Dear Readers,

Something BIG is happening in the gold sector.

Yet, the media has been extremely quiet about this. But those who are “in-the-know” are quietly making moves before things get out of hand.

And that means time is running out.

Today, I am going to introduce you to a Company that is primed to take advantage of this situation.

Any time now, the Company is expected to make a game changing announcement.

More on this in a bit.

Last week, I mentioned that regardless of the price of gold, big moves are being made in the gold sector.

During the last bull market, the big producers acquired a lot of mines in higher risk jurisdictions all over the world. It was a feeding frenzy as the price of gold shot to record highs.

But with gold’s reversal, the political and price risks associated with those mines no longer made sense. Thus, the major gold producers were forced to relinquish many assets, suffering tens of billions of dollars in write-downs over the last few years.

Things are different now.

Gold miners are now close to their cheapest valuation relative to book value in the last two decades, and the big boys have not only cleaned up their balance sheets but are making moves to replace their lost foreign assets with assets in the safest jurisdictions in the world.

In 2013, the ten biggest gold producers combined for a negative cash flow of $1.78 billion. Last year, the same group generated combined free cash flow of $4.17 billion.

Today, most of the senior gold-mining companies are expected to report significant free cash flow this quarter compared to last. BMO says that “the prospects for the sector to generate free cash flow improve for 2016E even at $1,100/oz.”

Now that the producers have beefed up their balance sheets, they are actively pursuing new assets in safe jurisdictions.

And from that standpoint, Canada has emerged as the most mining friendly jurisdiction in the world.

Canada also has the advantage of a weakening currency – a trend I expect to continue.

The strength of the U.S. dollar relative to the Canadian dollar provides an immediate benefit to Canadian gold miners since mining costs are paid in Canadian dollars while the gold produced is sold in U.S. dollars.

The combination of a weak currency and stable jurisdiction makes Canada one of the best places in the world to produce.

It’s no wonder why big producers have been, and continue to be, aggressively pursuing assets in Canada.

As I mentioned last week, we have already seen a rush to Canadian gold assets:

- February 2015: Centerra Gold and Premier Gold Mines became 50/50 partners on Premier’s Trans-Canada Property in Ontario.

- March 2015: Goldcorp acquired Probe Mines for their deposit in Ontario.

- April 2015: Alamos Gold acquired Aurico Gold through a merger to gain exposure to its Young-Davidson Mine in Ontario

- April 2015: Yamana acquired Mega Precious Metals for their Monument Bay Gold Project in Manitoba.

- October 2015: Alamos just bought out Carlisle Goldfields for a premium of 62% to Carlisle’s closing price on October 14, 2015, and a 117% premium to its 30-day volume-weighted average price

Now that all sounds great, but there’s a big problem: There just aren’t many advanced-stage, low-cost, high-grade, undeveloped assets left in Canada.

Those who fit the profile now have a big fat X painted on their back.

And I believe no other Company has a bigger X than the one I am about to introduce.

This Company not only ticks every check box that a major wants to see, but just made a massive discovery this year on an asset with critical mass.

Haywood Securities says that this Company’s flagship asset “has the potential to be financed and quickly put into production, given the location, existing infrastructure, and good grades.”

Macquarie Research says this Company’s asset is “well-located, near-permitted gold asset with critical mass…we would be buyers of this emerging gold production opportunity.”

Cormark Securities calls this company is one of their “favourite Canadian developers.”

Paradigm Capital says this Company’s asset is “one of the most appealing small development projects owned by a junior and an increasingly appealing takeover candidate.”

If you’re looking for:

- A near-term high-grade production opportunity with excellent infrastructure

- Major exploration upside with critical mass

- A potential takeover target in one of the best jurisdictions in the world

- One of the most aggressive exploration juniors in the world

- A company very much undervalued when compared to its peers

Look no further than:

Integra Gold Corp

(TSX-V: ICG) (OTCQX: ICGQF)

We’re not the only ones who think so.

Every analyst covering this story – and there are many – have buy ratings for Integra Gold (TSX.V: ICG) (OTCQX: ICGQF) with price targets well north of where Integra trades today.

That’s because they believe that Integra is one of the top takeover targets – especially given the significant events that have occurred this year.

GMP Securities also jumped in last week with a target price that’s more than double where Integra trades today.

GMP Securities also jumped in last week with a target price that’s more than double where Integra trades today.

But that’s not all.

In just a few weeks, I expect every analyst covering Integra to dramatically change their views on the Company.

Why?

Because Integra is expected to make a very big announcement – one that has the potential to significantly increase its value, resulting in an even bigger discount to Integra’s current share price.

This announcement could literally transform the Company and immediately light fires under those looking to acquire the best undeveloped Canadian assets.

I’ll get back to this later.

First, let’s talk about why every major is likely looking at Integra.

The Best Jurisdiction in the World

Long time readers know that one of my favourite jurisdictions for gold production is the Abitibi Greenstone area.

That’s because outside the Witwatersrand Basin in South Africa, no other area on Earth has produced more gold than the Abitibi Greenstone Belt of Quebec and Ontario, Canada.

The belt has been home to more than 100 mines producing over 180 million ounces of gold and is home to some of the world’s most famous deposits in the prolific regions of Timmins, Kirkland Lake, Rouyn-Noranda, Bousquet, and Val-d’Or.

And given the weakening Canadian Dollar, undeveloped, advanced-stage assets within these areas are even more attractive than ever.

The Asset

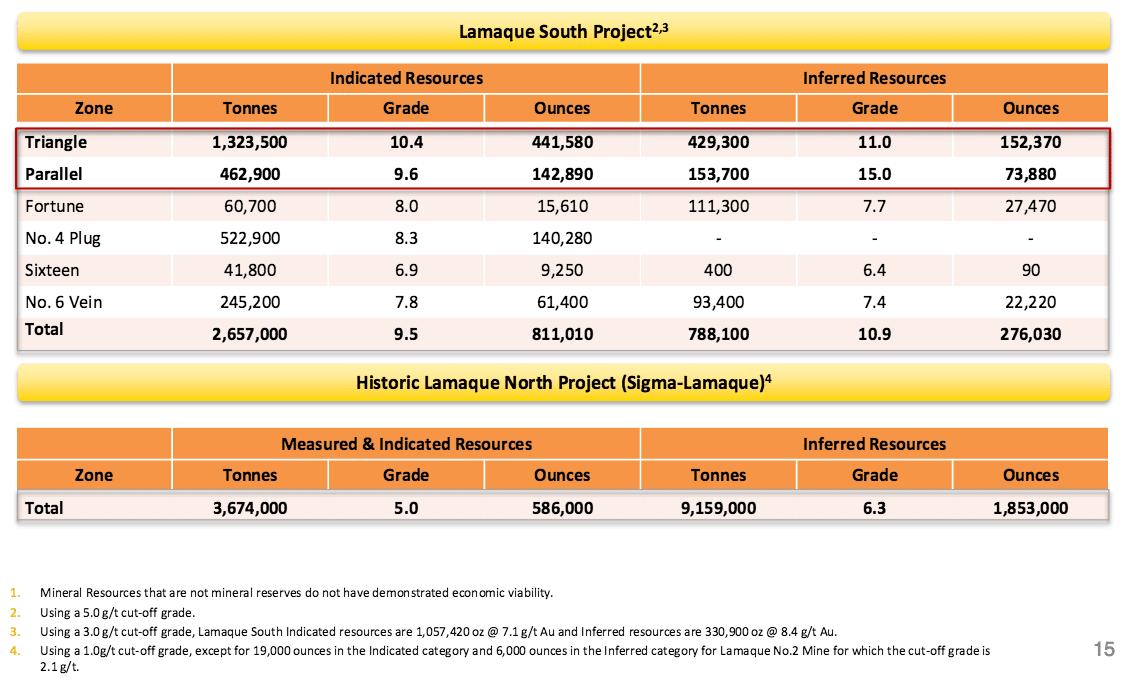

Integra Gold Corp (Integra) is a Canadian-based company focused on production planning for its 100%-owned, well-located, advanced-stage, high-grade 1.1moz (5g/t Au cut-off grade) Lamaque South gold project in one of Canada’s premier gold producing districts, the “Valley of Gold,” Val-d’Or, Québec.

Val-d’Or is a modern mining town with a population of 35,000 and advanced infrastructure. It has paved highways, access to low-cost power, water, and mining services and equipment. It also has a highly skilled and experienced workforce – so many that Integra’s management has received over 600 resumes from skilled miners, geologists, and contractors already.

Now before we get into the details of what I believe is one of the premier assets in Canada, let’s first talk economics – because geology doesn’t matter if the numbers don’t make sense.

Integra’s Lamaque: It Just Makes Sense

Integra’s South Lamaque project offers one of the highest IRRs of any development-stage gold project, one of the lowest pre-production capital requirements, and a low all-in sustaining cost.

In other words, it’s cheap to build and cheap to produce.

Take a look:

- Base case pre-tax IRR of 77% and NPV (5% discount rate) of C$184.3M (after-tax IRR of 59% and NPV of C$113.5M)

- Pre-production capital requirements of only C$61.9M

- Pre-production period of only 18 months

- Life of mine (“LOM”) cash cost of C$551 per ounce and all-in sustaining costs of C$731 per ounce

How is Integra able to build a mine for so cheap? How is it able to build one in only 18 months?

That’s where Integra’s management has shined.

Last year, Integra’s management team, led by Stephen De Jong, negotiated the consolidation of two significant properties in Val-d’Or that should have been consolidated many years ago: the Sigma and Lamaque.

Steve and his team were able to do what no one could in 80 plus years.

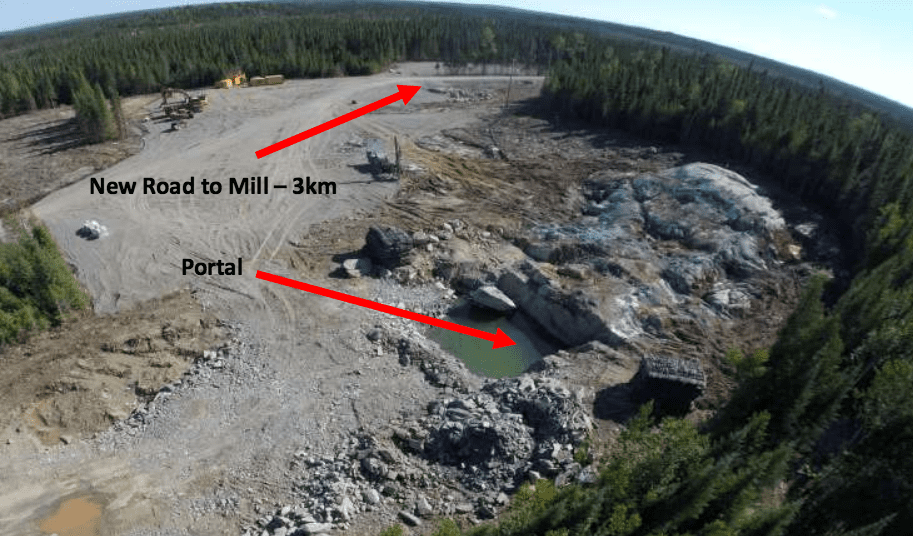

The consolidation immediately gave Integra a fully permitted, well-maintained, 2,200-tonne-per-day milling complex (that was still being used just a few years ago) located less than 500 metres from the boundary of Lamaque South.

It came with a tailings facility with 2 to 3 years of current permitted capacity and additional room available by raising the dam.

The acquisition also included three portals, mechanical shop, dry room, maintenance equipment, office, and all mining concessions and mineral claims on this past-producing property.

To build that type of infrastructure today would cost $100 million*.

How much did Integra pay? Only $8 million. What a great deal for shareholders.

(*It’s interesting to note that when the company that had this asset (Century Mining Corp) was acquired in 2011 by White Tiger Gold the deal was initially valued at $740 million. I’d say $8 million is a great deal!)

More importantly, the acquisition came with a very important piece of the puzzle: a permitted underground infrastructure.

Why is this important?

Without permits, a project is worthless. A permitted underground infrastructure means Integra already has environmental permits in place, and that is the hardest permit of all to achieve.

All of this makes the Integra value proposition extremely attractive.

But we’re not even close to being done.

Here’s the kicker: The PEA was conducted in January and uses an old mineral resource estimate that doesn’t include drilling completed since April 2013, or any of the Sigma/Lamaque mineral resources obtained in the acquisition.

Integra will have drilled nearly 100k metres before the year is over, and much of it has returned great results. You can do the math.

So as good as the numbers are in their most recent PEA, you can throw it out the window because the numbers are about to get better.

The question is: How much better?

To answer that, let’s look at Integra’s geological potential, which, as Macquarie Research says, “…is reaching critical mass.”

A Giant Gold System

Integra’s property is divided into three clusters: North, South, and West. The two main zones are the high-grade Parallel Zone in the North, and the Triangle Zone in the South, both of which are only 1km apart – and both less than 3km from Val-d’Or.

Those in the mining community are no strangers to this property, which, between Sigma and Lamaque, historically produced over 9 million ounces of gold since the 1930s.

In other words, Integra owns a giant gold system with a long production history.

In 2010, Integra began to explore these assets and have drilled to date nearly 200,000 metres.

Over the course of this drilling, they discovered a “New” Lamaque, which hosts an indicated resource of 1.06 million ounces grading 7.1 g/t gold and a total resource of 1.39 million ounces grading 7.4 g/t gold (see full details here.) The current resource here extends from surface to around 620 metres vertical depth and remains open to depth.

To give you an idea of how big Integra’s assets may become, its worth comparing them to the old Sigma and Lamaque mines.

Sigma and Lamaque

Lamaque produced 4.6 million ounces, while Sigma produced 4.9 million ounces. Both of the mines are only 500m apart and are considered some of Canada’s largest gold mines.

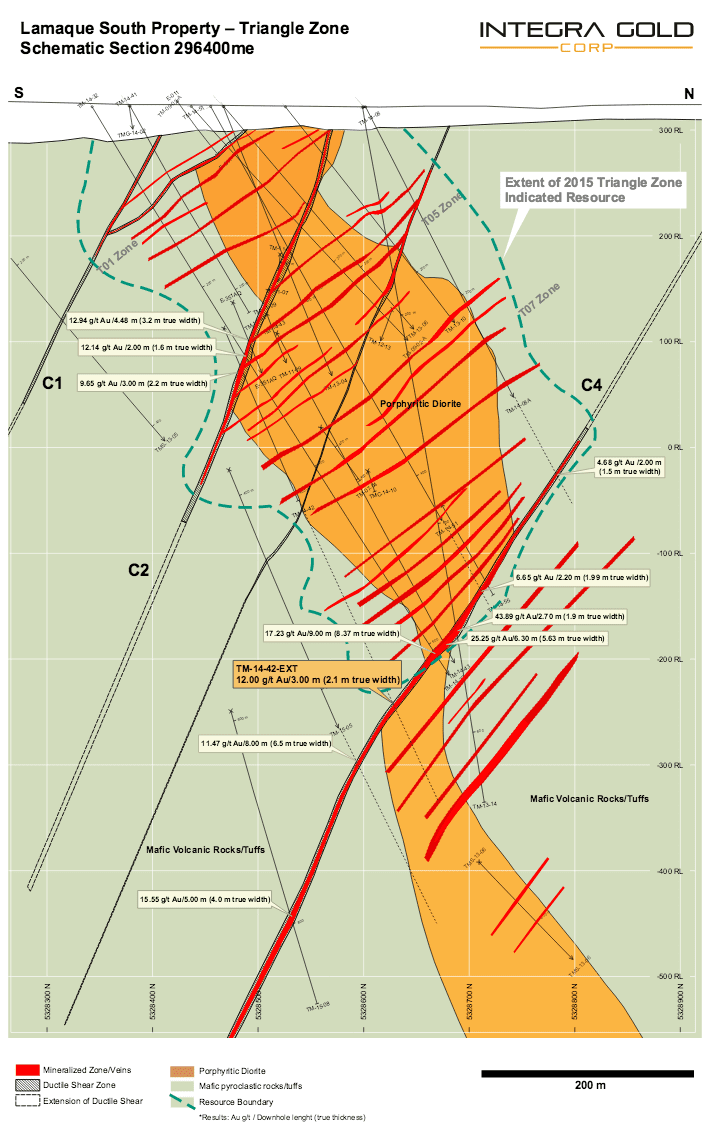

Within these two mines are a perfect model of geology for Integra to work with. They are very similar, with the only difference being that Lamaque is more of a vertical pipe plug, whereas Sigma is like a vertical pipe plug smeared out a kilometre wide.

The structures of the New Lamaque and other zones that Integra has discovered are very similar in nature to the Sigma and Lamaque historic mines, and can be described as “plugs” of mineralization.

When you get into the geology, it is these intrusive plugs that are exciting.

Integra modeled their exploration plan after the plug at the historical Lamaque mine, where the main intrusive plug accounted for over 80% of the 4.6 million ounces that mine produced.

Why is this important?

Let me explain.

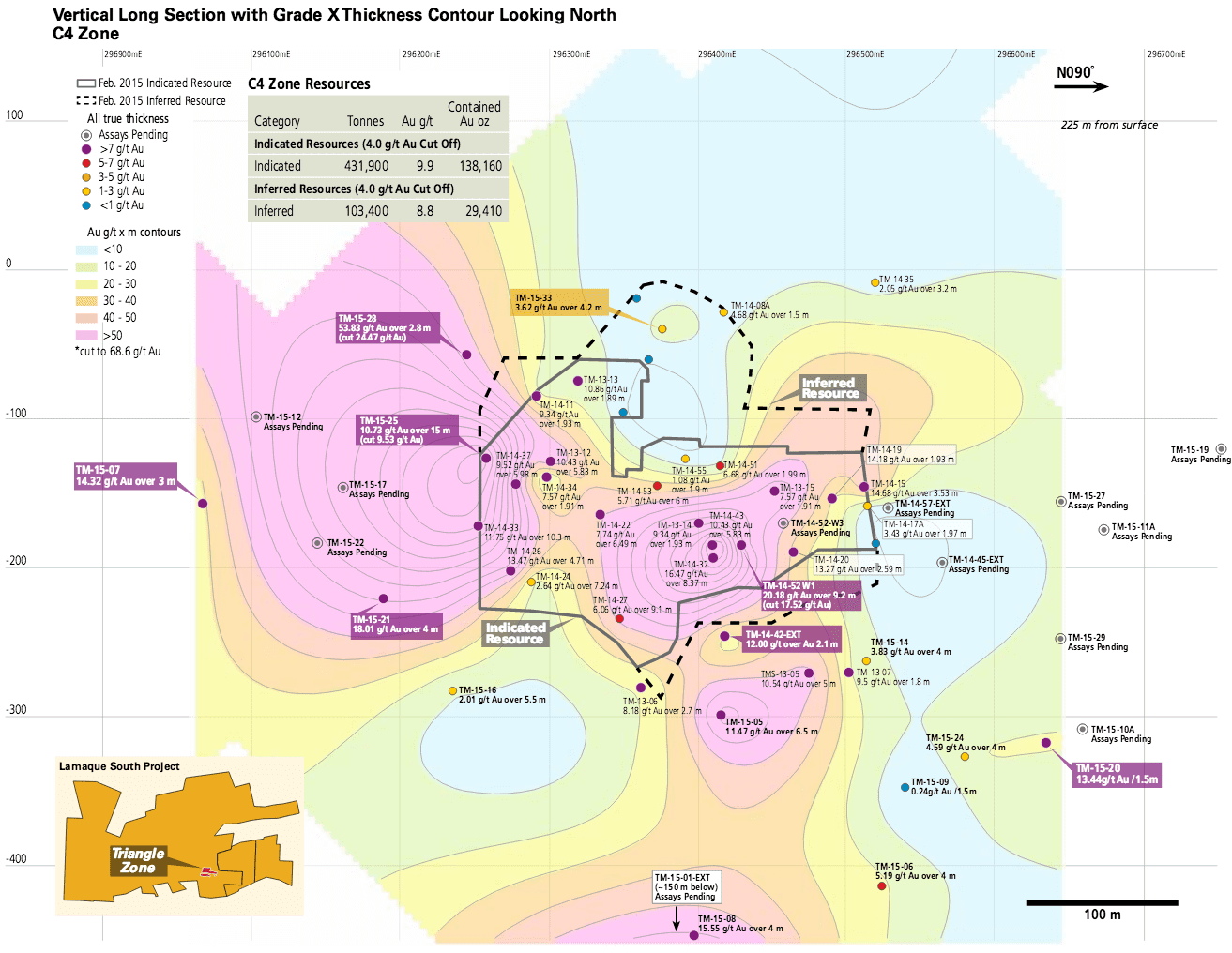

When Integra initially discovered the Triangle Zone, they initially thought that it was a pipe – much like the Lamaque historic mine. An easy explanation would be to imagine a vertical pipe with gold in it.

Because of the similarities between the structures, Integra modeled their exploration of the Triangle Zone after the Lamaque mine. When they drilled, they always drilled straight down from atop the plug.

As they drilled, they kept hitting gold, so they went deeper and deeper and continued to hit. They were focused on the plug, but to get to the lower section, they had to step out so they could drill in because the drill holes tend to go sideways.

But what they discovered was something extremely special.

To their surprise, as they stepped outside of that pipe, they actually continued to hit mineralization. So now a zone they thought was only 300m wide, all of a sudden is now 700 m wide. And they still haven’t found the edge!

That’s when things completely changed for the Triangle Zone and Integra.

That’s when things completely changed for the Triangle Zone and Integra.

What they thought was a Lamaque-style plug, is turning out to be more like a Sigma-style plug – one that could be even bigger.

Integra has now expanded the total area where it can go hunting for new ounces, which means it has the potential to make new discoveries in overlooked areas of Triangle Zone – many of which include shallower targets.

To put that into perspective, the Triangle is sitting next to a historic mine that was 2km deep and up to 1.5 km wide. And the resource at Triangle is already bigger than it ever was at either the Lamaque or Sigma mines..

The largest resource recorded at Lamaque was 500k ounces – yet it produced 4.5 million ounces of gold.

If you look at the footprint of the Triangle zone, they’re now down to 750 m, and 600 metres wide – that’s nearly twice is big as before.

But that’s not all.

Before, they used to think that all of the mineralized veins sat between 40-45 degrees – a more horizontal system. Horizontal veins are harder to mine because you have to pull the rock out along flat drifts. But recent drilling shows that the veins are actually 60-70 degrees, and that means they can let gravity do the work for them, making it cheaper and safer to mine.

These new sets of veins dip more steeply, have higher grades, and extend beyond the intrusive plug into the surrounding volcanic rock.

All of this means the economics of the project continue to get better and is substantially bigger than what they ever thought.

Bigger and Better than Ever

In the previous PEA, the Triangle Zone accounted for nearly 44% of the recovered ounces; it is the primary economic driver of the Lamaque Project.

Just imagine what these new structures will add to the ounces at Triangle going forward.

Laurentian Securities summed it up:

“The Triangle Zone has never been more important to ICG. We are confident Integra could increase the resource package and, more importantly, also increase ounces per vertical meter. A higher ounce per vertical meter number lowers necessary development to maintain production; effectively reducing sustaining CAPEX. With the steeper structures, Integra will need to redesign its mine plan and mine technique. At a bare minimum, we would expect dilution to decrease resulting in a higher head grade and subsequently lower cost. – Laurentian”

The significance of the discovery at Triangle has driven an already active explorer, into the most aggressive exploration junior in the world.

This year, Integra will drill nearly 100,000 metres.

Next year, they’re expected to drill another 100,000 metres.

This means they will be news heavy – which is important to keep the momentum going in the right direction.

The Big Announcement

We’ve talked about how big Integra’s discovery could be, but what does it mean? Well, we’re about to learn just how big things have become.

Any time now, Integra is expected to announce an updated resource calculation – one that includes another 30,000 metres of drilling.

I suspect that this upcoming resource calculation will completely change the economics of Integra’s project.

If you look at the last PEA, the numbers were great: 77% IRR, $185 million NPV. But not only did that PEA have a much smaller resource, it had a much more expensive mining method.

Integra now has a much bigger system with higher grades, and their new understanding of the geology is proving that its going to be cheaper to mine than before.

None of this information has ever been added to Integra’s resource and PEA calculations. And for the first time, it will be included in the upcoming resource calculation.

While Integra continues to expand the system, it’s been quietly doing something very important – something that makes them an even bigger target for a near-term takeover.

Not Just an Exploration Company

If Integra was just an exploration company, all you would see are trees, swamps and drill rigs. But they are much more than that.

Take a look at what Integra has done over the last four months.

They’ve been busy blasting and clearing out rocks and doing a lot of construction work to get ready to go underground. All of this has been happening while Integra has kept the public’s focus on its exploration.

Why? Because there are the two questions every explorer is asked:

- How much gold do you have? (how big is your resource?)

- How far are you away from production?

By starting the work to go underground, Integra is fast-tracking the road to production. So not only are they expanding the resource on one side, they’re actually decreasing the timeline to production at the same time.

But more importantly they’re not just waiting for someone to take them out: a year from now they’re likely going to be underground doing exploration work and the next year they’re likely going to put this into production.

So if you were a major looking to buy an asset, would you rather buy one that is 24 months away from production, or one that is 18 months?

It’s easy for a lot of juniors to claim they are a take-out target; Integra’s management doesn’t, but it clearly is.

And here’s where Integra once again separates itself from almost every other junior explorer.

Eldorado Gold Makes a Move

Eldorado Gold is a technically sound, low-cost, major gold producer based in Canada.

Yet, the Company has no Canadian assets or revenue.

Eldorado has built its business on foreign assets, including Turkey, China, Greece, Brazil and Romania. Around 40% of its NAV is composed of high-grade development-stage assets in Greece.

On August 19, 2015, the left-wing government of Greece revoked Eldorado’s permit for the Halkidiki mine after the Greek Energy Ministry revoked approvals for technical studies in the region.

This forced Eldorado to suspend all its activities at the mine, putting over 1300 employees out of work.

Eldorado has already sunk US$600 million (CDN$786 million) since 2012 and plans to invest another US$1 billion in its quest for gold, copper and zinc at two other sites.

This was obviously not a good sign.

In early October, Eldorado was finally allowed to temporarily resume mining operations in northern Greece until a final court ruling is made.

Over the last few years, Eldorado’s Greece operations have been met with a lot of Greek protests, leading to many arrests. The bottom line is simple: Greece remains a risky bet for investors.

In other words, Eldorado needs to diversify.

And what better place to look than in the most stable mining jurisdiction in the world?

Just a day before Greece suspended Eldorado’s mining activities, Eldorado announced that it would be putting C$14.6 MM (at C$0.28 per share) into Integra Gold to get a 15% equity ownership in the Company – a premium to market value at the time.

Obviously, it’s not the money that matters here.

What matters is that Eldorado is a very technically sound company that invests and buys only the lowest cost, critical mass producing assets – that’s why it has always invested in foreign projects.

If you take a look at Integra’s PEA – which is only expected to get better – it falls directly in line with Eldorado’s mindset of being a low-cost producer.

Via Eldorado Gold:

“Based on our continued strong results, we are upgrading our 2015 production guidance to be 710,000 ounces of gold at average cash costs of $565 per ounce and all-in sustaining costs of $870 per ounce.”

Note the average cost per ounce and all-in sustaining costs.

Now note Integra’s projected life of mine (“LOM”) cash cost of C$551 per ounce and all-in sustaining costs of C$731 per ounce – both are lower than Eldorado’s.

The triple whammy of low cash costs, stable jurisdiction, and weakening Canadian Dollar, makes Integra a prime target for Eldorado – that, and having recently put in $14.6 million into the Company.

But there’s a fourth whammy.

The investment into Integra is Eldorado’s first investment ever into a Canadian asset – the first investment into North America for that matter.

Why is this important?

Because Eldorado is a Canadian company with no Canadian revenue.

That means all of Eldorado’s corporate Canadian G&A (General and administrative) costs can’t be written off against taxes. It may not sound like a big deal, but Eldorado’s average G&A costs over the last couple of years were nearly US$70 million per year. How much of it is attributable to Canada is unknown but being a Canadian based company, I would assume it’s a lot.

This isn’t something new.

Tax benefits can play a big role in takeovers.

We saw the tax benefits when Canadian-based Alamos acquired Aurico; we saw the same when Centerra Gold partnered with Premier Gold Mines on Premier’s Trans-Canada Property; we saw the same when Yamana and Agnico took on Osisko.

So if you’re a Canadian-based companies with no Canadian revenue looking to acquire Canadian production, the tax benefits equate to a significantly cheaper acquisition price – especially over the life-of-mine which is often over five years – that’s years of write-offs on tens – maybe hundreds – of millions of dollars.

Eldorado’s investment into Integra a day before Greece’s actions was not a fluke. It looks to me like Eldorado is looking to diversify its jurisdictional risk while exploiting potential tax synergies that will affect its bottom line.

Eldorado has over US$380 million as of its last quarterly statement, which means it has plenty of cash for an attempted buyout.

And just to give you an idea of Eldorado’s past investments:

- Six months after buying 19.8% of Sino Gold, Eldorado acquired the whole Company

- Eldorado owned 19.9% of the shares in Glory Resources before buying them outright in October 2013.

In other words, Eldorado has a track record of not only following through on its investments but does so very quickly.

The fact is, if Eldorado – or any other major – was looking to acquire low-cost, high-grade, near-stage, Canadian production assets, they don’t have many choices. The project pipeline simply isn’t there.

We’ve already witnessed many Canadian deals over the last year, which means the pipeline is shrinking.

Oh, and lastly for Eldorado, I would bet that, unlike Greece, no one from the town of Val d’Or would try and stop Integra’s project

Back to the Asset

In just a few months, Integra is also about to get a whirlwind of coverage.

You see, Integra also has potential upside from another zone: the Lamaque Deeps.

But to explore that area would cost millions of dollars, and more importantly, take up a lot of time.

Both Integra’s CEO, Stephen De Jong, and its Chairman George Salamis, are two men who are willing to not only take risks but do things outside the norm. That is one of the reasons why Integra has done so well, and why Integra was able to consolidate two major properties when no one else could over the last 80 years.

And in a few months, they may pull off another massive win.

The Gold Rush Challenge

Long-time readers have heard me tell of the Goldcorp story and how Goldcorp harnessed a technological trend that most in the industry would have shunned.

Via My Letter, “The Gold Super Hero“:

“McEwen wanted to take all of the data the company has spent creating in the last fifty years, and he wanted to share it openly with the world by posting it on the internet: “Then we’ll ask the world to tell us where we’re going to find the next six million ounces of gold.”

At first, Goldcorp’s geologists were appalled at the idea of exposing their fifty years of secret data to the world. And they had good reasons to be. The mining industry is an intensely guarded business, and geological data is to miners what treasure is to pirates. Giving this sort of data away could not only subject you to takeover risks but can also imply that your company no longer has the ability to move forward on its own.

Despite the inherent risks, McEwen decided to push forward and in March 2000, he launched the “Goldcorp Challenge.” They posted every bit of information they could on their 55,000-acre property through their website and set up a contest offering $575,000 worth of prize money to the participants that could show Goldcorp the best methods and estimates on their property. As a result, Rob McEwen, the leader of Goldcorp, turned his destined-for-failure $100 million company into a company today worth billions of dollars.

McEwen’s courage to challenge the mining industry’s safe-keeping of geological data reveals to us that change can lead to astonishing results.”

After many years, Integra is about to do the same for its Lamaque Deep project – only this time, there’s much better technology.

Via Integra:

“Integra Gold owns the intellectual property on more than 6 terabytes of digital mining and exploration data, spanning more than 75 years of mining activity and 9 million ounces of gold production in Val-d’Or, Québec. Many millions of dollars has been spent by others acquiring this digital data – it’s now time to use it…”

Now here’s the exciting part: None of the Lamaque Deep is included in any of the resource calculations.

If, through this Gold Rush challenge, Integra can make a discovery, their 2,200 tpd mill could easily handle excess capacity. That means Integra has the potential to DOUBLE the annual production.

Instead of potentially being a potential 100k ounce producer, it could become a 200-250k ounce producer. That’s more than enough to get anyone’s attention – especially in that jurisdiction!

You can bet that other majors are already looking at the data from the Lamaque Deep, which means they could already be making their own assessments on its value.

That’s extremely exciting.

Integra going to get a lot of exposure from this, and its going to be the talk of the mining community when it announces the results at the world’s biggest mining conference, the PDAC, early next year.

Risks

As I always say, there are risks in all investments and Integra is no exception. What we need to do is weigh the risks vs. reward.

The obvious risk when investing in a gold company is the price of gold. But, like Australian miners, companies operating in Canada are backstopped by a currency that is weakening against the Greenback. I showed you this last week.

And since Integra isn’t yet a producer, it won’t have to manage cash flow issues – especially since it has around CDN$25 million in the bank.

The other risk is capital structure.

Integra has nearly 350 million shares outstanding as a result of all of the work the Company has done. While generally this is a headwind for an early-stage company, it can often be of benefit to acquirers. The share structure provides liquidity, and given Integra’s track record of volume and institutional demand, it could prove to be a benefit for those who want big chunks of Integra at a time.

This was most recently witnessed when 25 million shares held by Samson Bélair/Deloitte & Touche Inc. acting as Receiver of Century Mining Corp. in connection with the Company’s October 2014 acquisition of the Sigma-Lamaque Milling Facility, were all acquired by a group of international institutional shareholders in the open market.

With that perceived overhang out of the way, Integra’s shares have climbed – proving that institutional support is there in a big way. In October, Integra traded more than 60 million shares and was one of the most – if not the most – liquid stocks on the TSX Venture.

To add to the backstop, Integra is proving that its asset has critical mass, with drilling that proves the trend should continue. With 100,000 metres of drilling scheduled for next year, and an imminent updated resource estimate due, the catalysts to propel the Company are strong.

That means there’s lots of news flow ahead.

Conclusion

I believe management is every bit as important as an asset.

The Company is run by a lot of guys with heavy senior experience in that jurisdiction and led by a young, competent, bright, well-spoken, no-ego, CEO whose not afraid to take risks. Those qualities are very lacking in an industry that hasn’t changed in decades.

Furthermore, while analysts rarely talk about this, the IR group at Integra is extremely investor friendly – something that I have stressed to every public company is one of the most important aspects of being a public Company: you are only worth what your shareholders believe you are worth.

From an overall sector standpoint, I could go over all of the reasons why gold remains a sound and solid investment.

I could tell you that in India, gold may soon pay a dividend.

I could tell you that China has been selling US Treasurys to buy gold.

I could tell you that even Ben Carson, a candidate for President of the United States in the 2016, questions fiat money.

I could even tell you that a bank was just found to have used gold-plated metal as part of its “gold reserves.”

But the truth is, none of that matters. Gold will do what it is going to do, but it most certainly won’t disappear. And if the price of gold does fall further, you can bet the M&A scene will become more aggressive.

So let’s talk about what we do know.

Integra is expected to announce an updated resource that will be a major game changer for the Company.

The Company remains cheap relative to peers, and could be even cheaper after the updated resource comes out.

Integra is not only in one of the best jurisdictions in the world in a modern mining town, but it is a near-term production opportunity with:

- a very competent team

- exploration upside

- excellent infrastructure

- underground permits

- critical mass

- the backing of Eldorado

- no debt

- and lots of money

And while I don’t want to focus on Integra being a takeover target, it truly is one of the prime targets.

Personally, I would be shocked if Eldorado, or another major, doesn’t make a move within the next year. With an updated resource coming out, another 100,000 meters of drilling expected, and the potential at the Lamaque Deep through the Gold Rush challenge, anyone looking at acquiring Integra better move fast – because the price is likely going higher.

As Mackie Research put it: “The Real Action is just getting started.”

Integra Gold Corp

Canadian Trading Symbol: (TSX-V: ICG)

US Trading Symbol: (OTCQX: ICGQF)

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

We’re biased towards Integra Gold Corp because they are an advertiser. We don’t currently own shares at the time of this writing, but are looking to buy shares following this report. We also own options in the Company. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Integra Gold Corp. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Integra Gold Corp and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Thanks for another well researched company. I am up up nearly 100% on Newmarket and will be taking a dive into ICG. The money from Eldorado is a big deal, bigger than what people make of it imo

Why would ELD not buy Integra? Are they waiting to see the drill results or resource? If the drill results from next years planned program is good, its a no brainer that ELD will buy ICG.

way to many shares outstanding…………buy after the big roll back