This Could Kill the Stock Market: The 10 Year Treasury

Dear Readers,

A couple of years ago, I wrote that the S&P 500 would surpass the 1500 mark. This was during a time when investors were worried, the market appeared to be headed lower, and volume was non-existent.

Many doom and gloom experts called me a sucker. Some said I was crazy for thinking the market had the gusto to even move through 1400. They told me the fundamentals simply weren’t there.

And they were right.

The fundamentals for growth weren’t there – and they still aren’t.

Corporate earnings continue to beat analyst estimates but have seen so many downward revisions that beating market expectations doesn’t exactly mean there’s growth.

Housing starts and construction data are showing positive signs, yet mortgage applications continue to fall. I mentioned this a month ago, whereby mortgage applications dropped by 29% over an 8-week period – the biggest plunge in 30 months.

It dropped another 3% last week.

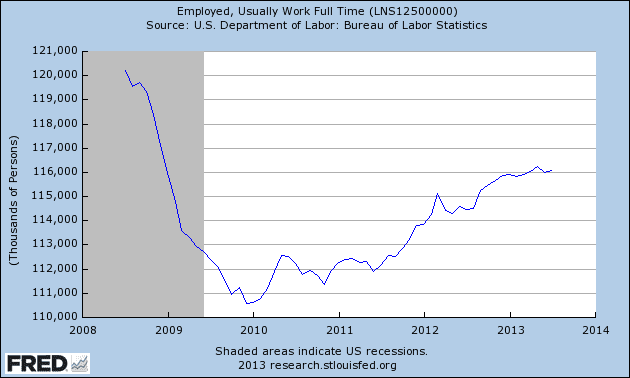

Unemployment remains lackluster and despite all of the good news you hear about more jobs being created, it’s not as rosy as it appears. I mentioned this many times before, but to sum it up:

“Of the 953K jobs that have been created so far this year, 731k of them were part-time jobs. That means only 23% of the newly created jobs, were full-time.”

Take a look at these charts:

But hey, at least jobs are being created.

So the “experts” were right: from a fundamental growth perspective, the market should not have gone passed 1500.

So why then did I argue that the market was going higher?

Herein lies the simplest answer to a very hard question.

Artificially Inflated Assets

Print money. Put that money into the system. Inflate prices.

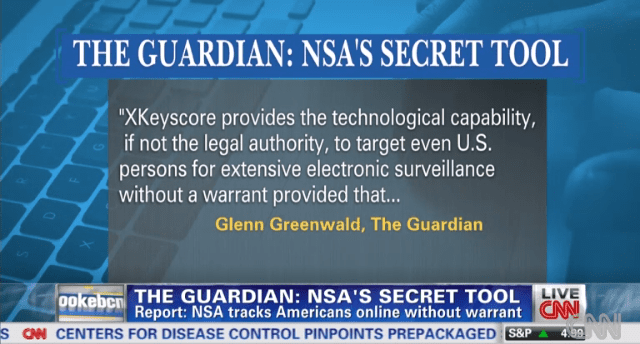

Bernanke and his crew can use whatever term they desire: QE, operation twist, and low interest rates – it doesn’t matter. It’s all the same. Create money and cheap credit and put it into the market.

It took some time for that money to enter the system, but now that it’s going in, the stock market has only one way to go, and that’s up.

But what happens when the money stops?

How can hedge funds be allowed to leverage so much? That should be an absolute crime. If their bet gets wiped out, investors once again will stand to lose trillions.

All for what? 5, 10, 20% returns?

Yes, Ivan, your report is right on the money…it’s adequate

time for us to prepare our assets and ‘get our finances in order’…

I believe we’ve all enjoyed these new highs that

the S&P has obtained — but it may now be wise to “take

some money off the table”

Hopefully, you will write a Part 2, with suggestions as to

where our money should go…

Thanks for a great article,

every investor should read this sobering advice

Kindest regards

Patricia

It’s hard to fathom the amount of money hedge funds have borrowed to make bets on the market. They were probably incentivized by the Fed to do so…so when all else fails no one is to blame.

someone give me a trillion and watch what I can do with the market.

What about gold and silver – short term and medium term targets

What about the times when interest rates were 5.6,7percent?

And mortgage rates were the same or a little higher

Didn’t the interest on savings help offset the interest on the mortgage? This low interest rate only helps big business,

not the little working guy.

unless you have about as much money as you do saved up as your mortgage, no chance the interest on savings will offset interest on mortgage. mortageg rates are also many percentage points higher than the current interest rate.

As said earlier wouldnt a stock market crash affect gold and silver shares.

The game is played on once again & again by them…It is unfortunate that 10% do what they wish leaving the rest of the folks hanging . they made a ton shorting gold . I am convinced that inside trading is involved and where is the SEC. Its the same 10% that keep on playing the same game they will force a down move on the overall equities as this is also within the time cycle of their usual thing to do. It is very much a calculated habit. Therefore the usual June to Oct move down should take place once again. Its another way to keep a negative balance in the pockets of the working individuals and this is just one sample of their use of control. It’s a game to them but a hardship for the rest of us. ONLY IF WE WOULD ALL WAKE UP and scream no more .I personally have had enough. If is true that Germany called their physical gold back it suggests that global economics are not in favor yet. Secondly The Fed has not announced any major significant move on the rate front yet. We are just being sucked in to their vacuum for the temporary usual habit playground play.

I personally prefer for the correction to take place and hopefully is a meaningful one then to buy in .(patience). Otherwise it is wiser to have a buy in plan and accumulate at opportune times till the fall.

Rates in my opinion will stay flat for years to come as it is not possible to carry the amount of personal debt that is in existence now versus income. The Feds need asset inflation to keep on going in order to satisfy their mandate/habitual implementation of control and this is a core of the philosophy.The Feds need the 90% of us to keep on borrowing unless they wish to implement a global bankruptcy as they did in the 30’s however I am of the opinion that this is too early yet in their agenda/plan to accomplish their pre-meditated/calculated World order Government as commoners still have plenty of an asset base to deal with this blow. God help us all then.

Seg funds should be well regulated or illegal. but when it comes to rich rich rich all is legal; semi-legal etc.

How much is enough.

I don’t see how seg funds ad value to the overall economics but rather its a game played for the few with a guarantee of the 90% folklore… (S.I.N. bond )

1930 + the 89 Fibonacci (2019-2021) seems to be a good number for global currencies depletion/change etc. it also coincides with the 1930 start of implementation of the crak-down.

Do some reading on some of the old books that have historical information beginning with the 1914 World War ;1921 wave move etc.

A-N-n-U-M S-A-N-C-T-U-M……

sincerely by; lino- tavares

well said. the banksters own the world. Anarchy

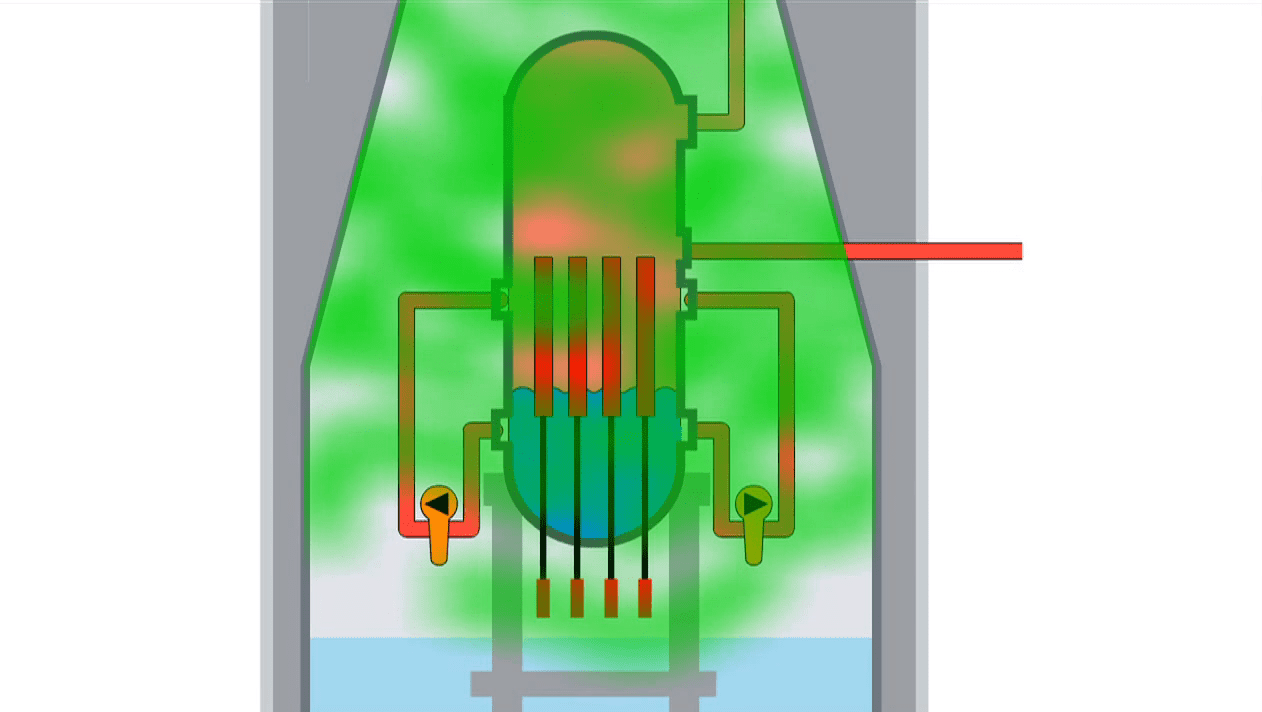

Anyone know what uranium company Lo is talking about?

The 16 trillion dollar question is when if at all? many a financial writer has forecast the big one. If the markets are manipulated to that point, then only the manipulators can pull the plug. Many have given a host of reasons for a collapse, from the Chinese selling their US treasuries to the creation of the gold Dinar none of which came to be qualified as a dam buster. The only way, like always is to figure out who will benefit from a crash and what’s the reason is to manipulate one. Then you will know the time of the event. Mathematic, fundamentals and technical analysis are meaningless in such an environment.

Physical gold and silver is probably the anti-bubble or asset protection. The COMEX has shown good signs that there is no longer physical gold to be had as they essentially have failed to deliver on future gold contracts. China and India have rapidly sucked up physical metals etc. I would buy physical gold or silver given the choice. There is way too much fraud in owning “paper” silver or gold. If you don’t have the metal in your piggy bank you will probably be left holding a lot of silver certificates if you folks remember those…

Sale in hot of cheap pittsburgh penguins jerseys china with high quality and big discount. i am sure you will love our cheap wholesale jerseys of various styles and sizes for you to choose.