Dear Readers,

So it is done. Canada has a new leader, and we will soon see what he is made of; or rather, what he will make of our great country.

As Harper graciously said in defeat, “the people are never wrong.”

But do the people know what is right? Can such an inexperienced leader lead this great nation?

Regardless, the question is not whether Trudeau can lead, but how the Canadian economy will fair under his leadership?

The Short Term Outlook Under Trudeau

Canada’s economy will be in a very tough position under Trudeau’s watch.

Trudeau will begin his economic leadership through government infrastructure spending in attempts to boost short-term growth and pack on the numbers in the GDP department. This will bring about temporary jobs, but we’re not sure how many since Trudeau has yet to reveal any specific plans on how the billions of dollars will be spent. His plan may bring a temporary boost to our economy, but there’s a good chance that the effects of his spending may be offset by one of Canada’s most important resources: oil.

Oil prices are likely to remain low for the following years. Trudeau is not a fan of Alberta or its oil industry, which likely means he won’t be giving that sector much support; he may even hurt it through his climate change initiatives that directly affect fossil fuels. A bet in either direction on oil and gas at this point is a crapshoot. Perhaps once Trudeau opens the books and realizes just how important Alberta’s oil is to Canada, he may change his mind. For now, investment funds and those in this space are waiting before they make their move – and you should too.

What do you think will happen to the oil sector under Trudeau?

The Silver Lining

After 2008, I was an all out bull toward the US market – not just because of the record sums of monetary injections, but because I knew Obama would spend his way out of a recession through unsound fiscal policy. The next President will have to deal with the ramifications of such actions, but in the short term, stocks would surge.

Spending almost always has a noticeable affect on the markets, and one historical statistic proves fascinating: stocks have generally performed better under a Democrat-led government than it does under a Republican government.

As I mentioned in my Letter, “Watch the Throne“:

“Some will say Democrats are better for the stock market (as shown by historical data). Others will say Republicans are better for the economy. Historical data suggests that the stock market performs best under a divided government, when the party that controls the White House differs from the majority party in Congress. In fact, it seems best for Wall Street when we have a Democratic president with a counterbalance of a GOP-led Congress; just look at the last four years.”

While I believe the US market is flirting with a top, there may be room here for Canada to play a little catch up under Trudeau.

Although the Conservatives are generally more left than Republicans, one could make the comparison that the Conservatives would be the Canadian Republican counterpart, and the Liberals the Democrats.

And under a Liberal leadership – much like the Democrats – stocks generally do well.

According to monthly data to August 2015 compiled by Bloomberg from the TMX Group Ltd., stock returns have been three times higher under Liberal prime ministers than with Conservative leaders going back to 1992.

Via Financial Post:

“Over about 63 years in power, the Liberals of Pierre Elliott Trudeau, Jean Chretien and Louis St-Laurent witnessed a weighted compound annual growth rate of 6.8 per cent for the Standard & Poor’s/TSX Composite Index and its predecessor TSE Index. That compares with a 2.2 per cent annual gain for the Tories of Stephen Harper, John Diefenbaker, Brian Mulroney and others, the data show.”

Now this isn’t to say that Liberals are better for the economy, as the article also notes:

“…Is it timing? Have the Liberals been lucky over 100 years to do so well?” said Livio Di Matteo, an economist at Lakehead University in Thunder Bay, Ontario. “Over 100 years there does seem to be a pattern. It could be that when economic growth is poor, people want austerity and think Conservatives are better managers. Then when things improve people get tired of that and they vote the Liberals in.”

And I believe Harper feels this way – he’s done a great job of managing the economy through turbulent times and at the peak of the turnaround, Canadians have voted him out:

“As with other leaders, Harper’s stock market record reflects events that are beyond his control. The incumbent Conservative-led the country through the worst global financial crisis since the Depression and more recently witnessed a 50 per cent drop in the price of oil, one of the nation’s biggest export products.”

So how will the stock market perform under Trudeau?

If history is any indication, we may see markets begin to move higher. But not just because of the historical statistic.

Trudeau will spend and put the country into deficit, but many will benefit from his spending. Whether it’s smart spending or not, money from the government will flow into private sectors as contractors and others win big government contracts.

In the short-term, this could mean a decline in the value of the Canadian dollar as the government puts itself into deficit. Combine deficit spending and a muted commodities outlook, the Canadian Dollar doesn’t have much hope of climbing higher.

There’s also talk of rate hikes in Canada, but this is not something that will happen anytime soon. The Bank of Canada just maintained interest rates and then gave a poor economic outlook for Canada given the decline in the price of oil.

Furthermore, with Trudeau promising to spend throughout his leadership, it’s in Canada’s best interest to maintain low rates for some time. Don’t expect a big rate hike over the next four years during his term.

Meanwhile, I am confident that a rate hike in the U.S. will happen before one in Canada, and that will certainly weaken the Canadian dollar against the Greenback when it happens.

How the U.S. manages its monetary policy will affect the value of the Canadian dollar, but all things remaining steady, the Canadian dollar should remain weak which should spur foreign investments into our market – including the capital markets.

Do you think the Canadian Dollar will weaken under Trudeau?

CLICK HERE to Share Your Thoughts

The Golden Egg

While the oil and gas sector remains a mystery under Trudeau, there is one sector that could benefit from a lower Canadian dollar.

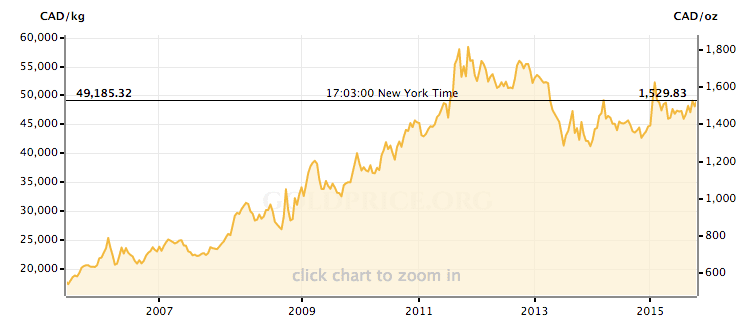

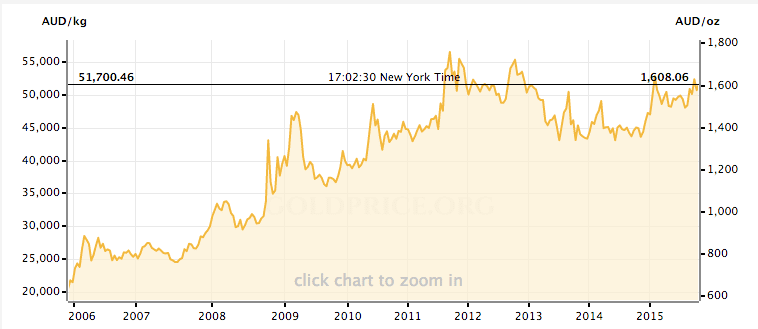

A strong U.S. dollar and lower input costs on the back of sliding energy prices are boosting gold producers in jurisdictions where the currency is weaker. This is particularly true for gold producers in Canada and Australia, where the currencies continue to weaken against the Greenback.

The market may already be giving us a glimpse of this event, with many Canadian-based gold stocks rising post-election.

As I mentioned earlier this year – and after many years of waiting – we may not only be near a bottom for gold stocks, but we may soon see many of them breakout.

Which is why I led this year off with my investment in Canadian-based, Australian gold miner Newmarket Gold (TSX: NMI) (OTCQX:NMKTF) – now up over 80% since my first report.

Newmarket is a perfect example of an Australian gold producer benefiting from lower input costs and a weak Aussie Dollar. Of course, management is superb, and their organic growth through exploration has been spectacular. In just a couple of weeks, the Company is set to announce its Q3, which should give us a glimpse of what’s to come. And looking at some of the numbers announced in recent press releases, combined with the continued strength of the gold price in Aussie Dollar, I expect the Company to have a fantastic quarter, which should help boost their valuation.

Looking to Build

Excluding Newmarket, it’s been a long time since I have added gold stocks to my portfolio. But given the action I have seen in this space, it may be time to include select late-stage exploration/development companies, in addition to a producer like Newmarket.

Regardless of the price of gold, big moves are being made in the sector.

During the last bull market, the big producers acquired a lot of mines in higher risk jurisdictions all over the world. But given the political and price risks associated with those mines, the major gold producers were forced to relinquish many assets, suffering tens of billions of dollars in write-downs over the last few years.

But things are different now.

Gold miners are now close to their cheapest valuation relative to book value in the last two decades, and the big boys have not only cleaned up their balance sheets, but are making moves to replace their lost foreign assets, with assets in safer jurisdictions such as Canada and Australia.

Via Bloomberg:

“The larger miners may be better positioned to consider acquisitions than in 2013 after cutting costs. The 10 biggest producers by sales, led by Barrick Gold Corp., may generate combined free cash flow of $4.17 billion this year, compared with a negative $1.74 billion in 2013, according to analysts’ estimates compiled by Bloomberg. That would be the highest for the group in at least eight years, the data show.”

Furthermore, it appears that the big boys are very actively looking at deals to buy.

Continued…

“Newmont Chief Executive Officer Gary Goldberg said on Sept. 24 the largest U.S. gold producer was searching for acquisitions to add low-cost gold or copper output after asset valuations fell. Goldcorp continues to evaluate potential deals, CEO Chuck Jeannes said the same month.”

Their comments last year spurred an uproar for deals in the gold sector.

In the following months, we witnessed:

- February 2015: Centerra Gold and Premier Gold Mines became 50/50 partners on Premier’s Trans-Canada Property in Ontario.

- March 2015: Goldcorp acquired Probe Mines for their deposit in Ontario.

- April 2015: Alamos Gold acquired Aurico Gold through a merger to gain exposure to its Young-Davidson Mine in Ontario

- April 2015: Yamana acquires Mega Precious Metals for their Monument Bay Gold project in Manitoba.

Notice any similarities?

That’s right, all of these deals were focused on assets in Canada – a safe and stable jurisdiction.

But that’s not the only reason.

As I mentioned before, the strength of the U.S. dollar relative to the Canadian dollar provides an immediate benefit to Canadian gold miners, since mining costs are paid in Canadian dollars while the gold produced is sold in U.S. dollars.

Now if these big producers believe as I do – that the Canadian dollar will remain weak – it only makes sense to make Canadian assets a primary focus. And with Trudeau in power, I believe the Canadian dollar will be even weaker given his “spend now, ask later” policy. And that bodes well for Canadian gold companies.

Start looking for late-stage Canadian gold explorers and developers that the big guys might want to buy. I am.

CLICK HERE to Share Your Thoughts

Seek the truth,

Ivan Lo

The Equedia Letter

Let’s be honest here if things work out well and the economy is OK, the boy will get credit. If things go bad, as I think they will, it will be Harper’s fault. Harper will not get any credit for the good foundation he left.

This boy will seek to glorify himself at whatever the expense-like his father.

This “boy” is going to kick butt – big time! He’s already shown he can, and Canada is already better for it.

I see Trudeau as the ultimate Central Planner, He is passionate, articulate, charming, but his constant butting in during debates tells me has has little patience for opposing views to his own. In other word,s he believes fervently that his idea’s are superior and he can solve all the problems through more government that is virtually guaranteed through more spending. Apparently he has not learned that you can not borrow your way to prosperity., and more than you can pull yourself up by your own boot straps.Neither has he learned as Kevin O’Leary has pointed out, that wealthy people who have the money and know-how to build businesses and create jobs will take their wealth and expertise to where it is treated the best, who can blame them. Just look at France if you want to know where taxing the rich takes you! Socialism has failed wherever it has been seriously implemented and it at best will give no more than a temporary boost to the economy, but in the long term it will fail.

Trudeau is an idealist, an impractical dreamer with little economic sense. He is just another step to One World government by “elites” who crave power and car not one whit for the average person.

Mr.Trudeau has a lot in common with Obama, pre-occupation with self and notions of grandeur. He will promote all that is perceived to be polular but not expedient for the country. He will join in with all the climate change fearmongerers and subject the economy to devastating restrictions, especially the energy sector.

He will hollow out the social and moral heart of the nation by legalizing marijuana, promote all the new sexual behavioural inventions, abortions (under health, ofcourse), he will “celebrate” multiculturalism at the expense of what genuinely is Canadian, he will allow all kinds of influences and practices of foreign ideologies. In less than two years of his type of fiscal management the dollars will sink another 10-15% and the debt rating will also go to the bottom. In the end we’ll all want to smoke pot!

Trudeau is the Joel Osteen of Canada, performing to dazzled audiences hysterical with pseudo worship – a perfect example of Extraordinary Delusions and The Madness of Crowds in the famous tome by Charles MacKay.

Electing Trudeau with a majority is like giving a kid with a learner’s permit the keys to your Bentley.

On stocks: I have shares in St. Andrews Goldfields, a stock that seems undervalued and should be a take over target. 100,000 ounces a year, all in the Timmins area where they employ 350 people. A second one is Alexco Resources, owners of the former Keno Hills silver mine in the Yukon.

Good heads up on Newmarket Gold … you nailed that one !

Ed

Bloated bureaucracy and economic regression.

Trudeau’s failure to understand/care that Canada’s large middle class is primarily built on the backs of oil and gas (where else can labourers make $100K/yr) is going to create a brain drain from Canada. This means oil and gas professionals (the middle class) leaving to work for third world and middle eastern countries with zero to negative effect on his environmental initiatives. But nice hair. Sunny days all y’all!

No ,I did not vote him in. But I will give him a chance.

Unlike most of the rants here socialism has worked very well in certain countries especially in northern Europe . Mr . Trudeau and his liberal party are not socialists or even close to it.

His ecomonic plan will be well thought out and this country very definitely need infrastructure spending as it has fallen apart almost as much as the USA.

Further more Mr Trudeau has absolutely no control over the oil industry and i am sure that he would love to see it rebound.

Climate change is another matter. Only a total idiot would stick his head in the SAND AND SAY that there is not a problem .

When New York and Boston are under water maybe these people will wake up if they have not drowned.

Fixing the environment will create good middle class jobs and this is a part of the Trudeau plan.

So give our new Prime Minister a chance, … and I think we will see excellent results in the future .

PS You Americans can keep Kevin O`leary as we do not want him representing our views.

Trudoh is clueless on how to run a business. He impresses me as someone who is not all that bright. He, like his father will figure out a way to destroy the energy business but in the process suck all money to Quebec or at least eastern Canada as per normal. He has stated this in the past. He has stated numerous times westerners are not capable of running their own affairs. He is totally deficient in understanding cause and effect.

JT is the most inexperienced and unqualified Prime Minister in the history of the Westminster parliamentary system. He has a massive ego, and is the epitome of form over substance. He won the election, however, so we all must hope that he is successful.

Of great concern is that the Liberal establishment is back in charge, and along with that the commensurate curruption and scandals. We saw this in the week preceding the election when is campaign chair was forced to resign because he was already lobbying for the new government on behalf of a company he was being paid by.

I agree that if the economy is successful, the media will increase it’s idol worshiping of hhim and shower his centralized, big government planning philosophy with praise. If the economy recedes, the media will blame Stephen Harper so JT cannot lose.

As for the economy, while it was expeditious and effective to promise tax hikes on the ‘middle class’ through a 4% tax hike on the 1% rich (who JT claims earn $200,000), it will create a penalty for hard work and ambition, and create incentives for businesses to shelter taxes through whatever means are available.

I thinck the new government will promote development of pipelines to the east and west coast and will also invest in building new processing plaants to make finished products and fuels to sell to world markets outher than the usa.the new government will probably rebuild trade with russia and england.you may eventually see the developementbof canadian made aircraft and defence systems.includeing new ship building.there is alot the new government can actually do to attract new investment to canada from around the world. Canada has been stale for too long under harpers rule.the new government also should lock in all existing interest rates on all buisness andbpersonal debt and raisebinterest rates so bancks can pay interest on money so people can save money and accumulate earnings on their money for their retirement instead of haveingballnofvthebinvestment scemes of today.keep it simple.make money have value again and everything else will fall into place..

One definition of insanity is “repeatedly doing the same thing over & over again and expecting a different result every time”!

Canada votes in the Cons and when dissatisfied with them switches to Libs, and then when dissatisfied with Libs, switches to Cons, & then switches to Libs, and on & on, over & over, again & again.

Apparently, after many centuries of experience in being subjected to governance, these are the only really acceptable alternatives to the general public, the other wannabee parties are lame in comparison.

However all Christians Worldwide are praying & hoping for the Kingdom of God to come on Earth, “and all the Governments shall be on His shoulders”. When, as prophesied, Jesus the Lord of all will come to restore sanity to a Planet bent on its own destruction!

Money markets, economies, even civilizations come & go, but the Lord is forever, HE is the alpha & omega, the beginning & the end, and the ONLY way for us humans to gain eternal life and be able to then forget paranoid economic worries, etc., as He can/will supply ALL our needs.

So what do ya think now

Not really a comment on the Gold Company, but it’s interesting that the price of gold is falling as the major Western Governments are printing more and more paper dollars. Shouldn’t the gold price be rising? I’ve read that a lot of people are buying physical gold coins, but perhaps the price remains low because too many of us realize that if the sh-t really hits the fan (and currencies/ stock markets and economies truly collapse) no-one will be trading their food or medicine for useless coins. A small amount of gold might be useful in a diversified portfolio if the Canadian dollar drops. But if the world economy collapses, I’m unconvinced that gold will protect my wealth (and yes, I have seen ads claiming gold protected wealth in the past as currencies failed).

On a side note, I’m tired of listening to all this liberal vs. Conservative hate mail. On a personal note, I don’t like Trudeau. However, the position he holds (democratically elected PM of Canada) needs to be respected. We will rightly scrutinize the actions his government takes- when they actually take any action. But in the big picture, I don’t see huge differences between these two parties. Under Liberal and Conservative majorities Big Banks continued to make record profits from interest paid by taxpayers (governments should only borrow from a zero interest loan from the Bank of Canada). Morally bankrupt politicians fed at the trough of tax payer money. Many native Canadians continued to live in third world conditions. Christians abroad were massacred in over 30 Muslim countries, while our governments did nothing to try and rescue them. Hundreds of thousands of young Canadians had their lives ended in “abortion clinics”… Other than a bit of tinkering (short term bribery) for the voters, what real changes have taken place for the benefit of the people?

Make no mistake this will not be a liberal government. His dad was a socialist through and through. Socialism and deficits are part of his genes. We will not see a balanced budget under his tenure. There is a reason Oboma’s people were up here campaining for him. They are pretty much aligned. Only difference is USA may come out of their mess but we won’t. He’s out to shut the oil industry down not build pipelines.

How long before Western separation rears its head??

Oil is a global commodity governed by the the simplest of all economic law of Supply and Demand. There nothing anyone can do to fix the oil situation. Only the global market can impact its future.

It’s not The new govt’s failure. It is the previous govt’s putting all its eggs’ in one basket.

Renewable energy is unlimited SUPPLY by definition. So is the appetite or DEMAND for it. What is missing is the govt’s leadership & long term vision and the Canadian political will to accept this new reality. Energy from renewables is not as portable as that from from fossils. Hence the the glacial adoption from jursdictions rich in oil like Canada. Europe, in general and Germany in particular is the complete. Hence it is the leader in devopment & adaption of renewables.

After WWII, massive investment in road construction enabled the North American economy, fuelled by transportation & low price of oil, to exponentially grow. Unfortunate & unforeseen side effect took several decades to manipest in disastrous climate change.

Such may not be true of renewables. Technologies are available but more innovation are needed now and the foreseeable future.

Canada’s geography, with the long term effect of climate change, is ideal for wind, solar, hydro, geothrmal & even tidal energy sources. Even alcohol from renewable farming & forest by-products. Tapping theses resources needs long term investments measured in years or even decades. The same is true for mineral resource developments.

Our financial institutions must invest in renewables above ground resources with the same enthusiasm as they do inthose under the ground.

Do we have rare earth metals in Canada? Yes! Do we have favourable amount of sunlight?. Yes! Do we have land acreage required in solar farms? Do we have engineers to undertake solar energy project? Yes! How long ago do we have them? Decades ago!

What don’t we have? Political will to support unpopular, inglamorous, in-sexy long term projects.