A curious change is happening in the labor market.

In the absence of strong unions and a “need to work,” today’s job hunters have become increasingly sanguine when they consider employment that suits their needs. There are more jobs than workers to fill them. So, despite the negative backdrop of COVID, one can be optimistic that the right “job” is out there.

It is most interesting to note that the needs of many workers go beyond the “bottom line.” This is a different generation than those that have preceded them. They live by the credo of “Job Must Equal Happiness.”

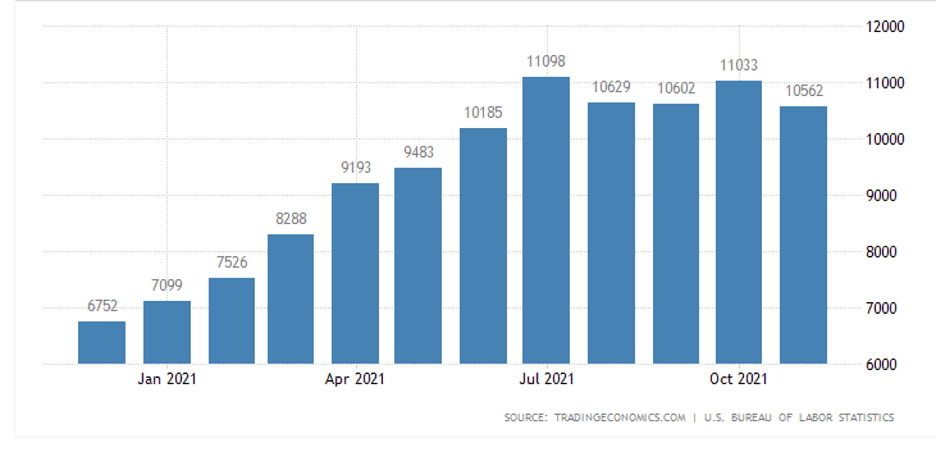

Here is a chart provided by the US Bureau of Labor that shows a rise in job openings:

There was a time in the 1980s when a bumper sticker started to appear on expensive sports cars: “He who dies with the most toys – wins.” Millennials mock this statement. Why would a person knowingly “waste their life” in a job that they don’t like, working with people they don’t get along with – all for a better car, clothes, watches, and the finer things in life.

Employers in Silicon Valley may have created a work/life environment for their “techies” that other businesses simply cannot emulate. The fruit and yogurt snack bars, exercise rooms, and open concept relaxing rooms don’t square well with factory workers that are monitored for their “bathroom breaks.”

As COVID starts to become endemic rather than pandemic, workers must be coaxed back to their former positions. An implied premise for economic growth is access to a labor pool that can fill new positions created by additional demand.

It remains an open question as to what it will take to bring the North American workforce back to work at pre-pandemic levels and beyond.

In Canada’s eastern province of New Brunswick, the minimum wage was increased by $2 per hour, the largest increase in 40 years.

Small businesses are already complaining that other inflationary pressures have squeezed margins and that a wage increase would only make matters worse.

Recently, there has been a substantial increase in the price of homes. This has made the task of hiring harder. Why?

For the few millennials who remain committed to trying to build assets via a lifetime of work, owning a home just got that much more difficult. It is a crushing blow to see your “dream home” get 20% more unaffordable.

The UK just announced the end of many COVID-related restrictions. They will be one of the first countries to “get back to work.”

Here in North America, the banking industry has had a few “false starts’ in the timing of recalling workers back to the office, but they will be among the first to get back to business as usual.

In summary, when one takes it all in and thinks about it, increasing inflationary pressure is going to be a natural outcome of COVID.

Unintended consequences are the hardest to predict. Who would have thought that “pausing” the economy for two years would result in worker shortages?

Yet, here we are. Help wanted signs are ubiquitous with the “new economy.”

Employment has become a negotiation. This was never the case in the past. If you wanted the job, you took it. Today, employees are not shy in defining what it is that they expect out of work. Inclusivity, even at very low levels, is a prime consideration. Everyone wants to be part of something, no matter how small that “something” is…

Perhaps another unintended consequence of COVID is that it afforded many people the opportunity for deep introspection. Have enough people distilled their experience of living through it to demand a “better job”?

The catchphrase for the next few years will be:

“Work/Life Balance.”

And COVID has tipped the scales toward Life.

What happens when less people work, but more is consumed?

The answer seems quite simple: higher prices.

– John Top