Not My Problem: The Real Generation Gap

Have you ever been to South Florida or the Bahamas and looked up at the TV to see the bold lettering “HURRICANE WARNING” staring back at you? The first time it happens, it can be frightening; the times after that, not so much. Complacency really does set in and changes the way you think about bad things that could happen to you.

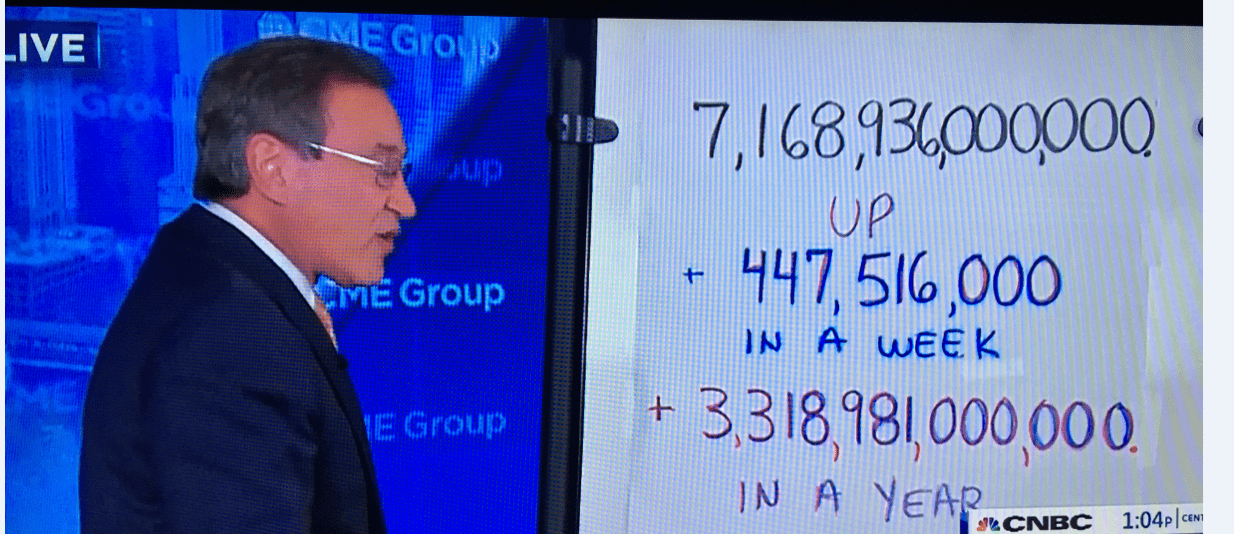

Today, we have a generation that is piling on boatloads of debt onto the next. The rationale has been made so simple that it has become mind-numbing: – “debt is the only thing that can save the economy.” And with that decision made, the FED balance sheet almost doubled from $4 trillion to $7 trillion.

Of course, the US government dips into this mountain of newly minted cash to facilitate government programs, including one that pays more money to some recipients not to work than they were receiving while working. And in Canada, it’s no different: those who made just $5,000 last year, are now getting $12,000. How’s that for buying votes? This is where over 100 years of government cooperation with FED stewardship has now taken us. I can sense that you are not amused.

The situation with government borrowing has gotten so bad that, despite slowly drowning in debt, the government is looking for ways to blow even more hot air into the rapidly expanding debt balloon.

How is this possible?

Today, at a congressional hearing with the FED chairman, the question was naively asked if the FED ever considered investing in 50-year or 100-year bonds?

The chairman politely pointed out that the decision to issue bonds with these extended terms was up to the US Treasury.

To date, there has not been a decision taken to issue very long term bonds, but it should be a “HURRICANE WARNING” that it is even under consideration.

Canada, Italy, and the UK have issued 50-year-long duration bonds. Not to be outdone, Austria, Argentina, Belgium, and Ireland issued 100-year bonds. The Austrian bond has performed exceedingly well while the Argentina bond has suffered.

See the link provided to learn why both bonds are considered “risky investments” going forward.

https://www.bloomberg.com/opinion/articles/2019-08-19/100-year-bonds-are-a-dangerous-temptation

Many years ago, I was helping my son construct a summary of an essay for a college writing course. The topic he chose was the basis for the American Revolution. I was struck by the byline of the day: “taxation without representation.” This has stuck with me over the years, and I guess in some tiny reserved corner of my mind, I have never really stopped thinking about it.

Until now.

Now is the time to focus on what exactly these words mean in the context of today.

The current social unrest and high degree of angst and uncertainty that goes with it are connected to this historical ideal. Everyone, every cause, every social or economic injustice, is now demanding to be heard. As a result, there is noise. A lot of noise.

I don’t know about you, but I don’t think very well with lots of noise. It has a negative effect on my mind’s ability to apply reason to chaos. Maybe this is why military training is so effective. The drill sergeant never gives you a chance to think. The military needs doers, not thinkers. The officers are the thinkers, and the enlisted men are the doers. It is a system that has deep roots in history.

So who is doing the thinking today?

The virus, the economic shutdown, the social unrest, have all coalesced to form the perfect storm whereby the mob cries for action has created a constant din of ever-present noise. Those that find a way to concentrate and come up with ideas on how to improve the situation are shouted down. We now live in a world where mob rule is prevalent in many forms and arenas.

It surely must be a “HURRICANE WARNING” when logical ideas, calmly presented, are shouted down.

Which brings us back to “taxation without representation.” It is not a stretch of the imagination to believe that future generations will question why they must pay for debts that they did not incur. This is obvious.

The chairman of the FED pointed out today that debt-to-GDP is rising and is unsustainable. I don’t know about you, but this sure sounds like another “HURRICANE WARNING” to me.

When I find a calm space to think, this is how it goes…

The Price of Inequality

The current social and economic unrest is based on failure to deal with real or perceived inequality. So how can all of this be resolved? The way I look at it is that it must begin with a basic philosophical agreement.

Basic philosophical agreement means the definition and agreement of both the problem and the solution. Unfortunately, this is where an irreconcilable difference between the Right and the Left is forming.

In some ways, the whole of the economic structure has been reduced to “pay me now” or “pay me later.” Seeing that there is no practical way to “pay me now,” both the Right and the Left have at least agreed on one thing: “pay me later.”

The same goes for social unrest. The “debts of the past” have come due. Change is the price paid. This change will occur later.

The price of economic choice is getting more expensive. It is one thing to enslave yourself with debt, but it is another to enslave your children. But, if the current situation continues to prevail for much longer, this is exactly what will happen. The price of social choice is much harder to quantify. Who really knows what the words “politically correct” will come to mean in the near future?

In the aftermath of the 2008 financial crisis, I became aware of a situation in Florida that made me think.

A large hedge fund went to a local bank and bought several thousand of underwater mortgages, with negative equity held by the homeowner. The fund then advised the homeowners that they could remain in their homes and offered generous rental terms. In one stroke of the pen, homeowners became renters, and the hedge fund became a “slum lord.” That may not have been the best example of capitalism at work as taught by the Ivy League business schools, but it helps define where the division between the Left and the Right originated*.

In a way, the FED is acting like the hedge fund. It has vowed to be as accommodative as necessary to allow its borrower time to pay. A decision has been made by the FED to put the facilities in place to intervene and keep rates low “until the end of 2022”. Despite the thunderous noises, the FED is not going to let a lack of liquidity lead to insolvency.

So how is it possible to feel comfortable about all that is happening today? That’s why the stock market must continue to reflect a bright, shining future; otherwise, hope is lost. After all, the implicit role of a leading economic indicator is to lead.

-John Top

*Ivan here. The same is happening in Canada. The Canadian government, under Trudeau, has put Canadians into more debt. In fact, even prior to COVID-19, Trudeau has borrowed more money than any other prime minister (not facing a world war or recession).

Via Fraser Institute in February 2020:

“Prime Minister Justin Trudeau has set another record—increasing the federal debt (per person) more than any other prime minister (not facing a world war or recession) since 1870.

He earlier set a spending record, as the Trudeau government has spent more money (per person) than any other prime minister in Canadian history.“

And now, with the ironically-labled COVID pandemic whereby most hospitals are actually empty instead of overrun, Canada’s debt is now looking it could easily grow to a trillion.

As you have said John, politics aside, this means our kids and future generations will have to pay for this. We already experience this in the form of higher taxes.

Property tax rates continue to climb alongside property prices, leading to a double whammy of increasing taxes. Just ask British Columbians and our so-called “school tax.” The government has been “helping” by offering homeowners, mostly over the age of 55, a deferral of their property tax – one that collects interest and is to be paid when the home is sold.

While that sounds great, those who saved their entire lives to retire and have a home they can pass down to future generations will likely lose much of that equity to the government – especially if interest rates go up.

Imagine being 55, retired, and using the government’s property tax deferral program. Let’s say you end up living until the age of 90. That’s 35 years of compounding debt with interest!

Goodbye, equity; Hello, debt.

In other words, under the property tax deferral scheme, the government essentially acts as a monopolized hedge fund on anyone that requires the “help” of these tax deferral programs.

And, as I have always said, the Fed doesn’t care which way the economy goes because, in the end, the debt belongs to them. And that means the Fed will always control the United States.

In Canada, with the way things are going, the government will always control you. And your children…through debt.