Dear Readers,

The world is once again on the edge of a cliff. I don’t say that lightly.

Take a look around. North Korea tensions are heating up, while Cypriots beg to pull their money out of the banks. Job data in the U.S. grows increasingly concerning, despite the record amount of money injected into the financial system.

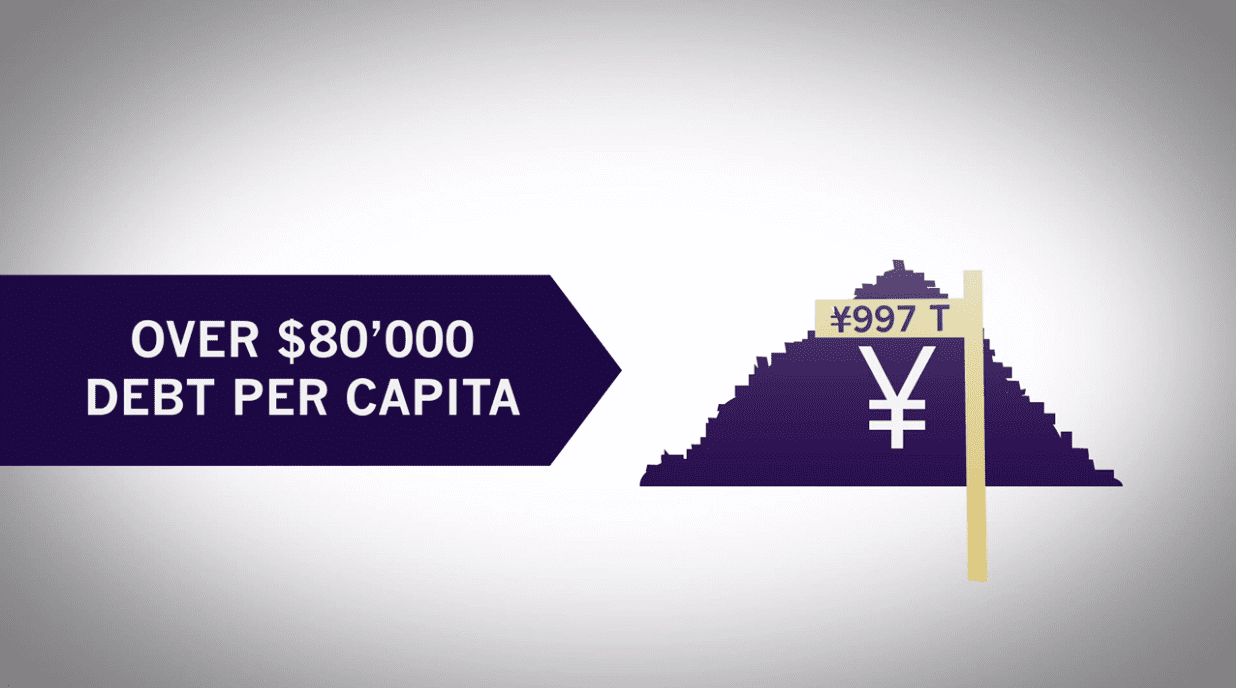

On the other side of the world, Japan has now officially opened the floodgates for one of the world’s biggest stimulus packages ever.

Open the Floodgates

The BOJ officially announced plans to purchase 7.5 trillion ($74.8 billion) yen of bonds a month and double the monetary base, which includes cash in circulation, in two years. This would mop up 70% of newly issued government bonds in the nation and is equal to printing 15% of its GDP each year in new money. It also plans to expand its asset-purchase programme to include riskier bets such as exchange-traded funds (ETFs) and real-estate investment trusts (REITS).

(Government intervention in the free markets is direct manipulation. When a country or central bank can directly influence the price of stocks, and now even indexes through ETFs, fundamentals stand little chance. Funny how people are getting arrested for manipulation and insider trading, yet the governments around the world are directly manipulating the capital markets. Some food for thought.)

For a country that hasn’t grown in the last 15 years and already mired in debt, it seems borrowing more money is their solution. Go figure.

And if you haven’t already learned over the last few years of reading this letter, and always reaffirmed by the Fed, front run the central banks aggressively. Japanese bond prices soared and yields on the country’s long-term securities tumbled to record lows near zero.

I said this would happen weeks ago, so it’s no surprise.

It seems that now the BOJ has officially announced its record stimulus, investors are finally piling in. But if you were smart, you would have already prepared for this.

Back on February, I wrote that Japanese equities would rally as a result of the new BOJ governor, Haruhiko Kuroda coming into power.

The Nikkei is now up over 10% since that time.

Thoughts?

Continue front-running the BOJ by borrowing yen and invest in productive assets outside of Japan; or short yen and long Japanese equities.

If you’re looking at Japan ETFs, I prefer ones that hedge against the yen while providing exposure to Japanese equity markets, such as WisdomTree’s Japan Hedged Equity Index (DXJ) or the MSCI Japan US Dollar Hedged Index (DBJP). These two ETFs provide great exposure to Japanese equities but also benefit from a declining yen; it’s like a double whammy of betting on Japanese equities while shorting the yen against the dollar.

Side note: The frenzy of BOJ front-running has just been acknowledged by the CME Group. Just like the precious metals, (see Prepare for Upside) it appears the CME is so worried about the leverage associated with the BOJ’s actions that they proceeded to hike margins across the entire Yen future spectrum between 19% and 33%.

Central Banks Collaborate on Record Printing

The world’s four biggest developed-market monetary authorities — the Fed, the European Central Bank, the Bank of England, and the Bank of Japan — are now all aligned in their money printing/inflation-inducing policies.

These powerhouses deny their race to debase, yet they have openly stated they want inflation. Do they believe we’re fools? How do you print to inflate without devaluing your currency?

Since the 2008 crisis, the Fed, the ECB and the BOJ have more than doubled the combined size of their balance sheets (the Fed tripling theirs), expanding them by more than US$4.7 trillion. Given the recent actions by the BOJ, that amount will likely increase by at least US$1.3 trillion by the end of 2014, and nearly US$2 trillion when combined with the Fed`s US$85 billion/month.

Meanwhile, the Fed continues to add to their balance sheet, and the ECB has just hinted at another rate cut and further asset purchases.

In the UK, Carney’s appointment as the BOE’s next governor starting in July has already raised the possibility of more easing, while their government has already loosened the central bank’s mandate to give it flexibility in reaching its inflation target.

The world’s printing presses aren’t stopping anytime soon. I’ve said it so many times before; it doesn’t matter if the Fed hints that it might stop or slow down, they won’t.

The threat of inflation and reckless monetary policies by the big four creates major tension over exchange rates and capital inflows with emerging markets including China, Brazil and South Korea. In essence, the big four’s monetary policies would be considered cheating and illegal in any other form.

The effects on trade from the BOJ’s actions are going to be very detrimental for the Koreans and the Chinese. As a result of the mass printing from the world’s largest monetary players, many credit markets, such as corporate debt, are already showing signs of potentially excessive risk-taking.

As I mentioned before, the four biggest developed-market monetary authorities have overleveraged themselves and now have to resort to more leverage in attempts to fix the situation. As they do this, emerging markets will suffer unwanted inflation as they attempt to keep up with the money printing by the big four monetary authorities.

In order to fix the problems that led to 2008, the world’s strongest economies needed to deleverage. Instead, they have gone in the opposite direction and are now more leveraged than ever.

For the BOJ to even come close to their 2% inflation target, the yen will have to devalue much further than where it’s at now. That means more economic experiments through money printing will take place.

Will the G7 nations tolerate this? Will emerging markets?

Americans Give Up

The unemployment rate for the U.S. dropped to a four-year low of 7.6% in March from 7.7 in February.

But that most certainly doesn’t tell the whole story.

First of all, people without a job who stop looking for one are no longer counted as unemployed. The United States Bureau of Labor Statistics just showed that many Americans have given up looking for jobs. The percentage of working-age adults in the labor force – what’s called the participation rate – fell to 63.3% last month. It’s the lowest such figure since May 1979.

That’s why the U.S. unemployment rate dropped in March despite weak hiring.

U.S. Labour Participation Rate

|

| Source: United States Bureau of Labor Statistics |

More than 496,000 left the labor force last month; if they had still been looking for jobs, the unemployment rate would have risen to 7.9% in March.

While some argue that part of the drop reflects the baby boom generation’s gradual move into retirement, I say it’s because there’s no new jobs out there for Americans.

Even in the prime working age group – 25 to 54 years old – are dropping out of the workforce. Their participation rate fell to 81.1% last month, tied with November for the lowest since December 1984.

(Canadian participation has been slowly declining from 67.7 in 2008 to 66.7 in 2012.)

That means despite the record printing, unemployment is showing no big signs of improvement. Earnings are also looking bleak as the cost-cutting strategies from the big corporations are starting to show signs of stalling. When corporate earnings stall, so does the ability to hire.

Bernanke has made it clear that aggressive asset purchases won’t stop until we see signs of employment truly improving, and even still, will continue to print for some time after.

It’s full steam ahead.

Gold – Massive Manipulation

All of the recent events should have boosted gold prices. From Cyprus banks losing billions of savers money and imposing capital controls, to the BOJ`s record stimulus announcement. Yet, here were are, and gold has been slammed.

I want to make one thing clear: Physical gold is different from its paper manifestation. Just like currency, stocks, and derivatives, anything that trades electronically and via a paper form can, and will, be manipulated. Don’t mistake a gold ETF for physical gold when protecting your wealth.

Federico Ghizzoni, CEO of Italy’s Largest Bank, UniCredit SpA, went on record last week stating that he is perfectly okay with confiscating money from uninsured deposits, as long as everyone else in Europe is doing it:

“Cutting large deposits in failing banks, along with other liabilities such as bonds, to offset losses is acceptable as long as small savers’ funds remain protected…it is acceptable if it becomes a European solution.” – Federico Ghizzoni, April 4, 2013

This type of mentality already has wealthy Italians scrambling to remove their wealth from the country. Just last week, Bloomberg caught wind of someone trying to smuggle their gold, worth over $6 million dollars, across the Italy-Switzerland border.

|

| click to play |

The gold was confiscated by Italian police. You have to wonder that for every car that gets caught moving across the border, another hundred cars might go through undetected. How many cars go by our own borders everyday not declaring their purchases made aboard?

Last week, I talked about Texas wanting their gold back. It seems the media has heard and is now finally covering the story…

Not only are European citizens worried about their gold and wealth being confiscated, states within the U.S. are as well…

North Korea

Not only is the U.S. deploying stealth and B-1 Lancer strategic long-range bombers to North Korea, but it is also apparently in the process of deploying the E-6 Mercury “Doomsday” planes, which are among the pinnacle in US Airforce nuclear war preparedness, according to investigative journalist and technologies expert Steve Douglass.

Whether it’s true or not, the situation surrounding North Korea grows intensely.

According to China’s official Global Times, Chinese military activities were concentrated in Jilin Province, which shares the longest border with the North. Forces were reportedly ordered to raise the alert status to the highest level on March 19:

“Large groups of soldiers were seen on the streets in Ji’an, a city in Jilin, amid reports that the [Army] had been ordered to combat readiness status,” the daily added.

“Heavy armored vehicles, including tanks and armored personnel carriers, were reported moving near the Yalu [Apnok] River that separates China from North Korea.”

Meanwhile, defectors from North Korea have been caught by the Chinese and sent back. While most of us believe nothing major will happen, soldiers in the area believe otherwise.

Via Reuters:

“As you all know, on the Korean peninsula, it is not a matter of whether we will have a war or not, but whether it will take place today or tomorrow,” an unidentified soldier said.

“This is a situation like being on the eve of a big explosion. Every minute, every second counts. We are right now set to march, once the order is given.”

Everyone seems to be getting hacked these days. And now, so has N. Korea.

Here’s a picture uploaded by hactivist group Anonymous that has apparently hacked at least two of North Korea’s government-run online sites yesterday. It was posted directly on N. Korea’s Flickr site. Underneath, the text reads: “Threatening world peace with ICBMs and Nuclear weapons/Wasting money while his people starve to death.”

Spread the word. Spread the picture.

Next week, as a result of undergoing some major changes and facelifts, the Equedia Letter will be sent to you under the name, “The Equedia Letter.” It will no longer be sent under the name “Equedia Weekly.” Please update your email address book to ensure proper delivery.

Until next week,

Ivan Lo

Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

Disclosure: I will likely be trading in and out of Japan ETF’s such as WisdomTree’s Japan Hedged Equity Index (DXJ) and MSCI Japan US Dollar Hedged Index (DBJP). I am long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies. Our reputation is built upon the companies we feature. That is why we invest in every company added to our Equedia Select Portfolio. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will.

Disclaimer and Disclosure

Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Companies do pay us to advertise on our website and we often distribute our reports on featured companies. While we are never paid to write a rosy and positive report on any company, we do market our reports using the advertising fees paid for by our featured companies. This process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Our revenue is generated by sponsor companies and we grow our readership by using the advertising fees we charge to distribute our reports. This helps both Equedia and our client companies gain exposure and allows us to provide you with our research at no cost.

Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

Comments 3