Dear Readers,

From Saudi airstrikes in Yemen to a report from the IEA that global oil demand is rising, analysts and experts have given us many different reasons as to why oil prices have been rising over the past few months.

The problem? It seems most of them have no clue.

What do I mean?

Oil Supply: Too Much, or Too Little?

Just last week, the Telegraph told us that prices were climbing because oil production has been slowing:

“US production has plateaued…(and) unless there is a dramatic turnaround in new drilling activity, the US will struggle to maintain output at current levels in the second-half of this year.”

That may be true, but according to UPI, US oil production is not only increasing, but the nation has taken the top spot among global producers:

“…an annual statistical review from BP this week found US oil and production has put it in the lead in terms of global output.”

Over in Saudi Arabia and OPEC, who together produce nearly 40% of the world’s oil, oil production also continues at record pace:

Via Financial Post:

“Saudi Arabia, the world’s largest crude exporter, boosted output to a record 10.25 million barrels a day last month from 10.16 million in April, according to the IEA.

…Output from OPEC, which provides around 40 per cent of the world’s oil, rose by 50,000 barrels a day to 31.33 million barrels a day, the highest level since August 2012, the IEA said.”

In other words, OPEC is not only continuing to pump out record production, but its pumping out a million more barrels than the world needs.

So if declining supply is not the reason for oil’s recent rise, then surely it must be on the demand side, right?

Oil Demand: Growing or Slowing?

The Telegraph tells us that growing demand, in particular from the world’s now biggest consumer of oil, China, is fueling the price of oil higher:

“The world’s second-largest economy is also showing signs of stronger demand. Orders for crude and liquid petroleum gas have started the year strongly. A recovery in Chinese demand would alone be enough to revive the oil market.”

The IEA also just raised its forecast for global oil demand, stating “recent oil market strength of course partly stems from unexpectedly strong global oil demand growth.”

However, according to ICIS, global energy consumption growth is at the lowest level since 1990 while China’s energy demand is growing at the slowest pace not seen for over 17 years:

“Global energy consumption growth slowed markedly last year to the lowest level since the late 1990s, apart from around the time of the financial crisis in 2008, BP said on Wednesday.

…Global primary energy demand growth slowed to 0.9% with Chinese growth at its lowest level since 1998 as its economy was rebalanced away from energy intensive sectors, BP said.”

Again, one source tells us that oil demand is increasing while the other tells us it’s slowing. So what happens when the media outlets – who report to millions of readers – aren’t sure why the price of oil is moving higher? They make stuff up.

Last week, First Post gave us a big oxymoron of an explanation:

“Oil prices edged up today on hopes of more economic stimulus in China after disappointing data from the world’s No.2 economy.”

Translation: China’s economic growth is slumping, which should lower oil growth demand, leading to lower prices; however, since growth is slumping, China may add stimulus, which will boost oil prices. In other words, the editor had no clue what he was talking about.

When you have so many conflicted views from so many different so-called experts, it’s hard to weed out the truth.

Yet, the answer is right in front of our face.

Why do you think oil prices are rising?

CLICK HERE to Share Your Thoughts

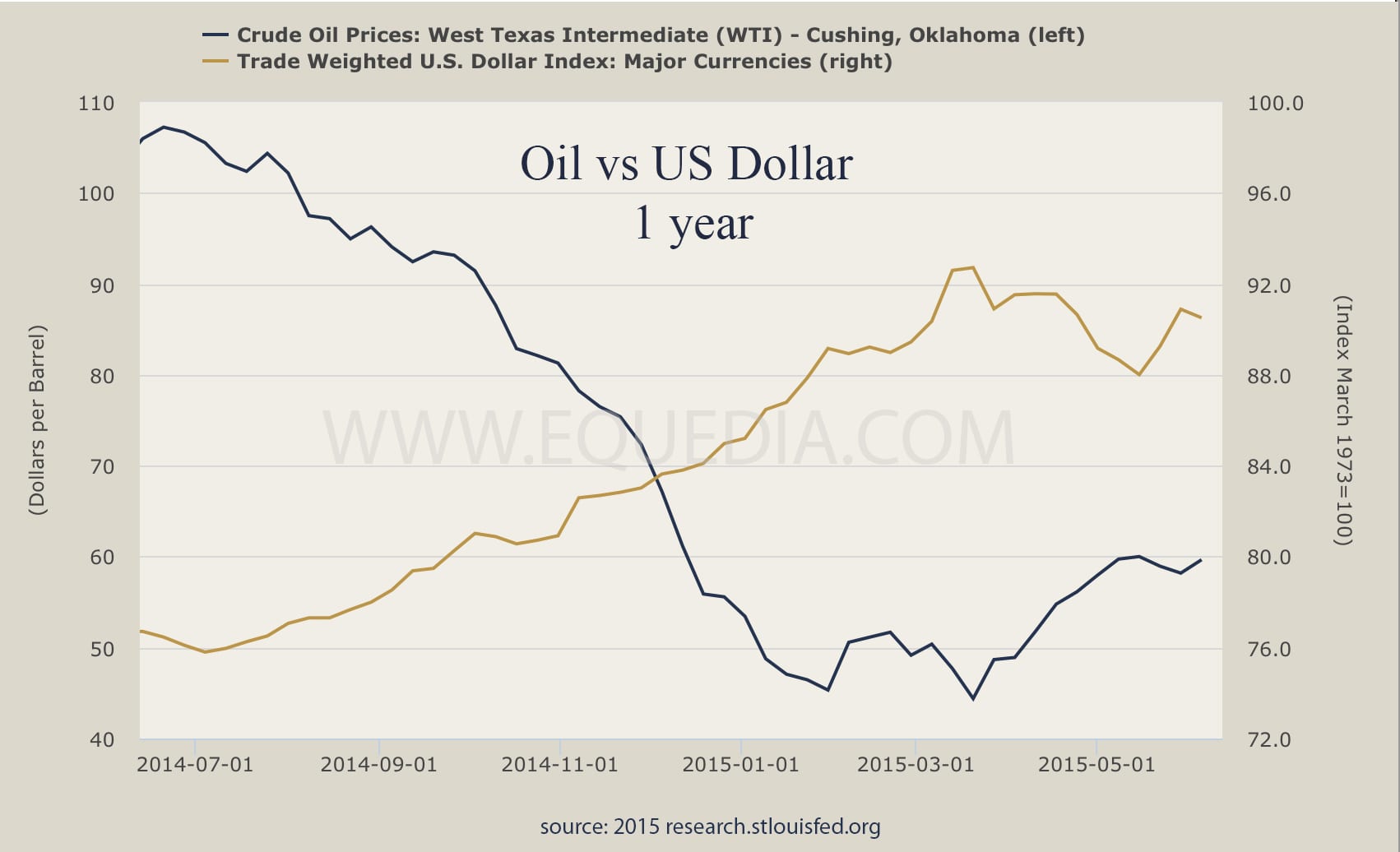

I can show you in one chart why oil prices are rising. Take a look:

The above is a chart of oil vs. the US Dollar index (a trade-weighted average of the US dollar against a basket of the world’s major currencies). When the US dollar falls, oil becomes more expensive; when it rises, oil becomes cheaper.

If we pit the US dollar against the currencies of its major trading partners, the chart looks almost identical.To show you this isn’t just a short-term phenomenon, here is a 10-year chart showing the same inverse correlation:

It doesn’t take an economics professor to see that all major swings in the price of oil have had a direct inverse correlation with the strength of the US dollar.

It is extremely important that we understand this simple correlation to understand not only why the price of oil really changes, but also how it relates to global politics.

The Petrodollar Phenomenon

Oil is priced in US dollars. If the value of the dollar falls, it takes more dollars to buy a barrel of oil.

Most of us – especially long-time readers of this Letter – know the history of the how the dollar gained such wide acceptance, in what has been dubbed the petrodollar phenomenon.

For those that don’t know, the petrodollar is money (US Dollar) earned from the sale of oil, which is recycled to purchase foreign goods and services, and saved in foreign assets held abroad.

The petrodollar started in the early seventies when the US negotiated a deal with Saudi Arabia to price the sale of oil in US dollar. In exchange, the US would offer military protection for Saudi Arabia’s oil fields and also provide the Saudis with weapons and guaranteed protection from Israel.

The only catch was that the Saudis would have to take the US dollars they earned from oil sales and use them to purchase arms and protection from the United States, as well as use them to invest in US debt securities, effectively recycling the petrodollars earned.

It didn’t take long for the other OPEC countries to join in. By 1975, all of the oil-producing nations of OPEC had agreed to price their oil in dollars and to hold their surplus oil proceeds in U.S. government debt securities.

Pricing oil in dollars was a great deal for the Saudis and members of OPEC, but it was an even better deal for the US: the US could now not only buy oil with its own currency – which it created at will – but it could even resell its own debt securities back to the Saudis and members of OPEC.

Currency Manipulation via Oil Manipulation

While oil is considered a finite resource, the Saudis can easily pump out as much oil as it wants and flood the markets to manipulate its price. They just did this last October, and they also did it back in the seventies; both times, intentionally hurting Iran.

In other words, the price of oil appears to be dictated by supply and demand, but its actually dictated by the value of currency and politics.

Knowing that, I want you to remember one very important thing: When the US dollar is strong, the price of oil is weak; when the US dollar is weak, the price of oil is strong.

Think hard about that.

In one of my past letters, I talked about the secret deal between the US and Saudi Arabia, and how they would drive the price of oil lower to attack Iran and Russia. At the time, oil was around $80/bbl and continued its sharp drop in the following months.

If you haven’t read that letter, I suggest you go back and read it now before continuing.

In a follow-up letter, Secrets of Bank Involvement in Oil Revealed, I said:

“As I predicted in my last letter, “The Covert Connection Between Saudi Arabia and Japan,” the manipulation of oil’s drop was meant partly to spur a rise in retail sales just in time for the holiday spending season, and just in time to boost markets before the end of the year.

Retail sales in Britain have now reached a growth not seen in over 25 years. In the US, it will be the first time in ten years that the Saturday before Christmas takes the top spot for the highest single sales day of the year. Meanwhile, sales estimates continue to top analyst expectations, and the market continues to climb.

That means oil’s drop has done what it was meant to do: hurt Russia, help Japan, boost consumer spending, and send the stock market to new highs.”

A month after that letter, the price of oil hit a new yearly low before beginning to rise slowly. Today, oil is just under $60.

Now aside from the “secret deal” with the US, and its attack on Iran, why else would Saudi Arabia want to force the price of oil lower?

Why do you think Saudia Arabia has intentionally been flooding the markets again

CLICK HERE to Share Your Thoughts

How to Buy More for Less

Like all consumers, when your currency is strong, you’re able to buy more for less. For example, when our Canadian dollar was strong, many rushed to the US for bargain deals.

Now remember, “If the price of oil drops, the US dollar strengthens.”

When the US dollar is strong, it allows holders of the dollar to buy more for less.

And guess who has A LOT of US dollars?

Saudi Arabia: The Third Largest Holder of USD

Saudi Arabia is the world’s third largest holder of US dollar, behind only Japan and China.

If you were about to go on a spending spree and had the ability to prop up the value of your money, wouldn’t you? That’s exactly what Saudi Arabia has been doing!

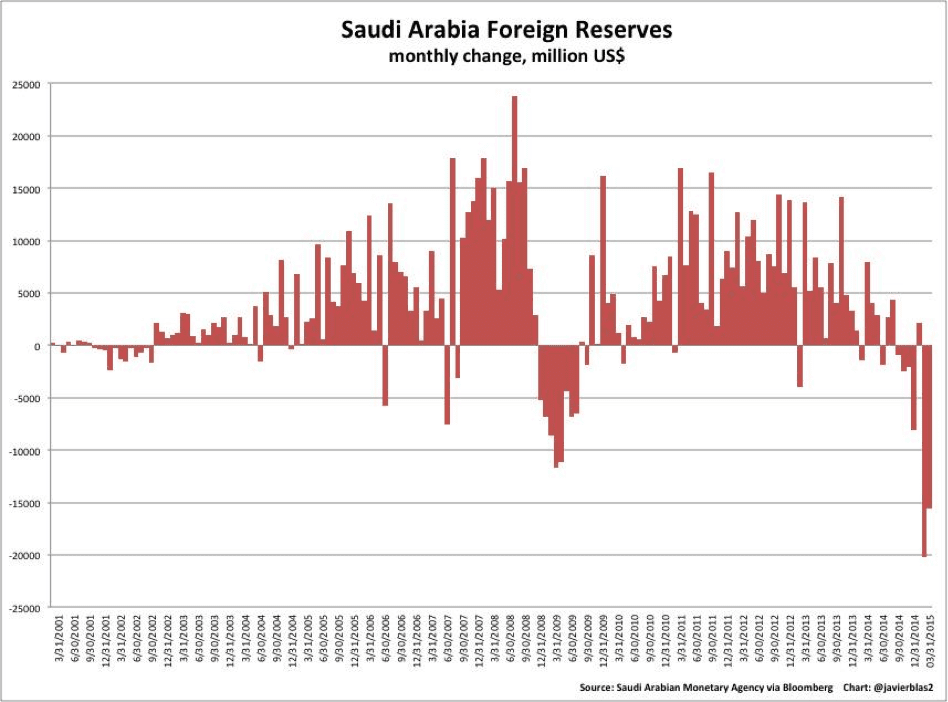

By flooding the market with oil, the Saudis have raised the value of the dollar and have gone on a massive shopping spree. Despite the drop in oil revenues, the Saudis have increased their spending in military and infrastructure, and have been burning through its USD reserves at record pace.

Via Bloomberg:

“The kingdom spent $36 billion of the central bank’s net foreign assets — about 5 percent of the total — in February and March, the biggest two-month drop on record, data released this week show. The fall was in part due to King Salman’s order to give government employees and pensioners a two-month bonus after he ascended to the throne of the world’s biggest oil exporter in January.”

With the drop in oil price, take a look at just how much US dollar Saudi Arabia has been spending:

Some may argue that Saudi Arabia’s recent drop in US reserves is a result of lower oil prices, forcing the nation to spend to cover its deficit. From the onset, this argument seems very logical.

But if it were that simple, why would the Saudis spend record amounts of money during a time when oil revenues are low? Why wouldn’t they postpone spending?

The Attack on the Petrodollar

If you knew your currency was about to lose value, would you not spend as much of it as possible now?

Perhaps that’s why the Saudis have gone on a massive spending spree.

I have written many pieces on how rising nations, such as China and Russia, are beginning to bypass the Dollar in international trade.

“A few months ago, Russia announced that it would begin selling oil in both Rubles and the Yuan, further penetrating the petrodollar system.

Shortly after that announcement, Russian and Chinese central banks signed an agreement on Yuan-Ruble swaps.

…Since that agreement was signed, the trading of the Ruble and the Yuan have already reached record levels according to the Moscow Times.

But China didn’t stop there.

Just a few weeks after the deal with energy power house Russia, China signed yet another one with Qatar, the world’s largest LNG producer.

…China has now signed currency swap deals with two major financial hubs – Europe and Singapore – and has now signed two massive deals with two of the biggest gas giants in the world, Russia and Qatar.

If China keeps this up, how much longer will the petrodollar maintain its dominance?

Even Argentina, a country that has been controlled by the IMF and World Bank, is now turning to China by activating their currency swap deal announced earlier this year.”

As a result of US sanctions, Russia has already begun to sell oil to China in Chinese currency, bypassing the dollar altogether. Earlier this month, Russia’s third-largest oil producer, Gazprom Neft, announced that it has been settling all of its crude sales to China in renminbi since January.

Via FT:

“Gazprom Neft, the oil arm of state gas giant Gazprom, said on Friday that since the start of 2015 it had been selling in renminbi all of its oil for export down the East Siberia Pacific Ocean pipeline to China.

… Gazprom Neft responded more rapidly than most, with Alexander Dyukov, chief executive, announcing in April last year that the company had secured agreement from 95 per cent of its customers to settle transactions in euros rather than dollars, should the need to do so arise.”

While the amount of sales haven’t been disclosed, we do know that oil exports to China from OPEC are slowing while oil imports from Russia are growing.

Via WSJ:

“…Chinese customs data released Friday show that China’s crude imports from some big OPEC nations have plummeted, while imports from Russia surged 36% in 2014. Meanwhile, imports from Saudi Arabia fell 8%, and those from Venezuela dropped 11%.”

It’s clear that China and Russia are challenging the dominance of the petrodollar. However, currency settlements between these two nations alone won’t be enough to encourage other nations to leave the petrodollar.

That’s why China has plans to launch its own yuan-denominated international oil pricing benchmark via a newly created oil-futures contract in Shanghai’s free-trade zone. Participation in the exchange will be open to all foreign investors, and the yuan will be fully convertible under the contracts.

And according to the Shanghai Daily, we’ll see a new oil futures market by the end of the year:

“China’s first oil futures contract is likely to start trading by the end of this year, said the Shanghai Futures Exchange (SFE) chairman Song Anping on Thursday.

“As an important consumer of crude oil, a crude oil futures contract in Shanghai will complement and perfect the existing global oil-pricing system,” said Song.”

I talked about this last year:

“With the recent manipulation of oil prices, China has also now approved the launch of the Shanghai oil futures exchange. This will mark the first internationalized futures contract in Chinese history.

China is the second largest oil consumer in the world, so it makes sense that oil will be traded in this nation.

However, for this exchange to take off, China will have to finally liberalize its oil sector – a feat that has been expected, but yet to be fulfilled, for quite some time.

But given China’s ambition to make its currency fully convertible, I would expect that China’s oil market will soon be liberalized in order to invite trust amongst foreigners. A new Petrodollar, so to speak.

For traders to trust China’s oil futures platform, China will have to back it with physical inventories. And that, of course, means China will have to buy a lot more oil.”

So have the Chinese purchased more oil? Let’s find out.

Via ABC News:

“The world’s second-largest economy has become the top oil importer in April. The key reason? China is taking advantage of cheap oil to boost its strategic reserves.

They’ve been building out strategic storage. The goal is to build out to about 500 million barrels, compared to the U.S. capacity of 700 million to 800 million barrels,” said Jeff Brown of Singapore-based energy consultants FGE.

Brown said that while the numbers are a little murky, China has already built out about 150 million barrels of extra storage, with more capacity planned through the end of the year.

“They take a lot of pride in buying oil when it’s cheap,” he said.

Despite the massive capacity boom, China is still buying more oil than it can store — and all that crude has to go somewhere.

The solution lies in the Strait of Malacca. At anchor just a few kilometers off the coast of Malaysia lies the TI Europe, brimming with about 3 million barrels of oil destined for China.

This 440,000 tonne monster is the world’s biggest tanker. She has been leased by the China’s state owned oil company at an estimated cost of $40,000 a day, to store oil until it can be shipped to China in smaller vessels.

And she’s not the only one. Oil tanker analyst Richard Matthews of Gibson Shipbroking in the U.K. says there has been a surge in the number of supertankers being leased for storage.

“Normally, excluding Iranian ships, you might see only two or three ships storing, and they could be supporting offshore projects,” he said. “Now there are up to 17 or 18 non-Iranian tankers.”

Supertankers can also be used to store oil in a market where the future price of crude is expected to be significantly higher than the current price.

Speculators buy cheap, bear the huge cost of storage and finance, and still make a profit when they sell a few months later.

But analysts say that, for now, the difference between the current and future price is not wide enough to rake in speculative profits, which points to China filling its boats.”

While we can’t predict the short-term manipulated price movements of oil, we do know:

- Saudi Arabia is spending record amounts of USD from its reserves

- China is hoarding oil and looking at launching a new oil benchmark by the end of the year

- The Petrodollar, while still the powerhouse, is slowly losing power as other nations continue to bypass the US dollar in international energy trade

All things remaining constant, the value of the US dollar will likely diminish in the future. And if the US dollar falls, the price of oil will rise.

The Equedia Letter

I think the relationship between the strength of the dollar and the price of oil may not be as strong as it appears on the 10-year chart . The chart is linear, appearing to show a fall of about $20 in the price of oil for every 4 point rise in the trade-weighted dollar index (and vice versa). Such a correlation could not extend much beyond the chart’s boundaries, as it would imply an oil price of zero if the index were to climb to around 104, and a negative oil price thereafter. I think a chart showing percentage changes rather than absolute amounts would more clearly demonstrate the relationship between dollar strength and oil prices.

The Dollar is definitely what will take the hit.as America continues expanding our welfare state,causing deficits to soar and the Fed to devalue those deficits.Also,I believe the 40 year oil bull market,1973-2013 is over.So,maybe a standoff,where the Dollar price of oil doesn’t crash or rises,but the real price of oil declines.

I mistakenly unsubscribed please reinstate