Dear Reader,

From illegal short sellers and market manipulation to the real reason for war in Syria, much of what I have revealed over the years may have once been considered conspiracies.

That is until the conspiracies proved to be true.

And this week, one of the biggest was revealed.

I have always said that most conspiracy theories have truths to them.

But turning them into actionable investment strategies requires us to connect the dots.

So today, we are going to do something different.

In this Letter, I am going to present you with a history of events, facts, and some charts.

But it is your job to decide the outcome; it is your job to determine whether the theory I am sharing with you at the end is true.

Let’s get started.

Watch the Video Instead:

Hear the Podcast Instead:

Apple Podcasts (click to download to your iPhone, iPad, or Mac): https://podcasts.apple.com/ca/podcast/conspiracy-revealed/id1462392573?i=1000451118477

MP3 (right click > save as: http://traffic.libsyn.com/equedia/September_23_2019_high.mp3

Conspiracy Part I: Nearly 10 Years Ago

Back in early 2010, I wrote a Letter on how Andrew Maguire, a successful metals trader and whistleblower, went to the CFTC with data that strongly suggested a small number of short-sellers had rigged the markets for both silver and gold.

Via my Letter on April 18, 2010: A Silver Conspiracy:

“Maguire not only provided the regulators on how the manipulation generally worked, but also warned them of a specific scenario where the SPDR Gold Trust (NYSE:GLD) and iShares Silver Trust (NYSE:SLV) markets would be manipulated.

Not only that, he told the regulators that a massive crime was about to happen, and the crime happened precisely as he predicted it would, forcing the CFTC to take a closer look.”

At the time, silver was trading just over $18/oz, while gold was trading under $1147/oz.

Many believed that what Maquire revealed was just a conspiracy theory – many of his facts were considered to be unreliable.

However, I suggested that we should prepare for gold and silver prices to take off because the precious metals manipulators would likely ease off their price suppression; they were, afterall, likely under a watchful eye.

Over the next few months, the price of both gold and silver experienced a rapid ascent.

In the end, the US Department of Justice dismissed any price-fixing claims that Maquire had revealed.

But the conspiracy didn’t stop there.

October 24, 2010, I revealed an even more sinister conspiracy.

In my Letter, Enron Lives On, I wrote:

“In the last 20 years, there have been two administrative judges presiding over investor complaints at the Commodity Futures Trading Commission (CFTC).

The CFTC oversees trading of the nation’s most important commodities such as oil, cotton, gold, and silver.

The agency’s administrative law judges, George Painter and Bruce Levine, are the ones that handle cases when investors allege that trading professionals or financial firms are violating any regulations – such as market manipulation.

Last week, a notice was released by the CFTC that retiring judge, George Painter, said Judge Bruce Levine had a secret agreement with former Republican chairwoman of the agency, Wendy Gramm, to stand in the way of investors filing complaints with the agency.

In other words, George Painter claims that Bruce Levine promised never to let the investors win:

“On Judge Levine’s first week on the job, nearly twenty years ago, he came into my office and stated that he had promised Wendy Gramm, then Chairwoman of the Commission, that we would never rule in a complainant’s favour…A review of his rulings will confirm that he fulfilled his vow.” – George Painter

Wendy Gramm, the woman Levine had promised, was head of the CFTC just before president Bill Clinton took office. She has been criticized by Democrats for helping firms such as Goldman Sachs and Enron gain influence over the commodity markets.

After a lobbying campaign from Enron, the CFTC exempted it from regulation in trading of energy derivatives under the power of Gramm. Gramm then resigned from the CFTC and took a seat on the Enron Board of Directors and served on its Audit Committee.

Wendy Gramm’s husband, former senator Phil Gramm, was also part of the Enron debacle and known as a financial deregulator. Phil was also partially blamed for the “Enron Loophole,” which exempted most over-the-counter energy trades and trading on electronic energy commodity markets from government regulation.

You can read more about Wendy Gramm HERE and Phill Gramm HERE, but that’s not where the story ends.

Painter requested that the CFTC not assign his pending cases to Levine because, he wrote, “Judge Levine, in the cynical guise of enforcing the rules, forces pro se (investors acting on their own behalf, without a lawyer) complainants to run a hostile procedural gauntlet until they lose hope, and either withdraw their complaint or settle for a pittance, regardless of the merits of the case.”

In his notice about his coming retirement written mid-September, Painter said he could not “in good conscience” simply leave his seven reparation cases to Levine, and he recommended that the CFTC try to enlist another administrative judge from elsewhere in the federal government.

To make the story more interesting, Judge Levine was featured in a story by the Wall Street Journal from 10 years ago titled, “If You’ve Got a Beef With a Futures Broker, This Judge Isn’t for You — In Eight Years at the CFTC, Levine Has Never Ruled In Favor of an Investor.”

In that article, the Wall Street Journal found that in nearly 180 cases, except for a small handful in which companies didn’t show up to defend itself, Levine had always ruled against the investor.

But that’s just the tip of the iceberg.

Just as Painter’s story got out last week, the Wall Street Journal published a piece saying that the 83-year-old Painter has been diagnosed with dementia, and, according to his wife, presided over cases while struggling with alcoholism and mental illness. (see Case Sheds Light on Judge)

Painter’s wife, from whom he is seeking a divorce, is seeking guardianship over him, citing his health and erratic behaviour. But Painter’s son, Douglas Painter, and a niece said in legal filings protesting the guardianship claim that the judge doesn’t exhibit the mental problems described in court records by his wife.

So was this recent story published to cover up the 20 years of scandal and manipulation by Judge Bruce Levine and company?

Was it really a coincidence that a story of George Painter’s mental problems was released just after the story of Painter’s accusations on Levine?

Who knows.

We’re not saying any of this is true. Nor or are we putting any blame on Wendy Gramm or Judge Levine. But our guess is that this story will more than likely get swept under the rug.

This isn’t the first time scandals and accusations over the commodities market have surfaced. Anytime there are billions of dollars involved, conspiracies will live on.

We know that the CFTC has been under heavy fire from the Gold Anti-Trust Action (GATA) Committee regarding the manipulation of silver on the futures markets by JP Morgan, and other institutions.

… Eventually, more truths about commodity price-fixing will come out. And as it does, it’s going to show everyone just how little gold or silver is really out there. It’s going to show that demand, especially in ETF contracts, is far outweighing supply.

As this happens, you can bet the price of commodities and precious metals will skyrocket further than where it is today.

And boy did that prediction come true.

By March 26, 2011, just months after that Letter, silver skyrocketed to a record-closing price of $46.47/oz.

By September 5, 2011, gold hit a record-closing high of $1896.50/oz.

But the investigations stopped. Coincidentally, both gold and silver began their climb back down.

Today, despite the many manipulation practices exposed, no one has really got in any trouble.

And as a result, the price of silver today is still under $18/oz – no higher than it was when I first wrote the Silver Conspiracy back in 2010.

With the price of everything else going up over the last decade, why has the price of silver barely moved up at all? What about gold?

Either:

- The true price of gold and silver from a supply and demand perspective is being valued correctly, or;

- Once the charges were dismissed, the manipulators were back at it again with their price suppression.

What do you think?

CLICK HERE TO SHARE YOUR THOUGHTS

Conspiracies Part II: Not Just Precious Metals

On July 23, 2013, I wrote how big banks could manipulate the price of basic commodities, and how they finally came under scrutiny for potentially doing so.

Via Commodities Manipulation Revealed:

“When major banks are able to trade and participate in the commodities market, their influence can lead to prices that don’t reflect true supply and demand fundamentals.

Last week, this conflict of interest had finally come under federal scrutiny.

The Commodity Futures Trading Commission (CFTC) has now taken the first step in an examination of warehouse operations controlled by Goldman Sachs, Glencore Xstrata, the Noble Group and others and used to store vast amounts of aluminum.

The operation is claimed to have inflated the price of aluminum, which has ultimately cost consumers billions of dollars.”

Around the time of these events, the price of aluminum was trading at around $0.79/lb – and much higher just months before the above news was revealed*.

*I suspect the moment the firms knew they were under investigation, they stopped their price suppression/manipulation. It could be why prices were falling just months prior to the news announcements.

But unlike precious metals, I predicted that the price of aluminum would actually drop because the big banks, such as JP Morgan, would sell off their warehoused inventories to remove themselves from this type of scrutiny:

“…the Big Banks’ controls over commodities give them the ability to affect the prices paid by manufacturers and ultimately, consumers. While there is no clear evidence of price manipulation, the recent investigations have already pushed JP Morgan to take action before it’s too late.

Over the past months, I have talked about the sharp decline of gold from JP Morgan’s vaults. With the recent headlines of big banks’ oligopoly in the commodity warehousing market coming under scrutiny, it seems that was enough for JP Morgan to get rid of its physical commodities business.

…Maybe this time it (JP Morgan) can sell their physical commodities business before it gets whacked with more federal investigations.

…I would be weary of base metal prices (especially aluminum) in the near-term – especially if the banks begin to unload their physical inventories…”

Over the next few months, the price of aluminum fell.

By the end of October 2015, it fell to a low of $0.65/lb.

(*Warehoused inventories of aluminum at the London Metals Exchange (LME) continue to hit record lows – year after year.)

You may be thinking: Why did the price of aluminum decline when manipulation was revealed, while the opposite happened to precious metals just a couple of years prior?

To answer that, let’s look at a letter I wrote on June 8, 2014, titled, “A Major Scam Revealed: How Non-Existent Metals Are Used to Borrow Money:”

“For years, I have talked about the manipulation of gold and other metals.

For years, I have talked about how these hard assets are being used to create paper (artificial) assets with values which are exponentially compounded.

One of these is the “rehypothecation” used in commodity financing deals.

Commodity Financing Deals

In short, banks and brokers lend money to their clients using assets that have been posted as collateral. These assets can be anything from currency to hard assets such as gold or other base metals.

The banks/brokers can then take these assets and use them for their own purposes to create other financial instruments; metal-backed currency, so to speak.

This is called rehypothecation. And yes, it sounds almost like a Ponzi scheme.

Many times, these assets are “supposed” to be sitting in a vault or storage facility somewhere, but because the “rehypothecation” process is often repeated many times over, no one really knows where the assets/metals/commodities are – if they exist at all.

For years, I have warned about the problem with the rehypothecation of commodities and metals; that we could see a major break in this system if strong evidence were presented that many of these collateralized assets may not actually exist.

So what would happen if a nation – one that’s home to the world’s largest market for two of the world’s most widely used base metals, copper and aluminum – were to tell the world that it may have a problem with collateralized lending, where the collateral doesn’t exist?

China to Investigate

Just this week, China announced that it is investigating a potential problem where copper and aluminum used as collateral to fund other deals may not actually exist.

…China is the world’s leading copper and aluminum market and news of this has already hit traders; the price of copper has taken a nose-dive downward, with its biggest weekly loss since March.

And if you go by the notion that copper is often referred to as “Dr. Copper” because of its unique ability to forecast economic trends, what does that say about the future of our world economy?

Further Downside?

While the price of copper has already dropped, the news of this could have further downside implications – much more significant than most realize at this point.

…The first thought is that if there really isn’t as much copper – or aluminum – in storage to back up these commodity-financed deals, the prices of the metals should rise.

But that isn’t the case here…at least not with the base metals.

From a commodity market perspective, the use of metals as collateral for financing deals creates excess physical demand. This puts tighter pressure on the physical markets, forcing prices to rise temporarily.

I have mentioned before how institutions (such as JP Morgan and Goldman Sachs) have manipulated prices of the metals higher by soaking up the supply from the physical market and holding them in storage.

In simple terms, institutions who hold even a small amount of metals in storage can unleash some of these metals into the physical market to lower prices in the futures market, or buy and withhold them from the physical market to increase the prices in the futures market.

(Since many western banks, such as JP Morgan, have been leaving the metals storage market, we have seen base metals prices – such as copper – fall as these banks unwind their physical position.)

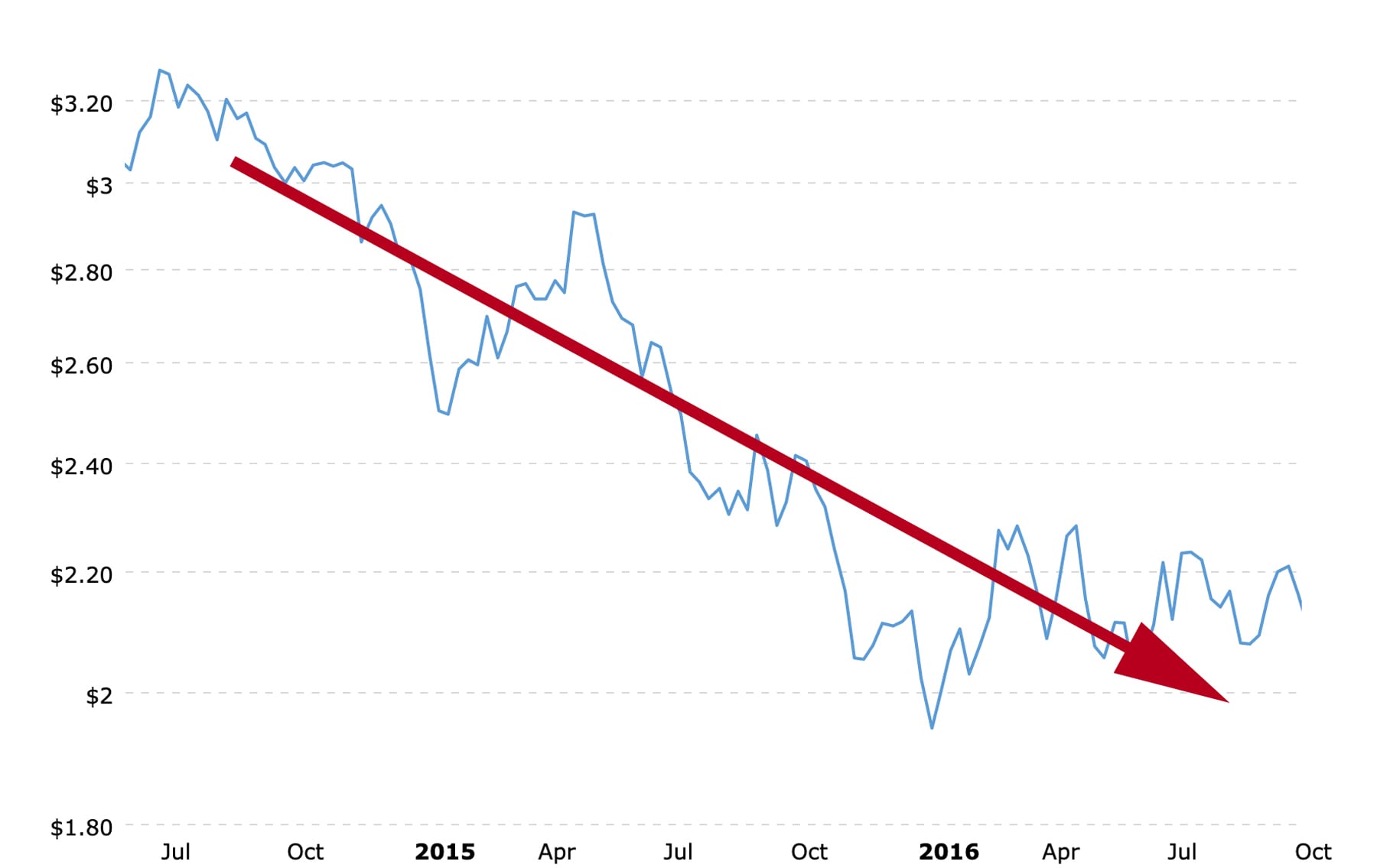

Here is the price chart of copper, showing when JP Morgan and other banks came under heavy scrutiny for manipulating the price of commodities:

As with most financially derived products, the paper market value is generally much larger than the actual value in relative terms than the physical market. As such, physical inventory is much smaller than the open interest in the futures market.

That means the impact of purchasing the physical commodity on the physical market has a much stronger effect than the impact of selling the commodity futures on the futures market.

These Chinese commodity-financing deals take supply from the physical market and thus places upward pressure on the physical price – giving the illusion of stronger demand.

If these Chinese commodity-financing deals begin to unwind as a result of the investigations, those who have claims to the underlying commodity would likely sell their ownership in physical inventory, while those with hedges against it would buy it back in the futures market.

And since the physical market has a stronger effect on prices, it would likely send the price of the underlying commodity lower.

As Reuters recently reported, those involved are beginning to question the legitimacy of their collateralized financing deals, and it would appear that an unknown number of deals have already begun to unwind.”

So did prices fall as we had predicted?

Take a look for yourself.

Here’s a chart of copper starting from the date of the above Letter:

To sum it up, when manipulators of base metal prices came under attack, the prices of those metals fell.

But when precious metals manipulation was revealed, prices went up.

So where are we today?

The Current Conspiracy: The Real Reason for Gold’s Rise?

It’s time to connect the dots.

Back on November 6, 2018, John Edmonds, a former JP Morgan trader, pleaded guilty to one count of commodities fraud and one count of conspiracy to commit wire fraud, price manipulation and spoofing.

Via CNBC:

“An ex-J.P. Morgan Chase trader has admitted to manipulating the U.S. markets of an array of precious metals for about seven years — and he has implicated his supervisors at the bank.

John Edmonds, 36, pleaded guilty to one count of commodities fraud and one count each of conspiracy to commit wire fraud, price manipulation and spoofing, according to a Tuesday release from the U.S. Department of Justice. Edmonds spent 13 years at New York-based J.P. Morgan until leaving last year, according to his LinkedIn account.

As part of his plea, Edmonds said that from 2009 through 2015 he conspired with other J.P. Morgan traders to manipulate the prices of gold, silver, platinum and palladium futures contracts on exchanges run by the CME Group. He and others routinely placed orders that were quickly cancelled before the trades were executed, a price-distorting practice known as spoofing.”

At the time, gold was trading at $1234.85/oz.

Over the next week, the price of gold actually fell to a low of $1197.55/oz.

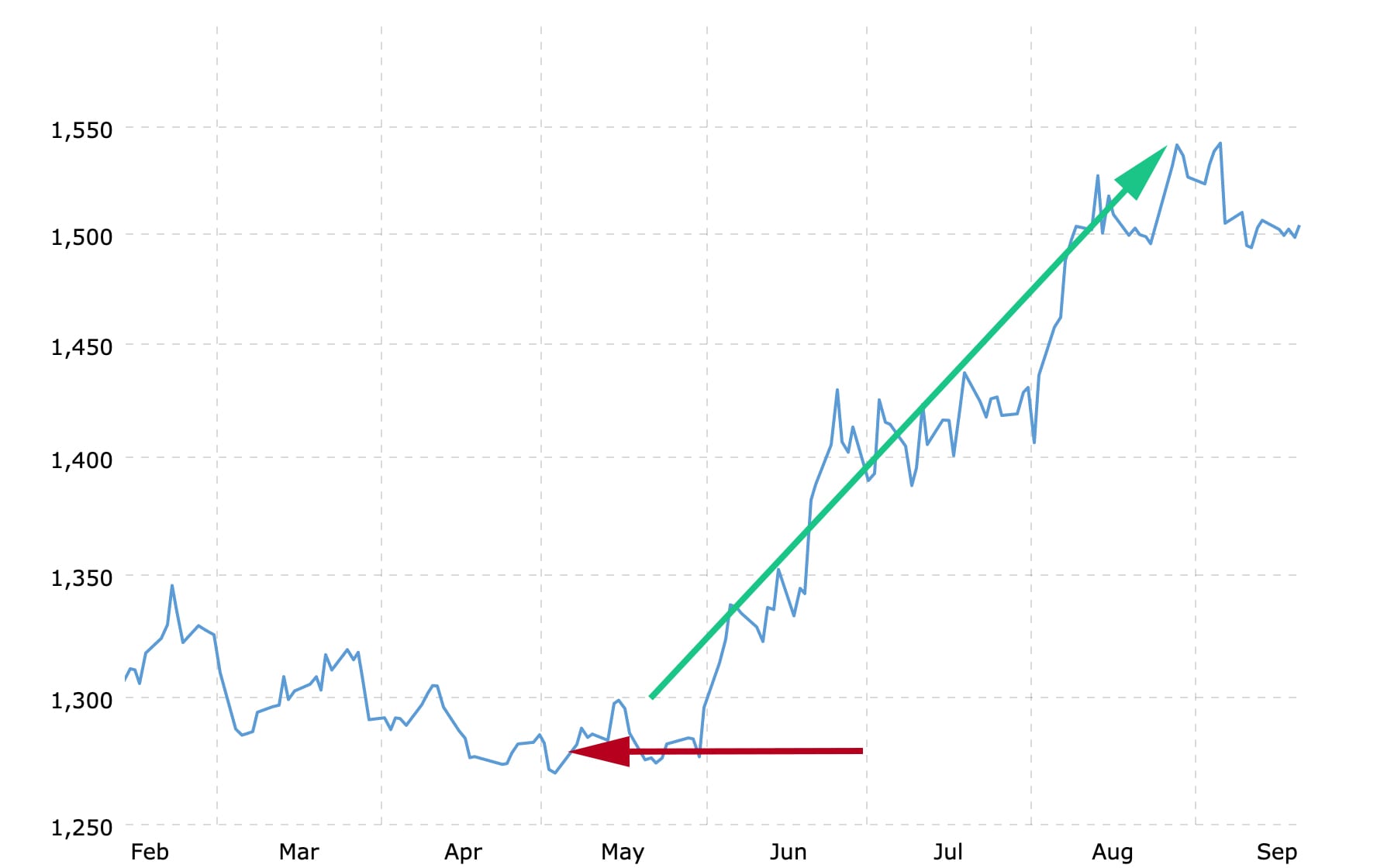

But it suddenly began to climb…

By February 20, 2019, gold had climbed to 1345.75/oz.

Over the next few months, after gold finally appeared to have come out of a slump and after the probe on possible manipulation of the metals market quieted down, it began to trade lower again.

That is, until May 2019.

On May 2, 2019, the price of gold was around $1278.

On that same day, CNBC wrote:

“The criminal sentencing of former J.P. Morgan Chase precious metals trader John Edmonds has been postponed six more months, to December, as federal investigators continue to probe possible manipulation of metals markets.

Edmonds, 37, pleaded guilty in October in Connecticut federal court to working with other “unnamed co-conspirators” to manipulate the prices of gold, silver, platinum and palladium futures contracts between 2009 and 2015 while employed at J.P. Morgan.

The New York City man admitted learning illegal trading tactics from senior traders — and to using those tactics with the knowledge and consent of supervisors.

His sentencing has been postponed twice, suggesting he is continuing to cooperate with prosecutors in their investigation. No one else has been charged.”

In other words, the prosecutors may have offered Edmonds leniency if he reveals more secrets – and that meant the potential market manipulators would be under a watchful eye once again.

Surely the manipulators wouldn’t dare suppress prices knowing they were being closely monitored?

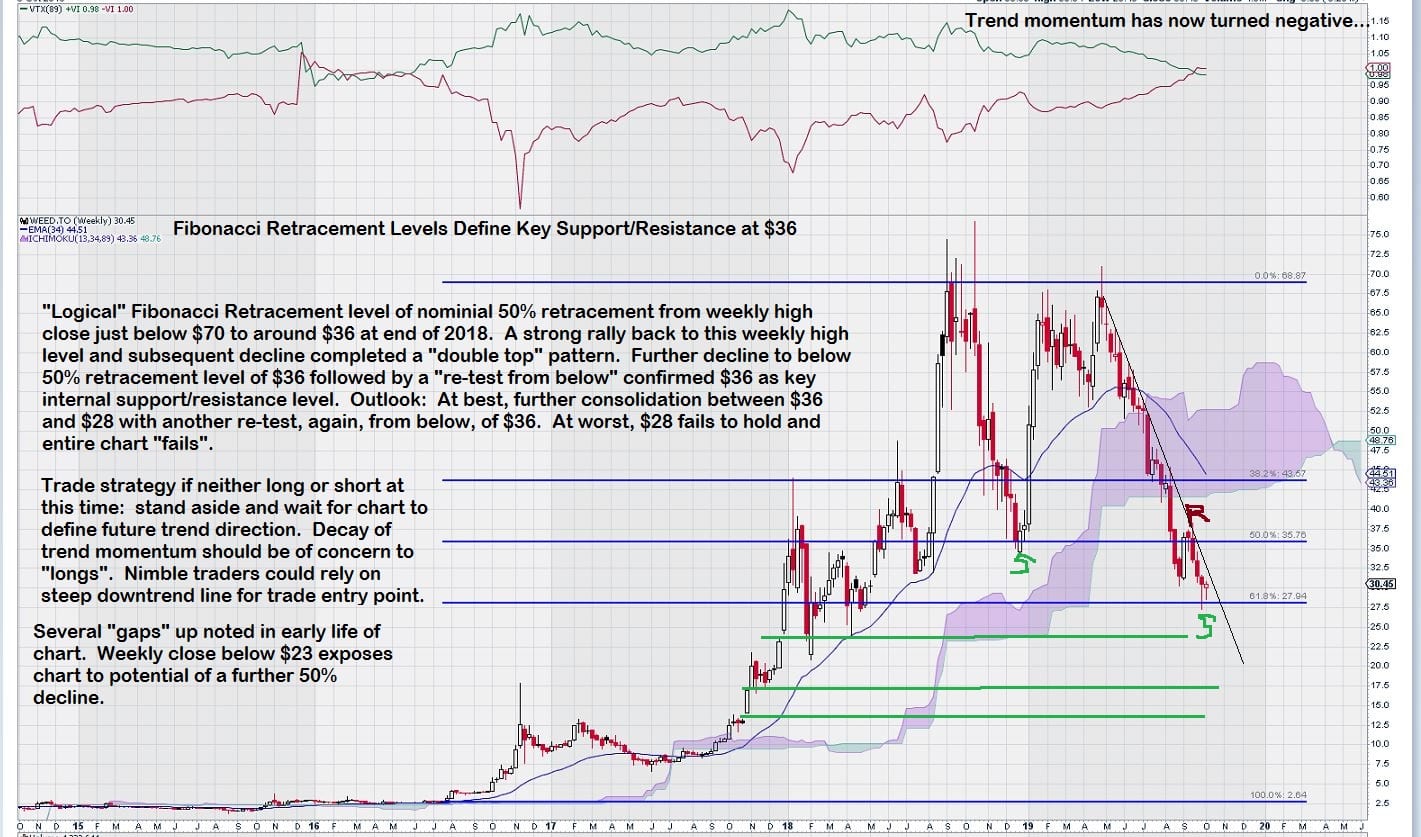

And just like the Silver Conspiracy Playbook we wrote of earlier, look what happened to the price of gold after US prosecutors delayed charges to get more information from Edmonds:

Connecting the Dots Today

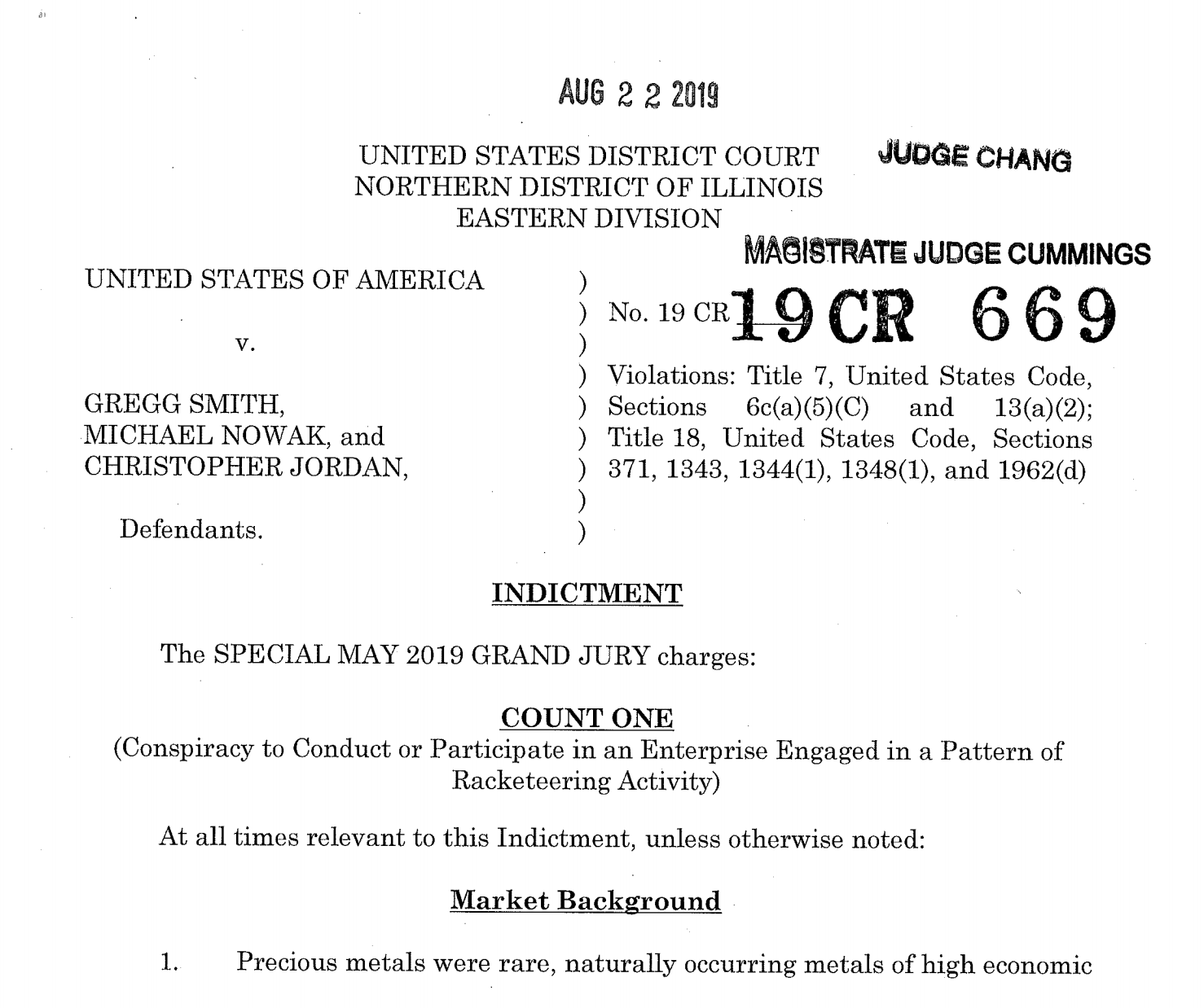

It turns out that Edmonds may have indeed been giving prosecutors more information.

This past week, more JP Morgan traders were charged – including the head of JP Morgan’s global precious metals trading operation.

Via Bloomberg:

“U.S. prosecutors took an unusually aggressive turn in their investigation of price-fixing at JPMorgan Chase & Co., describing its precious metals trading desk as a criminal enterprise operating inside the bank for nearly a decade.

The prosecutors charged the head of JPMorgan’s global precious metals trading operation and two others on Monday, accusing them of “conspiracy to conduct the affairs of an enterprise involved in interstate or foreign commerce through a pattern of racketeering activity.

That’s a reference to the Racketeer Influenced and Corrupt Organizations Act, or RICO, a law often used against organized crime rings. The U.S. has rarely invoked RICO law in big bank cases. Its use suggests that JPMorgan may face deeper legal jeopardy, going beyond the several individuals who have already been prosecuted.”

Here is the full indictment:

Today, the price of gold is over $1500/oz.

After trading range-bound between $1200-$1300/oz for over five years, gold has finally pushed higher.

When we connect the dots, a picture emerges.

Is it a coincidence that the price of gold has steadily climbed every time news of manipulation is exposed or comes under scrutiny?

Or did we finally connect the dots?

What do you think?

The price of gold has fallen slightly since the new charges against JP Morgan traders were revealed.

The last time this happened, gold prices fell for a week before taking off again.

Could we see the same higher price action for gold in the coming weeks and months?

CLICK HERE TO SHARE YOUR THOUGHTS

Gold Back in Action

The Fed has once again lowered rates – just as predicted. And I suspect that in November, we could see them announce some sort of new Quantitative Easing (QE).

That, combined with the revelations of precious metals manipulations that US prosecutors are calling a “Criminal Enterprise,” there’s no doubt in my mind that the price of gold can finally climb higher.

This has me really excited.

Why?

First, when sentiment is low, prices are as well.

And that’s where gold has been over the last five years.

Low prices are always good for buyers.

Second, we have knocked it out of the ballpark with many of our past precious metals stock investment ideas – especially following the revelation of potential price manipulation.

Last year, I was on the fence about gold stocks; Today, I am looking to climb over.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased toward gold and silver, as we own precious metals stock and physical gold and silver.

Help for my money

of course they are doing it…price suppression…if there is not punishment then the crooks see it as a blind eye from authorities and continue to do it…and it is not just the commodities markets they are manipulating it is also stocks and options…they sit and watch for money to go in and as it does they short everything overnight and everyone …retail investors …loose their shirts…they wait till the shark fest is over and bottom out on stocks and expiration dates of options and then jump back in and buy and wait for new investors to come back and rinse and repeat……

Massive corruption, And still no accountability

The storm is here.

Back about some time in 1968 I worked at a Brokerage Firm in Manhattan NY. On a Monday morning at our office we were told that Morgan had placed several million dollars of Bearer Bonds in their vault on Friday and they were not in their vault on Monday.We were told we had to search our vault and our desks to see if they in our office. This was told to every Brokerage Firm involved with all of Wall Street Trading ! That was the dumbest thing I ever heard any Company say.Why ! Because I said to one of the guys that worked in our office.Those Bearer Bonds were never put into the Morgan Vault ! Why ? Because what dummy would take the Bearer Bonds and leave all the cash in the vault ?

I have never doubted the manipulation of the financial markets, which still goes on including the Options market now more than ever.

As long as Republicans are in control deregulation will be the policy of the administration. The above conspiracy is an example of the results from deregulation.

Wasn’t there a matter after the financial sector collapse in ’08 of oil prices continuing to move higher despite a crippling recession? It was alleged oil moved up in what should have been a nose-dive market because energy analysts and traders at JP Morgan, who had formerly worked at Enron were publishing “buy” recommendations to artificially prop up oil prices because JPM owned a couple of tank farms in Connecticut where millions of barrels of crude were stored.

Hey guys,

I’ve owned gold since 2003 and followed Andrew Maguire’s work since 2010 and I became totally disgusted with the manipulation in jan/Feb of 2013!!

Why isn’t “Golden Boy” Jamie Dimon going to jail… he’s the Big Dawg, not only for the gold/silver manipulation but for insider information also, For example, Obama knocked on his door before his inagauration and before Obama’s interview on TV in Feb/March of 2009(bottom of great recession) Jamie bought 500,000 shares of JP Morgan at about $20/share, Brian Moynihan of Bank of America did the same. They both did it again back in June 0f 2016…same 500K shares guys(WTF), put these (MotherF%$#’s) away, I’ve been following this BS for many years as well. It’s all in plain sight if you pay attention and have a good memory!!

Bury these bastards… oh by the way, I have family on Wall St. over 30+ years and I haven’t spoken to them in over 25….arrogant MF’s as well. No favorites here,,,let them all burn in hell!!! Please pub;lish this email Thanks…Mike

For more than 5 years I have followed /GC. I was always puzzled why the gold price would occasionally spurt during off hours. And then drop back in to the price trough during normal business hours. My theory was that the gold market was some how being manipulated by the Chinese. Little did I know, that the market was being manipulated by crooks on Wall Street. No wonder the little guy can’t get ahead.

I’m going to go out on a limb and say that the US Gov’t or even the FED. is behind GOLD’s manipulation. I mean, with the trillions of $’s the US owes, it would be in their best interest to protect the Defacto standard or world’s reserve currency because of all it’s benefits. Think about it, the US can borrow more cheaply than it could otherwise, US banks and companies can conveniently do cross border business using their own currency, and when there is geopolitical tension, central banks and investors buy US T-Bills, keeping the $ high. A Gov’t that borrows in a foreign currency can go bankrupt, not so when it borrows from abroad in its own currency (through foreign purchases of US T-Bills). The US can spend as much as it likes, by keeping on issuing T-bills that are bought continuously by foreign governments. No other country can do this. If the US cannot do that, they become less relevant and SDR’s, Bitcoin or even GOLD may pave the wave for a new reserve currency. Since the US cannot pay back it’s debt, they will be doomed.

According to the IMF’s last quarterly report, the dollar’s share of global foreign currency reserves in Q2 2019 fell for the sixth straight quarter, to the lowest level since 2013. Tellingly, the start of the fall corresponds to when Trump took office as the 44th president. In January 2017, Trump’s inauguration, the ratio was 65.4%. In the first quarter of 2019 it was 62.5% and in the second quarter it slipped to 62.3%. We are now witnessing currency wars as countries are lightening up on T-Bills and $’s. More cooperation between Russia and China, through the signing of multi billion dollar energy deals and currency swaps that water down the $’s influence. The times of de-dollarization has begun. Central foreign banks are staying away from government bonds with record low or negative yields. They’re selling T-Bills and $’s, buying Gold, and to a lesser extent, yuan, euros and yen. The US will do whatever it can to stop the invasion and rise of GOLD, SDR’s and Bitcoin. Can the US hang on to it’s reserve currency status?

BIG DEAL!!!! Same old crap, wealthy evil minded people manipulate the markets or companies screw the consumer.

They get caught making tens of billions dollars, pay a cheap fine, claim no wrongdoing and nobody goes to jail!!

Nothing but a SCAM including members of Congress and high ranking Federal people and bought-off judges who

all become multi-millionaires. Isn’t that SWEET!!! All CRIME and no PUNISHMENT!! Whitewashed by the media and colleges

by BRAINWASHING the young idiots with socialism when they really mean communism.

I was a victim from Warren Buffet and Pres. Obama teaming up to stop the Dakota Access pipeline so Buffet’s BNSF RR

hauled the oil out of the N. Dak. Bakken making Buffet over $1 million per day. I lost $500,000.00 of my retirement savings.

The fix is harsh prison time and death penalties!!

Are the Canadians finally fed-up with their idiot president Justin Two-Door?? As bad as U.S. Pres. Hussein Odumbo!!

The prices of precious and base metals are set in the Comex Futures Market (paper), not the physical. That’s precisely why Russia, India and China have been able to buy so many tonnes of gold at low prices. Also, it is alleged that India has been able to buy a years worth of annual mine supply of silver. The research of GATA, Ted Butler and Ed Steer speak for themselves. However , their is an escape hatch. Firstly, a “force majeure” mechanism is in place to settle trades in cash in lieu of physical metal, and that there’s a circuit breaker in place temporarily; that only allows gold to increase by $100/day.

I lost $80k or better in a very short time in GLD ETF. I had a feeling that it was rigged against the investor. Now I know.

I own a lot of silver. I was told long ago (11 Years) that silver was a great investment and that it would eventually outperform Gold. Well, I bought silver at $15 per ounce 10 years ago and it’s still around that price today. I believe there is a conspiracy to keep the price of silver low so the average American doesn’t benefit in the long run from buying silver. We seem to be wasting our money on investing in something that goes nowhere and continues to remain low.