Dear Readers,

Last week, I wrote a Letter on why gold stocks were about to rebound.

On Friday, gold stocks had one of their best days in years with many of the producers climbing over 5%; Goldcorp climbed 6%, Eldorado Gold climbed 11%, and Yamana Gold climbed over 8%.

The surge on Friday helped the gold producer indices XAU and GDX end the week down around 1%.

While gold producers rebounded sharply, one stood out amongst them all…

The Beginning of a New Chapter

Last week, I introduced you to Newmarket Gold Inc. (TSX: NMI) – a gold producer that many have never even heard of.

I gave all of the reasons why I felt it was undervalued and why I believe it could not only outperform its peers but also do well during what may be one of the worst markets for gold stocks in history.

And the Company did not disappoint…

Newmarket Gold Inc (TSX: NMI)

Outperforms

While many of its peers started the week with more than a 5% drop on Monday, Newmarket Gold (Newmarket) started the week up a whopping 17%.

But it didn’t stop there.

Newmarket ended the week climbing over 28% from last Friday’s close while the primary gold producer indices (XAU/GDX) ended relatively flat despite Friday’s surge.

The question is: How did Newmarket outperform by such a wide margin?

Nearly 18 months ago, some of the best in the business – Lukas Lundin, Randall Oliphant, Blayne Johnson, Doug Forster, Ray Threlkheld, Doug Hurst – banded together to build Newmarket Gold, a producing gold company with 100oz/yr production profile.

Just over a year later, the team not only succeeded in its goal, they significantly surpassed it – establishing a new 200,000+oz/yr gold producer with quality gold assets and a large resource base located in the 2nd largest gold producing jurisdiction in the world, Australia.

The Best Quarter Yet

On Thursday, Newmarket delivered its best quarterly financials while many of its peers delivered some of their worst.

The Company is now on track to achieve top end of full year 2015 production guidance of approximately 220,000 ounces after it produced a record first half year of 115,674 ounces of gold.

But more importantly, Newmarket made money.

Despite the price of gold going crashing more than 7% over the last year, Newmarket’s operating cash flow actually increased by a whopping 78% year-over-year (YOY) to $54.6M for the first half of 2015.

In Q2 2015 alone, Newmarket generated operating cash flow of $27.1M – a strong 48.9% improvement from the $18.2M in Q2 of last year.

So while many producers are struggling to survive with today’s lower gold price – let alone make a profit – Newmarket is more profitable now than ever before.

But how?

It’s All About the People

As I mentioned last week, a bad barber with a great pair of scissors still won’t give you a good haircut. But a great barber with a great pair of scissors can do wonders.

Newmarket’s team has significantly turned a great asset around by decreasing costs and increasing operational efficiencies.

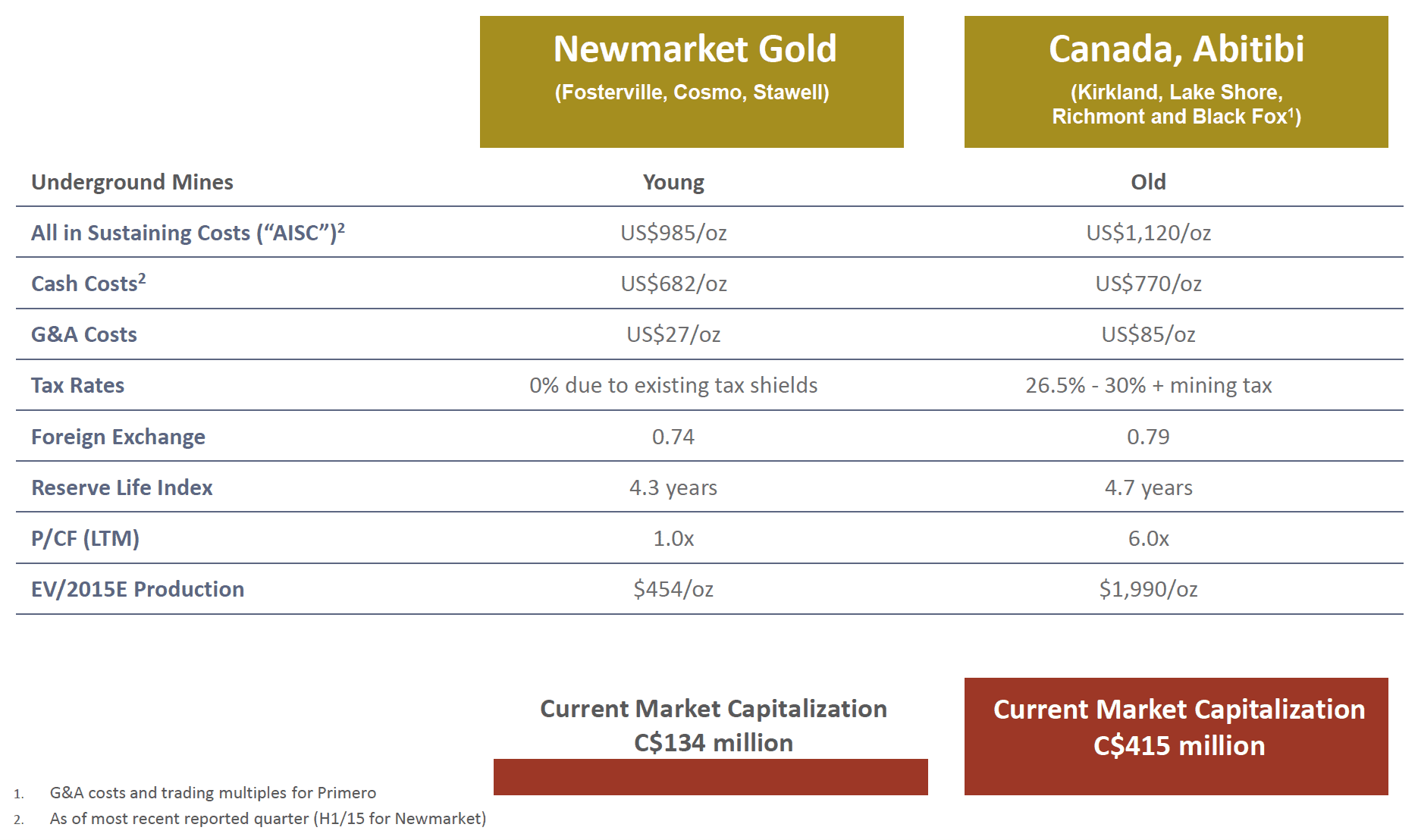

For the first half of this year, Newmarket was able to decrease operating cash cost per ounce by over 29% from $965 in 2014 to $682 in 2015, and decrease the all-important all-in-sustaining-costs (AISC) by over 9% from $1,311 in the first half of 2014 to a low $985 in the first half of this year.

But that’s not all.

Newmarket’s management has also significantly increased mill recoveries and gold grade profiles at all three of their mines.

Higher Recoveries

In the first half of the year, Newmarket managed to increase overall mill recoveries to 87.2% – a 5% increase over the same period in 2014.

It’s flagship Fosterville mine set a new monthly gold recovery record in May 2015 of 90.7%, while its Cosmo mine achieved the highest 6-month average gold recovery in the first half of this year of over 91%.

Improving Mill Grades

Mill grades for the first half have also been improving, averaging 3.44 g/t Au – a 15% increase over the same period in 2014.

At Fosterville, mill feed grades improved to an average of 5.92 g/t Au this quarter from Q2/14’s 3.95 g/t Au – that’s an awesome 50% increase and marks the fourth consecutive quarter of mill feed grade improvement.

Newmarket’s Q2 financials is one of the best I’ve seen in the gold sector this quarter.

The Company was able to significantly decrease costs, increase cash flow, and improve mill grade and recoveries.

But even with such promising numbers, there’s a chance that we may see things get even better…

A World of Discoveries

Every gold explorer drills in hopes they will make new discoveries – discoveries that can often be company makers themselves.

We’ve witnessed these transformations many times.

The problem with many of these new discoveries is that it could take many years – often decades – to convert the discoveries into gold out of the ground.

That’s why a new discovery in close proximity to an already producing mine is so valuable; it’s even more valuable when the discovery is made by the same operator and owner of that mine.In the first half of this year, Newmarket didn’t just make one discovery, it made three – one at each of their mining operations!

Three New Discoveries at Three Mines

Fosterville Discovery

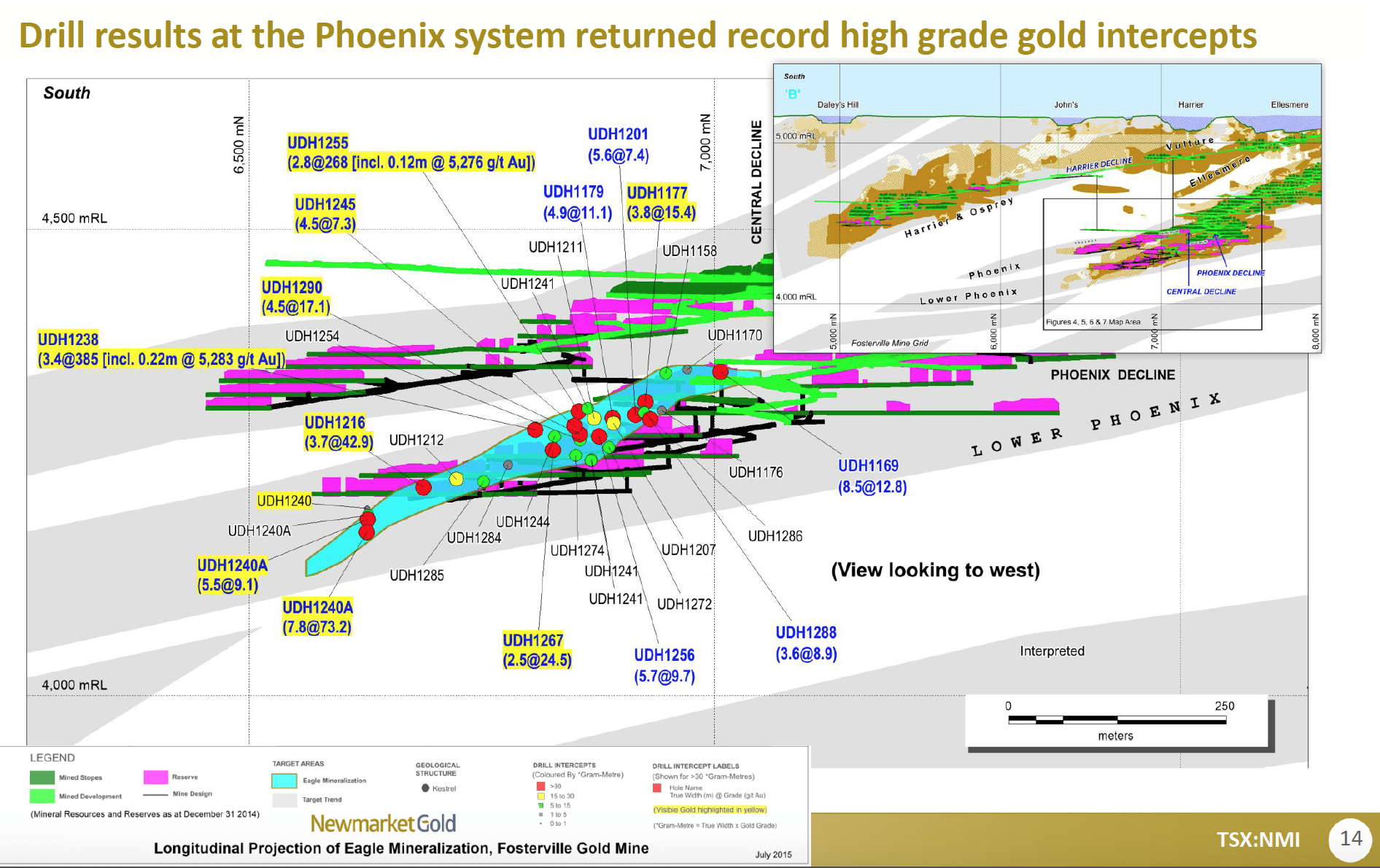

Fosterville has been in production since 2005 and has two zones in operation: Phoenix and Harrier.

It already has a strong resource base of 1.8 million ounces*, but recent drilling at Phoenix shows that grades are actually improving at depth after a decade of production.

*  On Monday, Newmarket announced a substantial new high grade discovery within the lower Phoenix system, the Eagle Fault, with one intercept returning a whopping:

On Monday, Newmarket announced a substantial new high grade discovery within the lower Phoenix system, the Eagle Fault, with one intercept returning a whopping:

9.15m @ 386 g/t Au

7.85 m @ 268 g/t Au

The drill results represent the highest grades ever recorded at Fosterville and are some of the best I have seen in a long time.

But what does that mean?

Traditionally, mineralization at Fosterville has been a plunging structure-controlled sulphide gold deposit.

There are a number of different structures that Newmarket is currently drawing ore from, with the Phoenix and the Lower Phoenix being the two main structures they are working with.

But now they’ve discovered the Eagle Fault, which is really the intersection of two structures: the westerly-dipping Lower Phoenix and the easterly-dipping Eagle.

It is the junction of these two structures where they are now finding strong mineralization. And this is typical: when you get intersecting structures in a plumbing system within a structure-controlled gold deposit, that tends to be where the best grades occur.

As I mentioned, Fosterville has been in underground production for about 10 years.

Traditionally, grades have varied, but over the last couple of years its averaged roughly 5-6 g/t. But over the last four quarters, grades have been increasing quarter-over-quarter. This shows that after 10 years of production, they may just be scratching the surface.

Being a sulphide mineralization-type deposit, there hasn’t been a lot of visible gold in the system to date. But now, as can be seen in the recent drill results, they’re getting significant visible gold.

This is new for Fosterville in terms of the style of mineralization, which is very exciting.

Even more extraordinary is that the Eagle, the Lower Phoenix Footwall, the East Dipping, and the Kestrel, are all new structures that have been found this year!

While its still early, these discoveries may add significant resources to Newmarket’s already strong resource base. The new Eagle zone is outside the current reserves and resources envelope. When Newmarket completes a new reserves and resources calculation at the end of this year, they should be able to include the eagle mineralization in that resource estimate.

If one discovery has management excited, what about two more?

Cosmo Discovery

A new discovery was made at the Western Lodes target, Cosmo, located only 160 m from current development and infrastructure.

Some highlights include:

- 7.42g/t gold over 4.3m, 6.59g/t gold over 6.4m (potential for identifying grades and widths amenable for underground mining and in close proximity to existing infrastructure)

- Cosmos Inner Dolerite 5.33g/t gold over 7.54m

- Cosmos central internal metasediments 6.79g/t gold over 6.15m

Take a look:

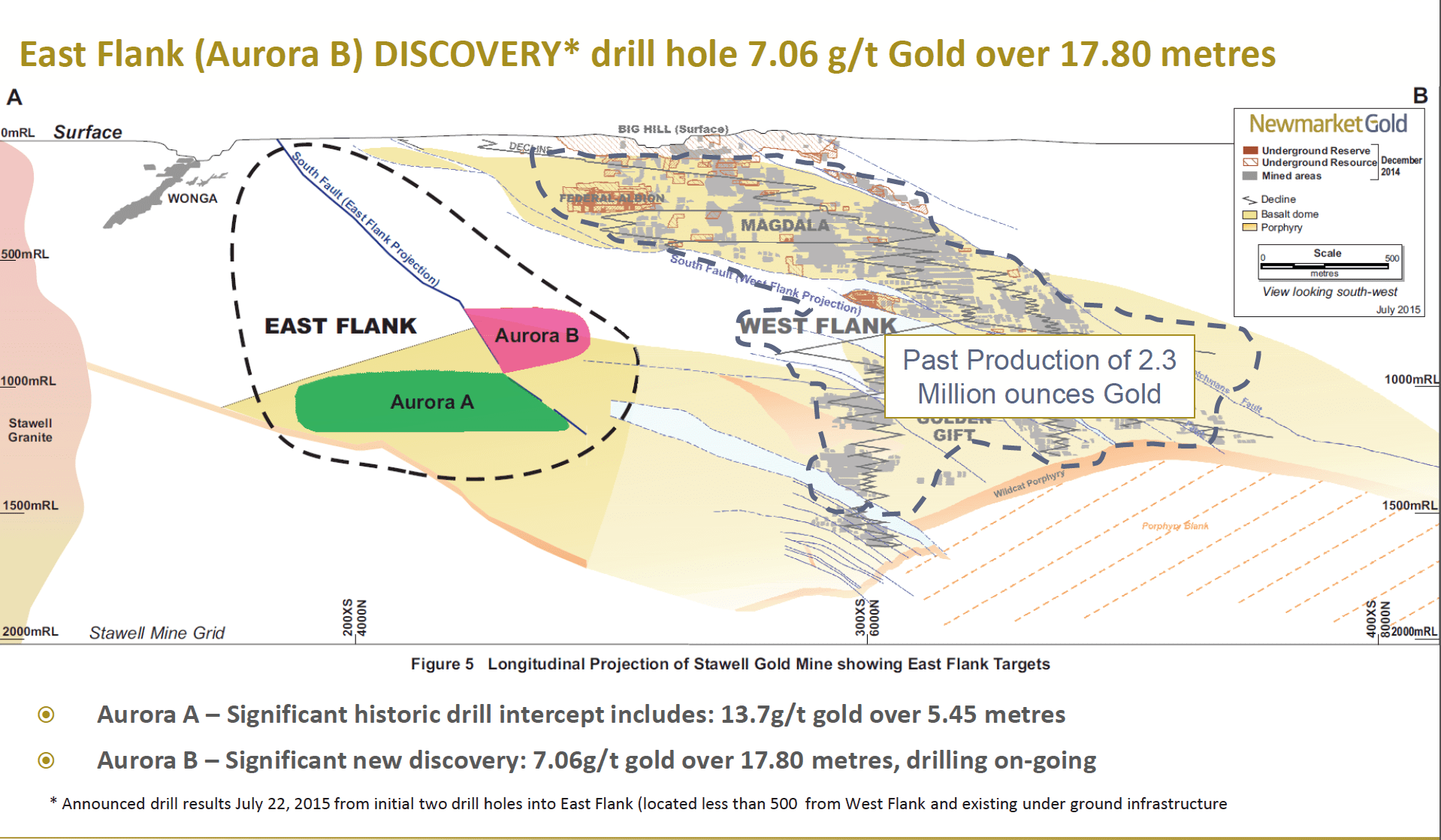

As seen above, the West Flank at Stawell has produced 2.3 million oz gold, while the East flank has no recorded production.

As seen above, the West Flank at Stawell has produced 2.3 million oz gold, while the East flank has no recorded production.

Just as few weeks ago, Newmarket announced that it had made a new discovery at the Aurora B East Flank, with drilling on the Aurora B discovery returning high-grade intercepts containing visible gold including 7.06 g/t gold over 17.80m (estimate true width 8.3 m).

I could go on about the potential of all three discoveries, but you get the point.

So let’s take a look at how Newmarket stacks against its peers now that its Q2 has been released.

Even Better than Before

Here’s a look showing a side-by-side comparison of the opportunity Newmarket represents when compared to some of its peers in the Abitibi:

And how does it compare with its peers from a valuation standpoint after its recent Q2 financials? Even better…take a look:

From a simple valuation perspective, Newmarket is clearly undervalued when compared to its peers; add the new discoveries into the picture and it may be even more so.

I believe that this is just the beginning for Newmarket Gold. The Company has no analyst coverage yet, has not been to any marketing roadshows, and we’re still in the middle of summer – when the majority of investment professionals are away.

Just a year ago, the operations were losing money. Today, they are all making money under a new board of directors and management.

It’s amazing what a strong team can accomplish in such a short time.

New discoveries, strong cash flows, improving mine operations, record production, phenomenal management, and significantly undervalued when compared to its peers – what more could you want when looking at gold producer opportunities?

The Equedia Letter

We’re biased towards Newmarket Gold Inc. because they are an advertiser. We now own shares which were purchased in the open market following our initial report dated July 26, 2015. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Newmarket Gold Inc. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Newmarket Gold Inc. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

A while ago you wrote a similarly glowing piece on Falco Resouces, the shares of which have declined by more than %0% since then.

Is there any good reason why Newmarket shouldn’t be expected to fare a badly for any possible number of reasons?

Also, an update on Falco would be of interest at this time.

Regards

Al

Good article!

I could only locate NewMarket Gold Inc as NMI.DB at TSX with a online broker I deal with, and NMI.DB seems idle and has no market movements info. Is this stock exclusive and can only be bought through certain brokers?

Thank you very much for your reply!

Calla

xchina@shaw.ca

My brokerage service does not allow investors to buy stocks on TSX or TSV exchanges! Do you know which broker firm can YS citizens buy Canadian gold and Li and Marjuana stocks?