Dear Readers,

I am about to share with you a timeline of events that will not only shock you, but give you a whole new perspective of the world’s financial system.

For years I have been writing about our economic decay and the growing financial war. The threats I mention are real. The facts are real. And the dangers are real.

Triggers are waiting to be pulled. You’re seeing it all over the news:

- Coordinated attacks against Western embassies in the Middle East.

- The assassination of a U.S. Ambassador at the hands of an anti-American terrorist in the Libyan US Embassy.

- Iran and Iraq on the brink of war, with cruisers, aircraft carriers and minesweepers from 25 nations converging on the Strait of Hormuz in defence.

- Iran just made a serious threat of World War Three today

You’re seeing this all over the news, but can you connect the dots?

Connecting the Dots

The United States has just announced an open-ended QE3; printing billions of dollars every month as they see fit. This reckless money creation, a weapon by the US to balance trade deficits, is causing havoc worldwide.

(If you missed the last few issues of the Equedia Letter, GO HERE to catch up – it is very important you understand what’s at stake.)

Countries around the world are feeling the effects of this currency war. It’s created higher food prices in Egypt and stock bubbles in Brazil. Printing by the Fed leads to higher unemployment in developing economies as their exports become more expensive to Americans. While higher food prices means a lower standard of living for first world nations, it’s a matter of survival (see America’s Gold Wiped Out.) for the smaller developing nations.

As a result of the currency war and the reckless abandonment of sound fiscal policy by the United States, countries around the world are beginning to leave the dollar in droves. The capital markets are now hanging sitting on the edge of a major fiscal cliff.

Imagine what would happen to our markets if the Russians decided to launch a resources assault (they control the world’s biggest gas company, producing 17% of the world’s gas), the Chinese retaliates and launches a currency assault, and Iran triggers World War III.

Can our capital markets withstand a culmination of these events?

The threats are extremely real. I urge you to read everything below and judge for yourself. Open your eyes.

A Shocking Timeline of Events

- January 1, 2006: Russia cuts off all gas supplies passing through Ukrainian territory

- October 28, 2008: RIA Novosti reports Russian Prime Minister Vladimir Putin proposed that Russia and China should gradually switch over to national currency payments in bilateral trade.

- November 15, 2008: Reuters reports that Iran has converted financial reserves into gold to avoid future problems.

- November 19, 2008: Guangzhou Daily reported that China’s central bank is considering raising its gold reserve by 4,000 metric tons from 600 tons to diversify risks brought by the country’s huge foreign exchange reserves of dollars.

- March 23, 2009: People’s Bank of China reported that Zhou Xiaochuan, Governor of the People’s Bank of China calls for the establishment of a new international reserve currency to replace the dollar.

- March 30, 2009: Agence France Presse (AFP) reports that Russia and China are coordinating proposals on a new global currency that could replace the US dollar as a reserve currency to prevent a repeat of the global economic crisis

- March 31, 2009: The Financial Times (FT) reports that China, which is pushing to end the dominance of the dollar as a worldwide reserve, has agreed a currency swap with Argentina that will allow it to receive renminbi instead of dollars for its exports to the Latin American country.

- April 26, 2009: AFP reports that China is calling for the reform of the world monetary system.

- June 16, 2009: Reuters reports that the BRIC nations of Brazil, Russia, India and China called for reform of international financial institutions, sweeping changes to the United Nations to give a bigger role to Brazil and India and a “stable and predictable” currency system.

- November 3, 2009: Bloomberg reports that India has purchased $6.7 billion worth of IMF gold to diversify out of the dollar, as ballooning U.S. debt and low interest rates weaken the currency.

- June 29, 2010: Reuters reports that a new United Nations report released calls for abandoning the U.S. dollar as the main global reserve currency, saying it has been unable to safeguard value.

- November 7, 2010: World Bank president Robert Zoellick says that the G20 should consider a new financial system that considers employing gold as an international reference point of market expectations about inflation, deflation and future currency values.

- November 24, 2010: China Business Daily reports that China and Russia have decided to renounce the US dollar and resort to using their own currencies for bilateral trade.

- December 15, 2010: Bloomberg reports that both China and Russia have called for the dollar’s role in global trade to be diminished since the global financial crisis, and Russia is promoting the ruble as a reserve and trading currency within the former Soviet Union. Moscow’s Micex exchange started trading the yuan against the ruble for the first time today, as Russia and China seek to reduce the use of dollars in trade.

- May 4, 2011: Financial Times reports that Mexico has quietly purchased nearly 100 tonnes of gold bullion, as central banks embark on their biggest bullion buying spree in 40 years.

- July 24, 2011: Financial Times reports that Iran and China are discussing using a barter system to exchange Iranian oil for Chinese goods and services, as U.S. sanctions have blocked China from paying at least $20 billion for oil.

- August 1, 2011: Reuters reports that South Korea’s central bank bought 25 tonnes of gold over the past two months in its first purchase in more than a decade, saying the time was ripe to boost its gold holding.

- August 17, 2011: Venezuelan President Hugo Chavez said that he plans to nationalize the gold sector. He’s also ordered the repatriation of 90 percent of Venezuela’s gold reserves held abroad, returning the country’s gold reserves back to Caracas.

- December 26, 2011: The Japanese government reports that Japan and China will promote direct trading of the yen and yuan without using dollars and will encourage the development of a market for companies involved in the exchanges.

- December 28, 2011: India and Japan sign new $15bn currency swap agreement

- January 7, 2012: Iran and Russia replaces the U.S. dollar with their national currencies in bilateral trade.

- January 17, 2012: Reuters reports that the People’s Bank of China said China and the United Arab Emirates have signed a currency swap agreement.

- February 21, 2012: Bloomberg reports that the Turkish central bank said China and Turkey have signed a three-year currency swap agreement

- March 22, 2012: BBC reports that China and Australia have signed a currency swap agreement in a bid to promote bilateral trade and investment.

- March 30, 2012: Bloomberg reports that Iran and its leading oil buyers, China and India, are finding ways to skirt U.S. and European Union financial sanctions on the Islamic republic by agreeing to trade oil for local currencies and goods including wheat, soybean meal and consumer products. Iran also has sought to trade oil for wheat from Pakistan and Russia, according to media reports from the two countries.

- June 1, 2012: Asia Times reports that Japan and China have started direct trading of their currencies, the yen and the yuan, on the inter-bank foreign exchange markets in Tokyo and Shanghai in an apparent bid to strengthen bilateral trade and investment between the world’s second- and third-largest economies.It is the first time that China has allowed a major currency other than the dollar to directly trade with the yuan.

- June 7, 2012: Reuters reports that Kazakhstan’s central bank will increase the share of gold in its foreign exchange reserves.

- June 22, 2012: Financial Times reports that Brazil has provided a vote of confidence in China’s efforts to promote the renminbi as a reserve currency by becoming the biggest economy yet to agree a swap deal with Beijing.

- June 26, 2012: Xinhua reports that Chinese Premier Wen Jiabao and Chilean President Sebastian Pinera announced the establishment of China-Chile strategic partnership and the completion of negotiations on investment-related supplementary deals to a bilateral free trade agreement. Wen suggested that the two sides launch currency swaps and expand settlement in China’s renminbi. Wen then states that China is also ready to discuss and sign currency swap agreements with more ECLAC countries (Economic Commission for Latin America and the Caribbean).

- August 1, 2012: Bloomberg reports that The Bank of Korea, which has the world’s seventh-biggest foreign-exchange reserves, boosted gold holdings for the third time since June last year, joining central banks from Russia to Kazakhstan in buying bullion to diversify assets.

- September 4, 2012: The European Commission launches an anti-trust case against Gazprom, opening the formal legal probe based on “concerns that Gazprom may be abusing its dominant market position in upstream gas supply markets.”

- September 21, 2012: Reuters reports that Brazil threatened a further clampdown on speculative foreign capital, firing a warning shot in a “currency war” its finance minister blamed on money-printing by Western central banks. Finance Minister Guido Mantega said Brazil would not allow its currency, the real, to strengthen as a result of aggressive monetary stimulus by the United States and other developed nations.

- September 23, 2012: Tehran’s military officials continue to threaten Israel with annihilation should it strike nuclear facilities; Senior commander of Islamic Revolutionary Guard Corps says Iran will not start war, but “warn that US involvement in conflict will trigger WW3.“

The threats and events mentioned above are not simply extreme worst-case scenarios, but a maelstrom of events happening all over the world. I give you strong examples that China, Russia, Brazil, and other nations are seeking alternatives to the dollar as a world reserve currency.

As I mentioned in America’s Gold Wiped Out, a “currency war” is a fight between countries to achieve a lower exchange rate for their own currency. In other words, its competitive devaluation. In short, the cheaper your currency, the more money you attract from foreign entities; this leads to increased exports, growth, and job creation. But never has printing during a global slowdown resulted in any growth or job creation.

The Printing Domino Effect

As the United States prints, other developed nations print in order to keep up.

The Bank of Japan just announced it has extended its asset purchasing programme by 10 trillion yen ($126bn; £78bn) – a domino effect as a result of the unlimited bond-buying programs just announced by the Federal Reserve and the European Central Bank.

Believe me, the further we progress into the world`s current currency war, the bigger the dangers are to our wealth, savings, and everything that we have ever worked for.

The largest nations are all devaluing their currency with reckless abandon. This is real and it is very serious.

As this currency battle wages on, the only real support of wealth will be in commodities, precious metals, and hard assets such as fine art and real estate. As seen in the timeline of events, commodities such as gold, oil, and food, are very easily replacing currency in massive world trades.

Gold and silver will go higher. Oil and gas will climb.

You should be watching oil, as it could climb much higher given the current tensions in the Gulf. Iran has already threatened to retaliate to any attack by attempting to mine or blockade Hormuz. A look at oil ETF’s or oil producers may not be a bad idea given what’s happening in the Middle East.

(The Strait of Hormuz passes approximately 35 per cent of the world’s oil traded by sea and 20% of oil traded worldwide. If Iran is successful in blocking the passage, it would be extremely painful for the already fragile economies of Britain, Europe, the United States and Japan – all of which rely heavily on oil and gas supplies from the Gulf.)

Things are heating up in the Gulf. Even an Iraqi patrol boat was recently spotted there. Keep an eye on this.

Today, Iran said that if they were sure Israel would attack, they would strike first and wipe Israel off the map. If the US gets involved, they warned it could trigger World War III.

Amir Ali Hajizadeh, a brigadier general in the Islamic Revolutionary Guard Corps, made the comments to Iran’s state-run Arabic language Al-Alam television, according to a report on the network’s website:

“Iran will not start any war but it could launch a pre-emptive attack if it was sure that the enemies are putting the final touches to attack it,” Al-Alam said, paraphrasing the military commander.

“We cannot imagine the Zionist regime starting a war without America’s support. Therefore, in case of a war, we will get into a war with both of them and we will certainly get into a conflict with American bases,” he said.

“In that case, unpredictable and unmanageable things would happen and it could turn into a World War Three.”

For now we stand in the eye of the hurricane.

What to Expect

I know a lot of really smart guys telling everyone to stay out of the markets – they have been for the last year. Yet, the market continues to climb. My prediction remains: The markets will continue to climb, even if its with volatility. I said it earlier this year in “A Shocking 2011 Cover-Up.”

However, if Iran attacks Israel, then all bets are off. Better buy oil.

Remember, inflation also leads to higher stock prices and printing leads to both as a result. You shouldn’t worry too much about stocks if you’re worried about inflation because a company’s revenue and earnings should increase at the same pace as inflation (see Everything Has Changed.)

We’re also less than 2 months away from the US elections. I have a strong feeling Obama will stay in power; if the market continues to rise for the next few months leading up to the election, he will.

My Current Actions

I doubt we will ever see the day where we common folk use only gold and silver in trade, but we’ll continue to rely on them as the only true store of wealth and value.

In the meantime, I continue to add positions in gold, silver, and other resource stocks, such as oil and gas, focusing on:

- Undervalued gold, silver, and oil/gas producers

- Explorers with advanced-stage projects near producing mines

- And low market cap junior gold, silver, and oil companies with a near-term, low capex production story.

I wrote a report on Timmins Gold (TSX: TMM)(NYSE.A: TGD) last month because it was significantly undervalued when compared to its peers, and it had a growing production profile with near term cost reductions.

Timmins Gold continued to shine this week, hitting a high of CDN$3.00, before closing at CDN$2.93 on the Canadian side; it closed at $US3.04 on the American side, hitting a high of US$3.08.

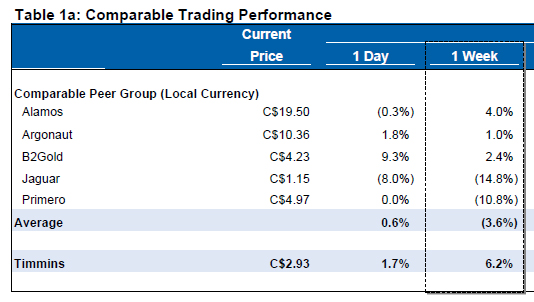

Timmins Gold beat their peers again this week, trading up 6.2%, while its peers traded down an average of 3.6%:

|

| Week Ended September 21, 2012. Courtesy: RBC Capital Markets |

For the last three months, Timmins Gold has outpaced its peers significantly, climbing 58.4% while its peers climbed an average of 20.8%.

But don’t think that Timmins is done; they’re still down 12.8% on the year while their peers are up 14.3%. That means Timmins still has more catching up to do.

As a result, it appears the big money continues to flow into Timmins shares, and out of its peer group.

With a growing production profile and an upcoming quarter that may their best yet, big money continues to pour into Timmins. You can clearly see this in the significant volume increases on both exchanges since my first report.

I am also watching Balmoral Resources (TSX.V: BAR)(OTC: BALMF) very closely as I expect them to have news out soon with the results from their recent drilling at Martiniere, their flagship project.

For those that don’t remember, or don’t know, Balmoral Resources has the largest land package right next to what will become Canada’s biggest gold mine next year, Detour Lake. You can find the original report on Balmoral by going to: A Recipe for Success: One of the Biggest and Best Mining Packages.

I said Balmoral’s management would deliver the goods.

Just last month they announced an amazing hole that returned, on an uncut basis, 272.39 g/t (8.0 oz/ton) gold over 3.88 metres (12.7 feet), sending their shares much higher.

I expect more to come.

Why? That hole was the first hole Balmoral drilled in the footwall to their Bug Lake Gold Zone. What are the chances, given they have drilled and hit high grade everywhere in the area, they will find not find more holes like it? I wouldn’t bet against them at this point.

The follow up holes to the Footwall discovery are expected in the next few months and if they get another hole similar to the one I just mentioned, pack a lunch – they’re going to soar. Heck, even if they return grades a fifth, a tenth, even a fiftieth, of that hole, its still super high grade.

I am long on Balmoral because I have a gut feeling that the next round of news releases will be big. They’ve done lots of drilling and based on guidance in their previous releases, I expect news soon.

Companies in this report:

Timmins Gold Corp (TSX: TMM) (NYSE MKT: TGD)

Now up 33%* since my initial report.

Balmoral Resources (TSX.V: BAR) (OTC: BALMF)

Now up 82%* since my initial report.

*based on Canadian share price

Until next week,

Ivan Lo

Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

Disclosure: I am long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies. We’re biased towards Timmins Gold Corp. because they are an advertiser, we own options, and we own shares. We’re biased towards Balmoral because they are an advertiser and we own shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including Timmins Gold Corp. and Balmoral Resources. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will.

Furthermore, the management teams at Timmins Gold and Balmoral Resources have no control over our editorial content and any opinions expressed are those of our own.

Disclaimer and Disclosure

Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Companies do pay us to advertise on our website and we often distribute our reports on featured companies. While we are never paid to write a rosy and positive report on any company, we do market our reports using the advertising fees paid for by our featured companies.

This process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Our revenue is generated by sponsor companies and we grow our readership by using the advertising fees we charge to distribute our reports. This helps both Equedia and our client companies gain exposure and allows us to provide you with our research at no cost.

Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below.

Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid $7143 plus HST per month for 7 months which totals $50,000 plus hst of media coverage on Balmoral Resources Ltd. plus any additional expenses we may incur as a result of additional advertisements. Balmoral Resources Ltd. has paid for this service. Equedia.com owns shares and may purchase shares of Balmoral Resources Ltd. without notice and intend to sell every share we purchase for our own profit. We may sell shares in Balmoral Resources Ltd. without notice to our subscribers. Equedia Network Corporation., owner of Equedia.com has been paid $9167 plus HST per month for 12 months of advertising on Timmins Gold plus any additional expenses we may incur as a result of additional advertisements. We have also been granted 150,000 options at $2.15 by Timmins Gold. Equedia.com and its owner own shares of Timmins Gold and may purchase shares of Timmins Gold Corp without notice. We intend to sell every share we purchase for our own profit. We may sell shares in Timmins Gold Corp. without notice to our subscribers.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

Selective but interesting none the less “timeline” with the very notable absence of the criminal insanity in the ponzy casino banking whorehouses and toxic cesspits of Wall st and ESPECIALLY the scumbags in the “city” of London.

And easy on the WW III and Iran WMD bullshit… you only have to look at the way Camermoron and O-bummer got slapped down by Putin – and China – over Syria and are now playing footsie with the Iranians as the the jewboy/anglo/american (and lesser extent French) mafia is increasingly coming up against a BRICS wall…

What is REALLY fucking scary is that instead of sitting around a table like adults to deal with the humongous and very REAL social/economic/political AND environmental problems we ALL face, we get the pathetic, petulant and absurdly puerile tantrums and squabbles – especially from the western so-called leaders…

Cheezus! time to stop behaving like stupid lemmings and also wake the fuck up and realize that Mother Nature does NOT do “bail outs” and “QE”…

I’m gone to convey my little brother, that he should also go to see this blog on regular basis to obtain updated from most recent gossip.