Dear Readers,

Gold was hovering around US$1320/oz. at the time.

Take a look at what gold stocks have done in the days following that Letter:

Earlier this week, gold climbed to over US$1360 before it was smashed back down by a so-called “great” jobs report – which I’ll discuss in an upcoming Letter.

Regardless of the gold smack down, gold’s recent move higher sent stocks in the Equedia Letter portfolio to new highs.

Our latest gold idea just hit a high of CDN$2.24 this week – a potential gain of over 20% in less than 2 weeks since the idea was announced in the last Letter.

The gold idea before that is up over 60% in the last few weeks.

What about one of the most aggressive gold junior explorers that was introduced last November at a price of CDN$0.335?

It climbed to a new high of $0.96 this week – a potential gain of over 186%*

And the Aussie gold producer led by a stellar management team that was introduced last year at CDN$0.82?

It hit a new high of CDN$4.71 this week – a potential gain of over 474%.

*Calculated from the price at introduction to 52-week high following the introduction.

It’s not just the latest ideas that have shown our readers success – nearly every one of our Equedia Investment ideas over the last year has shown tremendous profit potential since their introduction in this Letter.

Timing is Everything

No matter how good you are at selecting stocks, or how strongly you believe in certain economic outcomes, your ability to succeed boils down to one critical factor: timing.

Since the financial crash of 2008, you’ve read numerous newsletters and articles on why the stock market was supposed to crash, why it shouldn’t be so high, and why gold and silver should do nothing but climb to the moon.

But after gold climbed to a record high of nearly $2000/oz., it lost more than 40% in short time. This sent gold and silver stocks down tumbling, which led to a near complete failure of the junior resource market in Canada.

Meanwhile, US stocks surged, while gold bugs continued to tell us that gold would hit $5000/oz. – but it hasn’t even come close.

So how could so many newsletter writers, analysts, and experts have been so wrong?

Well, they weren’t – not in their analysis anyway.

But they were wrong in their timing.

And timing makes the biggest difference when it comes to investing.

The Biggest Difference

A couple of years ago, I told readers that gold stocks simply weren’t ready to go.

Meanwhile, I am sure you read numerous other investment publications that told you otherwise – that gold was about to climb to the moon.

If you listened to me, you wouldn’t have made any money.

But if you listened to them, you would’ve likely lost money.

Take a look:

Not longer after that, my sentiment changed…

Sentiment Change

What I witnessed in July 2015 (see above chart) was the catalyst for what I felt was the bottom in gold and gold stocks.

Here’s an excerpt from my Letter in July 2015:

“…This week was one of the worst weeks for gold, as a bear raid forced its price down to the lowest level in five years. It sent the benchmark Philadelphia Stock Exchange Gold and Silver Index of the largest producers to its lowest since 2001.

But shortly after the last time we witnessed panic selling like this, the leading gold-stock index more than quadrupled in value, and many of the smaller gold miners with strong fundamentals climbed even higher.

Gold stocks are now trading at fundamentally ridiculous price levels today and have never been cheaper relative to the gold price itself. This is an anomaly that simply isn’t sustainable.

Which is why I believe that gold’s actions this week may have just set us up for an incredible opportunity. It couldn’t have been timed better.”

Okay, so the leading gold-stock index hasn’t quadrupled in value – yet. But the GDX (VanEck Vectors Gold Miners ETF) is up well over 110% since that letter, while the GDXJ (VanEck Vectors Junior Gold Miners ETF) is up over 150%.

And the Company I introduced in that Letter (one of the smaller gold miners with strong fundamentals)?

That one did more than quadruple in value.

I know many readers that made a small fortune on that one company alone.

If you bought gold stocks in 2014, you would’ve likely lost money the following year; if you bought them after the July Letter in 2015, you could’ve made a lot of money.

Clearly, timing plays a most important role when it comes to investing.

Which is precisely why I want to give an update on a Company I introduced earlier this year.

A Timing Opportunity

I think we’re being presented with another great “timing” opportunity…

It’s not a gold stock, but I believe that shares of this particular Company won’t stay this low much longer.

That’s because very specific clues hidden in the press release of this Company tells us that something big is about to happen.

And it’s being reflected in the way the Company has been trading over the past weeks.

The support levels of this stock are beefing up and those wanting to accumulate appear willing to pay higher prices. Sellers are also becoming more hesitant to sell. And they should be…

This could be the last time we see shares of this Company trade this low.

NexOptic Technology Corp.

(TSX VENTURE: NXO) (OTCQB: NXOPF)

If you have been following this Letter, you would know how excited I am about NexOptic Technology Corp. and one of its Canadian-born technologies that could change the way we see the world.

If you haven’t read my initial report, you can by CLICKING HERE.

In short, NexOptic Technology (TSX-V: NXO) (OTCQB: NXOPF), is an innovative company developing disruptive lens technologies that could revolutionize conventional lens systems.

Its core technology breaks the basic fundamental of traditional optics: that apertures need to be curved and circular. This is a formula that hasn’t been broken in over 400 years!

The company is utilizing flat lenses for imaging with its patent pending Blade Optics™ technology. And they will first demonstrate their breakthrough via their Proof of Concept Prototype (POC), a first-of-its-kind imaging telescope that’s much shorter and more compact than the traditional telescopes we’re accustomed to.

On June 5th, I wrote:

“As we move closer to the completion of the prototype, I expect shares of NXO to move higher. The stock has traded within this C$0.30 range for some time now, and it appears the market has shaken out much of the weaker shareholders – the ones who don’t understand what patience is.

But I believe their lack of patience provides an opportunity for more sophisticated investors to participate at these price levels.

I’ve bought more stock since the last report, and continue to add to my position.

I have yet to sell a single share, but why would I?

We’re only months away from the completion of the prototype and that’s when the story really begins.

Anyone selling now is either a short-term thinker or not very smart in my eyes.”

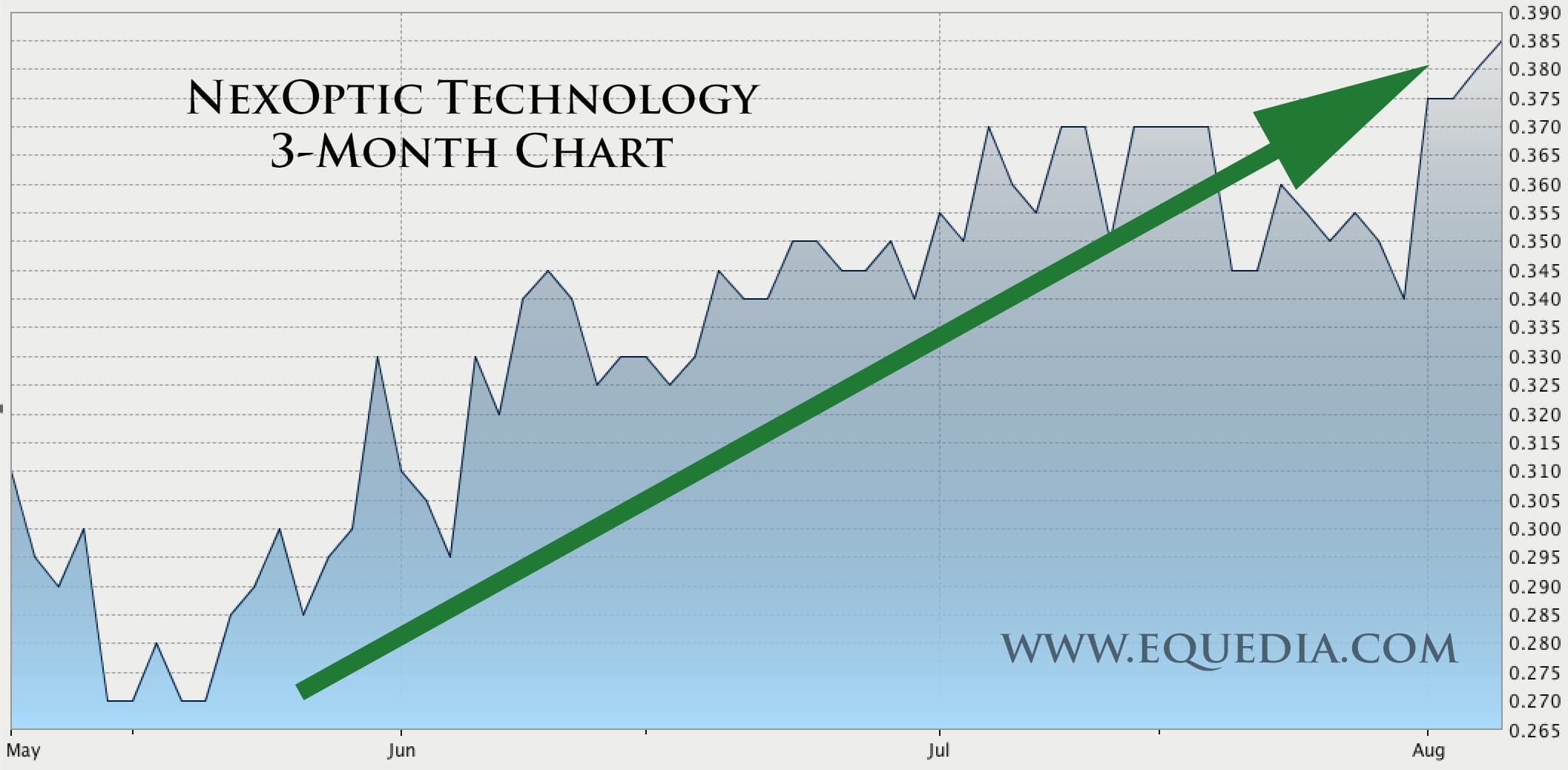

At the time of that Letter, shares of NXO were at CDN$0.29. Today, it’s at CDN$0.385 – an increase of more than 30%.

Take a look:

I still haven’t sold a single share and I believe the opportunity to buy shares of NXO at these levels will soon disappear.

That’s because management has now given us concrete clues regarding the timing of the prototype completion.

Prototype Imminent

A month ago, NexOptic Technology Corp. and Spectrum Optix Inc. (Spectrum) told us that it has completed orders for all optical elements required to build the lens stack for their proof of concept prototype.

That means the most important pieces of the prototype have now been ordered.

More importantly, we were told that these optical elements – the key pieces to NexOptic and Spectrum’s breakthrough lens prototype – would be manufactured and delivered in approximately ten weeks:

“NexOptic Technology Corp. (TSX VENTURE: NXO) and Spectrum Optix Inc. are pleased to announce that Spectrum has completed orders for all optical elements required to build the lens stack for their proof of concept prototype.

Included in the order is the glass procurement and construction, using existing optical industry glass types, of Spectrum’s patent pending Blade Optics™ technology, which contains flat lenses.

The optical elements, ordered entirely from North America, are anticipated to be manufactured and delivered in approximately ten weeks.”

That was four weeks ago.

According to the Company’s Prototype Development schedule:

“…The Companies are currently nearing completion of Phase III of IV for their POC development program. Phase III includes, but is not limited to, completing the engineering of the mechanical components required to hold the ordered optical elements in place and the tooling designs to assemble the device.

The final phase of the POC development (Phase IV) will be the assembly phase that will join the optical elements and mechanical components together. This phase will also include characterizing the optical quality and performance metrics of the POC.”

In simpler words, once the optical elements arrive, they really just need to put the pieces together – which I suspect shouldn’t take long.

Given that the optical elements are expected to be delivered in around 6 weeks (10 weeks from the date of the July 6 press release), we could see the prototype completed before the end of this coming September.

Then the fireworks begin.

I suspect we’ll see some early sparks reflected in NXO’s share price leading up to that event.

Next Week

It’s been an extremely busy summer filled with lots of opportunities.

With this junior bull market momentum, we need to take every advantage of these opportunities – they don’t come often. These are the times where the right investment decisions can change lives.

Next week, I will be taking some time off to spend with my family on our annual bass fishing trip. But I won’t leave my readers hanging. A lot has happened in the past week that you should be aware of.

That’s why I have already begun to write my next Letter, which I hope will help weed out much of the market noise and chatter I am sure you’ve all been hearing.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure: I am an early investor in the Blade Optics™ Technology, through my investment in NexOptics.

We’re biased towards NexOptic because they are an advertiser. We also own shares which were purchased both in the open market and in the private placements announced on Feb 14, 2014, Sept 21, 2015, and June 3, 2016. We’ve also purchased shares in the open market. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including NexOptic. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, NexOptic and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Thanks Ivan for the update on Nxo. Have a great trip

Appreciate all your investment advice and especially Nexoptic an opportunity of a lifetime definitely!!!!!!!

Thanks

Investigate IML

You should check out WHY and do a report on them. They have a huge find and are located in BC Canada

Hi Ivan, I really enjoy your newsletter and have made some very profitable trades thanks to you and your great work. I am also an investor in nexoptic and was wondering if you had heard of a team out of Harvard that has also been successful with a breakthrough using flat lens technology using nanotechnology, specifically titanium oxide, for all visible and non visible light wave lengths.

I think it is different from the technology used by nexoptic, but would be interested to hear your thoughts on this potential competitor.

Thank you.

Thank you I Ivan for your great news letter. I’ve been reading for 6 months and really appreciate you thorough analysis. Enjoy your fishing trip!!