Tapering Disaster?

We’re now hearing all of this talk about the Fed scaling back on its record $85 billion per month in bond purchases. We’re hearing the Fed will completely stop the purchases at the end of 2014.

Yet, the market takes it in and keeps on chugging – knowing that as long as money is entering the system at a faster pace than it’s moving out, the market will climb.

After years of working its way up, the stock market climbed to yet another all time high this week.

But here’s where it starts to get really interesting.

The Real Indicator You Should Be Watching

Something happened last week that few retail investors noticed.

And it should wake up misinformed bulls.

Take a look at the following chart of the benchmark 10 Year Treasury bond:

In the last few months, the 10-year bond price has continued to fall. Now take a look at this:

The yield on the benchmark 10 Year Treasury bond has now shot passed 2.7% – a dramatic rise of 1% in less than 3 months.

If this trend continues, it could be the tipping point that pops the stock market bubble.

Let me explain.

The 10 Year US Treasury yield is the benchmark indicator – not just for the U.S., but also for the rest of the world.

The higher the yield on the 10-year, the higher the interest rates worldwide.

And in the last few months, this number has soared more than 60% – its greatest percentage move since 1962.

Higher interest rates makes housing less affordable and among other things, will slow GDP growth. Given that the housing sector is already being affected, as noted by the continued decline of mortgage applications, the 10-year yield continues to prove itself as a consistent indicator.

The decline in mortgage applications clearly indicates the effect of the 10-year yield. Mortgage rates in the U.S. have already jumped from 3.4% in early May to 4.4% today. When the 10-year yield goes up, so do mortgage rates.

And the drastic decline in mortgage applications follows.

Not only do rising rates cause a major slowdown to economic growth – especially during a time when growth is needed – they can have an adverse effect on the financial markets.

An Extremely Leveraged Market

As I wrote before, margin debt levels continue to climb:

“Margin debt amounted to $379.5 billion in the month of March. The highest margin debt amount previously was $381.4 billion back in July 2007. That means the amount of money people are borrowing to buy stocks are now back at pre-2008 levels.”

If interest rates rise further, investors will likely bail out of stocks. Given that margin debt levels are already near all-time highs, a stock market collapse is more likely to happen.

Margin debt allows speculators to borrow money to buy stock. These “loans” are collateralized by stock holdings, and much like a short, must be covered when the market goes south. That means if a bet goes the other way, these speculators have to find more money, or sell out of their “collateralized” stock holdings to cover the margin.

The low interest rate environment has made the cost of borrowing so low that speculators have been piling up on margin debt.

The Trillion Dollar Gamble

According to Bloomberg, the nation’s (US) largest hedge funds borrowed more than $1 trillion as of the fourth quarter, yet only had net assets of $1.47 trillion:

“The nation’s largest hedge funds had $1.47 trillion in net assets and more than $1 trillion in borrowings as of the fourth quarter, according to the first report compiled on confidential data they provided to the U.S. Securities and Exchange Commission.

…The funds reported having $1.47 trillion in net assets and $1.06 trillion in aggregate debt during the fourth quarter. Debt includes secured and unsecured borrowings for each fund and excludes “other significant methods of incurring leverage,” such as derivatives, according to the report.

…The report also provided details on the liquidity of the assets held by the funds.

Twenty-seven percent of their $1.47 trillion in net assets could be divested within a day, according to the SEC. Fifty-three percent of the net assets could be liquidated in a week or less, the large managers said, and 71 percent would take no more than a month to sell. Fifteen percent of assets would take more than six months to liquidate.

The agency also detailed how quickly the managers allowed their investors to cash out. About 7 percent of the $1.47 trillion could be withdrawn by investors in a day, and 24 percent could be taken out within a month. Investors could redeem about 59 percent of the total capital within 180 days, the report said. About 26 percent of capital would take more than a year to get back.”

Not only are hedge funds highly leveraged, but their leverage is now likely much higher than the Q4 reports. If that is the case, then hedge funds are borrowing over $1 trillion.

But what happens if interest rates continue to climb causing the stock market to fall?

Fund Redemptions

We’ll likely see a massive exit of money from the stock market as investors scramble to salvage what is left.

In other words, hedge funds are so highly leveraged that a small crash in the market could lead to a major stock market collapse.

Remember, the value of American subprime mortgages was estimated at $1.3 trillion as of March 2007. That was more than enough to send the stock market into a free fall. Hedge fund debt has now topped $1 trillion – that doesn’t include the smaller funds.

The recent rise in rates has already caused emerging markets and asset prices around the world to crash.

In less than a month, Brazil’s stock market has already lost 20% of its value.

While we still have room for the stock market to climb, as a 2.7% yield on a 10-year is still very low – especially from a historical perspective – but if it continues to rise, it will put a screeching halt to stocks.

Oh, and there is now more than 440 trillion dollars worth of interest rate derivatives in the world financial system. What will happen to those derivatives if interest rates spike?

Scary thought.

End Notes

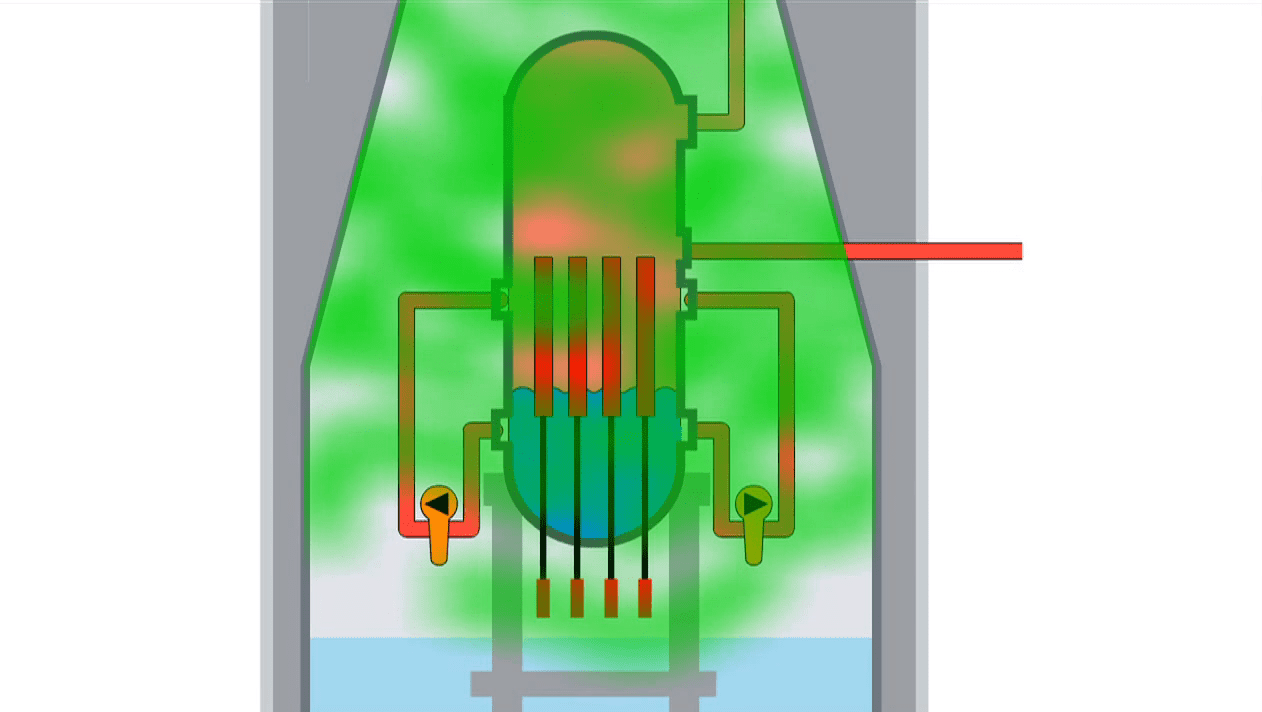

While hedge funds are raising their bets on gold, and the world continues to shine its spotlight on the precious metals sector, one sector that is likely to boom again is the uranium market.

Already we have seen uranium stocks make a strong comeback, as I called in a previous letter, but this is just the tip of the iceberg.

The opportunity to participate at these low levels may soon be over.

While most of the industry stays quiet for the holidays, it gives those of us still working the time to pick up stocks before the institutions wake up form their slumber in September.

That gives us a great opportunity to pick up stocks before they do.

I’ll be looking to release a new report shortly.

How can hedge funds be allowed to leverage so much? That should be an absolute crime. If their bet gets wiped out, investors once again will stand to lose trillions.

All for what? 5, 10, 20% returns?

Yes, Ivan, your report is right on the money…it’s adequate

time for us to prepare our assets and ‘get our finances in order’…

I believe we’ve all enjoyed these new highs that

the S&P has obtained — but it may now be wise to “take

some money off the table”

Hopefully, you will write a Part 2, with suggestions as to

where our money should go…

Thanks for a great article,

every investor should read this sobering advice

Kindest regards

Patricia

It’s hard to fathom the amount of money hedge funds have borrowed to make bets on the market. They were probably incentivized by the Fed to do so…so when all else fails no one is to blame.

someone give me a trillion and watch what I can do with the market.

What about gold and silver – short term and medium term targets

What about the times when interest rates were 5.6,7percent?

And mortgage rates were the same or a little higher

Didn’t the interest on savings help offset the interest on the mortgage? This low interest rate only helps big business,

not the little working guy.

unless you have about as much money as you do saved up as your mortgage, no chance the interest on savings will offset interest on mortgage. mortageg rates are also many percentage points higher than the current interest rate.

As said earlier wouldnt a stock market crash affect gold and silver shares.

The game is played on once again & again by them…It is unfortunate that 10% do what they wish leaving the rest of the folks hanging . they made a ton shorting gold . I am convinced that inside trading is involved and where is the SEC. Its the same 10% that keep on playing the same game they will force a down move on the overall equities as this is also within the time cycle of their usual thing to do. It is very much a calculated habit. Therefore the usual June to Oct move down should take place once again. Its another way to keep a negative balance in the pockets of the working individuals and this is just one sample of their use of control. It’s a game to them but a hardship for the rest of us. ONLY IF WE WOULD ALL WAKE UP and scream no more .I personally have had enough. If is true that Germany called their physical gold back it suggests that global economics are not in favor yet. Secondly The Fed has not announced any major significant move on the rate front yet. We are just being sucked in to their vacuum for the temporary usual habit playground play.

I personally prefer for the correction to take place and hopefully is a meaningful one then to buy in .(patience). Otherwise it is wiser to have a buy in plan and accumulate at opportune times till the fall.

Rates in my opinion will stay flat for years to come as it is not possible to carry the amount of personal debt that is in existence now versus income. The Feds need asset inflation to keep on going in order to satisfy their mandate/habitual implementation of control and this is a core of the philosophy.The Feds need the 90% of us to keep on borrowing unless they wish to implement a global bankruptcy as they did in the 30’s however I am of the opinion that this is too early yet in their agenda/plan to accomplish their pre-meditated/calculated World order Government as commoners still have plenty of an asset base to deal with this blow. God help us all then.

Seg funds should be well regulated or illegal. but when it comes to rich rich rich all is legal; semi-legal etc.

How much is enough.

I don’t see how seg funds ad value to the overall economics but rather its a game played for the few with a guarantee of the 90% folklore… (S.I.N. bond )

1930 + the 89 Fibonacci (2019-2021) seems to be a good number for global currencies depletion/change etc. it also coincides with the 1930 start of implementation of the crak-down.

Do some reading on some of the old books that have historical information beginning with the 1914 World War ;1921 wave move etc.

A-N-n-U-M S-A-N-C-T-U-M……

sincerely by; lino- tavares

well said. the banksters own the world. Anarchy

Anyone know what uranium company Lo is talking about?

The 16 trillion dollar question is when if at all? many a financial writer has forecast the big one. If the markets are manipulated to that point, then only the manipulators can pull the plug. Many have given a host of reasons for a collapse, from the Chinese selling their US treasuries to the creation of the gold Dinar none of which came to be qualified as a dam buster. The only way, like always is to figure out who will benefit from a crash and what’s the reason is to manipulate one. Then you will know the time of the event. Mathematic, fundamentals and technical analysis are meaningless in such an environment.

Physical gold and silver is probably the anti-bubble or asset protection. The COMEX has shown good signs that there is no longer physical gold to be had as they essentially have failed to deliver on future gold contracts. China and India have rapidly sucked up physical metals etc. I would buy physical gold or silver given the choice. There is way too much fraud in owning “paper” silver or gold. If you don’t have the metal in your piggy bank you will probably be left holding a lot of silver certificates if you folks remember those…

Sale in hot of cheap pittsburgh penguins jerseys china with high quality and big discount. i am sure you will love our cheap wholesale jerseys of various styles and sizes for you to choose.