dear Reader,

History is being ripped apart. Statues are being torn down. Buildings are being vandalized. Cops are being killed. Businesses are being ransacked. Innocent bystanders are being assaulted.

Yet, the stock market remains near its all-time highs. Go figure.

But why shouldn’t it?

According to the Bank of America, total global stimulus, including both fiscal and monetary, has already reached a whopping US$18.4 trillion this year.

“Trading stocks was among the most common uses for the government stimulus checks in nearly every income bracket, according to software and data aggregation company Envestnet Yodlee.”

Especially with what’s going on in the U.S.

In my last letter, Reality Exposed, I showed you excerpts of previous predictions on what would happen once Donald Trump became president.

In fact, I laid out precisely what will happen and how in my letter These Six Events Will Determine Our Future.

But more specifically, as it relates to today:

“They want us to be blind to the real problems in our society. And they do this by pitting us against each other; by using race as the focus of inequality, rather than economic inequality itself.

That’s because racial inequality pits one group against another, whereas economic inequality pits citizens against the rulers of an empire.”

Now, before you go and attack Trump and blame him for economic inequality, look at this:

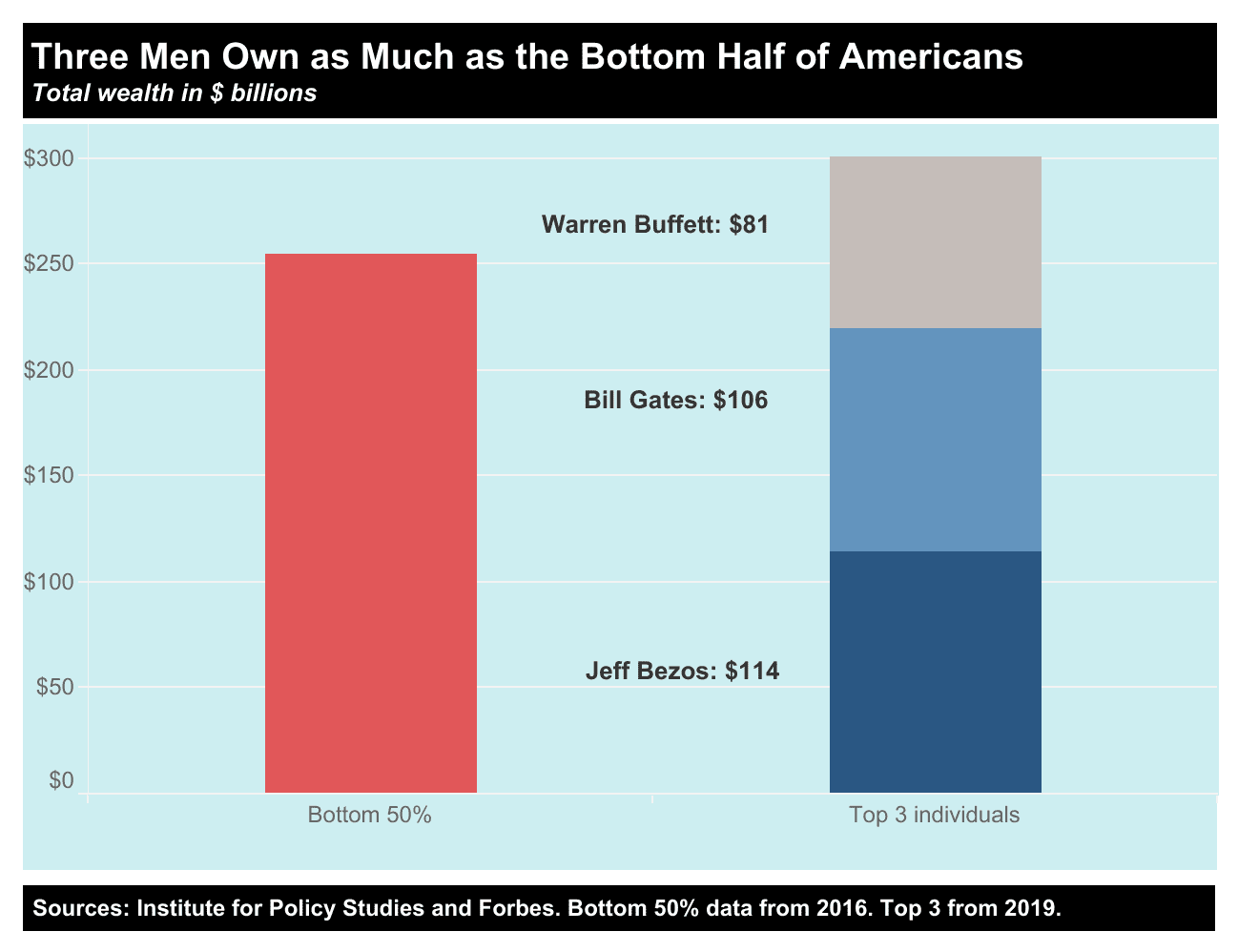

Together, Warren Buffet, Bill Gates, and Jeff Bezos own more wealth than the entire bottom half of Americans – that’s nearly 165.5 million people. None of these men are Trump supporters.

Together, Warren Buffet, Bill Gates, and Jeff Bezos own more wealth than the entire bottom half of Americans – that’s nearly 165.5 million people. None of these men are Trump supporters.

What I am trying to say is that Trump vs. the Left is just a distraction from the actual reality that exists today: control.

When the biggest corporations and the wealthiest people control all of the media, the banks, and government, the control of society is easy: They show you what They want you to see; They control your money; They make the rules.

So, where does that leave us today, and how should we be investing?

If you haven’t already, I strongly urge you to read my letter, These Six Events Will Determine Our Future.

In short, this was the chain of events I predicted:

“1. Inflate: Make people feel good by giving them cheap money through Quantitative Easing (Q.E.) and low-interest rates – increase the money supply.

2. Deflate: Take the good feeling away by taking away cheap money through Quantitative Tightening (Q.T.) and higher rates – decrease the money supply.

3. Control: Subdue the population by taking their focus away from the real situation. Think media control; think the increase of opioid usage and the legalization of marijuana; think President Trump; think billionaire-funded protests.

4. Divide: Segregate society by inducing riots and hate crimes.

5. War: Mask the international financial and economic crisis through the rhetoric of war, or even war itself.

6. Reset: Global economic reset will be blamed on war, not the monetary actions of the powerful elite.”

Given that we’re already heavily into stage 4, the inevitable path to stage 5 is near: war.

We’re already seeing global tensions rise – not just with countries, but with global organizations such as the United Nations and even the World Health Organization.

And in the U.S., a third of GOP voters believe a civil war is about to ensue.

Via the Rasmussen Report:

“The latest Rasmussen Reports national telephone and online survey finds that 34% of Likely U.S. Voters think the United States will experience a second civil war sometime in the next five years…”

And if Trump remains president this year, I am betting things are going to get completely out of hand.

As I said in my letter last year, A Most Radical Prediction, if Trump wins again in 2020:

“After Trump wins, he is going to go berserk.

Not only will he likely control the entire government, but he will unleash a new fiscal policy that will change everything.

He will lower taxes on the rich and those who are job creators; he will give huge incentives to businesses in the U.S. via tax breaks; he will borrow a boatload of money and begin a massive infrastructure spending spree, which will create jobs.

Heck, he may even convince the Fed to do QE4 – all of which will lead to a bigger bubble.

After all, he will have nothing to lose – there’s no more election to win.

In other words, he will do whatever it takes to prop up the economy and the stock market.

Champion or Fall Guy?

If the market can hold off until the U.S. elections next year, we may see yet another burst of enthusiasm in stocks.

The rich will certainly get richer under Trump, but he will create more jobs and make many blue-collared Americans happy.

For investors, the goal over the next couple of years is to make as much money as possible in the market before it comes crashing down. Because given the amount of exuberance in the market and the credit bubble that has been brewing for nearly a decade, things will break at some point.

And that some point will likely come during Trump’s last couple of years in office (if he wins) because he will unleash a fury during the first two.

But why? Why will things come crashing down if Trump will do whatever he can to make American great again?

The answer lies in the Letters I wrote back in 2016 and 2017.

From 2016, before Trump became president:

“For all we know, Trump, the master of the deal, may have already struck a deal with the bankers and politicians.

But as we know right now, Trump is anti-establishment and anti-globalization.

If Trump is elected under that presumption, we’re going to see the building blocks of the Establishment and globalization come under attack, and they won’t like it.

They will fight back, leading to major conflicts, including riots, protests, and potentially even war and assassination attempts.

It is quite possible that the Establishment might even be allowing Trump to succeed in order to cause chaos to show the people that the Establishment is a necessity once all hell breaks loose.”

Note the last sentence.

What I write may be difficult to grasp at first, but as time passes, the light will shine.

Just keep in mind that throughout American history, whenever the Establishment has been challenged, it has always been followed by bear markets and economic contractions.”

Three years ago, when I made these predictions, they were hard to fathom.

But today, with the passing of time, has the light shined?

The stage is set for Donald Trump to fall. We’re already seeing riots and protests everywhere – the likes of which are extremely damaging to humanity. I am not talking about peaceful protests; I am talking about the killing of innocent cops, the deformation of property, and the destruction of law and order.

In other words, as I have stated very clearly in many past letters: make as much money as you can in the stock market today because SHIT will hit the fan. You need to be prepared.

This isn’t about greed – it’s about protecting your family.

Eventually, all of the debt we accumulated will have to be repaid – just as past social injustices are being repaid today.

Which leads to my friend John Top’s latest article…

What a load of crap. The only thing I agree with in this gas lighting letter is that there is a crash coming. Keep ur right wing politics out of ur letters. There are hundreds of thousands out of work and your blaming the gov for stimulus ? Who’s ur editor ? Harper?

Sorry, but perhaps you didn’t read the part where Trudeau has set records for record spending – all prior to Covid?

Your comment is precisely what is going on with people these days – if you don’t like something, you just yell.

The fact that Trudeau has been the biggest spender is just simply fact, regardless of political views.

Trump would be considered right and he too launched stimulus. So not sure why you immediately claim that this is a right political view.

God bless you! You analogy is consistent through out history! The masses are not educated in history or finance! The USA does not teach civics in our schools

Fundamentals of Goverment and separation of powers lost in the minds of many! High School graduates can not balance a check book! Civil liberties will soon be lost!

You are right! High schools don’t teach the very basic lessons of money. Also interesting to note that the majority of school systems have been overtaken by left-wing politics. In both the US, and Canada.

Dear Equedia,

What a fantastic letter. It is sad that we as Canadians are going to witness and experience the devaluation of the worth of our currency due to massive borrowing and interest costs. Its so simple to read the prophecies of the major religions to arrive at the same conclusion; that interest Will effect every person on this planet until collapse of the financial monetary system.

It would be great for you to advise on how Canadians can protect their families and generations from this interest fall out and how to secure themselves against debt and financial ruin. We need advisors who can advise Canadians and a government that puts in place measures against local and global financial catastrophe.

Here are some solutions for Canadians:

1. Educate yourselves everyday on the financial protection of your families

2. Engage and train your children on how finance works, and to save more, create more and spend less.

3. How to create passive and active income from all family members

4. Use Government and private funds to put in place a generational monetary and asset plan that creates passive and active income streams

5. Training on empathy, inclusion, education, faith and charity to ensure the family survival as the money supply erodes from everywhere…

Thanks Karim for your words. I, too, agree that much of what has happened and is happening has been prophesized by many religions. Thus far, my solution over the past decade has been to invest alongside the Fed actions – thus, building your family wealth, so that when all things come crashing, your family is protected. I will write more basic solutions in future letters also, as per your recommendation. Thanks again for your support.

The writing on the wall has become britghter as age has taken over.There is another factor whitch no one talks about the state of humanity mental health as the middle class becomes a race of junkies and thieves with no hope or way out. I believe this needs to be factored in for without the bottom the top can’t exist. When you back a dog into a corner you will get bitten.

Jim. You are very correct! Which is why I am invested in a private company that deals with mental health on a mass scale. Will have more info in a few months!

Ivan I wish you a GREAT FATHER’S DAY TOO …I enjoy your well thought out articles and unfortunately agree with most of their content…one caveat though?

How do we get out of this savage government debt without armed conflict within our country as well?

Do you think we must spill blood too?

Kindly,

Hasmet

Funny you mentioned armed conflict – perhaps that is why Trudeau is trying to guns away from Canadians. Unfortunately, the only way out is to take many, many years of sound fiscal policy, reign back spending on social issues outside of Canada, and lower corporate taxes to entice businesses to come to Canada. However, that is just an ideal solution – the likely solution is much higher taxes in all forms – especially for the wealthy. But, as we all know, higher taxes on the the wealthy includes small businesses, which are the biggest employers of all.

Thanks Hasmet! I seriously hope that blood does not have to be spilled. Unfortunately, the road to clearing up this savage government debt isn’t pretty and will take a lot of pain and a very, very long time to get out of. With the short-term mentality of today’s civilization, I fear that this is near impossible without some form of reset. The other view is that we just continue to pile on more debt, and that high debt becomes the new norm – which is likely where we’re headed. Of course, this means less for the lower class and more for the extremely wealthy. The middle class is slowly being eroded away, as government will most certainly tax these individuals more. Meanwhile, the super elite will continue to find ways to avoid taxes. This is also where most people, especially those on the left, have it wrong: higher tax on the wealthy should be higher taxes on those corporations who make billions – not individuals or small businesses who make $150,000-$200,000/year; if you tax these individuals, where will the motivation be to hire more people and grow? These individuals almost always pay their fair share of taxes because it is too costly to conduct the tax schemes required to avoid taxes; these type of schemes are generally only affordable for the ultra-rich – those who make tens of millions, or more, per year.

Fantastic,it shows you how to the real thing the future, based on facts on the past thank you.

Trump already set himself up to fail by constantly lying, flagrantly approving and posting absurd and even vicious conspiracy theories, supporting the worst racist and hate mongering publications and leaders in America, and depleting his cabinet of all competent members he had and filling it with ignorant yes men and women. He is a classic egotistical narcissist who is praising our enemies and condemning our friends. And all you and other greedy business people care about is the FUC****G ECONOMY.

You are the worst of what is wrong with Capitalism, which I think is the greatest creation ever, but not to the destruction of everything else. Trump is an amoral, vicious and vain child who lacks compassion or empathy for anyone or anything. The American version of Joseph Stalin.

William, while I appreciate your opinion – I believe you chose the wrong words. “YOU” are the worst of what is wrong with Capitalism. Not sure what you mean by this? 1. We are Canadian – so not a Trump supporter. I simply write what I believe is going to happen. Please don’t let your hatred for one individual cloud and overshadow everything else. I wrote many of these predictions years ago and they have come true. I didn’t say I wanted Trump to win, or lose, simply that he would become President. Did he? Yes. Are there riots and protests everywhere? Yes.

Hope this helps.

I am surprised that you still have a connection to facebook and twitter. Wait till something from your website displeases them. Most of the people that are involved in the protests are in it for the money and the loot.

Funny you mention this Hank. Ironically, one of our posts was “flagged” for potentially misleading information – only, and ironically, it was a post of CNBC’s interview with the WHO.

Spot on!

Article very illusive. Cut it down to one third and finally who retires at 55 and lives to 90.?

Thank you for your complicated, penetrating article about “..the actual reality that exists today: control.” As most students know, the US Constitution provides for 3 branches of government; Legislative, Executive, and Judicial. These are the 3 de jure branches of government in the States. You further write “If Trump is elected…we’re going to see the building blocks of the Establishment and globalization come under attack”… a stunningly accurate prediction. So’s let’s look at Trumps favorite targets, “the Deep State” and “Fake News.” Many will deny the existence of “the Deep State.” “…the Deep State is not a homogenous or centrally controlled organization. It is not a conspiracy of spooks, meeting in secret and plotting a takeover of the country. Instead, it includes hundreds of thousands of people who already run the country. It is a loose and tacit alliance of cronies, politicians, bureaucrats, consultants, experts, economists, lobbyists…, and the military and its contractors…The most powerful and dangerous…is the one Dwight Eisenhower warned about: the military-industrial complex…It’s gotten much more complex…and much more powerful…since Eisenhower outed it in 1961.” (Bill Bonner, Bonner Part V: The Deep State, Not Trump or Congress, Runs the Country”) The term “Deep State” is relatively new to American politics and is roughly analagous to the older term “military industrial complex.” Now onto Trumps other favorite target, “fake news.” “For a long time there have been murmurings of a fifth estate, an alternative sphere of influence, another component of society” (Artem Cheprasov, Study.com) “The history of the FIfth Estate has been a continuous challenge to all authority, manifested in the 1960’s civil rights and antiwar movements… “(Peter Werbe, History of the Fifth Estate: The Early Years) It is primarily the ever-increasing power of the culturally liberal, politically correct, non-deplorable elite on CNN and similar news outlets to shape and mold public opinion in any way they chose that Trump is railing about when he blasts “fake news”. With the advent of 24/7 Cable News, “the Fifth Estate” has gone mainstream. Although the Constitution provides for 3 branches of government, the States have at least two de facto spheres of power (not explicitly recognized in the constitution), or is there a third? You write “the FED will always control society” and you have written recently about how big banks gained control of society. I mostly agree. Wall Street, the powers that keep it running such as the FED, and those entities that benefit the most from its existence, the big banks, make up the third and newest “de facto” sphere of power. Perhaps the best proof of this is Ben Bernanke’s designation of “too big to fail” banks and the resulting far-reaching economic policies. Unfortunately, the power of Wall Street, the Fed, and banks that are “too big to fail” is expanding quickly. President Trump, whose criticism of “the deep state” and “fake news” is likely on the right path, actually uses the stock market’s performance as a barometer of his administration’s success. This is the contradiction that is Donald Trump. As you correctly write, “he will do whatever it takes to prop up the economy and the stock market.” I believe my comparatively simple observations about the 3 “de facto” spheres of power dovetails well with your recent articles. You are right. It is about control, and hence power (Constitutional or otherwise)

Thanks for this well-written and educated response! It’s inspiring to know that there are still citizens who read and pursue information outside that of the mainstream media, or rather “fifth estate.” As far as the banks go – we have to remember who truly controls them: the Fed. The Fed is the king of the banks and oversees all of their operations; most people just believe that they are the bank of last resort and deal with monetary policy, but they actually dictate and control most of the rules for every bank in the U.S. In other words, the biggest banks are just an extension of the Fed. Again, thanks for your comment! Very well-researched!

From what I’ve reading the petrodollar is losing its place in the world , can America really afford to let that happen ? Can the rest of the word survive without an America that will no longer have a say so in almost every aspect the world , a superpower , our soldiers in so many countries , our dominance and our fiat currency that most desire for now.

Have we sanctioned too many for too long ? Will Gold solve anything ?

I didn’t know property could be defamed.

The historical correlation with Rome and the British empire (as well as others) is strikingly and broadly similar. Throughout history when the balance of wealth becomes so tilted that the obscenely rich have total control, whether by greed, sin or pride, morality falls and a global reset is inevitable. The flash to bang cycle is faster due to technology, but the result is the same. It continues but usually there is enough time between generations for people to forget and the cycle is repeated. I don’t think it will be so this time. Technology is everywhere and recorded. As much as the rich would like to think the masses are ignorant, we are not, What the rich can’t control though is God. God is watching. Bow now or bow later, all will bow. At some point God will be tired of being mocked and the level of global reset that He sets will destroy even the obscenely rich. Don’t believe me, look at history. Non-believers say it was a natural disasters, a true global pandemic, etc. Believer’s know better. Look at the level of morality and then see what happens in God’s creation. Even those holed up in Belize and other rich people escapes will not escape the reset. We have choices, chose wisely.

?The killing of innocent cops? Did you really mean that, as shown in this quote?

“We’re already seeing riots and protests everywhere – the likes of which are extremely damaging to humanity. I am not talking about peaceful protests; I am talking about the killing of innocent cops, the defamation of property, and the destruction of law and order.”

Yes.

https://www.ctvnews.ca/world/widow-retired-police-captain-died-protecting-friend-s-store-in-st-louis-1.4966913

Not to mentioned paralyzed.

https://www.cbsnews.com/news/shay-mikalonis-las-vegas-police-officer-shot-george-floyd-protest-paralyzed/

What if biden wins?? What will happen?

Buffet, Gates & Bezos. Tell me 1 way their ownership of a large fraction of the economy negatively affect my $70 000/ per annum mostly pension income. Why do you mention Police Killings and not the number of George Floyd killings? You should keep to your rule of not pushing any investment. When you do, it makes you look like a “pumper” – of which I have previously accused you. You never say which stocks you are selling. Incidentally, are you a racist-hater of non-whites? Do you believe that there,s racism in the U.S. and Canada?

Thanks Malcolm. Your comment is warranted. However, we can’t tell people when to sell – it is literally against securities rules. We also don’t tell people when to buy – we can only present our ideas. And absolutely not a hater of non-whites, what would make you think that? I am not white. Never have been. I have friends of all races. I have never experienced true racism in my decades here in Canada. I have black, brown, yellow, red, and white friends. I do believe that racism exists, but I believe there are for more non-racists than racists.

The other day, I was at the park with my son, who is half white and half Chinese. We walked to find a white boy, playing with a black boy, playing with a brown boy. The black child was adopted by a white person. The parents were great, as were the kids. Not one of us looked at each other and said, “Hey, that kid is black. Or Brown. Or Mixed.”

Racism will never end if we keep saying racism exists – its a self-fulling prophecy.