If you’ve been following us for a while, you know Equedia has a bloodhound nose for miners.

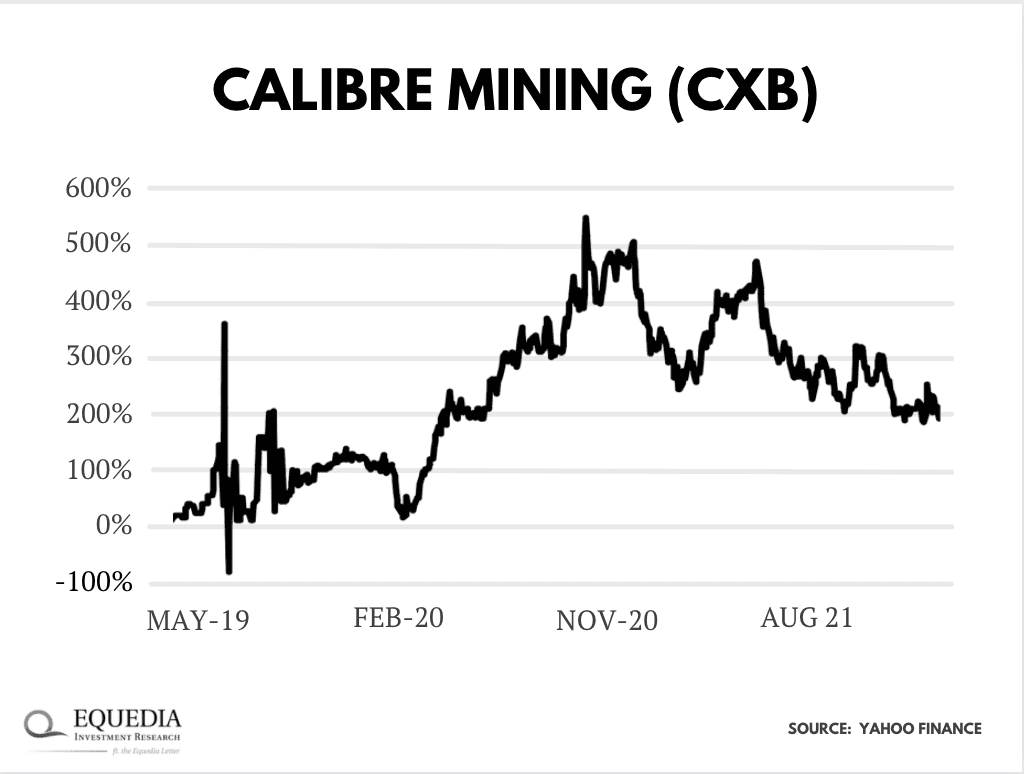

In late 2019, we introduced you to Calibre Mining (CXB). The stock was in a trough, but we knew it was coming back with a bang. And came back it did.

A year after our introduction, Calibre Mining lept a strong 272%.

A few years earlier, we introduced a junior miner that was bought out for C$600 million – good for a 400%+ yearly return.

Idea before that?

A mining giant acquired that company for over C$1 billion – the buyout took place in just over a year of our introduction.

Today, I am going to introduce you to yet another potential multi-bagger idea.

I can tell you that this appears to be a very favorable setup. But the window to get in on this before the storm breaks and investors pile in is quickly closing.

Let me explain.

The Financial System as We Know It Is Slowly Coming Apart

It doesn’t seem so because gradual changes are hard to grasp, but the telltale signs are flashing blinding red if you zoom out.

Consider this:

- There is more debt than there ever was: As of last quarter, the world’s debt grew to just shy of $300 trillion. And get this, half of it was accumulated in the past five years! For every dollar in GDP, now we have a record three dollars of debt. For perspective, that’s twice as much as the last peak in the ’40s when nations borrowed to finance WW2.

- The highest inflation since the ’70s: Inflation is sweeping across the world like wildfire. The official massaged numbers, which record double-digit price increases in many parts of the world, are already daunting. But when you look at the prices that really matter to the average person, it’s clear that fiat is burning up before our eyes.

For example, home price growth is in the high teens and shows no sign of stopping. Last October, prices in America’s hottest markets, including Phoenix, Tampa, and Miami, grew 26-32% compared to a year ago.

At the pump, you’ll fork over 57.8% more than a year ago. Food prices have also jumped big time—with the main source of protein in most people’s diets—meat, poultry, and fish—going up 9-26%.

- The most leveraged and overvalued market in history: like homeowners and governments, America’s corporations hauled in a record pile of debt to stay afloat and exploit the Fed’s zero rates. So, today we are witnessing not only the most overvalued market but the most indebted.

- Central banks keep printing: Meanwhile, central banks have printed up $11 trillion out of thin air. The Fed alone spit out around $4.5 trillion, which comes to one-fifth of all US dollars in circulation.

And guess what… even in 2022, two of the four major central banks are keeping their money taps wide open despite the booming economy and soaring inflation. (See “Total Asset of Major Central Banks” here.)

- The economy is crumbling under its own weight: and the worst part—which in a way answers why central banks keep printing—the debt-soaked economy is so sensitive to interest rates it can’t withstand any significant tightening.

In other words, the financial system is an inflated debt caravan chugging down a dead-end alley. The government isn’t saying so out loud, but it’s painted itself into a corner and now has to choose between two evils…

- EITHER keep inflation elevated for years to monetize the debt it’s taken on,

- OR crash the economy.

For cash holders, savers, and even index investors, that’s terrible news. But for mining investors like us, this is a once-in-a-century opportunity and one of the best macro setups to load up on mining multi-baggers.

Why Even Its Worst Critics Are Backing Up the Truck with This “Relic” Currency

As you probably know, gold has a certain rep among fund managers and policymakers.

Warren Buffet famously said gold has “no utility.” When questioned about why central banks hold gold, former Fed Chairman Ben Bernanke simply said “tradition.” And Wall Street often laughs off gold as a relic asset.

This is why you won’t hear much about this metal on the news.

Yet, when things hit the fan… everyone piles into gold, including its most vocal critics.

For example, when Covid broke out, Buffet suddenly had a change of heart and snapped $564 million worth of shares of Canada’s gold darling, Barrick Gold (GOLD). Meanwhile, investors poured a record $48 billion into gold ETFs.

(Side note: there’s a new, anecdotal anti-gold narrative. It argues cryptos are replacing gold as its digital successors. Don’t buy this lie. Just look at what happened to cryptos when stocks recently wobbled. If anything, this asset class is a market risk amplifier, not a store of value.)

Meanwhile, central banks are hoarding more gold than ever to counter their eroding fiat reserves. Last September, central bank reserves grew to a new high of 36,000 tons and blew away a previous record set in 1990.

So, why are the biggest money managers hoarding a supposed “relic” asset?

The Unmatched 3,000-Year Track Record

Despite its rep, no asset or currency can beat out gold’s track record.

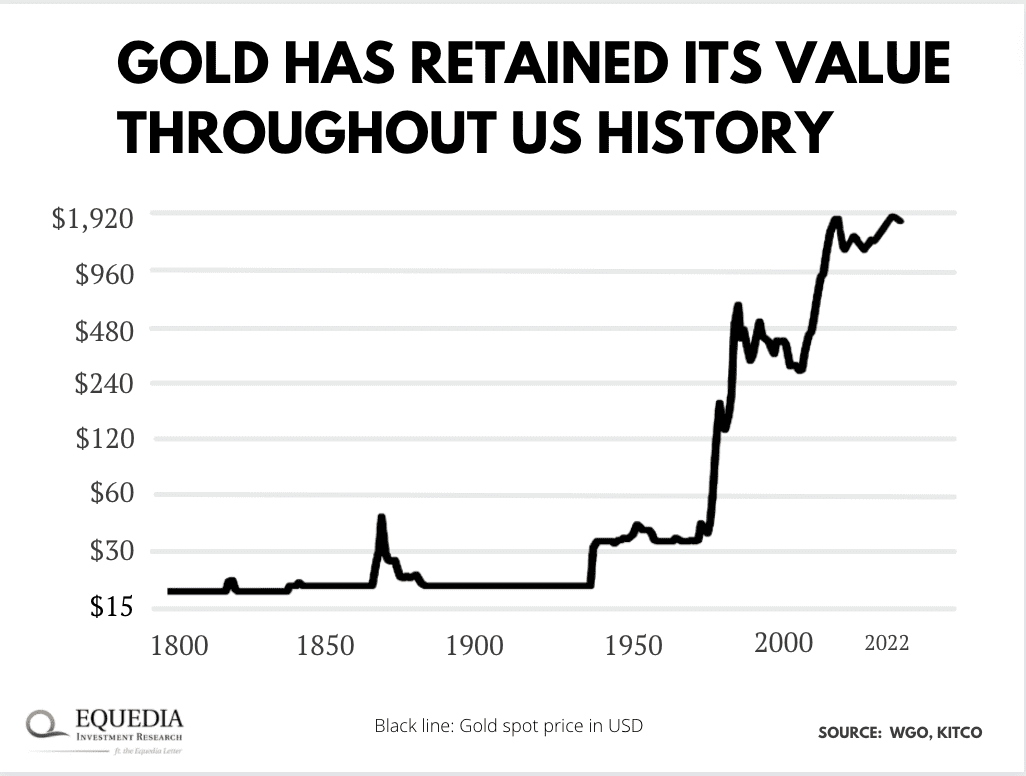

Over the past 3,000 years, gold has proven itself as the most reliable store of value and investment. For proof, look at the price of gold since the creation of America.

Since going off the gold standard in 1933 and ending full convertibility in 1971, the gold price has been in a long-term uptrend. But it’s not just about the past couple hundred years.

Consider how gold’s purchasing power has lasted throughout the centuries…

- In the Roman Empire times, an ounce of gold would buy a Roman his toga (suit), a leather belt, and a pair of sandals. Today, one ounce will still buy a good suit, a leather belt, and a pair of shoes.

- In 400 BC, during the reign of King Nebuchadnezzar, some scholars reported that an ounce of gold bought 350 loaves of bread. Today, an ounce still buys about 350 9-grain loaves at Whole Foods ($1,800 divided by 350 = $5.14/loaf).

- In 1979, gold averaged $306.68 per ounce. This bought an average-priced full-size bed. Forty-three years later, $1,800 will still buy you a posh queen-size bed.

Here’s something you may not be aware of: fiat currencies are a relatively new invention. And none have lasted! Unlike gold, they’ve all eventually failed.

On top of that, gold is the most reliable insurance against today’s overpriced markets because it’s negatively correlated to stocks. That means when stocks take a dip, gold often jumps up, offsetting losses in stocks.

See how gold performed during the recent market rout?

When nearly every asset class went into freefall… when the beloved Nasdaq shed 15% of its value… when many major cryptos tumbled in half… gold didn’t even flinch. It grew in value.

In other words, you don’t have to be a doom-and-gloomer or a conspiracy theorist to own gold. Many gold critics, including government officials, hold it, if only for diversification.

Turbocharge Your Returns in the Next Gold Supercycle

And this macro backdrop doesn’t just make gold good insurance for your nest egg.

When reality dawns, there’s a good chance the yellow metal is bound for a triple-digit supercycle. If you think that’s too farfetched, just Google the 1970s inflation outbreak when gold moonshot more than 10x.

In fact, renowned fund managers, including Dan Oliver, predict that eroding fiat currencies can send gold to $10,000 in the near term. (Watch Kitco’s interview with Oliver here.)

Meanwhile, Jim Sinclair, Chair of the Advisory Board for the Singapore Gold Exchange, goes even further. After accurately predicting gold at $1,800 when it was just under $400, he recently issued a mind-boggling $50,000 call.

If you are a long-time Equedia reader, you know very well how we juiced the best returns during similar setups many times over the last decade. We upped the ante by loading up on up-and-coming gold miners.

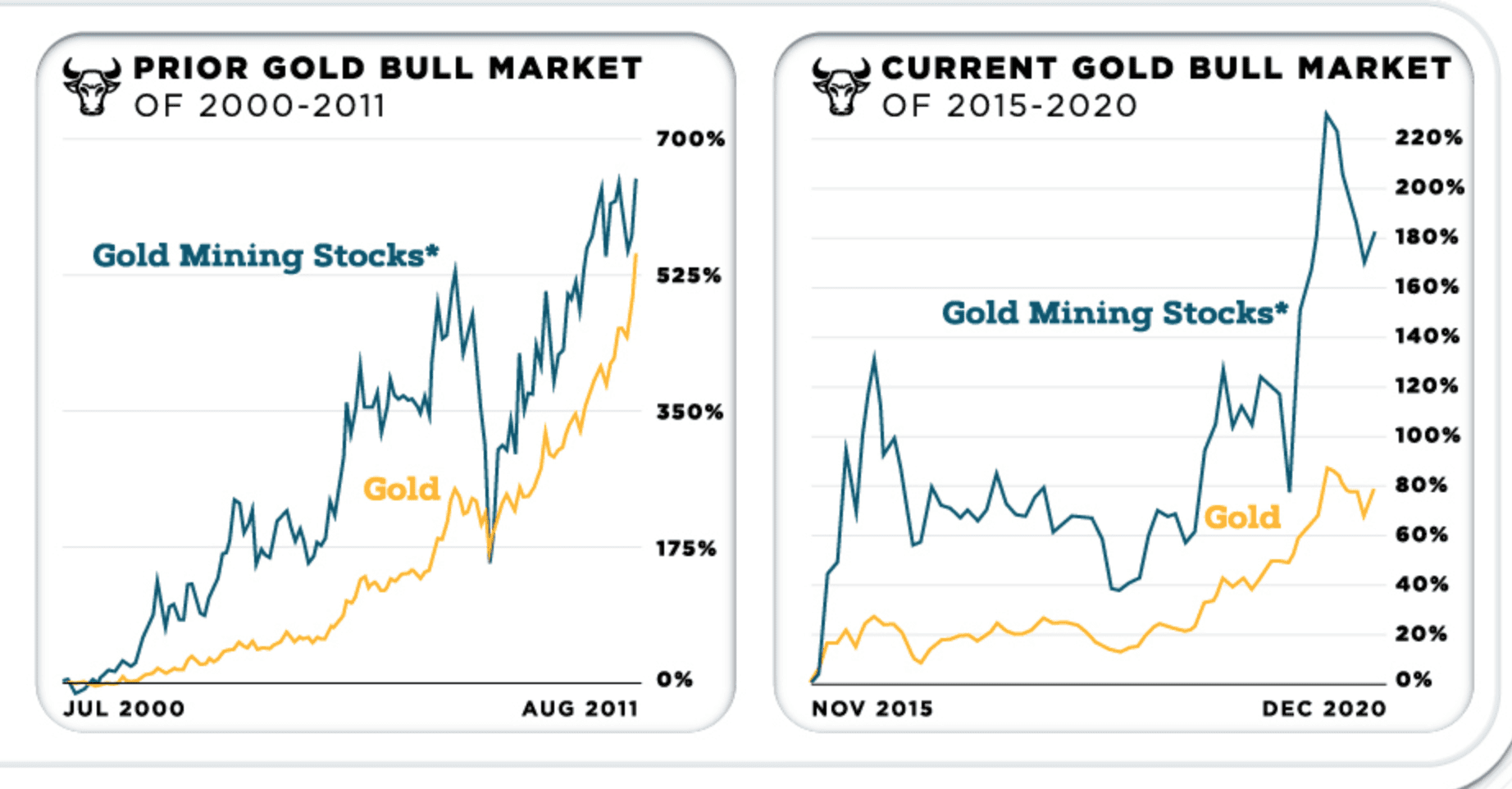

Although these stocks are closely correlated to the gold spot price, they have a much higher beta. It simply means they are more reactive than gold prices. When the gold price goes up, these stocks go up even more.

That’s because miners are leveraged to gold prices. And when gold zips higher, operational leverage kicks in, amplifying their profits as well as the value of their mining projects. And vice versa (so yes, there’s a risk).

I’m not cherry-picking.

As you can see below, gold stocks on average have outperformed gold by a triple-digit margin in the two most recent bull markets:

And data from institutional investor Vaneck shows the younger the miner, the bigger the margin.

In other words, if well picked, gold miners don’t just protect the purchasing power of your dollar during inflation breakouts. They can also hand you a triple-digit return in the span of a few years.

That’s the reason Buffet bought Barrick Gold instead of simply snapping the physical metal during Covid. And that’s the reason we recommended Calibre Mining ahead of the last gold rally that began in 2019.

Just take a look at how Calibre Mining took off when gold inched higher in 2019:

And today… drum roll please… I’m excited to introduce a stock that ticks a lot of boxes to become a winner in this coming gold run-up.

NevGold: New Kid on the Canadian Mining Block

(TSX-V: NAU) (OTC: NAUFF) (FRANKFURT: 5E50)

NevGold is a budding Canadian gold miner with rare upside potential. It was listed just this past June and has successfully raised C$6.5 million. The company owns 100% of three mining projects in two of the world’s most lucrative mining jurisdictions.

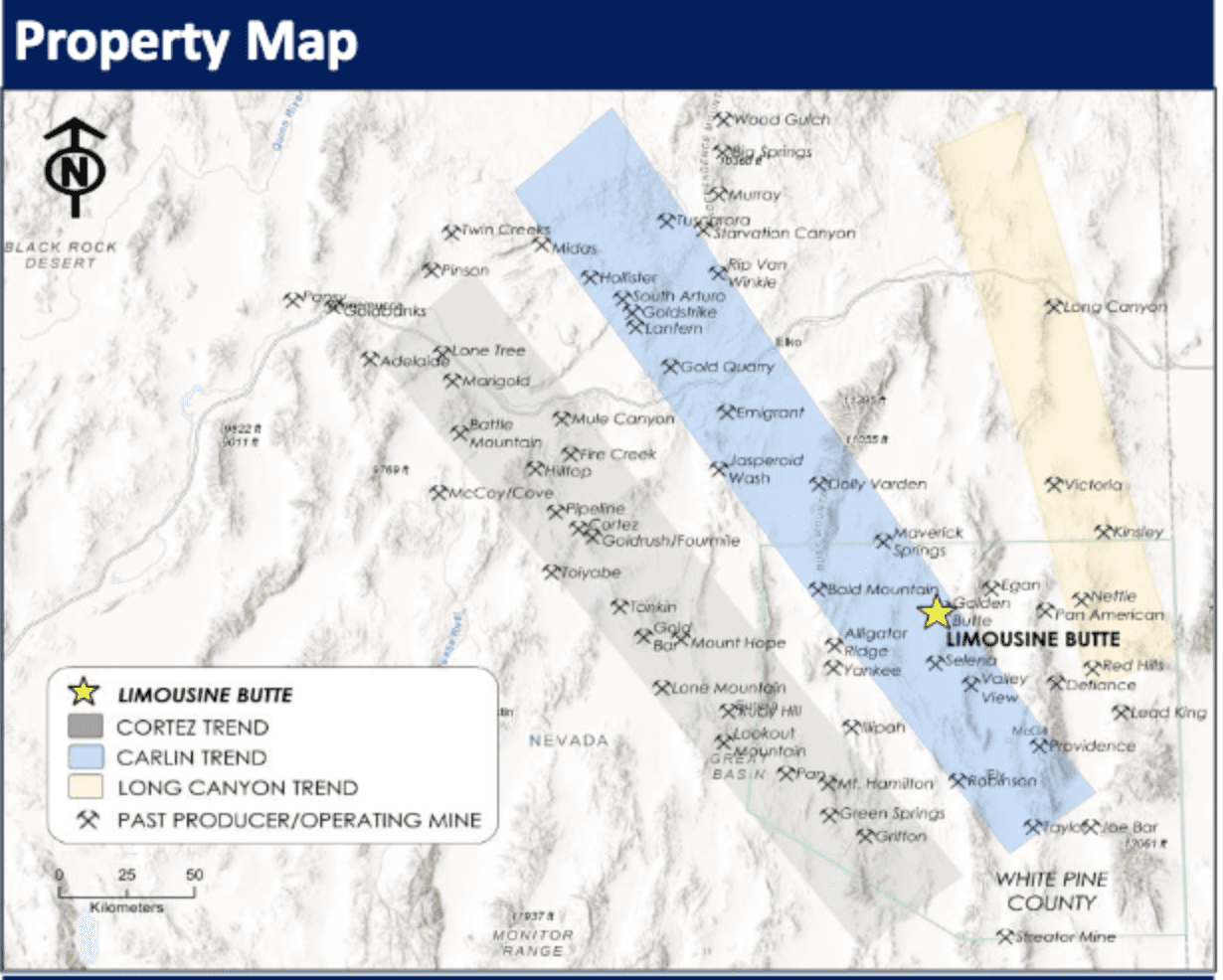

Last year, NevGold bought out two promising land packages in under-explored areas of Nevada, the mecca of mining: Limousine Buttle (Limo) and Cedar Wash (Cedar).

The two projects are open-pit mining operations targeting near-surface oxide gold resources. In simplest terms, they are mining an ore containing gold resources, which they later leach away using chemical compounds like cyanide – a very straightforward, low-cost method.

Limousine Butte is a gold exploration project (6,650 ha or 66.5 km2) that sits approximately 65 miles (104km) to the northeast of Ely, Nevada. The project was a past producer with the Golden Butte mine, which hit it big and yielded approximately 100,000 oz of gold in 1989-1990.

Part of the company’s drill program is focused immediately adjacent to the past-producing Golden Butte pit, which increases the probability of success.

The previous owners of Limo conducted an extensive shallow exploration program into the deposit. They pricked over 900+ holes and drilled through 120,000 m of the soil. NevGold estimated it would cost $50 million to replicate such a drilling program—which gives the miner a good head start and a great opportunity as the historical drilling only “scratched the surface” of what could be there.

The Limo asset has an estimated gold resource of close to 300,000 ounces. While today that is on the smaller side, it could be a rather conservative estimate, and it is a great base for the company to work from. Most projects do not even have a resource to start from, which means a lot more development time and money, meaning NevGold has a head start.

From its past exploration, its geology is akin to a nearby mine called Bald Mountain, which is owned by Kinross and produces approximately 200,000 oz. of gold per year. Bald Mountain has been producing since the 1980s and still has over 5.4 million ounces of gold resources.

Meanwhile, Cedar is an earlier-stage mine (4,450 ha, or 39 km2) and one of Nevada’s latest gold discoveries. It is located 75 kilometers off Pioche, in the Clover Mountains—the part of Nevada that few miners have sunk their drills in.

Before 2015, the Clover Mountains, mainly composed of Claron formation rocks, were thought to have no gold. That changed after seeing many geological similarities to the Goldstrike Project in Utah, which has a resource of 1.2 million ounces of gold.

After the discovery, McEwen began its exploratory drilling program at Cedar. And by 2017, as expected, the drilling program found a number of promising gold targets that contain high-grade gold mineralization.

That said, the evidence of gold in the Clover Mountain is limited to a few pits. On the flip side, there’s a good chance NevGold is sitting on a pot of gold in one of the most underexplored mining areas of Nevada.

So, it’s high risk, high return.

The Path to a Multi-Million-Ounce Upside

Let’s talk about the economics of these assets.

NevGold snapped the Limousine Butte and Cedar wash assets for just C$600,000, which comes to less than $7/ounce. This is a hell of a bargain because the average industry acquisition cost is close to $100/ounce.

Keep in mind this calculation is based on the conservative historical resource estimate, which gives NevGold even more room for upside.

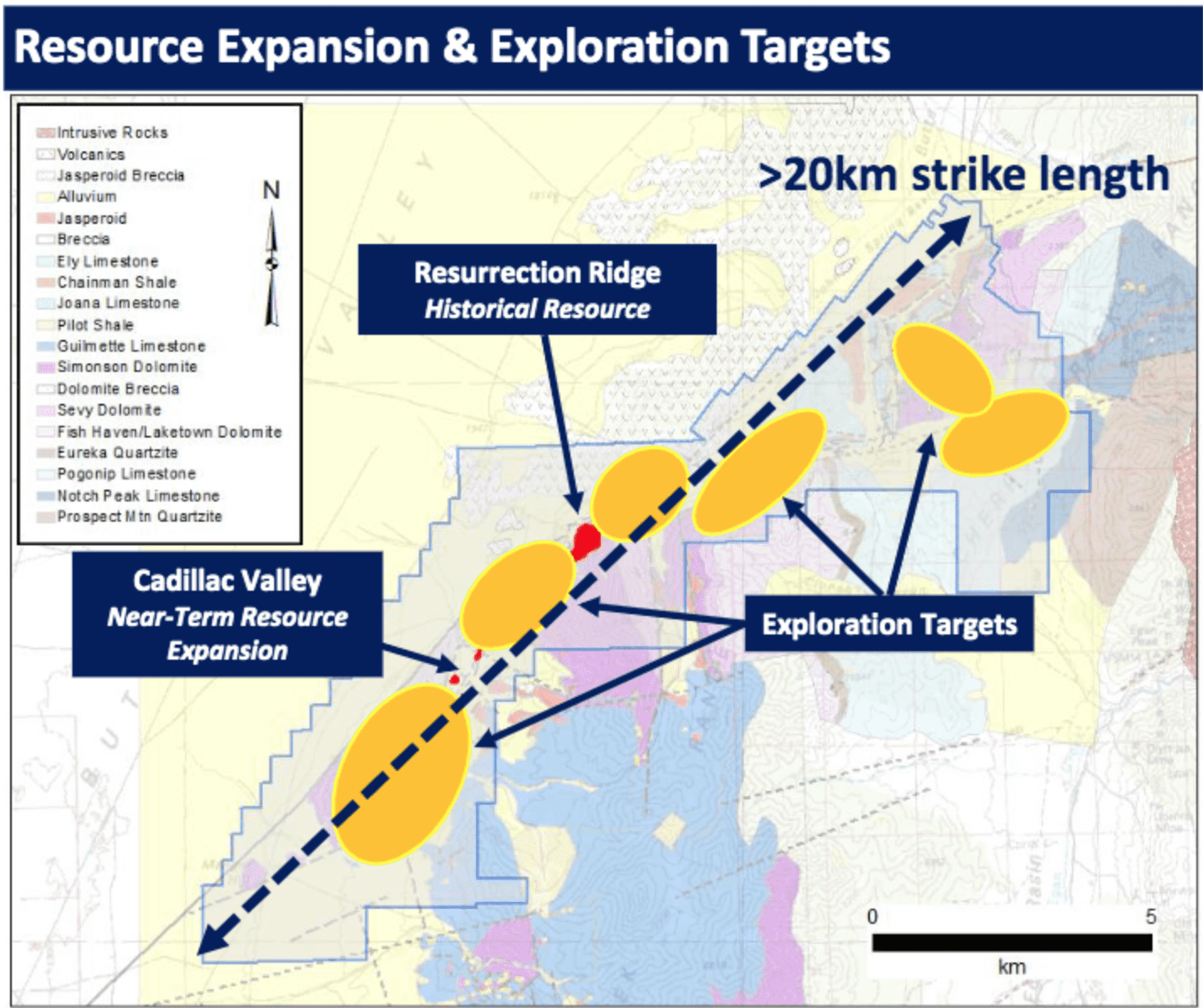

For example, at Limo, NevGold expects to grow its resource base to a million ounces as soon as this year. It’s a doable target given the historical exploration showed an extra 500,000 oz at the Cadillac Valley area alone.

That’s a 3x resource upside within a year.

On top of that, the company owns a promising land package called Ptarmigan in British Columbia. The property spans 9,900 ha (or 93 km2) and is located in the Purcell Mountains. It’s a high-grade polymetallic asset that has a long track record of yielding silver, copper, and gold with historical grades of +2,000 g/t silver, +37 g/t gold, and +1% copper.

NevGold has not worked on this asset to date, so it is not yet baked into the stock price. But they are planning to advance it this year, which will be another value generator for the company. Bonanza grade projects with historical high-grade production are hard to find, especially in marquee jurisdictions like British Columbia – but they most certainly exist in many parts of the province.

These assets all have the potential to grow into a multi-million-ounce project in the long run.

This offers fantastic resource and exploration upside potential for a $20 million market cap company. If they pull that off, their stock valuation could be bound for a 10X upside or even more. (More on that in later sections.)

Another important thing: the drilling projects are fully funded for two years ahead. After listing, NevGold successfully raised over C$6 million and now has C$4 million on its balance sheet.

For a junior mine, that’s a big cash cushion. It’s also enough of a runaway to wrap up its current drilling programs without gasping for extra funding and diluting its investors with share issuances.

Many Upward Price Catalysts This Year

The economic shambles aren’t the only reason this trade is so timely. This quarter, the miner is also going to report on its first exploration program into its most promising Limo deposit.

The first results could come out at any time.

Last October, the company kicked off a 10,000 m drilling program to assess the mineral extents and grade of the deposit at Limo. The first ore samples have been sent to an assay lab for evaluation.

NevGold will report Limo’s assay results very soon, which will likely surprise on the upside. Their CEO told me its geologists expect to report an interim resource update, with the potential for over a million ounces of gold within the next year.

(Remember, its resource is currently at approximately 300,000 ounces. This interim update could possibly deliver a 3x upside as soon as this year.)

After that, the company will ramp up its drilling program at Limo and add more rigs to the property.

– End Update –

In other words, this is the perfect time for this up-and-coming miner before its drill results are baked into its stock price, which can happen as soon as tomorrow.

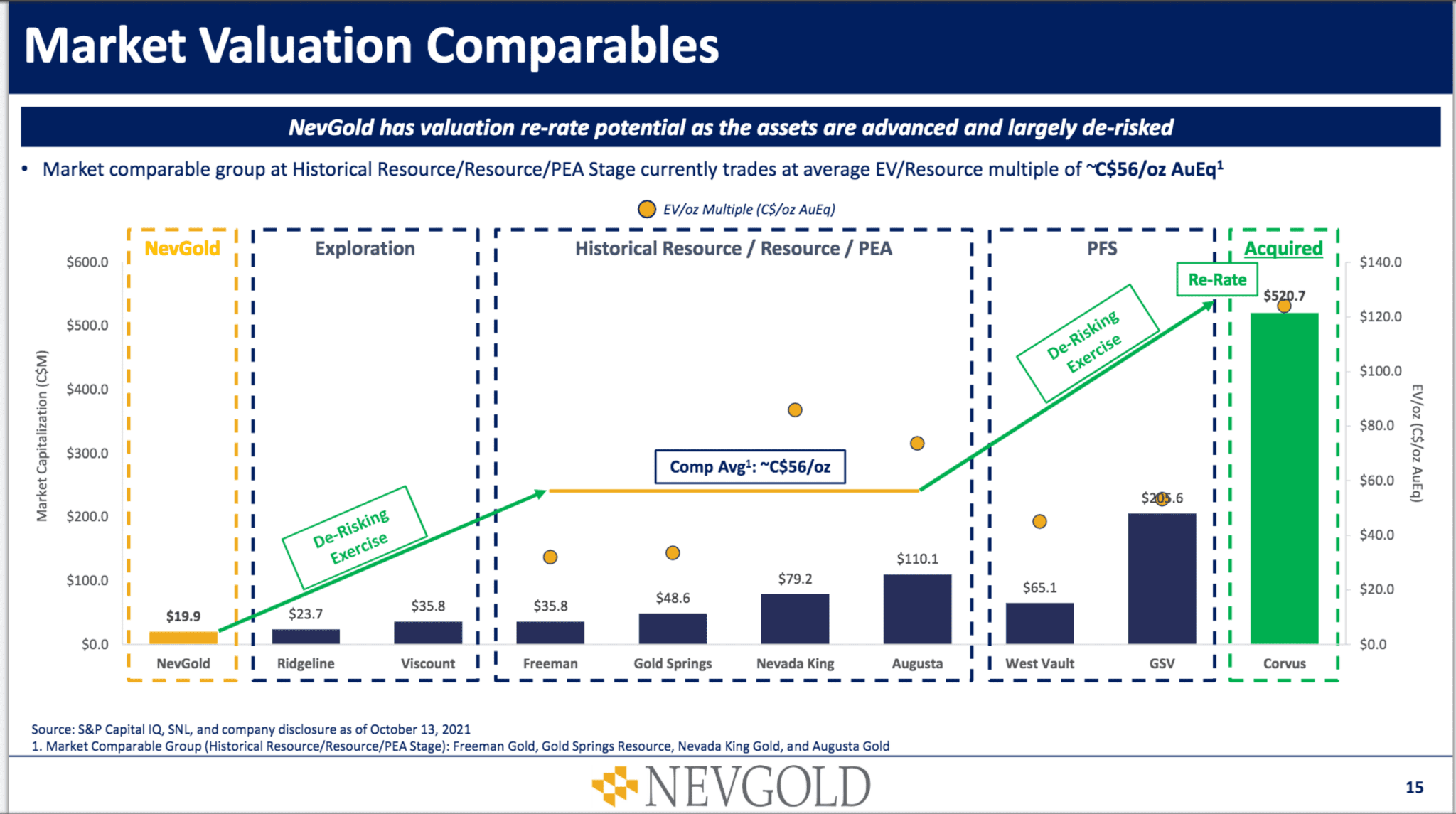

NevGold is Going on a Valuation Re-rate Spree

For those who are new to junior miners, let me give you a quick 101 on how the market values these stocks.

If you had to put a fair price tag on an average S&P 500 company, you’d probably use an earnings multiple, such as P/E or EV/EBITDA. These metrics weigh the company’s earnings against its stock price, which is useful for the likes of P&G or Coca-Cola.

In the world of junior miners, things are different.

The mines aren’t that far along in development to project cash flows or earnings. Besides, gold is a commodity that institutions often buy by the truckload. That means, unlike consumer goods, this metal is almost always in demand.

So, at this stage, the miner’s valuation is not so much about how much money it’s raking in as it is about how much gold they are potentially sitting on.

For those reasons, investors often use a metric called EV/oz to value junior miners. The metric takes the enterprise value of the company and divides it by the total resources of gold in the ground.

NevGold is trading at an approximate C$20 million market cap today. Peer companies with gold resources in Nevada trade at C$69/oz in the ground.

If NevGold drives to the 1 million ounce mark, that should drive the company to a valuation close to C$70 million, which is more than 3.5x where it is trading today.

NevGold is selling for cheap because it currently has a relatively small resource, and its properties, although very promising, aren’t producing gold yet. They are still in the exploration and drilling phase, which means there’s a lot of risk and uncertainty involved.

The risks of an early-stage mining operation are what’s holding the lid on the company’s valuation. But that lid could start coming off as soon as they begin releasing drill results.

And over the next few months, the assay results will shed more light on the economics of its Limo project.

Plus, we are likely to see Limo’s resources grow a few times.

Suppose the company pulls off a million-ounce target as it expects, and its EV/oz multiple trades with its peers, the stock could easily triple from today’s levels on those catalysts alone.

And that’s just the Limo operation. This year, the company will kick off exploration on its Cedar and Ptarmigan deposits, which will imminently add to the miner’s resources.

There’s also the prospect of a buyout.

If you’ve been following our mining stocks recommendation for a while, you know that happens very often with junior miners – at least the right ones, anyway.

For the most recent example, Calibre Mining recently bought out Fiore Gold for C$160M. Fiore had one producing mine in Nevada called Pan, and two exploration projects in Nevada and Washington. The flagship Pan Mine produces approximately 45,000 oz per year and has a total resource of only 450,000 oz. (less than half of what NevGold is shooting for this year.)

Let’s do some quick back-of-the-envelope math.

If NevGold hit its million-ounce target (which is a conservative target considering all the exploration potential and properties it owns) and was bought out at the same multiple as Fiore Gold…

…the company could hand investors 1,600% gains. That’s assuming gold prices won’t budge higher, which is also unlikely. And as long-time Equedia readers know, such gains are not that much of a stretch when you bet on early-stage miners at the right time.

Of course, Fiore is a producing gold miner, so we can remove some percentages there. But you get the point.

The Management Trait Every Mining Moonshot Shares

From my years of experience in trading mining stocks, I can tell you there’s one thing that all successful mining moonshots have in common. It’s management that can do two things and do them very well:

- run mining operations

- and raise money.

NevGold’s management knows way more than just how to dig the soil. They also have a knack for capital markets, thus attracting investors and efficiently financing their operations.

It’s rare management make-up that can send the junior miner to the moon like Calibre Mining and Newmarket Gold (which got bought out for over $1 billion).

Take a look at the key people running the show at NevGold.

Brandon Bonifacio, CEO

Brandon is a mining engineer and finance professional with over a decade of experience, specifically focused on mergers & acquisitions and project evaluations. He has a knack for finding good deals and undervalued projects, which gets back to the very low acquisition cost (less than 7/oz) they paid for the projects in Nevada.

Before founding NevGold, he worked for GoldCorp—a multi-billion dollar gold producer that merged with Colorado-based Newmont Mining into the largest gold company in the world (~$29 billion market cap).

Board of Directors

NevGold’s Board, including Chairman Giulio Bonifacio, who has been leading mining operations for 30+ years and raised over $700 million through equity and debt financings, is the right group of individuals to support the company as they advance.

Many of them have had direct mining experience in Nevada, and they understand the roadmap. There is a reason this company has been able to hit the ground running.

What makes NevGold’s team particularly impressive is that management has a lot of skin in the game. The management holds over 50% of the company’s shares. That’s way above the industry average, where insiders typically have around 25% of equity.

This capital structure is a strong assurance that the interests of shareholders and managers are aligned. Most important, it’s a testimony to how confident they are about what they can do.

High Risk, High Return

Before I sign off, I’d like to stress that this is a very early-stage company.

These junior explorers are by no means a substitute for gold, which serves as a store of value and insurance for your portfolio. And I do not recommend swapping out your entire gold portfolio for companies like NevGold.

That said, NevGold could be great leverage to cash in the potential coming gold run-up. After all, when fiat erodes at high double digits, it doesn’t hurt to own a slice of a budding gold explorer that’s digging up the world’s most valuable currency.

But again, it’s a high-risk, high-return kind of investment. So, make your own risk assessment before placing your bets.

NevGold Corp.

Canadian Trading Symbol: NAU

US Trading Symbol: NAUFF

German Trading Symbols, FRA or DEU: 5E50

– This is a sponsored post –

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards NevGold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.