Dear Readers,

As a proud Canadian, I find it extremely difficult to read the investment opinions of Canadian journalists who have never invested a penny into the markets themselves.

Sure, they might have some ultra conservative mutual funds or GIC’s that are automatically taken from their paychecks every month, but the majority of them don’t even know what’s being purchased for them.

When the markets turned in 2008, they complained that their fund managers should’ve never put them into such risky investments. Now that the markets have turned, and their mutual funds climbing, they stand around cocktail parties bragging about their investment decisions – made by other people.

Sadly, this is a scenario that applies to many Canadians. Our ultra-conservative (not to be confused with politics) views on life can sometimes be our biggest enemy. We’re too afraid, or too comfortable, to make decisions or bets that come with risk.

Sadly, this is a scenario that applies to many Canadians. Our ultra-conservative (not to be confused with politics) views on life can sometimes be our biggest enemy. We’re too afraid, or too comfortable, to make decisions or bets that come with risk.

And when things appear risky, we simply turn to our Canadian journalists – who have never invested a penny into the markets – for their advice.

That’s a really dumb move. It’s like hopping on a plane with a pilot who has read about flying, but never flown.

What do you think of Canadian financial journalism? Share your thoughts by CLICKING HERE.

Newspapers everywhere are filled with reports on the Canadian housing market; how strong and robust it is, and why we should keep buying.

For every one negative article about the housing market, another ten positive articles follow.

I get it. They want the public to slowly – really slowly – wean themselves from the housing market in order to prevent a dramatic collapse. The big banks, on the other hand, want this housing trend to continue*.

(*Big banks in Canada are all seeing strong profits and their shares are all near all time highs as a result.)

But those who listen to the advice of these articles may have a lot to lose.

The Reality of Canadian Debt Levels

I have written about the rising rate of Canadian debt levels before; how we’ll soon come to a tipping point where consumers can no longer afford to meet their debt obligations, and how we’re awfully close to America’s debt level prior to their housing crash in 2008.

But when I pick up my local newspaper, I am reading the opposite.

A few months ago, I read an article featured in the Financial Post that included statements from an economist at a major Canadian bank telling us that Canada’s household debt levels are nowhere close to the U.S. peak – especially when you make them comparable:

“There are differences in the methodologies used to calculate both debt and income…Bringing the numbers more into line yields a Canadian debt level of 156%, compared with 152% in the U.S. However, that’s still far off from the 177% peak U.S. households hit in 2007.”

…All of a sudden, Canada’s household debt doesn’t look so out of control.”

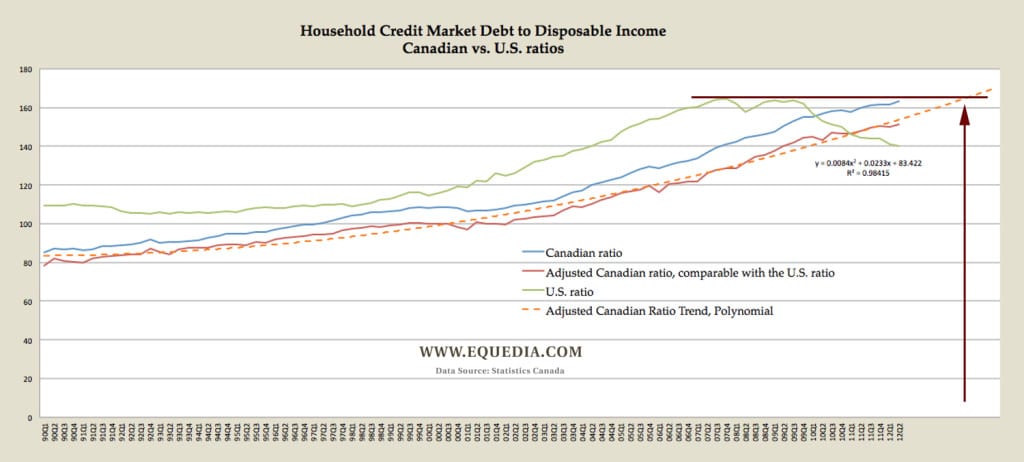

But take a look at this chart (click it to enlarge):

This is a chart of the household credit market debt to disposable income in both Canada and the U.S, with an adjusted Canadian ratio to adjust for the differences in the numbers used to derive this data.

This is a chart of the household credit market debt to disposable income in both Canada and the U.S, with an adjusted Canadian ratio to adjust for the differences in the numbers used to derive this data.

As you can see, when adjusted to make the data streams more comparable, Canada is indeed below the threshold that broke the American housing market in 2007, just as the economist had said.

But to tell us that we’re nowhere close to America’s peak levels? Well, take another look at the chart.

If the trend line is correct, Canadians will be reaching that threshold within one year.

That same Financial Post article ended with:

“…It should also be noted that Canadian households are deleveraging. Data from Statistics Canada showed that after households hit a record debt level in 2012, they have since deleveraged in both quarters this year.”

But has it?

According to Statistics Canada’s latest findings in October, the ratio of credit market household debt to disposable income has actually increased in the second quarter to 163.4 per cent, up from 161.8 per cent in the previous period.

That’s an increase of 1.6 per cent in one quarter alone.

Since this data came out, that same economist from the Financial Post article is now changing her tone.

Here’s her comment in a recent article published by CBC:

“Today’s (October 15) report indicates that Canadian households are more financially vulnerable than had previously been thought.”

The article continued:

“The changes in the historical data suggest that the increase in household indebtedness since 2004 has been sharper than previously thought, with credit growing an average of one percentage point higher per year than was originally reported.”

The biggest share of that increase? Mortgages.

Despite the Canadian Real Estate Associations (CREA) eagerness to pump out rosy data, their October data finally shows that sales of existing homes fell 15.1 per cent in September from a year ago.

But these numbers could be worse than people think.

In a recent column by the Globe and Mail, CREA’s data have been coming under scrutiny:

“Canada’s surprisingly strong real estate market is leading to heightened scrutiny of the data used to assess sales.

…As people try to make sense of the market’s twists and turns, some are raising questions about the accuracy of CREA’s statistics. One of the main critics is former Member of Parliament and blogger Garth Turner, who has recently been calling CREA’s numbers into question on his blog. He alleged, among other things, that the numbers are being distorted by real estate agents listing one house with two or three local real estate boards (so more buyers will see the listing).”

The next time you read stats from CREA, just remember that one of their core goals (directly from their website) is to support a vibrant real estate sector. You can’t achieve that goal if people aren’t buying homes.

If you’re looking at buying – especially as an investment – ask yourself this: “What will drive prices higher?”

Interest rates are already at all-time lows and housing prices are already at all-time highs. Foreign purchases can only sustain a small portion of the market. Unless we see a major surge in wage increases, what could possibly drive real estate further?

Do you think housing prices will climb? Click Here to Leave a Comment and Share Your Thoughts

That’s why I am shocked to see Canadians – who are generally ultra conservative in their investments – still investing in real estate. When you look at it from an investment point of view, you’re borrowing hundreds of thousands of dollars to make a bet. If real estate drops 10-20%, you’re likely spending the next 5-10 years just paying the loss on your home.

That doesn’t make sense to me.

If you’re selling your home to buy another one, it’s relative. But if you’re buying for the first time or looking to make an investment, it just doesn’t make sense to me.

I am sorry, but there’s a better chance of the stock market in Canada going up than real estate.

Buying a home now might not be playing it safe anymore.

High Prices Lead to More Debt

Rising home prices have contributed to a much bigger problem than just the housing market itself.

Canada’s growing housing unaffordability is starting to trickle directly into personal debt – which will have an overall effect on growth and spending.

In RBC’s recent annual debt poll, the average personal debt load, which doesn’t include a mortgage, jumped by $2,779 to $15,920 from last year.

That’s an increase of over 21%.

Albertans experienced the biggest jump in their personal debt load (likely due to the flood), with the average amount-owing coming in at more than $24,000 – a 63 per cent increase from the year prior.

B.C. followed with an increase of 38 per cent, Manitoba/Saskatchewan jumped 32 per cent, while Ontario saw a 13 per cent climb.

As I mentioned in The Truth About the Housing Market, British Columbians are the most highly leveraged Canadians, mainly due to unaffordable housing prices and lower wages:

“The average income in Metro Vancouver in 2009 was only $41,176, according to Canada Revenue Agency statistics. Richmond residents are barely scraping by at $33,350 a year – the lowest average income in the region, followed by Burnaby, with an average of $34,961.

According to Andrew Romlo, executive director of Urban Futures, only 0.56 per cent of British Columbians declared incomes higher than $250,000.”

Interest rates will remain at low levels and will continue to encourage homebuyers to over-extend their debt load capacity. And since most of our equity comes from real estate, and many are borrowing against it, a crash scenario is more serious than most economists make it out to be.

I love real estate. I studied it in University – everything from development to economic projections.

But in this environment, there are better places to put your money.

Canadian Stocks vs. American Stocks

With record injections of liquidity, I’ve been buying stocks.

Many readers have asked me why do I keep showing charts of the S&P and why do I keep telling my readers to invest in the American markets? Why not the TSX or the TSX Venture? Isn’t this a Canadian investment newsletter?

Yes, it most certainly is.

But that doesn’t mean you should only invest in Canadian stocks.

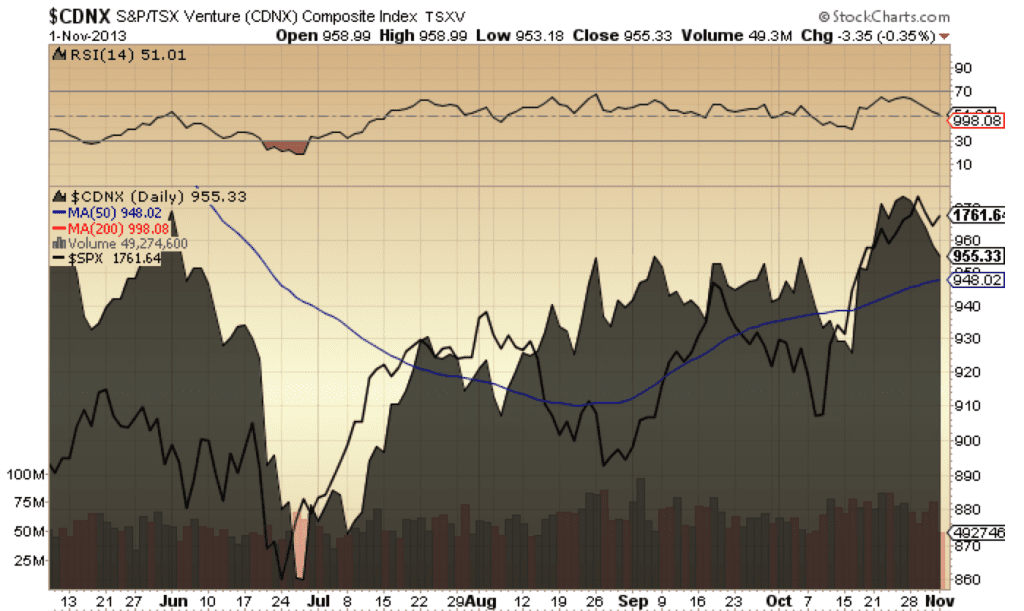

As a matter of fact, it’s just as easy to trade American stocks, as it is to trade Canadian. And if you would’ve invested in American stocks over Canadian stocks, well…take a look at this chart:

Clearly, American stocks have significantly outperformed Canadian stocks since 2008*.

(*except between 2008-2010, when the TSX Venture led the way. If you recall back in 2008, I told my readers to jump heavily in the junior resource sector, as well as the American markets.)

But Canada has a long history of following lagging American footsteps.

While many in the industry are running scared, both the TSX and TSX Venture have seen support lately and are actually climbing nicely in synch with the S&P on a relative basis over the last few months.

Here is a chart of the TSX Venture against the S&P, with the area shading representing the Venture and the dark line representing the S&P:

This goes hand-in-hand with my prediction back in the last week of June where I said the Canadian markets have capitulated, especially for the junior miners.

While we’ve had our ups-and-downs, it seems that Canadian stocks are finally starting to react in synch with American stocks – more so with the TSX than the TSX Venture.

If American stocks continue to climb, as I expect they will, the general trend for both the TSX and TSX Venture is up.However, I’d be keeping a close eye on any Canadian gold stock holdings, as gold price wavers. The direction remains unclear in the near term.

Speaking of Gold…

While many technical analysts were calling for gold to break out last week, all it took were a few headlines of tapering for gold to be pushed right back down. This is exactly as I had mentioned would happen in a letter from a couple of weeks ago, when gold was looking to break out:

“The fundamentals for higher gold prices are all there, but there are obviously occurrences that suggest gold price manipulation. It’s going to take a serious probe by world organizations on gold price manipulation to truly send gold to the levels that people like Peter Schiff predict in the near term.

And since all buyers of gold would rather pay a cheaper price anyway, whose going to lead the way in a global investigation?”

Again, be weary of near-term gold prices.

We Can’t Curb Debt

Since we’ve been talking about Canadian debt, let’s look at American debt.

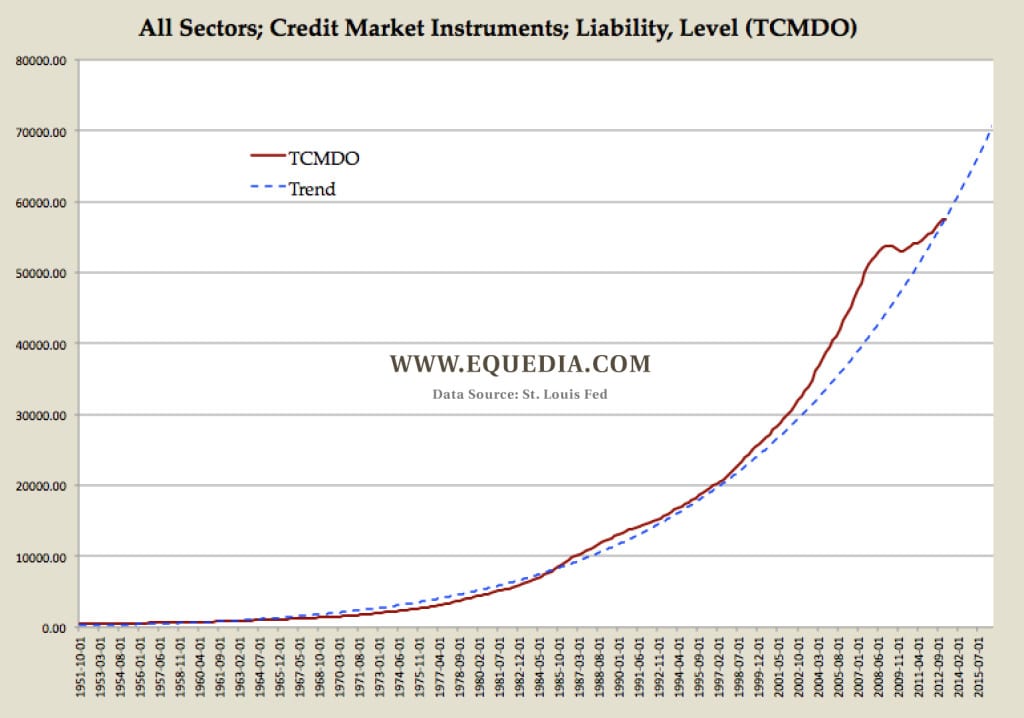

Take a look at this chart (in $US billions):

This is a chart of all credit market instruments and liabilities in America; in other words, debt.

As I mentioned last week, since the Nixon Shock in the early 1970’s, America (and the world) has continued to rampantly borrow more and more money.

A lot of experts – including some of the world’s most successful investors – have written extensive reports showing why this borrowing cannot continue, and why we will soon witness a financial crisis of epic proportions.

To which I have to ask, “Why won’t it continue? It has for the last 50 years…”

Inevitably, this debt trend will continue because the more debt that is created, the more debt will have to be created to service that debt.

The world’s financial system will have to break to buck this trend, but with the world so engrossed in American dollars, I find that a hard path to follow.

The Fed’s Real Intentions

The Fed’s plan isn’t to stimulate the economy, nor steer us out of a recession.

The Fed’s plan is actually the opposite.

They want us to borrow as much as we can, so that we – and our way of life – will be forever entangled into their financial system.

They don’t want to see deflation because that means America and the world is deleveraging, and thus moving further away from their banking system.

As economic conditions continue to recover – even at a slow pace – banks will be more comfortable lending, which will only cause debt to increase.

Even if the Fed tapers, there will still be record amounts of money sitting in the banks waiting to be lent out.

Credit will remain cheap, and thus consumers will be more comfortable borrowing. Since everyone will have access to easy cash, things will get more expensive.

When things become more expensive, it means our currency is being devalued.

We are already seeing a major shift from paper assets (stocks, dollars, bonds) to the ownership of tangible assets (gold, diamonds, art, collectibles). As this wealth transfer continues, it will make our dollars less valuable and increase the price of everything else that can’t be reproduced as easily.

And that is a trend that will not change.

Great report on the Canadian housing market. The absurdness of Canadian housing prices needs to be addressed. Anyone that thinks buying a condo for $500,000 is a great deal needs to a reality check. I am ashamed to say that Canadians are now over borrowing to buy houses that they cannot afford.

Someone needs to address this situation. This is a good start.

politicians won’t address this because the bankers in Canada pay them too much not to. Since the banks are lending out money off record mortgages, why will they stop?

If all goes south, the government (CMHC) fits the bill anyway. The banks are protected, so they will lend at will.

Canadian journalism has really gone downhill. Same old stories with the same old language. Nothing insightful.

Its no wonder the newspapers are failing.

Id much rather pay for this newsletter than pay for a subscription to a Canadian newspaper now. Canadian journalism really has gone downhill with nothing insightful.

Please keep up the great work.

Housing prices will continue to rise because of these low rates and foreign buyers. It may not rise quickly but it will continue to go up. People buy homes to live in and it is no different if they buy now or later.

It seems Jacob has never been to Vancouver, where the price of a small 2000 sq ft home built in 1970 is over $1 million, while the average income is $40,000, meanwhile average debt in BC is around $39k. How does that even work? How can someone carrying that debt afford a million dollar home? Richmond is even worse.

The problem as I see it is “normalcy bias” i.e. things will continue as they always have. Not true when you are dealing with a Ponzi scheme, (which is what our fractional reserve banking system really is), eventually new borrowers to feed the “DEBT MONSTER” will become scarce and not enough new loans will be taken out to replace the ones being paid back, and not enough to allow interest payments to continue. With less and less viable collateral being available banks have had to resort to “teaser loans” at zero to 4.9% interest rates to lure people into debt, which they can then not repay when rates rise.

Low interest rates are actually a CURSE because they lure people into buying much more house than they can actually afford, (liars loans, subprime mortgages etc.) and when these repossessed homes are finally dumped on the market. it depresses prices leaving tens of thousands of people paying mortgages that exceed the resale value of the home. Rising house prices lead to an industry fostered delusion that “real estate always goes up”. which is NOT TRUE! The PROFIT is also an illusion, the price increases merely represent the accumulated interest (read inflation) NOT real spendable increased value or “purchasing power” only by downsizing can you come out ahead.

The real and foundational problem is that WAGES and/or profits for the self employed never seem to keep up with rising prices for all goods. The establishment tells us that there is “no inflation by cooking the books” with manipulated statistics that do not take into account the latest industry trick of reducing package sizes while maintaining price levels, just another way of cheating customers.

Housing prices can only go up if wages keep pace with rising prices. Same with automobiles, the second big ticket item that is foundational to our economy, the industry has only been kept alive by INCREASING DEBT, i.e. increasing the payment period being extended from what used to be normal, (3 years) to now as long as 7 years.

The most glaring, blaring,blatant, misinforming piece of journalism I have ever seen or experienced was written by the Northern Miner of Whitehorse, Yukon.

Their article had elevated the chief geologist, John Felderhof, of Bre-X to the Mining Geologist of the Year.

Soon after, the world discovered that Bre-X was one, if not the largest money ($6 Billion) scam ever. Although my personal loss was minor compared to many, I had chosen to cease trading in stocks altogether.

Well you cant really blame the writer for that. Its not his duty to verify geological data. Its the duty of that John Felderhof who scammed thousands of people. Its scams like that that deter everyone from investing in Canada.

The message that I was trying to convey is that myself, and probably thousands of other investors learned the hard that journalists can get us on a band wagon without getting all the facts just to make headlines and sell papers. In this case, the newspaper was quick to honor Mr. Felderhof when due diligence on Bre-X’s property was not done yet.

I’m sure that many subscribers to the Northern Miner assumed that the paper was accurate at the time and trusted it’s elevated honor for Mr. Felderhof. This paper is likened to “someone reading about flying to be a pilot and then thinking he is one”.

By the way, after years of stalling, Mr. Felderhof was cleared of any wrong doing.

Let’s just say that in the end the Bre-X scandal “fell flat” upon Mr. Micheal de Guzman.

I disagree with looking at mortgage debt levels through debt-income levels. Many house buyers are purchasing properties they are going to stay in well into their elderly years.It is more relevant to consider their debt-assets ratios. Numerous people are getting mortgages on the basis of future pension income being more than sufficient to cover what will at that time be a smaller liability. Some are immigrants who are housing extended families with more than a couple of incomes. Barring significant unemployment it would probably require a 150 basis point rise in interest rates before mortgage default rates see a noteworthy increase. The 2004-2007 US market featured increasing house flipping and NINJA loans. Not to mention escalating costs due to softwood protectionism (more than 4000.00 per house on avg.) and mortgage interest write-off. finally, a lot of CDN buyers do have additional assets in tax deferred RRSP’s. A plausible outcome is that buying starts to dry up by the time interest rates begin increasing and house prices drift down somewhat for a time such that debt to asset averages would first flatten, and then as house prices stabilized begin to slowly drop due to ongoing future deleveraging in a higher interest rate environment.

Debt to asset ratios is exactly what Mr. Lo was talking about:

“And since most of our equity comes from real estate, and many are borrowing against it, a crash scenario is more serious than most economists make it out to be.”

Paul, you mentioned that “it is more relevant to consider their debt-assets ratios”

You measure your home as an asset, but if housing prices drop, your debt doesn’t drop with it. That is a problem.

Yes, Canadians want a safe investment that gives 1000 % return on average. That is why we only sell our natural resources at a discount so other countries can make the products for value added monies.

Debt is not what is important it’s return on investment that keeps the financial system going. In Windsor ON you can buy a nice duplex for $125-150,000 Layout $30K for a down payment, amortize the mortgage over 30 years and collect $15-1800 a month in rent and end up with a 30-40 % ROI. after expenses. Hard to beat that on the stock market.

Not if housing prices drop…

And not everyone can afford a second mortgage…most can’t even afford one at these prices.

Did you miss the location, Windsor ON dropped big time when the auto industry about died. it is just now making a come back.

Who cares about Windsor? If every Canadian decided to invest in that small city, the prices would go up just as well. People can be so pathetic and everyone seems to be an expert.

Hey Big Belly, Did you even read the comments, Its about investing and making money. I’ve got a ROI of nearly 40% Clearly you can’t beat that in the shithole of you mother’s basement you call home.

You write “increase of 1.6 per cent”.

Not.

It is an increase of **1.6 percentage points** over a base of 161.8 and actually equates to very close to an “increase of 1 per cent”. (Actually 0.988%)

The lay press misuses (out of ignorance or connivance) such figures for exaggeration and shock effect.

A financial letter needs to heed the math more closely.

The author never said an increase over the last period. He said increase in the quarter. If it goes from 161.8 to 163.4, that’s an increase of 1.6% overall in the quarter.

Some people think they are so smart…

Ms Jill

Looks the the math needs some explanation.

An increase of 1.6% over the 161.8 base would be 161.8 * 1.016 = 164.38

Not 163.4.

Lo is talking percentage **points**, not percentages.

Doesn’t matter whether the increase occurs over a ‘quarter’ in the example given or over a microsecond in a high frequency trade, percentage increases are not the same as increases in percentage points.

what are the future of any mining claims, gold-bearing? NORMAND

There is still room in some areas for Real Estate to grow such as in Quebec’s rural areas. I agree that in general housing prices are out of control in particular Condo’s which are a waste of money compared to your own house.

Even though in a year Canadian threshold might meet the threshold that broke the American housing market in 2007, you must consider unemployment rate.

2007 USA unemployment was much worse than Canada will be in a year. Not all but most Canadian will be able to keep up their payments.

Lots of Americans got mortgages while being unemployed. Everyone saw the housing crash coming.

Ivan:

There appears to be a contradiction. On the one hand you recommend gold as it is a hard asset can’t be printed. On the other hand you recommend US stocks which are just paper issued by the companies. How financially sound will these companies be when the US collapses due to the debt load?

You are negative on gold in the short term? When are you looking for gold to move up?

Have you heard of Robert McHugh and his technical newsletter? Interesting read. http://www.technicalindicatorindex.com

THANK YOU for the education you are passing on to the public. I have been in banking for 30yrs and seeing things from my side of the table here is my personal opinion. Debt levels in Canada is very high. Income levels have and will not keep pace with the debt level. so the consumer balance sheet generally speaking for most of us is out of whack. Seeing What I see from my end I see families struggling to keep up and the only thing that is saving us is low rates and the continuation of inflated home prices to be able to refinance and keep borrowing. Canadian banks are pushing also to the limit, to extend the offer of additional funds available to consumers. GOLD is being manipulated the way I see it so were ,the interest rate hikes we saw in recent months. This is the forth time interest rates been pushed up and if we been paying attention we have learned the habits of the ELITE. and read between the lines what they are up to. They never stop sucking the blood of the common-ner They pushed the bonds down by the rate hike and now buying into it lower pricing. Same with GOLD. General markets are pushing up technically and a short correction is mandated. MOST OF THE MONEY IS MADE BETWEEN NOV. TO APRIL in most of the times in equities. A lot of the money pumped into the economy need a place to be invested and I guess dividend stocks is the place. Gold will take its turn up again as the Elite will make some more again. Small Cap. usually has a seasonal debut Mid January till May , including gold.. Lumber stocks seasonality is Mid Nov to April as they buy supply according to their projection for next spring frenzy. Tech stock accumulate staring August & dump early January.(new phones/Christmas presents etc ) This is a lot of common sense just by paying attention to things. INTEREST RATE SPECIAL FOR MORTGAGES WILL TAKE PLACE IN MARCH 2013. Both the FED and the copy cats, our banks need to pump up the lending figures UP. Almost free visa cards sales to continue as this is a most profitable unit.(only If they would make a mutual fund in visa cards, instead only the elite get to get in this high yield inv. etc.) RATES ARE TO STAY LOW FOR LONG TIME as global economics are not in favor of the day yet. Probably till 2020, if you follow cycles.( world war 1914);;; What happen to the NEWS commentators about the USA economy being in good shape last year Yet most of their T-BILLS were bought by the FED. ( are we reading between the lines, then one would have known that the recent interest rate hike was about manipulation) when GDP goes over 100% the FED has the country by the b…….Third world countries will be the AIM now. The CAPITAL PLUS INTEREST RATE WE ALL PAY go back to the folks who created the DEBIT out of thin air.so for them is free money , they never loose, and a must keep the rates low is a mandate to keep consumer borrowing and afloat. All this means is that the real asset they are sucking is our hard labor for everything else is DEBITS & CREDITS. just fictional stuff. Leverage is Unlawful way of doing business yet so common. so all debts in excess to a corporation net-worth is fictional stuff, in my opinion. Banks are not allowed to leverage yet the practice is accepted.

URZ stock : looking at the chart it will be a buy in if the price penetration holds above the 1.15 cad. in my opinion. They also would have to show the plan of expand-ion with the funds received.

by: lino-tavares

just my opinion

The same thing I think of main-stream TV. Not much.

jr

Canadian journalism, like main stream tv, is far too bland and uninformative. Always telling us stuff we already know

I trust journalists (of any kind) as much as I trust politicians (which is basically zero).

I find your comments fascinating. I don’t know alot aboutinvesing actually nothing but I have been reading up on it and I have found what you have stated quite on the money so to speak. My question is where should you invest now today.

After reading these responses, i realize, you haven’t been to the Caymen Islands, to speak to someone mentioned here….

And you fail to mention, most Canadian’s own their own homes.

I do think it’s sad when i have to read this crap………

pathetic, if your rag is the fastest growing investment newsletter in this great country, were in a load of trouble.

First of all, its Cayman Islands. Second of all, what does Cayman Islands have anything to do with this issue?

Most Canadians own their homes, that’s right. But they also own a fat mortgage. The numbers being released are by the banks.

Why people cannot accept facts is beyond me and why people post stupid comments that have nothing to do with the content makes no sense.

I just can’t help but think that in my grandparents day (Post WWII), families had one income, everyone ate well, the car was bought with cash, and the mortgage was paid off in a few years. What the heck happened? Now we spend so much of our income on disposables, (ipads and things we throw out a year later because a newer better one came out) and upgrades to crap we don’t need (Try buying a basic car with an engine, four tires and hand crank windows… I doubt you will find one from any dealer of any make) Nissans and Hyundai’s are now far nicer (and better quality) than Cadillacs. We are all guilty. We borrow to buy fancier things than we can afford, and in trade, in the average family, both partners work full time, kids are in daycare raised by strangers and stress levels are so high families disintegrate seemingly more often than not. Sad society we have. In many ways I wish I lived in my grandfathers day.

I looked at my mortgage situation and I wondered how much of an investment it is. I bought this house (a duplex), in order to house my family. With all the necessary upgrades that I have made to the house, the ever increasing municipal taxes, school taxes, parking restrictions which catches you on an off day with 52 dollars parking tickets, I believe that the only return that I will see is the happiness of living in the building. If we consider that a mortgage payed off after 20 – 30 years have also payed the lender close to the same amount borrowed or even more, then the house that you sell is only to recoup what you have put in to keep it standing. So for me, a mortgage and a house does not equal an investment, but a place to house a family.

Agree with you 1000%, Canadians these days are too wrap up in thinking housing is an investment

Weslee has it right, real estate is no longer a sure fired winner, it has instead become a debt trap where you never really end up paying it off in a reasonable time period. Many people just keep refinancing to stay semi-solvent, but that is the essence of the fractional reserve banking game, keep people in perpetual debt to pay the accumulating interest. While wages stay primarily stagnant, the prices of everything else keep rising including taxes, no matter how many politicians naively say they won’t raise taxes. They have to, because the only way an economy can stay solvent is with increasing injections of new currency borrowed into existence as debt.

Since the system never “creates” interest, mathematically the only way it can be paid is if new loans being made equal the amount being paid back, PLUS the accumulated interest, PLUS any growth factor needed for an increasing population. When people and corporations do not voluntarily borrow the needed funds into existence because they have no unattached collateral to secure new debt then the government becomes the borrower of last resort. When the government becomes overextended then the “last man standing” is the Federal Reserve that then monetizes the debt, so this Ponzi scheme is getting a little long in the tooth.

Once Nixon in 1971 removed gold backing from the dollar it was all downhill from there with the dollar rapidly losing its purchasing power. It is a travesty of language to still call the worlds reserve currency, (U.S. phony paper) a “dollar” with about 3c of purchasing power when it was originally defined as 417 grams of pure silver, (coinage act of 1792) so if you want to compare VALUE of paper against precious metals, simply determine what a given essential good, energy, food, a house, a car

etc. costs in todays debased paper currencies compared to how many gold or silver coins it would take to buy the same amount of goods. Only then will you have a clear picture of which you should own, to protect your purchasing power, depreciating paper currency or precious metals that have retaining purchasing power for at least 5000 years.

Being from the USA I do not thing we have the option of telling anyone anything, we have made our neighbors look bad when they had so much to offer but in the world of Obamaism we have taken what is close and pushed it far away, under the bus you might say. Sure it gets cold in many ways,but there are many ways to get warm together. I was and guess I am still proud to be am American but I think it is more like from the NORTH AMERICAN CONTINENT. Stay the coarse that once was strong, because these new changes are trying and are pushing us down a trail that we don’t belong. The USA money printing is turning into world currency made for the fire place and I hope and wish that the time is to stick together is not to late. The far west is buying THE USA AND CANADA WITH OUR OWN MONEY. The worst part is that we know it is true and being done right now. It will take 2 strong nations to somehow be one and don’t know if it is possible but the end result is we don’t will be there pawn. They need us separated which is already done, but for us to be strong and fair would not be easy but the alternative is there will be a new ruler a dictator coming from them and what you have now will finally run full circle on Chinese Rail built by them a hundred years ago. We need to come together not north and south that has got us here now although it is better than it once was. THE ONLY WAY IS TO START ACTING ON IT NOW IT WILL BE THE HARDEST THING EVER DONE BUT IT IS THE ONLY ANSWER OR THEY WILL HAVE US ON THE RUN FOREVER, THE USA AND CANADA NEED TO PUT OUR DIFFERENCES ASIDE AND COME TOGETHER AS ONE OR WE STAND NO CHANCE WE WILL BE RUN OVER AS THE SAME AS ONE. LOOK WHAT HAPPEN IN THE CIVIL WAR A YANKEE AGAINST A REBEL SURE THERE WAS A WINNER BUT IT TOOK 100 YEARS AND THERE IS STILL PAIN BUT IT IS SLOWLY CHANGING SOME GOOD SOME BAD BUT THE LAWS OF THE CONSTITUTION HAVE HELD TOGETHER AND MANY A COUNTRY HAS TRIED TO BREAK THEM APART. WE HAVE THE BIGGEST SMARTEST AND BEST NEW EMERGING NATION RIGHT HERE ON THE NORTH CONTINENT USE IT WISELY OR WE WILL SURLY FALL. THERE COULD BE A NEW CONDITION IN THE BEST CONSTITUTION EVER WE COULD SHAKE HANDS AND BE (ONE AND NEVER HAVE TO RUN) FROM THOSE THAT ARE TRYING TO US TO.( THIS MIGHT NOT BE THE ANSWER BUY IT IS ALL WE HAVE.) ( THE NORTH CONTINENT CANADA AND AMERICA #1 )

Helpful info. Lucky me I discovered your website by accident, and I’m shocked why this coincidence did not came about

earlier! I bookmarked it.

I was suggested this web site by my cousin. I am not sure whether this

post is written by him as nobody else know such

detailed about my trouble. You are amazing!

Thanks!

You are so right on target and the deceived multitudes simply don’t get it. Our fractional reserve banking system based on debt financing is a gigantic Ponzi scheme that has passed its “best by date”!

Mathematically it can not survive because as you so succinctly said; “Inevitably, this debt trend will continue because the more debt that is created, the more debt will have to be created to service that debt.’ Thats the part that people don’t get, since interest is never created, only the principal of loans, it necessarily follows that covering of interest payments of existing loans means a perpetual requirement for more and bigger loans to keep the system liquid, while also covering the accumulated interest that can only result in a pyramid of debt that ultimately can not be repaid.

One of the most egregious hoaxes that has ever been perpetuated is the banking establishments mantra of the “MAGIC of COMPOUNDING” to lure people into debt instruments, but the simple truth is that only a small percentage of investors will ever be able to be net beneficiaries of compounding investment profits. Mathematically the simple truth is that if everyone could win by that strategy then who would be left to PAY the interest? The brutal truth is that since Nixon took us off the gold standard in 1971, what has been compounding is DEBT, with only the few at the top of the pyramid benefiting, while the majority are descending into debt slavery.

An interesting discussion is definitely worth comment.

I do think that you should write more on this issue, it may not be a taboo matter

but typically people don’t speak about these issues.

To the next! Cheers!!

I usually do not drop a ton of remarks, however i did a few searching and wound up here Equedia Investment

Research The Reality of Canadian Debt Levels

I wish someone sensible would explain to me why the Canadian dollar fails to equal or exceed in value over the U.S. dollar.

The U.S. debt is well on its way to 18 trillion dollars. This debt will not be reduced never mind ever being eliminated. I don’t have concrete numbers to present, but I am confident enough to say that the Americans owe far more money per capita than Canadians per capita.

Canadian dollars have ranged from 1.10 to as low as .62 U.S. over 4o years. The Canadian dollar has stabilized at .92 for the last 2 months. If Ivan Lo is correct in that the U.S. dollar will be worthless in the very near future, does that mean that when that happens our Canadian dollar will be worth minus (-.08) eight cents?? looks like it to me.

Canada is rich in resources and should be demanding world prices for its commodities especially oil. Oil should not be sold to the U.S. at $60/barrel. Energy hungry countries such as China should be given priority over the U.S. They seem willing to pay world prices. Its time that Canada stop subsidizing the Americans.

I suspect that our dollar is being manipulated (but by who?, the Americans?)to be worth less than it should be in comparison to the U.S. dollar. They are suckering our commodities at bargain basement prices.

Anyone care to comment differently? Probably not, because its true.

When the mass of people lose their jobs that is when the egg laid will hatch. In the near term this is about to happen after the sto k market crash. Companies will be forced to adjust to new PE metrics and many will be caught in the debt spiral. Prepare or take the roller coaster drop the smart money is out of the game.