When a nation is presented with the option of growth with the push of a button, it takes that action.

American government, corporations, and banks have taken advantage of this “button” all over the world for many years. They offer money to developing countries who are striving for growth and stability in return for “favours” that range from trade agreements to resource access.

The “end” result for the borrowers is never-ending debt; working even harder to pay back a loan that can never be repaid.

Instead of achieving economic growth – as promised by the lenders – these borrowing nations turn into the puppets of its lenders. They’re no longer working to achieve growth in their own economies, but are rather forced into the growth and profits of its lenders.

Let me explain.

Let’s say you borrowed $100 at 10% so that your business could achieve 15% growth in revenue, with your base revenue being $100. However, your forecast was wrong and your revenues end up growing only 5%, say to $105.

Now you owe an extra 5% for the interest on the loan, or $5, of which you don’t have.

Since you want to keep your business running, you have only two options: Either run out of money, or borrow more.

This is an extremely simplified example of how powerful banks and nations have taken advantage of developing countries all over the world.

But if you think this scheme has only been forced onto developing nations, think again; it’s been forced onto all of us, including the world’s most powerful nation, the United States of America.

America at the Mercy of Debt

The U.S. national debt to GDP is above 100%. That means the nation owes more money than the value of everything it produces in a year.

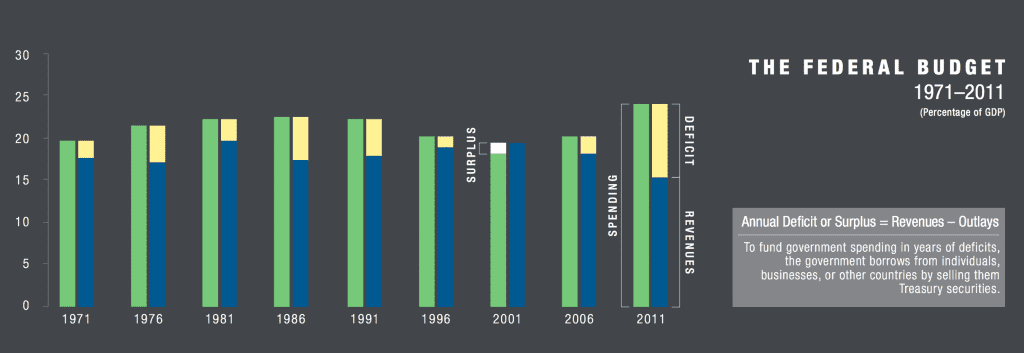

While this debt burden is due in part by the large deficits incurred to mitigate the effects of the financial crisis, and the poor recovery following the aftermath, we should note that America has been over spending for many years.

The bulk of this overspending started during the early 1970’s when the government started to significantly increase spending without a corresponding increase in tax revenue; a product of the Nixon Shock – a series of economic measures enacted by United States President Richard Nixon in 1971. More importantly, it included unilaterally canceling the direct convertibility of the United States dollar to gold which ended the existing Bretton Woods system of international financial exchange and ushering in the era of freely floating currencies that remains to the present day (see America’s Gold Wiped Out.)

In other words, it represented the move to a fiat currency backed by nothing more than promises (see How the Government Borrows Money.)

As I said earlier, when a nation is given the opportunity to grow with the push of a button, it takes it.

Since America pushed this button in the 1970’s, the reins have yet to be pulled back.

This trend has only gotten worse.

America is now spending significantly more, while bringing in less. Take a look:

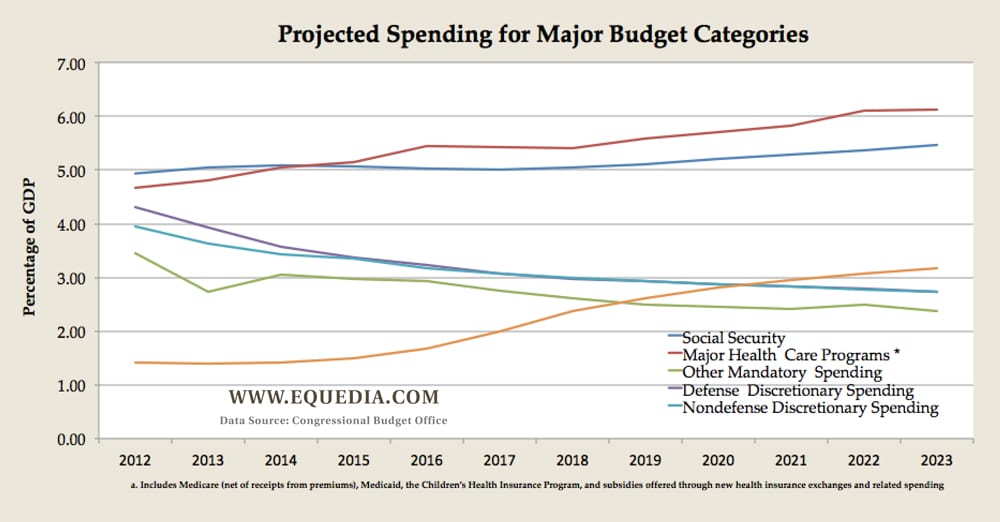

Despite the above projections that show revenues and outlays will grow in-synch over the next few years (but still running a heavy deficit), we have to note that most of the increase in deficit spending over the years – and moving forward – can be attributed to increases in Medicare:

I am not going to debate the pros and cons of Obamacare and turn this into a political debate.

If you have comments on Obamacare, you can LEAVE IT HERE.

Borrowing from Peter to Pay Paul

Obama promises cost-savings over the long haul under Obamacare, but that is something that can be seriously debated.

What cannot be debated is that Obamacare is going to cost taxpayers a lot more upfront, which in turn will add to the deficit and the national debt quickly.

The below chart shows the interest payments of America’s outstanding debt, which includes the monthly interest for: U.S. Treasury notes and bonds, Foreign and domestic series certificates of indebtedness, notes and bonds, Savings bonds, Government Account Series (GAS), State and Local Government series (SLGs) and other special purpose securities.

In the last 12 months America has paid nearly half a trillion dollars in interest alone.

If interest rates were any higher, this number could soon reach the trillion-dollar mark within the next few years. That’s why America will do everything in its power to keep rates low.

As I mentioned last week, the government’s main source of income is tax revenue. On a federal level, the U.S. government is estimated to collect about $2.7 trillion this year, of which $1.9 trillion comes from income tax (not including sales taxes and property taxes, and social insurance taxes such as Social Security, unemployment and hospital taxes.)

That means 22% of the income tax an American pays goes directly to servicing America’s debt.

In other words, nearly a quarter of all federal income tax revenue goes directly to paying only the interest on loans.

How do you feel about this? Share your thoughts HERE.

At the rate America is borrowing and spending, no amount of taxes will solve the growing debt issue.

Furthermore, raising taxes would significantly affect output; higher taxes equals less growth, and less growth equals less taxes.

Like the developing nations of the world who borrow from America and other wealthier sources, we too are trapped in this debt bubble.

America’s debt ceiling will continue to climb every year, and simple mathematics tell us that America will need to keep borrowing to continue moving forward.

And since the real demand for U.S. debt continues to shrink (see a Shocking 2011 Cover-Up), there is only one private institution that can provide funds for America’s growing debt: the Fed.

In other words QE has become the norm.

So where does that leave the market?

A Highly Leveraged Market

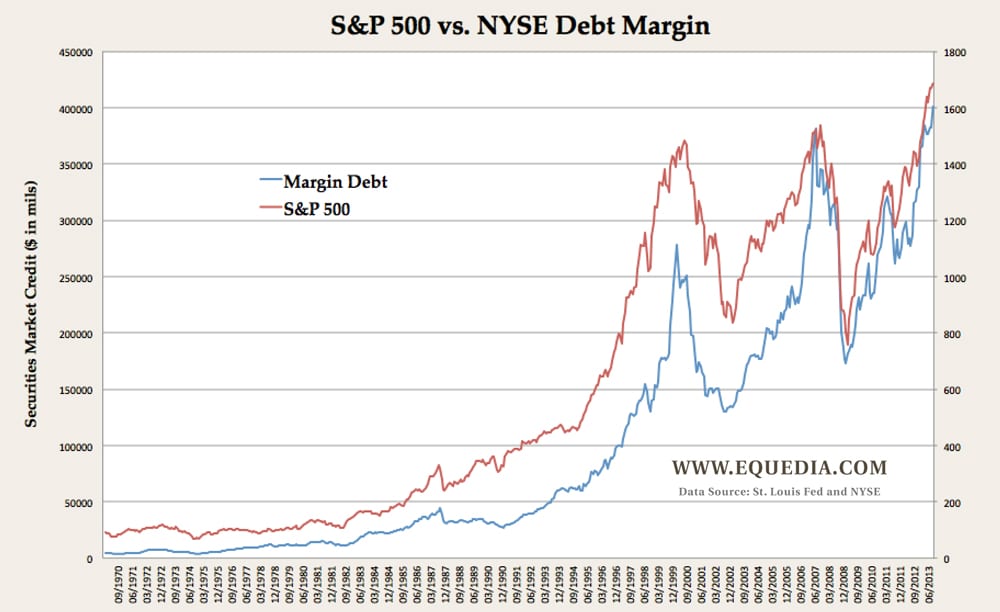

A while ago, I talked about how NYSE debt margin has skyrocketed to record levels (see The Monarchs of Money.)

“Margin debt amounted to $379.5 billion in the month of March. The highest margin debt amount previously was $381.4 billion back in July 2007. That means the amount of money people are borrowing to buy stocks are now back at pre-2008 levels.”

In September, the NYSE margin debt level reached a record-breaking $401.2 billion.

Take a look this chart:

Going back to the 1970’s (and beyond), margin debt levels never surpassed the S&P 500, relative to this chart overlay.

But when the margin debt level crossed the S&P 500 back in 2007…well, we all know what happened in 2008.

Since 2007, the distance between the S&P 500 and NYSE margin debt level lines in this chart have been very close. This shows us that the amount of leverage in the stock market has never been higher, and that the rise in the S&P is closely associated with the amount of “borrowing to buy stock” taking place.

It also means the market is walking a very fine line. Any sudden drops could force margin calls that could slam the market down extremely fast.

However, I suspect that if that were to happen, we’ll likely see a trading halt across many stock exchanges in order to prevent a major crash. Then it will be blamed on the algo-softwares not being able to handle all of the trades, as the banks and cohorts collaborate to prevent the margin calls from slamming the market back down.

Remember, there’s already been many instances where trading has been halted to prevent the market from turning (see The Truth Behind the NASDAQ Glitch.)

I present you the above chart to show you the fine line we’ve been walking since 2008, and how close we have been to falling down. However, I still predict that we will see the S&P move to 1800 before the end of the year, barring any major economic shock.

Just because we’re walking a fine line, doesn’t mean that line is not pointing up.

The Equedia Letter

How can the regulators allow so much debt? This seems absurd to me.

Jennifer, they allow it because these funds have stock market that is used as collateral for bigger bets, like all margin trading accounts. That’s why Mr. Lo said if the market turns, all of these guys will be scrambling to cover by selling other stocks and hence a big swing to the downside.

The regulators are the Government..

It’s American voters,who choose the politicians,who promise,the most “something for nothing”.An honest person,like Ron Paul,would never be elected President,because he tells the truth.So,in conclusion,as a whole,the country is getting the leaders,it deserves.

Obamacare will destroy the American economy. Obama will make the next President pay for his mistakes. Universal healthcare makes sense, but not when it will destroy our childrens’ future.

I personally believe sociopaths have taken over our Governments , don’t matter who you vote for , were in serious decline because of them.

The USA finds themselves riding in a leaky boat and drilling a hole in the bottom to let the water out.

Health care insurance is too expensive,because health care providers massively overcharge,for their services.That’s why I won’t be buying,I can afford to self insure and will do that.There are no enforcement,in Obamacare,of penalties levied,for not having health care insurance.If everyone had NO health care insurance,people would have skin in the game ,wouldn’t pay the overcharges and prices would fall.I have to negotiate,still overpriced services,when I need them.Still much better deal than paying for insurance.What’s going to happen,with Obamacare,is that the sick,who use a lot of healthcare and the poor,who will get govt subsidies,will sign up.The healthy and non poor,the ones Obama is counting on to pay for the others,hopefully will,like me,not sign up and we can sink this fascist(govt force against citizens) program.

That’s the problem. It will raise the price that healthcare providers charge because they know the government will fit the bill for the poor.

Thank you..informative, concise, precise.

Actually Ivan, what you pull back on are “reins” not “reigns”. Sorry, I can’t help it, I was a teacher for 38 years.(and your word correction won’t help you as they are both correctly spelled (or spelt as some prefer.) All that aside, I enjoy each issue of the Equedia Investment. Letter they are extremely thought provoking.

A lending institution (bank) to start up needs real capital injection (asset=debit),

for example.

bank A starts with 10 investors $1MM

Lends to 10 borrowers (credit) $1MM

collects principal plus interest

Leveraging starts.(the snow ball effect)

Bank A phones the FED bank as they

have a loan payable to them now $1mm

FED debits their out of thin air account

sends $1MM to Bank A

FED debit——————————-$1MM

Bank A credit—————————$1MM

Bank A loans out—————-$1MM

Receives from borrowers———$1MM

Borrowers pay principal and interest on these loans to Bank A

Bank A repays back the FED IOU

Principal and interest minus their

interest spread (commission)

Principal———————————-1MM

Interest net say 2% to Fed—————$20TH

FED receives this credit and cancels

their out of thin air Debit

What just happen ?.

Bank A earned their commission (interest spread) as the middle man and the FED collects principal and interest created out of thin air =to nothing.

Remember that the original asset of $1MM at bank A is the only real asset still existing.

Think about it, principal and interest paid back out of thin air, for what? to have the FED manage the global banking system.. Seems to me an illegal rate charged to the borrower. There are laws against this type of monopoly, however the FED themselves have written any laws they so please for their own gain and protection ? they think. until the 90% of us say no more.. FED is a private corporation . No access to their own records by the public. No full disclosure. So many laws broken against the Natural Being (human race) Remember that the Debit & Credits continue to take place out of thin air. We made to believe that the fact that homes have gone up in value that we are benefiting, this is cause we don’t look at the other side of the transaction. A $35k home (my dads home in Toronto) in 1970’2 was $30 thousand now about $300-400k is there a positive to this investment. do the math, taxes, expenses etc.Inflation is the other side of the equation that leaves us all blind to the fact it has. It benefits whom?.

The USA housing market collapse, Was the FED out of pocket money??? besides these folks are experts in economic manipulation. did they short the housing market for double the profits. We will never know // ALL THIS CAN BE FIXED BY HAIVNG EACH GOVERMENT PRINT THEIR OWN OUT OF THIN AIR MONEY and of course there are rules, same rules we are using now on qualifying etc. but rather to pay principal & interest to a private corporation we the citizens pay back to our own country or our own banking system for which we can still use debits and credits thus benefiting all of us. THIS WILL BE THE FUTURE BANKINGG SYSTEM once most of us wake up from this dream. Bank A is not authorized to leverage under their own existing laws. Only the FED and yet its a practice well accepted by society cause we are not informed otherwise (no disclosure). thus all lending beyond the original $1MM capital + interest (corp. net-worth ) is UNLAWFULL. There’s so much to say, please dig yourself the knowledge for at least be a little bid informed. Example of $1MM is just for example purpose only, to keep it simple as different countries have different rules on the amount of leverage allowed.so lets keep it simple.

LET THE UNIVERSAL MIND ALLOW US TO BELEIVE THAT THERE IS A BETTER WAY AND EVENTUALLY IT WILL TAKE PLACE PEACEFULLY.

IN GOD WE TRUST.

The federal debt is essentially interest earning savings accounts at the Federal Reserve Bank. Normally folks do not lose their sanity when a bank has a rather large number of dollars “residing” in accounts at their bank. Somehow, for reasons beyond logic, savings accounts at the FRB exceeding $13t in marketable securities somehow verges on economic Armaggedon. How ludicrous! FACT: Interest on the federal debt is paid for by selling more securities. The principle on the federal debt is NEVER spent. Stop blowing smoke and ignorance. Plus, debt/GDP (ratio) is a meaningless equation for a currency sovereign such as the US.

Great goods from you, man. I hawve understand your stuff previous to

annd you are just extremely fantastic. I really like what you have acquired here, really like what you are stating and the way

inn which you say it. You make it enjoyable and you still ake cre of to keep

it smart. I can’t wait to read far more from you.

This is rally a tremendous website.

It is climbing the ladder of inflation, which enable it to not called as an easily affordable substitute

for purchasers. If you are buying a rental in Mumbai the first time then its better to seek help

of a realtor who’ll direct you all over the country process.

There is going to be certain houses that fall in your price range plus some that may be too expensive.