Dear Readers,

The start of a new year always promises to be one of many positive resolutions.

Those who did well in the markets last year, will make bigger bets this year to top the last; those who did poorly, will make bigger bets to make up for their losses.

In other words, our natural instinct always leads us to invest – that is, until the market absolutely collapses. It is then when we decide enough is enough and say to ourselves, “I am never going to trust the system again.”

After the dust settles, the market bounces, and we’re once again drawn in – like a moth toward a light.

We can talk about all different kinds of financial cycles, but that is the financial cycle in all its simplicity.

And that is what fuels central bank policies.

What I am about to share with you is of the utmost importance; it will give you a better idea of the strategy being used by the Fed and the U.S. to counteract its loose monetary policies.

I believe – unlike what many experts may tell you – that the Fed actually has a plan…

We’ll get to this in a bit.

Despite poor global economic fundamentals that should have sent the market lower, financial fundamentals – i.e. record share buybacks and liquidity injections – caused the market to move higher.

That is why I have strongly stood behind the stock market and its upward direction, every year after the financial crisis of 2008.

Now seven years later, can the market maintain this momentum?

The True Focus of 2015

The question I keep getting is: What should we expect for 2015?

There are all kinds of global imbalances that could shift the stock market back into negative territory; from Greece woes, to Japan’s deflationary worries; from China’s slowing economy, to Europe’s recession.

But these are all, for now, short-term nuisances for the market.

The main focus – as it has been for the last seven years – is: How much further will can financial fundamentals boost the stock market?

To put in simpler terms, how much newly created global currency will be used to backstop liquidity?

First, let’s take a look at the United States.

What do you think should be the focus in 2015?

CLICK HERE to Share Your Thought

Pile on the Debt

Despite the media and government officials talking about the deficit shrinking, debt continues to pile on.

Total public debt outstanding has now reached over $18 trillion.

And while President Obama has talked about the dramatically shrinking deficit, he has failed to acknowledge that under his policies, this deficit will conveniently skyrocket once he leaves office.

Via NBC:

“The Congressional Budget Office said Tuesday that higher tax revenues and restrained spending will produce smaller budget deficits in the next few years, but after 2015 deficits will start rising again. That will happen because federal spending will grow more quickly than the economy will.Beyond 2017, the budget office is forecasting that economic growth will be less than the average growth over the past several decades, in part due to an aging population and slow-growing labor force.”

Over the next decade, the deficit is expected to reach nearly one trillion dollars due to an aging population, rising healthcare costs (which is expected to rise over 85 percent) and an expansion of federal subsidies for insurance.

Furthermore, via the CBO:

“Federal debt held by the public will reach about $12.8 trillion by the end of this fiscal year, an amount that equals 74 percent of the nation’s total output (gross domestic product, or GDP) this year. If current laws generally remained unchanged-the assumption that underlies CBO’s baseline projections-CBO projects that such debt would climb to $20.6 trillion, or 77 percent of GDP, in 2024.

Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3 percent of GDP, to $799 billion in 2024, or 3.0 percent of GDP-the highest ratio since 1996.”

Within the next ten years, interest payments will equal almost all – maybe more – of the total expected $960 billion U.S. deficit.

Furthermore, these interest payments represent only the interest payments on federal debt held by the public, and do NOT include interest on intragovernmental holdings.

If we include interest payments held by intragovernmental holdings, it could easily consume the bulk of the U.S. deficit.

Intragovernmental holdings, in short, means the U.S. government is borrowing from another branch of government, such as Social Security, Civil Service Retirement Fund, and the Military Retirement Fund. Therefore, it’s conveniently not counted in the federal budget.

However, more than $5 trillion of intragovernmental holdings is owed to these retirement-esque departments – departments that American citizens pay into. As people draw on their social security, this money is withdrawn from its reserves.

By 2016, conveniently when a new U.S. president is elected, the troubled finances of Social Security’s disability program are actually projected to run out of reserves.

That means an automatic cut to the benefits that citizens have been paying into – kind of like a default on a loan.

Via ABC News, AP:

“House Republicans want Congress to address the troubled finances of Social Security’s disability program, setting the stage for a contentious debate that could affect 11 million people in the middle of the next presidential campaign.

The House has adopted a procedural rule that could force lawmakers to tackle the issue by the end of 2016, when the program is projected to run out of reserves, triggering automatic benefit cuts.

…Overall, Social Security’s retirement trust fund is projected to run dry in 2034. At that point, it would only collect enough payroll taxes to pay about 75 percent of benefits.

Social Security has more than $2.7 trillion in reserves, but the retirement program has been paying out more in benefits than it collects in payroll taxes since 2010.

The disability program has been paying out more than it collects since 2005.”

Here’s what AP – and every other media outlet – doesn’t tell you: When you pay out more benefits than you are receiving, you eventually draw from your reserves. But what happens when those reserves aren’t there, because they have been lent out to the government for other spending?

That is exactly what has been happening since 2010.

Are there solutions? Sure. I won’t go into the details of them all, but the punch line is: Be prepared to pay more taxes.

Or print more money.

What other solutions are there?

CLICK HERE to Share Your Thoughts

Who is Next in Line to Buy U.S. Debt?

Despite the deficit shrinking in 2014, the U.S. will still have to borrow nearly half a trillion dollars this year to cover its budget – a budget which includes nearly $231 billion in interest payments, or nearly half of the overall deficit.

Since we know that the Fed has been the biggest buyer of U.S. debt over the last few years, who is going to buy the majority of U.S. bonds now that the Fed has stopped? Who is going to buy all of the U.S. debt that’s necessary for the U.S. to avoid a default?

While many experts – including former PIMCO bond king Bill Gross – had the same questions, it seems the answer has been apparent to the Fed since day one: Create a scenario where others have to buy your debt.

With other world economies showing further signs of deterioration, it seems there is once again a rush to buy U.S. debt.

According to Bloomberg, the U.S. government’s ability to finance itself in the bond market in 2014 will go down as one of the best on record:

“At U.S. debt auctions in 2014, investors submitted bids for $6.3 trillion of interest-bearing Treasuries, or 3 times the amount sold. Since 1994, the bid-to-cover ratio this year has been exceeded only twice — in 2011 and 2012. Before the financial crisis, the high was 2.65 times.”

And since yields on 10-year Treasuries are now higher than notes from 17 other developed nations, including Italy, Hong Kong and the U.K., there are signs that 2015 could be just as strong as 2014 for newly created U.S. debt.

But with so much debt to buy, and so much global economic uncertainty, will there be enough money from foreigners to continue buying U.S. debt – especially when they will likely have to buy debt of their own?

The short answer is no…

And that’s why we need to create more money.

The World’s Greatest Liquidity Transfer

The world – in particular the U.S. – would be a complete disaster if the U.S. were the only one printing record amounts of money; many countries would be bankrupt and many fiat currencies would have turned to worthless pieces of paper.

Do you think that the U.S. and the Fed would have allowed that to happen? Do you think they would have unleashed QE if they didn’t already know that others would have to follow suit?

A few months ago, I wrote about the connection between Japan and the U.S. In that letter, I talked about how Japan “coincidentally” announced one the most aggressive financial injections from a developed nation in the history of mankind, just days after the U.S. Federal Reserve announced an end to its own QE program.

Via my Letter, The Convert Connection Between Saudia Arabia and Japan:

“…The Bank of Japan (BOJ) has once again decided to go all-in by recently announcing yet another massive QE that may see it buy every new bond the government issues. It’s already the largest single holder of Japan’s bonds.”

But debt isn’t the only thing the BOJ is buying. In addition to traditional assets purchased under QE – and knowing that the real effects of QE can’t immediately affect the economy – the BOJ announced another round of direct open market stock purchases.

To add even more fuel, Japan’s national pension fund announced that it would even double its holdings of stocks.

Via my Letter, Is Japan Secretly Working with the United States:

“…the BOJ has stepped in and is now directly buying Japanese stocks.

So much so that it is now the second-biggest shareholder of Japanese stocks – second only behind the Government Pension Investment Fund.

And that’s not about to change anytime soon.

That’s because in conjunction with the BOJ stimulus, Japan’s national pension fund, the largest in the world, just announced that it would double its holdings of foreign and domestic stocks.

Once this allocation occurs, Japan’s government pension investment fund will have half of its money in stocks. In other words, Japan wants others to invest in its stocks and is leading by example.

If stocks collapse, Japan is doomed.”

Japan is not only the world’s third largest economy, but it’s also home to the third most traded currency in the world: the yen. That means its monetary policies have an enormous global impact.

As I have said before, the only solution short of a global financial collapse is to print more money. So is it a “coincidence” that the BOJ (home to the world’s third most traded currency) announced an upgraded QE, just days after the Fed (home to the world’s most traded currency) ended its own QE?

Remember, a coincidence is only coincidence if you don’t have all the facts.

Policy makers know that the euphoria from QE is short lived: once QE is gone, momentum ultimately stops. They know that in order for the market to continue marching, and avoid a financial collapse, another major world participant capable of printing currency has to step in.

The Second Most Traded Currency in the World

The European Central Bank (ECB) is home to the second most traded currency in the world: the euro.

It has been widely reported – and speculated – that the ECB is about to announce a massive EUR500 billion QE program on Jan. 22, because the banks soon have to repay more than EUR200 billion in loans.

Via Bloomberg:

“European Central Bank staff presented policy makers with models for buying as much as 500 billion euros ($591 billion) of investment-grade assets, according to a person who attended a meeting of the Governing Council.

…The ECB intends to expand its balance sheet toward 3 trillion euros, from 2.2 trillion euros now. Banks must repay more than 200 billion euros in loans early this year.”

If half a trillion euros is indeed the target, it would mean – as Goldman’s Sylvia Ardagna has put into perspective – the ECB will be buying more than five times as much as the net issuance of long-term bonds.

Via Zerohedge:

“Should the ECB announce EUR500bn in government bond purchases to be implemented over a one-year period, as our European Economics team expects, this programme would compare in size to the average monthly purchases of USTs by the Fed during QE3, but it would be significantly larger than the average monthly Fed purchases since the beginning of the global financial crisis.

Moreover, given the smaller stock and lower net and gross issuance of government debt in the Euro area than in the US, the programme size would imply a significant absorption of government securities available for private sector investors.

The ECB’s stock of eligible Euro area government bonds is EUR7trn (by comparison, the stock of US government securities is about $12trn) and we estimate 2015 net government bond issuance to be around EUR90bn and gross issuance to stand at around EUR800bn (see Macro Rates Monitor, December 19, 2014). The ECB would, hence, buy about 62% of gross issuance of long-term bonds in the Euro area countries and more than five times as much as the net issuance.”

The amount of liquidity provided by the ECB (if it happens) will further calm the markets in the coming months, and will have to continue – as I have mentioned many times over – in order to preserve the global financial system dominated by the three most-traded currencies in the world.

What to Expect in 2015

The fact that the richest nations have to print so much money is an immediate implication that the world, and its top economies, is in bad shape. Ironically, it is this additional liquidity that is giving the world faith.

So my prediction is very simple: The markets will hold up until 2016.

We may witness some volatility throughout the year, especially leading up to the next debt ceiling, but overall, I expect 2015 to end in the green.

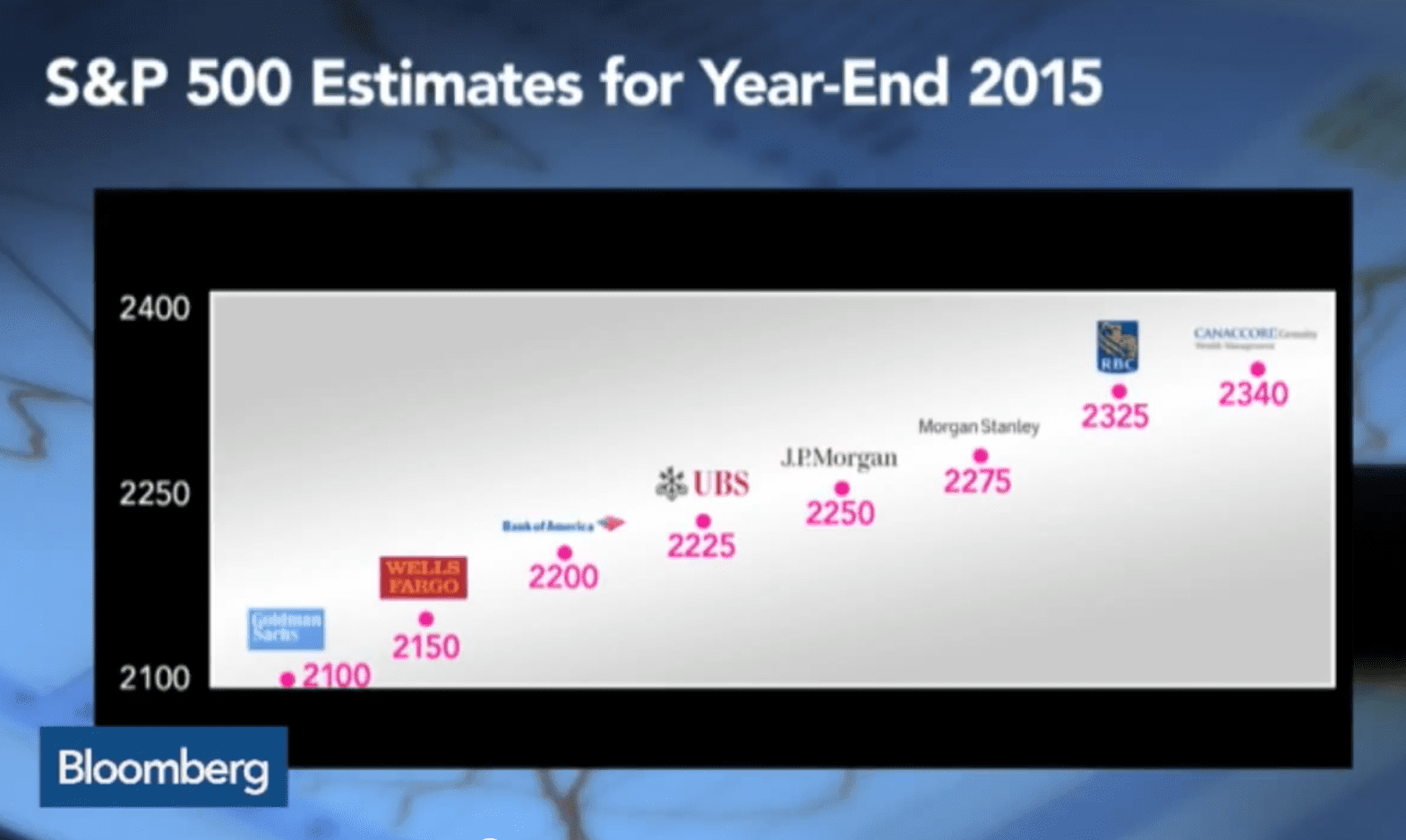

It seems EVERY major financial institution is also expecting the year to be positive; with more record-shattering IPO’s, and a continued climb in the S&P 500.

Furthermore, Obama still has another year in office. Historically, that means the market could continue to rise under a democrat, before it corrects itself during election year:

And since I do believe that the Fed has a plan, I don’t expect the market to fall just yet.

Eventually, the Fed will have to begin winding down its assets, which means there will be a lot of bonds to soak up.

Foreign liquidity won’t be able to soak up all that has been printed. That means money will have to come from somewhere else. And that somewhere – I believe – is from the stock market.

If the stock market continues to climb, it will create more liquidity for bonds. Why? Because the stock market will eventually correct at some point, and when it does, investors will seek the safety of bonds; thus, soaking up much of the bonds held by the Fed.

The higher the stock market climbs, the more money is available for bonds on the way down.

This is the Fed’s true plan.

A Time of Great Change

Regardless of how you invest, it’s gambling. Investing is merely a glorified calculated gamble against the policies of the Fed.

The problem is that gamblers always ride the wave up; and they almost always ride the wave back down.

While I may seem cautiously optimistic about 2015, I have no doubt that the market will correct at some point. I also have no doubt that we are on a debt collision course in what has been coined as the debt super cycle.

The next five years will be one of great change; from global politics to a complete change in the global financial system. Lithuania has just joined the euro, adding yet another country to a failing currency system controlled by a conglomerate of countries facing a deep recession.

Perhaps the goal is to bring everyone down at once, so that the world will have to restructure together; sort of a kamikaze, “If I go, I am taking you with me,” mentality. This will undoubtedly fuel the conspiracy fires of a new world order and a one-world, cashless, currency system.

Don’t be surprised if that actually happens.

The Equedia Letter

do not be a piker…………in january 2017…….three trillion amnesty for all student debt

So,when will the abused Dollar and other junk,fiat currencies collapse?

Johnathan Swift has got nothing on us. We’re living the Lillopusion dream. It’s hard to believe over 7 billion souls collectively share the same willful blindness. For example world debt now exceeds its GDP. Debt (money) is created on the premise that the principal will be paid back with interest. To meet this interest additional debt has to be created in order for the money supply to cover the earlier interest. It’s a Ponzi Scheme. If total debt does not continue to grow the structure collapses. AND THIS IS ONLY JUST ONE FACT BEING IGNORED! The whole humanitarian disaster that is Syria is all about moving Persian Gulf natural gas into Europe. Our numbers are exceeding the capabilities of our institutions and resources.

You are 100% correct. But how many people play into a Ponzi scheme even when they know it is a Ponzi scheme? Greed overcomes common sense. The world is due for a revolution. Bankers will be hanging from the lamp posts.

The sad thing is that this didn’t have to happen. Until we imported the federal reserve bank and turned over our money to the papermongers, exited the gold standard, abandoned the idea of a freedom, and began growing government and stifling the economy with regulations, taxes and lies like global warming, the world was our oyster, and everything was possible. It was the banksters and the socialists that created this problem, and it won’t go away until we start being truthful, and doing things the way the founders set our society up to work; with freedom and sound money.

We are definetly overleveraged over the 1929 era. This on derivatives.

How long the FED will be able to buy U.S. Treasuries being dumped by foreigners to buy gold ,is a key factor.

WE ARE ON THE 100 YRS CYCLE (1914) and it must be played out somehow. things will get better in 2018 as per this cycle rotation

Invest in hardcore companies with hard core assets (railways) per Warren Buffet.

Another precious stone that no one talks about that is super manipulated , controlled is DIAMONDS.

Two years ago I intuitively predicted the Euro at 1.20.

So my prediction for oil to stabilized in the low 40’s as this is 50% + 1/8 correction. (1.612) ratio repeated so often. If so than Oil should reach a top of $70’s range wave.

SO MUCH FOR PREDICTIONS WE ALL HAVE. IF ONLY WE HAD A CRYSTAL BALL then again there would be no markets to invest in. Best is to go with the TREND. as this is the most predictable forecaster.

ENJOY YOUR DAY NO MATTER WHAT… There is always a tommorow

One quote from your letter stood out for me: “Eventually, the Fed will have to begin winding down its assets, which means there will be a lot of bonds to soak up.” My question is, Why will the Fed EVER have to wind down its assets? Who or what is going to make this happen? Why can’t the Fed hold onto its assets, valuing them at book or even add more as the need arises, on into infinity? The whole investment world knows the score and happily goes along with it, regardless of the obvious absurdity. The entire global financial community has a stake in its continuation, I believe. What is your answer?

Great question. The simple answer is you’re right, the Fed doesn’t have to sell. Buying and selling is their way of controlling interest rates through the money supply; selling raises the interest rates, and buying decreases it. And there is a possibility – as the Fed has already mentioned – that it could and will buy more assets if necessary.

History shows us the goal of the Fed is to control. With the massive amount of bond purchases by the Fed over the last seven years, the Fed has effectively taken full control of the U.S.

Without getting into further details, the last time the Fed didn’t have its way, it contracted the money supply in the U.S. and the country fell into a deep recession.

So, no, the Fed doesn’t have to sell its bonds, but there does come a time, when – as Bill Gross put it – zero-based (and in some cases negative yields), fail to generate sufficient economic growth. While such yields almost automatically result in higher bond prices and escalating P/E ratios, their effect on real growth diminishes or in some cases, reverses.

When you push the limits beyond what is acceptable, other global economies will eventually retaliate, leading to a very strong possibility of war via the shifting balance of financial assets. This could be an all-out attack on the dollar, which the Fed does not want.

The unwinding of bonds by the Fed – likely at a very, very slow pace – is simply a way to keep some sort of perceived balance.

Thanks again for your comments; it’s great to see there are those out there that are educated enough to see what is going on.

-Ivan

two things that would put a fix

A) Pass a law USA military not go beyond it’s borders

B)Put a law that if the media or Law makers lie on any issue–Jail time until convicted and beyond

Biggest problem America and the west, is the governments and media are hi jacked by a sinister evil religious group.

Sorry, while your intentions may be good, its clearly out of whack.

Passing more laws re: jail time will just allow them more control by putting in jail any journalists or reporters that report on a story they don’t like

Bit of speculation here:

If all currencies fail the blame can be leveled at the failure of governments and banks and men. If the failure is bad enough the the world will demand financial salvation at almost any price. That salvation will be offered. I would suspect something on the order of a world scale Bitcoin, which can be “regulated” to insure the financial of all. Draw your own conclusions.

Hasn’t a precedent already been set? That reporting on this remarkable ACHIEVEMENT is scarce to none only serves to accentuate the efficacy.

I’m referring to, of course, Iceland.

what is really going on reaperishere.weebly. com

Here is humanity’s #1 problem, summed up:

The International Jew by Henry Ford

“Wikispooks.com 9/11 Israel Did It”

http://www.bibliotecapleyades.net/sociopolitica/secretsoc_20century/secretsoc_20century03.htm#CHAPTER%206

Economy