This industry just experienced one of the most significant supply deficits on record.

It’s the second year in a row with a tremendous shortfall.

In fact, the combined shortfalls of the past two years alone have entirely offset the cumulative surpluses of the last 11 years.

And this trend isn’t expected to reverse.

Instead, many believe this market is headed to one of ongoing deficits. I’ll explain why in just a bit.

It doesn’t take an economics professor to understand how this continued supply deficit will affect prices in the future.

And those who see it now could be in prime position to profit from it.

I am talking about silver.

And in just a bit, we’ll reveal an overlooked silver company that is set to take advantage of this timing.

But first…

Demand Up, Supply Down

Global demand for silver surged 18% last year, reaching an all-time high of 1.24 billion ounces.

According to the Silver Institute, silver demand set a record in every category last year.

For the fifth consecutive year, net physical silver investment reached a new high.

Silver jewelry fabrication saw a 29% year-on-year increase, also reaching a new high.

The demand for silverware jumped 80%, marking another record high.

Industrial demand for silver – another record high.

Much of the industrial growth was attributed to green energy initiatives, such as electrification in the automotive sector and investments in power generation and distribution.

But even moreso, it was the growth of the solar energy sector, specifically photovoltaics (PV), which consumed a substantial 140.3 million ounces of silver.

And that’s just the beginning.

Solar Growth

Silver is an essential element in the production of solar panels due to its outstanding electrical conductivity.

A recent study by scientists at the University of New South Wales predicts that solar manufacturers will require more than 20% of the current annual silver supply by 2027.

By 2050, silver demand for solar panel production is expected to eat up a staggering 85–98% of the world’s existing silver reserves.

And with good reasons.

Despite the rhetoric, solar power technology could very well put us on the path to sustainable and renewable energy.

As Elon Musk recently reiterated on the Joe Rogan show, we could power the entire United States with 100 miles by 100 miles of solar panels when combined with batteries.

And despite recession worries, which would typically hurt industrial demand for silver, the photovoltaic industry – and other green energy initiatives – remain largely recession-resistant thanks to global government support.

In fact, the International Energy Association (IEA) predicts that the investment in the solar power industry this year will exceed the amount of money flowing into oil production.

Continued Deficit

The remarkable increase in silver demand has resulted in a substantial supply deficit.

According to the latest World Silver Survey, the silver market experienced a deficit of 237.7 million ounces in 2022, which has been described as potentially the most significant deficit ever recorded.

And this is after the 51.1 million ounce shortfall the year prior.

This year, silver is expected to be undersupplied again by over 142 million ounces.

These deficits won’t fix themselves anytime soon.

Due to a prolonged period of reduced silver prices over the past decade, silver mine production has declined. Consequently, numerous silver mines have been forced into care and maintenance or ceased operations altogether.

Meanwhile, there has been little investment in the silver mining sector.

In other words, silver production cannot be materially increased over the short term as it can take over ten years to commence new mining operations.

That means, even if silver prices were to trend higher, it would be a long time before mine production increases enough to balance it all out.

And this presents an excellent opportunity for investors.

The Opportunity

All of this leads to the obvious: We need more silver.

But how many silver producers are there out there? Not many.

Few discoveries have been announced in the last decade, and most silver produced now comes from the last stages of existing mines.

But that’s what makes me excited about the company I am about to introduce.

It’s a company that has not only strategically prepared itself for this coming silver shortage but struck an incredible deal last year to acquire a silver mine that could be put into production in relatively short time.

Readers of this Letter will understand our bias towards management teams who can strike incredible deals – like the management team at Newmarket Gold, who took their twenty five million dollar company, bought a mismanaged gold producer, and in just over a year, sold it for more than $1 billion.

The company I am about to introduce closed a deal earlier this year to buy a silver mine that was put into care and maintenance when silver fell below US$14 in 2018.

If you were to rebuild the infrastructure of that mine today, it would cost you over US$170 million – that’s not including the over 236,000 meters of drilling already completed.

Now get this: they paid just US$35 million – in shares, valued at $0.65.

At the time of the agreement, silver traded at around US$18/oz.

Today, the price of silver is around US$23/oz.

More importantly, the stock is currently trading at just $0.38.

Theoretically, one could argue that investors today are paying just over US$20 million for a mine that would cost over US$170 million to build – not including the land package or the drilling.

And this company just announced something BIG.

Something that makes the deal seem even crazier.

This company is…

Sierra Madre Gold & Silver

TSX-V: SM | OTCQX: SMDRF

Sierra Madre Gold & Silver (TSX.V:SM)(OTCQX:SMDRF) (Sierra Madre) is a precious metals development and exploration company led by a team of seasoned industry vets who have played key roles in managing the exploration and development of more than 22Moz gold and 600Moz silver in combined reserves and resources.

Collectively, this team has raised over $1B for mining companies.

A couple of years ago, we introduced you to this company when it was exploring and developing its Tepic and La Tigra properties in Nayarit, Mexico.

While those are exciting assets in their own rights, we knew management was looking to do something much bigger – especially given their track record.

CEO Alex Langer, who has been a part of many deals we have profited from (including Millennial Lithium, acquired for nearly half a billion dollars) has told us that it was his goal to become a near-term silver producer.

With Langer’s background in finance, we could understand why.

It takes a lot of time, money, and luck to become a producer. Along the way, unless the timing is perfect, a lot of dilution can happen when trying to finance an exploration company to production.

As we mentioned earlier, it can take up to 10 years to put a silver mine in production. And a lot of things have to go right – especially the right financing environment to fund these capital-intensive projects.

This is why exploration companies often change hands many times before it finally becomes a producer.

The faster you produce, the less dilution shareholders experience.

So, when Langer told us it was his goal to become a near-term producer, we weren’t quite sure how Sierra Madre could get there.

But, less than a year later, Sierra Madre announced the acquisition of the past-producing La Guitarra silver-gold mine from First Majestic Silver.

And what a great deal it was.

At the time of negotiation, silver traded at around US$18/oz.

By the time the deal closed in March 2023, silver had hit over $24/oz.

Kudos to the Sierra Madre team for striking when they did.

Of course, a deal is only a good deal if it benefits both parties.

And the guys at First Majestic Silver (worth nearly $2 billion) are no slouches when it comes to business. We’ve met their CEO, Keith Neumeyer, before – he is a smart and savvy entrepreneur.

This is likely why First Majestic sold the La Guitarra mine in shares of Sierra Madre instead of taking cash – they know there is much more value to be unlocked.

By taking shares in exchange for the asset, First Majestic could keep its interest in the La Guitarra mine; that way, it could focus on its other assets while Sierra Madre operates the mine moving forward.

The Asset

The La Guitarra mine is a fully permitted 500 tonnes per day (t/d) facility that’s a short ~100 km drive from Mexico City.

Past production was on the order of 1 to 1.5moz of silver-equivalent per year.

It was purchased for US$174M by First Majestic in 2012. Since acquiring it, First Majestic has spent a lot of time and resources on it.

In fact, we visited the mine and couldn’t believe how clean, new, and functional everything was.

The asset includes:

- Two underground centres (La Guitarra and Coloso).

- The 500 (t/d) flotation mill.

- A permitted tailings facility.

- Multiple work buildings.

- Equipment.

- Related infrastructure.

If you were to replace this infrastructure today, it would cost upwards of US$170M – likely more.

Here are just some of the replacement value estimates:

- 500t/d facility US$60M

- 50km of underground development US$70M

- Buildings and infrastructure US$30M

- Equipment US$13M

- Plus over 236,000 meters of drilling in 1408 holes (from 2012 to 2018, First Majestic completed approximately 128,671 metres of drilling in 689 diamond drill holes)

The Silver Resource

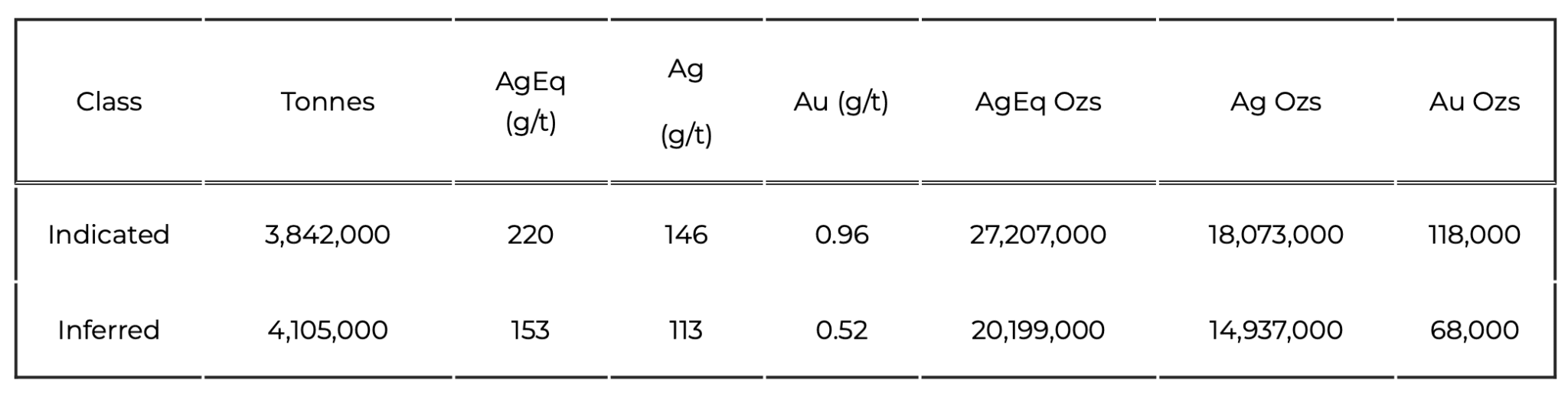

Earlier this week, Sierra Madre made a massive announcement: a 373% increase in its measured and indicated silver-equivalent resources at La Guitarra, with a 204% increase in its inferred silver-equivalent resource.

In other words, in just a few short months of acquiring the asset, Sierra Madre’s management was able to more than triple the resources at La Guitarra.

But that’s not all.

The tailings facility currently contains 2-2.5 million tonnes at 0.4-0.6 g/t gold and 35-40 g/t silver.

If Sierra Madre can secure a permit to use cyanide, it would allow for the reprocessing of the existing tailings.

Furthermore, initial test work completed by First Majestic suggested that 80% gold and 70% silver recoveries were achievable using cyanide leaching. This would not only bring a massive economic benefit for the overall operations, but it would allow Sierra Madre to make additional cash from reprocessing the existing tailings.

The next goal is to bring this mine out of care and maintenance and put it back into operation.

Advancing La Guitarra Towards a Restart

Sierra Madre is now putting together a Mine and Restart Plan, due in the first quarter of 2024, consisting of a capital and operating cost study.

Given the history, we believe the mine has already been quite de-risked. Costs are well-established based on the operating history of First Majestic, including production, reagent and processing, water, labour, and energy costs.

Next year, Sierra Madre will be working hard to procure additional equipment, repair existing equipment, and upgrade the mill to be ready for Q1 2025 commercial production.

If the company is able to complete these tasks, it expects to begin production at 350 t/d and advance up to 800 t/d if things go well.

Previously, at 500 t/d, La Guitarra was producing 1.2Moz to 1.5Moz of silver equivalent per year.

Sierra Madre believes, with the right upgrades and permits, it can hit upwards of 2Moz of silver equivalent per year – equal to US$46,000,000 in annual revenue at US$23/oz silver.

There’s even an opportunity to double that production again, but this is a discussion for after Sierra Madre restarts mining operations.

There is still risk, however.

Rough cost estimates to restart production are between US$3-$5M.

And that means the company will likely need more money to make this happen.

Given the team’s financing capabilities and background, we don’t believe this will be a big issue. For example, there is no offtake agreement attached to La Guitarra, and offtakes can often be used to finance development. This could be a non-dilutive way for Sierra to fund its mine restart.

Plus, the team has collectively raised over $1 billion in the past for other projects, so our expectation is they’ll be able to raise US$3-$5M if a non-dilutive option isn’t on the table.

Moreover, Sierra Madre just announced a much bigger resource – one that has the potential to become even bigger.

Exploration Upside

Becoming a producer is the ultimate goal for every junior exploration company. But once in production, exploration upside is what can drive share prices even higher (aside from higher silver prices, of course.)

And Sierra Madre has plenty.

Sierra Madre controls a full 40,000ha district at La Guitarra, with 5 former mines at the site, plus an additional +53 km of vein material (stockworks) on surface.

The company’s mining concessions cover the entire Temascaltepec mining district and contain numerous Spanish Colonial, 19th, and early 20th-century mines.

In other words, there remains a lot of upside to uncover.

Sierra Madre has already completed the first project-wide geologic mapping program, and a surface and underground sampling program is expected to start shortly.

This could bring yet another catalyst for share price appreciation.

And I haven’t even begun to talk about Sierra Madre’s other projects, Tepic and La Tigra. More info can be found in our original report.

Of course, a company is only as good as its management team.

And First Majestic wouldn’t have sold this asset, in shares, to a team that it didn’t believe could execute.

A Good Combo

Great companies, especially in the mining sector, consist of two very important roles: the operator and the money.

Sierra Madre has both.

There are a handful of geologists whose discoveries have become mines. Greg Liller, Sierra’s Chairman and COO, has done it seven times – playing a key role in discovering and developing more than 11 million ounces of gold and 600 million ounces of silver. One common thing in all of those transactions is that the companies were all purchased by bigger players after production began.

Then there’s CEO Alex Langer, who comes from the capital markets side of the business. He has helped raise money for over 100 private and public companies, many of which have made us a lot of money. He’s also been a founder and a part of many recent successes, including Millennial Lithium, a company that has done very well for readers of this letter. If you recall, Millennial Lithium was sold for $491 million.

In addition, there is one crucial asset when it comes to trusting a management team: skin in the game.

This aspect CANNOT be overlooked.

Management and founders of Sierra Madre own over 20%, institutions hold just over 10%, and First Majestic Silver owns nearly 48%.

In addition, CEO Alex Langer has been increasing his position. In the last week alone, he has purchased another $40k plus worth of stock – bringing his personal total to over 3.1M shares.

We, too, have increased our position since our first introduction to Sierra Madre. And we haven’t sold a share.

Conclusion

Economics 101 tells us that when demand beats supply, prices go higher.

This means the upcoming impact of the photovoltaic industry on silver prices should not be overlooked.

As such, it should come as no surprise that silver prices are expected to climb.

While investing in silver directly can reap good rewards, one of the biggest leverages to silver is investing in the companies that produce it.

That’s because as the price of silver goes up, the bottom line for the miners goes up even more.

If silver prices do catch up to supply and demand fundamentals, Sierra Madre could not have planned the acquisition and restart of the La Guitarra Mine any better.

It’s extremely rare to find a junior company that has the potential to achieve commercial production in such a short amount of time.

In addition, new investors in Sierra Madre today are arguably paying for the La Guitarra mine at a steeply discounted price of $0.38 vs the $0.65 per share that First Majestic sold it for when silver prices were just US$18/oz.

Today, silver is over $23/oz.

And supply and demand fundamentals suggest it should be higher.

In other words, silver – and Sierra Madre – are effectively on sale.

Sierra Madre Gold and Silver

Canadian Stock Symbol: SM

US Stock Symbol: SMDRF

Seek the truth and be prepared,

Carlise Kane

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Sierra Madre Gold and Silver (SM) because we currently own shares of SM. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in SM or trading in SM securities. SM and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. SM is not currently an advertiser, but they may become one in the future.

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this letter.

This letter contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this letter only, and both Equedia and Sierra Madre do not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”, “anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, statements with respect to the completion of the Transaction on the terms set out in the definitive agreement (or at all) and the ability of Sierra Madre to obtain requisite corporate and regulatory approvals for the Transaction, including but not limited to the approval of the Exchange, Mexican antitrust approval and other governmental approvals as currently anticipated.

In making the forward-looking statements included in this letter, Sierra Madre has applied several material assumptions, including that Sierra Madre will be able to receive all required regulatory approvals by the timelines currently anticipated (or at all); and that it will be able to complete the Transaction on the terms of the definitive agreement. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Sierra Madre to control or predict, that may cause Sierra Madre’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, the risk that Sierra Madre is not able to complete Transaction on the terms set out in the definitive agreement (or at all) and the risk that Sierra Madre is unable to obtain requisite corporate and regulatory approvals, including but not limited to the approval of the TSX Venture Exchange, the Mexican antitrust approval and governmental approval as currently anticipated.

Such forward-looking information represents management´s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.