GLD Gold ETF inflows and China Gold Demand

China Gold Association has just told us that China has become the world’s largest gold producer and second largest consumer of gold, with total gold usage reaching 320.54 metric tonnes in the first quarter.

According to CGA, purchases of gold bars surged 49% to 120.39 tonnes while jewelry gained 16% to 178.59 tonnes. In the first three months of 2013, gold consumption in China soared 26% from a year ago.

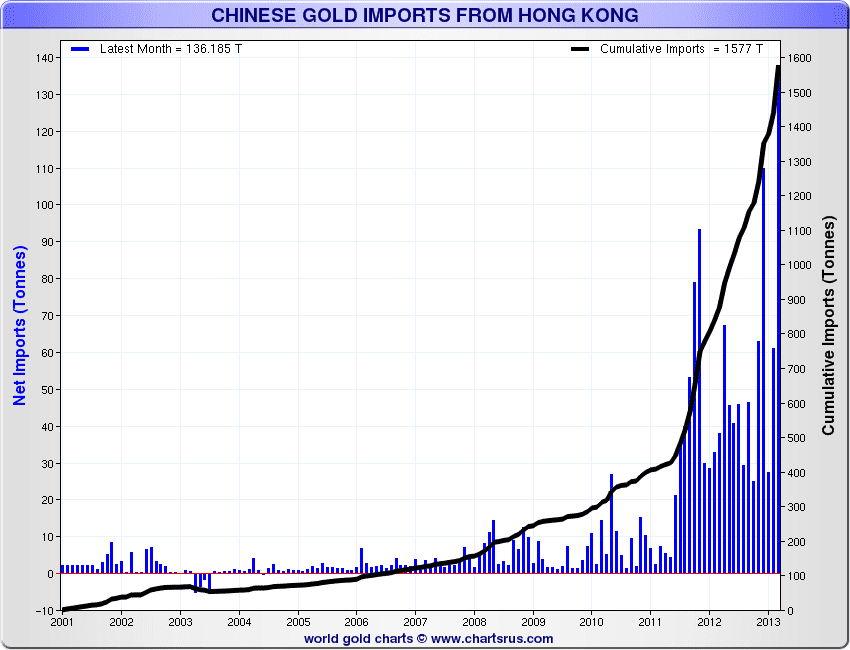

This massive spike in demand came in March as China’s net gold inflows from Hong Kong rose to 223.519 tonnes. Take a look (courtesy of Sharelynx):

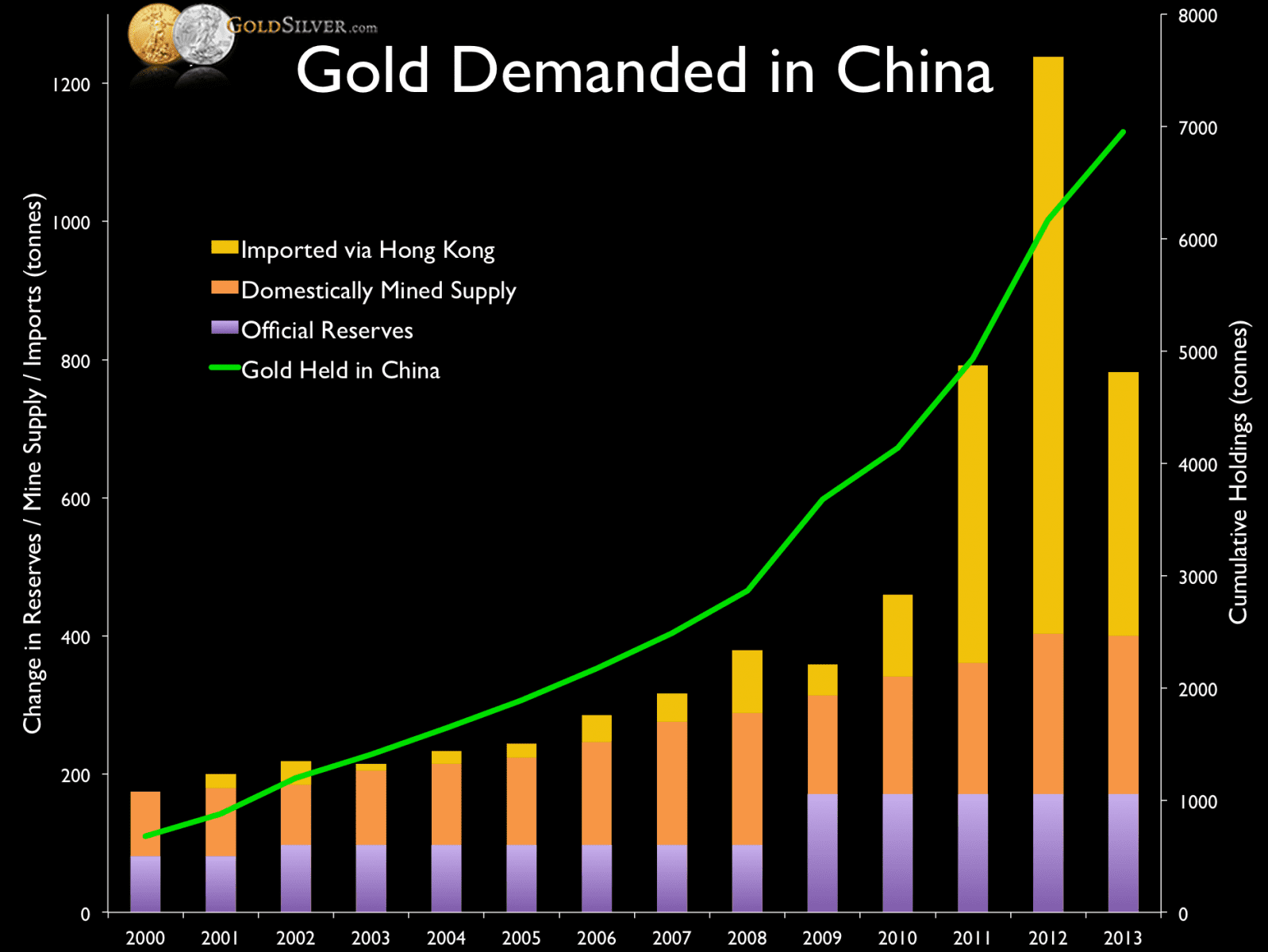

And from Goldandsilver.com:

China’s gold demand is already nearing its 2011 numbers, and well above half of its record 2012 demand. We’re not even half way through the year yet.

Even as the demand for physical gold surges, prices have been falling…Interesting…

Strong ETF Gold Inflows

Yesterday, the SPDR Gold Trust (GLD), the world’s largest gold exchange-traded fund, saw investor inflows of US$127 million, the largest since March 19. Finally, after a ridiculous string of redemptions, investors are adding to their positions after nearly two months. But is it just your average retail investor?

The IAU gold ETF also saw its strongest inflow in months.

Conspiracy?

A few weeks ago, in my Letter, “A Staggering Bank Outflow of Gold,” I mentioned that rumours were spreading amongst many underground investigative reporters that many of the big banks are forcing the price of gold down because of their own shortage.I mentioned that JP Morgan, who have been investigated on numerous occasions for precious metals manipulation, saw an amazing outflow of gold from their vaults prior to the gold crash:

Over the last 90 days without any announcement, stocks of gold held at Comex warehouses plunged by the largest figure ever on record during a single quarter since eligible record keeping began in 2001 (roughly the beginning of the bull market).

…Total drainage of physical inventories reached nearly 2 million oz.’s of gold, which at today’s prices represent roughly $3,000,000,000 dollars.

…What is most interesting in reviewing this chart data, is seeing where the largest drops have occurred. The largest inventory drainage is being reported from JP Morgan Chase & Scotia Mocatta warehouses…JP Morgan Chase’s reported gold stockpile dropped by over 1.2 million oz.’s, or rather, a staggering $1.8 billion dollars worth of physical gold was removed from its vaults during the last 120 days.

Take a look:

|

| Source: Nick Laird, Sharelynx.com |

|

| Source: Nick Laird, Sharelynx.com |

Perhaps with prices showing support once again for the yellow metal, JP Morgan (if the rumours are true) may have already begun to replenish its supply shortage?

Perhaps while they, or whoever, jointly forced the price of gold down in an attempt to buy gold at cheaper prices, found that their strategy backfired, as physical demand increased astonishingly worldwide.

Perhaps gold may have finally broken its downtrend, as those who forced it down can no longer buy it at cheap prices, because everyone and many central banks, are trying to get their hands on the physical metal.

Let’s not forget, Germany still wants their gold back from the U.S…

The fact that JP Morgan has no gold in its vaults, why doesn’t anyone ask questions? Also, I’ve read stories on equedia before about how the london gold exchange doesnt have the gold it claims to have, by as much as 100 to 1, how come those aren’t being audited?