Dear Readers,

Coincidence is often described as a remarkable concurrence of events or circumstances without apparent causal connection.

However, we often forget to include the word “apparent” in our use of “coincidence”.

As I mentioned in my last letter, “The Hidden Epidemic Behind Ferguson,” control of power in our modern era is no longer maintained or enacted through invasion or dictatorship because modern society supports freedom.

That is why global power is now maintained through strategies that involve misdirection and deception. Like magic.

The art of misdirection is the most powerful tool that rulers use to make its citizens believe they are voting/fighting for the right causes.

“For we are opposed around the world by a monolithic and ruthless conspiracy that relies primarily on covert means for expanding its sphere of influence–on infiltration instead of invasion, on subversion instead of elections, on intimidation instead of free choice, on guerrillas by night instead of armies by day. It is a system which has conscripted vast human and material resources into the building of a tightly knit, highly efficient machine that combines military, diplomatic, intelligence, economic, scientific and political operations.

Its preparations are concealed, not published. Its mistakes are buried, not headlined. Its dissenters are silenced, not praised. No expenditure is questioned, no rumor is printed, no secret is revealed. It conducts the Cold War, in short, with a war-time discipline no democracy would ever hope or wish to match.”

Misdirection often blinds its audience to the real problems. I talked about this last week re: the Ferguson case, whereby rulers turn citizens against each other in order to maintain rule; because, of course, a unified revolt cannot take place if the people aren’t unified.

This week, I want to talk about the “apparent” coincidences happening all over the world; from falling oil prices, to more “black” men being killed by “white” cops, to more central bank stimulus. The more you see these coincidences, the more you begin to realize that the causal connection between certain political events becomes much more “apparent.”

Once you finish this Letter, you may begin to see the not-so-coincidence, coincidences.

A World of Covert Coincidences

Merriam-Webster’s second definition of the word coincidence is:

“the occurrence of events that happen at the same time by accident but seem to have some connection.”

However, in global politics and finance, what appears to be an accident rarely ever is.

Before I get into the covert economic coincidences of world politics involving oil, I can’t help but write a small continuation from my last letter about the riots springing up all over America as a result of the non-indictments of police officers who killed unarmed “black” men.

Less than a few days after my Letter about the Ferguson case, America is presented with yet another decision not to indict a white New York police officer over the death of an unarmed black man, Eric Garner.

Thousands of protestors swarmed the streets of New York, with protests spreading throughout America; from Boston to Oakland, from Chicago to Dallas.

Last week, I clearly stated that the Ferguson case is being used to blind America to the real problems facing our society; that it was used as a way to turn American citizens against one another*.

(*Some argue that the Michael Brown protests were a unified revolt, with “white” people joining the protests. But what unified revolt involves burning down innocent local businesses?)

Is it a coincidence that just a few days later, we’re presented with yet another Ferguson-like case that just happens to be the primary focus of the big media conglomerates?

While America should be raising questions about the excessive force being used to detain suspects, America should not be protesting or rioting against racial discrimination.

Let’s not fuel ignorance. Change comes from unity, not stupidity.

CLICK HERE to Share Your Thoughts

Let’s Make One Thing Clear

The big media outlets continue to publish the obvious, yet misguided, reasons for oil’s tumble; from OPEC’s attack on US fracking, to excess supply in the market

Let’s make one thing clear: oil is everywhere and it always has been.

In 2009, the big media outlets published numerous articles on peak oil with dramatic headlines such as:

“Warning: Oil Supplies are Running Out Fast”

Of course, this was during a time when oil prices had fallen dramatically as a result of the 2008 crisis. But just as quickly as prices had fallen, they immediately climbed following reports that the world was running out of oil.

Here we are a few years later and instead of running out of oil, the media tells us we have too much.

Has demand dropped so significantly, and supplies increased so dramatically, to cause the price of oil to fall so sharply?

Oil is (apparently) a finite energy supply, and the demand for it is relatively inelastic with respect to price because it has few direct substitutes. That should mean the price of oil should never drop so sharply – ever.

Yet, oil has fallen nearly 40% this year.

The Supply and Demand for Oil

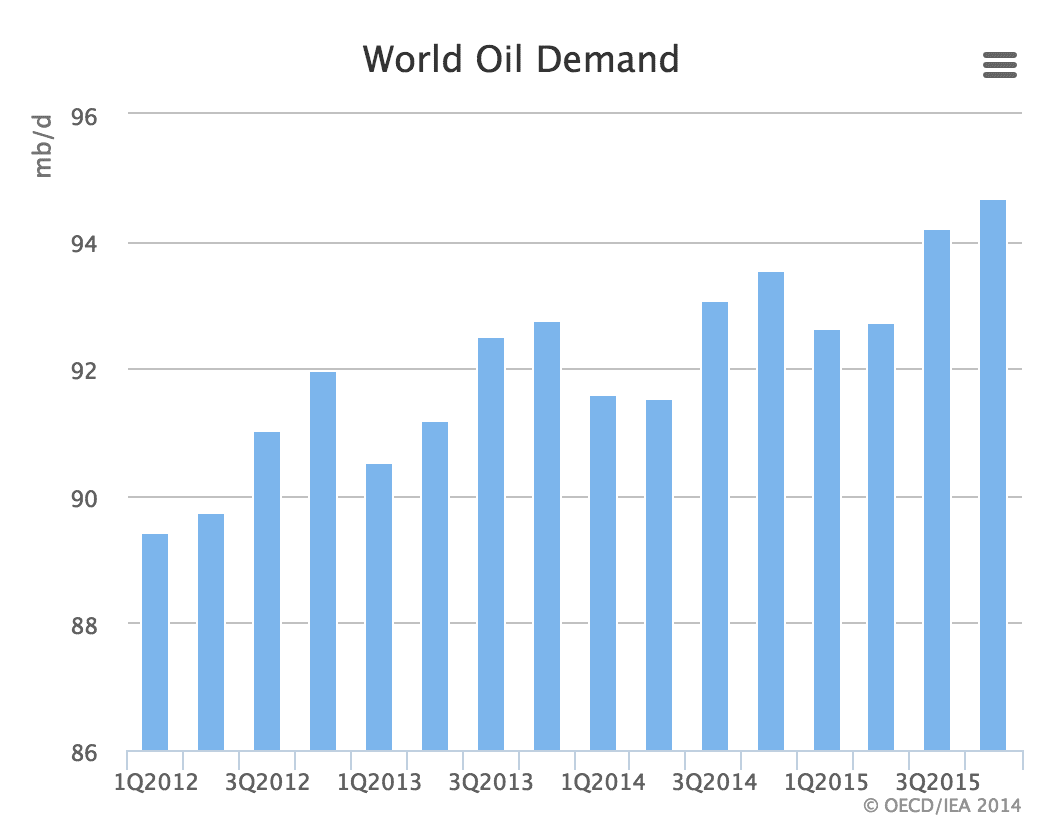

While agencies have found innovative ways to explain declining oil demand, the world has never consumed more oil.

In 2010, the world consumed a record 87.4 million barrels per day. This year, the world is expected to consume a new record of 92.7 million barrels per day.

Global oil demand is still expected to climb to new highs.

Take a look:

Since we know that demand is actually growing, that can’t be the reason for oil’s dramatic drop.

So does that mean it’s a supply issue? Did the world all of a sudden gain 40% more oil?

Obviously not.

So no, the reason behind oil’s fall is not the causality of supply and demand.

The reason is manipulation. The question is why.

Interconnected Global Politics

There are many reasons why oil producers would want to manipulate the price of oil higher. But why the heck would they manipulate the price lower?

The media outlets will have you believe that Saudi Arabia lowered prices to:

a) stifle American competition because it knows shale production isn’t profitable at lower prices and,

b) be more competitive with sales to the world’s fastest growing oil consumer, China.

While both reasons seem logical at first glance, a closer look shows that clearly neither are really the case.

Why?

Because despite lower oil prices, US oil production will continue.

Via Bloomberg:

“OPEC’s price war against the American shale industry will erode drilling budgets, shrink profits and even bankrupt some companies. It won’t do the one thing cartel leader Saudi Arabia wants: reduce U.S. production.

…Shale producers won’t shut oil wells in response to the market’s collapse because most still are profitable, and even those that aren’t need to provide cash flow for debt service and other corporate expenses.”

Also via Bloomberg:

“The boom in U.S. oil production will live to see another week.

…”There’s just so much momentum built up in the system right now and a lot of projects have already been funded,” Kurt Hallead, co-head of RBC Capital Markets’ global energy research team, said yesterday by telephone from Austin, Texas. “There are some projects that will continue on into the next quarter. Right now, you’re seeing the smoke, and you won’t really see the fire until about the second quarter.”

Don’t believe that Saudi Arabia is stupid enough to lose profits in order to fight a battle it likely won’t win.

Furthermore, as I mentioned in my past Letter, despite Saudi Arabia’s price drop, China hasn’t taken advantage of more Saudi oil imports, but has significantly increased its imports from Africa, Columbia, and Russia.

Perhaps this will change, but it hasn’t yet – likely because purchasing more oil from Saudi Arabia during this time would be a direct slap in the face to the suffering Russians, a Chinese energy ally.

So if Saudi Arabia didn’t lower the price of oil to stifle the American Shale revolution, nor to stay competitive in the Asian markets, why the heck did they do it?

CLICK HERE to Share Your Thoughts

Global Political Tactics – It’s Magic

A few weeks ago, I wrote a letter that gave insight on how the U.S. may have struck a deal with Saudi Arabia to lower oil prices in order to hurt Russia, while stimulating its own economy via lower energy prices:

“The strategy of low interest rates to stimulate the housing market and consumer spending has exhausted. With QE coming to an end, what’s left to stimulate the American economy?

As the holiday season nears next month, oil prices continue to fall, with global oil prices posting a fifth consecutive weekly loss.

Is it simply a coincidence that oil’s decline has come on the heels of the end of QE?

Is it possible for the United States to manipulate the price of oil to further stimulate growth?

… Over the last year, Qatar and Saudi Arabia have been urging for U.S. support to unleash airstrikes on Syria.

On September 11, Saudi Arabia finally inked a deal with the U.S. to drop bombs on Syria.

But why?

Saudi Arabia possesses 18 per cent of the world’s proven petroleum reserves and ranks as the largest exporter of petroleum.

Syria is home to a pipeline route that can bring gas from the great Qatar natural gas fields into Europe, making billions of dollars for Saudi Arabia as the gas moves through while removing Russia’s energy stronghold on Europe.

Could the U.S. have persuaded Saudi Arabia, during their September 11 meeting, to lower the price of oil in order to hurt Russia, while stimulating the American economy?

… On October 1, 2014, shortly after the U.S. dropped bombs on Syria on September 26 as part of the September 11 agreement, Saudi Arabia announced it would be slashing prices to Asian nations in order to “compete” for crude market share. It also slashed prices to Europe and the United States.”

Following Saudi Arabia’s announcement, oil prices have plunged to a level not seen in more than five years.

Is it a “coincidence” that shortly after the Saudi Arabia-U.S. meeting on the coincidental date of 9-11, the two nations inked a deal to drop billions of dollars worth of bombs on Syria? Then just a few days later, Saudi Arabia announces a massive price cut to its oil.

A week later, I wrote the piece, “Is Japan Secretly Working with the United States?”

“Is it a coincidence, or an agreement between two nations, that a day after the end of US’ QE program, Japan announces yet another “surprise” increase in added stimulus, sending both U.S and Japanese stocks higher?

Is it a coincidence that the US has accused other countries, such as China, with currency manipulation, but has never accused Japan who has unleashed more QE per GDP than any other developed country in the world?

Remember, the US is Japan’s ultimate nuclear protector and Japan is the world’s third largest holder of US debt (third only to China and the Fed).

Could the US and Japan be working together in this round of currency wars?”

So what does Japan have to do with Saudi Arabia?

Why am I revisiting a past letter on Saudi Arabia’s oil, then immediately revisiting Japan’s QE?

Let’s look at the timely “coincidences” of Japan’s QE and Saudi Arabia’s price cut.

The Covert Connection Between Japan and Saudi Arabia

Japan is a nation that has faced the threat of deflation every year, for over 20 years.

Its central bank, the Bank of Japan (BOJ) has once again decided to go all-in by recently announcing yet another massive QE that may see it buy every new bond the government issues. It’s already the largest single holder of Japan’s bonds.

Despite the BOJ’s efforts, the outlook for the Japanese economy is getting worse – especially since Japan has been hammered by higher energy prices following the Fukishima incident.

Via the EIA:

“Nuclear generation in Japan represented about 26% of the power generation prior to the 2011 earthquake and was one of the country’s least expensive forms of power supply.

Japan replaced the significant loss of nuclear power with generation from imported natural gas, low-sulfur crude oil, fuel oil, and coal that caused a higher price of electricity for its government, utilities, and consumers.

Fuel import cost increases have resulted in Japan’s top 10 utilities losing over $30 billion in the past two years.

Japan spent $250 billion on total fuel imports in 2012, a third of the country’s total import charge.

Despite strength in export markets, the yen’s depreciation and soaring natural gas and oil import costs from a greater reliance on fossil fuels continued to deepen Japan’s recent trade deficit throughout 2013.”

Japan is the third largest oil consumer and importer in the world behind the United States and China. It is also the world’s largest importer of liquefied natural gas (LNG) and second largest importer of coal behind China.

It’s no wonder that higher energy costs in Japan have reached a critical point. The burden of a depreciating yen, deflationary concerns, aging population, and increased energy imports are destroying any chance of growth that Japan’s stimulus was expected to provide.

At this pace, Japan will collapse.

Last Resort

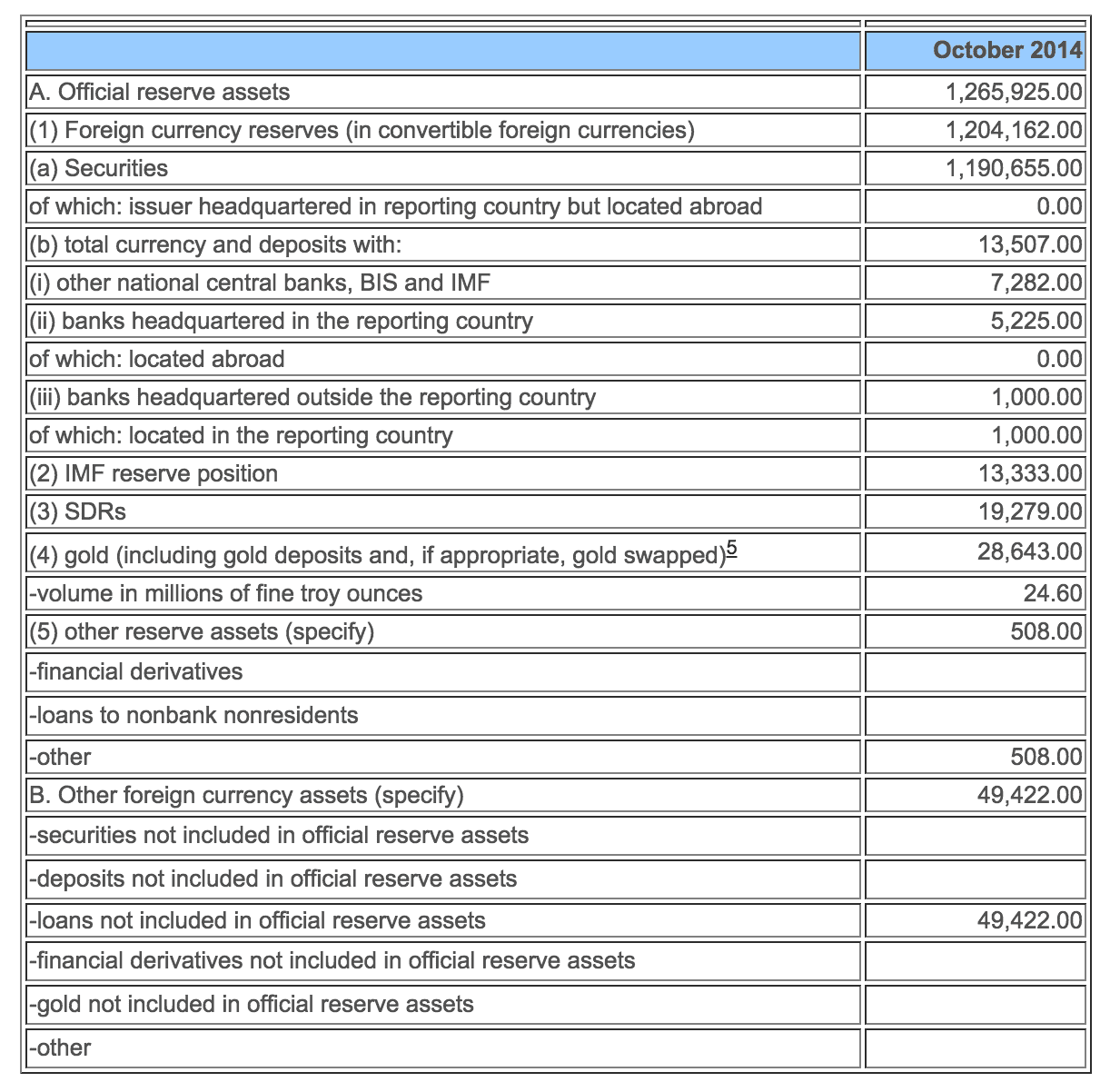

Since almost all options have been exploited (i.e. QE, open market stock purchases, yen devaluation), the only logical solution Japan has left when poop hits the fan is to – like Argentina and Ukraine – sell its foreign reserves.

Foreign reserves, which is dominated by US Treasury Securities, or simply, U.S. debt.

Japan has racked up over $1.2 trillion of foreign reserves as a result of years of buying dollars and selling yen to limit the strength of its currency.

More than 95% of Japan’s official reserve assets are in foreign reserves as of October 2014.

While Japan doesn’t disclose the breakdown of its reserves, it’s not hard to find out how much U.S. securities Japan actually has.

In October, the IMF estimated Japan foreign reserves to be $1.204 trillion.

While the Japanese government wants to further devalue the yen, it also knows that the internal consequence of its sinking yen and high energy prices is corporate bankruptcies.

Via Japan Times:

“Corporate bankruptcies linked to the yen’s slide hit a new record in November, highlighting the strains on small and midsize companies as Prime Minister Shinzo Abe campaigns for re-election on his deflation-busting economic strategy.

Forty-two of the companies that failed in November cited the weakened currency as a contributing cause, bringing total bankruptcies associated with the yen so far this year to 301, almost triple that of the same period in 2013, according to a survey by Teikoku Databank Ltd.”

In order to prevent a mass dumping of U.S. Treasurys, the U.S. can’t allow Japan to fail – not yet.

So how can the U.S. help?

Two Birds, One Stone

There are temporary solutions that could slow Japan’s bleeding.

The most obvious is to find lower energy prices.

Is it a coincidence that Japan announced its biggest round of QE, which propped up U.S. stocks, shortly after Saudi Arabia dropped its oil price?

Is it a coincidence that Japan and its pension plan – the largest on the planet – announced they were going to buy an additional $50 billion worth of US stocks, shortly after Saudi Arabia dropped its oil price?

Knowing that, could it have been possible that the U.S. also struck a deal to lower oil prices for Japan’s sake, in order to protect its own Treasury market?

Are you starting to see the coincidental timing of these geopolitical events?

Perhaps it’s Apophenia.

Perhaps I am connecting dots for a picture that doesn’t exist.

However, if these dots connect, then I expect the following to happen.

The price of oil will begin to rise in 2015 because the U..S will have seen the immediate benefits of lower oil prices through consumer spending over the holidays – which in turn will boost the stock market even higher for the time being.

Some of Japan’s nuclear reactors are also expected to come back online in 2015, which means the country will use less oil and gas. While this would lower the demand for oil, it also means – based on the above coincidences – that the U.S. can allow prices to rise, as it would not harm Japan as much as it has in the past years.

Once the US has achieved its temporary goal of increased consumer spending and higher retail stock prices, and Japan no longer needs as much oil, then Saudi Arabia may have lived up to its secret agreement with the U.S.

Since every oil producer wants to sell oil at higher prices, then perhaps Saudi Arabia will once again increase prices once it has fulfilled its secret agreement with the U.S.

Oil companies without debt are already set for a massive wave of acquisitions. Just ask the oil guys who are already looking for bargain assets to snatch up.

Oil stocks may not have bottomed, but its time to start looking.

The Equedia Letter

the good old us of a knows how to manipulate this organized mess to it’s advantage,so be on guard and invest wisely.

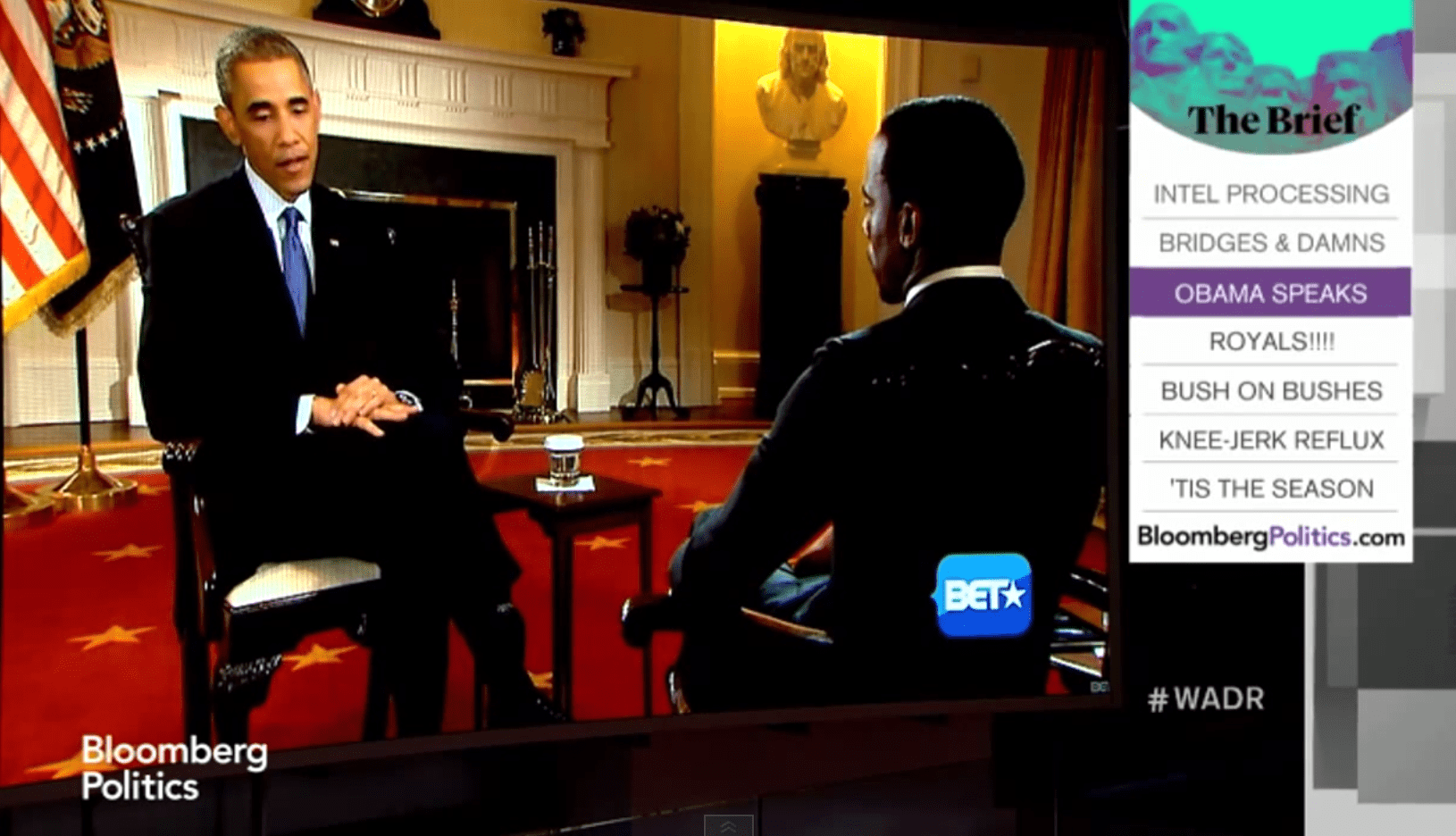

Why would SA help the US when Obama has decided to dump SA to the benefit of Iran?

SA could sell “cheap” its oil to Japan!

This is a fascinating piece from Paul Mylchreest on gold price manipulation and the Nikkei, which generally supports your thesis:

http://www.zerohedge.com/news/2014-12-04/inside-look-shocking-role-gold-new-normal

Were all victims of these…just be aware n b carefull…Look at those big time financial employees committing ‘suicide’collateral damage…

When all sectors fall there are economic circumstances that we the public may not be aware of. Logic for these market movements is not visible or are hidden to the commoner.

And there are plenty this time around. November 2008 to November 2014 is a 5yr cycle repeating itself again.

Price Monopoly has been the game for ever.

An example of this is Ontario Hydro begging US to accept free electricity yet Hydro prices keep going up in Ontario. Lack of public demand for full disclosure allows them to do as they please. For the same reason that gas prices jumped from 0.80 cents liter to $1.50 in six months made no sense as this was 60% increase in short-time period.

All was a set up for what is happening now if you can read between the lines (COINCIDENCES ?). Meaning that company coffers are full of cash to survive this pull back in oil prices.

This is a message to the public to start spending now as they expect public confidence to carry the markets now.

MY OPINION:

HOLD ON TO YOUR CASH TILL 2018 AS NEITHER OIL OR RATES SHALL INCREASE MUCH.

This is also 100 yrs. cycle of 1918 to 1922 boom.

Oil at these lower prices countries or parties are accumulating enough oil to make a killing. Its only you and me that are not allowed to have large enough tanks for storage of oil and gas..get it….

The earthy population need to unite together to affect change for better economic ways then to evolve and believe me , the new generation sooner than later will do so in taking things(government) into their own hands.

The control of demand and supply only benefits a few and definetly not the commoner.

MONARCHIES:

I can’t stand them or the kings or queens and politicians and specially religion banking system ( ROME). For what they have done to society and still doing it. All in the name of liberty and religious believes they control not only our pocket book but our lives (slavery)..

The Royal Family recent visit to US and most folks still fall for their tricks. They were only messengers on economic issues for congress as to what next will take place.

Same way that the Canadian prime minister visited Israel with a monetary gift only it was to finance the war that started 3 weeks later.

Yes. we Canadians are financing that war too.. I am of the believe that Steven Harper acted on instructions from the upper management.

SO MUCH FOR DEMOCRACY AS IF THEY KNOW WHAT IT REALLY IS.

JAPAN: misunderstood.

how can a country debt to GDP be so high and still survive. Japan survives and will continue to do so cause they buy their own assets, thus being their own bank.

something we all need to learn from, after all they own a big portion of the largest empire “US” & “USA”…

CONSPIRACY theory:

The earth quake was man made likely (as the natural ways of earth quakes was not much immenent) and mostly by H>A>R>P technology to get them to buy in ,into the west/british/roman banking system

911: the same story and still we don’t wake up…

have a good day

======================

I assume you meant the headline of this letter to read “The covert connection between….” And not “convert”

Enjoyed the article otherwise.