Emotions play a very important role in our lives. Being human, it is the one thing that separates us from machine.

Machines capable of true emotions is the stuff of fantasy. For years, man has tried to create machines with artificial intelligence capable of exhibiting real human emotions.

None have succeeded.

But so much of our lives are run by machines created without emotion. This was clearly evident when the Dow dropped close to 1000 points in less than a few minutes, spurred by a chain reaction of computer glitches and human emotional events.

So while there is no such robot that can exhibit real emotions, there is a metal that can. We call it the human metal.

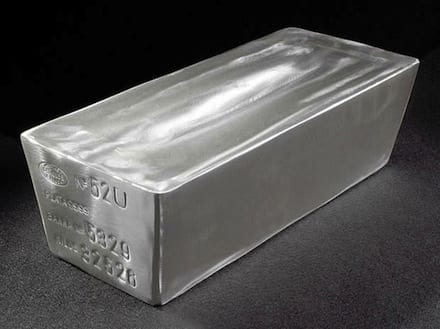

Silver – The Human Metal

Nothing demonstrates the mood swings of today’s markets better than the price of silver.

Call it silver’s split personality: It’s both a precious metal investors turn to for safety and an industrial metal that gets dragged down on signs of economic weakness.

When gold moves, silver moves. When base metals moves, silver moves as well. Silver is a metal that can move with both gold, and copper.

So while investors turn to precious metals on concerns of Europe’s debt crisis, the growing concerns over a potential slowdown in China has caused the price of silver to go in both directions. A tug of war, if you will.

That makes silver tough to predict. One week it’s flirting with the high price of gold, while the next it’s lured away by copper, zinc and lead. Silver’s behaviour reminds me of my ex — seeing wild mood swings from one day to the next. But there is one big difference between the two: I can make money with silver.

And there is no better time to do this than the present.

While silver has been volatile, the price is expected to continue rising due to flat supply, rising industrial demand in China, a North American recovery, as well as continued strong investment demand, according to a report released Thursday by London-based metals firm GFMS Ltd.

The report shows world investment demand for silver nearly doubled in 2009 to a whopping 216 million ounces, compared with the year before. That’s a value of about $3.2-billion on an average price of $14.67 per ounce in 2009. Of those investments, about 137 million ounces were from silver exchange-traded funds, a 184-per-cent year-over-year increase – the highest level in the past 20 years.

Silver bullion coins are also being snatched up at record pace. As of May 26, the American Silver Eagles sales has already reached 3.5 million. This is closing in on the all-time monthly record of 3,696,000 set in December 1986.

The demand for silver is not just growing, it’s exploding.

But there’s a problem.

Silver supplies are running low. Real low. Just take a look at the 2009 results:

- Net silver supply from above-ground stocks dropped by 86 percent in 2009.

- Scrap silver supply dropped for the third consecutive year and hit a new 13-year low of 165.7 million ounces.

- Government silver stocks reached their lowest levels in over a decade.

All of this leads to the obvious: We need more silver. Not just the silver that we claim is in the ground. We need people to pull it out. That’s why our current investment philosophies are directly geared towards the silver miners and those with the potential for some big discoveries.

Despite being a precious metal, silver has also been dramatically affected by industrial demand – not to mention the possibility of price manipulation (see The Silver Conspiracy). So while the price of silver should move with gold, it has been hampered by industrial demand.

Silver has tracked copper prices many times over the past year, during which time economic growth was substantially hindered. But as economies around the world recover and grow in 2010, demand for industrial use silver will, too.

Signs of industrial demand are already picking up strongly. According to GFMS’ executive chairman Philip Klapwijk, this expected growth in industrial demand for silver may lead the white metal to outperform gold in 2010…and have silver reach $20 an ounce “in the next couple of months.”

You can see why our stance on silver and silver plays remains strong. The key to investing is diversification. This year, our key is to diversify into different precious metals plays.

Can’t Hide the Truth

Let’s be real. The US dollar has recently shown its strength. But that’s only because the Euro is on the verge of destruction. Contrary to popular belief, the US dollar will remain strong in the long run. However, it will only remain strong against other world currencies – not gold and silver.

We already know that the European Union is in trouble and is printing money to salvage what they can. Citizens in those countries are already scrambling to buy gold and silver coins to protect themselves from their own currency.

But the EU is not the only one in trouble. This problem still exists in the US.

Back in our December 6, 2009 issue, “The Impressive News Release,” the US national debt sat at just over $12 trillion. That’s roughly $111,045 of debt per US taxpayer.

Today, it has already surpassed $13 trillion. The debt load per US taxpayer is now $118,058 – and growing.

That’s an astounding $1 trillion of borrowed money in six months. And it happened right under your nose.

Take a look yourself:

click to see real-time debt clock

|

The Greece crisis was one thing, but you may not realise that many of the US states are in even worst shape.

Surprised?

Don’t worry, we’re sure Uncle Sam will bail these guys out. This will ultimately lead to more printed money…and higher gold and silver prices.

So stay tuned. We expect silver and gold to once again break new highs…

Until next week,

Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies.Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Equedia.com has been compensated to perform research on specific companies and therefore information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/termsr. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financnial reports. Equedia Network Corporation is a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.