Last week, Biden signed an unmistakably partisan $430 billion spending package called the Inflation Reduction Act.

If spending half a trillion dollars to tackle inflation isn’t enough of an oxymoron, the rose-colored imagination of politicians didn’t end there.

Here are a few pledges that circulated across the mainstream media:

- Senator Sherrod Brown (D-OH) said it’s a “historic step” to fight inflation.

- Congresswoman Jan Schakowsky (D-IL) pleaded this Bill will “crack down on corporate greed.”

- Senate Majority Leader Chuck Schumer (D-NY) promised this Bill would tackle inflation by cutting federal debt.

Politics have reached a point where lawmakers can slap a random name they believe best appeals to voters on a bill even though it flat out contradicts the very thing the bill does.

The 740-page document Democrats have spent a year ironing out has nothing to do with stopping inflation. It’s yet another deficit-exploding program that will only compound the problem.

And considering the energy situation we discussed last week, this is more dangerous than ever – especially since it’s highly likely that less than 0.1% of the population will read the entire document.

But we will, so let’s take a closer look.

Spending on Green Energy and an Army of IRS Agents

The lion’s share (about 80%) of spending in the Inflation Reduction Act is aimed at green energy.

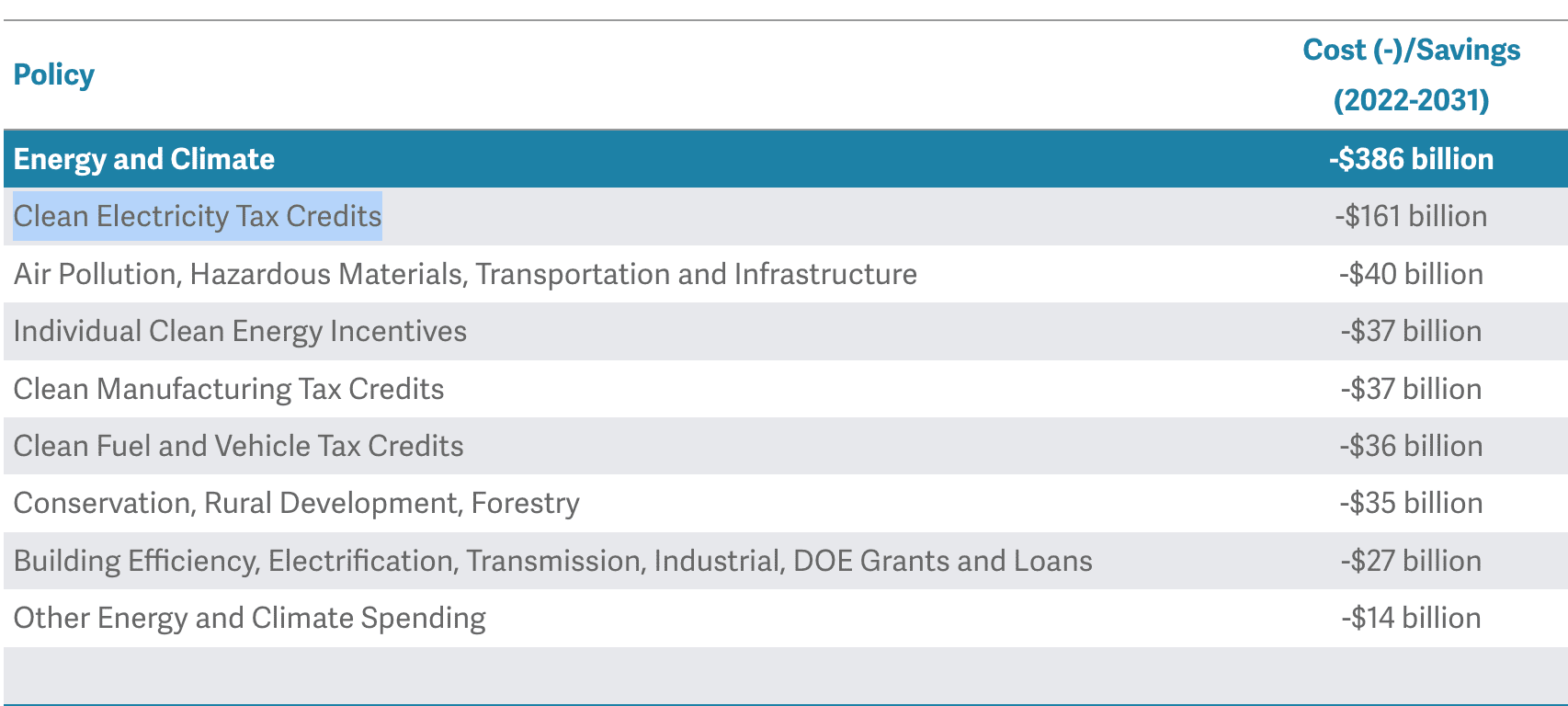

The Bill will empower the government to splash out $386 billion on green energy policies: corporate grants, tax credits, and infrastructure investments.

Here’s a breakdown:

The remaining $98 billion will go to the Affordable Care Act and other healthcare subsidies. Yes, climate change initiatives are apparently more important than your health.

There’s also a hidden $80 billion in funding to expand the IRS, half of which ($45.6 billion) is allocated for “enforcement.” The outlay is tucked away under “revenue” because, well, they figured the extra IRS agents would squeeze more than $80 billion from taxpayers, otherwise known as YOU.

We have inflation so let’s tax everyone more! You can’t make this up.

This brings us to the most outlandish claim of this Bill…

Spending to Pay Down Debt (they say)

According to the Democrats, this over half a trillion in extra spending is going to reduce the deficit and—hang on to your hat— “pay down [our] national debt,” as Senate Majority Leader Schumer claimed.

That’s bold.

Not only will this Bill save our planet and stop inflation, but it will also write off $100 trillion in federal debt. (If you missed The Great Debt Trap (Part 1), here’s a refresher on why the official US federal debt is grossly miscalculated):

“America closed out 2021 just shy of US$30 trillion in federal debt. It doesn’t sound like much anymore, but consider this: it acquired more debt in the past ten years than in the previous 45 combined (adjusted for inflation and population growth ).

[That’s] just the official, on-the-books federal debt. It doesn’t include the lion’s share of other obligations—such as Medicare and Social Security.

In fact, the Treasury’s February fiscal report data revealed that, if you include benefits and entitlement programs, total federal obligations crest over $100 trillion.”

How are they going to square up all these obligations?

The obvious answer: they won’t.

The Congressional Budget Office (CBO) estimated that the Bill could save an aggregate of $305 billion. That’s a total. And not in a year or two, but in ten years!

That’s not all.

The even more absurd thing is how the politicians arrived at this figure.

For one, $200 billion will come from supposed better tax compliance. Not only do they assume that the 80,000 extra IRS workers will catch more tax evaders, which is speculation at best, but it will somehow help the American people.

From the Congressional Budget Office:

“Based on the CBO score, the legislation would reduce deficits by $305 billion through 2031 – including over $100 billion of net scoreable savings and another $200 billion of gross revenue from stronger tax compliance.”

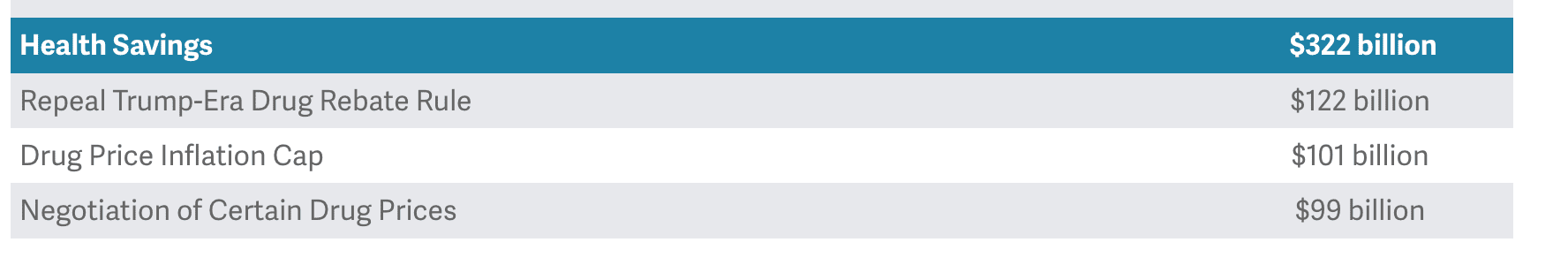

Then the Bill’s policies will supposedly save us $322 billion from future drug price hikes that they’ll prevent.

I mean, don’t get me wrong, I’m all for lower drug prices. The proposed changes will empower Medicare to negotiate prices for a handful of prescription drugs and will help some very sick people.

I mean, don’t get me wrong, I’m all for lower drug prices. The proposed changes will empower Medicare to negotiate prices for a handful of prescription drugs and will help some very sick people.

My pet peeve with it is the math they use to justify the other spending.

Because what they are saying is they will ask Big Pharma to hike their drug prices a little slower. In return, they can spend all this “saved” money that people shouldn’t be charged in the first place on something else.

It’s like telling your spouse, “Look, I was going to buy this Mercedes Benz AMG GT for $130,000, but I won’t. Instead, I’ll buy a $60,000 Tesla and spend $70,000 on something else because, hey, I’ve saved us a bunch of money!”

That’s, in a nutshell, the thought process of how this Bill will “pay down [America’s] national debt.”

Reducing inflation by killing the cheapest energy source?

Now, we’re all for preserving our planet for future generations. But the Democrats’ approach, including this spending bill, is not only highly inflationary, but it’s also counterproductive to its cause.

Here’s the rub.

If you introduce a policy that effectively pledges to annihilate an extremely capital-intensive industry in the next decade (oil and gas), you should have enough brains to know that investors won’t touch that industry.

Meanwhile, the world is nowhere near ready to fully transition to green energy. Renewables barely cover 30% of the world’s energy. And as we’re now learning the hard way through exorbitant gas prices, we need the other 70% right now – not decades from today.

We saw the first red flags last year.

After a few dormant years, the economy roared back to life only to face a stark energy shortage because green policies crowded out legacy energy producers and disincentivized any investment in fossil fuels.

As Goldman Sachs analysts summed up the situation: “The new economy [green energy] is overinvested. Gas, coal, oil, metals, mining — you pick — the old economy is severely underinvested.”

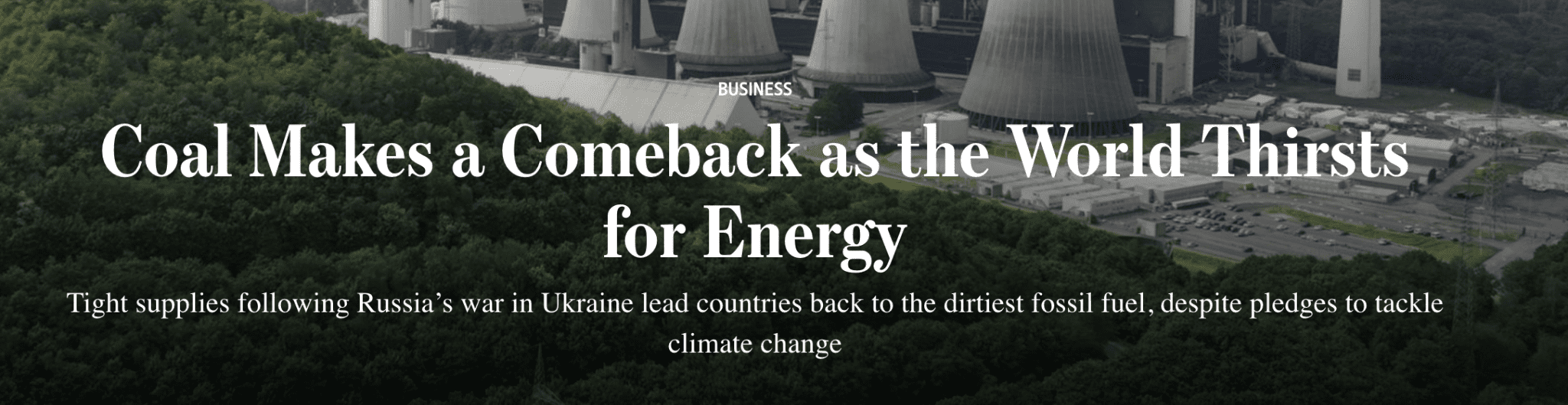

The counterproductive result is that this supply shortage is stoking energy prices to the extent that governments are shifting to the dirtiest fuel of all, coal, and polluting even more:

Via WSJ:

“From the U.S. to Europe to China, many of the world’s largest economies are increasing short-term coal purchases to ensure sufficient supplies of electricity, despite prior pledges by many countries to reduce their coal consumption to combat climate change. The global competition for coal—also now in short supply after years of declining investment in new mines and resources—has driven benchmark prices to new records this year.”

If you ask me, they should do the exact opposite: subsidize legacy energy producers—who have no interest in investing in the sector that the government wants to annihilate. That would keep our energy costs down while the free market transitions us to green energy.

Yet, this Inflation Reduction bill will most definitely raise the cost of energy and the price at the pump. So much for fighting inflation.

You just wait and see what your energy and gas bills will be in a few years…

Smoke and Mirrors

Even though raising taxes has never – EVER – benefited ANY economy, maybe it will be different this time?

The Bill comes with two corporate taxes that are supposed to offset this spending.

One is a 15% minimum corporate tax for companies earning more than $400,000, and the other is 1% on corporate buybacks.

Is that going to move the needle?

Let’s do some quick back-of-the-napkin math.

By Goldman Sachs calculations, both taxes will lower the earnings of S&P 500 companies by 1.5%. Considering that S&P 500 companies are raking in roughly $1.5 trillion a year, the “historic” Bill will at best generate $20-30 billion in tax revenue every year.

That’s nothing. It will barely cover half the payroll for that army of 87,000 IRS agents.

Add in the rest and maybe it will generate another $10 or 20 billion? But hey, it will only cost more than half a trillion to do it.

What about the long-promised buyback tax? Obviously a window dressing solution because 1% isn’t going to do a thing. In fact, broker fees for merely transacting those shares probably cost as much, if not more.

Via the New York Times:

“We don’t think it will make a large difference,” said Ben Snider, an equity strategist at Goldman Sachs. Though he acknowledges that the new legislation might have an effect “at the margin,” the bank’s analysts have not changed their forecast for the number of shares companies will repurchase this year or next.

Mr. Snider pointed to a basket of stocks of some of the most active share repurchasers that has risen in line with the S&P 500 this month, even after Congress passed the new tax. “It tells us investors, and the equity market more broadly, do not expect a major impact from this tax,” Mr. Snider said.”

At the end of the day, these tax policies will only force corporations to siphon more profits into shareholder pockets instead of reinvesting back into the business and, more importantly, the people who are sweating blood to run them.

Who pays the Bill (pun intended)?

Ironic as it sounds, the “Inflation Reduction Act” is one of the most inflationary policies in recent decades, especially considering the historic energy crunch I broke down in the last letter.

And contrary to what Democrats claim, it’s not well-off corporations that will pick up the tab. It’s us.

We’ll pay through record-high energy prices, which will keep stoking inflation across the board.

And mark my words, somewhere down the line, they’ll start tossing around new taxes because of exploding federal debt, which this joke of a corporate tax code won’t offset in a million years.

We warned you higher taxes were coming.

Via our June 2020 edition, “Reality Exposed”:

“…Remember, debt has to be repaid; if not in your lifetime, your children’s. We, and they, will be taxed so much that we’ll never be able to afford anything or get ahead. Property taxes will go up. Income tax will go up. And there will be tax on top of tax…

…Just how are Social Security and Medicare mostly financed? Payroll taxes on earnings paid by employees and their employers and income from investments. These investments are comprised of U.S. government bonds, which are directly affected by interest rates.

In other words, the only way to service Social Security is to have higher taxes and higher interest rates…

…Remember: the less people work and the more free money the government gives them, the wider the income equality gap will get – especially when taxes have to climb to pay for all of this. In other words, what people believe is free money is simply a deferral – debt.”

No wonder they’re building an IRS army.

Seek the truth and be prepared,

Carlisle Kane

Excellent analysis!!

Hi Ray mansfield here from Maine. I’m 59 and I’ve never seen the United States of America government be so ignorant and clueless. It’s like they keep printing money out in the back offices and absolutely no concern of the long term affects. I can’t understand why the oil companies and pharmacist companies, who keep robbing us middle class of big portions of our salaries. Do to them like what the government did to dairy farmers in 70s. Regulate what they can charge/ profit. I wish I could charge more when wiring house, because I assume my cost of living is going to more next month so I shouldn’t have to honor my bid. I’m JK. But make the oil companys invest a percentage of their profits in to green energy. They have become multi trillions since when Obama was first in office. I’m done complaining

Thank you for your article I appreciate your well informed.

Ray

In addition to the impacts of legislation and increased enforcement, there is the huge tax drain of non-enforcement. Specifically I refer to the open southern border. The estimated illegal 5 million Biden immigrants, have placed a tax burden on Federal, State and Local governments. It would be great if someone would put a price tag on that. We cannot find accommodation for the homeless American citizens, but we are filling available spaces, and paying for it , for illegal immigrants.

Today’s children get another day older and deeper in debt, while the society they grow up in deteriorates at all levels. Fear not though, the 1% keep getting richer, and are safe behind their ivory towers and tax breaks, like political contributions.

A good estimate of the costs would do wonderful things for clarity in the next election

I don’t believe any politician could be this stupid, this is very deliberate and planned . Power and greed do not equate to intelligence and long term sustainability, otherwise the political flavor of the day would invest in today’s industries with an open door for tomorrow’s realistic improvements.

Another great article Carlisle, always enjoy reading them , I don’t always like what you say but I believe like you and Ivan “Seek The Truth And Be Prepared”

I really enjoy reading your perspectives on monetary policy and such but I can’t say I agree with all of the above.

“If you ask me, they should do the exact opposite: subsidize legacy energy producers—who have no interest in investing in the sector that the government wants to annihilate. That would keep our energy costs down while the free market transitions us to green energy.”

It seems to me that most of the investing dollars will follow the subsidies. Continuing to subsidize outdated forms of energy will not advance us more quickly to a modern / flexible energy grid. I agree the path forward is complicated and solar and wind alone will not solve our problems. Personally, I think nuclear makes a lot of sense, especially small reactors that limit large over expenditures. What you are suggesting is a move in the opposite direction and I don’t believe that following that course of action will be benefit North America in either the medium or long term, even if it does mean it hurts a bit in the short term.

I’d love to hear your response, I’ve learned a lot from this letter. Keep up the good work.

lots of recent big picture theories here recently …based on all the noise out there and like they say ignore the noise

…. this is a big ship that being the world economy when you turn it to the left in covid and now to the right as we return to a more normal scenario …patience people …what we need is investment ideas here …I say all forms of energy …as US dollar comes off when rate raising is done that will provide a precious metals trade ….Personally I like ZINC8 (ZAIR) for a big runway in energy storage and Quantum E Motion (QNC) as a major disruptive cybersecurity technology ..watch both in the next 3 months

It’s like telling your spouse, “Look, I was going to buy this Mercedes Benz AMG GT for $130,000, but I won’t. Instead, I’ll buy a $60,000 Tesla and spend $70,000 on something else because, hey, I’ve saved us a bunch of money!.”

Who thinks this way. Only the rich.

I would like to think that you are wrong on the IRS Tax Army. I have this optimistic view that our government will finally step up and SIMPLY tax those who hoard millions of dollars a year.

Truth is, I have not read what you have just wrote anywhere else. Thus, thank you. I will be back for more.