Something seismic is brewing beneath the markets, hidden from plain sight but glaringly obvious if you know where to look.

While the world breathes a sigh of relief over Trump’s 90-day tariff ceasefire with China—signed May 13, 2025—smart investors see it differently.

Beneath the façade of peace and diplomatic handshakes lies an explosive situation primed to ignite the next great metals bull run. But here’s the kicker: most investors remain oblivious, caught sleeping at precisely the wrong moment.

This isn’t just a story about tariffs or geopolitics—it’s about power, money, and control of the world’s most critical resources.

From antimony to uranium, cobalt to scandium, a quiet race is underway. Trump’s massive deals in Saudi Arabia, the strategic pivots of the Gulf’s petrodollars, and hidden moves by the world’s biggest players like BHP and BlackRock—these aren’t isolated events. They are interconnected signals, screaming one clear message:

Act now, or watch this generational opportunity pass you by.

Here’s why the next few months could make or break fortunes—and how you can position yourself on the winning side.

Let’s dig in.

The Setup: A Truce with Teeth

Trump’s tariff timeout isn’t an olive branch—it’s a geopolitical chess move.

China controls 70-90% of rare-earth processing and critical minerals.

But this isn’t a case of Washington relying on wishful thinking.

Since early 2025, Trump has greenlit sweeping initiatives to unlock deep-seabed mining for critical minerals, weighing sovereign wealth fund strategies to back U.S. miners, and signaling support for direct investments into strategic mineral companies. These aren’t paper promises—they’re backed by federal agencies and real capital.

And we’re not just talking about lithium or copper.

The administration is eyeing overlooked but indispensable elements like antimony—a key flame retardant and alloying agent—along with cobalt, tellurium, and scandium. These are the unsung linchpins not just of energy storage and grid infrastructure, but also of defense and tech supremacy—essential for fighter jets, missile systems, AI hardware, and high-performance computing.

This 90-day breather dodges a tariff bullet, but the war’s far from over.

Global electricity demand could surge 169% by 2050, but so will the strategic demand for these minerals across military, AI, and industrial domains. Supply chains are creaking, and this truce is just the calm before the storm.

The Riyadh Wildcard: Peace or Power Play?

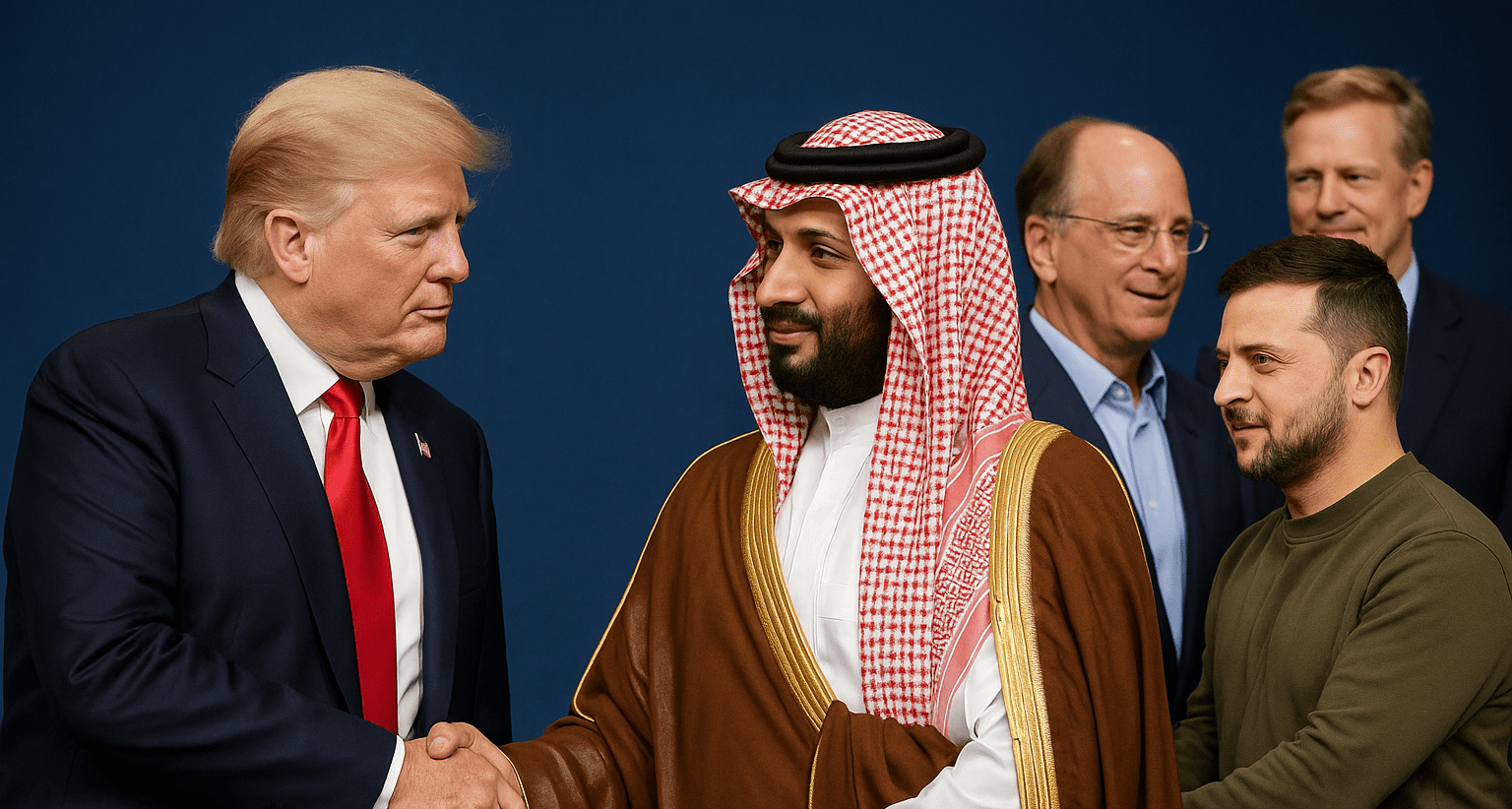

On May 13, 2025, Trump began a significant Gulf tour aimed at securing major economic deals, underscored by a historic $600 billion investment commitment from Saudi Arabia. These massive agreements span infrastructure, technology, renewable energy, and defense, clearly signaling an economic pivot to the Gulf.

This isn’t a departure from Trump’s modus operandi—it’s an extension. Throughout his business career, Trump championed high-leverage deals, often using other people’s money to finance massive projects. Now, he’s applying that same blueprint on a global stage, enlisting one of the wealthiest nations on earth to fund strategic American interests. This Saudi-U.S. collaboration could drastically amplify demand for critical minerals and metals.

The implications are clear: stability in the region translates into infrastructure projects—solar farms, desalination plants, tech hubs—that rely heavily on copper, lithium, and rare earths.

But there’s a deeper strategy at play.

When a nation like Saudi Arabia commands enormous cash flow from oil exports, it must reinvest that wealth into emerging technologies and future-proof assets.

Petrodollars don’t just sit—they buy leverage.

We’ve already seen the Saudis make headline investments in media, entertainment, sports, and tech platforms like X.

But quietly, they’re funneling serious capital into the foundation of future empires—resources.

Saudi Arabia is actively investing in the critical minerals sector as part of its “Vision 2030” strategy to diversify its economy away from oil dependency. The Kingdom is aiming to become a global hub for critical mineral mining and refining, leveraging the Public Investment Fund (PIF) and the state-owned mining company Ma’aden.

With domestic oil reserves estimated at $2.5 trillion, a $100 billion mining commitment underway, and global partnerships in motion, they’re targeting minerals like lithium, nickel, and rare earths.

The goal? Use petrodollars to buy, own, and control the physical inputs of the next industrial age—ensuring that Saudi Arabia retains its wealth and relevance in a world looking to shift away from fossil fuels. Controlling access to resources like antimony, cobalt, and rare earths gives the Kingdom a seat at the next global table—one defined not by oil, but by AI, defense tech, and energy storage.

Furthermore, the narrative around Trump’s Saudi agreements reveals trillions in projected economic benefits for the U.S., echoing historical episodes where Middle East diplomacy precipitated explosive growth in resource sectors.

It’s strategic power politics dressed as diplomatic handshakes—metals markets are the hidden prize.

The Numbers Don’t Lie

Fund flows show smart money positioning for a metal boom. The Sprott Critical Materials ETF (SETM) recorded significant inflows—$7.3 million net in Q1 2025—highlighting investor interest in uranium and rare earths. Meanwhile, Global X Lithium & Battery Tech ETF (LIT) lost $80.9 million over the same period, signaling a shift away from traditional lithium plays toward vertically integrated operations.

But that’s nothing compared to the bigger money.

The U.S. Department of Energy has committed $725 million in grants aimed at domestic battery-material processing to directly remove China’s dominance in the sector. USA Rare Earth secured $75 million for its critical Texas project, and mining giant BHP poured US$2.1 billion into copper ventures – that’s after BHP announced plans to invest up to $14 billion in expanding its copper operations in Chile—one of the most resource-rich regions in the world.

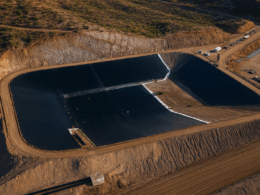

And just this week, in a groundbreaking move to bolster domestic critical mineral production, the U.S. Department of the Interior has greenlit the Velvet-Wood uranium and vanadium mine in San Juan County, Utah—marking the nation’s first project approved under a newly accelerated 14-day environmental review process, initiated in response to the national energy emergency declared by President Donald J. Trump.

These aggressive expansions reinforce the metal demand narrative and show that the big players are positioning for a long-term supply squeeze.

But that’s not all – there’s even bigger money at play.

Recall when we talked about Blackrock’s play on Ukraine?

Via our Letter from September 2024, “Why Big Government Favours the Elite”:

“Shortly after Biden took office, the conflict with Russia spiraled out of control, and Russia “invaded” Ukraine.

And almost immediately, Ukraine began to receive billions upon billions of financial aid – more than US$380 billion since January 2022.

But that’s not all.

Almost immediately after Russia “invaded” Ukraine, BlackRock, the world’s largest asset manager, began conversations with the war-torn nation.

Via the President of Ukraine, Volodymyr Zelensky:

“In accordance with the preliminary agreements struck earlier this year (2022) between the Head of State and Larry Fink, the BlackRock team has been working for several months on a project to advise the Ukrainian government on how to structure the country’s reconstruction funds.

Volodymyr Zelenskyy and Larry Fink agreed to focus in the near term on coordinating the efforts of all potential investors and participants in the reconstruction of our country, channelling investment into the most relevant and impactful sectors of the Ukrainian economy.”

Despite the ongoing war, the biggest Wall Street firms, including BlackRock and JP Morgan, agreed to invest billions into rebuilding Ukraine earlier this year.

Via QZ:

“A coalition of investors, with support from BlackRock and JPMorgan, are aiming to put together $15 billion in aid to rebuild Ukraine. In a new group known as the Ukraine Development Fund, they are supporting investments from state bodies and capital markets; the fund will bring together a consortium of investors to finance at least $15 billion of reconstruction work in the country after two years of Russian invasion.”

From no money to billions – what a great and timely coincidence!”

BlackRock, the world’s largest asset manager, aren’t just dipping their toes—they’re diving headfirst into Ukraine’s reconstruction boom.

In 2023, BlackRock partnered with Ukraine’s Ministry of Economy to launch the Ukraine Development Fund (UDF), a powerhouse initiative designed to channel billions in private and public capital into rebuilding the nation’s war-torn economy. We’re talking about a staggering $400 billion target for projects in energy, infrastructure, and tech—sectors that devour critical minerals like copper, uranium, and rare earths.

Is it a coincidence that some of the biggest funds in the world, including Blackrock, have been investing heavily in strategic and critical metals?

BlackRock isn’t flying solo.

The UDF is a magnet for big money, already aiming to secure $500 million to $1 billion in catalytic capital to kickstart projects, with a roadmap to mobilize up to $15 billion in total investment. This is a calculated play—using public funds and guarantees to “de-risk” the landscape, pulling in private capital that would otherwise balk at a conflict zone.

The Dominoes are Falling

JPMorgan, McKinsey, and other titans are circling, ready to claim their stake. Meanwhile, stateside, the DOE’s $725 million is a direct jab at China’s mineral dominance, while private players like USA Rare Earth get a staggering $75 million and BHP unleashes US$2.1 billion to lock down supply chains – after already promising to commit $14 billion the year before. The numbers don’t lie—this is a flood of capital, not a trickle.

Zoom out, and the picture gets clearer.

The Riyadh talks between MbS and Trump could ignite Gulf cash into U.S. assets and Middle East infrastructure—think solar farms, EV hubs, and tech corridors, all ravenous for the same metals BlackRock’s betting on.

The real prize is control of future resources. Trump’s Saudi agreements, coupled with potential regional stability, position critical minerals as a geopolitical chess piece.

The truce with China? It’s smoke and mirrors. The fundamentals—the raw, unrelenting demand for critical minerals—are the freight train barreling down the tracks. BlackRock’s UDF, the DOE’s war chest, and billions in private bets are laying the rails.

The smart money’s already on board. Are you riding it, or are you stuck watching it roll by?

Seek the truth and be prepared,

Carlisle Kane

Excellent article, Thanks for the heads up

Greetings Carlisle you are on point. For me politics has become all theater for the past 40 years at least. There is so much behind the scenes when it comes to money and power. Pres. Trump is a ruthless business man. Alway has been. His made a statement on an interview that his second favorite book of all time is ‘The Art of the Deal’. His main focus is business. Plus he doesn’t give a sh*t what people think. The likes of Jobs, Musk, Bezos etc. As the wisest man who ever lived King Solomon said. Nothing new under the sun. You can put all the names together I mentioned. No one comes even close to him. Cheers