Dear Readers,

From UFO’s and leaked documents showing the government could be experimenting with alien technology, to yet another close call with Iran, the world just can’t seem to slow down and make sense of itself.

Meanwhile, despite all the global uncertainty, the stock market continues to rise – hitting yet another all-time high last week.

If you moved your money to the sidelines, you would’ve missed out on a cool and easy 19% gain – simply by investing in the S&P 500.

And despite what the bears and analysts tell you, I have repeatedly shown you how to gauge the market by following one of the most accurate market indicators.

If you don’t know what that is, you can check it out by clicking here: The Most Accurate Market Indicator

Today, I want to revisit a Letter I wrote back in 2016.

Why?

Because not only does it provide many of the answers as to why the stock market is moving higher, but it also helps us gauge and understand what’s really happening with the trade war between the US and China.

And with gold once again surpassing US$1400 per ounce – something we haven’t seen in nearly six years – it may also help you understand why gold is rising and where it may go next.

Here we go.

Watch the Video Instead:

How Money Works

(The Equedia Letter, September 2016)

A mass exodus of wealth is coming.

It will be a cataclysmic event unlike anything our world has ever seen.

It will be so powerful that it will make all previous financial disasters look like a bed of flowers.

Yet, contrary to what you might be thinking, I am more heavily invested in the market than I have been in a very, very long time.

But why? Wouldn’t that be in direct contradiction to what I just said? Shouldn’t we exit the market if such a financial disaster was coming?

In order to answer this, it’s best I explain things from a macro perspective.

The Main Reason for Collapse

Every economic boom over the last few centuries was created as a result of credit expansion.

Every economic bust was also created as a result of credit expansion.

So let’s go back in time to understand why.

When Things Were Simple

Not long ago, trade between countries were conducted by exchanging goods and services.

For the simplicity of this story, we’ll use gold as the currency of exchange – since every nation viewed gold as money back then.

A few hundred years ago, trade between the English and the Dutch was strong.

When the English traded with the Dutch Republic and imported more than it exported, the English would have a trade deficit.

To take care of this trade deficit, England would send gold to the Dutch Republic as payment.

Since gold was the only real form of money, England’s money supply would contract.

This contraction meant English banks would then have less money to lend, which meant interest rates would rise because the cost of borrowing would go up, which meant less money was available for economic growth.

If this continued, it would eventually lead to an English recession, and deflation would take place.

But the opposite would happen to the Dutch.

The trade surplus meant the Dutch had more gold – and since gold was the only real form of acceptable currency, this meant it’s money supply grew.

The increased money supply meant the Dutch has more money to lend out, making borrowing cheaper and thus expanding credit, which led to an economic boom that eventually caused inflation.

With more money, the Dutch purchased more English goods, which were cheaper as a result of England’s deflation.

The English, on the other hand, had less money, and couldn’t buy as many Dutch goods because Dutch goods cost more as a result of inflation.

Eventually, England’s trade deficit with the Dutch Republic would come back into balance.

In other words, the international balance of trade was maintained by using gold as money.

But this balance only lasted as long as money was not manipulated.

World War I

Prior to World War I, the world operated on a gold standard – where gold was the only form of acceptable money globally.

But when World War I started, none of the countries had enough gold to finance the war.

So what did they do?

They printed money to fund all of the government bonds and deficit spending required to fund the war.

When the war was over, there was so much money created from printed debt that it fueled a global economic boom led by Western nations.

We know this boom as the Roaring Twenties.

American companies had record production figures, increasing sales, and millions of dollars in profits. These profits led to high dividends and even higher share prices. So thousands of investors flocked to the stock market, and many leveraged themselves and borrowed money to buy even more.

No one thought this boom would end.

But American companies began to produce so much that it was making more goods than consumers were able to buy.

This, in turn, led to declining sales, prices, and profits.

And with all of the debt that was accumulated during the war and the boom thereafter, much of it couldn’t be repaid.

This led to the panic of 1930.

In 1930, when much of the debt couldn’t be repaid, the US stock market collapsed, the money supply collapsed, and the banking system collapsed. This led to the international monetary system collapse, which led to the collapse of world trade.

Over the next decade, the entire world was stuck in a rut, which became known as the Great Depression.

The Great Depression had profound effects on American society and the world. Millions of people lost their jobs and their homes. Thousands starved to death. Suicides skyrocketed.

(Note: Right now, the US is showing many signs that it’s already in a recession. From growing riots and protests to income inequality, to the highest suicide rate not seen for over 30 years.)

With the depression still raging on, World War 2 started.

World War II

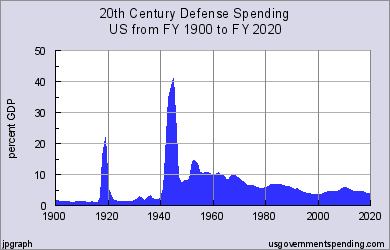

Again, in order to fund the war, the US government increased spending by a whopping 900%, with defense spending climbing to an incredible 41% of GDP!

Again, in order to fund the war, the US government increased spending by a whopping 900%, with defense spending climbing to an incredible 41% of GDP!

When World War 2 was over, the world needed a new financial system – one that global trading partners could trust, and one that could prevent currency manipulation with strict financial controls.

In other words, the world wanted a system where governments couldn’t manipulate their own currency to impact trade, and one where there wouldn’t be an unfair rise in rapid credit expansion.

The only way to do that was to create a system backed by something that not only holds its value but couldn’t be manipulated.

That something was gold.

But going back to a gold standard meant deflationary concerns would once again rise for many nations.

Furthermore, the US had now controlled nearly a third of the world’s gold after WW2, and international trade couldn’t exist in a world where one side had all the gold.

So the Bretton Woods system was created whereby the US dollar would serve as the international currency, backed by gold at a fixed price of $35 per ounce.

Under this system, countries holding US dollars had the right to convert those dollars into gold at US$35/oz.

This system worked…but not for long.

Fiscal Exuberance

The US began to overspend during the 1960’s to fund the Vietnam War and its many social welfare programs*.

(*Just like the US and Canada are doing today)

That meant more and more money had to be printed to fund all of President Johnson’s exuberant deficit spending.

But the Federal Reserve couldn’t just keep printing money. Why?

Up until 1968, each Federal Reserve Bank had been required to hold a gold certificate reserve of not less than 25 percent against its Federal Reserve note liability.

In other words, if the Fed wanted to print $100 dollars, it needed at least $25 dollars worth of gold.

But the US gold reserve had shrunk so much that the Federal Reserve banks couldn’t issue any more dollars because they didn’t have enough gold to back it up.

So President Johnson got approval from congress and removed the law that required the Fed to maintain this gold backing.

From 1968, there was no longer any backing for gold domestically.

Meanwhile, the value of the dollar kept increasing. As a result, US trade deficit continued to climb.

The rising value of the dollar made it better to invest the dollars outside of the US, so US banks and corporations began investing even more dollars in foreign nations such as Europe.

Of course, this caused more dollars to leave the US, which meant an ever-growing trade deficit.

The Balance of Gold

As US government spending continued to rise along with the uncertainty of government policies, foreign nations holding US dollars began converting their dollars into gold.

As a result, the US lost half of its gold reserves in the sixties. By 1971, there were four times the amount of dollars overseas than the US had gold for conversion.

So in that same year, President Nixon told the world they would no longer be able to convert their dollars into gold.

By 1971, there was no longer any backing for gold internationally.

The world was in shock and the global monetary system collapsed.

Under the Bretton Woods system, currencies were all pegged at a fixed exchange rate, and trade – for the most part – was in balance.

But as soon Nixon removed gold backing internationally, along with record government spending, the system collapsed.

Inflation also took over and commodity prices skyrocketed. Oil, for example, went from $3.60 to over $35 in 10 years, climbing nearly 900%.

Fixed exchange rates became floating exchange rates and trade imbalances began to blow up.

Via Cato Institute:

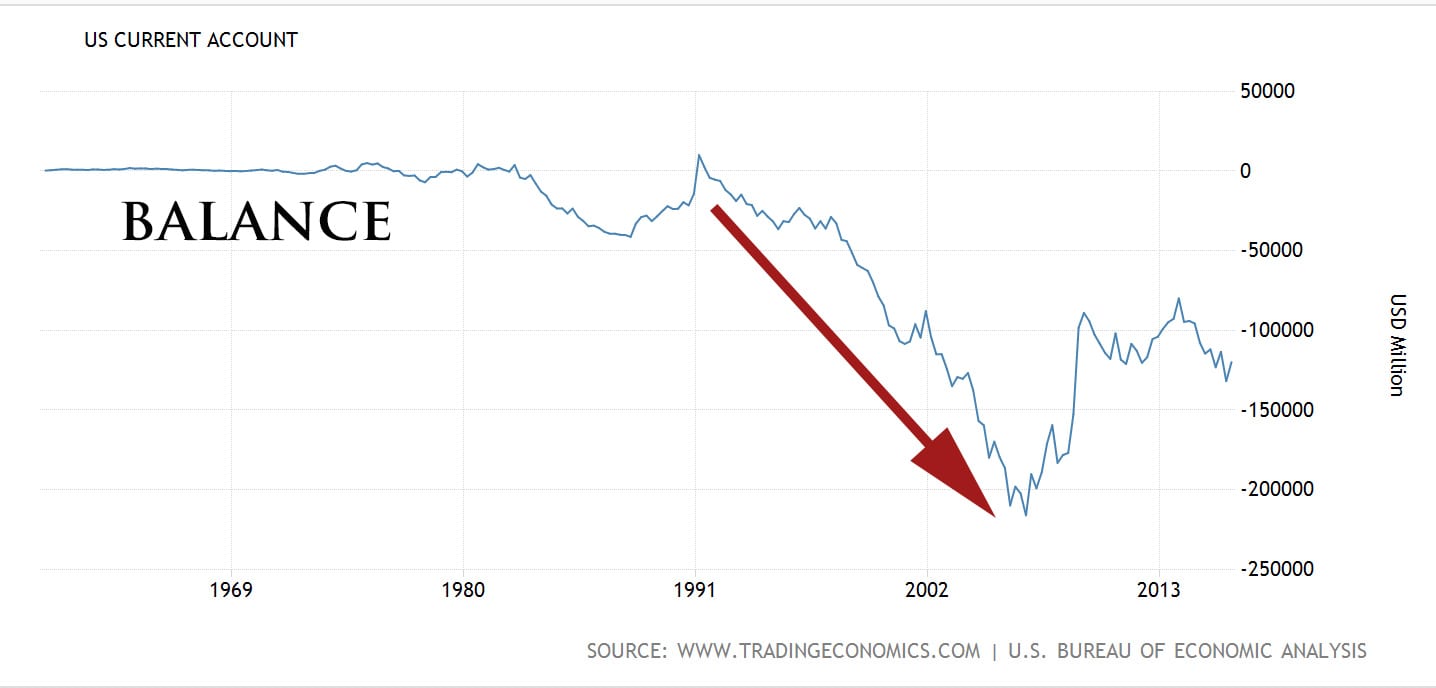

“Beginning in the early 1980s, annual U.S. trade deficits reached unprecedented levels. After decades of postwar surpluses, the U.S. trade deficit topped $100 billion in 1984 and peaked at a record $153 billion in fiscal year 1987.”

Most of this deficit was with Japan. And that meant a boat load of dollars went into Japan.

The Japan Downfall

All of the dollars going into Japanese banks caused rapid deposit growth.

When banks hold deposits, they have to lend it out – otherwise, they would be forced to pay interest on those deposits.

So in order to make money, the banks have to lend those deposits out – otherwise, they would lose money.

All of the dollars entering Japan caused a massive credit boom, which fueled the Japanese stock market and had stocks trading at 100-times plus PE multiples. It also sent property prices skyrocketing.

But the surplus kept getting bigger and bigger because the US didn’t deflate because it didn’t run out of money. The US kept on printing and Japan kept on absorbing all of those printed US dollars.

Now here’s the kicker.

When US dollars enter Japan, the Japanese can’t spend it at home because it’s not their currency. So they have to convert their dollars to yen by trading dollars for yen.

But when that happens, it decreases the money supply of yen.

This would force the yen higher and eventually take away the currency benefit of having a cheaper yen, leading to lower exports and a tumbling economy.

It didn’t take long for central banks around the world to realize that without a gold-backed system, they too could print money and use that money to buy dollars to hold down the exchange rate.

Eventually, however, the Japanese economic bubble popped.

The bubble was so big that Japan is still battling deflation and is no bigger today than it was in 1993.

The Plaza Accord

Between 1980 and 1985 the dollar had appreciated by about 50% against the Japanese yen, Deutsche Mark, French Franc and British pound – the currencies of the next four biggest economies at the time.

In order to fix the massive US trade deficit, these five nations reached an agreement to devalue the dollar. This became known as the Plaza Accord.

By 1987, the dollar devalued by as much as 51% against the Mark and the Yen.

By 1991, the devaluation brought the US trade back into balance.

Of course, this balance didn’t last very long.

Enter China

After the Plaza Accord, trade relations with China and the US “coincidentally” began to get better.

And with a massively devalued dollar, US corporations began looking elsewhere for cheaper labour.

This is where China starts coming into the global economy, along with other Asian countries.

The cheap workforce in Asia led to an increase in US trade, and so the US trade deficit grew once again.

By August 2006, the US trade deficit had grown to a record high of US$762 billion.

That’s nearly US$1.5 million leaving the US every minute.

This, of course, was great for the global economy.

But as the US trade deficit got bigger with China, China’s surplus got bigger. That meant China now had a ton of money coming into the country.

And as we just learned in the case of Japan, when money enters China, it causes rapid deposit growth leading to rapid credit expansion. It also forces China to print money in order to hold down the exchange rate.

That’s how China’s foreign exchange reserves grew to over US$4 trillion, while Japan holds over US$1 trillion. That’s also why both Japan and China have printed trillions upon trillions of their own currencies.

Exponential Money Growth

When the US prints money, China and countries all around the world do as well. That means every dollar the US prints increases the global money supply exponentially.

But that’s not all.

China and Japan can’t just leave the foreign reserves sitting in a bank because if they did, it would simply sit there and do nothing. So it has to invest it in US-dollar denominated assets such as US real estate, US stocks, and of course, US corporate and government bonds, otherwise known as debt.

Of course, this pushes the price of everything in the US higher including stocks and bonds. And when the prices of bonds go up, yields go down, so interest rates go lower and lower.

This massive amount of investment back into the US was what helped finance the bonds issued by Fannie Mae and Freddie Mac, who borrowed trillions of dollars, largely financed by these foreign central banks. This, along with low-interest rates caused by the bond-buying spree, pushed up property prices and created the property bubble that burst in 2007.

As you can see, all of the money leaving the US goes back into fueling the financial bubble.

And the bigger that bubble became, the more money Americans had to buy things from China and Japan, thus fueling the bubble even further.

This is the main reason why the price of bonds and stocks in the US are so high and why interest rates are so low right now. It’s why real estate prices all over Canada have skyrocketed.

It’s also why we’re in the biggest financial bubble the world has ever seen.

What Hike?

Which brings us back to today (keep in mind that while I said this in 2016, it still applies today).

When the 2008 financial crisis hit as a result of rapid credit expansion, the world tumbled.

Today, we’re in an even bigger financial bubble than we were in 2008 because, as I just explained, all of the dollars printed to fix the 2008 bubble has exponentially grown the global money supply and fueled an even bigger credit expansion worldwide.

Asset prices and the global economy are being held up by the rapid expansion of credit and low-interest rates around the world.

If, and when, interest rates rise, asset prices will crash and the economy would likely sink into a very deep recession – we already saw this occur (in 2015) when the Fed raised rates just slightly.

The question is, when will the central banks allow interest rates to rise? In most of the world, central banks aren’t allowing them to.

It is only in the US where the Fed has hinted at raising interest rates, yet fail to do it every time.

Even if the Fed does raise interest rates, you can bet that massive stimulus measures would follow.

A few weeks ago (again, keep in mind we’re talking about 2016), I wrote the Letter, “Can the Fed Buy Stocks?”

“Even more disturbing are the hints Yellen gave suggesting the Fed could break policy and consider “some additional tools that have been employed by other central banks.”

This, of course, includes buying a wider range of assets or raising the inflation target – both of which means the Fed will own more, for less.

It could also mean that the Fed may buy equities in the future.”

In other words, raising rates would undoubtedly be a threat to the economy and political stability – unless the Fed were to do something else.

Something like QE4.

And that would mean another massive increase in the global money supply.

In fact, precursors to QE4 are already here.

Housing Bubble Gets Bigger

In May 2016, I wrote how America’s biggest banks were already being forced to lower their lending standards and thus creating the next housing bubble.

“Wells Fargo & Co. has started offering a new type of mortgage that requires a tiny down payment and could appeal to customers who might otherwise get loans backed by the Federal Housing Administration.

…They’re not the only ones offering these non-FHA, 3%-down, riskier mortgages.

Last week, JP Morgan announced the launch of a similar product…

The Bank of America also announced a similar program back in February.”

Turns out, Freddie Mac wants in on the fun.

Via Realtor Mag from September 2016:

“In a new pilot program, Freddie Mac and two non-bank lenders are easing income and documentation requirements for mortgage borrower applicants.

The aim is to fuel more mortgage originations among first-time buyers, who tend to have more low to moderate incomes and to better reach those who live in underserved areas, The Wall Street Journal reports.

In the pilot program, Freddie Mac says that applicants will be able to use the income of others who live with the borrower but who aren’t going to be on the mortgage to qualify.

Also, income from second jobs that borrowers have held, even for a short period of time, can now be factored in. The program will also not require borrowers to come up with bank statements to show how they saved for their down payment.”

We’re already seeing 2008 all over again – only on a much bigger scale*.

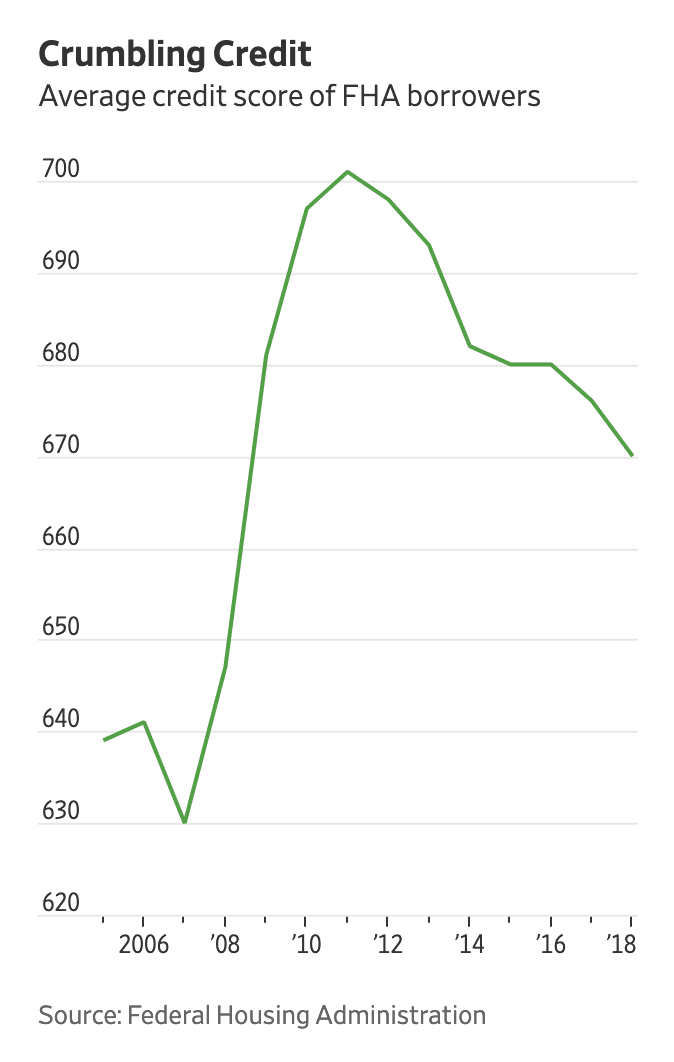

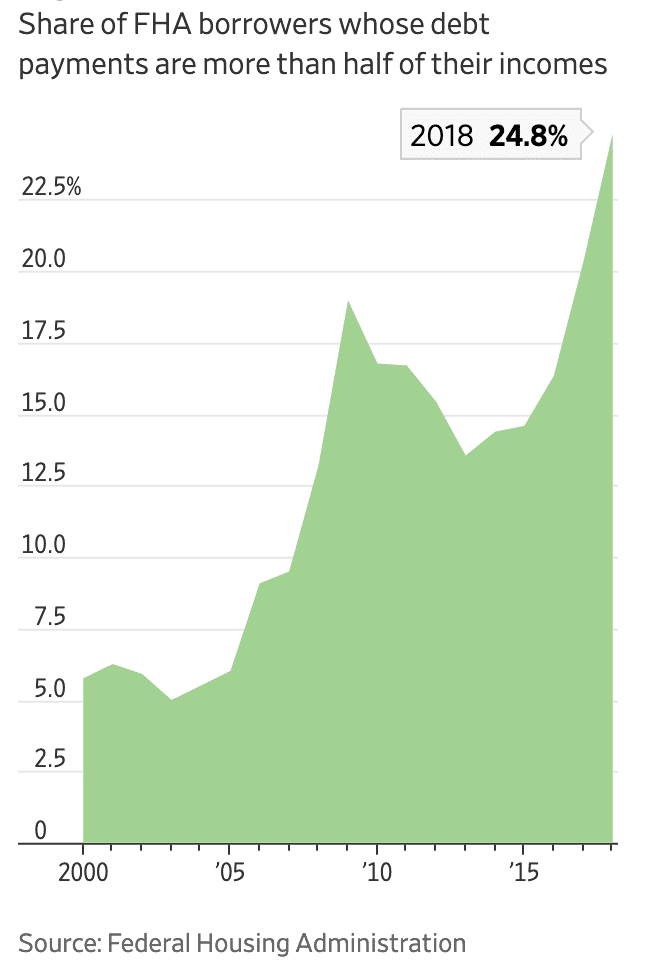

*Note: In March 2019, the Federal Housing Administration finally told lenders that it would begin flagging more loans as high risk:

“…The FHA’s decision to tighten underwriting standards could mean fewer first-time home buyers are able to get mortgages.

The move is an about-face from a 2016 decision to loosen underwriting standards. At the time, the FHA removed an earlier rule that required manual underwriting for mortgages with credit scores below 620 and a ratio of debt to income above 43%.

“Since that happened, we have observed a steady increase in the endorsement of higher-risk loans,” Mr. Becker said. The FHA has also been warning of rising risks in the portfolio that it insures in its annual reports submitted to Congress.”

Just take a look at the share of FHA borrowers whose debt payments are more than half of their income and the average credit scores of FHA borrowers:

Back to my 2016 Letter…

China: The Next Great Depression?

China, now considered a global economic leader, has been producing an excessive amount of goods and excess industrial capacity.

In fact, in just three years from 2011-2013, China produced more cement than the US did in the entire 20th century combined!

It hasn’t slowed down and it’s eerily reminiscent of what led the US to the Great Depression.

I expect that while the US dollar has been strong in anticipation of a Fed hike, the US Dollar will likely fall against the Yen, Euro, Canadian, and Aussie dollar, going into the New Year and maybe even before.

So don’t be surprised to see gold climb higher as the US dollar drops in value.

Make Hay When the Sun Shines

I believe the only way to protect and prepare ourselves for this rapid credit expansion is to build as much wealth as possible and transfer it to the things that matter most, like your home.

Over the years, and including some of my more recent letters, I have told readers to take advantage of this massive financial boom.

From my 2016 Letter, “Can the Fed Buy Stocks?“:

“…Our job is to protect our wealth based on (central bank) policies.

This includes everything from investing in and exiting the right areas at the right time.

(Yes, gold is just one of the viable long-term options in this regard.)

We’re in an era of cheap money and there is A LOT of it – but only if we put it to work.

Holding cash means you’re likely losing wealth over time. If you want to protect your wealth, you have to put it to work – that is the position the central banks have put us in.”

If we sit and risk nothing, we’ll see the value of our money depreciate very rapidly in this world of expanding money supply and credit.

We have been very lucky over the past years and have had some incredibly big winners.

I’ve fueled a lot of these profits into new – and more – investment opportunities, and will continue to do so until I see stronger signs that the “economic reset” button is about to be pushed.

Conclusion

I wrote this Letter back in September 2016. And despite all of the uncertainty that has shrouded our global economy, stocks have moved higher.

Furthermore, this Letter gives us strong insight into what is happening now with the US-China trade war.

Despite all of US President Donald Trump’s attempts to balance the trade deficit with China, he will fail. Tariffs won’t be enough, nor will some sort of currency agreement where China agrees to holding their currency at a specific rate against the US dollar. It simply can’t happen under our current financial system.

While he may reach a deal to shrink the trade balance slightly, there is simply no way to balance it when money is now backed by nothing more than the promises of central banks.

Perhaps that’s why gold is once again rising and why inflows into gold have continued to climb all year.

If an agreement can’t be reached between China and the US, gold prices will likely go even higher. This, of course, means gold stocks should do very well in near-term.

Just keep in mind that for as long as interest rates remain low and the Fed continues to intervene, money will likely continue to flow into the stock market – which means gold will still take a backseat.

And while we have had many grand successes with gold stocks before, and believe we should maintain a small portion of our portfolio in these assets, we shouldn’t be too excited yet.

Gold is up 10% on the year, but the S&P 500 is up almost double that.

It’s time to once again to look at gold stocks, but don’t jump all the way just yet.

Until next time.

Seek the truth,

Ivan Lo

The Equedia Letter

Disclosure:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will.

economy

Very interesting information!!

Thank you Ivan for helping us to decrypt the world

economy