Dear Reader,

Tesla and Apple shares are falling. Interest rates are at all-time lows. And a second-wave of COVID-19 may be coming.

Investing in this environment couldn’t be more difficult. But there is ONE industry that could rise above it all.

And it’s not what you think.

Here goes…

The Fed’s Conundrum

The official website of the Federal Reserve is very clear on what the FED’s objectives are in conducting monetary policy:

“The Federal Open Market Committee (FOMC) is firmly committed to fulfilling this statutory mandate.

…The objectives as mandated by the Congress in the Federal Reserve Act are promoting (1) maximum employment, which means all Americans that want to work are gainfully employed, and (2) stable prices for the goods and services we all purchase.”

Let’s take a closer look at the FED’s twin objectives: “maximum” employment and “stable” prices.

What is “maximum” employment, and how is it defined?

To the Fed, maximum employment means achieving an unemployment rate between 3.5% and 4.7% over an extended time.

The current unemployment rate reported by the US Bureau of Labor Statistics is 8.4%, as reported on September 4, 2020. This means that if the FED wants to follow its own monetary policy – as mandated by Congress – it would be expected to continue with the previously stated goal of “lower for longer” when setting interest rates.

Even though the US stock market has recouped most of its “pre-pandemic” losses, the job numbers keep telling us the goal of “maximum” employment has not yet been achieved.

But what happens if the damage to the job market is structural? What happens if restaurants, airlines, tourism and other sectors of the economy take a very, very long time to get back to their former levels?

Was this observation the reason why Warren Buffet bailed on airlines, losing billions along the way?

Via Forbes, May 4, 2020:

“Billionaire investor Warren Buffett, chairman of Berkshire Hathaway, told shareholders on Saturday that he had sold all of the company’s airline stocks, admitting that he had made a mistake and that coronavirus had changed the business in a “very major way.”

“The world has changed for airlines,” Buffett said, noting that the industry has been “really hurt by a forced shutdown” due to the coronavirus.

…Buffett said Berkshire originally invested between $7 billion and $8 billion for large stakes in the major airlines, but the company didn’t get anywhere near that in return for its investment.

“It turned out I was wrong,” the Oracle of Omaha said, adding that he’d made an “understandable mistake” given the unforeseen downturn in the industry.

“I don’t know that three, four years from now people will fly as many passenger miles as they did last year,” Buffett warned. “You’ve got too many planes.”

His comments show the humility of a man who has spent most of his lifetime on the “right side” of trades and investments: “It turned out I was wrong” and, “the world has changed for airlines.”

The damage done to the US economy will be directly measured against the job market.

Economists, banks, traders, and government officials all have their eye on the same thing:

“How quickly will unemployment drop back to the FED prescribed level of “maximum employment?”

This has become a tricky situation for the US Federal Government because the massive financial relief program has given workers a brief taste of what life would like if there was “guaranteed income.” Workers have experienced the “sugar high” that comes when small children get their first taste of candy or other sweets. They instinctively want more, and more, and more…

Regrettably, there is a dangerous, seamless transition from a hand up to a handout. Is this what is happening now? One has to be genuinely concerned with the sense of entitlement that goes with the receipt of a government check every two weeks or every month.

Let’s think about it for a moment.

Today, we have various governments around the world doling out untold hundreds of billions of dollars to help their citizens through a challenging period of their lives.

The nightly news is a stark reminder that social order would quickly disintegrate if these weekly and monthly handouts stop.

Those that do not have would simply take from those who do.

A Logical Solution?

One of my younger brothers experienced the complete breakdown of social order while working as a fishing guide in St. Thomas during Hurricane Marilyn.

Post-hurricane, for almost a week, all the survivors’ wants and needs were condensed into just two things: fresh water to stay alive and a firearm to stay protected.

Supplies of fresh water were critically low, and there was widespread looting. Order was only restored once FEMA and the US Marines stepped in. This is what it took to get the situation back under control and for the economic and social recovery to commence.

It is frightening to consider the entire United States in the same position as St. Thomas post-hurricane.

Currently, there are several major US cities in which social order is starting to fail. So far, the entire country does not appear to be at risk. But it is interesting to note that Democrat-led states appear to have far greater social unrest and looting problems than Republican-led ones.

Could it be because the Democrat-led states don’t want Trump and the Federal government to intervene with military force? One must wonder if federal action is indeed the solution – as it was with St. Thomas.

Maximum Employment?

The path back to “maximum employment,” doesn’t look like it will be a smooth one.

Let’s think about demographics.

The Baby Boomers are now lining up in droves to retire. Sure, this leaves more jobs to fill.

On the surface, that seems to be a reasonable and fair assumption.

But is it?

Let’s take one of the most significant shifts in consumer consumption as an example: the electric vehicle.

The one great downside to the electric vehicle (EV) is that it will forever change the automotive industry.

You see, major car manufacturers have built a great business selling their products through franchised dealerships. These dealerships rely heavily on the service, repair, and maintenance side of their business to take care of daily expenses. Thus, the sales side of car dealerships is the profit center. The more cars sold, the more money is made. It’s a simple and easy-to-follow business plan.

In fact, the auto industry is one of the single most important industries for the US.

Read what the Center for Automotive Research has to say about US carmakers:

“The auto industry is one of the most important industries in the United States.

It historically has contributed 3 – 3.5 percent to the overall Gross Domestic Product (GDP).

The industry directly employs over 1.7 million people engaged in designing, engineering, manufacturing, and supplying parts and components to assemble, sell and service new motor vehicles.

In addition, the industry is a huge consumer of goods and services from many other sectors, including raw materials, construction, machinery, legal, computers and semi-conductors, financial, advertising, and healthcare.

The auto industry spends $16 to $18 billion every year on research and product development – 99 percent of which is funded by the industry itself. Due to the industry’s consumption of products from many other manufacturing sectors, it is a major driver of the 11.5% manufacturing contribution to GDP. Without the auto sector, it is difficult to imagine manufacturing surviving in this country.”

But therein lies the problem.

What happens when you take away a large portion of this workforce?

You see, electric cars are practically maintenance-free. There are no oil, transmission fluid, coolant, spark plugs, or timing belts to change.

And, when they do need repair, it is a simple matter of replacing a component part – such as the battery.

But that’s not all.

Many millennials do not even own a car, nor do they want one. They seem to prefer public transportation, UBER, or ride-sharing options.

Maybe that’s the result of the high maintenance costs associated with owning a car. Or maybe it’s a complete shift in how transportation is viewed in this new generation. After all, self-driving cars will soon be the norm – which could also replace hundreds of thousands of taxi and chauffeur jobs. I haven’t even begun to talk jobs provided by the trucking and delivery industry.

Where will this leave the automotive business in the future? More importantly, how many jobs will be required to replace those that are lost? Perhaps that’s why Elon Musk is a supporter of Basic Income – he knows his EV’s will change the workforce.

A similar argument could be made for the airline industry.

Many airline companies have made some hard decisions. If it doesn’t pay to operate flights, they cancel them. Older pilots are opting for early retirement, while younger pilots have no means to replace them because the airline can not operate when they lose money. No business can.

Sure, the President of the USA made a pronouncement on national TV that he would not “allow” Boeing to fail. But at what cost? And for how long? If people remain skeptical about flying, no amount of reassurance will change it.

Are you starting to see the difficult position the FED is now in regarding their shrinking flexibility when it comes to monetary policy?

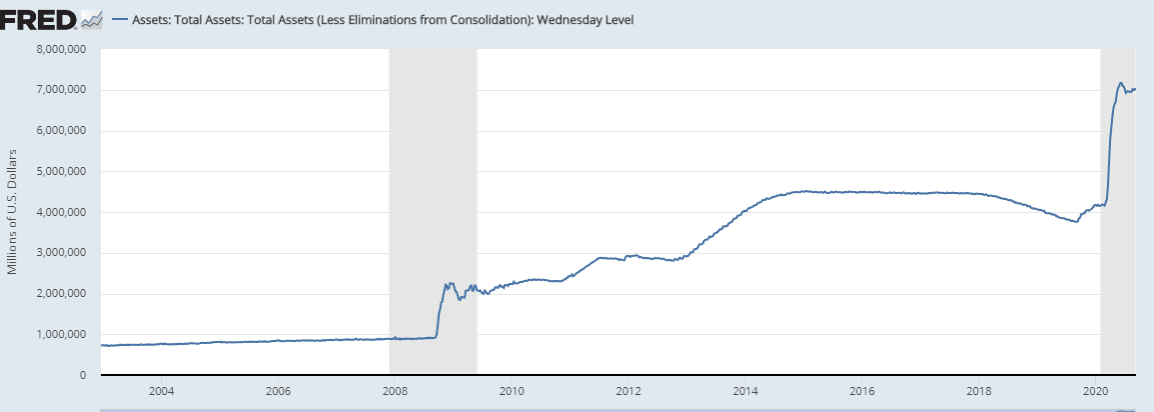

This chart shows how the Financial Crisis of 2008 and how the Pandemic of 2020 impacted the FED balance sheet.

The FED balance sheet quadrupled between late 2008 and 2014 after an initial doubling. But in just a few short months this year, it doubled again. It’s scary to imagine what the next five or six years will bring.

Alan Greenspan, the former FED Chairman, was interviewed on CNBC on September 10, 2020. He pointed out that the “government may be underestimating the size of future budget deficits.” This comment was made in support of his view that entitlements for the coming wave of retirees will put additional stress on these budgets.

He also mentioned that “he’s worried about inflation.” He encapsulates his views on inflation with the following:

“My overall view is that the inflation outlook is unfortunately negative, and that’s essentially the result of entitlements crowding out private investment and productivity growth.”

So far, the response from the FED has been to “adjust” its triggers for a policy response.

Now, 2% inflation is no longer a “line-in-the-sand” target but merely an “indication.” The FED is prepared to let inflation rise beyond 2% without an immediate policy response.

This is a radical shift in the previous policy that was directed at “getting out in front of inflation” before it starts.

Think about the wildfires in California; like most fires, they are easy to put out after they first start but not so easy once they get going. Inflation is like that. Easy to contain at first; not so later. Anyone who experienced the 1980’s knows exactly what happens when inflation becomes a “wildfire.”

Baby Boomers still fear inflation. Millennials do not. This is purely a generational difference; the first case based on experience, and the second case, the lack of it.

But can we blame Millennials for their lack of inflation fears?

Outside of housing, and even with record stimulus via low rates and cash injection, inflation has been non-existent.

FXSTREET, a website dedicated to finance and related topics provided a concise summary of this view:

“The central bank had long considered a tight job market as the precursor to wage and then price inflation. Traditionally, as unemployment sank below 4%, policymakers began to move to a rate tightening cycle even if there was no sign of rising prices or wages.

Practical experience over the 12 years since the financial crisis has helped modify that view and also the interplay between quantitative easing liquidity and price inflation.

As the unemployment rate dropped below 5% in October 2016 and then 4% in May 2018, long seen as the neutral rate of unemployment below which wage inflation must begin, inflation remained quiescent.

The unemployment rate was below 4% for 19 of 21 months until February 2020 and for a record 13 straight months to the onset of the pandemic in March but inflation did not appear.

That recent evidence confirmed the quantitative easing data of the previous decade. Despite several rounds of credit market purchase and a quadrupling of the Fed balance sheet between late 2008 and 2014, inflation barely moved. At no time did it make a sustained push above the 2% target. Not until almost five years after the purchases stopped did inflation approach the target averaging 1.96% in 2018.

Based on this experience and now codified as policy, the FOMC will be far less inclined to consider raising rate based solely on a drop in the unemployment rate.“

How to Benefit from the FED’s New Mandate

The FED has a new mandate.

No longer will a drop in unemployment below 4% be the catalyst for the start of a rate tightening cycle. The valuable and practical experience gained from the post-2008 era shows that inflation has not reappeared despite strong employment.

So what does that mean, and how do we act on this?

From an investment standpoint, it’s time to start looking for the “best-of-breed” base metal producers.

Why?

Because no matter where inflation heads, the scenario for base metal producers is positive.

First off, we know that governments around the world will need to spend money on infrastructure in order to create jobs and prevent GDP from shrinking.

China is already there.

Via PIIE:

“…special local government bonds totaling RMB 3.75 trillion (US$525.9 billion)—RMB 1.6 trillion (US$224.4 billion) more than the amount in 2019—will be issued, and the proceeds will be primarily spent on infrastructure, both new and conventional, and on stimulating private consumption.”

But that spending should come as no surprise for those who have been following China’s Made in China 2025 mandate.

For those unfamiliar, the Made in China 2025 mandate is China’s blueprint of shifting itself from a low-end manufacturer to becoming a high-end producer of goods.

Via China-Briefing:

“Made in China 2025 seeks to engineer a shift for China from being a low-end manufacturer to becoming a high-end producer of goods. The goal is to tap into China’s increasingly wealthy home consumer base as well as the value-added global sourcing segment.

This has required transitioning the country’s existing manufacturing infrastructure and labor market towards producing more specialized output – with targeted investments in research and development (R&D) and an emphasis on technological innovation.

To centralize this vision, the government’s Ministry of Industry and Information Technology released a Made in China (MIC) 2025 document in 2015 – pushing for leadership in robotics, information technology, and clean energy, among other sectors.”

This mandate also includes a massive focus on the automotive industry.

So it should come as no surprise that, despite the COVID-19 shutdown, China’s factory activity just hit its highest level in nearly a decade.

Via MarketWatch:

“A private gauge of China’s manufacturing activity rose to its highest level in nearly a decade last month, supported by strong domestic and external demand and faster production activity.”

In order to achieve China’s massive ambitions, a significant supply of base metals will be required.

In other words, the price of base metals should react positively moving forward.

But that’s not all.

The largest cost components of base metal miners are fuel, energy, and labor.

As we have witnessed over the past decade, a benign inflation environment means that base metal companies should not be subject to cost increases over which they have no control.

They can continue to tweak their operations for maximum profitability over the life of the ore deposits that they are mining. That, coupled with an increase in demand by China and other countries, could send the share prices of base metals producers significantly higher.

The FED meeting on September 15, 2020, could give the green light to base metal investors and set the stage for a long period of steady, controlled growth with little, if any, productivity cost dislocations.

The base metal sector represents the perfect environment for the large pools of unallocated capital looking for the “right place to invest.”

After all, base metal projects require a significant amount of capital – and there’s lots of that to go around.

Seek the truth,

John Toporowski,

with edits and input from Ivan Lo

The Equedia Letter

www.equedia.com

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. We are also not doctors or experts on viruses. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in base metals or trading in base metal securities.

It has been my observation– that the weak part of the Chinese various Sectors — is HEALTH and HEALTH ADVANCEMENT. I have taken many trade missions into all parts of China and can speak with some knowledge on this. The question also- I would have – is if the USA either taxed (in addition to Chinese Students coming to the USA to College) another minimum of 1mill. per student. Or best- not allow Chinese Students to US Universities. How many American Students are going to Chinese Universities– No where near the 385,000++ Chinese Students here.

A great company to take advantage of this mining potential is West High Yield (why). They have a world class find with magnesium, nickel, silica, and lots of gold. They are at the final stages to get their permit. The find is located in British Columbia, Canada

Who are some of the base metal companies one should be looking to invest in?

Keep your eyes on Champion Iron , they are perfect for take over China needs lots of iron ,! so I totally agree with your letter.

I’m interested in your thoughts on how everything in your article would change if there was a treatment for COVID-19, because Cytodyn (cydy) from Vancouver, WA, USA has a monoclonal antibody, leronlimab which has had significant results in their FDA trial for mild/moderate patients with COVID, and their severe/critical trial completion will be soon.

Go to Cytodyn. com and study the science on their website.

The United Kingdom is interested in leronlimab, and in the very near future the whole world will be wanting leronlimab.

In which Bitcoins, altcoins, and cryptocurrencies, are sovereign funds invested?

I don’t understand your acceptance of govt inflation numbers.I assume,like Democrats,you really believe in big govt and all it does.Why do you and others think politicians are dishonest and lie to get elected,but once elected,they are honest in their dealings with the little people and would never dream of lying about inflation or any other govt action.If you are so rich that you don’t pay attention to prices of what you buy,you should change your behavior and start paying attention.It will help you understand what is really happening.Current inflation is at least 6% and probably nearer 10%.It is likely to go much higher,no matter what govt tells you.

China likes to buy commodities when they are low in price so that they stockpile. My gut feeling they will start stocking up on zinc and oil but I also feel that uranium will come into play as those reactors will need their feed. Since there is a shortage of copper they probably will continue to import.

https://www.counterpunch.org/2020/09/14/screwing-with-the-unemployment-statistics/

Hi, love the information that you provide. How can get a list of highly recommend base metal producers to invest in?

Would like to frame out summary points from the article for discussion below:

1. unemployment rate could be lowered. Taking out conventional automobile industry in replacement of EV, you might have massive unemployment rate

2. there is a worry on forecasted inflation

3. infrastructure and metal bloom

Therefore,

1. The lock down over such a long period of time making life hard for the hard core who earn their income on daily wages….. Without contract, without proper protection, they rely on social welfare and government hand outs, may be their minute saving and garden vegetables and fruit to get by…. The next hit is middle class small biz owners. They need to fork out for rental of business premises and bills without income. Most would not be sustained for more than 6 months to a year……. We create a new pool of urban poor, the latest popular trend of modern tribe commonly acknowledged by well known institutions of the world. How do we lower the unemployment rate with such low consumption turn over rate in the market?? Nearly not likely, or no??

Automobile has been a major industry in all countries progressive enough in the world…….. Changes in the industry would affect people in the industry for sure……. How to minimize the impact could be a topic worth looking into?

2. In contrast to inflation, a more popular adoption could be a DEFLATION…..

With low consumption turn over rate, low viable income for the majority, reduce the prices could probably encourage affordable spending on necessities for most and revitalize a few parts of the market.

In laymen preposition, if the production costs of a loaf of bread is 30 cents, the marginal profit usually required could be 60 cents. Then we have a common price of 90 cents to a dollar a loaf of bread. But, people are considering hard between a can of beer of 45 cents and a loaf of bread of a dollar. Low turn over and may be loss could be induced over this period.

If we lower the marginal profit required,i.e. to 30 cents….. now we have a loaf of bread at the price of 60 cents……It could be sold like a hot cake. The high turn over would generate profit more than enough to cover the operational costs, or no??

Therefore, deflation could help not only the people in need, but also the business owners, the market, and the country…..

3. Commonly belief that infrastructure is the basic of development………… Massive deforestation for development purposes has been a common trend and strategy adopted or copied throughout the world……. Most developed countries left may be 10 to 20% of their forest as reserves………. There has been an encouraging remeditive trend of reforestation……… However………… If we were to cut down and replant, with foreseeable side effects known or observed, could we encourage better planning and designs before we develop?? Crowd thinking or flowing with the crowd although is an easy and popular method, it might not necessary be the best strategy, or no??

Thank you

No comments.

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/