If you believe electric vehicles are the future…

This one company owns one of the largest and most advanced undeveloped lithium projects in the world.

In fact, investors can now buy shares of this Company for 70% less than what a group of strategic Chinese investors did a couple of years ago – a group that invested more than $30 million at a price of C$3.50 per share.

Right now, the Company trades at only $1 per share.

Even better is the fact that the project is now much more advanced than it was when those investors put in over $30 million.

And, after a series of key announcements in 2019, this Company has gone from prospect to world-class leader.

But before we tell you about what we believe to be an undervalued opportunity, a little background is in order.

The New Era

Lithium, the world’s lightest metal, has been hailed as “the new gasoline” by Bob Koort with Goldman Sachs Research. It’s an ideal component in the construction of lightweight devices ranging from car batteries to smartphones.

Though strong enough to handle virtually any job – even being used to build nuclear weapons – lithium’s recent rise to prominence is thanks to the explosion of consumer products that need long-lasting battery life.

Credence Research’s latest report projects that the lithium sector will grow at a compound annual growth rate of 16% until 2025. The firm says this is due to the growing demand for consumer electronics in conjunction with the rise of lithium Giga factories across the globe.

In 2019, India announced its commitment to the renewable arms race, increasing its own proposed Giga factory’s output from 40 GW to 50 GW. The nation has previously said it hopes to ensure 30% of its vehicles are electric by 2030 in an attempt to curb pollution but has likely been paying close attention to Tesla’s network of Giga factories.

The international effort against global warming and the increasing popularity and affordability of EVs means Japanese, Korean, European, Chinese, and American car manufacturers (Tesla, of course, and Chevy’s new Bolt) are all jockeying for market share.

Ford, the American automotive giant, announced its aim of deriving the lion’s share of its revenue from EV sales by the end of 2022 due to stagnating demand for gas-powered vehicles.

Heck, even Ferrari and Lamborghini is touting that their new vehicles will be hybrids.

There’s no doubt Tesla’s recent death-defying comeback confirmed the enthusiasm among consumers for environmentally-conscious products: The Company’s share price went from its year-low of $177 per share to $969 per share earlier this year.

While Musk is a media darling and generates incredible excitement in the markets, the sector at-large is also showing signs gaining momentum. Chinese EV manufacturer NIO Inc. nearly doubled the number of units delivered between 2018 and 2019 and reported a 58% increase in revenue over the same period.

It’s clear EVs aren’t going away – they’re just raring up. The issue is that lithium pricing is now approaching marginal cash cost and with demand set to continue skyrocketing, finding ways to maximize profit margins will be crucial.

Especially as lithium mines shut down.

EV’s Picking Up, Lithium Supply Shrink

Australia, a renowned mining locale, is unsurprisingly the world’s largest lithium producer. The nation’s boundless natural resources make it a miner’s paradise, and hard-rock mining has been used there since the mid-19th century.

Eventually, industry down-under began to look favorably on lithium and, though the process was costly, the market was quickly flooded with the metal. This created an environment where only brine projects can remain both profitable and cost-competitive.

Furthermore, a lasting bear market slump due to a glut in lithium supply has brought on a worldwide slowdown of new lithium projects and production from those currently operating.

A February article in Reuters explained the French miner Eramet’s decision to freeze the development of its lithium mine project in Argentina, only one recent example of a rapidly emptying arena.

As the old adage goes: ‘stay ready, you don’t have to get ready.’ With much of their competition on the sidelines, companies like ML may be positioned to supply an underserved market as EV production continues its inevitable, yet whisper-quiet, roll towards the roads of tomorrow.

The Big Four

As much as 90% of today’s lithium market production comes from just four companies: Soc. Quimica & Minera de Chile SA, Albermarle Corp., FMC Corp., and China’s Tianqi Group.

That means they’re the ones setting the price for almost all of the world’s current lithium supply.

So why haven’t others entered the space?

Just because something is abundant, doesn’t mean it’s economical. The costs of extraction and the production of lithium are precisely why many lithium juniors, and others who have tried to enter the space, have failed.

If you want to be a lithium player, you better have economically viable lithium assets.

Cheap Lithium

Under current conditions, outside the rare occurrence of extremely high-grade hard rock operations, truly economic lithium is most abundant in one form: lithium found in salty pools of water known as brines.

This is accomplished due to the high-quality of lithium extracted from brines. According to S&P Market Intelligence, “the value of the concentrates produced at hard-rock mines is on average, US$6,250/t LCE lower than that of the lithium chemical products produced at brine operations.”

Once extracted, the concentrates are then in need of refinement. Australian mines must export their evaporated lithium to nations like China for processing and production.

Then, products for rechargeable batteries are manufactured out of the lithium–these services typically range between $7-9 thousand/tonne.

Latin American lithium is poised to exploit this inefficiency: companies like Millennial Lithium have operations in the world-class mining jurisdiction of Argentina to both extract and produce lithium domestically.

The Company expects to produce lithium at a rate of $2-4 thousand/tonne, on-par with other South American competitors.

But there’s a problem: Not only does the brine have to have high enough concentrations of lithium, but it also has to have the right chemistry. And even then, it’s still not enough.

You also need the right climate for nature’s evaporation process to take place.

And there is only one place on earth with lots of lithium brine and the right climate…

The Lithium Triangle

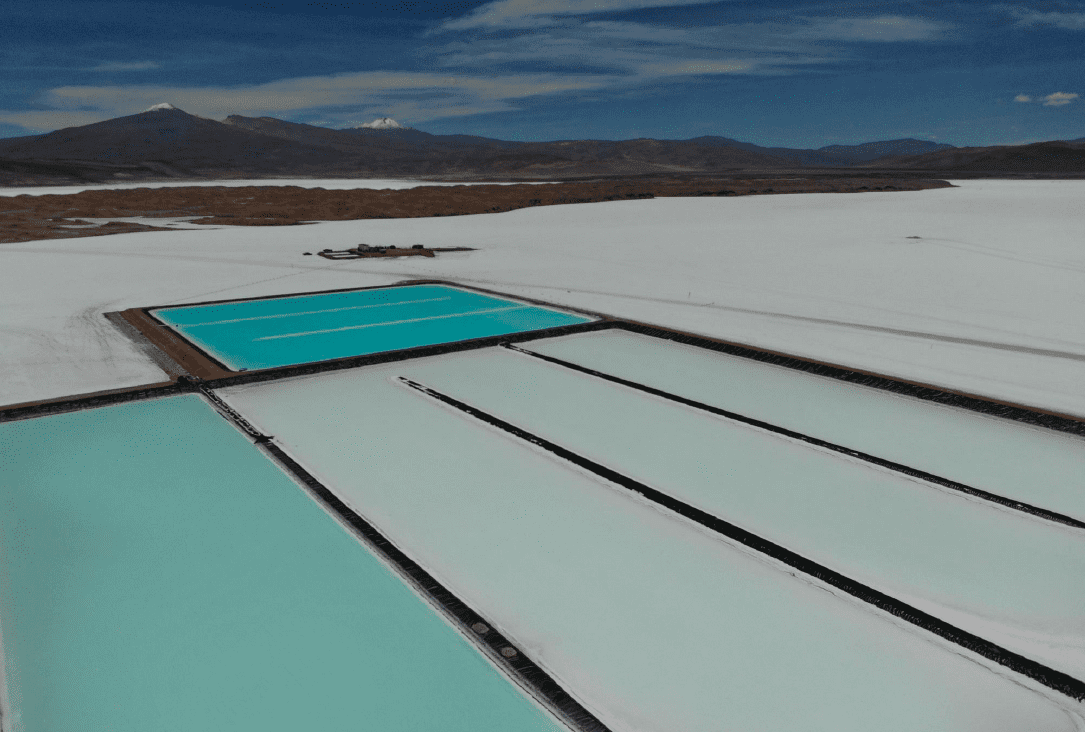

The most famed accumulation of lithium brine in the world can be found in the Atacama Desert, part of what has been dubbed the “Lithium Triangle” of Bolivia, Argentina, and Chile.

More than 70 percent of the world’s long-term supplies of lithium is found within this triangle. And being the driest non-polar desert in the world, it’s also the right climate for evaporation.

There is so much lithium here that people are calling these three nations, the new Saudi Arabia.

But don’t think anyone can just jump in and invest. Bolivia, for example, has been quite hostile towards foreign investment – it wants to control and limit how much lithium is produced every year, and it just suspended lithium mining last year after opposition from local residents around the enormous lithium-containing Salar de Uyuni salt flats.

Meanwhile, Chile is not currently granting any new concessions. And if you’re going to develop lithium in Chile, you’re likely going to do it in partnership with the nationalized mining company, Codelco.

This is why if you want to get into the lithium triangle, you really only have one logical choice…

Argentina

That said, Argentina isn’t a monolith, and investors would be well-served researching the country’s respective provinces for a suitable investment climate.

Provinces like Salta are especially of interest, having ranked fourth on the Fraser Institute’s 2019 Investment Attractiveness Index comparing Latin America and the Caribbean Basin.

Argentina is well-known for its world soccer elites, like Diego Maradona and Lionel Messi, beautiful landscape, and of course, beautiful women.

It’s also the world’s number three lithium producer – producing 17% of the world’s lithium supply.

According to Argentine mining secretary Jorge Mayoral, Argentina sits on resources that may surpass 128 million tonnes of lithium carbonate.

But that’s not all.

Unlike Bolivia and Chile, the nation’s previous administration of Mauricio Macri was all about business.

Via Reuters: “Macri has begun making sweeping changes in a bid to return the country to economic orthodoxy, removing onerous capital controls and sending a message that the country is open for business again after more than a decade of protectionism.”

What’s more, the nation’s current president has been called a “boon for miners,” and one Company stands to benefit big from this opportunity.

In fact, they have direct contact with the very highest levels of the Argentine government.

One of the Largest and Most Advanced Undeveloped Lithium Assets:

Millennial Lithium

Canadian Trading Symbol: TSX-V: ML

US Trading Symbol: OTCQB: MLNLF

Millennial Lithium (TSX-V: ML) is a Canadian lithium play with two lithium-brine projects in one of the most favourable lithium places in the world: Argentina.

Over the last few years, Millennial Lithium has been aggressively acquiring and advancing lithium assets in the Argentinean portion of the Lithium Triangle. To date, the Company is one of the most advanced plays on the continent and holds one of the largest undeveloped lithium projects in the entire world.

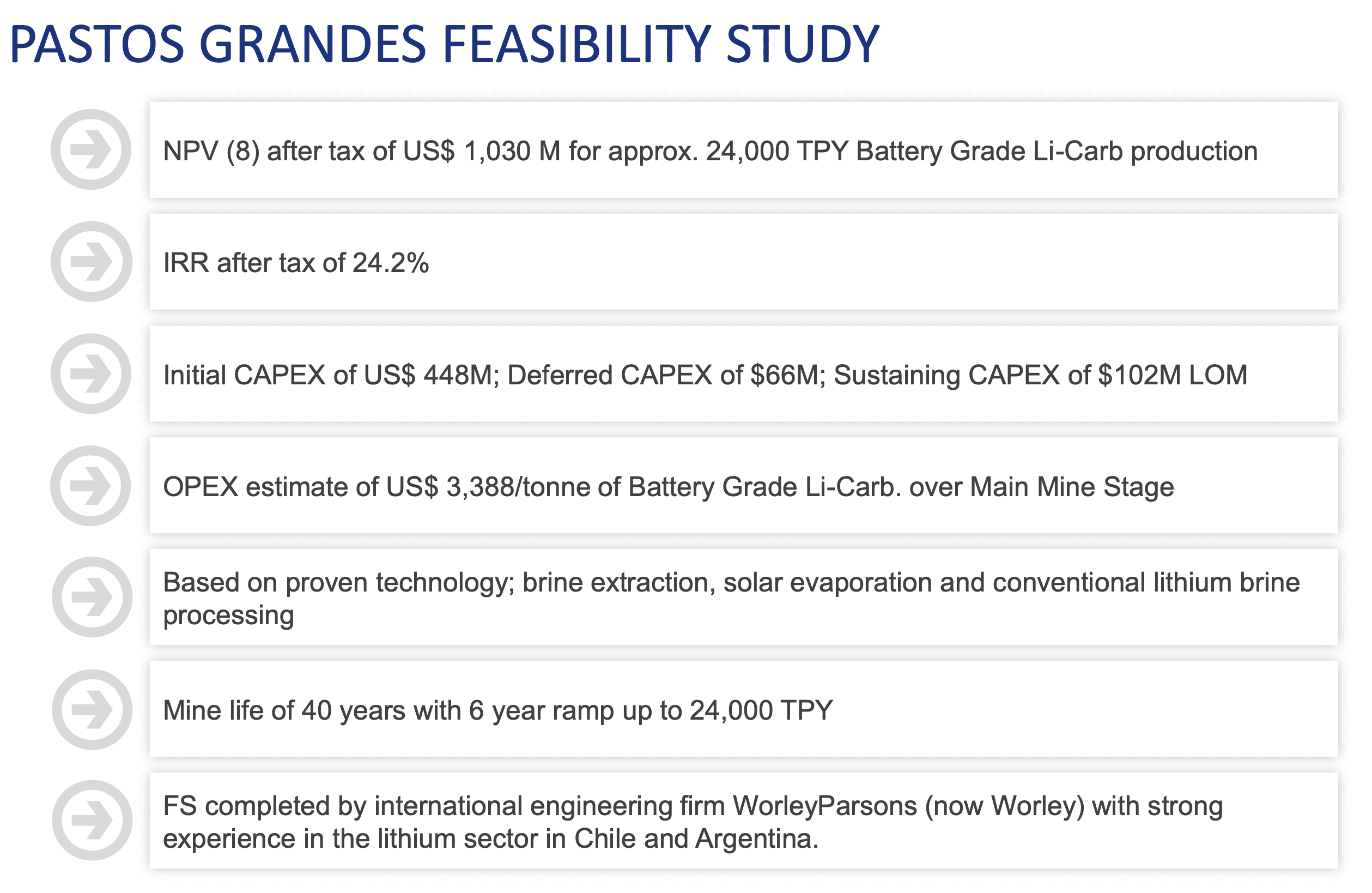

Together, the assets cover roughly 23,000 Hectares, and their 100% owned Pastos Grandes has a Measured and Indicated Resource of 4.12 million tonnes of Lithium Carbonate Equivalent and Proven and Probable reserves of 179,000 and 764,000 tonnes of LCE, respectively. This is huge. Under their recent Feasibility study, this is a 40-year mine life…to start.

These Projects are smack in the middle of other lithium properties owned by companies with market caps well above Millennial Lithium’s current valuation.

The Company’s flagship project is the 100% owned Pastos Grande Project

The Pastos Grandes salar is located 231 Km from the city of Salta at an elevation of 3,800 meters and sits right along the Borate Belt in Argentina, where boron and lithium are the lithophilic elements.

In Layman terms, it sits in an area home to a lot of lithium.

In fact, you can literally draw a line from Salar del Hombre Muerto, where FMC (one of the world’s largest producers of lithium) is currently producing, up through a number of lithium projects in development, to the top end where Orocobre is also producing.

In fact, you can literally draw a line from Salar del Hombre Muerto, where FMC (one of the world’s largest producers of lithium) is currently producing, up through a number of lithium projects in development, to the top end where Orocobre is also producing.

Along that trend, you have Millennial Lithium’s Pastos Grandes project, which sits right in the place you’d expect it to.

If the names sound familiar, it’s because Orocobre’s project in Salta is 30 percent owned by Toyota.

Gang Feng, China’s largest lithium-compound producer, also has a 50 percent interest in Lithium America’s project.

Even ML has received investment capital from GCL, a major Chinese energy provider. It’s a tremendous amount of investment in this jurisdiction from some of the biggest names in the industry.

So if you’re looking for an elephant, you look in elephant country. And Millennial is right in elephant country, smack in the middle of a huge trend, with an asset that has all the earmarks of a strong lithium project.

There are major crustal features that trend northwest-southeast that intersect the borate and lithium trend. And precisely where they intersect, you have these basins that were fed by volcanoes that were spewing out the lithophile elements.

And that’s where you find the lithium brine.

The project is accessible year-round using paved highway and dirt roads from Salta.

Just 12 Km north of the properties is the Los Pastos Grandes village, home to 120 inhabitants and a generous provider of nearby infrastructure including a domestic water system and diesel-based power generation of 220 volts.

Just 12 Km north of the properties is the Los Pastos Grandes village, home to 120 inhabitants and a generous provider of nearby infrastructure including a domestic water system and diesel-based power generation of 220 volts.

A 600MW, 375-kilovolt power line between Salta and Mejillones in Chile passes 53 Km to the north of the project, with a natural gas pipeline passing through San Antonio de los Cobres to Salar de Pocitos, just 26 Km northwest from the Millennial Lithium properties.

Not Everyone is a Winner

Speed is another one of the Company’s substantive advantages over its nearby competitors: Millennial Lithium is the only miner in South America with a completed feasibility study to its name.

The Company has not only completed its Bankable Feasibility Study in Q4 2019, but it have already received a Federal Fiscal Stability certificate* from the Government of Argentina.

Furthermore, the Environmental Impact Assessment has been submitted and is awaiting approval. The final major permits are weeks away, making Pastos Grandes truly the most advanced, shovel-ready project in the Lithium Triangle.

*This certificate reduces the Company’s corporate tax rate from 30 percent to 25 percent for their Pastos Grandes project for the next 30 years.

Comparables

First of all, let’s take a look at the market cap of some of the comparable players. Clearly, Millennial has upside in value when you compare the companies based on market cap alone.

Lithium Americas, Galaxy Resources, and Orocobre Resources have valuations in the hundreds of millions of dollars, and FMC Corp. is even larger.

Millennial has one of the lowest market caps out of its competitors in the region, but the Company also has another selling point: The Company owns 100% of the project – something not even Lithium Americas can boast.

Right Place, Right Time

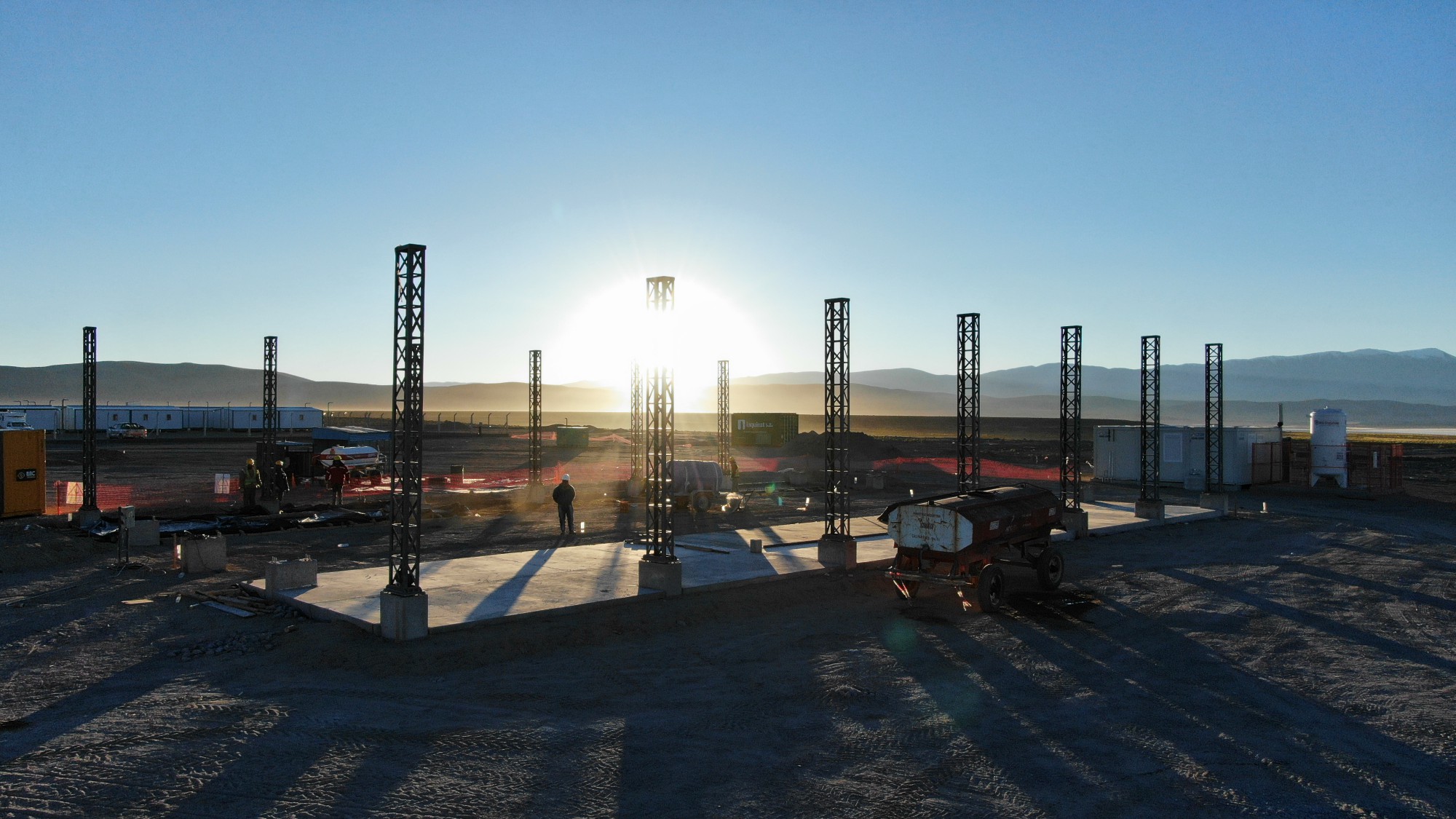

Drilling started at Pastos Grandes on November 15, 2016, and the first hole was completed on-time and on-budget. Since then, the Company has drilled, produced two resource reports, a PEA, a positive Bankable Feasibility study, and an operational pilot plant…

Millennial has a 12-month timeline to production at Pastos Grandes.

Millennial’s Risks

As always, there are risks to everything. It is our job as investors to judge if the reward outweighs the risk.

First and foremost is management’s ability to execute on what seems to be a very promising asset. Millennial has an incredibly valuable asset in Iain Scarr but has also beefed up the help with the addition of Dr. Vijay Mehta, as part of the technical advisory board.

Dr. Mehta has an extensive forty-five years of experience in the field of Ore and Brine-based technology, which is used for the recovery of Lithium, Potash, Magnesium, and Boron. He was also previously responsible for coordination and communications with lithium producers around the world.

In short, he is very well-known in the industry, and his addition is sure to spur interest into the Millennial Lithium story.

There’s also Farhad Abasov, President and CEO of Millennial Lithium, who is a 15-year veteran of the resource sector. Abasov has demonstrated a proven track record of profitable exits, evidenced by his tenures at companies like Allana Potash Corp. and Potash One, which were acquired for $170 million and $430 million, respectively.

Then there’s always the risk of the asset itself.

Just like other mining operations, things may not always go as planned. But given the data and Iain’s technical expertise, Millennial’s Pastos Grandes project, along with its pipeline of other assets, looks very promising.

Then, of course, there’s a chance that we may find alternatives to Lithium-Ion technologies. But if you do some research, you will see that there really are no other feasible near-term economic alternative power solutions.

Millennial has CDN$22 million in the bank with just over 83 million shares issued and outstanding, demonstrating a certain independence from dreaded debt financing for the foreseeable future. Management, including friends and family, owns a healthy 10 percent of the Company – that’s confidence-inspiring.

Conclusion

When you consider that pure electric vehicles account for barely more than two percent of all vehicles on the road, the potential growth for lithium is astonishing.

Elon Musk has already told us that for Tesla to meet its target of 500,000 cars a year, the company would basically need to absorb the entire world’s lithium-ion production.

Yet, Tesla is just the tip of the iceberg.

China is expected to build twice as much new lithium-ion battery capacity as the US by this year.

In other words, the lithium market is only getting bigger, and those who have a piece of the pie now will control it. I expect that as many of the juniors advance their project, the big guys will attempt to buy them in order to maintain this control.

That means investors in these early explorers and developers could reap the rewards – but only if they invest in the right assets – after all, there aren’t many players to choose from.

How about one of the most advanced and largest undeveloped lithium projects in the world?

That’s Millennial Lithium.

The Company is staying ready while lithium projects worldwide are either delayed or outright halted–the Company is even acquiring projects thanks to its strong cash position.

And that’s why we believe Millennial Lithium could be the next lithium buy out.

Millennial Lithium Corp

Canadian Trading Symbol: (TSX-V: ML)

US Trading Symbol: (OTCQB: MLNLF)

Disclosure: This is a sponsored post. We’re biased towards Millennial Lithium Corp. because they are an advertiser. We currently own shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Millennial Lithium Corp. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Millennial Lithium Corp. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.