The Most Important Aspect of Investing

Dear Readers,

There are a few things that every successful investor should know.

First of all, never bet against an entity that can print unlimited amounts of money.

I’ve said this many times before and explained why again in my letter, How the Government Borrows Money.

I had a lot of success early in my career with making the right calls using my own combination of fundamental/trend/psychology analysis. But there have been a few times that no matter how strong my analyses were, I was wrong.

At the time, I couldn’t understand why.

But then I recalled what I had learned from the wisdom of some of the best traders in the world.

I remember reading the advice of Michael Marcus, who is reputed to have turned his initial $30,000 into $80 million, and how he got his best advice from Ed Sakota – another very successful trader.

One time Ed was short silver, and the market kept going down, even while every one was bullish. Every one was talking about why silver had to go up because it was so cheap, but Ed stayed short. Michael couldn’t understand Ed’s rationale, but Ed simply said, “the trend is down, and I am going to stay short until the trend changes.”

In Jesse Livermore’s Reminiscences of a Stock Operator (recommended to me by my friend Peter in New York):

“During a bull market, most stocks will ride the primary trend up to higher prices. A rising tide lifts all boats. During a bear market, most stocks will fall in price. Even folks adept at stock picking, if they are fighting the primary trend, are not likely to achieve excellent trades. Shorting stocks in a bull market or buying stocks in a bear market, almost regardless of their individual stories, is very risky and has a high probability of failure.”

Investors should learn to never bet against a trend. This is the most common wisdom that every major successful investor/trader shares. It is the most important aspect of investing.

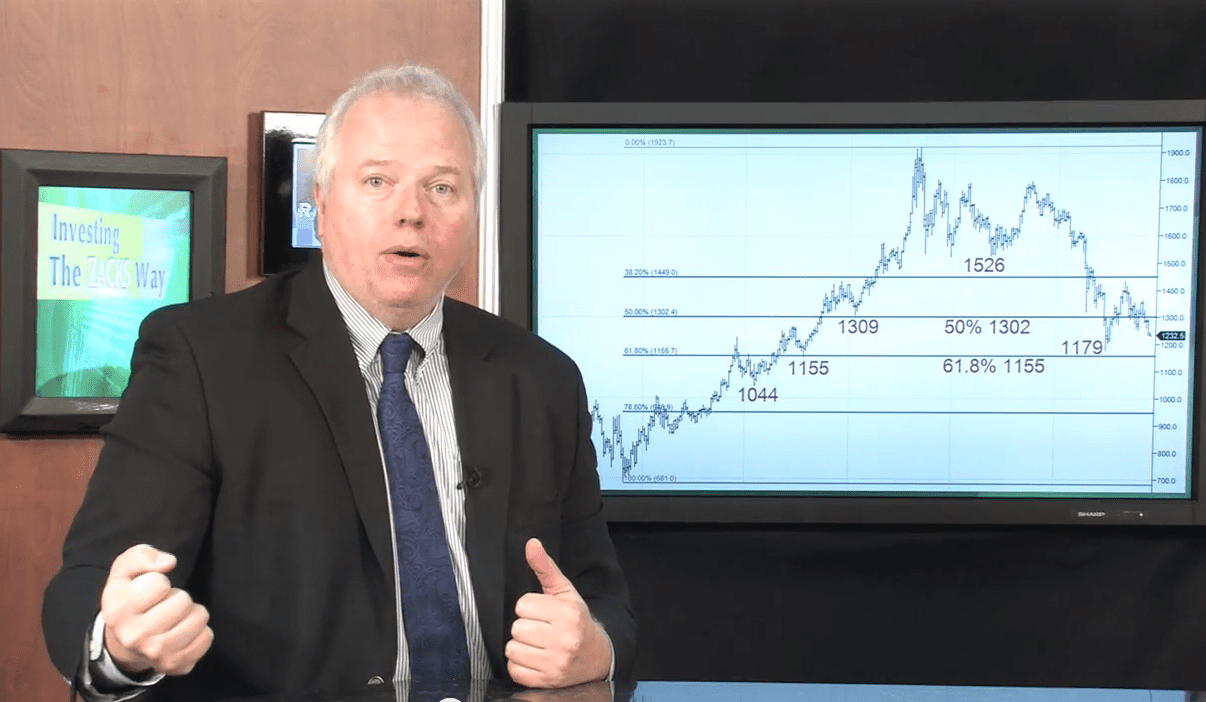

The market has now soared passed 1800 – just as predicted earlier in the year.

Yet, there’s still a lot of white noise in the media about the stock market being bubbly and frothy.

We’ve been hearing about this bubble over the last few years, but the bulls continue to march forward.

And the bears continue to get crushed.

Has the stock market gone up too high, too fast? Maybe.

Are there fundamental and economic indicators that suggest the market should move down? Yes.

But the general trend is still up.

I have given many reasons why the market would hit 1800.

From the record of money sitting on the sidelines entering the market forcing fixed income investors to shift asset mixes toward equities (see The Monarch of Money), to the mass psychology of the retail investor (see How Leveraged is the Stock Market); it’s all playing out as expected.

The Retail Investor is Back

Last week, stock funds in the US lured in the most cash in 13 years.

Via Bloomberg:

“…Morningstar, stock funds won $172 billion in the year’s first 10 months, the largest amount since they got $272 billion in all of 2000, with domestic equity deposits the highest since 2004.

…The market run-up has left investors as a group with an unusually high allocation to equities, at 57 percent, said Francis Kinniry, a principal at Valley Forge, Pennsylvania-based Vanguard Group Inc., the world’s largest mutual-fund company.

Equity allocations were higher only twice in the past 20 years, Kinniry said: in the late 1990s leading up to the technology stock crash of 2000, and prior to the 2007-2009 global financial crisis. He based his calculations on the total amounts of money in mutual funds and exchange-traded funds across asset classes at U.S. firms.”

With the amount of cash entering the system, we have to be cautious of when the music will stop. When things turn, retail investors are usually the bagholders.

Eventually, people take profits. For now, euphoria has a stranglehold on the market.

Update on Uranium and

Uranerz Energy (TSX: URZ) (NYSE MKT: URZ)

Last week, Uranerz Energy (TSX: URZ) (NYSE MKT: URZ) was up more than 17% on Friday alone. This week after my update, Uranerz (URZ) is up another 10%.

With the HEU agreement now officially over, expect uranium prices to climb – and with it, uranium stocks.

URZ is currently waiting on a Wyoming State Loan of US$20 million and I suspect this financing risk remains one of the biggest reasons why URZ shares have been suppressed (despite being the share price leader in the space over the last two weeks.)

But there’s light at the end of the tunnel.

Last month, Wyoming granted a $34 million loan to another uranium company. This shows that the state has strong intentions to move uranium production forward. I suspect that URZ shouldn’t have an issue getting their loan approved.

If URZ is granted the loan, my opinion is that a lot of risk will be taken off the table, enticing funds to come pouring back in – and the Shorters scrambling to cover.

Keep a very close on URZ and the uranium sector as a whole.

The Equedia Letter

We’re biased towards Uranerz Energy Corporation because they are an advertiser and we own options. We currently own shares at the time of this writing and thus we’re bias. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including Uranerz Energy Corporation. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Uranerz Energy Corporation and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Fed , Think of Germany before world war 2 , If you bet against their money printing you would have made a fortune .

Slow march forward for uranium I think. The US military can and have been replacing Russian stocks.

Food for thought : Laramide resources was probably the biggest gainer in the last boom yet it seems under the radar for the current recovery.

The only way to bet against Fed money is to bet on inflation. Look what happened in 1970’s when the Fed really stepped on the pedal.