Time is Running Out: The Charts You Need to See

Last week, I released a special report on uranium and a company that I really like, Uranerz Energy Corporation (TSX: URZ)(NYSE MKT: URZ).

If you missed it, I strongly suggest you click the following link to read it:

Here is a brief excerpt from last week’s letter:

“There is a remarkable opportunity emerging in a market where demand growth is running into a serious wall of tightening supplies. And we’re about to witness a dramatic shift in control for this supply.

I have talked about this change before in many of my past letters. But the time to act on this change is running out.

Literally.

By the end of the year this shift will take place. And it will put America at a major disadvantage.

The global market is about to run headlong into its first major supply deficit; one that will be controlled by a major world player that doesn’t play ball with the West.

Major institutions, such as JP Morgan, are predicting that prices will more than double within the next few years. But I think that’s being conservative

There is strong evidence that prices will go even higher; including a recent political change in a major economy.

There has never been a better time to speculate on these events.

In this special edition letter, I am not only going to introduce you to this explosive opportunity, but also introduce you to a Company that is poised to take advantage of this upcoming explosive market.

Analysts are already shooting out buy signals for this Company with prices much higher than where the Company trades today.

Industry experts are already touting that, “this Company is primed for growth” and “sees (its) current price as a gold-plated bargain.”

The opportunity within the uranium sector is building. When the funds and brokers get back to work in September, they’re going to be jumping all over the opportunity.

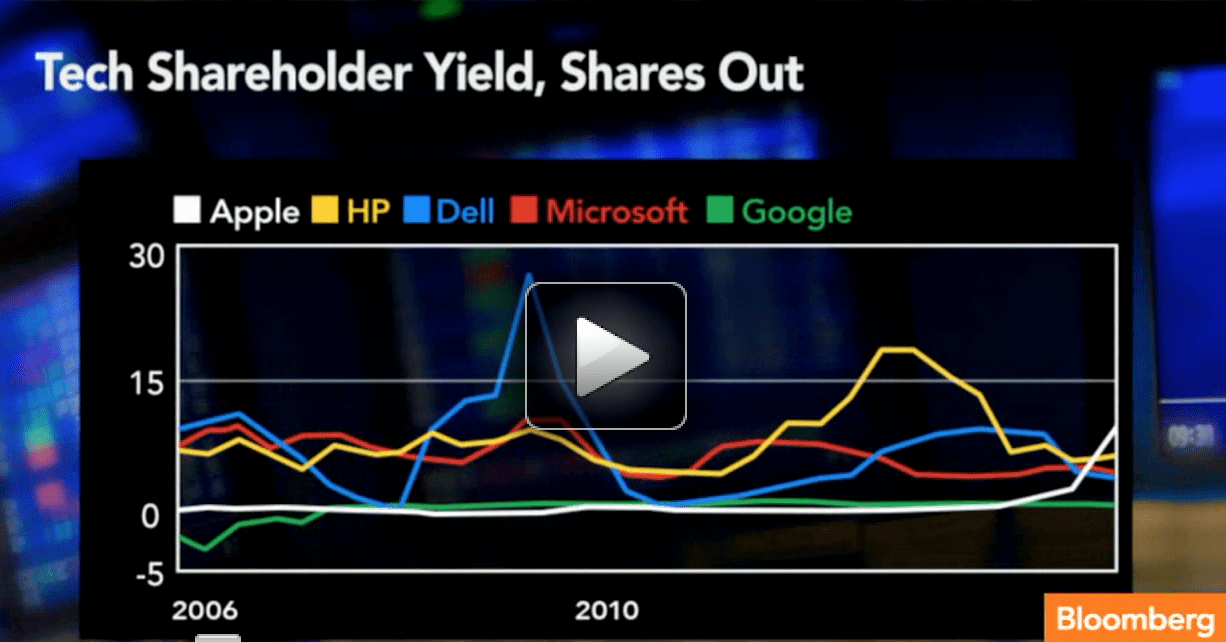

Many of these money managers are already missing much of the upside within the precious metals sector, as I mentioned they would a few weeks ago.

As a matter of fact, many of the miners are already up double-digits and it looks like there’s lots of room for upside.

I said this would happen just a few weeks ago in my letter, “This Could Kill the Stock Market.”

In that letter, I also mentioned that it was time to get defensive on American markets because of the action on the 10-year yield.

That was August 4, 2013.

Turns out that Friday, August 2, was the stock market peak; both the DOW and S&P 500 has continued to fall since those highs. The DOW also posted its worst week of 2013.

After two weeks of seeing red, is the correction over?

Let’s look at the market’s most accurate indicator again for some more insight.

The Most Accurate Indicator: The 10-Year Yield

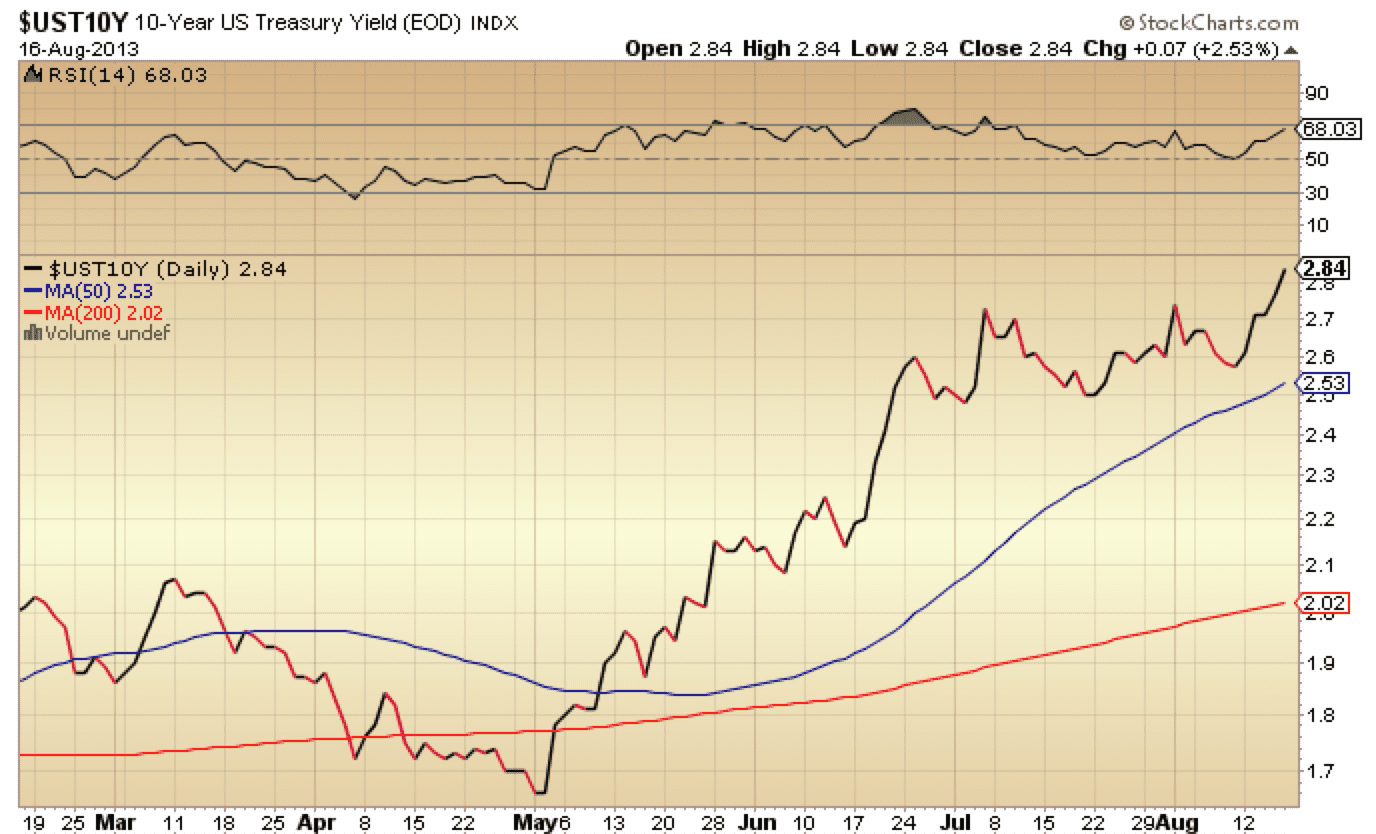

Since the 10-year yield crossed both its 50 and 200-day Moving Averages, it has been on a meteoric rise; a rise not seen since 1962.

The 10-year yield soared to a fresh two-year high this Friday, climbing as high as 2.86%, before settling around 2.84%.

It’s now up 75% since its lows in May.

The 10-year yield is the benchmark interest rate index. As it rises, the cost of borrowing and doing business becomes much greater, leading to declines in affordability and economic growth:

“Higher interest rates makes housing less affordable and among other things, will slow GDP growth. Given that the housing sector is already being affected, as noted by the continued decline of mortgage applications, the 10-year yield continues to prove itself as a consistent indicator.

The decline in mortgage applications clearly indicates the effect of the 10-year yield. Mortgage rates in the U.S. have already jumped from 3.4% in early May to 4.4% today.

When the 10-year yield goes up, so do mortgage rates.

And the drastic decline in mortgage applications follows.

Not only do rising rates cause a major slowdown to economic growth – especially during a time when growth is needed – they can have an adverse effect on the financial markets.”

This shift in market sentiment has recently changed the minds of many to once again move some profits into safe haven assets and away from risk.

That, of course, leads us to gold.

Front-Running for Profits

Remember when I told you on July 17, 2013 that the big banks – including JP Morgan – were suddenly buying gold:

“The world’s real financial system is a complete mess, hidden by accounting procedures and complex derivatives. That, combined with continued worldwide monetary stimulus, should send gold prices soaring.

But it hasn’t.

That’s because many of the big banks have manipulated and forced the price of gold down so they can rebuild their position. Of course, I can’t be sure this is happening but all evidence points to that being the case, and there really is no other answer for how gold has been forced down.

Big banks like JP Morgan continue to lose gold from their vaults, dropping its total inventory to a fresh record low last week, according to recent COMEX updates.

Combined with the moves in JPM and HSBC inventory, the total Comex gold holdings have now dropped to a new low not seen for the first time since 2006.

A couple of weeks ago, Brinks saw 24% of its entire registered gold holdings, or 133k ounces, withdrawn. That number has now dropped from 570,000 ounces on July 3rd to 257,000 ounces last week, representing a decline of 55% in just one week.

But here’s where it turns.

U.S. banks are now starting to rebuild.”

This time JP Morgan is telling us that because of the questionable weak price action in the paper markets, combined with unprecedented physical demand, seasonal positives and physical supply constraints, we should be long gold and gold and silver miners:

“The World Gold Council reported today that physical gold demand remains strong, questioning the price weakness seen in paper markets. Additionally, gold supplies could be constrained in September if labor strikes are initiated in South Africa. There’s typically some positive seasonality to the gold price in August/September helped by India, which is still the largest single (28%) gold market.”

They’re also telling that we should be buying gold ahead of the Denver Gold Conference in September:

“The conference attracts many of the larger gold investors and given the other positives for the metal (and that the depressing effect of the Q2 results is past) we would not be surprised to see a stronger gold price in the run up to the show. We’d encourage shorter-term investors to consider getting long the gold space with a four to five week time horizon. This year the Denver Gold Forum will be from the 22nd to 25th September.”

Given that none of what JP Morgan has told us are new facts, why are they now telling us to buy gold?

“From a technical perspective, we are really beginning to see signs of capitulation. Could gold move up violently from these levels? Yes – especially from a technical perspective.”

Take a look at the dates when I wrote those letters:

The chart speaks for itself.

The Best Correction Indicator

One of the best correction indicators, as explained by our friends at Zacks, is the Bullish Percentage Index (BPI):

|

| click to play |

The video explains, and proves, how the BPI could’ve been used to gauge the recent sell-off in the American markets.

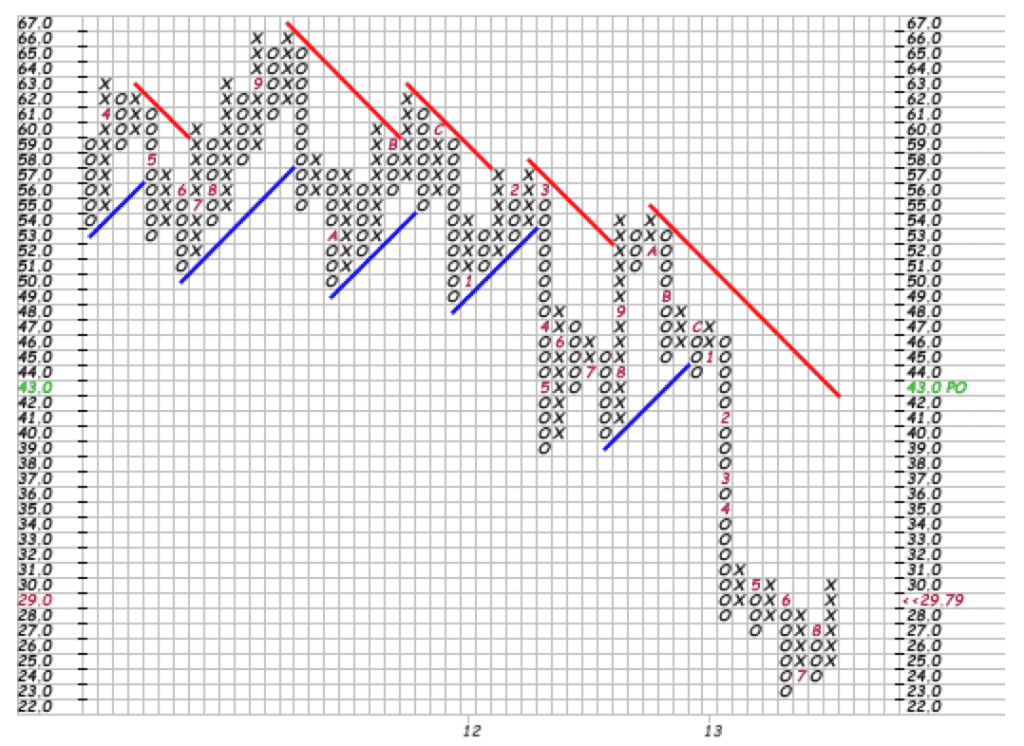

The market (S&P 500) (represented by the black line) is now well ahead of the NYSE BPI (represented by the dark area), which indicates that a bigger correction could be coming:

Now let’s take a look as it relates to the gold market.

The Gold Miners BPI is now at 51.72 – an extremely strong reversal in buy sentiment since we were alerted of the bull confirmation exactly one month ago.

The GDX (Gold Miners index) confirms the BPI bull alert signal from last month, with the index up nearly 37% since the lows of June, and up nearly 9% this week alone.

A double top breakout with strong signals of further upside can now be seen in the GDX, with a P&F target projection all the way up to 43. While this doesn’t mean it will go there, it does signal that the current technical base is strong enough to allow for a rise up to 43.

The GDXJ (Junior Gold Miners Index) gave as an Ascending Triple Top Breakout alert on Monday, proving that demand is clearly outstripping the supply of stock available. Since that alert, the GDXJ is up nearly 12% and up over 50% since its June lows, with demand still building.

All of the gold miners are being supported by the recent action in gold.

Here is the P&F chart for the GLD (the paper gold index), which shows a double top breakout pattern with plenty of support to allow for a move to 150 – very similar to the recent pattern of the GDX:

The GLD, GDX, and GDXJ have all now moved passed their 50-day moving averages, giving us more buy-side signals in the near-term.

As I mentioned before, I think that this run will likely head through September; those that are currently out of the market will likely miss out on a lot of upside.

And that is why I always encourage my readers NOT to take time away from the markets in the summer.

Equedia Selects Shine in Rebound

Balmoral Resources (TSX: BAR) (OTCQX:BALMF)

Balmoral Resources (TSX: BAR) has now graduated to the senior TSX exchange, which puts them in a much better opportunity to attract funds and other institutional buyers.

This was evident with the recent climb of 16% this Friday – the day Balmoral rung the bell on the TSX. Balmoral is now up over 103% since its low just a few months ago on June 27, 2013.

Since we’re looking at charts this week, take a look at Balmoral:

Balmoral has shown great strength since moving passed its 50-day moving average and is now looking to hit its 200-day. The stock has also signaled an extremely strong new uptrend. While the RSI over 74 shows that BAR is slightly overbought, the continued move in gold could send BAR much higher.

Aurcana Corporation (TSX.V: AUN)

Aurcana (TSX.V: AUN), another Equedia Select company, has been the number one performing silver stock over the past few months, climbing up nearly 167% since its low – also on June 27, 2013 – of $1.15.

Aurcana has also passed its 50-day moving average and the P&F chart shows us a double top breakout, with a technical base that would “allow” for the stock to rise to $5 (price objective):

If gold and silver continues to move – which I believe they will – I expect all of our Equedia Select companies to perform well.

Summer is almost over.

With the precious metals market looking to breakout, the chances for buying cheap stock within the sector may be running out.

Until next time,

Ivan Lo

The Equedia Letter

We’re biased towards Uranerz Energy Corporation, Balmoral Resources, and Aurcana Corporation because they are advertisers and we own options. We own shares of all of the companies at the time of this writing, and may buy more shares following this report. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including Uranerz Energy Corporation, Balmoral Resources, and Aurcana Corporation. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Uranerz Energy Corporation,Balmoral Resources, and Aurcana Corporation and their management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Please visit for full disclosure: http://www.equedia.com/terms-of-use/

please adjust the images as I can not see the charts??!!

Sorry! The charts have been updated and you should now be able to see them. Thanks for your patience.

Balmoral etc….Three months later……Ouch

Now watching to see whether the uraniums do likewise

Can’t say we DON’T appreciate your coverage however

Keep up the good work

Thanks

I purchased mining and gold shares at the end of September and some are up 25% plus. I expect a small pullback in gold thru late September, then it should take off again thru 2016. Good investing

Witth your comments on the TSX attracting investors, shouldwe expect to see better performance, particularily in energy?

You were pushing Uranerz in past couple of weeks when you probably knew that company was doing a placement at a lower price , unethical! All your ” stock picks” are doing horribly!!!

All of the predictions in this news letter turned very bearish within 10 days. After reviewing the chart pattern moving averages, I found that all the rallies mentioned on the stocks and index’s were in the context of a Bear Market. Thus signifying the rallys as a “BULL TRAP” in technical lingo.

For what it is worth Gold has been in a Bear Phase since March 2013 “within the context of an extended 12 year Bull Market”.

Fibonacci shows a top in the 13th year, 2014 – 2015. It would only take Gold to a new High in the most likely low $2000. range.

It only today displayed continued over-extended selling to $1241.70 with the days trading displaying golden cross close. (Island Reversal) Fridays open and close will lead the way into February.

My suspicion is with option expiry monday Nov 25, a sustainable rally will commence Tuesday Nov. 26 carrying the gold price to $1400 by January 2014.

The US Major Market index’s have been in an extended Bull Phase and should show weakness into year end with trader lockup profit syndrom. Bond yields have been very Bearish since July 2012 so it is likely the Indexes will show strength to Mid February.

Important long term Gold moving averages are at an Index convergence; with the 4 year moving average. Should Gold not Rally substantially to around $1500 by Summer 2014, which should carry Gold to the low $2000. price tag. It is likely a very volatile sideways market will develop for several years most likely between $1150 and $1450.

With oil back to $95 today, is becoming apparent that it may also channel between $90 and $110.

Dont forget production (supply) over the past several years has been in a decline. While demand although latent in North America is well and alive elsewhere in the World.

Dividends for cash flow from mid to senior producers would be a minimal risk entry before Xmas. Look at ETF’S with assets only in gold producers paying out monthly dividends and option writing profits.