Fully Discounted and Orphaned Copper Deals Worth a Look for Patient Long Players?

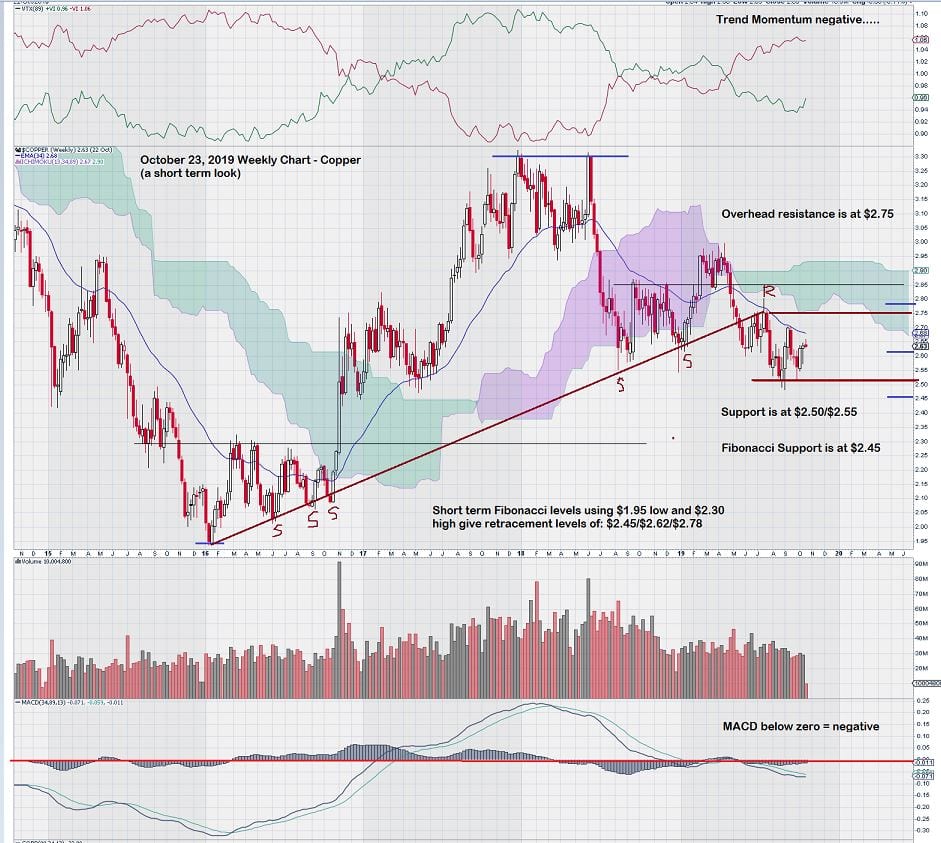

Here’s a look at the copper chart analysis for October. The simple fact is that copper has negative trend momentum and a negative MACD reading on weekly charts with trend settings; this needs to improve before price gains can be achieved. In the meantime, the market is imposing severe discounts to copper projects held by juniors that have no way to advance them except through unacceptable dilution due to very, very low share prices.

Private equity groups are in the process of evaluating these deals.