On June 24, 2016, I issued a special report on a gold stock outside of my regular Sunday Letters.

By July 14, 2016 the stock climbed from CDN$0.67 to a high of CDN$1.31.

That’s an increase of more than 95% in less than three weeks.

But I am not here to tell you about our recent success – long time readers of this Letter know the track record we have together.

Today, I want to tell you about another opportunity.

And once again I am issuing this report outside of my regular schedule.

That’s because anytime now – literally – this Company is about to hit a major milestone.

Shares are already reacting and momentum is building rapidly.

The company I am about to introduce is a double-whammy because not only are they about to achieve a major milestone, they also have significant speculative upside in exploring a large and promising property package that could prove to be enormous.

I am not the only who thinks so.

Just ask the former executive Vice President of Exploration of the world’s largest gold producer.

He thinks that the Project is one of the most prospective in its country.

Considering that this country is home to numerous massive gold deposits, that’s something to be excited about.

Just how big are some of these deposits?

There’s a 19 million ounce gold deposit to the West.

…A 28 million ounce gold deposit to the North.

…And a whopping 40 million ounce gold deposit to the East.

This Company’s project sits right in the middle of them all.

And I haven’t even begun to talk about the other multi-million ounce gold deposits in the country.

…Like the 18 million ounce gold deposit called Frieda that also has 11 million tonnes of copper.

…And another 14 million ounce gold deposit called Ok Tedi that also has 4.8 million tonnes of copper.

Which is exactly why I want to introduce you to this Company right now.

K92 Mining Inc.

(TSX-V: KNT) (OTC: KNTNF)

K92 Mining Inc. (TSX-V: KNT) (OTX: KNTNF) is a new junior gold company with a large land package covering 410 km² in Papua New Guinea (PNG).

It’s currently advancing the Kainantu Gold Mine, its flagship asset, located in the Eastern Highlands province of PNG, towards production.

The Kainantu Resource

The Kainantu Gold Mine is highlighted by a NI 43-101 Compliant Resource of 1.84Moz @ 11.6 g/t AuEq Inferred and 240,000 oz @ 13.3 g/t AuEq Indicated.

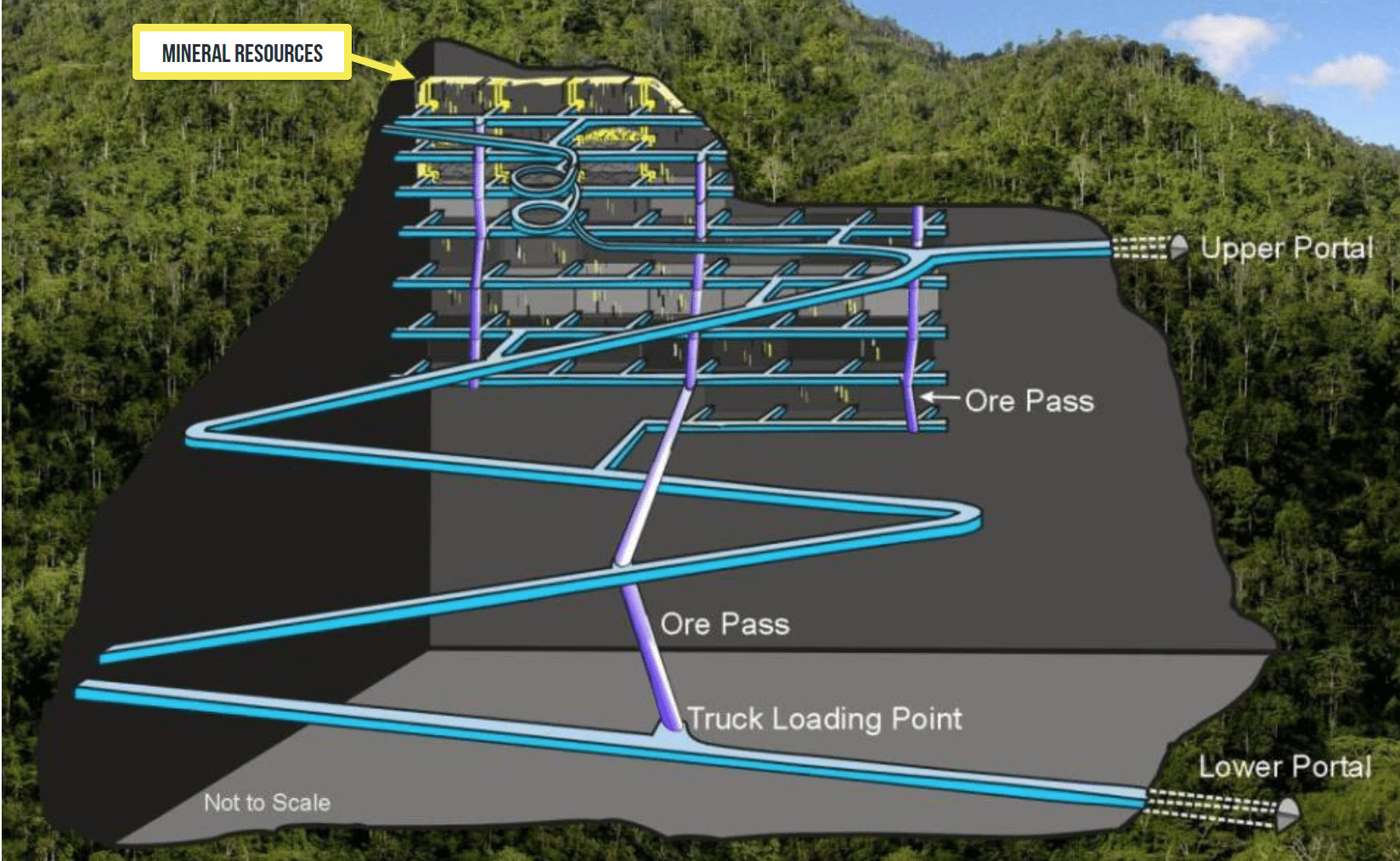

It has existing infrastructure including underground mine development, mill processing facility, staff housing, licensed tailings pond, office space, paved access roads and reliable hydro supply via a dedicated power line.

It has existing infrastructure including underground mine development, mill processing facility, staff housing, licensed tailings pond, office space, paved access roads and reliable hydro supply via a dedicated power line.

It’s fully funded through mine restart at its Irumafimpa Deposit, and more than USD $41 million has been invested in exploration drilling and definition drilling with the current resource estimate based on 78,935m of drilling via 767 drill holes.

So how does K92 and its resource stack up with its peers?

Take a look:

Despite the recent run up in share price, K92 is still undervalued when compared to its peers in many departments; it has higher grades, fewer shares outstanding, and a lower enterprise value to gold ounces.

Despite the recent run up in share price, K92 is still undervalued when compared to its peers in many departments; it has higher grades, fewer shares outstanding, and a lower enterprise value to gold ounces.

But more importantly, it’s fully funded for a restart of mine operations.

Of course, none of this would matter if K92 can’t make money.

And this is where a risk/reward opportunity comes in.

There’s no feasibility that outlines just how economic the Kainantu mine could be.

But we do have some clues.

Management expects that costs should be relatively in-line with past production costs, which means that a cost of $750/oz could not only be achievable, but probable.

K92 is expected to run at a steady rate by the end of this year, and should produce between 55,000 to 60,000 ounces per year at an annualized rate once it does.

But how is this possible? How is a Company that just began to trade in May this year this close to producing gold?

The Story

Timing, as I have mentioned in many Letters, is the key to profitability.

No matter how good a management team is or how strong their engineers are, timing always trounces them all.

K92’s story is one of great timing and perseverance.

In 2005, Highland Pacific spent an estimated US$80 million on the Kainantu project and began commercial gold production in 2006. But they ran into troubles with their hedge book and were forced to sell.

In 2007, Barrick Gold – the world’s largest gold producer – saw a great opportunity at Kainantu.

They purchased the asset for US$141.5 million.

The reason for Barrick’s purchase was obvious: Papua New Guinea is a land of large mines.

The country is home to Wafi-Golpu with a resource of 40 million ounces of gold, Lihir with 28 million ounces of gold, and Porgera with over 19 million ounces of gold.

This is not a country of small mining operations.

Take a look:

Then there’s Kainantu sitting right in the middle.

Then there’s Kainantu sitting right in the middle.

When the 2008 crisis hit, Barrick placed the mine on care and maintenance, but it didn’t stop advancing the asset.

Between 2007 and 2014, Barrick invested ~USD$100 million in underground mine development along with processing facilities infrastructure and more than USD $41 million on exploration and definition drilling.

But as we all know, things got pretty tough for the major gold producers not long ago, and many were forced to put their non-core assets on fire sale.

Barrick was no different. It had a large debt position and it needed to reduce its net debt position by at least US$3 billion.

So it began a fire sale of its assets worldwide…including those in PNG.

It sold 50% of its interest in the 19 million ounce Porgera Gold Deposit to China’s Zhijin Mining Group. And it put the Kainantu project up for sale.

For Barrick, leaving Kainantu was, by comparison, a small position when compared to Porgera.

What they didn’t want to do is spoil their reputation any further by selling Kainantu to the wrong group because that could have negative consequences for its interest in Progera within the PNG government circles.

And that’s where Ian Stalker and his team at K92 come in.

Been There, Done That

K92 is led by CEO Ian Stalker, a man with over 40 years of mining experience.

He has helped put together 10 mines throughout the world from start to finish and been involved on the other side of the capital markets by leading a CDN$36 million resource company to a CDN$2.5 billion buyout in just over a year.

Combined, the management team has been involved in building over 20 mines and $5 billion in buyouts.

As a result of the poor market conditions in 2014, Barrick sold the Kainantu asset to K92 for only US$2 million, with up to an additional US$60 million in future payments if certain milestones are reached – such as producing more than 1 million ounces of gold over the next nine years.

Buying the asset at a ridiculous discount is one thing, but raising the money to make it work during tough times is another.

And that’s where K92’s management proved itself.

The money required to put the Kainantu mine back into production wasn’t easy to find, but eventually, the team found it.

However, it wasn’t easy money.

The financiers put strict restrictions on releasing the funding in multiple tranches based on the Company meeting certain milestones.

The Company met them all.

They fully commissioned the processing plant, added modifications to it, the crusher load has been commissioned all the way through the secondary crushers and into the fine ore bin, through the mill, into the float, and into the filter plant.

They have rehabilitated the mine and added more support to the structures.

The Company is now in a position to pull the first ore from underground this month.

By the beginning of September, the first concentrate shipment is expected to be on its way to China for sale.

From Challenges to Reward

To say that a mine restart isn’t without challenges would be ignorant.

K92 has already recognized some of the challenges that Barrick and Highland had when they were operating it.

One of the most obvious was that the area they’re working in is in an area of high rainfall.

Yet despite that, what had been built was a Western Australian-type plant, which is designed for little to no rainfall.

With rain comes mud, and the plant couldn’t handle it.

So what they did was actually get hoses and wash the mud stroke fines away – they didn’t even try to treat it.

But that’s washing away gold.

Why?

When you start a mining operation and you’re drilling and blasting, a lot of the gold reports to the fine fraction.

That means there’s every reason to believe that a fair amount of gold that was mined was washed away before it even got to the mill.

And that’s where K92 sees another strong opportunity.

They’ve taken that knowledge and built into the plant a drum scrubber that receives all the material from underground. It washes the mud and slime out into a pump station, which pumps forward to the mill, where it then goes into a classification circuit.

Any coarse material goes back through the mill for grinding; any fine material that’s the right size goes forward to the flow plant. Any gold that had been lost previously is now collected.

That means there’s potentially, and conservatively, half a gram to a gram per ton of extra gold that could come in.

The previous owners calculated head grade simply by taking the amount of gold in the tailings and combined it with the gold in the concentrate.

Of course, that calculation ignores any losses whatsoever, like theft, or like anything that might disappear off from spillage in the plant itself.

…Like gold trapped in the mud that was washed away.

The grades that came into the plant in past production were between 7.5 to 8.4 grams per ton.

If you consider the potential that there have been significant losses within the operation – from spillage, theft, washed away mud – it’s likely that the grades could be much higher.

In short, that means potentially higher margins and lower costs of production.

But upside in recovery rates isn’t the only thing going for K92.

Efficiency

When Barrick first arrived at the Kainantu project, the lower portal didn’t exist.

That means access to the mine could only be done by helicopter. As a consequence, the number of helicopter rides back and forth probably added US$20-30 dollars or more for every tonne mined.

That means access to the mine could only be done by helicopter. As a consequence, the number of helicopter rides back and forth probably added US$20-30 dollars or more for every tonne mined.

Barrick finally completed this development and added the lower portal.

Today, they can drive right into the mine and access it from the camp in less than 20 minutes.

Suddenly your ability to get things fixed is quicker. Your productivity gets better. Your grade control improves because supervision improves with the easy access. The ability to backfill and prevent dilution improves dramatically.

Furthermore, they’ve now closed off the upper access so it’s only a ventilation access. That means potential theft from the villagers living above the mine is now no longer a threat.

With better supervision on the ground and a better handle on the grade control, there is a strong chance that K92 can now deliver better head grades than when the deposit was first mined.

But the mine restart is just the tip of the iceberg.

K92’s Kainantu project could become something much bigger.

Alex Davidson, a former executive Vice President of Exploration at Barrick Gold, says that the “Kainantu Project is one of the most prospective in Papua New Guinea. The strength of the structures and veins are most impressive. And they contain significant high-grade gold!”

Need a little background?

Alex Davidson holds a strong pedigree when it comes to exploring for big opportunities.

He has not only been awarded the A.O. Dufresne Award by the Canadian Institute of Mining, Metallurgy and Petroleum, an award that recognizes exceptional achievement and distinguished contributions to mining exploration in Canada, but he was also once named Prospector of the Year by the Prospectors and Developers Association of Canada.

If a man that was in charge of exploring for gold at the world’s largest gold company says that the Kainantu Project is one of the most prospective projects in PNG, you can bet that translates into huge potential for K92’s exploration prospects.

Especially considering that PNG is home to numerous massive gold deposits.

The Kora Deposit

Irumafimpa is where K92 will begin operations since its already developed.

Just 700km away lies the Kora Deposit, which Barrick discovered as part of their exploration plan.

Unfortunately, by the time they found Kora, they never got a chance to develop it.

But that only means more upside for K92.

As you can see, the Kora exploration drive is only 700 meters away from the existing drive coming in where you access Irumafimpa.

As you can see, the Kora exploration drive is only 700 meters away from the existing drive coming in where you access Irumafimpa.

At the beginning of 2017, K92 is expected to begin the development of the exploration drive to Kora and by the end of that year, they should be directly underneath the deposit.

By the beginning of 2018, not only are they expected to have the Irumafimpa ore available for the process plant, they should be able to supplement that using the ore from Kora in the early part of 2018.

This is significant.

We talked about the modifications K92 has made to the plant and what it means for the upside in both recoveries and grade. But those modifications also lead to an upside in tonnes.

They’ve modified the crusher section to handle nearly 100 tonnes per hour. Right now, they’re only calling for 35 tonnes.

With the mill, they estimate they can get between 300-350k tonnes, but they’re only going to put 200k from Irumafimpa.

In other words, with supplemental ore from Kora, K92’s operations can potentially go from 60,000 ounces to over 100,000 in 2018.

Here’s where the upside gets even bigger.

The ore body at Irumafimpa is roughly two meters on average width; at Kora, it’s five to six meters.

That means with upgrades, the mining rate at Kora can potentially increase to 200,000 ounces a year.

But that’s just the tip of the iceberg.

Kora – The Potential to Be Much Bigger

Take a look at this:

The orange section is Kora’s existing and known ore body.

The purple section is an expansion area that K92 is targeting for growth.

There are at least four bore holes that sit outside the known resource. If you look at some of the grades and intersections, you can see why there’s a lot to be excited about.

In fact, if you look at hole BKDD0023, you can see 6.4m @ 5.53 g/t gold and 8m @ 3.7% copper. This intersection is part of an overall 30-meter intersection at depth.

That’s the only deep hole that Barrick ever drilled there!

Why?

Because these holes were drilled from the hillside, and that was expensive.

Drilling from underground is cheaper, faster, and less intrusive – meaning they don’t have to get agreements from the landowners.

So once K92 builds the Kora exploration drive, it will be able to drill from underground and explore what many believe to be a very large deposit.

But don’t take my word for it.

Alex Davidson was involved in approving the Kainantu sale to Barrick back in 2007, so he clearly believes that there is potential to find a lot more gold there.

He’s now an advisor to K92.

Then there’s Doug Kerwin.

Doug Kirwin is a former Executive Vice President at Ivanhoe Mines until its takeover by Rio Tinto in 2012 and was a member of the joint discovery team for the Hugo Dummett deposit at Oyu Tolgoi in Mongolia.

For those unfamiliar with the project, the Oyu Tolgoi project is the largest known deposit of copper and gold in the world.

Doug was also the co-recipient of PDAC’s inaugural Thayler Lindsley Medal awarded for most significant international mineral discovery in 2004.

He thinks that the existing Kora ore body, with the kind of extension we expect to see, could potentially grow much bigger, with multi-million ounce potential:

– Doug Kirwin, Former Executive VP, Ivanhoe Mines, current K92 Mining Advisor

What is now a junior mining company with a great project, could suddenly become a mid-tier company with a tremendous amount of upside potential.

If experts like Doug and Alex are even half right, than K92 could turn into something very big.

And remember, Barrick didn’t buy the Kainantu project for the small mine. They bought it for the potential of something much bigger…

More Upside

We already know Kora has the potential to outgrow its current resource.

But outside of Kora, K92 also owns many prospective projects within its 410km² holdings.

Within ML150 is the Kora lodes which are strongly mineralized at the limit of drilling and open in all directions, as well as the Judd, Karempe and other unnamed mineralized lodes parallel to defined resources, which have potentially economic grade surface and/or drill values from very limited work to date.

Within ML150 is the Kora lodes which are strongly mineralized at the limit of drilling and open in all directions, as well as the Judd, Karempe and other unnamed mineralized lodes parallel to defined resources, which have potentially economic grade surface and/or drill values from very limited work to date.

A major porphyry Cu-Au target is evident at shallow depth in the A1/Tempe/Tankuanan area to the southeast of ML150.

Outside the ML there are continuations of the lodes listed above, as well as the strongly mineralized Mati-Mesoan lodes proximal to the mining lease.

…Then there’s Maniape with a historic open pit resource estimate of 560,000oz Au*.

…And Arakompa with a historic resource of 800,000 oz. Au @ 9g Au/t*.

When you start putting these together, you start seeing why Barrick was hot on the asset.

The blue sky that was there from day one is still there, but much of it is no longer blue sky because there’s been a lot of money spent on it. It’s real.

There’s a lot of telltale holes, geological information, structural information, mapping, etc. that tells us that K92 has genuine targets.

The growth potential is huge.

Risks

Of course, everything can’t be perfect, and no investment is without risk.

First and foremost, a mining restart can be stressful and come with many issues including delays and cost overruns. But I believe management has built more than enough mines to not only be aware of the many issues that may arise, but know precisely how to deal with them if they do.

Then there’s political risk and local risks since no definitive agreement with the locals have been reached. However, K92’s team is very involved with the local community and I expect K92 will do whatever it can to provide the community with lots of support and benefits.

Then there’s the risk in the price of gold – and you all know my view is that it will be higher.

The biggest risk in my view is the amount of cheaper stock that’s due to become free trade within the next few months – especially considering the rapid rise in share price over the last week.

During the tough times, K92 had to raise money at much lower prices – as did many companies. Those financings will hit the market in the next couple of months.

For example, on August 16, 2016, a small tranche of a CDN$0.35 private placement with a $0.50 warrant will become free trade.

Then in September 2016, over 17 million shares at $0.15 will become free trade.

That’s a ten-bagger for those who took the risk nearly a year ago.

That means I would expect some profit-taking and the stock could pullback at that time – especially given the run we have seen already.

However, there was a large tranche that became free trade earlier this month – that was when K92 shares fell just below CDN$1. But shares bounced back with a vengeance – proving that there are new investors and institutions that believe K92 is undervalued.

Given the volume and liquidity in K92 stock, and the upside to the project, we could see much of the profit-taking get soaked up when it becomes free trade.

The Risk/Reward

I think that gold’s run has barely scratched the surface. And I believe that the price of gold won’t sit this low after July.

In September, the ECB is once again expected to boost stimulus.

World debt is accumulating at the fastest pace in history, while business debt will likely climb to $75 trillion from its current $51 trillion level by 2020, according to S&P Global Ratings.

Some may tell you that the run in gold stocks won’t last, but the volume and demand for them say otherwise.

There is real money flowing back into the sector and investor participation hasn’t even scratched the surface.

If a gold stock is undervalued today, imagine where it could climb to a year from now if gold prices were to shoot past the psychological threshold of US$1400/oz.

I believe K92 is a near-term gold producer with massive exploration upside potential that we should be watching very closely.

It’s about to hit its first major milestone anytime now and it has a low market cap when compared to its peers – despite the strong run this week.

Given the upside potential of Kora and the potential for management to under-promise and over deliver, I expect that K92 could eventually catch up to its peers in terms of valuation and that would mean some upside for investors around these levels.

K92 Mining Inc.

Canadian Trading Symbol: (TSX-V: KNT)

US Trading Symbol: (OTC: KNTNF)

Disclosure: We’re biased towards K92 Mining Inc. because they are an advertiser. We also own shares purchased in a private placement subject to a 4-month hold expiring August 16, 2016. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including K92. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, K92 and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Can you update us on a fire at the site? Set by unhappy local land owners? K92 are not saying a word…