Dear Readers,

If this one event happens, the world could be in for a very disastrous and disturbing surprise.

In this Letter, I’ll tell you what that event is and what to do if it should happen.

Is This a Joke?

You can’t read or watch the news without hearing about Donald Trump.

The mere mention of his name and most people think, “Is this a joke?”

I promise it isn’t. In fact, Trump’s rise to the top of American politics will forever change the system.

I am not yet saying he will become President. But I do believe, as I have from the beginning, that he has a strong chance.

The first question is:

Why?

Then come the questions:

What will happen if he becomes President?

How should we invest?

What should we do with our financial assets?

Let’s start by answering the first, since it represents the truth about America’s stability.

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

Trump’s Rise to the Top

When I first spoke of Trump’s potential success last year, people thought I was crazy. They thought Trump’s ambition of becoming President was merely a sideshow for a struggling country with numerous homegrown issues.

And at first, it was.

It gave the media something to talk about. It gave the people a distraction.

But as Trump continued his rally and gained the further support of the American people, things changed.

Trump is not only a real contender but is now at the top of the polls.

You may ask, “Why are people so stupid as to vote for Trump?”

“He has no political background.”

“What does he know about running a government?”

“Have you heard the things he has said?

But none of the above matter anymore.

You see, voters aren’t simply voting for Trump; no, they are voting to fight back against the regime of corrupt politicians, greedy bankers, and manipulative oligarchs, who together represent the Establishment.

Just as Canadians voted for change when we elected Justin Trudeau as our Prime Minister, the American populace is leaning towards Trump because they too want change.

In fact, I find it quite odd how many of us Canadians laugh at America’s support for Trump.

We elected Justin Trudeau – a man without any history of hardship, leadership, or political background. I am not saying Trump is a better leader, but from the perspective of accomplishments, he has Trudeau beat.

Yet, here we are laughing at American politics.

Instead, what we should really be doing is looking at why Americans are supporting Trump.

What do you think of Trump vs. Trudeau?

Who has accomplished more?

Let us know what you think by CLICKING HERE

Fighting Back

For years, I have written about how big banks gained control of society via our financial markets and the manipulation that go on within.

I have been able to use that information and turn it into something positive by making investments based on the fundamentals of what I believe is really happening, as opposed to what the media tells us is happening.

But the majority of Americans haven’t been able to do the same.

The majority of Americans have been sitting on the sidelines, struggling to pay the bills while watching the following headlines splash across the news:

Corporate profits soar to new highs

Stock market soars to new highs

Number of millionaires in the US soar to new highs

The media hasn’t exaggerated those statements; those are all true.

The stock market is at an all-time high and corporations are raking in the profits. And there certainly are more millionaires in the U.S. than ever before.

But guess what? There are even more people without jobs and homes – many more.

Those without jobs and those barely making ends meet, are watching the news and seeing how great things are supposed to be.

And they’ve had enough.

They’re tired of the lies the media has been spilling about the economy. They’re tired of the years of deceit.

That is why they are voting Trump.

Trump, despite some of his controversial views, represents anti-establishment.

We generally have this idea of Republicans being all for profit and capitalism that they forget the little guys. Billionaire Trump most certainly fits this character.

But people are starting to realize that Democrats are no better. In fact, since 2008, they have raised and spent more money than the Republicans by hundreds of millions.

If you take a look at the amount of money from funds, corporations, and celebrities that have gone to support Democratic campaigns, you would see that the numbers are quite high.

For example, billionaire George Soros – who is shrouded by evil conspiracies – has already given Hillary Clinton and other Democrats this election cycle more than $13 million.

In the last mid-term elections, Liberal hedge-fund billionaire Tom Steyer poured nearly $74 million to support the Democrats.

These are the same fund managers that are the target of anti-establishment voters. And as we all know, in the world of finance, no one pours that much money without expecting a return.

Perhaps that’s why, despite less campaign spending, Trump is killing it.

The Strongest Campaign in History

Trump has capitalized on the years of anger and disillusionment of the voters to propel one of the most powerful political campaigns we have ever seen.

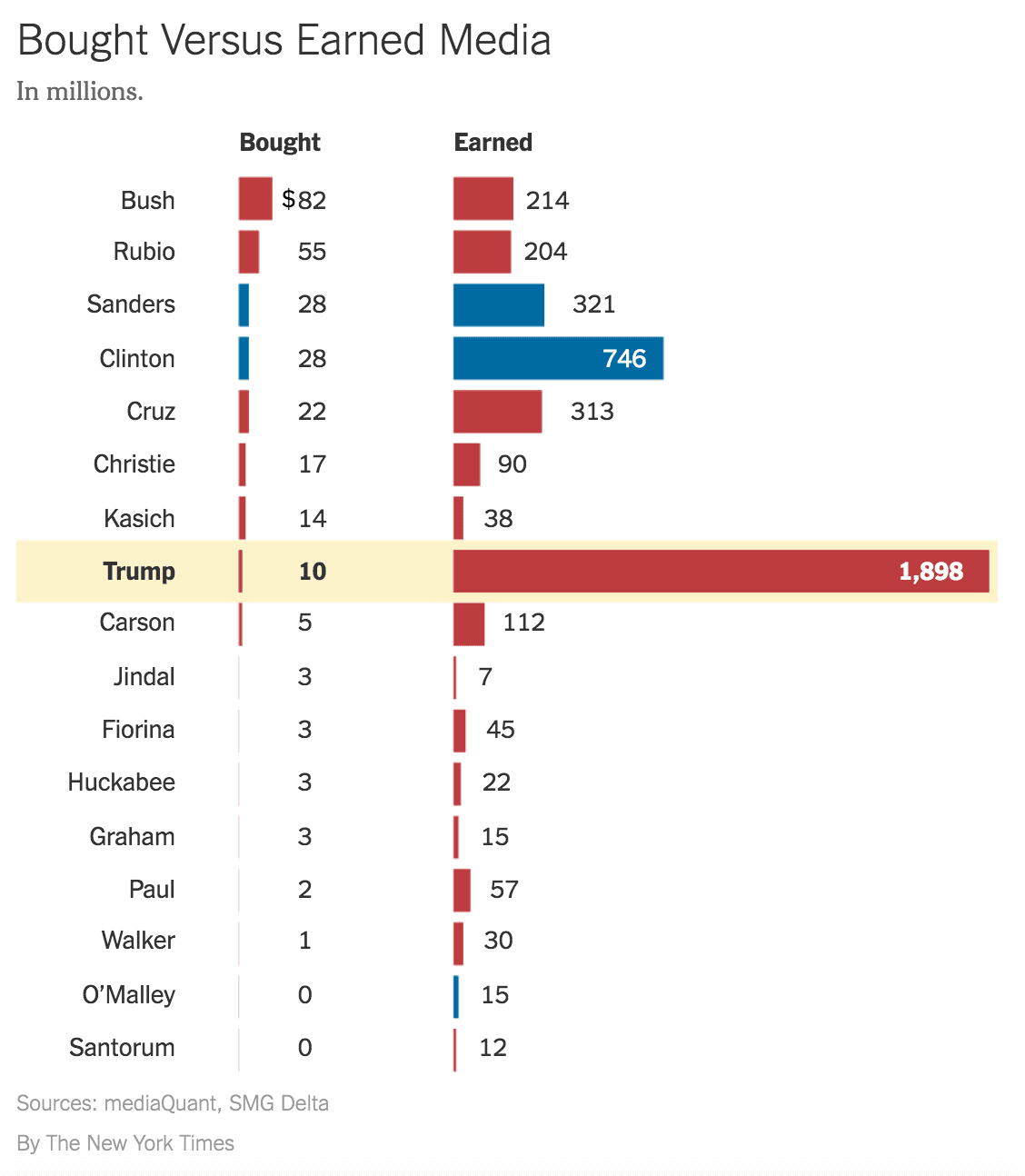

According to mediaQuant, and via New York Times, Trump has managed to achieve close to $2 billion worth of media attention since he began his campaign. That’s about twice the all-in price of the most expensive presidential campaigns in history. It’s also more than twice the estimated $746 million that Hillary Clinton, the next best at earning media, took in.

In February alone, Trump earned as much media as Ted Cruz and Hilary Clinton combined.

You may be thinking, “That’s because he has so much money, and so many rich friends to pay for his campaign.”

Well, actually, that couldn’t be further from the truth.

Take a look at this:

The above chart represents the amount of bought and earned media by the candidates in the 2016 election.

Trump has not only spent significantly less on media than his adversaries, but he has also gained significantly more than any of them – by a wide margin.

So much so that this week, Trump beat Rubio in his home State of Florida; thus, giving him the support of a majority of Republican primary voters nationwide.

What do you think of Trump’s media triumphs?

CLICK HERE to Share Your Thoughts

Trump’s momentum continues and anti-Trump Republicans are now preparing with all their might to stop his train.

But can they?

Every day, more Americans turn up to support Trump.

Americans are supporting Trump because he has been telling the truth when no one else will:

America’s economy is NOT what it appears to be.

Americans – the ones who are sitting at home watching the rich get richer while they get poorer – want the truth exposed. And they are voting for Trump because he is exposing the truth about the American economy.

Hence Trump’s slogan, “Make America Great Again.”

But if Trump is indeed the anti-establishment leader he is making himself out to be, and continues to gain support, what then?

The Attack on the Establishment

For all we know, Trump, the master of the deal, may have already struck a deal with the bankers and politicians.

But as we know right now, Trump is anti-establishment and anti-globalization.

If Trump is elected under that presumption, we’re going to see the building blocks of the Establishment and globalization come under attack, and they won’t like it.

They will fight back, leading to major conflicts including riots, protests, and potentially even war and assassination attempts. It is quite possible that the Establishment might even be allowing Trump to succeed in order to cause chaos to show the people that the Establishment is a necessity once all hell breaks loose.

What I write may be difficult to grasp at first, but as time passes, the light will shine. Just keep in mind that throughout American history, whenever the Establishment has been challenged, it has always been followed by bear markets and economic contractions.

What do you think will happen if Trump is elected as President?

CLICK HERE to Share Your Thoughts

Market Outlook

For now, things remain bubbly, and the market continues to be propped up by Fed-induced euphoria and corporate share buybacks.

This week, the Fed left rates unchanged, just as I said they would over a month ago in a past Letter:

“…Those who believe the Fed will raise rates in March should think again. Unless the Fed and the banks are directly planning to steal assets through defaults, a rate hike in March is highly unlikely.”

If you have been reading my Letters over the past years, front-running the Fed has been a great trading strategy almost every time.

On Feb 11, just a few days after I said the Fed would leave rates unchanged, the S&P 500 closed at 1829 on fears that the Fed may raise rates since the “numbers” were looking good.

Today, the S&P 500 sits at 2049 – that’s a profit of more than 12% from a major index in less than a month.

Now do you see why hedge fund managers and the like have poured so much money into Democratic campaigns?

Corporate Buybacks

Over the last few years, I talked about how corporate share buybacks have continued to grow at record pace and how much of the buybacks have been purchased with borrowed money from – you guessed it – banks.

Via How the Fed Influences the Stock Market:

“…Share buybacks continue at record pace, and I expect billions of dollars in transactions over the next few months alone.

But there’s even more to this story than what the face value suggests.

While the headlines tell us of record cash holdings at corporations (giving the illusion sales are great), what they don’t tell us is that US corporate cash holdings are at the lowest level relative to corporate debt.

…companies aren’t borrowing money to hire new workers; they’re borrowing record amounts of money just to give away to shareholders.”

And Via The Great US Debt Rotation:

“The companies in the S&P 500 are poised to spend more than $1 trillion on buybacks and dividends in 2015, shattering the record set last year, according to a new report.

Corporate buybacks have been surging since the financial crisis, with S&P 500 companies spending nearly $2.3 trillion on them since 2009, according to a new report from Aranca Investment Research. Last year’s $553 billion in repurchases fell just short of the peak reached in 2007 while the $904 billion spent on buybacks and dividends combined set a new record, Aranca said.”

And just as I predicted, these buybacks haven’t stopped.

Via Bloomberg this week:

“Demand for U.S. shares among companies and individuals is diverging at a rate that may be without precedent, another sign of how crucial buybacks are in propping up the bull market as it enters its eighth year.

… Assuming Bank of America maintains a roughly 8 percent share in the total buyback pool since 2009 and the pace of transactions last through the end of March, corporate repurchases may reach $165 billion this quarter, data compiled by Bloomberg show. That would bring the 12-month total above $590 billion, an amount that’s higher than the record $589 billion in 2007.”

And more from WSJ:

“U.S. companies authorized $158 billion of new stock buyback programs in January and February, according to Birinyi Associates Inc. While there is no guarantee the rest of 2016 will maintain such a pace, it marked the best start to a year since the research firm started tracking this data in 1984.”

As investors pull money out of the market, corporations are using their own cash to buy back shares in order to prop up the value of their companies – instead of using that money to invest in infrastructure and, of course, hiring more workers.

With the Fed once again showing the true colours of the economy by leaving rates unchanged, the demand for safe-haven investing is coming back.

Gold and Silver

Last year in July, I wrote in a report:

“Commodities, resources, and precious metals have continued their slide, crippling the majority of the Canadian market.

That’s why over the past year, I have told my readers to stay away from the Canadian market while looking to the US market that was, and still is, hot.

This week was one of the worst weeks for gold, as a bear raid forced its price down to the lowest level in five years. It sent the benchmark Philadelphia Stock Exchange Gold and Silver Index of the largest producers to its lowest since 2001.

But shortly after the last time we witnessed panic selling like this, the leading gold-stock index more than quadrupled in value, and many of the smaller gold miners with strong fundamentals climbed even higher.

Gold stocks are now trading at fundamentally ridiculous price levels today and have never been cheaper relative to the gold price itself. This is an anomaly that simply isn’t sustainable.

Which is why I believe that gold’s actions this week may have just set us up for an incredible opportunity. It couldn’t have been timed better.”

The Company I mentioned in the report was New Market Gold (TSX: NMI), which at the time was trading at CDN$0.82.

Today, the Company’s shares are trading at CDN$2.31, an increase of over 181%.

During that same time, the Market Vectors Gold Miners ETF, GDX, was trading at US$13.57 on July 27, 2015.

Today, the GDX sits at US$20.61, a gain of over 50%.

As the risk-on mentality begins to lose support, it transfers over to the support for gold and silver stocks.

In fact, silver may also be looking to break out.

Via Bloomberg:

“Investors own the most silver in exchange-traded products in seven months, boosting holdings from a three-year low.”

Could these investors be preparing for a big silver run?

Perhaps.

Last week, China became an official participant in setting prices for one of the world’s most important precious metals markets: London Bullion Market silver price.

Via USA Today:

“…one of China’s largest banks just became a member of an elite group of players that controls fluctuations in this key metal.

CME Group, which runs the process for price setting of silver in London, said Sunday that China Construction Bank will officially join as a member of the silver price process. Putting it alongside existing participants HSBC, JPMorgan Chase, The Bank of Nova Scotia, Toronto Dominion Bank, and UBS.

These groups will now participate in price bids that go into setting the official London silver price. The first time that China will have direct influence on this process.

The expansion into China in itself is significant. And the entry of China Construction Bank into the market could also have some other important consequences for precious metals.

…Especially when it comes to currencies. With the Chinese bank having said it will support the development of renminbi-denominated futures contracts for physical delivery in London.

Such products would represent the first time that physical silver can be bought and sold here in China’s home currency. A move that could reduce the longstanding relationship between the U.S. dollar and precious metals prices.”

Silver is still trading at a low of US$15ish per ounce, but I suspect we could see this price move to the upside soon. Perhaps that’s why silver stocks have been on the rise.

The smart money is piling in, and I think the move has just begun.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure: We’re biased towards both NexOptic and Newmarket Gold because they are advertisers. We also own shares in NexOptic which were purchased both in the open market and in the private placements announced on Feb 14, 2014 and Sept 21, 2015. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including NexOptic and Newmarket Gold. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, NexOptic, Newmarket Gold and their management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Trump is using the same playbook now that he used in the 1930’s. Then promised to make Germany great again; now promises to make America great again. He scapegoated the Jews then, now Islam and immigrants. He promoted the Nordic race, blue eyes and blond hair, superior to all others. This time around he returns with blue eyes and blond hair and with the same angry followers that brought him to power and his country into destruction in the 40’s.

Want the truth for yourself, just go within in meditation and ask. Let him with the eyes to see, see.

Wow, we really have a bunch of fascist losers on this comment board. Comparing Trump to Naziism…real kool aid drinkers…or is it paid shills. Probably some punks living in their mother’s basement playing adult and yapping about something they have absolutely no knowledge of….So to all the idiots and bullies that posted their obvious retarded bias and proof of low EQ and IQ, you are probably also the 39.8% that actually voted our loser into power, Truedolt. To compare a trust fund baby that taught acting for not even two years to a self made mogul…only goes to prove how clueless you all are. Good luck to both Canada and the USA…and may Trump win and Trudeault get shot….now….that would be good politics…not for the globalist…but for the common people…that would be good politics…and that’s why Trump will win.

Yeah.. self made mogel… with a million dollar loan from daddy, has nearly countless failed business ventures, and has declared bankruptcy…4 times I do believe.. the you bitch about Trudeau trustfund, funny. Claiming to be an adult with childish name calling and insults. Keep drinking the gas station brand kool-aid. Comes in conservative blue. (Windshield cleaner incase you didn’t understand)

Hitler had a trained cohort of bullies going around trashing and killing. There is no comparison with Trump. And by the way all politicians study the devious tactics of the Hitler/Goebells propaganda machine. America led the way in this from 1920 on – albeit from the insights of an immigrant student of Austrian psychology.

http://www.historyisaweapon.com/defcon1/bernprop.html

Those same techniques are in use today to confuse the public and make them compliant to political and corporate aims. The establishment has more money and more to lose than Trump. Now their evasive schemes are exposed by their actions, whether that is just pure greed or complete arrogant disregard for the American public.

The week spot is the digital currency controlled by a small elite that disregards balanced budget and just creates more and more debt based assets that support suppression and military adventurism and killing foreigners and treasure hunting at the publics expense.

All that digital wealth that flows back to the super rich is just that – digits. Those digits exist only because the public is compliant and accepts the smoke and mirrors.

I should add that successful states exist only because of a social contract supported by citizens. That social contract can be created by elites for their benefit but can survive only if that elite has a moral and ethical foundation and a transparent policy that flows through to everyones ultimate benefit.

We are herd animals and no one can survive a herd turning.

Amazing Hugh how Hillary has you by the testicles. You are blind and blindly following her criminal enterprise. You have no respect for individuals but like Hillary… Follow the money, forget the conscience.

Some potential issues in play here might bring forth the processes employed previously by both Nazi of Communist regimes. Separating people into groups and punishing all groups for many different things, whether rezl or trumped up, and then explaining to subject groups that they are being punished beczuse of the actions of some other group, thereby giving the target group areason to believe they were punished unfairly and someone else to blame. Slowly all target groups get punished again and again with the planned outcome being one group agInst the other until the groups be ome smaller and smaller thereby being easier to target and control.

The eventual group size for perfe t control is one, the individual. Germany did this repeatedly and rarely needed the GestPo to envorce things once they got started, natural animosity took over and no one ever challenged the government becuse they would then become a target and “stick or carrot” be omes a strong messenger with those who resisted the changes be oming the enemy of the state.

Regarding buy backs: Should I take out the equity in my house, buy gold, wait until the price skyrockets, pay back the loan and retire to another country?

Trumps party will get offshore US investors to bring their money back to the US. The US will become a tax haven. No capital gains tax, no dividend tax etc. The return of that money will stimulate their economy. Of course there are Billions if not Trillions offshore waoting for that opportunity to stimulate their economy…and it will happen.

Canadians will head south of the border.

I think Trump would make The Camp counsellor Trudeau look like he was still in kindergarten

Trudeau is a failure experiment based on the same false hope and change mantra that Obama used. Obama after bush after Clinton after bush feeding the sheep lies and bullshit.

That is how we got to Trump people are sick of being slaves and he may be the last chance.

If we extradite Trudeau and The House of Lords perhaps Trump will have sympathy on them and present them with their own island, Alcatraz.

dew

Trump is a wheeler dealer and has made a lot of money. Trudeau is a know nothing and inherited what he has. Trump could be good for his country, Trudeau will be a disaster for Canada, mark my words.

‘Canadians voted for change’? Gotta be kidding. Harper or Trudope, both in the Media Party – but the Media Party directed us to change horses as the old one was getting tired. Canukleheads have no clue.

Americans have even less clue but Trump has one supreme advantage – he knows how to declare bankruptcy! Exactly what the patient needs.

Uh-huh, all very interesting, but what was ‘the ‘one event that could destroy the world’?

I didn’t vote for the stupid ass in Ottawa or Alberta. I’m 60 years old and have seen these idiots come and go leaving a swath of destruction in their wake. Mark my words. These people, Trump included, are in this for heir own personal gain and noterity. They couldn’t care less about the needs of the Canadian or American people. They were and are caught up in the Mob Mentality right now and won’t know what hit them until the smoke clears. Again. Mark my words!

The writer appears to be a far left leaning person with an agenda.

It is not the general population that generate a country’s wealth. But rather the business minds who through their efforts generate the jobs for the working class. That allows the average citizen to up scale their lifestyles. Without the brain power of numerous employment creators you have Third world countries.

Trump is not a stupid person. America will do far better with Trump than under the present administration. He may well go down in history as a President who rallied patriotism and rescued America from the traitorous attacks which is being attempted upon it’s constitutional values.

Did you actually read what was wrote? Typical Yank

Unfortunately, even if ever you read the article, wealth is not created by business men but by those who are creative enough, inventors and other discoverers who provide the opportunity to create business.

What was written. Typical Canadian.

I think one thing Trump has right, bring all the US military and money back to the USA!! In the past 60 years they have been continuously embroiled in wars that have done little but suck money, men and energy out of their country. The war machine has profited, the medical establishment treating returning wounded have profited, but the people have been robbed. How many young men died in Korea, Vietnam, Iraq, Afghanastan and now Syria? Just think what their youth and ability would have contributed to the US. How many trillion dollars have been spent? I don’t doubt for a minute that if those dollars had been spent on domestic problems, drug addiction, crumbling infrastructure, gutting of industry, declining education and other issues, that America WOULD STILL BE GREAT. I think the UN has pressured the US to denounce isolationism in order to bankrupt the country and eventually erode the very prosperity that gave them the ability to help other countries that is now gone.

Trump will not be a lone wolf, no one could ever pull the levers of government without a lot of help, but that is the one issue that I fear will derail his efforts to do what most Americans want; break up the banks and brokers, close the many loopholes that allow people like George Soros, Jamie Diamon and the Koch Brothers to buy influence through political donations, rebuild a stock market that offers a level playing field to every investor etc. He needs to clean house, especially in Commerce, Finance, Legal and Environment Departments. If he relies on the same old Elite Cronies nothing will change. Obama had the opportunity to indict men like Diamon, they orchestrated the 2008 Recession then ran to the government for a bail out. Only a couple of years later, while pensioners lost their investments, and others lost their homes, the top guys on Wall Street were right back to collecting multi-million dollar bonuses! Occupy Wall Street was on the right track, but as usual, political influence made the cops shut it down.

I think Trump will win, I am not sure what will happen in the next 4 years but I don’t believe it will be any cataclysmic event.

Donald Trump is the only candidate I would vote for . We already voted for him in the primary in Illinois.

The US media does not understand that the more they criticize Mr.Trump the more we appreciate his contributions present and future!

Contrary to the Media characterization, I am not totally uneducated:

My C.V. reads: Lycee Condorcet in Paris, M.D. University of Chicago, tenured Professor etc.

Thank you for asking for a comment!

E. Paloyan

I just want to remind all the past commenters and readers that the Government is made up up three entities and the President of the United States has the least control unless he is backed by Congress and the House. Our future is dependent on the bi partisan numbers available in those government structures . I believe in the old adage that “a house divided will fall” We all need to concentrate on achieving a WORKING government and one of the best ways to reach that goal is to dissolve the electoral college. We don’t need it any longer, we have the technology to vote direct and give the American citizen back the majority rule to eliminate bought voting. This is supposed to be a government for the people ,BY THE PEOPLE. Let’s bring that back !

Donald Trump is at least a successful businessman who has had to meet a payroll and pay taxes.

Much better than the career leeches we call politicians.

Trudeau has no idea how to run a popcorn stand let alone a multi billion dollar government.

I think Trump is the right man to clean up the mess in the USA caused by all the bought and paid for politicians. Which genius decided to put the USA into debt another 12 trillion dollars in the last 7 years? This will only lead to disaster and I think Donald can help head it off. Donald is head and shoulders above pretty boy Trudeau.

Trump, to me, a senior, Viet Nam era vet and retired military guy, Trump represents the antidote to the quasi-seditious ideology of Obama. It’s just that simple. Plus all the things you said in your fairly balanced article. When I was born FDR was president. I have seen so many since then. I voted for Obama in the California primary in 2008 and then soon after saw the error of my ways and stopped buying into the snake oil sales program of an intolerably arrogant Obama. Now, almost 8 years later I want the next president to drive a freight train right into the belly button of WashDC and place Americans first again (within our own system) before people like Barack give everything away to globalists or worse (i.e., Iran). This is not rocket science. Not at all. Our leaders must place Americans in the top spot again, in everything they do. Obama has done the opposite ever since he snuck by the radar and fooled us all. I believe either Trump r Cruz would be right to balance the dangerous side to the left wing precipice we now find ourselves at. WE must balance the radical left wing ideology with something on the right. The more the better. It’s just that simple.

This is a bunch of nonsense. Retell this story in October. Americans may be naïve but not stupid.

This is the most powerful nation on earth. I bet most responsible republicans would rather see Hillary Clinton they don’t like as President than Donald Trump that would set American international reputation back several generations.

Are you listening to the concerns being raised from every major capital in the world?

Donald, the duck Trump represent what America is decelerating from any dignity, quality or character. A coward and bully who beat the draft, dumped multi bankruptcies and losses on others yet thinks he will be gods gift to the salvation of American political problems. An ignoramus whose hand gesticulations and repeating of words reveals his ignorance of the most fundamental historical facts and theory of world politics and history. Need we go on to outline the trump duck. WRC

All Donald Trump needs is a good PR man to filter his comments. He hasn’t let anyone die under his watch LIke Hillary (Bengazi). Some of his ideas are a little far fetched, but I’m sure his advisors will let him know, that you can’t actually do this and that like you said you wanted to do. Hillary is in the pocket of big business, has continually been ablove the law, from insider trading to a private email server, has called the American people stupid and says the government needs to run their lives and even the comment about Brazil “we need to be more like Brazil” The government wiped out the middle class with their tax structure, you are either super rich or dirt poor. Most middle class citizens went down to poor not up to rich. At least Donald can be molded into the type of President we need, where as Hillary has already decided she will be the evil queen we all dread. Anyone but Hillary, and if the only of choice is the Donald, then so be it. And I’m not alone in this line of thinking. Give me someone who I can believe in.

What is hurting ordinary working people is the financial system, banks and the stock market – to call it by its name, Capitalism. Portraying Trump as anti-capitalist is weird – he is a successful capitalist and shows no signs of wanting out. And since the author of the article starts by flaunting his own successful stock-market operations, I don’t trust him either.

I’ve heard it said that our(?) Trudeau can do a one armed push up, that has to give him some creditably .

If Trump becomes president then its’s time for all Americans to get out as he is a total nut case, a liar and a cheat, just thinks of himselt, no real family values, when his wife gets old she will be dumped like the rest, he has been bailed out so many times, caught out so many times, why are people still voting for the idiot, is beyond me, must be something to do with being a racist

I love the United States, I studied there, and worked for the State Dept for 16 years! I’ll be sad to have him as President of the United States. I don’t like what he represents but it is a question of polittical views! I’ve learned that religion,politic and ratial matters we don’t discuss them!

Why ? Because some people are just stupid.

Donald J. Trump will the next President of the United States because most Americans, and I would hope Canadians, are sick and tired of being lied to constantly by their governments at all levels, by their political representatives, by their corporate leaders, and above all, by the globalizers and international bankers. For over 30 years, I was a board-level consultant in financial communications to many of the significant banks on this planet. There was a reason I would never sign a document containing any banks’ financial reports. These unpatriotic, greedy bastards are crooks! I can recall a very few exceptions. Through there control of each central bank, but notably, The Fed, they control US, everyone of US. And Donald Trump understands that. True power has moved from Washington to Zuerich, Geneva, London, and Wall Street. Globalization my butt. This is the most private and self-serving club on Earth.

My only fear is that even Trump cannot destroy this sewer, and thereby have a chance to fix it and save us all.

You know the left is always telling us we can’t say or do something that might offend someone else’s religion, minority, race, sexual preference or gender and the list goes on, But every time I see a trump2016 some left writes how stupid you are and must be an uneducated bum! I really think the trump supporters have one thing the lefts don’t have and was not learned in their 6 years of college and its COMMON SENSE! Canada P.M. is a young kid he should have never got in and the only reason he is in was the vote from pot smokers and Canadians are talking about the American voters and Trump and how stupid they are lol roll up another joint sit back and watch as Trump wins!

What is known about him is not so far from what we knew about Romney: capitalism pushed to its extremes with bankruptcies, etc. However you are right: he may be elected as GWB was because, nowadays, ostracisms, nationalisms and extremes remain far more attractive, far more “easy” to understand, than cooperation and diversification.

After all the next few generations are far more interested in robots and robotics than in thinking human beings. Setting the dictatorship of capitalism – I mean a system promoting a few rich and powerful people driving the populace as you said – is far interesting for the empowered few and far more acceptable by a dependent but not responsible populace. This is how dictatorships are set and, of course, demagogy helps. I saw the rise of many dictatorships. From Hitler to Pinochet, from Togo to Franco and Peron: each and everyone of them had the same arguments, the very same behavior and it seems that America is searching for this type of experience since GWB.

You ask what will happen but there is a short and long answer. In the short term maybe a few weeks the share market will drop and it will be a field day for those with money to buy. After that the share market will rise and as trump gets into his stride the share market prices will start to rise and even get better than before the election. Once the share market realizes that the world just carries on as usual and Trumps promises of less tax on company’s and more money in peoples pockets will boost the spending power even if not in the first few months, certainly in six months time. After all investments are a gamble and there is a possibility of gain from sales etc. Look at what happened to the UK with Brexit.

Also Trump still has to agree with the Senate and Congress to make changes so he is controlled. But Trump makes a great General charging ahead of his troops in the battles of the economy and letting America stand up great.

A fired part time grade school teacher (told 2nd hand for being absolutely incompetent) and not trusted by the party to be alone in Quebec and Ontario or in parliament (told to me by a long time Laurier club member and former power broker in party) for fear of what he is going to say or do. Hence party keeps him on the road. Compare this to Trump who received approx. 3 million from his father as a gift/ loan, runs a business, created jobs, cause one to believe effete snobs characteurations apply to Canadians who believe we have competent leadership.

Let’s See, Trudeau is not rich, Trump is so he don’t need the money. Trudeau in it for the money, Trump isn’t.

Trudeau does not give a rats ass for the low class and low income homeless Canadians, Trump will take care of all home less and low income, low class Americans, and probably put a stop to refergee’s getting in America and taking American jobs, and he will put Americans first. Trudeau will just keep bringing refergees in at Canadians expense and feed them give them free homes and just give them jobs and welfare and throw all Canadians aside except the rich, cause he’s just like the rest of the politicians, Lining their pockets for when they either retire or get voted out. If trump was prime minister of Canada we would be a lot better off then we are with Trudeau, Trudeau is a joke just like his father was. Lets face it Trudeau makes big money bringing refergees into Canada, we see none of it.

He’s winning because the alternative is a lying sociopathc NeoCON who should be in prison…and everyone knows it. Nuff said

Learn Even more about the Fastest Wealth Builder in The World Today at http://cryptocoingiants.com