You won’t like this, but a housing collapse is coming.

If you think I am being paranoid, just wait till you see the evidence.

In June, 22,239 properties were foreclosed in the U.S.

While that doesn’t sound like much, it’s a 226% jump from a year ago.

Meanwhile, the chief economist of Freddie Mac—one of the biggest industry “insiders”—warned real estate sales are grinding to a halt:

And Michael Burry of Big Short fame thinks real estate will go up in flames once again—only this time in a more violent way.

But you don’t have to take my or any of those commentators’ words for it.

Just look at raw data.

Mortgages Are at a Standstill

Let’s start our investigation by getting down to the core of the real estate business: mortgages.

Since most people take out mortgages to buy a home, loan officers are one of housing’s “canaries in the coal mine.” If they are underwriting fewer loans, it means people are less interested in real estate, and vice versa.

So how has the mortgage business been faring lately?

Not good.

Loan applications have been slowing throughout 2022, but the summer has brought a near-dead stop to the mortgage business (even when excluding refinancings).

In the second week of July, mortgage applications for new homes dropped a staggering 52.7% compared to a year ago, according to the Mortgage Bankers Association.

For perspective, that’s the lowest demand since 2000.

This raises the question: why have people suddenly stopped taking out loans?

The answer is simple: they can’t afford them anymore.

Leverage Matters

When economists and T.V. pundits weigh on housing, they often look at nominal prices and compare them to what they were before.

But that’s not how home buyers view real estate.

Most homebuyers mortgage their home. In other words, they don’t pay the whole nominal price upfront. Typically, they put down 10-20% of the home’s value and pay the rest through monthly instalments over the next 25-30 years.

And that monthly bill is what matters most.

Say you get pre-approved for a principal, interest, taxes, insurance (PITI) mortgage of $2000/month. Would you care much whether your dream house costs $500,000 or $550,000? Most don’t. You likely care that your mortgage payment won’t exceed your PITI limit.

In other words, most homebuyers see nominal house prices through the lens of monthly mortgage bills. Instead of a $250,000 house, they see $1,000/month. And instead of $500,000, they see $2,000/month.

But look what happens to mortgage bills when the Fed messes around with interest rates:

- Between 2020-2021, the 30-year fixed mortgage rate averaged 3%. A $500,000 house would have cost you ~$1,800/month

- Today, interest rates are at 5.7%. That same house would now cost $2,500/month

- And if the rate jumped to 10%, the same house would set you back $3,750/month.

In other words, a mere rate increase of 2.7% means a monthly mortgage payment on a $500,000 home goes up by nearly 40%; a 7% increase takes the payment up over 108%!

See how much “leverage” mortgage rates carry over nominal house prices? Even a few percentage-point rate change can double (or slash in half) a monthly bill on the same house.

That’s why people were snapping up real estate during the pandemic. The Fed’s zero rates have shrunk mortgage bills so much that they offset insane nominal housing prices – or, in reality, drove them up.

But now that mortgage rates aren’t just back to pre-pandemic levels but bound for the highest levels in two decades, who can afford today’s real estate prices at those rates?

How High Can Mortgage Rates Go?

Can mortgage rates go to 9%, 10%, or even higher in the coming year?

If history is an indication of what’s to come (and most often times it is), not only could they, but they likely will.

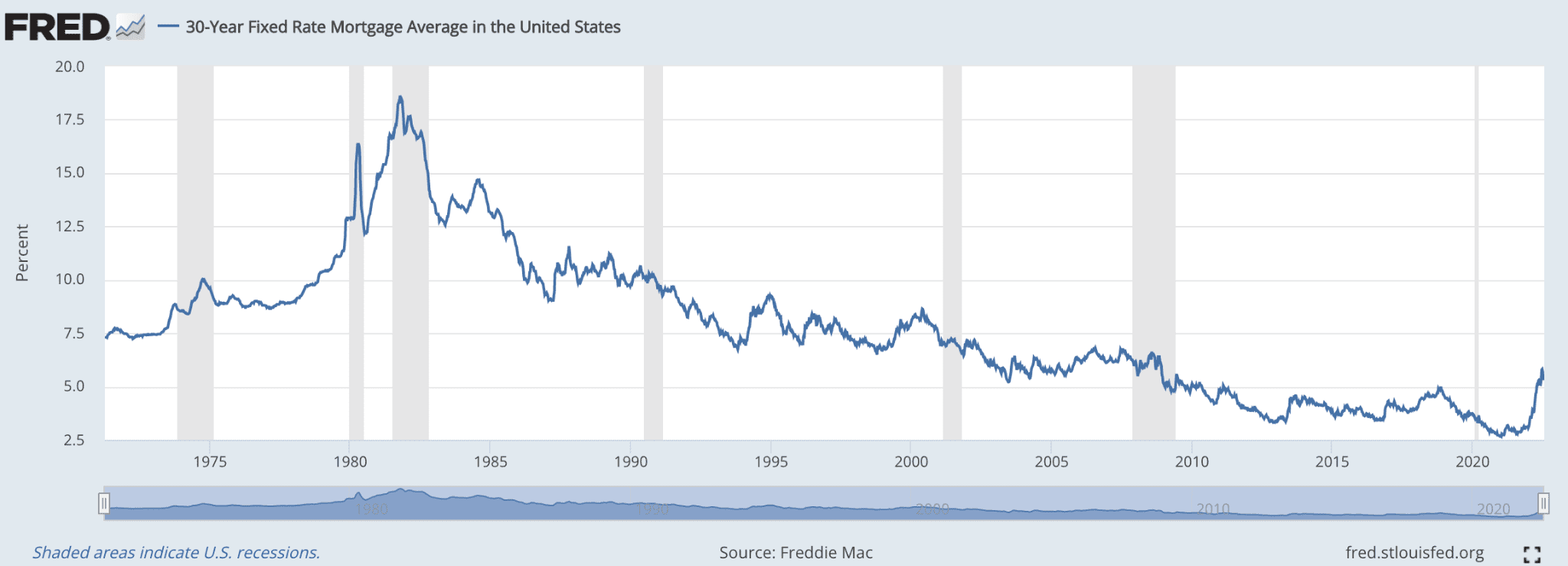

Take a look at the history of the 30-year fixed mortgage, especially during the 1970s. You’ll see that, for the most part, mortgages rates have been much higher than they are today:

If you go back to 20 years ago, mortgage rates were never below today’s 5.7%. And when then-Fed chair Volcker was fighting 1970s inflation, mortgage rates peaked at a mind-blowing 18%.

It seems like something that would never happen in our time, right? But like the double-digit inflation we are fast approaching, history often repeats itself when least expected.

In fact, at today’s 9% inflation, we are almost two-thirds of the way to the 1970-style inflation. And yet, the Fed has barely mustered a measly rate increase of 1.75%. So, rates are still far off from where they could be to match Volcker’s tightening.

Could you imagine mortgage bills at 18%? The same $500,000 house with a $1,800/month payment would increase to a monthly bill of $6,450!

Will we ever see 18% interest again? Maybe not in the near term.

But the scary part is that we won’t need 18% or even 10% to see a massive correction in the housing market.

A Breaking Point is Just Decimals Away

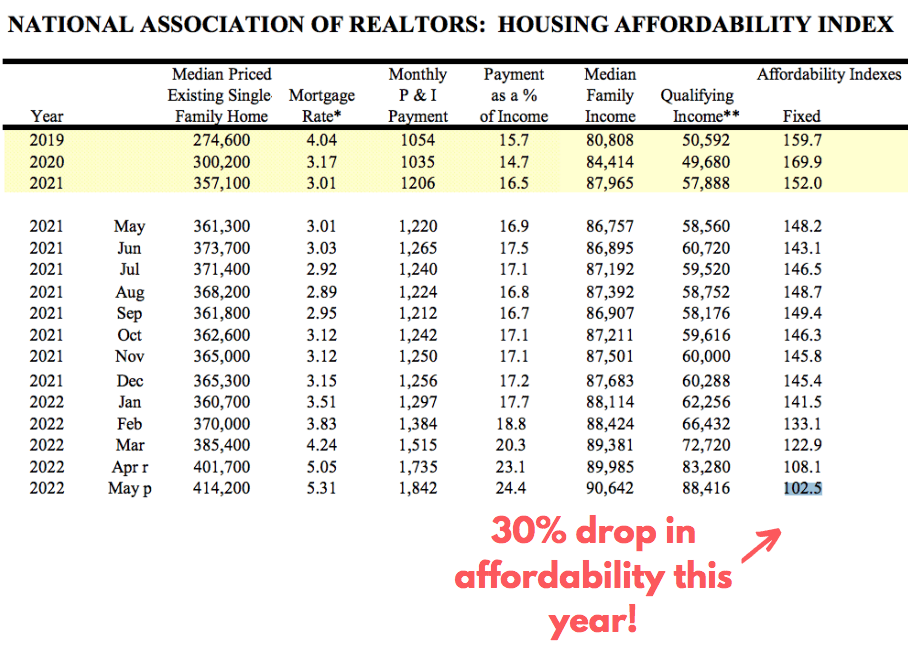

The National Association of Realtors’ Housing Affordability Index is the #1 benchmark for home affordability in the U.S.

In short, this index shows whether the median-income family can afford a mortgage to buy a median-priced home. For example, a value of 100 suggests that the average household has just enough income to buy an average home.

If the index is at 95, the median-income family is 5% short of buying the median home; conversely, if the reading is higher than 100, the family has more income than it needs to buy a median home.

So let’s take a look at how “affordable” housing got over the past few years:

At the beginning of 2020, housing affordability was at a strong 169. But as housing prices grew over the pandemic, the affordability slumped to 145. Still, the median income family had more than enough money to afford a median home based on 2020 rates.

But look what happened when the Fed began hiking rates.

As mortgage rates crest over 5% in May, housing affordability in the U.S. dropped 30% to 102.5 – in less than half a year!

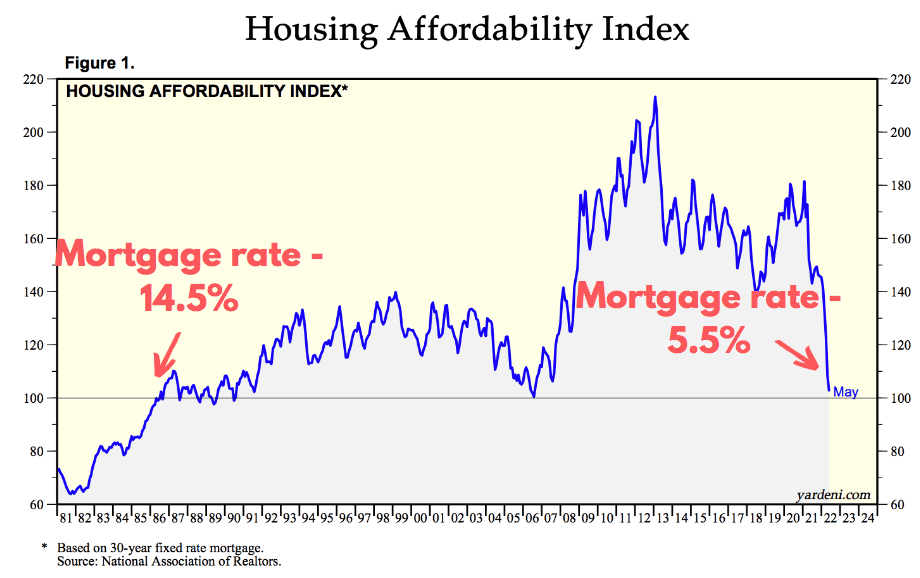

For perspective, that’s the lowest level since 2006—the heat of the last housing mania. And it’s on par with affordability in 1986 when mortgage rates reached 14.5%, as you can see here:

In other words, housing today is so expensive that with still historically low 5.5% mortgage rates, it’s as unaffordable as it was when mortgages were at a crazy 14.5% in 1985!

That means a breaking point is closer than we think, potentially just a few rate hikes away.

Warnings Signs Flashing

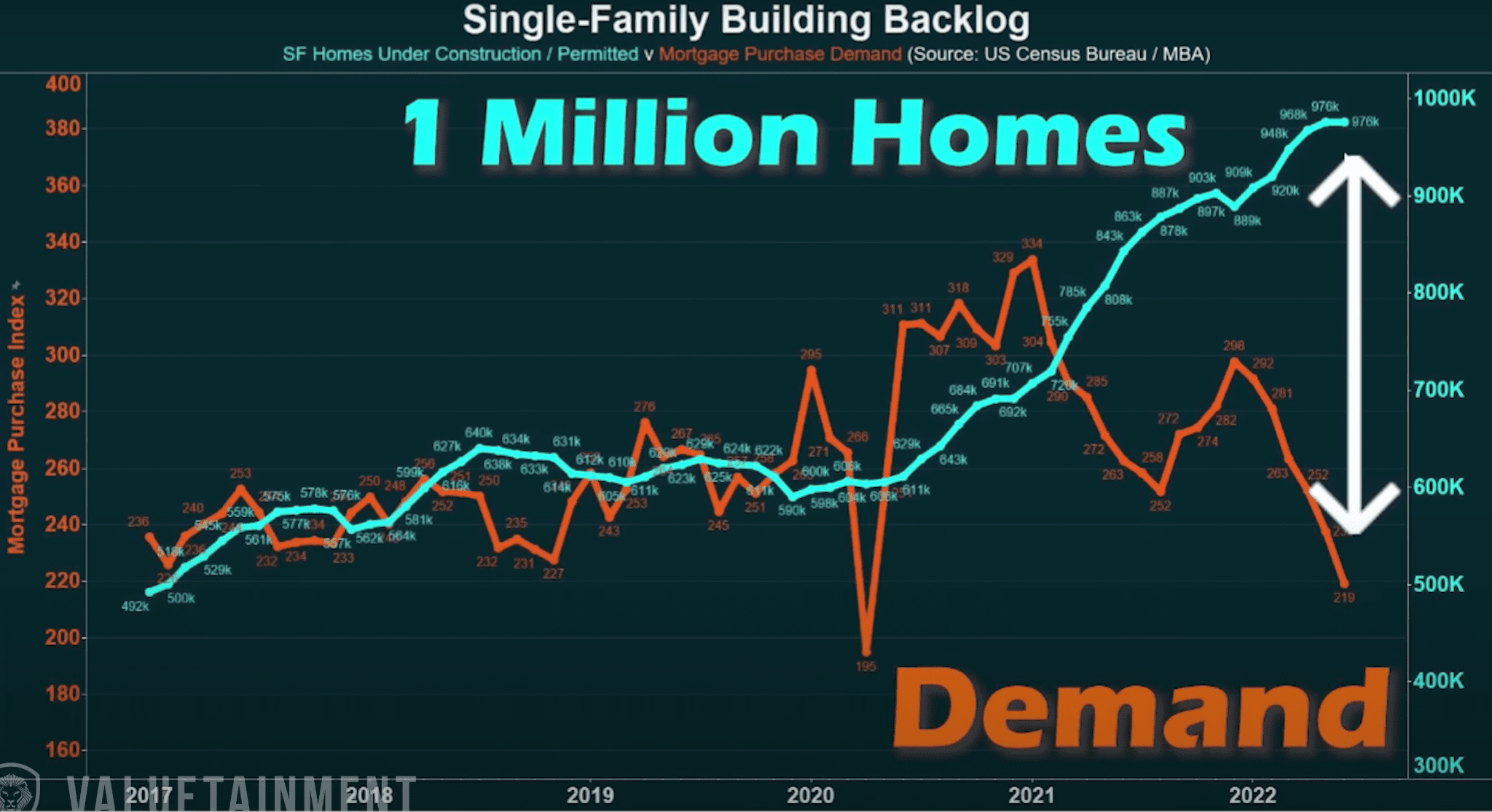

Take a look at this chart that plots homes under construction against mortgage demand.

Note how these two lines forked off when the Fed started raising rates and mortgage rates jumped. So while homebuilders keep cranking out houses, the demand for them is falling off a cliff.

As one builder in Atlanta told Marketwatch: “Someone turned out the lights on our sales in June!”

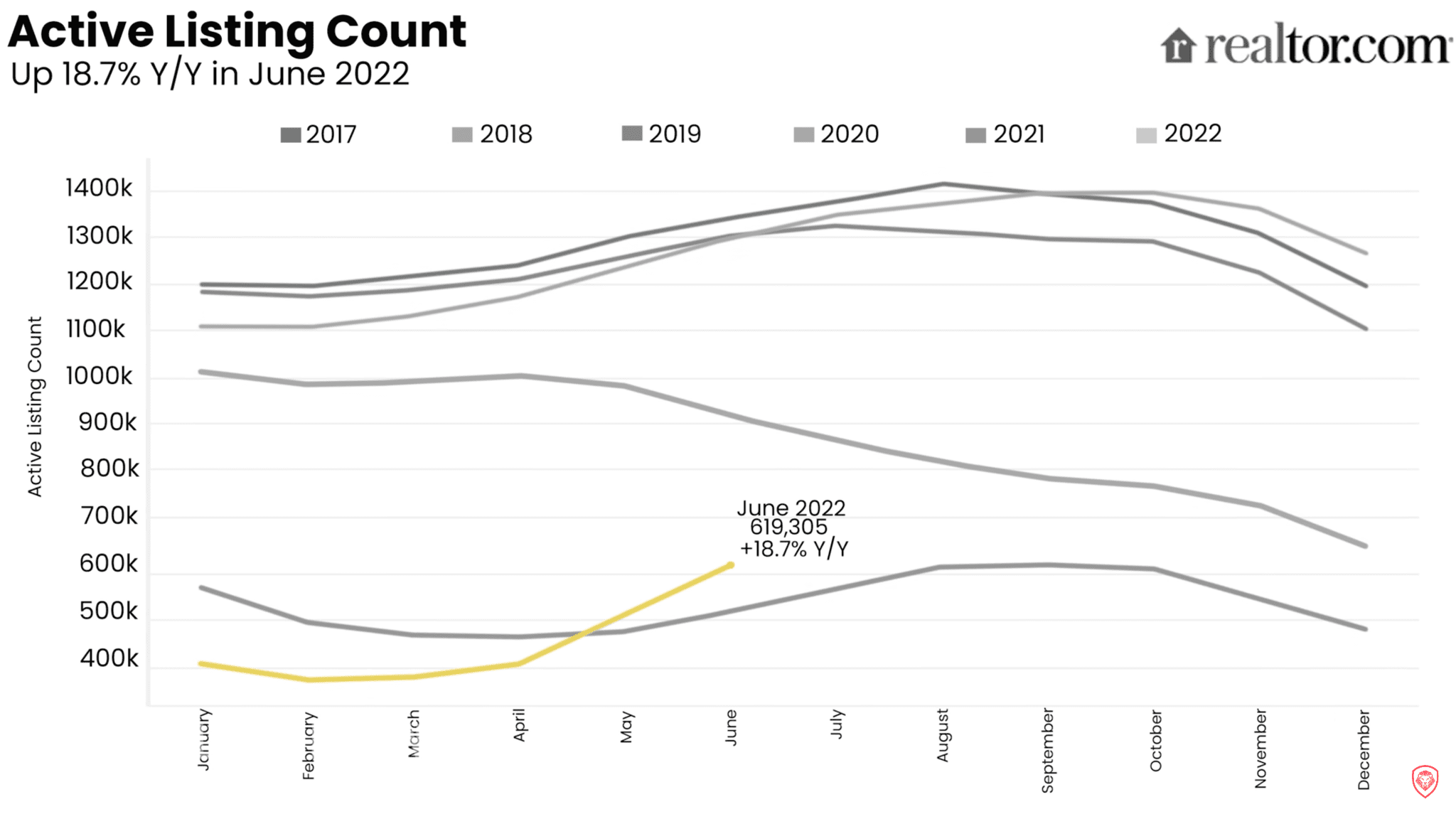

Meanwhile, active listings are growing rapidly, up nearly 19% compared to a year ago and over 50% since the start of this year.

Mark my words, the market will soon be flooded by tens of thousands of spare houses nobody can afford. And homebuilders will have no choice but to slash prices to sell them.

In fact, according to John Burns Real Estate Consulting survey, 1 in 4 builders already are.

Worse Than 2008?

There’s one thing that could make the looming real estate bust more contagious than 2008—or anything we’ve ever witnessed before.

Not only is housing “un-affordability” off the charts, but over a decade of money printing and record-low rates led the economy to pile up so much debt that it’s crumbling under its weight.

Federal debt? Record high:

Household debt? Record high—and accumulating at the fastest rate since 2003, as I wrote in "The Great Debt Trap (Part 1):

Last year, consumers were taking out loans at the fastest clip since 2003.

Via CNBC:

"Consumers ended 2021 with record levels of debt, leading into a year in which interest rates are expected to rise substantially.

Total U.S. consumer debt at the end of the year came to $15.6 trillion, a year-over-year jump of $333 billion during the fourth quarter and just over $1 trillion for the full year, according to data released Tuesday from the Federal Reserve's New York district.

The quarterly rise was the biggest since 2007, and the annual gain was the largest ever in records going back to 2003."

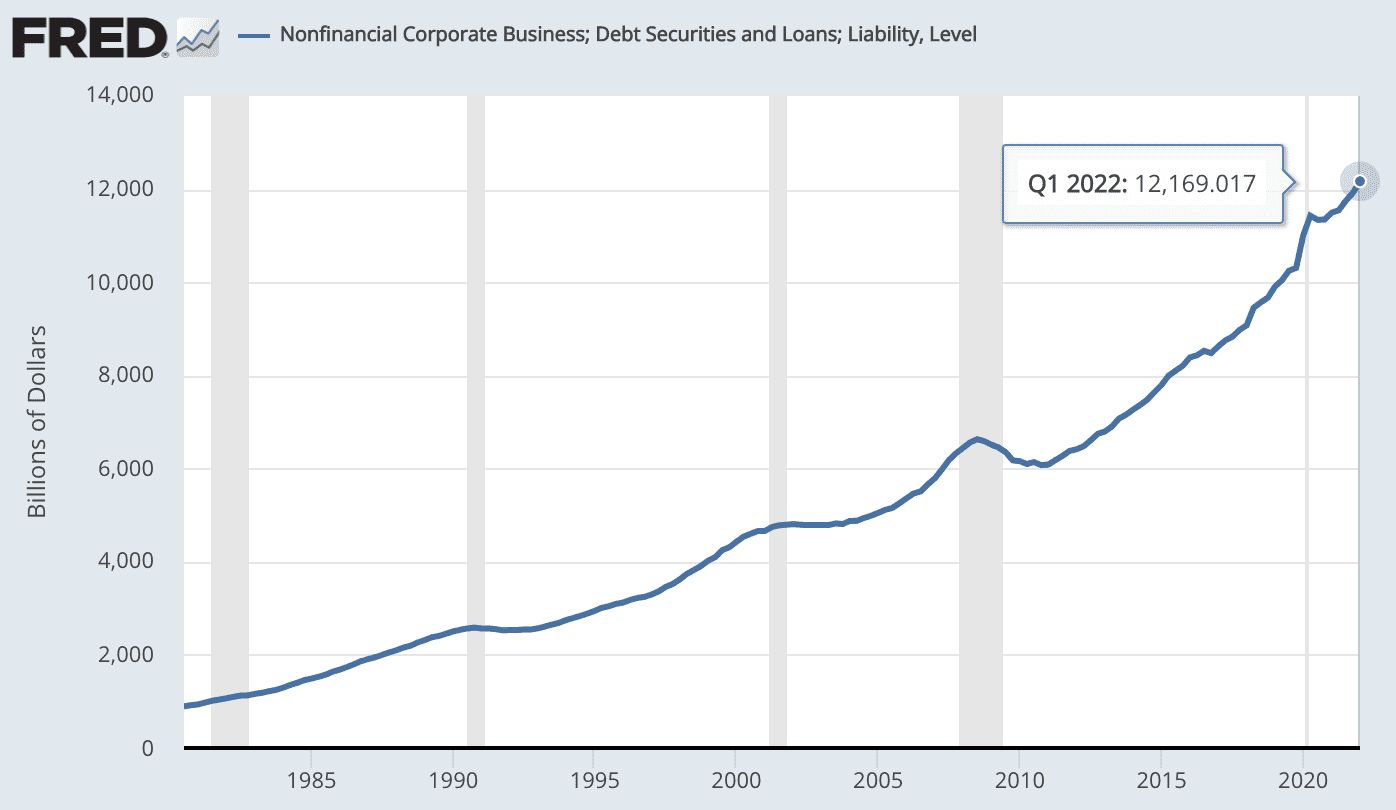

Corporate debt? More than doubled since the housing collapse…

Worse, the Fed's unspoken Covid "bailout guarantee" urged investors to throw caution to the wind and lend to near-bankrupt companies. The result is that unsustainable businesses have been indiscriminately showered with billions of dollars.

No wonder we've seen massive layoffs among Fortune 500 companies. As the Fed normalizes the cost of money, the over-indebted companies begin layoffs to stay balanced.

Here are just a few of the many layoffs this year:

- JPmorgan - 1,000 employees

- Re/Max - 17% of its workforce

- Coinbase - 18% of all employees

- Giant car dealer Carvana - 2,500 employees (or 12% of its workforce)

- Mortgage startup Better - 4,000 employees

Many think that the Fed will soon throw in the towel and stop the rate hikes. But for now, it seems determined to bring down inflation - even if that price is millions of unemployed Americans. After all, people are just pawns to the elite.

Case in point, as Quartz reported, "Fed officials see unemployment climbing over the next three years, whereas three months ago they predicted it wouldn't start rising until 2024."

It doesn't take a genius to connect the dots here.

As the Fed keeps bringing the cost of money back to reality, mortgage payments will go up. Meanwhile, nationwide layoffs will destroy incomes, which are supposed to pay those increasingly expensive mortgages.

Something has to give.

Can you now see what the era of cheap money has done to affordability? While the masses believe low interest rates makes things more affordable, on a longer timeline, it does the opposite.

Real Estate Is Going on Clearance

In all likelihood, the mortgage boom is over.

If things don't change their course immediately—which doesn't seem likely—we are likely going to see the beginnings of a real estate implosion this year. And with so much debt, what's upon us may dwarf anything we have witnessed to date.

What should you do to prepare?

Arm yourself with patience, hoard cash, and get ready for the next few years. Assets are going on clearance.

Seek the truth and be prepared,

Carlisle Kane

I often wonder what is not being taken into consideration with an article like this. No one writing this kind of doom and gloom asks “what’s different this time?” I would put forth that the wealth transfer effect (trillions coming in the next 20 yrs), will have the effect of nullifying much of what gets put forth as financial disaster. Aside from the trillions in cash sitting on the sidelines waiting, money moves to where it will get the highest return. There will be lots of big returns coming should any of what you theorize comes to pass, which will get passed on in this massive wealth transfer.

I’ve pointed to the stars and heavens above. But you still only see the tip of my finger.

This is round two in a push for what many call “The New World Order”

Blackrock deliberately created the Sub-Prime Crash to pave the way for Operation Jade Helm but that plan fell apart when the LEOS nationwide said they wouldn’t help the UN carry out the Disarmament Treaty signed by Obama that would allow the Disarmament of America and put the US under UN authority. That was round one.

Round two began with the riots of 2020 under the umbrella of Systemic Racism.

George Sorus had container ships docked at all major ports and they unloaded pallets of bricks and Strategically placed them in those cities for his paid antagonists (Antifa) to achieve thier objective. To crush law enforcement. Make them hate thier jobs, the people or both if possible to get to the people. It had absolutely nothing to do with systemic racism. They were effective as mass leos resigned and most that were left could give two craps. Now look how far they’ve come.

That’s why Blackrock purchased thousands of single family homes above market value to pave the way for Biden.

Biden only had but two milestones laid out for him.

One, to create an economic collapse of the United States economy.

Two, once the collapse was well on its way, grant the UN authority to dissolve the Sovereignty of the United States of America and allow the UN, WHO and WEF control over our constitution.

The housing market collapse will happen along with the elimination of the dollar.

I’m not sure if the NWO was real or a distraction. I’ve read the material and seen it mentioned by every world leader along with the Illuminati. But I can say with absolute certainty that while everyone was focused on that, they rebuilt BRICs and that’s the endgame.

Somebodies, maybe, should climb out of that tree and take their meds.

I remember when we were happy to get a 9% mortgage! And we got about 20% interest on money market funds.

The Fed will blink. The result will end the dollar’s role as a reserve currency and hardship for all.

I agree with this newsletter, but this is only one aspect of a bad situation.

I have read 75% of all households, do not have $500 saved for emergencies, that was before the inflation started up. I believe I read that in a newsletter 1st quarter 2020.

With the inflation at 9.1%, that savings number is deteriorating by 9.1% per month.

I have cut back on my spending, and I would bet so have the 75%.

The stock market driven 70% by consumers.

If 75% of the households cut their spending by 9%, not only will houses go down, so will everything else will too.

To everyone, FAZ is an ETF selling under $25 on the stock market now, that went to over $6MM per share in 2007-2009.

Go on Barchart.com oi any charting service and check it out.

10 Shares will cost under $300.

I suggest everyone buy 10 shares and consider that an insurance policy against the crash that is coming.

Most people will read this and do nothing, until it’s too late and this amount is less than they pay for car insurance each year.

Regards

Frank

I have a grand daughter that was born in the US and has a Social security Card . She lives in Canada is a Canadian citizen . At one time you had an article how to get rid of the US citizenship . She is 21 now would appreciate any info I can get.She also wants to invest some in the US .

I see that the richer keep getting rich and the poor could only dream of owning a home. The American dream has plummeted and been destroyed. it seems that the poor will always be renters and eventually homeless and the rich will be the only investor. How can we become homeowners when interest is so high? I love California and I don’t want to leave at this moment. I am teachable teach me how I can become a homeowner with one income.

It’s all in the way people Think! That’s the Real Real – You can be made to Think, you are Sick! When, you’re Not! But please let the FOOL know, if he gets up and starts and runs around, he’ll Think, he’s Now Well. One should Think, he’s Bullet-Proof against any, and all 0-Thining, or -0 Thinking.

Two – Once I made myself Think,

I could become a millionaire, so I opened my business account with $49.00 and went about becoming a millionaire, winding up the Mental venture with US$33,000,000 it only took 10 happy years as I went along my millionaire route. O and apart of my work, the money making part was, building houses, and Financing, apart of the home-prices so my buyers could get into a home. Of coarse I seen Banks putting Interest Rates up, and, down.

So, the so-called Inflation is Nothing More Than Peoples Thoughts, and Thinking – Steady, yourself, go about YOUR OWN BUSINESS seeing you are on your way to accomplishing a great life in all endeavors. Success! That’s all I know.

Have a GREAT Life that is what its all about – Do Not Look down at the gutters of life, when you can just as easily look up and see beauty all around you!

Mortgages, and, Mortgage-Banking, is NOT what it appears to be – It is a HALO misleading your Think-ing!